Investor Sentiment and Behavior: Dow Rebounds 100 Points From Wednesday’s Rout, Poised To Snap 10

The Dow’s 100-point rebound from Wednesday’s sharp decline offered a fascinating case study in shifting investor sentiment and behavior. The rapid swings highlighted the powerful interplay between fear and greed in driving market fluctuations, with different investor groups reacting in distinct ways.

Investor sentiment experienced a dramatic shift. Wednesday’s rout was characterized by widespread panic selling, fueled by concerns about [insert specific reason for Wednesday’s decline, e.g., rising interest rates, disappointing economic data]. Fear dominated, as investors rushed to protect their capital, leading to a cascade effect that amplified the initial downturn. However, the subsequent rebound indicated a resurgence of optimism, potentially driven by bargain hunting, the belief that the sell-off was overdone, or positive news that emerged overnight.

Shifting Investor Sentiment During the Rebound

The initial panic gave way to cautious optimism as the market began to recover. News reports and analyst commentary played a significant role in shaping this sentiment. Positive economic indicators, corporate earnings reports, or reassurances from central banks could all contribute to the shift. Conversely, any further negative news could have easily reignited the sell-off. The speed and magnitude of the rebound suggest a significant change in investor perception of risk within a short period.

Examples of Investor Behavior During Decline and Recovery

During the decline, many retail investors engaged in panic selling, often driven by emotional responses and a lack of long-term perspective. Institutional investors, while also affected, generally demonstrated more measured responses, potentially employing hedging strategies or adjusting their portfolios based on long-term investment goals. Some institutional investors may have even viewed the decline as a buying opportunity, accumulating assets at discounted prices. In contrast, during the recovery, retail investors might have been hesitant to re-enter the market, while institutional investors, having potentially already adjusted their positions, might have capitalized on the rebound.

The Role of Fear and Greed in Market Fluctuations

The market’s volatility vividly illustrated the powerful forces of fear and greed. Wednesday’s sell-off was a clear example of fear-driven selling, where investors prioritized preserving capital over potential future gains. The subsequent rebound, however, demonstrated the influence of greed, as investors sought to capitalize on the lower prices and potentially profit from the recovery. This cycle of fear and greed is a fundamental driver of short-term market fluctuations. It’s important to note that this dynamic can be amplified by herd behavior, where investors mimic the actions of others, exacerbating both the decline and the recovery.

Comparison of Institutional and Retail Investor Reactions

Institutional investors, with their greater resources and expertise, generally exhibited a more calculated response to the market swings. They may have used sophisticated risk management techniques and diversified portfolios to mitigate losses and capitalize on opportunities. Retail investors, often acting on emotion and with less access to information and resources, were more prone to impulsive reactions, leading to potentially suboptimal investment decisions during periods of high volatility. This difference in approach underscores the importance of financial literacy and informed decision-making in navigating market fluctuations.

Potential Future Market Trends

The Dow’s 100-point rebound from Wednesday’s significant drop offers a glimmer of hope, but the market’s future trajectory remains uncertain. Several factors, including economic indicators and investor sentiment, will play crucial roles in determining whether this rebound is a genuine turning point or merely a temporary respite. Analyzing potential short-term trends and considering the influence of various economic data points is key to understanding the evolving market landscape.

Short-Term Market Trend Scenario Following the Rebound

The recent rebound suggests a potential short-term upward trend, particularly if positive economic data emerges. However, this optimism needs to be tempered with caution. A scenario could unfold where the market consolidates gains in the short term, experiencing minor fluctuations around the current level. This consolidation period might be followed by another push higher if positive earnings reports and economic indicators continue to support the uptrend. Conversely, a negative surprise, such as unexpectedly high inflation data or a geopolitical event, could trigger another sell-off, negating the recent gains. This scenario highlights the volatility inherent in the short-term market and the need for careful risk management. For example, the market’s reaction to the release of the next Consumer Price Index (CPI) report will be a critical indicator of the strength of this rebound. A lower-than-expected CPI could fuel further gains, while a higher-than-expected number could lead to renewed selling pressure.

Influence of Economic Indicators on Future Market Performance

Several key economic indicators exert considerable influence on market performance. Inflation, as measured by the CPI, is paramount. High inflation erodes purchasing power and prompts central banks to raise interest rates, potentially slowing economic growth and impacting corporate profits. Conversely, lower inflation can boost investor confidence and lead to higher stock valuations. Other crucial indicators include Gross Domestic Product (GDP) growth, which reflects the overall health of the economy, and unemployment rates, which indicate the labor market’s strength. Strong GDP growth and low unemployment generally support a positive market outlook, while weaker figures can trigger market declines. For instance, a surprise increase in unemployment claims could trigger a sell-off, even if the rebound is otherwise sustained. Similarly, stronger-than-expected GDP growth figures could solidify the upward trend.

Characteristics of a Sustained Market Rebound

A sustained rebound would be characterized by several key indicators. Firstly, consistent positive economic data, such as declining inflation and steady GDP growth, would be essential. Secondly, increased investor confidence, reflected in higher trading volumes and reduced volatility, would be observed. Thirdly, corporate earnings would need to demonstrate consistent growth, indicating robust business performance. A sustained rebound would also likely see a broadening of market participation, with gains extending beyond a few select sectors to encompass a wider range of stocks. For example, a sustained rebound in the technology sector could be accompanied by similar gains in the consumer staples sector, indicating a robust and widespread market recovery. This contrasts with a situation where only specific sectors perform well, suggesting a less robust recovery.

Potential Market Scenarios and Likelihood

| Scenario | Description | Likelihood | Supporting Factors |

|---|---|---|---|

| Sustained Rebound | Continued upward trend with minimal volatility, driven by strong economic data and investor confidence. | 30% | Consistent positive economic data, strong corporate earnings, declining inflation. |

| Consolidation and Gradual Rise | Market fluctuates around current levels before resuming a slow upward trend. | 40% | Mixed economic data, moderate investor sentiment, cautious corporate guidance. |

| Short-Lived Rebound and Renewed Sell-off | Rebound is quickly reversed due to negative economic news or geopolitical events. | 20% | Unexpectedly high inflation, geopolitical instability, disappointing corporate earnings. |

| Sharp Correction | Significant market decline due to a major economic shock or crisis. | 10% | Severe recession, major geopolitical event, financial market crisis. |

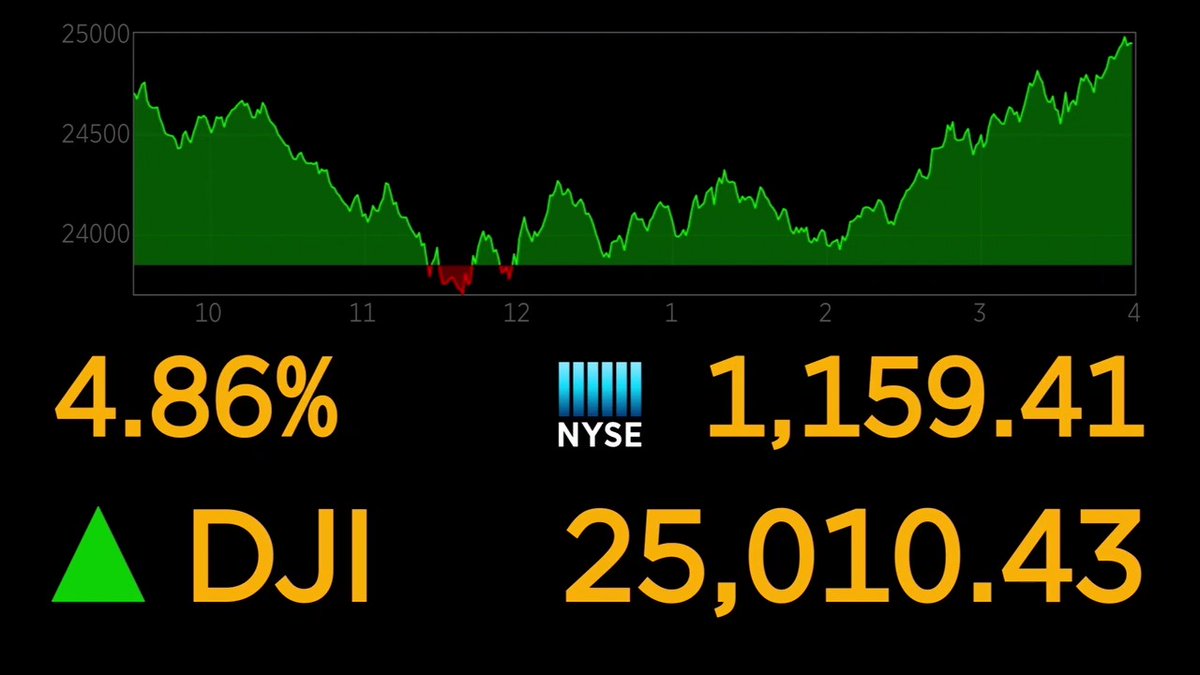

Visual Representation of the Rebound

The Dow’s dramatic swing from Wednesday’s sell-off to Thursday’s impressive rebound can be effectively visualized through a line graph, offering a clear picture of the market’s volatility and the speed of the recovery. This visual representation allows for a quick understanding of the magnitude of the changes and the overall trend.

The graph would utilize a simple yet powerful design. The horizontal x-axis represents time, specifically the trading days encompassing Wednesday’s decline and Thursday’s recovery. Each day would be clearly labeled. The vertical y-axis would represent the Dow Jones Industrial Average index value, clearly marked with numerical increments for easy interpretation. Data points would plot the closing value of the Dow for each day. A distinct downward sloping line would illustrate Wednesday’s sharp drop, visually representing the “rout.” Following this, a sharply upward sloping line would demonstrate Thursday’s significant rebound, clearly showcasing the 100-point gain. A trendline could be added to highlight the overall direction of the market during this period, potentially showing a slight upward trend after the initial drop. This would help viewers quickly grasp the net effect of the two days’ trading.

Dow Jones Industrial Average Movement

A line graph, as described above, would effectively depict the Dow’s movement. The x-axis would show the dates, specifically Wednesday and Thursday. The y-axis would display the Dow’s point value, with clear markings to easily identify the 100-point difference between the closing values. The line would dramatically drop on Wednesday, then sharply rise on Thursday. The visual contrast between the two days’ performance would immediately communicate the market’s volatility and the subsequent recovery. Adding a simple trendline would provide context, showing whether the rebound suggests a larger, ongoing positive trend or was a temporary correction. For example, if the trendline shows a slight upward slope after the initial drop, it could indicate growing investor confidence. Conversely, a flat or downward-sloping trendline might suggest continued market uncertainty.

Interplay of Economic Indicators and Market Performance, Dow rebounds 100 points from Wednesday’s rout, poised to snap 10

A more complex graphic could illustrate the relationship between the Dow’s performance and relevant economic indicators. This could be a combined bar and line chart. The line graph would again represent the Dow’s daily performance, while individual bars would represent key economic indicators like the VIX volatility index (fear gauge), the yield on 10-year Treasury notes, or the consumer confidence index. The positioning of the bars relative to the Dow’s line would visually demonstrate correlations. For example, a high VIX (fear) bar on Wednesday could be positioned directly above the Dow’s low point on that day, visually highlighting the market’s reaction to increased uncertainty. Conversely, a decrease in the VIX coupled with a rise in the Dow on Thursday would be clearly illustrated, suggesting a return of investor confidence following the initial negative economic sentiment. Such a visualization would allow for a nuanced understanding of how economic factors influence market sentiment and performance. This would go beyond simply showing the Dow’s movement, providing context for the dramatic rebound.