Understanding 1099 Travel Reimbursement

1099 for travel reimbursement – Navigating the world of independent contractor work often involves unique tax considerations, particularly when it comes to travel reimbursements. A 1099 form, issued by a company to an independent contractor, Artikels the payment for services rendered, including expenses like travel. Understanding the nuances of 1099 travel reimbursement is crucial for both contractors and the companies that employ them to ensure compliance and avoid potential issues.

What is a 1099 Form and its Role in Travel Reimbursement?

A 1099-NEC form, issued by a business to an independent contractor, details the payments made for services provided. This includes reimbursements for business-related expenses, such as travel. The form acts as a record of income for the contractor and is a crucial component of the tax reporting process for both the contractor and the company.

Difference Between 1099 and W-2 Travel Reimbursement

The key distinction lies in the employment relationship. W-2 employees are considered employees, while 1099 contractors are independent. W-2 travel reimbursements are often part of the employee’s overall compensation package, while 1099 reimbursements are explicitly documented and reported separately. The tax implications for each vary significantly, as detailed below.

Tax Implications for the Contractor (1099)

Contractors are responsible for paying both income tax and self-employment tax on their 1099 income, including reimbursements. This contrasts with W-2 employees, whose taxes are often withheld by the employer. The contractor must estimate and pay these taxes quarterly, using IRS Form 1040-ES. The specific tax rate depends on the individual’s income and tax bracket.

Tax Implications for the Employer (1099)

Employers issuing 1099 forms for travel reimbursements must adhere to specific reporting requirements. They are responsible for accurately documenting and reporting the payments made to the contractor. This includes properly classifying the contractor as independent and ensuring the reimbursements are for legitimate business expenses. Failure to comply with these regulations can result in penalties.

Figuring out 1099 for travel reimbursement can be tricky, especially if you’re a high-end traveler like an affluent traveler. Understanding the nuances of expenses, receipts, and documentation is crucial. Properly claiming your travel costs is key to ensuring accurate 1099 processing.

Common Scenarios for 1099 Travel Reimbursement

1099 travel reimbursements are often employed in situations where a company needs specialized skills or expertise for a project. This could include freelance writers, consultants, or marketing specialists who travel to client locations or events. Additionally, 1099 contractors may travel to perform services for multiple companies.

- Independent consultants traveling to provide advice or support.

- Freelance writers covering events and traveling to interview sources.

- Marketing specialists attending industry conferences and trade shows.

- Contractors performing maintenance or repair services on-site.

Potential Benefits of 1099 Travel Reimbursement

For the employer, 1099 travel reimbursements can be more flexible and potentially cost-effective. There are no employer payroll taxes or benefits to consider. For the contractor, 1099 arrangements can offer greater control over their work schedule and potentially higher income potential, if they are able to effectively manage their expenses and taxes.

- Flexibility for the employer: Adjusting the work arrangement based on project needs.

- Potential cost savings for the employer: No employer payroll taxes or benefits.

- Potential higher earnings for the contractor: Greater control over income.

Potential Drawbacks of 1099 Travel Reimbursement

The complexities of self-employment taxes and record-keeping can be significant burdens for contractors. Employers must ensure proper classification to avoid potential legal issues. Careful planning and documentation are essential for both parties to ensure compliance.

Figuring out 1099 for travel reimbursement can be tricky, especially if you’re running a travel business. You’ll need to consider things like a travel agency merchant account to handle payments from clients smoothly. A good travel agency merchant account, like the one offered by travel agency merchant account , will make processing reimbursements and other payments a breeze, ultimately simplifying your 1099 filing for travel reimbursement.

It’s a crucial part of ensuring accurate and compliant travel reimbursement procedures.

- Complex tax obligations for the contractor: Estimating and paying quarterly taxes.

- Strict classification requirements for the employer: Avoiding misclassification issues.

- Potential for higher administrative burden: Proper documentation and record-keeping.

Documentation and Record-Keeping

Proper documentation is crucial for a successful 1099 travel reimbursement claim. A well-organized record of expenses ensures the claim is processed efficiently and accurately. Clear documentation minimizes potential disputes and delays, ensuring you receive the reimbursement you deserve. It’s essential to understand the specific requirements and maintain meticulous records throughout the trip.

Essential Documents for 1099 Travel Reimbursement Claims

Maintaining a comprehensive record of travel expenses is paramount for a smooth reimbursement process. This involves gathering various documents, each providing crucial evidence for the claimed costs.

| Document Type | Description | Required Information |

|---|---|---|

| Airline Tickets | Proof of transportation costs. | Passenger name, flight number, dates, origin and destination, ticket price. |

| Hotel Receipts | Evidence of lodging expenses. | Hotel name, dates of stay, room type, number of nights, total charges, and guest name. |

| Rental Car Receipts | Proof of car rental costs. | Rental company, dates of rental, car type, mileage, total charges, and driver’s name. |

| Meals Receipts | Proof of meals consumed during travel. | Restaurant name, date and time of meal, total amount, and description of items ordered. |

| Transportation Receipts (e.g., taxis, ride-sharing) | Proof of transportation costs other than airfare or rental car. | Company name, date and time of service, destination, fare amount, and driver’s name (if applicable). |

| Parking Receipts | Proof of parking fees incurred during travel. | Location of parking, date and time, total amount, and parking lot name. |

| Other Receipts | Supporting documents for any additional expenses (e.g., tours, activities). | Name of vendor, date of service, description of service, and total cost. |

Methods of Travel Expense Documentation

Various methods exist for documenting travel expenses, each with its own set of advantages and disadvantages. Choosing the right method ensures clarity and efficiency.

| Method | Advantages | Disadvantages | Examples |

|---|---|---|---|

| Digital Documentation | Easy to store, share, and access. Allows for automated categorization and tracking. | Reliance on technology; potential for data loss or corruption if not properly backed up. | Photos of receipts, scanned copies, expense tracking apps. |

| Paper Receipts | Tangible proof of expenses. | Can be bulky, difficult to organize, and prone to damage or loss. | Physical copies of receipts, printed expense reports. |

| Spreadsheet/Expense Tracking Software | Organized record-keeping. Easy to calculate totals. | Requires time to input data. Potential for human error. | Microsoft Excel, Google Sheets, dedicated expense tracking software. |

Organizing Receipts and Supporting Documents

A well-organized system for storing and retrieving receipts and supporting documents is crucial for successful reimbursement claims.

A dedicated folder or file system, categorized by trip, can streamline the process. Organize receipts chronologically within each trip folder. Use labels, color-coding, or a spreadsheet to track expenses. Keep copies of all supporting documents in a separate, secure location. This will allow for easy retrieval if needed.

Importance of Accurate and Complete Documentation

Accurate and complete documentation is essential for a smooth 1099 travel reimbursement process. Inaccurate or incomplete records can lead to delays, disputes, or rejection of the claim. This includes ensuring all required information is present on receipts and that the documentation accurately reflects the claimed expenses.

Retention Period for Travel Records

The length of time travel records should be kept depends on specific requirements and local regulations. Generally, records should be retained for at least three years. Some jurisdictions may require even longer retention periods, and you should consult with tax advisors if you have any specific questions.

Expense Reporting Procedures

Navigating the world of 1099 travel reimbursements can feel like navigating a maze. Understanding the precise steps and procedures is crucial for both the freelancer and the employer to ensure a smooth and accurate process. This section Artikels the critical aspects of expense reporting, providing a clear roadmap for submitting and processing claims.

Step-by-Step Procedure for Submitting a 1099 Travel Reimbursement Claim

This detailed procedure streamlines the process, minimizing potential delays and errors. Following these steps ensures your reimbursement claim is processed efficiently and accurately.

- Gather Documentation: Collect all necessary receipts, confirmations, and other supporting documents for your travel expenses. This includes flight itineraries, hotel confirmations, car rental agreements, and receipts for meals and incidentals. Thorough documentation is essential for verification.

- Prepare Expense Report: Create a comprehensive expense report, clearly itemizing each expense with dates, descriptions, amounts, and supporting documentation. Use a standardized format to ensure clarity and accuracy. A sample form is provided later in this section.

- Submit the Claim: Submit the completed expense report and supporting documents to the designated contact person or department, following the established procedures. Clearly communicate any specific requirements or deadlines.

- Claim Review and Approval: The employer or designated personnel will review your claim for accuracy and compliance with company policies. This process often involves verifying receipts and expenses against company guidelines.

- Payment Processing: Upon approval, the reimbursement will be processed according to the agreed-upon payment terms.

Comparison of Travel Reimbursement Claim Submission Methods, 1099 for travel reimbursement

Different methods for submitting travel reimbursement claims offer varying advantages and disadvantages. Choosing the right method depends on individual circumstances and company policies.

| Method | Advantages | Disadvantages | Examples |

|---|---|---|---|

| Convenient, accessible from anywhere. | Potential for misplacing documents, less secure, lacks official record. | Sending a scanned copy of receipts and expense report. | |

| Online Portal | Secure, organized, and easy tracking. | Requires internet access and familiarity with the platform. | Using a dedicated company platform to submit and track claims. |

| Physical Form | Tangible record of submission. | Time-consuming, less convenient, slower processing. | Filling out and submitting a printed form and physical receipts. |

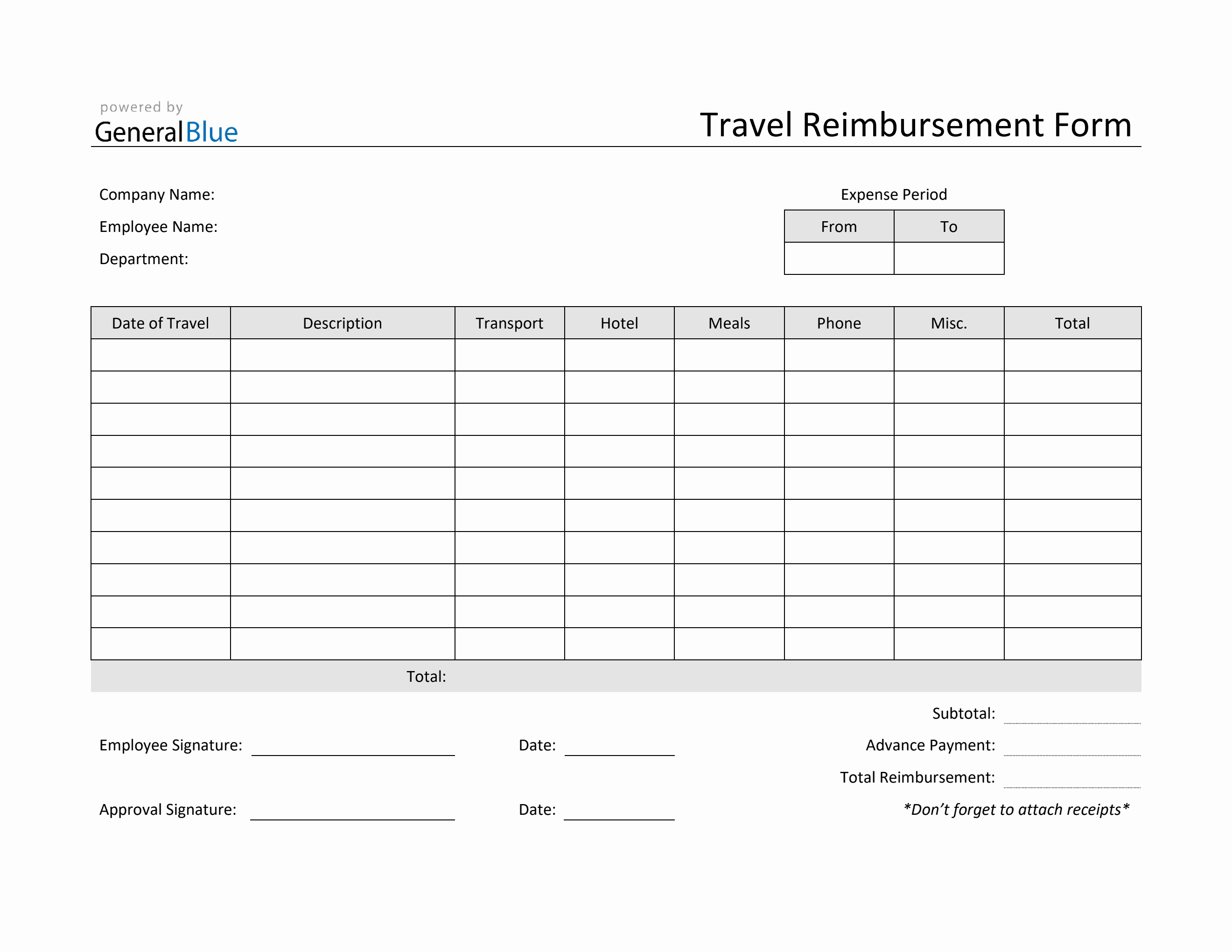

Sample Travel Reimbursement Form for 1099 Employees

A well-structured form is essential for clarity and efficiency. This form is a template and should be customized to reflect company-specific requirements.

Employee Name: [Employee Name]

Employee ID: [Employee ID]

Trip Dates: [Start Date] – [End Date]

Travel Destination: [Destination]

Purpose of Trip: [Purpose]

Expenses:

Expense Date Amount Supporting Documentation Flight [Date] [Amount] [Confirmation Number] Hotel [Date] [Amount] [Confirmation Number] Meals [Date] [Amount] [Receipt Numbers] Transportation [Date] [Amount] [Receipt Numbers] Total Expenses: [Total Amount]

Employee Signature: [Signature]

Date: [Date]

Verifying and Approving 1099 Travel Reimbursement Claims

A meticulous verification process is crucial to ensure accuracy and compliance. This process should adhere to established policies and procedures.

- Documentation Review: Thoroughly examine all supporting documentation, cross-referencing it with the expense report and company policies.

- Policy Compliance: Confirm that the expenses align with the approved travel policy, including permissible costs and limits.

- Expense Validity: Verify the authenticity of receipts and other documentation, ensuring the expenses are legitimate and incurred during the specified travel period.

- Approval Process: Implement a clear approval workflow, assigning roles and responsibilities for review and authorization.

Role of the Employer in the 1099 Travel Reimbursement Process

The employer plays a critical role in facilitating a fair and efficient reimbursement process. Their responsibilities include setting clear guidelines, providing necessary resources, and ensuring timely processing of claims.

- Establishing Policies: Define clear policies and procedures regarding allowable expenses, documentation requirements, and claim submission methods.

- Providing Support: Offer guidance and support to 1099 employees regarding the reimbursement process, ensuring they understand the requirements.

- Timely Processing: Implement a system for prompt review and approval of claims to minimize delays in reimbursement.

Tax Considerations for 1099 Employees

Navigating the tax landscape as a 1099 employee can feel complex. Unlike W-2 employees, who have taxes withheld from their paychecks, 1099 workers are responsible for paying their taxes on their own income, including any travel reimbursements. Understanding the different types of taxes and how reimbursements impact your tax liability is crucial for accurate financial planning and avoiding potential penalties.

Properly calculating and paying taxes on travel reimbursements is essential. Ignoring these obligations can lead to significant financial consequences. Careful record-keeping and understanding the tax implications are key to smooth tax filing and avoiding issues with the IRS.

Types of Taxes for 1099 Employees

1099 employees are responsible for paying various taxes, including income tax, self-employment tax, and potentially state and local taxes. Understanding each type is vital for accurate tax planning. Income tax is based on your total earnings, while self-employment tax covers Social Security and Medicare contributions. These contributions are typically higher for 1099 workers because they are responsible for both the employee and employer portions. State and local taxes may vary by location and need to be researched based on your residence.

Impact of Travel Reimbursements on Tax Obligations

Travel reimbursements are considered part of your gross income and thus subject to taxation. The amount of the reimbursement is added to your total income for the tax year. This increase in taxable income directly impacts your tax liability for income tax and self-employment tax. Crucially, the reimbursement amount will also increase your self-employment tax burden, as both the employee and employer portions of these taxes are due.

Importance of Understanding Tax Implications Before Submitting a Claim

Before submitting a travel reimbursement claim, meticulously calculate the tax implications. Understanding the tax impact ensures that you are aware of the total amount of tax you owe. Accurate calculations will help you budget accordingly and avoid any surprise tax liabilities at the end of the year.

Comparison of Tax Obligations: 1099 vs. W-2 Employees

| Characteristic | 1099 Employee | W-2 Employee |

|---|---|---|

| Income Tax | Pay estimated taxes quarterly | Taxes withheld from paycheck |

| Self-Employment Tax | Pay both employee and employer portions | Employer pays employee portion; employee pays their portion through withheld taxes |

| State and Local Taxes | Potentially responsible for state and local taxes | Taxes withheld from paycheck, if applicable |

| Record Keeping | Essential for accurate tax reporting | Record-keeping is important, but typically less complex |

Calculating Taxes on Travel Reimbursements

To calculate the correct amount of taxes to pay on travel reimbursements, follow these steps:

- Determine the total amount of your travel reimbursement.

- Include the reimbursement in your total gross income for the tax year.

- Calculate your income tax liability based on your total income, using tax brackets and applicable deductions.

- Calculate your self-employment tax liability by considering both employee and employer portions.

- Account for any applicable state and local taxes based on your location.

Example: If your travel reimbursement is $1,500, this amount will be added to your overall income for the year. Your tax liability will be calculated based on this increased income, factoring in your other income sources and applicable deductions. This example demonstrates the direct correlation between travel reimbursements and your overall tax obligations.

Common Mistakes and Solutions

Navigating the 1099 travel reimbursement process can be tricky, even for seasoned freelancers. Understanding potential pitfalls and having a clear strategy for avoiding them is crucial for a smooth experience and accurate tax reporting. This section Artikels common errors and provides practical solutions to ensure your reimbursements are handled correctly.

Incorrect Expense Documentation

Thorough documentation is paramount for a successful 1099 travel reimbursement. Incomplete or inaccurate records can lead to delays, rejection, or even tax penalties. This section details critical aspects of proper documentation.

- Missing receipts: Failure to obtain receipts for all expenses, especially for lodging, transportation, and meals, is a common oversight. This omission makes it difficult to justify the expenses. Solution: Always obtain a detailed receipt for every expense, including the date, amount, description, and vendor’s name and address. This documentation is critical for supporting the reimbursement request.

- Unclear or vague descriptions: A receipt alone isn’t always sufficient. Detailed descriptions on the expense report explaining the reason for each expense are essential. Solution: When documenting expenses, use specific language to explain the purpose of the trip. For example, instead of “Travel Expenses,” write “Travel expenses for attending the XYZ Conference in San Francisco.” This helps clarify the purpose of the trip and validates the expenses.

- Incorrect or outdated dates: Inaccurate dates can lead to issues with reimbursement requests. Solution: Ensure all dates on receipts, expense reports, and travel itineraries match and accurately reflect the dates of the travel.

Inaccurate Expense Reporting

Submitting an inaccurate expense report can lead to delays and rejection. Understanding the correct reporting procedures is vital for a smooth reimbursement process.

- Exceeding the allotted budget: Sometimes, freelancers exceed their pre-approved travel budget. Solution: Before embarking on a trip, confirm with the client or employer the total amount for travel reimbursement and keep accurate track of expenses. If an unforeseen event occurs, such as an emergency, the 1099 employee must discuss the issue and propose a reasonable solution with the employer.

- Incorrect expense categories: Misclassifying expenses can lead to reimbursement issues. Solution: Ensure that expenses are categorized correctly, aligning with the pre-defined categories established by the employer. If unsure, consult the employer’s guidelines to avoid misclassifications.

- Lack of expense support: Expense reports must be backed up by supporting documents. Solution: Ensure all expenses have appropriate documentation. For example, receipts for lodging, meals, and transportation are crucial for validating expenses. Do not rely on memory alone; maintain a meticulous record of all expenses.

Table of Common Problems and Solutions

| Problem | Solution |

|---|---|

| Missing receipts for travel expenses | Obtain detailed receipts for all expenses, including lodging, transportation, and meals. |

| Vague descriptions of expenses | Use precise and specific language to explain the purpose of each expense. |

| Inaccurate dates on expense reports | Ensure all dates on receipts, expense reports, and travel itineraries match and are accurate. |

| Exceeding the pre-approved travel budget | Maintain accurate track of expenses and, if necessary, discuss and propose a solution with the employer. |

| Incorrect expense categorization | Consult the employer’s guidelines to ensure proper expense categorization. |

| Insufficient supporting documentation | Ensure all expenses are backed up with appropriate supporting documents. |

Examples of Incorrect or Incomplete Documentation and Consequences

- Example 1: A freelancer submits a travel reimbursement request with a blurry receipt for lodging. Consequences: The reimbursement request might be rejected due to insufficient documentation.

- Example 2: A freelancer submits a reimbursement for meals with only a vague description like “Restaurant Meals.” Consequences: The request may be rejected for lacking detailed information on the meal’s purpose.

- Example 3: A freelancer submits a reimbursement for transportation expenses without a receipt or valid documentation. Consequences: The reimbursement request may be rejected due to missing supporting documents.

Legal and Compliance Aspects: 1099 For Travel Reimbursement

Navigating the legal landscape of 1099 travel reimbursements is crucial for both employers and independent contractors. Understanding the specific regulations and potential penalties for non-compliance can prevent costly errors and maintain a healthy working relationship. This section will delve into the legal requirements, relevant laws, and penalties for non-compliance, as well as strategies for ensuring compliance.

Legal Requirements for 1099 Travel Reimbursement

The legal framework for 1099 travel reimbursements is multifaceted, encompassing tax laws, employment regulations, and potentially state-specific guidelines. Compliance demands a thorough understanding of these various elements. Proper documentation is paramount, and it must clearly Artikel the reimbursement process.

Relevant Laws and Regulations

A comprehensive understanding of the regulations surrounding 1099 travel reimbursements requires considering various legal aspects. Federal tax laws, like those Artikeld in the Internal Revenue Code, dictate reporting requirements for both the employer and the independent contractor. These laws specify the proper classification of the independent contractor relationship, which impacts the reimbursement process. State laws may also impose additional requirements. Employers should consult with legal counsel to determine the specific regulations applicable in their jurisdiction.

Penalties for Non-Compliance

Non-compliance with travel reimbursement procedures can result in significant penalties for both the employer and the independent contractor. These penalties can range from IRS penalties for incorrect tax reporting to potential legal action for violations of state labor laws. Incorrect classification of a worker as an independent contractor, even if reimbursement is provided, can lead to substantial penalties. For example, misclassification of an employee as a 1099 contractor can result in back taxes, penalties, and interest, as well as potential lawsuits. Thorough understanding and compliance are crucial to avoid these penalties.

Ensuring Compliance with Relevant Regulations

Maintaining compliance requires a multi-pronged approach. Firstly, accurate record-keeping is essential, meticulously documenting all travel expenses, reimbursements, and supporting documentation. Secondly, the employer should consult with legal counsel to ensure compliance with relevant federal and state regulations. This step is critical for avoiding potential legal issues. Thirdly, the employer should implement clear and detailed travel reimbursement policies. These policies should Artikel the procedures for requesting, approving, and receiving reimbursements. Finally, the employer should provide thorough training to their staff on the proper handling of 1099 travel reimbursements.

Navigating Compliance Issues

Compliance issues regarding travel reimbursements can be navigated effectively through a proactive approach. By understanding the specific regulations, developing clear policies, and seeking legal counsel when necessary, employers can minimize the risk of penalties. Regular review and updates of policies are also crucial to ensure continued compliance with evolving legal requirements. A well-defined process for expense reporting, including clear guidelines for receipts and documentation, will significantly reduce potential issues. This includes outlining the necessary documentation for expenses, ensuring all documentation is retained, and maintaining clear communication channels between the employer and the independent contractor regarding reimbursement processes.