Overview of Zoho Finance Plus

Zoho Finance Plus is a comprehensive suite of financial applications designed to streamline and automate financial operations for businesses of all sizes. It consolidates various financial processes into a single platform, offering a unified view of a company’s financial health and enabling better decision-making. This suite aims to simplify accounting, billing, expense management, and other financial tasks, reducing manual effort and improving accuracy.

Core Functionality and Primary Features

Zoho Finance Plus offers a robust set of features across several key financial areas. This suite’s core functionality revolves around automating and integrating various financial processes, improving efficiency, and providing insightful financial data.

- Accounting: Zoho Books, the core accounting software within the suite, provides features like accounts payable and receivable management, bank reconciliation, financial reporting, and multi-currency support. It allows users to track income and expenses, manage invoices, and generate financial statements such as profit and loss statements and balance sheets.

- Billing and Invoicing: The suite includes tools for creating and sending professional invoices, managing recurring billing, and accepting online payments. Users can customize invoice templates, set up automated payment reminders, and track payment statuses.

- Expense Management: Zoho Expense helps users track and manage business expenses. It allows for the creation and submission of expense reports, receipt scanning, and integration with credit cards and bank accounts.

- Inventory Management: Zoho Inventory, when integrated, provides features for tracking stock levels, managing purchase orders, and controlling inventory costs. This integration is crucial for businesses that sell physical products.

- Payment Gateway Integrations: Zoho Finance Plus integrates with various payment gateways, enabling businesses to accept online payments from customers. This includes integrations with PayPal, Stripe, and other popular payment processors.

- Reporting and Analytics: The suite offers comprehensive reporting and analytics capabilities. Users can generate a wide range of financial reports, such as cash flow statements, sales reports, and expense reports. These reports provide valuable insights into a company’s financial performance.

- Workflow Automation: Zoho Finance Plus allows users to automate various financial processes, such as invoice approvals and payment reminders. This automation helps reduce manual effort and improve efficiency.

History and Evolution of Zoho Finance Plus

Zoho Finance Plus evolved from individual financial applications developed by Zoho. The company strategically bundled these applications to offer a comprehensive financial solution. This evolution reflects a growing demand for integrated financial management systems.

The initial offerings, like Zoho Books, were developed to provide accessible and user-friendly accounting solutions for small and medium-sized businesses (SMBs). Over time, Zoho expanded its suite by adding applications like Zoho Expense and integrating them with other Zoho products such as Zoho CRM. This expansion was driven by user feedback and the desire to create a complete business management platform. The development of Zoho Finance Plus was a response to the increasing need for businesses to have all their financial tools working together seamlessly.

Zoho Finance Plus offers robust financial management tools, but understanding its competitive landscape is key. To gain a broader perspective, one might explore options beyond just the usual suspects, and this is where the resources on beyond finance crunchbase come in handy. Ultimately, comparing Zoho Finance Plus to a wider range of platforms ensures the best fit for specific business needs.

Target Audience and Ideal User Profile

Zoho Finance Plus is designed to serve a diverse range of businesses. The suite’s scalability and adaptability make it suitable for different business sizes and industries. Understanding the ideal user profile helps in maximizing the suite’s benefits.

- Small and Medium-Sized Businesses (SMBs): SMBs are a primary target audience. The suite’s ease of use, affordability, and comprehensive features make it an attractive option for these businesses. For example, a retail business with 20 employees can use Zoho Finance Plus to manage its inventory, sales, and accounting needs without investing in complex, expensive software.

- Startups: Startups benefit from the suite’s scalability and cost-effectiveness. Zoho Finance Plus provides a solid financial foundation without requiring a large upfront investment. A tech startup can use Zoho Finance Plus to track expenses, manage invoices, and generate financial reports from day one.

- Growing Businesses: As businesses grow, Zoho Finance Plus can scale to meet their evolving needs. The suite’s advanced features, such as multi-currency support and workflow automation, are beneficial for growing companies. A growing e-commerce business can use Zoho Finance Plus to manage its international transactions, handle multiple currencies, and automate its financial processes.

- Businesses Seeking Integration: Companies that need to integrate their financial processes with other business functions, such as CRM and project management, find Zoho Finance Plus beneficial. The suite’s integrations with other Zoho applications and third-party tools streamline workflows. A marketing agency can integrate Zoho Finance Plus with Zoho CRM to track project profitability and manage client billing more efficiently.

- Businesses Prioritizing User-Friendliness: The suite’s intuitive interface and ease of use appeal to businesses that want a simple and straightforward financial solution. Companies without dedicated accounting staff can easily manage their finances using Zoho Finance Plus.

Key Modules and Features

Zoho Finance Plus offers a comprehensive suite of modules designed to streamline financial operations for businesses of all sizes. These modules work in tandem, providing a unified platform for managing accounting, invoicing, inventory, and reporting. This integrated approach reduces the need for multiple software solutions and enhances data accuracy and efficiency.

Accounting Module Capabilities

The accounting module within Zoho Finance Plus is a robust system designed to handle various financial tasks. It’s built to automate and simplify complex accounting processes, saving time and reducing the risk of errors.

- General Ledger: This core component manages all financial transactions, providing a complete record of a company’s financial activities. It supports the creation of chart of accounts, journal entries, and the generation of trial balances.

- Accounts Payable: This feature streamlines the process of managing vendor invoices and payments. It allows users to track outstanding bills, schedule payments, and maintain vendor records.

- Accounts Receivable: The accounts receivable module helps businesses manage customer invoices and payments. It supports invoice creation, payment tracking, and aging reports.

- Bank Reconciliation: This crucial feature enables users to reconcile bank statements with the company’s financial records. It helps identify discrepancies and ensures the accuracy of financial data.

- Budgeting: Zoho Finance Plus allows users to create and manage budgets, track spending against those budgets, and analyze variances. This feature aids in financial planning and control.

- Multi-Currency Support: Businesses operating internationally can manage transactions in multiple currencies. This feature automatically converts currencies and provides real-time exchange rate updates.

Invoicing and Billing Features

The invoicing and billing module in Zoho Finance Plus is designed to simplify the process of creating and sending invoices, as well as managing payments. It provides a user-friendly interface and a range of customization options.

- Invoice Creation: Users can easily create professional-looking invoices with customizable templates. They can add their company logo, branding, and specific details about the products or services provided.

- Customization Options: The platform offers extensive customization options for invoices. Users can personalize invoice layouts, add custom fields, and include specific terms and conditions.

- Recurring Invoices: Businesses can automate the creation and sending of recurring invoices for subscriptions or regular services. This feature saves time and ensures timely billing.

- Payment Gateways: Zoho Finance Plus integrates with various payment gateways, allowing customers to pay invoices online securely. This speeds up the payment process and improves cash flow.

- Automated Payment Reminders: The system can automatically send payment reminders to customers, reducing the likelihood of late payments.

- Invoice Tracking: Users can track the status of invoices, including whether they have been sent, viewed, or paid. This provides valuable insights into the billing process.

Inventory Management Feature Comparison

The inventory management features in Zoho Finance Plus are designed to help businesses track and manage their stock levels effectively. It is important to compare it with other accounting software solutions to determine its capabilities and limitations.

- Stock Tracking: Zoho Finance Plus allows users to track inventory levels in real-time. This includes monitoring stock quantities, reorder points, and stock valuations.

- Purchase Order Management: The system supports the creation and management of purchase orders, streamlining the process of ordering new stock from suppliers.

- Warehouse Management: Businesses can manage multiple warehouses and track inventory movement between them.

- Integration with Other Modules: The inventory module integrates seamlessly with the accounting and invoicing modules. This ensures that inventory changes are reflected in the financial statements and invoices.

- Comparison with Other Software: Compared to some dedicated inventory management systems, Zoho Finance Plus’s inventory features may be less extensive. However, it offers a good balance of functionality and integration with other financial modules. For instance, it may lack advanced features such as serial number tracking or lot tracking, that are available in dedicated solutions like Fishbowl Inventory or Unleashed Software.

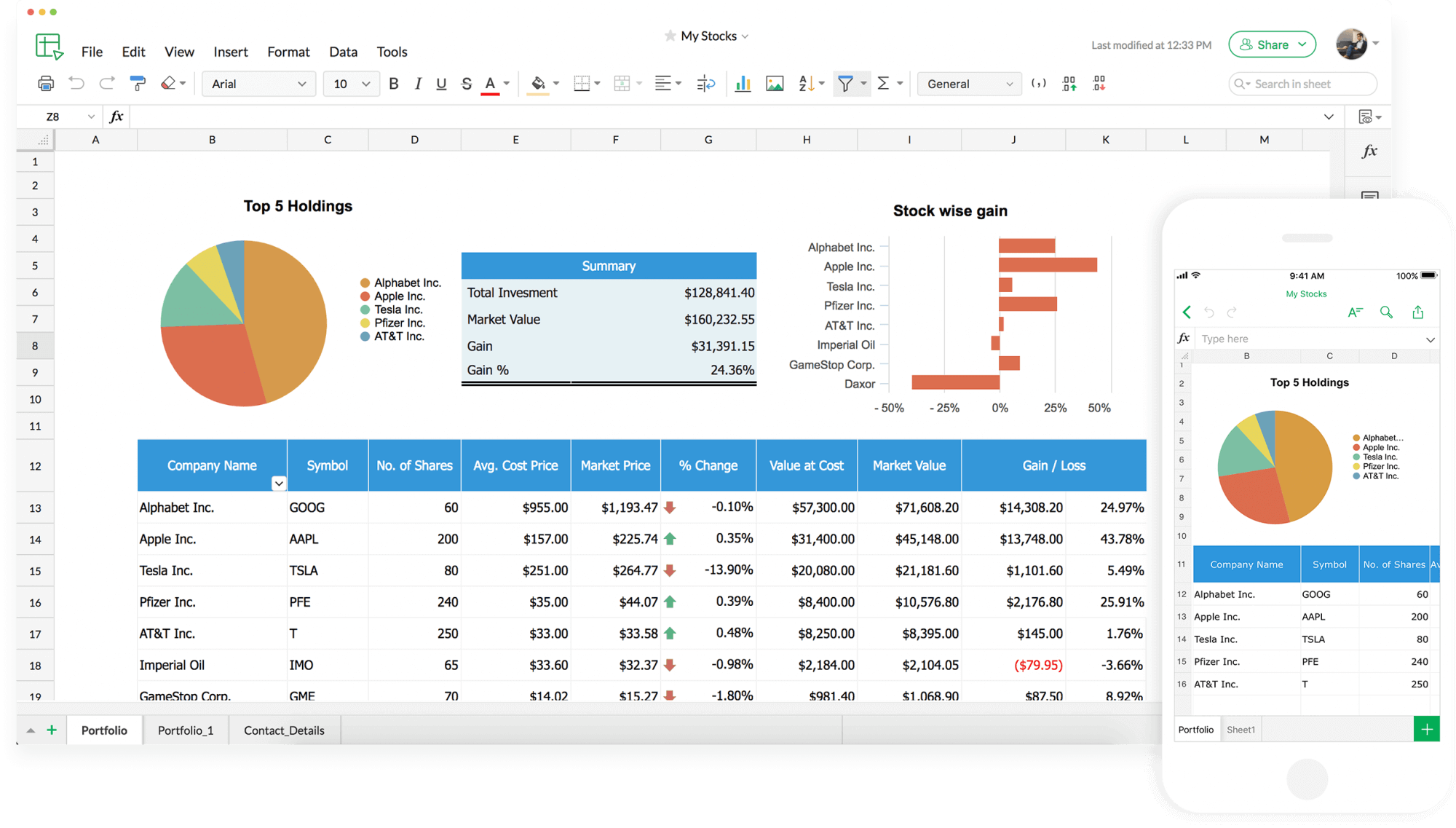

Reporting and Analytics Tools

Zoho Finance Plus provides a comprehensive set of reporting and analytics tools to help businesses gain insights into their financial performance. These tools offer various data visualization capabilities to make financial information easier to understand and analyze.

- Pre-built Reports: The platform offers a wide range of pre-built reports, including profit and loss statements, balance sheets, cash flow statements, and aging reports. These reports provide a quick overview of the company’s financial health.

- Custom Reports: Users can create custom reports tailored to their specific needs. This allows them to analyze data in various ways and gain deeper insights.

- Data Visualization: Zoho Finance Plus offers various data visualization tools, such as charts and graphs, to present financial data in an easy-to-understand format. This helps users identify trends, patterns, and anomalies.

- Dashboard: The dashboard provides a real-time overview of key financial metrics. Users can customize the dashboard to display the information that is most relevant to their business.

- Drill-Down Capabilities: Users can drill down into the data behind reports to gain a more detailed understanding of the underlying transactions. For example, clicking on a specific number in a profit and loss statement can reveal the individual transactions that make up that number.

- Examples of Visualizations: The software uses various chart types like bar charts, line graphs, and pie charts to represent financial data. For instance, a bar chart might display revenue by product category, while a line graph could show trends in sales over time. A pie chart could illustrate the percentage of expenses in different categories.

Integration Capabilities

Zoho Finance Plus shines not only in its core financial functionalities but also in its impressive ability to connect with other applications. This seamless integration is a key factor in streamlining workflows, eliminating data silos, and ultimately boosting productivity. By connecting various business tools, users can create a unified ecosystem where information flows freely, leading to better decision-making and operational efficiency.

Zoho App Integrations

The tight integration with other Zoho applications is a major strength of Zoho Finance Plus. This interconnectedness allows for a cohesive business management experience.

The integration capabilities with other Zoho apps include:

- Zoho CRM: Integrating with Zoho CRM allows for automated tracking of sales data and customer information. This connection can automatically create invoices based on closed deals, track payments against those invoices, and provide a holistic view of the customer lifecycle, from lead generation to revenue collection. For instance, when a deal is marked as “won” in Zoho CRM, an invoice can be automatically generated in Zoho Books (a core component of Zoho Finance Plus) and sent to the customer.

- Zoho SalesIQ: By integrating with Zoho SalesIQ, businesses can gain real-time insights into customer interactions and website activity. This allows for proactive customer service and the ability to address financial inquiries directly from the SalesIQ interface. For example, a customer visiting the pricing page on a website can trigger a notification in SalesIQ, allowing a support agent to proactively offer assistance or answer billing questions.

- Zoho Inventory: The integration with Zoho Inventory facilitates accurate inventory management alongside financial tracking. When an order is placed, the inventory levels are automatically updated, and invoices are generated. This synchronization prevents overselling and ensures accurate cost of goods sold (COGS) calculations.

- Zoho Subscriptions: Zoho Finance Plus seamlessly integrates with Zoho Subscriptions, especially crucial for subscription-based businesses. This integration automates recurring billing, tracks subscriptions, and manages revenue recognition based on the subscription terms. This automation significantly reduces manual effort and ensures accurate financial reporting.

Third-Party Integrations

Zoho Finance Plus offers a wide range of third-party integrations, expanding its capabilities and connecting with tools commonly used in various business operations. These integrations improve workflow efficiency by automating tasks and centralizing data.

Examples of third-party integrations and their impact on workflow efficiency include:

- Payment Gateways: Integration with payment gateways like Stripe, PayPal, and Authorize.net allows businesses to accept online payments directly within Zoho Finance Plus. This automation streamlines the payment process, reduces manual data entry, and provides real-time updates on payment statuses.

- Banking Integrations: Connecting with banks through secure integrations enables automatic bank feed imports. This means transactions are automatically imported into Zoho Finance Plus, saving time on manual reconciliation and reducing the risk of errors.

- E-commerce Platforms: Integrating with e-commerce platforms like Shopify, WooCommerce, and BigCommerce allows businesses to synchronize sales data, inventory levels, and customer information. This creates a seamless flow of information between the online store and the financial system.

- Project Management Tools: Integrations with project management tools such as Asana and Trello facilitate tracking project-related expenses and profitability. This allows businesses to associate costs with specific projects, track budget vs. actuals, and improve project financial management.

Setting Up an E-commerce Platform Integration

The process of setting up a new integration with a common e-commerce platform, such as Shopify, demonstrates the ease and efficiency of connecting external applications. The steps involved typically follow a standard pattern.

Here’s a simplified example of setting up a Shopify integration with Zoho Finance Plus:

- Access the Integration Settings: Within Zoho Finance Plus, navigate to the “Integrations” section, often found in the settings or setup area.

- Select Shopify: Choose Shopify from the list of available integrations. This might involve searching for “Shopify” or browsing through a category of e-commerce platforms.

- Authorize the Connection: The system will typically prompt the user to authorize the connection with Shopify. This usually involves entering Shopify store credentials and granting Zoho Finance Plus permission to access the necessary data. This process often involves an OAuth (Open Authorization) flow, ensuring secure data transfer without exposing sensitive credentials.

- Map Data Fields: Once the connection is established, the user will be prompted to map data fields between Shopify and Zoho Finance Plus. This involves matching Shopify’s fields (like product names, order IDs, and customer information) with the corresponding fields in Zoho Finance Plus (like items, invoices, and customer profiles). This mapping ensures that data is correctly transferred between the two systems.

- Configure Sync Settings: Define how the integration will synchronize data. This includes specifying the frequency of synchronization (e.g., daily, hourly, or real-time), the types of data to be synced (e.g., orders, customers, products), and any filters to apply (e.g., only sync orders placed after a specific date).

- Test and Verify: After the initial setup, it’s essential to test the integration. Create a test order in Shopify and verify that the data correctly appears in Zoho Finance Plus. This helps identify and resolve any mapping errors or configuration issues before the integration goes live.

Pricing and Plans

Zoho Finance Plus offers a tiered pricing structure designed to cater to businesses of varying sizes and needs. The plans are structured to provide scalability, allowing businesses to access more features and capabilities as they grow. Understanding these plans is crucial for businesses to choose the option that best aligns with their budget and operational requirements.

Zoho Finance Plus’s pricing strategy focuses on delivering value for money, providing a comprehensive suite of financial tools at competitive rates. This section details the different pricing plans available and compares the features offered in each.

Zoho Finance Plus Pricing Plans Overview

Zoho Finance Plus provides a selection of plans, each equipped with a specific set of features and capabilities. These plans are designed to accommodate the diverse requirements of businesses, from startups to established enterprises. The pricing structure is transparent and offers flexibility in terms of scalability.

Here’s a breakdown of the different plans:

* Standard: This plan is suitable for small businesses or startups needing core financial management features.

* Professional: This plan builds upon the Standard plan, offering more advanced features for growing businesses.

* Premium: The Premium plan is tailored for businesses with more complex financial requirements, providing enhanced capabilities and functionalities.

* Ultimate: The Ultimate plan is designed for large enterprises requiring a comprehensive suite of financial tools with advanced features and support.

The following table provides a detailed comparison of the features available in each plan.

Zoho Finance Plus Feature Comparison Table

The following table details the feature set available in each Zoho Finance Plus plan. This table enables businesses to easily compare the offerings and select the plan that best suits their needs. The comparison focuses on key features, providing a clear overview of the capabilities available in each plan.

“`html

| Feature | Standard | Professional | Premium | Ultimate |

|---|---|---|---|---|

| Number of Users | Up to 3 | Up to 5 | Up to 10 | Unlimited |

| Invoicing | Yes | Yes | Yes | Yes |

| Expense Tracking | Yes | Yes | Yes | Yes |

| Bank Reconciliation | Yes | Yes | Yes | Yes |

| Project Tracking | No | Yes | Yes | Yes |

| Inventory Management | No | Yes | Yes | Yes |

| Custom Reports | Limited | Yes | Yes | Yes |

| Workflow Automation | No | Limited | Yes | Yes |

| Advanced Analytics | No | No | Yes | Yes |

| Multiple Currencies | Yes | Yes | Yes | Yes |

| Budgeting | No | Yes | Yes | Yes |

| Customer Support | Email & Chat | Email, Chat & Phone | Email, Chat, Phone & Dedicated Account Manager |

“`

This table highlights the scalability of Zoho Finance Plus. The Standard plan offers core functionalities, while the Professional plan adds features like project tracking and inventory management. The Premium and Ultimate plans provide advanced features such as workflow automation, advanced analytics, and dedicated account management, designed for businesses with complex financial needs.

Value Proposition of Zoho Finance Plus’s Pricing

Zoho Finance Plus’s pricing is competitive within the market, offering a comprehensive set of features at a reasonable cost. Its value proposition stems from its all-in-one suite approach, which consolidates various financial functions into a single platform, reducing the need for multiple software subscriptions.

Zoho Finance Plus competes with other financial management software providers, such as Xero and QuickBooks Online. While pricing can vary, Zoho Finance Plus often provides a more affordable solution, especially for businesses requiring a wide range of features.

Here’s a comparison highlighting the value proposition:

* Cost-Effectiveness: Zoho Finance Plus typically offers more features at a lower price point than competitors, especially in the higher-tier plans.

* Integration: The seamless integration with other Zoho apps enhances efficiency and streamlines workflows.

* Scalability: The tiered pricing structure allows businesses to scale their financial management tools as they grow.

* All-in-One Solution: Zoho Finance Plus’s comprehensive approach eliminates the need for separate software subscriptions for accounting, invoicing, and other financial functions.

For instance, a small business might find that the Zoho Finance Plus Standard plan provides all the necessary features for a lower cost than a comparable plan from Xero or QuickBooks Online. As the business grows, the option to upgrade to the Professional or Premium plans offers more advanced capabilities without a significant price increase compared to the competition. The Ultimate plan caters to large enterprises that require a complete financial management solution.

User Interface and Experience

Zoho Finance Plus is designed with a user-centric approach, prioritizing ease of use and efficiency for finance professionals. The interface aims to streamline complex financial tasks, allowing users to focus on strategic decision-making rather than struggling with the software. The design emphasizes clarity, intuitive navigation, and a customizable workspace to meet diverse user needs.

Design Principles of the User Interface

The user interface of Zoho Finance Plus is built upon several core design principles. These principles guide the overall look and feel, ensuring a consistent and positive user experience.

- Clarity and Simplicity: The interface is uncluttered, with a focus on displaying essential information. Unnecessary elements are minimized to reduce visual noise, making it easier for users to find what they need.

- Intuitive Navigation: The navigation structure is logical and consistent across all modules. Users can easily understand where they are and how to move between different sections of the application.

- Accessibility: Zoho Finance Plus adheres to accessibility guidelines, ensuring that the software is usable by individuals with disabilities. This includes features like keyboard navigation, screen reader compatibility, and adjustable font sizes.

- Customization: Users can personalize the interface to suit their preferences and workflows. This includes the ability to customize dashboards, reports, and other elements.

- Responsiveness: The interface is designed to be responsive, adapting seamlessly to different screen sizes and devices, ensuring a consistent experience across desktops, tablets, and smartphones.

Navigation and User Experience

Effective navigation is crucial for a positive user experience. Zoho Finance Plus employs a clear and organized navigation structure, allowing users to easily access all features and modules.

The main navigation typically consists of a top navigation bar and a sidebar. The top navigation bar provides access to core modules such as accounting, billing, inventory, and reporting. The sidebar often provides more granular navigation within each module, allowing users to drill down into specific features and settings. The use of breadcrumbs further enhances navigation, showing users their current location within the application and providing a clear path to return to previous pages.

Zoho Finance Plus offers robust financial management tools, but even the best software needs a solid foundation. For trucking businesses, understanding the complexities of financing a trucking business is crucial for success. Effective financial planning is key, and Zoho Finance Plus provides the insights needed to make informed decisions and manage cash flow efficiently.

Here are examples of common workflows:

- Creating an Invoice: From the “Billing” module, a user can select “Create Invoice.” They then input customer details, add line items, and generate the invoice. The interface guides them through each step, providing clear prompts and options.

- Reconciling Bank Transactions: Within the “Accounting” module, users can access the “Bank Feeds” section. They can import bank statements and match transactions to existing records. The system offers suggestions for matching transactions, streamlining the reconciliation process.

- Generating a Profit and Loss Statement: From the “Reports” section, users can select “Profit and Loss Statement.” They can then customize the report’s date range, accounting periods, and other parameters before generating the report.

Features Enhancing User Productivity

Zoho Finance Plus includes several features designed to boost user productivity and efficiency. These features automate tasks, provide insights, and streamline workflows.

- Automated Workflows: Users can set up automated workflows for tasks such as invoice reminders, payment confirmations, and recurring billing. This reduces manual effort and ensures timely execution of key processes.

- Customizable Dashboards: Users can create personalized dashboards to monitor key financial metrics. These dashboards provide a quick overview of critical data, allowing users to stay informed and make data-driven decisions.

- Advanced Reporting: The software offers a comprehensive suite of reports, including financial statements, sales reports, and expense reports. Users can customize reports to meet their specific needs and gain deeper insights into their financial performance.

- Real-time Collaboration: Features like commenting and activity feeds facilitate collaboration among team members. Users can discuss transactions, share insights, and track progress within the application.

- Mobile Accessibility: With dedicated mobile apps, users can access their financial data and perform key tasks on the go. This ensures that they can stay connected and manage their finances from anywhere, at any time. For instance, a user can approve an expense report while traveling, or check the status of an invoice from their mobile device.

Security and Data Privacy

Zoho Finance Plus prioritizes the security and privacy of user data, implementing robust measures to protect sensitive financial information. This commitment extends to compliance with global data privacy regulations and the implementation of reliable data backup and recovery procedures. The platform’s security infrastructure is designed to provide a secure environment for managing financial operations.

Security Measures for Data Protection

Zoho Finance Plus employs several security measures to safeguard user data. These measures are integral to the platform’s architecture and are constantly updated to address emerging threats.

- Data Encryption: All data transmitted and stored within Zoho Finance Plus is encrypted using industry-standard encryption protocols, such as AES-256, ensuring that data is unreadable to unauthorized parties. This encryption applies to data at rest and in transit.

- Access Controls: The platform utilizes role-based access control (RBAC) to manage user permissions. This means that access to specific data and features is granted based on a user’s role within the organization, minimizing the risk of unauthorized access. Administrators can define roles and assign permissions to employees, ensuring that sensitive financial information is only accessible to those who need it.

- Multi-Factor Authentication (MFA): Zoho Finance Plus supports multi-factor authentication, adding an extra layer of security by requiring users to verify their identity through multiple methods, such as a password and a code sent to their mobile device. This significantly reduces the risk of unauthorized access even if a password is compromised.

- Regular Security Audits and Penetration Testing: The platform undergoes regular security audits and penetration testing conducted by independent security experts. These audits help identify and address potential vulnerabilities, ensuring that the platform remains secure against evolving threats. The results of these audits are used to improve the platform’s security posture continually.

- Network Security: Zoho Finance Plus employs robust network security measures, including firewalls, intrusion detection systems, and intrusion prevention systems, to protect against network-based attacks. These measures monitor network traffic, detect suspicious activity, and prevent unauthorized access to the platform’s infrastructure.

Compliance with Data Privacy Regulations

Zoho Finance Plus adheres to various data privacy regulations to ensure the responsible handling of user data. This commitment helps users meet their own compliance requirements.

- General Data Protection Regulation (GDPR): Zoho Finance Plus is GDPR compliant, meaning it adheres to the requirements Artikeld in the GDPR, including data minimization, data security, and the right to be forgotten. This ensures that user data is handled with the utmost care and in accordance with European Union regulations.

- California Consumer Privacy Act (CCPA): The platform also complies with the CCPA, providing California residents with rights regarding their personal information, such as the right to access, delete, and opt-out of the sale of their data. This ensures that users in California have control over their personal information.

- Data Processing Agreements (DPAs): Zoho Finance Plus provides Data Processing Agreements (DPAs) to its customers, outlining the responsibilities and obligations of both parties regarding data processing. These agreements ensure transparency and accountability in data handling practices.

- Privacy Shield Framework (Inactive): While the Privacy Shield Framework is currently inactive, Zoho Finance Plus had previously been certified under the framework, demonstrating its commitment to protecting the privacy of data transferred from the EU to the US. This commitment is now reflected in the platform’s GDPR compliance.

Data Backup and Recovery Procedures

Zoho Finance Plus implements comprehensive data backup and recovery procedures to ensure data availability and business continuity. These procedures are critical for protecting against data loss due to unforeseen events.

- Automated Backups: The platform performs automated backups of user data on a regular basis. These backups are stored in secure, geographically diverse locations to protect against data loss due to hardware failures, natural disasters, or other unforeseen events.

- Data Redundancy: Zoho Finance Plus utilizes data redundancy, storing multiple copies of data across different servers and data centers. This ensures that data remains accessible even if one server or data center experiences an outage.

- Disaster Recovery Plan: A comprehensive disaster recovery plan is in place to ensure the platform can be restored quickly in the event of a major disruption. This plan includes procedures for restoring data from backups and bringing the platform back online.

- Data Retention Policies: Zoho Finance Plus has clearly defined data retention policies that specify how long user data is stored and when it is deleted. These policies comply with legal and regulatory requirements and help ensure that data is only retained for as long as necessary.

- Regular Testing of Recovery Procedures: The platform’s data recovery procedures are regularly tested to ensure they are effective and can be executed quickly in the event of a data loss incident. These tests help identify any potential issues and ensure that the recovery process is optimized.

Advantages and Disadvantages

Zoho Finance Plus, like any comprehensive software suite, presents a mixed bag of benefits and drawbacks. Understanding these aspects is crucial for businesses considering its adoption. This section delves into the advantages and disadvantages of Zoho Finance Plus, specifically focusing on its impact on small businesses and comparing it with competing software solutions.

Advantages for Small Businesses

Zoho Finance Plus offers several compelling advantages tailored to the needs of small businesses. These benefits contribute to improved financial management, operational efficiency, and overall business growth.

- Cost-Effectiveness: Zoho Finance Plus provides a range of plans, including a free plan with limited features, making it accessible for startups and small businesses with budget constraints. The pricing structure is generally competitive compared to other comprehensive financial software. This affordability allows businesses to access robust financial tools without a significant upfront investment.

- Comprehensive Suite: The platform integrates multiple financial modules, such as accounting, invoicing, expense tracking, and inventory management. This all-in-one approach streamlines financial operations, reducing the need for multiple software subscriptions and data silos. For example, a small retail business can manage sales, track inventory levels, and generate financial reports all within a single platform.

- User-Friendly Interface: Zoho Finance Plus boasts a user-friendly interface that is relatively easy to navigate, even for users without extensive accounting knowledge. The intuitive design simplifies tasks like invoice creation, expense tracking, and report generation, enabling business owners and their teams to quickly learn and utilize the software.

- Automation Capabilities: The platform automates several financial processes, including recurring invoicing, payment reminders, and bank reconciliation. Automation reduces manual effort, minimizes errors, and frees up time for business owners to focus on core business activities.

- Integration Capabilities: Zoho Finance Plus seamlessly integrates with other Zoho applications, such as CRM, and also offers integrations with third-party applications like payment gateways (e.g., PayPal, Stripe) and e-commerce platforms (e.g., Shopify, WooCommerce). This integration enhances data flow and provides a unified view of business operations.

- Scalability: Zoho Finance Plus is designed to scale with a business. As a small business grows, it can upgrade to higher-tier plans with more features and capacity. This scalability ensures that the software continues to meet the evolving needs of the business.

- Mobile Accessibility: The availability of mobile apps for both iOS and Android devices allows users to access and manage their finances on the go. This mobile accessibility is particularly beneficial for business owners who travel frequently or need to stay connected to their finances remotely.

Disadvantages and Limitations

While Zoho Finance Plus offers significant advantages, it also has potential drawbacks that businesses should consider.

- Feature Limitations in Free and Lower-Tier Plans: The free plan and lower-tier paid plans have limitations on the number of users, transactions, and features available. This can restrict the functionality for businesses with higher transaction volumes or more complex financial needs.

- Complexity of Advanced Features: While the user interface is generally user-friendly, some advanced features, such as custom report creation and advanced accounting configurations, may require more training and expertise to fully utilize.

- Dependency on Internet Connectivity: As a cloud-based software, Zoho Finance Plus requires a stable internet connection to function. This can be a limitation for businesses operating in areas with unreliable internet access.

- Customer Support: While Zoho provides customer support, the quality and responsiveness can vary. Some users have reported delays in receiving support or difficulty resolving complex issues.

- Limited Customization Options: While Zoho Finance Plus offers some customization options, they may be limited compared to more specialized or enterprise-level financial software. This can be a drawback for businesses with unique or highly specific financial reporting requirements.

- Learning Curve: Despite the user-friendly interface, there is still a learning curve associated with adopting and utilizing the software effectively. Businesses need to invest time in training their staff to ensure they can use the software correctly.

Comparison with Similar Software: Pros and Cons

Comparing Zoho Finance Plus with similar software solutions reveals a more nuanced understanding of its strengths and weaknesses. This comparison considers key competitors in the small business accounting software market.

| Software | Pros | Cons |

|---|---|---|

| QuickBooks Online |

|

|

| Xero |

|

|

| Wave Accounting |

|

|

| Zoho Finance Plus |

|

|

This comparison highlights that Zoho Finance Plus provides a strong value proposition for small businesses, especially those already invested in the Zoho ecosystem. While QuickBooks Online and Xero offer more extensive features, Zoho Finance Plus often provides a more cost-effective and integrated solution, especially for businesses that prioritize a unified suite of applications. Wave Accounting offers a free option, but its functionality is significantly limited. The best choice depends on the specific needs, budget, and existing software ecosystem of the business.

Implementation and Setup

Setting up Zoho Finance Plus is a crucial step in streamlining your financial operations. Proper implementation ensures you can leverage the platform’s features effectively and integrate it seamlessly into your existing business processes. This section provides a comprehensive guide to help you navigate the setup process, from creating your account to customizing settings for your specific needs.

Setting Up a New Zoho Finance Plus Account

Creating a Zoho Finance Plus account is a straightforward process designed to be user-friendly. It involves several key steps, ensuring a smooth onboarding experience.

- Account Creation: The first step is to visit the Zoho Finance Plus website and sign up for an account. You’ll be prompted to provide your email address, create a password, and accept the terms of service. Alternatively, you can sign up using your Google, Microsoft, or other social media accounts.

- Verification: After signing up, you’ll receive a verification email. Click the link in the email to verify your email address and activate your account. This step confirms your identity and ensures you have access to your account.

- Company Information: Once your account is verified, you’ll be asked to provide information about your company. This includes your company name, business address, industry, and currency. This information is essential for generating accurate financial reports and invoices.

- Subscription Plan Selection: Zoho Finance Plus offers various subscription plans, each with different features and pricing. Choose the plan that best suits your business needs based on factors like the number of users, the volume of transactions, and the features you require.

- Payment Information: After selecting a plan, you’ll be prompted to enter your payment information. Zoho Finance Plus accepts various payment methods, including credit cards and other online payment gateways.

- Account Setup Completion: Once your payment is processed, your Zoho Finance Plus account is set up. You can then begin customizing your account settings, importing data, and exploring the platform’s features.

Data Migration Checklist from Other Accounting Software

Migrating data from your existing accounting software to Zoho Finance Plus requires careful planning and execution. A well-defined checklist helps ensure a smooth and accurate transition, minimizing potential disruptions to your financial operations.

- Data Backup: Before you begin the migration process, create a complete backup of your existing accounting data. This backup serves as a safety net in case of any data loss or errors during the migration.

- Data Export: Export your data from your current accounting software in a compatible format. Zoho Finance Plus supports various import formats, including CSV, Excel, and other common file types.

- Data Mapping: Map your data fields from your existing software to the corresponding fields in Zoho Finance Plus. This step ensures that your data is correctly organized and interpreted within the new platform.

- Chart of Accounts Import: Import your chart of accounts, which includes your general ledger accounts, to maintain the same structure and categorization of your financial data.

- Customer and Vendor Data Import: Import your customer and vendor data, including contact information, payment terms, and other relevant details. This data is essential for generating invoices, processing payments, and managing relationships.

- Inventory Data Import (If Applicable): If you manage inventory, import your inventory data, including product details, quantities, and costs.

- Transaction Data Import: Import your historical transaction data, such as invoices, bills, payments, and journal entries. This provides a complete view of your financial history within Zoho Finance Plus.

- Data Validation: After importing your data, validate it to ensure accuracy and completeness. Review your reports and compare them to your previous accounting software to identify and correct any discrepancies.

- User Training: Train your team on how to use Zoho Finance Plus. This training ensures they understand the platform’s features, workflows, and best practices.

- Go-Live and Testing: Once you have completed the migration and training, you can go live with Zoho Finance Plus. Before fully transitioning, test the system by running sample transactions to ensure everything works correctly.

Customizing Settings for Specific Business Needs

Zoho Finance Plus offers a high degree of customization, allowing you to tailor the platform to meet the specific needs of your business. This customization enhances efficiency, improves accuracy, and ensures the platform aligns with your unique workflows.

- Currency Settings: Configure your base currency and any other currencies you use for international transactions. This ensures that all your financial data is accurately represented in the appropriate currency.

- Tax Settings: Set up your tax rates and tax codes to comply with local and international tax regulations. This includes configuring VAT, GST, sales tax, and other relevant taxes.

- Payment Terms: Define your payment terms, such as net 30, net 60, or custom payment terms, to specify when invoices are due.

- Invoice Customization: Customize your invoice templates with your company logo, branding, and other design elements. You can also customize the fields displayed on your invoices, such as payment terms, due dates, and shipping information.

- User Roles and Permissions: Assign user roles and permissions to control access to sensitive financial data. This ensures that only authorized personnel can view, edit, or approve financial transactions.

- Workflow Automation: Automate repetitive tasks, such as invoice reminders and payment follow-ups, to improve efficiency and reduce manual effort.

- Report Customization: Customize your reports to track the specific financial metrics that are most important to your business. This includes creating custom reports and dashboards to monitor your performance.

- Integration Settings: Configure integrations with other Zoho apps and third-party applications, such as payment gateways, CRM systems, and e-commerce platforms, to streamline your workflows.

Customer Support and Resources

Zoho Finance Plus understands the importance of robust customer support and comprehensive resources for its users. This commitment ensures users can effectively utilize the platform, resolve issues promptly, and maximize their return on investment. The following sections detail the various support options, documentation, and community resources available.

Customer Support Options

Zoho Finance Plus provides several avenues for users to seek assistance and resolve issues. These options cater to different needs and preferences, ensuring that users can access support in a manner that best suits their situation.

- 24/7 Email Support: Users can submit their queries via email at any time. Zoho’s support team aims to respond promptly, providing detailed answers and guidance.

- Phone Support: Phone support is available during specific business hours. This allows users to speak directly with a support representative for immediate assistance. The availability of phone support varies depending on the user’s plan.

- Live Chat Support: Live chat is often available within the Zoho Finance Plus interface. This offers real-time assistance from support agents, allowing for quick resolution of common issues.

- In-App Support: Contextual help and support are integrated within the application itself. This includes tooltips, guides, and FAQs that provide immediate answers to common questions related to specific features.

- Help Center: A comprehensive Help Center provides access to FAQs, troubleshooting guides, and articles covering various aspects of the software.

Documentation, Tutorials, and Learning Resources

Zoho Finance Plus offers a wealth of resources designed to help users learn and master the platform. These resources cater to different learning styles and skill levels, from beginner to advanced users.

- User Manuals: Detailed user manuals are available, providing in-depth explanations of each feature and module within Zoho Finance Plus. These manuals are invaluable for understanding the platform’s capabilities and functionalities.

- Tutorial Videos: Video tutorials guide users through various processes, such as setting up the software, generating reports, and managing transactions. These videos are easy to follow and provide visual guidance.

- Webinars: Zoho regularly hosts webinars on various topics related to accounting, finance, and Zoho Finance Plus. These webinars often feature expert speakers and cover best practices, new features, and industry trends.

- Knowledge Base: A searchable knowledge base provides access to a wide range of articles, FAQs, and troubleshooting guides. This resource allows users to quickly find answers to common questions and resolve issues independently.

- Blog: The Zoho Finance Plus blog features articles, tips, and updates on the platform. This resource provides valuable insights into industry best practices and new features.

Community Forums and User Groups

Zoho fosters a strong community around its products, including Zoho Finance Plus. This community provides a valuable platform for users to connect, share knowledge, and seek assistance from peers and experts.

- Zoho Forums: The official Zoho forums provide a platform for users to ask questions, share experiences, and discuss best practices. These forums are monitored by Zoho support staff and experienced users, ensuring that questions are answered promptly and accurately.

- User Groups: Local and online user groups offer opportunities for users to connect with each other, share insights, and learn from experienced users. These groups often host meetings, workshops, and events focused on Zoho Finance Plus and related topics.

- Social Media: Zoho Finance Plus maintains an active presence on social media platforms, such as Twitter, Facebook, and LinkedIn. These platforms provide a way for users to stay up-to-date on the latest news, updates, and tips.

- Integration with Zoho Community: The Zoho Community is a centralized platform for all Zoho products. It allows users to access a vast library of resources, connect with other users, and get help from the Zoho support team.

Future Developments and Updates

Zoho Finance Plus, like all successful SaaS platforms, is in a constant state of evolution. Zoho demonstrates a commitment to continuous improvement through regular updates and the addition of new features. This proactive approach ensures the platform remains competitive and meets the evolving needs of its users.

Upcoming Features and Updates

Zoho regularly releases updates and new features for its Finance Plus suite. These updates often focus on enhancing existing functionalities, addressing user feedback, and incorporating new technologies. While specific release dates are subject to change, here are some examples of the types of features that are frequently in development:

- Enhanced Automation: Zoho continues to expand its automation capabilities. This includes features such as automated invoice generation, payment reminders, and bank reconciliation. Automation reduces manual effort, minimizes errors, and allows businesses to streamline their financial processes.

- Advanced Reporting and Analytics: Upgrades to reporting and analytics are a constant focus. Expect to see new dashboards, more customizable reports, and deeper insights into financial data. These enhancements empower users to make data-driven decisions.

- AI-Powered Features: Zoho is incorporating Artificial Intelligence (AI) into its platform. AI-powered features might include intelligent invoice scanning, fraud detection, and predictive analytics. This will improve efficiency and provide valuable insights.

- Integration with Third-Party Apps: Expanding the ecosystem is a key priority. Expect to see new integrations with popular business applications, further enhancing the platform’s versatility. This includes integrations with e-commerce platforms, CRM systems, and other financial tools.

- Mobile App Enhancements: The mobile apps for iOS and Android will continue to receive updates, providing users with more features and a better user experience on the go. This includes improvements to the user interface and functionality.

Zoho’s Commitment to Improvement

Zoho’s commitment to the continuous improvement of Finance Plus is evident in several ways:

- User Feedback: Zoho actively solicits and incorporates user feedback into its development process. This ensures that the platform evolves to meet the real-world needs of its users.

- Regular Updates: Zoho releases frequent updates, including bug fixes, performance improvements, and new features. This ensures that the platform remains stable and up-to-date.

- Investment in R&D: Zoho invests significantly in research and development. This allows the company to stay ahead of the curve and incorporate new technologies into its platform.

- Agile Development Methodology: Zoho employs agile development methodologies, allowing for rapid iteration and responsiveness to changing market demands. This allows them to release updates and new features quickly.

- Transparency: Zoho provides transparency regarding its development roadmap and upcoming features. Users can often access information about what is being worked on and when it is expected to be released.

Outlook on the Future of Zoho Finance Plus

The future of Zoho Finance Plus in the market appears promising. Several factors contribute to this positive outlook:

- Growing Market Demand: The demand for cloud-based financial software is increasing. Businesses of all sizes are adopting these solutions to streamline their financial operations.

- Competitive Pricing: Zoho Finance Plus offers competitive pricing plans, making it an attractive option for small and medium-sized businesses.

- Strong Brand Reputation: Zoho has a strong brand reputation, built on a history of providing reliable and feature-rich software solutions.

- Continuous Innovation: Zoho’s commitment to innovation and its focus on incorporating new technologies will ensure that the platform remains competitive.

- Expansion of Ecosystem: The continued expansion of the Zoho ecosystem, including integrations with other Zoho products and third-party applications, enhances the platform’s value proposition.