Introduction to 1West Finance

1West Finance is a financial services provider dedicated to offering comprehensive financial solutions. Our services are designed to empower individuals and businesses to achieve their financial goals. We focus on building long-term relationships with our clients, built on trust, transparency, and a commitment to their financial well-being.

Core Business Activities

1West Finance operates within several key areas of the financial services sector. We provide a range of services designed to meet diverse financial needs.

- Investment Management: We offer investment strategies tailored to individual risk tolerances and financial objectives. This includes portfolio construction, asset allocation, and ongoing monitoring to help clients grow their wealth over time. We utilize a diversified approach, considering various asset classes to mitigate risk.

- Financial Planning: We assist clients in developing comprehensive financial plans that encompass retirement planning, education funding, and estate planning. Our financial planners work closely with clients to understand their unique circumstances and create personalized roadmaps for their financial futures.

- Wealth Management: We provide a holistic wealth management approach, integrating investment management, financial planning, and other services such as tax planning and insurance. This integrated approach allows us to address all aspects of a client’s financial life.

- Lending Solutions: We offer various lending products, including mortgages, personal loans, and business financing. Our lending services are designed to provide flexible and competitive financing options.

Mission Statement and Values

1West Finance is driven by a clear mission and a set of core values that guide our actions.

- Mission: To empower individuals and businesses to achieve their financial aspirations by providing expert financial guidance and innovative solutions, fostering long-term relationships built on trust and integrity.

- Values:

- Integrity: We operate with honesty, transparency, and ethical conduct in all our interactions.

- Client-Centricity: We prioritize the needs of our clients and are committed to providing personalized service and solutions.

- Expertise: We maintain a high level of professional expertise and continuously seek to enhance our knowledge and skills.

- Innovation: We embrace innovation and leverage technology to deliver efficient and effective financial solutions.

- Collaboration: We foster a collaborative environment, working together as a team to achieve common goals.

Target Audience and Their Financial Needs

1West Finance caters to a diverse clientele, each with unique financial requirements. Our services are tailored to meet the specific needs of these different groups.

- Individuals: Individuals often seek help with retirement planning, investment management, and debt management. They need guidance to secure their financial future and achieve their personal financial goals. For example, a young professional might need assistance with saving for a down payment on a house or starting a retirement fund.

- Families: Families require comprehensive financial planning, including education funding, insurance, and estate planning. They need solutions to protect their assets and ensure the financial well-being of their loved ones. A family with children might need assistance with setting up college savings plans or purchasing life insurance.

- Businesses: Businesses need access to financing, investment strategies, and financial planning services to grow and succeed. They require solutions to manage cash flow, optimize investments, and navigate complex financial regulations. A small business owner might need help securing a loan to expand operations or manage their company’s finances.

Products and Services Offered by 1West Finance

1West Finance provides a comprehensive suite of financial products and services designed to meet the diverse needs of its clients. From personal loans to investment opportunities and insurance solutions, the company aims to empower individuals and businesses to achieve their financial goals. The following sections detail the specific products and services offered, highlighting their key features and benefits.

Loans Offered by 1West Finance

1West Finance offers various loan products catering to different financial needs. These loans are designed with flexible terms and competitive interest rates to provide accessible and manageable financing options.

- Personal Loans: Personal loans are available for various purposes, such as debt consolidation, home improvements, or unexpected expenses. These loans typically offer fixed interest rates and repayment terms, providing borrowers with predictable monthly payments.

- Home Loans: 1West Finance provides home loans to assist individuals in purchasing or refinancing their properties. These loans come with a range of options, including fixed-rate and adjustable-rate mortgages, catering to different risk appetites and financial situations.

- Business Loans: For entrepreneurs and business owners, 1West Finance offers business loans to support growth and operational needs. These loans can be used for working capital, equipment purchases, or expansion projects. Terms and rates are tailored to the specific needs and creditworthiness of the business.

Investment Options at 1West Finance

1West Finance provides a range of investment options to help clients grow their wealth. These options are designed to suit various risk tolerances and investment horizons.

- Stocks and Bonds: Clients can invest in a diversified portfolio of stocks and bonds, offering potential for capital appreciation and income generation. 1West Finance provides access to a wide range of securities, allowing clients to tailor their investments to their financial goals.

- Mutual Funds: Investment in mutual funds provides a professionally managed, diversified portfolio. 1West Finance offers a variety of mutual funds, including equity funds, bond funds, and balanced funds, to suit different investment objectives.

- Retirement Accounts (401(k) and IRAs): 1West Finance facilitates the establishment and management of retirement accounts, such as 401(k)s and IRAs. These accounts offer tax advantages and are designed to help clients save for their retirement.

Insurance Products from 1West Finance

1West Finance offers a selection of insurance products to protect clients from financial risks. These products provide financial security and peace of mind.

- Life Insurance: Life insurance provides financial protection to beneficiaries in the event of the policyholder’s death. 1West Finance offers various life insurance policies, including term life and whole life, to meet different needs.

- Health Insurance: Health insurance helps cover medical expenses, protecting individuals and families from the high costs of healthcare. 1West Finance provides access to a range of health insurance plans, including individual and family plans.

- Property and Casualty Insurance: This insurance protects assets from damage or loss. 1West Finance offers property and casualty insurance to cover homes, vehicles, and other valuable possessions.

Product Comparison Table

The following table compares key features of selected products offered by 1West Finance.

| Product | Key Feature | Benefits | Target Audience |

|---|---|---|---|

| Personal Loan | Fixed interest rates, flexible repayment terms | Debt consolidation, home improvements, predictable monthly payments | Individuals needing funds for various personal expenses |

| Home Loan | Fixed-rate and adjustable-rate mortgage options | Property purchase or refinancing, diverse risk management | Homebuyers and existing homeowners |

| Stocks and Bonds | Diversified portfolio, access to a wide range of securities | Potential for capital appreciation and income generation | Investors seeking long-term growth |

| Life Insurance | Term life and whole life options | Financial protection for beneficiaries | Individuals seeking to protect their families |

1West Finance’s Investment Strategies

1West Finance employs a disciplined and diversified investment approach designed to meet the unique financial goals and risk tolerance of each client. The firm prioritizes long-term value creation through a combination of strategic asset allocation, rigorous security selection, and proactive portfolio management. This approach is rooted in a commitment to understanding market dynamics and adapting to changing economic conditions while maintaining a focus on sustainable growth.

Managing Investments

1West Finance’s approach to managing investments centers on several key principles. The firm begins by thoroughly assessing a client’s financial situation, including their goals, time horizon, and risk tolerance. This information informs the development of a customized investment strategy tailored to the client’s specific needs. The strategy then guides the selection of appropriate investment vehicles and the ongoing management of the portfolio.

1West Finance emphasizes a long-term investment horizon, believing that this approach is more likely to generate consistent returns over time. The firm actively monitors market conditions and makes adjustments to the portfolio as needed, but avoids frequent trading and market timing strategies. A core tenet of the firm’s philosophy is diversification, which helps to mitigate risk by spreading investments across a range of asset classes and sectors.

Investment Vehicles

Clients of 1West Finance have access to a diverse range of investment vehicles designed to meet various financial objectives. The availability of these options allows for the construction of portfolios that align with individual risk profiles and investment horizons.

- Stocks: Investments in individual company shares or diversified stock funds, providing potential for high growth. Examples include shares of companies listed on the New York Stock Exchange (NYSE) or the NASDAQ.

- Bonds: Investments in debt securities issued by governments or corporations, offering relatively stable income and capital preservation. Examples include U.S. Treasury bonds or corporate bonds issued by reputable companies.

- Mutual Funds: Professionally managed investment funds that pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other assets. Examples include index funds tracking the S&P 500 or actively managed bond funds.

- Exchange-Traded Funds (ETFs): Similar to mutual funds, ETFs trade on stock exchanges and offer a cost-effective way to gain exposure to a specific market segment or asset class. Examples include ETFs tracking the performance of the technology sector or the real estate market.

- Real Estate: Direct investments in real estate properties or through Real Estate Investment Trusts (REITs), providing potential for rental income and capital appreciation. Examples include commercial properties, residential buildings, or REITs specializing in healthcare facilities.

- Alternative Investments: Investments in assets outside of traditional stocks and bonds, such as private equity, hedge funds, or commodities, offering potential for diversification and higher returns. Examples include investments in venture capital funds or commodity futures.

Risk Assessment Process

1West Finance employs a rigorous risk assessment process to ensure that investments align with each client’s risk tolerance. This process involves a detailed evaluation of various factors to understand the potential risks and rewards associated with each investment. This approach helps in constructing portfolios that are appropriate for each client’s circumstances.

- Risk Profiling: The process begins with a comprehensive risk profiling questionnaire to determine the client’s risk tolerance, investment goals, and time horizon. This assessment helps to classify the client’s risk profile as conservative, moderate, or aggressive.

- Asset Allocation: Based on the client’s risk profile, 1West Finance develops an asset allocation strategy that specifies the proportion of the portfolio to be invested in different asset classes, such as stocks, bonds, and real estate. The allocation is designed to balance risk and return based on the client’s objectives.

- Security Selection: 1West Finance conducts in-depth research and analysis to select individual securities that align with the overall investment strategy. This includes evaluating the financial health of companies, the economic outlook, and the valuation of assets.

- Portfolio Monitoring: The firm continuously monitors the portfolio’s performance and makes adjustments as needed to maintain the desired asset allocation and manage risk. This includes regular reviews of market conditions and the performance of individual investments.

- Stress Testing: 1West Finance employs stress testing techniques to evaluate how the portfolio would perform under various adverse market scenarios, such as economic recessions or interest rate hikes. This helps to identify potential vulnerabilities and implement risk mitigation strategies.

Loan Products and Terms at 1West Finance

1West Finance understands that access to financial resources is crucial for individuals and businesses alike. Therefore, we offer a diverse range of loan products designed to meet various financial needs, each with its own specific terms, interest rates, and repayment schedules. This section provides a comprehensive overview of the loan products available at 1West Finance, along with detailed information on their associated terms.

Types of Loans Available

1West Finance offers a comprehensive suite of loan products catering to both personal and business needs. These loans are designed to provide financial flexibility and support a wide range of goals, from homeownership to business expansion.

- Mortgages: For individuals seeking to purchase or refinance residential properties. We offer various mortgage options, including fixed-rate mortgages, adjustable-rate mortgages (ARMs), and government-backed loans.

- Personal Loans: Unsecured loans for various personal expenses such as debt consolidation, home improvements, or unexpected expenses. These loans typically offer fixed interest rates and flexible repayment terms.

- Business Loans: Tailored for businesses of all sizes, including term loans, lines of credit, and equipment financing. These loans are designed to support business growth, working capital needs, and equipment purchases.

Interest Rates, Fees, and Repayment Terms

The terms of a loan at 1West Finance are dependent on the type of loan, the borrower’s creditworthiness, and prevailing market conditions. We strive to provide transparent and competitive terms to ensure our clients understand the financial implications of their borrowing decisions.

1west finance – Interest rates are influenced by factors such as the prime rate, the borrower’s credit score, and the loan’s risk profile. Fees may include origination fees, appraisal fees, and closing costs, which vary depending on the loan type and amount. Repayment terms also vary based on the loan product, ranging from a few months for personal loans to several years for mortgages and business loans.

Here’s a table summarizing the general terms for each loan type. Please note that these are examples, and actual terms may vary.

1West Finance, a player in the financial sector, often finds itself in discussions about innovative funding models. Interestingly, the strategies employed by companies like social finance inc boston offer compelling insights into alternative investment approaches. These insights can inform and potentially influence the strategic direction of 1West Finance as it navigates the evolving financial landscape.

| Loan Type | Interest Rate (Example) | Fees (Example) | Repayment Term (Example) |

|---|---|---|---|

| Mortgage (Fixed-Rate) | 4.5% – 6.5% (APR) | Origination Fee: 1% of loan amount, Appraisal Fee: $500 | 15, 20, or 30 years |

| Personal Loan (Unsecured) | 7% – 15% (APR) | Origination Fee: None, Late Payment Fee: $35 | 1 to 5 years |

| Business Term Loan | 6% – 12% (APR) | Origination Fee: 1.5% of loan amount | 3 to 7 years |

Disclaimer: APR = Annual Percentage Rate. The rates and fees presented are examples and may vary based on individual circumstances and market conditions.

1West Finance, a key player in the financial landscape, often considers strategies for growth. A significant element of this involves securing capital for expansion, a process closely tied to expansion financing. Understanding this funding is critical for 1West Finance to achieve its strategic objectives and maintain a competitive edge in the market, ensuring sustainable growth and profitability.

Step-by-Step Guide to Applying for a Loan

Applying for a loan with 1West Finance is a straightforward process designed to be as convenient as possible. We provide support and guidance throughout the application journey, ensuring that our clients have all the information they need to make informed decisions.

- Pre-qualification: The initial step involves a pre-qualification process. This allows potential borrowers to get a preliminary estimate of how much they might be eligible to borrow. This can often be done online and provides a general overview of the loan terms they might qualify for.

- Application Submission: Once pre-qualified, the borrower can formally apply for the loan. This involves completing an application form and providing necessary documentation. Documentation typically includes proof of income, employment verification, and financial statements.

- Underwriting and Approval: The application undergoes underwriting, where the lender assesses the borrower’s creditworthiness, financial stability, and ability to repay the loan. This process includes a credit check and a review of the provided documentation. If approved, the lender will issue a loan commitment.

- Loan Closing: After approval, the loan closing process begins. This involves signing the loan documents and finalizing the loan terms. For mortgages, this often involves a closing day where all parties involved sign the final paperwork. The loan funds are then disbursed to the borrower.

Example: John wants to buy a house and applies for a mortgage with 1West Finance. He first gets pre-qualified online, providing basic financial information. Then, he submits a formal application, including his tax returns and pay stubs. After underwriting, his mortgage is approved, and he attends the closing to finalize the loan. John now owns his new home.

Insurance Offerings from 1West Finance

1West Finance understands that securing your financial well-being goes beyond investments and loans. We recognize the critical role insurance plays in protecting your assets and loved ones from unforeseen circumstances. That’s why we offer a range of insurance products designed to provide comprehensive coverage and peace of mind. Our insurance solutions are tailored to meet the diverse needs of our clients, ensuring they are adequately protected against various risks.

Types of Insurance Products Offered

1West Finance provides a selection of insurance products to safeguard your financial future. We offer a range of options, carefully selected to address common financial vulnerabilities and offer clients a safety net against life’s uncertainties. These products are designed to be adaptable to individual needs and circumstances.

- Life Insurance: This type of insurance provides a financial safety net for your beneficiaries in the event of your death. It can help cover expenses such as funeral costs, outstanding debts, and future living expenses for your dependents. We offer various life insurance policies, including term life, whole life, and universal life, each with different features and benefits to suit your specific needs.

- Health Insurance: Health insurance helps cover medical expenses, providing access to quality healthcare services without the burden of exorbitant costs. Our health insurance plans offer comprehensive coverage for doctor visits, hospital stays, prescription medications, and other medical treatments. We aim to offer various plans to meet different budgets and healthcare needs.

- Property Insurance: Property insurance protects your valuable assets, such as your home, against damage or loss due to covered perils like fire, theft, or natural disasters. This insurance can cover the cost of repairs, replacement, or reconstruction, helping you recover financially from unexpected events. We offer policies for homeowners, renters, and commercial property owners.

Coverage Options and Policy Features

Our insurance policies are designed with flexibility in mind, allowing you to tailor your coverage to your specific needs and budget. We provide various coverage options and policy features to ensure you receive the protection you need.

- Life Insurance Coverage Options:

- Term Life Insurance: Offers coverage for a specific period (term), providing affordable protection with fixed premiums. For example, a 20-year term life policy can provide a death benefit if the insured dies within the 20-year period.

- Whole Life Insurance: Provides lifelong coverage and includes a cash value component that grows over time. This cash value can be borrowed against or withdrawn, offering an additional financial benefit.

- Universal Life Insurance: Offers flexibility in premium payments and death benefit amounts, allowing policyholders to adjust their coverage and premiums based on their changing needs.

- Health Insurance Coverage Options:

- Comprehensive Plans: Cover a wide range of medical services, including doctor visits, hospital stays, and prescription medications. These plans typically have higher premiums but offer more extensive coverage.

- High-Deductible Health Plans (HDHPs): Offer lower premiums but require you to pay a higher deductible before insurance coverage begins. These plans are often paired with a health savings account (HSA) to help cover healthcare expenses.

- Preferred Provider Organization (PPO) Plans: Allow you to see any doctor or specialist without a referral, but offer lower costs when using in-network providers.

- Property Insurance Coverage Options:

- Homeowners Insurance: Protects your home and personal belongings against damage or loss from covered perils, such as fire, theft, and certain natural disasters.

- Renters Insurance: Covers your personal belongings and provides liability protection if you rent your home.

- Commercial Property Insurance: Protects your business property, including buildings, equipment, and inventory, from damage or loss.

- Policy Features:

- Guaranteed Renewable: Ensures your policy can be renewed each year, regardless of your health or other factors.

- Cash Value Accumulation: For whole life and universal life policies, allows the cash value to grow over time, providing a source of funds for future needs.

- Coverage for Pre-existing Conditions: Some health insurance plans may offer coverage for pre-existing conditions, ensuring you can access necessary medical care.

- Liability Protection: Property insurance policies include liability coverage, protecting you from financial losses if someone is injured on your property.

Comparison of Insurance Plans

The following table provides a comparison of different insurance plans offered by 1West Finance, highlighting key features and benefits to help you make informed decisions.

| Insurance Plan | Coverage Type | Key Features | Ideal For |

|---|---|---|---|

| Term Life Insurance | Life | Affordable premiums, fixed term, death benefit only | Individuals seeking affordable life insurance for a specific period, such as covering a mortgage or providing for children’s education. |

| Whole Life Insurance | Life | Lifelong coverage, cash value accumulation, fixed premiums | Individuals seeking permanent life insurance with a cash value component for long-term financial goals and estate planning. |

| Comprehensive Health Plan | Health | Extensive coverage for medical services, including doctor visits, hospital stays, and prescription medications | Individuals and families seeking comprehensive healthcare coverage with access to a wide range of medical services. |

| Homeowners Insurance | Property | Protects your home and personal belongings against damage or loss from covered perils, liability coverage | Homeowners seeking to protect their property and assets from various risks, including fire, theft, and natural disasters. |

Customer Service and Support at 1West Finance

At 1West Finance, providing excellent customer service and support is a top priority. We understand that navigating financial products and services can sometimes be complex, and we are committed to ensuring that our clients receive the assistance they need, whenever they need it. Our dedicated customer support team is available through various channels to address inquiries, resolve issues, and guide clients through their financial journey.

Channels for Customer Support

1West Finance offers multiple channels for customer support to accommodate diverse preferences and needs. This multi-channel approach ensures that clients can easily connect with us and receive timely assistance.

- Phone Support: Clients can reach our customer service representatives by calling our toll-free number. This provides immediate access to assistance for urgent matters and detailed inquiries. Our phone support is staffed by knowledgeable professionals ready to address a wide range of financial questions.

- Email Support: Clients can submit inquiries and requests via email. This channel is ideal for providing detailed information and attaching supporting documents. We strive to respond to all email inquiries promptly and thoroughly.

- Online Chat: For quick and convenient assistance, clients can utilize our online chat feature available on our website. This allows for real-time conversations with a customer service representative, offering immediate answers to common questions and guidance.

- Physical Branch Visits: Clients can visit our physical branches during business hours. This option allows for face-to-face interactions, personalized consultations, and direct assistance with account management and other financial services.

Customer Service Hours and Contact Information

We are committed to providing readily accessible customer service. Our operating hours and contact details are designed to ensure clients can reach us when they need assistance.

- Phone Support: Available Monday through Friday, from 9:00 AM to 6:00 PM (EST). Toll-free number: 1-800-1WEST (1-800-193-78).

- Email Support: Available 24/7. Email address: [email protected].

- Online Chat: Available Monday through Friday, from 9:00 AM to 6:00 PM (EST).

- Physical Branch Visits: Branch hours vary. Please refer to our website or call our toll-free number for specific branch hours and locations.

Process for Resolving Customer Complaints

1West Finance is dedicated to addressing and resolving customer complaints efficiently and fairly. We have established a clear process to ensure that all complaints are handled with the utmost care and attention.

- Complaint Submission: Customers can submit complaints through any of our customer support channels (phone, email, online chat, or in-person at a branch). It is essential to provide detailed information, including the nature of the complaint, relevant account details, and any supporting documentation.

- Complaint Acknowledgment: Upon receiving a complaint, we will acknowledge its receipt within one business day. This acknowledgment will include a reference number for tracking the complaint and a general timeline for resolution.

- Investigation: Our customer service team will thoroughly investigate the complaint. This may involve reviewing account records, communication logs, and other relevant information. We may also contact the client for further clarification or additional information.

- Resolution and Communication: We will strive to resolve the complaint as quickly as possible. Once the investigation is complete, we will communicate the resolution to the client. This communication may include an explanation of the findings, any actions taken to resolve the issue, and details of any compensation or adjustments, if applicable.

- Escalation Process: If a client is not satisfied with the initial resolution, they can escalate the complaint to a supervisor or manager. Further review will be conducted, and a final decision will be communicated to the client.

We are committed to adhering to all applicable regulations and guidelines regarding customer complaints. Our process is designed to ensure fair and transparent resolution of all customer concerns.

Technology and Innovation at 1West Finance

1West Finance leverages technology to streamline operations, enhance customer experiences, and provide innovative financial solutions. The company’s commitment to technological advancements is evident in its digital platforms and the integration of modern tools to improve efficiency and accessibility for its clients. This section details the technological infrastructure and its impact on 1West Finance’s service delivery.

Use of Technology to Enhance Services

1West Finance integrates technology across various aspects of its operations, aiming to deliver faster, more efficient, and more personalized services. These advancements encompass automated processes, data analytics, and secure communication channels. The company’s technological infrastructure is designed to support a seamless and user-friendly experience.

- Automated Loan Processing: Technology automates significant portions of the loan application process. This includes initial application screening, credit scoring, and document verification. This automation accelerates loan approvals and reduces manual errors.

- Data Analytics for Personalized Financial Advice: 1West Finance utilizes data analytics to understand customer financial behavior and needs. This allows for personalized financial advice, tailored product recommendations, and proactive support.

- Enhanced Security Measures: Cybersecurity is a top priority. The company employs advanced encryption, multi-factor authentication, and regular security audits to protect customer data and financial transactions.

- Integration of AI-Powered Chatbots: 1West Finance utilizes AI-powered chatbots on its website and mobile app to provide instant customer support, answer frequently asked questions, and guide users through various processes.

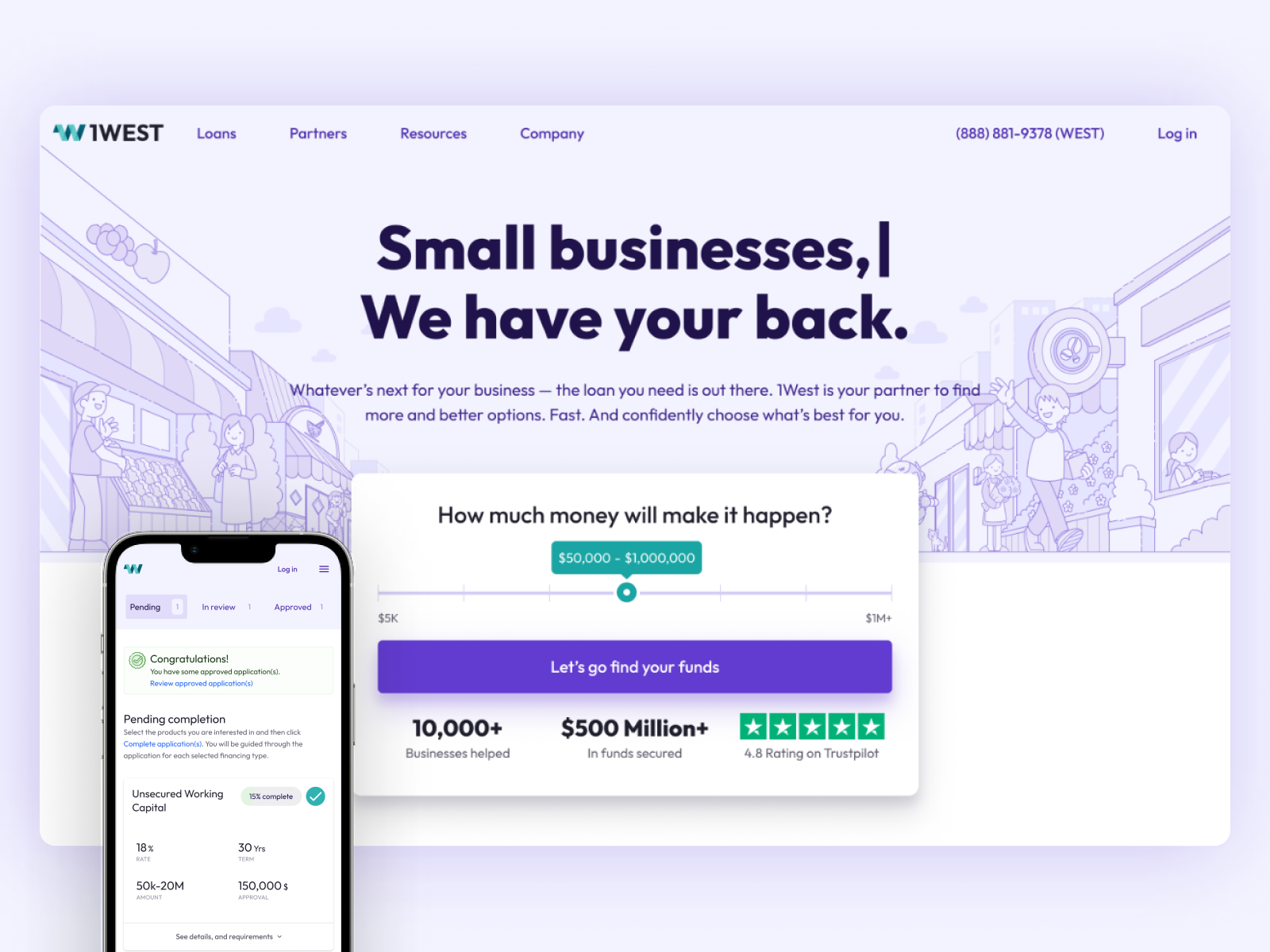

Online Platforms and Mobile Apps

1West Finance offers both an online platform and a mobile app, providing customers with convenient access to their accounts and services. These digital tools are designed to be user-friendly and accessible from various devices. The platforms support a wide range of features, including account management, transaction history review, and application for new products.

- Online Platform: The online platform is accessible via web browsers and offers a comprehensive suite of features, including account management, investment tracking, and loan applications. It is designed to be intuitive and easy to navigate.

- Mobile App: The mobile app, available for both iOS and Android devices, provides a streamlined experience for customers on the go. It allows users to manage their accounts, make payments, and access financial information from anywhere.

- Accessibility Features: Both platforms are designed with accessibility in mind, adhering to industry standards to ensure usability for individuals with disabilities.

User Interface of the Online Platform

The online platform’s user interface is designed with a focus on simplicity, clarity, and ease of navigation. Key features are prominently displayed, allowing users to quickly access the information and services they need. The layout emphasizes user experience, ensuring a smooth and efficient interaction with the platform.

The homepage provides a clear overview of the user’s financial portfolio. Key features include:

- Dashboard: The dashboard provides a snapshot of the user’s accounts, including account balances, recent transactions, and any outstanding loan information.

- Navigation Menu: A clearly labeled navigation menu allows users to easily access different sections of the platform, such as “Accounts,” “Loans,” “Investments,” and “Support.”

- Account Summary: The “Accounts” section provides detailed information about each account, including transaction history, statements, and account settings.

- Investment Portfolio: The “Investments” section displays the user’s investment portfolio, including asset allocation, performance charts, and market updates.

- Loan Management: The “Loans” section allows users to view their loan details, make payments, and track their loan progress.

- Secure Messaging: A secure messaging system allows users to communicate with customer support and financial advisors.

1West Finance’s Compliance and Regulatory Framework

1West Finance operates within a robust framework of compliance and regulation designed to protect its customers and maintain the integrity of the financial system. The company prioritizes adherence to all applicable laws and regulations, ensuring transparency and ethical conduct in all its operations. This commitment is fundamental to building and maintaining trust with clients and stakeholders.

Adherence to Financial Regulations

1West Finance meticulously adheres to a wide range of financial regulations, demonstrating its commitment to responsible financial practices. Compliance is a continuous process, involving ongoing monitoring and adaptation to evolving regulatory landscapes.

- Anti-Money Laundering (AML) and Know Your Customer (KYC) Regulations: 1West Finance rigorously implements AML and KYC procedures to prevent financial crimes. This includes verifying customer identities, monitoring transactions, and reporting suspicious activities to the relevant authorities. These measures are crucial for preventing money laundering and terrorist financing.

- Data Privacy Regulations: The company complies with data privacy regulations such as GDPR and CCPA, protecting customer data and ensuring responsible data handling practices. This includes obtaining consent for data collection, providing data access and deletion options, and implementing data security measures.

- Consumer Protection Laws: 1West Finance adheres to consumer protection laws to ensure fair and transparent practices. This involves providing clear and concise information about products and services, avoiding deceptive practices, and addressing customer complaints promptly and effectively.

- Financial Reporting Standards: The company complies with financial reporting standards, such as those set by the Financial Accounting Standards Board (FASB) or the International Accounting Standards Board (IASB), to ensure accurate and transparent financial reporting. This allows stakeholders to make informed decisions based on reliable financial data.

Security Measures for Customer Data Protection

Protecting customer data is a paramount concern for 1West Finance. The company employs a multi-layered approach to security, utilizing advanced technologies and robust protocols to safeguard sensitive information.

- Encryption: 1West Finance uses strong encryption protocols, such as AES-256, to protect customer data both in transit and at rest. This ensures that even if data is intercepted, it remains unreadable without the appropriate decryption key.

- Firewalls and Intrusion Detection Systems: The company utilizes firewalls and intrusion detection systems to monitor and control network traffic, preventing unauthorized access to its systems. These systems constantly scan for suspicious activity and block potential threats.

- Regular Security Audits and Penetration Testing: 1West Finance conducts regular security audits and penetration testing to identify and address vulnerabilities in its systems. These audits are performed by independent third-party security experts to ensure objectivity and thoroughness.

- Access Controls: Strict access controls are in place to limit access to sensitive customer data to authorized personnel only. This includes the use of multi-factor authentication, role-based access control, and regular access reviews.

- Employee Training: Employees receive comprehensive training on data security best practices, including phishing awareness, password security, and data handling procedures. This helps to create a security-conscious culture within the organization.

Privacy Policy and Customer Information Handling

1West Finance’s privacy policy details how customer information is collected, used, and protected. The company is committed to transparency and provides customers with clear and accessible information about its data handling practices.

- Data Collection: The privacy policy Artikels the types of data collected, including personal information, financial information, and usage data. The company collects data only for specified, legitimate purposes and with the customer’s consent where required.

- Data Usage: The privacy policy explains how customer data is used, including providing services, personalizing experiences, and improving products. The company uses data responsibly and does not share it with third parties for marketing purposes without explicit consent.

- Data Sharing: The privacy policy details circumstances under which customer data may be shared with third parties, such as service providers or regulatory authorities. Data sharing is always conducted in compliance with applicable laws and regulations.

- Data Retention: The privacy policy specifies the data retention periods, ensuring that data is kept only as long as necessary for the purposes for which it was collected. The company has established data disposal procedures to securely delete data when it is no longer needed.

- Customer Rights: The privacy policy informs customers about their rights regarding their data, including the right to access, correct, and delete their personal information. 1West Finance provides clear instructions on how customers can exercise these rights.

Competitive Landscape for 1West Finance

Understanding the competitive landscape is crucial for 1West Finance’s success. This section analyzes the key players in the financial industry, highlights 1West Finance’s unique strengths, and addresses the challenges and trends shaping the market. A thorough analysis enables 1West Finance to refine its strategies, optimize its offerings, and maintain a competitive edge.

Comparison with Main Competitors

The financial services market is highly competitive, with numerous players vying for market share. 1West Finance faces competition from both traditional financial institutions and newer fintech companies. A comparative analysis highlights the key differences.

- Traditional Banks: Large established banks like Bank of America, JPMorgan Chase, and Wells Fargo offer a wide array of services, including loans, investments, and insurance. Their advantages include brand recognition, extensive branch networks, and a large customer base. However, they can be slower to adapt to technological advancements and may have higher fees.

- Online Banks: Fintech companies such as Chime, Ally Bank, and SoFi offer digital-first banking experiences with competitive interest rates, lower fees, and user-friendly interfaces. Their agility and focus on technology allow them to quickly introduce new products and services. However, they may lack the physical presence and established trust of traditional banks.

- Credit Unions: Credit unions, like Navy Federal Credit Union and State Employees’ Credit Union, are member-owned financial cooperatives. They often offer competitive rates and personalized service. However, their membership eligibility requirements may limit their customer base.

- Specialized Fintech Companies: Companies like LendingClub (peer-to-peer lending), Robinhood (commission-free trading), and Betterment (robo-advising) focus on specific financial products or services. They often offer innovative solutions and target niche markets. Their limited scope, however, may restrict their ability to provide comprehensive financial solutions.

Unique Selling Propositions (USPs) of 1West Finance

1West Finance differentiates itself from competitors through a combination of factors that provide unique value to its customers. These USPs are critical for attracting and retaining customers.

- Personalized Financial Planning: 1West Finance emphasizes personalized financial planning services tailored to individual client needs. This includes comprehensive financial assessments, customized investment strategies, and ongoing support to help clients achieve their financial goals.

- Transparent Fee Structure: Unlike some competitors with complex fee structures, 1West Finance is committed to transparency. Clients are fully informed about all fees and charges, building trust and fostering long-term relationships.

- Cutting-Edge Technology: 1West Finance leverages advanced technology to provide a seamless and user-friendly experience. This includes a robust online platform, mobile applications, and data analytics tools to optimize investment strategies and improve customer service. For example, 1West Finance uses AI-powered tools to analyze market trends and personalize financial advice.

- Community Focus: 1West Finance actively engages with the local community through financial literacy programs, charitable initiatives, and partnerships with local organizations. This commitment to social responsibility enhances its brand reputation and strengthens customer loyalty.

Industry Trends and Challenges

The financial services industry is constantly evolving, presenting both opportunities and challenges for 1West Finance. Understanding these trends is essential for strategic planning and long-term success.

Industry Trends:

- Digital Transformation: Increased adoption of digital platforms and mobile applications is driving the need for enhanced online services and user experiences.

- Data Analytics: The use of data analytics and AI is transforming financial decision-making, enabling personalized services and improved risk management.

- Regulatory Compliance: Stricter regulations, such as those related to data privacy and cybersecurity, require ongoing compliance efforts.

- Sustainability and ESG Investing: Growing interest in environmental, social, and governance (ESG) factors is influencing investment decisions and product development.

Challenges:

- Competition: Intense competition from both traditional and fintech companies requires continuous innovation and differentiation.

- Cybersecurity Risks: The increasing sophistication of cyber threats necessitates robust security measures to protect customer data.

- Economic Uncertainty: Fluctuations in the economy and market volatility can impact investment performance and customer confidence.

- Changing Customer Expectations: Evolving customer preferences and demands for personalized services require ongoing adaptation and innovation.

Financial Performance and Stability of 1West Finance

Understanding the financial health of 1West Finance is crucial for investors, clients, and stakeholders. This section delves into key financial metrics, stability indicators, and the accessibility of financial reports to provide a comprehensive overview of the company’s fiscal standing. A strong financial foundation is paramount for sustained growth and the ability to meet obligations.

Key Financial Metrics and Performance Indicators

Evaluating 1West Finance’s performance requires examining several key financial metrics. These indicators offer insights into the company’s profitability, efficiency, and overall financial health.

- Revenue: Total income generated from providing financial products and services, including interest earned on loans, fees from investment management, and insurance premiums. Revenue growth indicates the company’s ability to attract and retain customers. For example, an increase in loan origination volume would directly impact revenue.

- Net Income: Profit after all expenses, including operating costs, interest, and taxes, have been deducted from revenue. Net income is a primary measure of profitability and is often expressed as earnings per share (EPS).

- Assets Under Management (AUM): The total market value of assets that 1West Finance manages on behalf of its clients, primarily in the investment management segment. A growing AUM reflects the company’s ability to attract and retain investment clients and generate investment returns.

- Return on Equity (ROE): A measure of how effectively the company uses shareholder investments to generate profit. It is calculated as net income divided by shareholder equity. A higher ROE generally indicates better financial performance.

- Loan Portfolio Quality: The percentage of loans that are performing (current on payments), past due, or in default. Loan portfolio quality is assessed by analyzing the non-performing loan (NPL) ratio. A lower NPL ratio indicates a healthier loan portfolio and lower credit risk.

- Efficiency Ratio: A measure of how efficiently the company operates, calculated as operating expenses divided by revenue. A lower efficiency ratio indicates that the company is managing its costs effectively.

Company’s Financial Stability and Credit Rating

Financial stability is a critical factor in assessing the long-term viability of 1West Finance. This involves evaluating its capital adequacy, liquidity, and access to funding.

- Capital Adequacy: The ability of 1West Finance to meet its financial obligations. This is often measured by the capital adequacy ratio (CAR), which compares a bank’s capital to its risk-weighted assets. A higher CAR indicates a stronger financial position. For example, the CAR can be calculated using the following formula:

CAR = (Tier 1 Capital + Tier 2 Capital) / Risk-Weighted Assets

- Liquidity: The company’s ability to meet short-term obligations. This is often assessed by looking at the company’s liquid assets (cash and equivalents) and its access to short-term funding.

- Credit Rating: A credit rating from a reputable agency, such as Moody’s, Standard & Poor’s, or Fitch Ratings, provides an independent assessment of the company’s creditworthiness. A higher credit rating indicates a lower risk of default. If 1West Finance is rated, the rating and its outlook (e.g., stable, positive, negative) are important indicators of its financial stability.

- Debt-to-Equity Ratio: A measure of the company’s leverage, calculated as total debt divided by shareholder equity. A lower debt-to-equity ratio indicates a lower level of financial risk.

Overview of the Company’s Financial Reports and Their Accessibility

Transparency in financial reporting is vital for building trust and providing stakeholders with the information they need to make informed decisions. This section covers the types of financial reports 1West Finance provides and how they are made available.

- Annual Reports: Comprehensive reports that include audited financial statements (balance sheet, income statement, cash flow statement), management’s discussion and analysis (MD&A), and other relevant information. These reports provide a detailed overview of the company’s performance and financial position for the fiscal year.

- Quarterly Reports: Shorter reports that provide an update on the company’s financial performance for each quarter. They typically include unaudited financial statements and key performance indicators.

- Accessibility: 1West Finance should make its financial reports accessible through its website, investor relations section, and/or through filings with relevant regulatory bodies (e.g., the Securities and Exchange Commission in the United States). The reports should be easily downloadable and searchable.

- Investor Relations: A dedicated investor relations team or department is often responsible for communicating with investors and analysts, answering questions about the company’s financial performance, and providing updates on key developments.