Understanding Crypto-to-Cash Conversion Methods

How to turn crypto into cash – Converting cryptocurrency into fiat currency involves several methods, each with its own advantages and disadvantages regarding fees, speed, and security. Understanding these differences is crucial for making informed decisions.

Crypto-to-Cash Conversion Methods: A Comparison

The primary methods for converting cryptocurrency to fiat currency include using cryptocurrency exchanges, peer-to-peer (P2P) trading platforms, cryptocurrency ATMs, and cryptocurrency debit cards. Each method offers a unique balance of speed, cost, and security.

| Method | Fees | Processing Time | Security |

|---|---|---|---|

| Cryptocurrency Exchanges | Variable, depending on the exchange and trading volume; typically ranges from 0.1% to 1% per transaction. | Minutes to several days, depending on the verification process and withdrawal method. | Generally high, but vulnerable to hacking and user error. Security measures like two-factor authentication are crucial. |

| Peer-to-Peer (P2P) Platforms | Variable, often negotiated between buyer and seller; may include platform fees. | Highly variable, depending on the payment method and responsiveness of the counterparty; can range from minutes to several days. | Moderately high; security depends on the platform’s security measures and the user’s due diligence in selecting a trustworthy counterparty. |

| Cryptocurrency ATMs | High, typically ranging from 5% to 20% of the transaction value. | Immediate. | Low to moderate; susceptible to theft and technical malfunctions. Location matters, choose well-lit and secure ATMs. |

| Cryptocurrency Debit Cards | Variable; may include transaction fees, monthly fees, and potentially high exchange rates. | Instant for most transactions. | Moderate; security depends on the card provider and the user’s adherence to secure banking practices. |

Using Cryptocurrency Exchanges

Cryptocurrency exchanges are online platforms where users can buy, sell, and trade cryptocurrencies. They provide a relatively straightforward method for converting crypto to cash, but require careful attention to security.

Selling Cryptocurrency on an Exchange: A Step-by-Step Guide

- Create an account and complete identity verification.

- Link a bank account or other payment method.

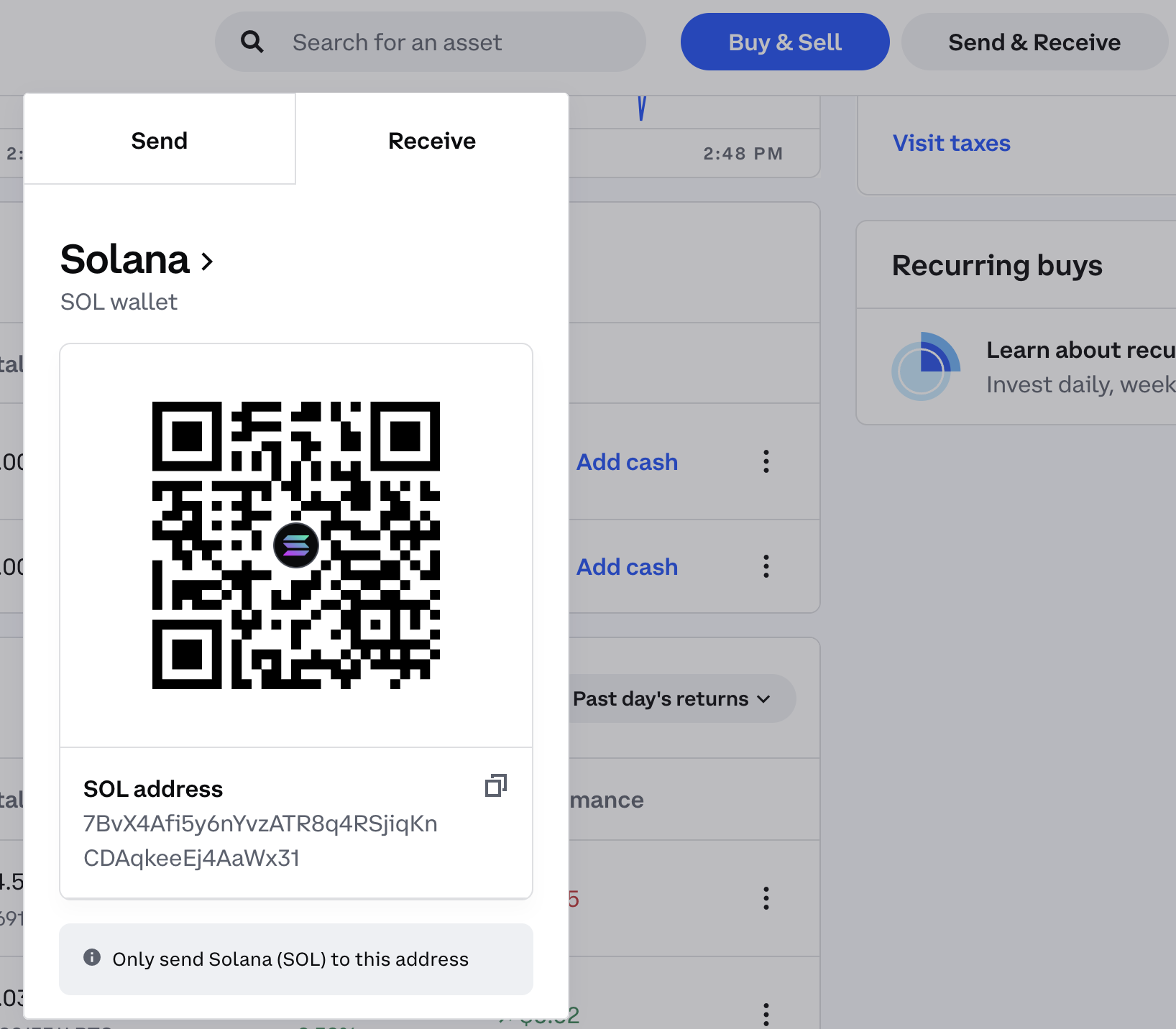

- Deposit your cryptocurrency into your exchange wallet.

- Place a sell order at your desired price.

- Once the order is filled, withdraw your fiat currency to your linked bank account.

Exchange Account Security Best Practices

- Use strong, unique passwords.

- Enable two-factor authentication (2FA).

- Regularly review account activity for unauthorized transactions.

- Be cautious of phishing scams and suspicious emails.

- Use a reputable exchange with strong security measures.

Peer-to-Peer (P2P) Trading Platforms: How To Turn Crypto Into Cash

P2P platforms connect buyers and sellers directly, allowing for more personalized transactions. However, they carry inherent risks requiring careful consideration.

Reputable P2P Platforms and Their Features

Examples of reputable P2P platforms include LocalBitcoins and Paxful. Features often include escrow services to protect both buyers and sellers, various payment methods, and user ratings and reviews.

P2P Transaction Flowchart

A typical P2P transaction involves: Buyer initiates a trade request -> Seller accepts the request -> Buyer and Seller agree on terms (price, payment method) -> Buyer releases payment through the platform’s escrow service -> Seller releases cryptocurrency -> Transaction complete.

Mitigating Risks in P2P Trading

- Use escrow services whenever possible.

- Thoroughly vet potential trading partners.

- Communicate clearly and professionally.

- Report suspicious activity to the platform.

Utilizing ATMs and Debit Cards

Cryptocurrency ATMs and debit cards offer convenient, albeit sometimes costly, ways to convert crypto to cash. Understanding their limitations is essential.

Cryptocurrency ATMs and Debit Cards: A Comparison, How to turn crypto into cash

ATMs provide immediate cash access but usually incur higher fees. Debit cards offer broader acceptance but may have monthly fees and less favorable exchange rates. The choice depends on individual needs and priorities.

Factors to Consider When Choosing a Crypto ATM or Debit Card Provider

- Fees and exchange rates.

- Geographic availability of ATMs.

- Security measures employed by the provider.

- Customer support and reputation.

Tax Implications of Crypto-to-Cash Conversions

Converting cryptocurrency to cash has significant tax implications that vary by jurisdiction. Accurate record-keeping is crucial for compliance.

Capital Gains Tax on Crypto Sales: A Hypothetical Scenario

Suppose you bought 1 Bitcoin for $10,000 and sold it for $20,000. Your capital gain is $10,000, and you’ll likely owe capital gains tax on this profit. The specific tax rate depends on your location and income bracket.

Record-Keeping Best Practices for Tax Purposes

- Maintain detailed records of all cryptocurrency transactions.

- Track the cost basis of each cryptocurrency asset.

- Consult with a tax professional for personalized advice.

Security Best Practices for Crypto-to-Cash Transactions

Security is paramount throughout the crypto-to-cash conversion process. Protecting personal information and avoiding scams are critical.

Verifying the Legitimacy of Cryptocurrency Exchanges and P2P Platforms

- Check for reviews and testimonials from other users.

- Verify the platform’s registration and licensing information.

- Be wary of platforms that promise unrealistically high returns.

Common Security Risks and Mitigation Strategies

- Phishing scams: Avoid clicking on suspicious links or providing personal information via email.

- Exchange hacks: Use strong passwords and enable 2FA.

- P2P scams: Only use escrow services and vet trading partners thoroughly.

Choosing the Right Method Based on Individual Needs

Selecting the optimal method for converting cryptocurrency to cash depends on several factors, including transaction speed, fees, and security preferences.

Decision-Making Flowchart for Choosing a Crypto-to-Cash Conversion Method

Consider the following: High speed needed? Use ATM or Debit Card. Low fees needed? Use Exchange or P2P (depending on volume and security preference). High Security Needed? Use Reputable Exchange with 2FA. Then select the method that best aligns with your priorities.