Introduction to Associate Degree in Finance

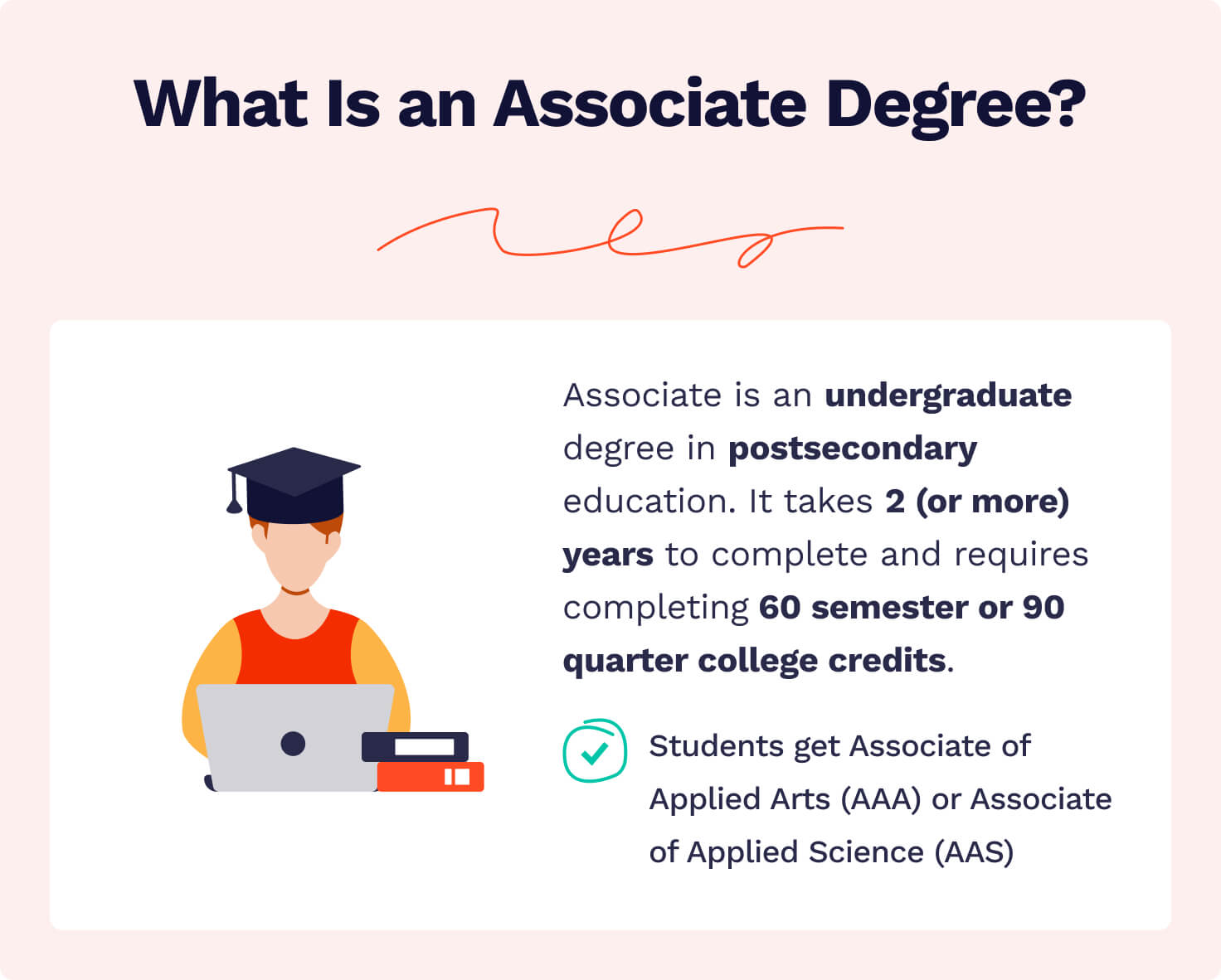

An Associate Degree in Finance serves as a foundational stepping stone into the world of financial services. It provides students with the fundamental knowledge and skills needed to understand financial principles, manage finances, and potentially begin a career in the finance industry. This degree is designed to equip individuals with practical skills applicable to various entry-level roles.

Core Purpose of an Associate Degree in Finance

The primary objective of an Associate Degree in Finance is to provide a solid base of financial knowledge and skills. It equips students with the ability to analyze financial data, understand financial markets, and make informed financial decisions. The program is designed to prepare individuals for entry-level positions in the financial sector or to serve as a pathway to a bachelor’s degree in finance or a related field.

Typical Coursework in a Finance Associate Degree Program

Finance associate degree programs typically cover a range of core financial concepts. These courses provide students with a comprehensive understanding of financial principles.

- Financial Accounting: Students learn to record, classify, and summarize financial transactions. They gain an understanding of financial statements, including the income statement, balance sheet, and cash flow statement. This knowledge is crucial for analyzing a company’s financial performance.

- Managerial Accounting: This course focuses on using accounting information for internal decision-making. Students learn about cost accounting, budgeting, and performance evaluation. This knowledge is essential for managing and controlling costs within an organization.

- Principles of Finance: This course introduces core financial concepts such as the time value of money, risk and return, and financial markets. It provides a foundation for understanding how financial decisions are made.

- Business Law: Students learn about legal principles relevant to business operations, including contracts, property law, and business regulations. This knowledge is essential for understanding the legal framework within which businesses operate.

- Economics: This course covers microeconomic and macroeconomic principles. Students learn about supply and demand, market structures, and economic indicators. This knowledge helps students understand the broader economic environment that impacts financial decisions.

- Business Communication: Students develop essential communication skills, including writing, presenting, and interpersonal communication. Effective communication is crucial for success in any business role.

- Microcomputer Applications: This course teaches students how to use software applications such as Microsoft Excel for financial analysis and data management. Proficiency in these applications is a key skill for many finance roles.

General Career Paths Available After Obtaining This Degree

Graduates with an Associate Degree in Finance can pursue various entry-level positions in the financial industry. These roles offer opportunities for career advancement and further education.

- Accounting Clerk: Accounting clerks perform a variety of tasks, including data entry, maintaining financial records, and assisting with accounts payable and receivable. According to the U.S. Bureau of Labor Statistics, the median annual wage for accounting clerks was $40,930 in May 2023.

- Bookkeeper: Bookkeepers are responsible for recording financial transactions and preparing financial statements. They ensure the accuracy and completeness of financial records.

- Financial Analyst Assistant: Financial analyst assistants support financial analysts in tasks such as data analysis, report preparation, and financial modeling. They help with the financial planning and analysis.

- Loan Officer Assistant: Loan officer assistants help loan officers with tasks such as processing loan applications, verifying information, and communicating with clients. They play a crucial role in the loan origination process.

- Banking Teller: Banking tellers provide customer service, process transactions, and handle cash. They are the primary point of contact for customers at a bank.

- Budget Analyst Assistant: Budget analyst assistants help budget analysts with tasks such as preparing budgets, analyzing financial data, and monitoring spending. They play a key role in financial planning and control.

Skills and Knowledge Acquired

An Associate Degree in Finance equips students with a foundational understanding of financial principles and the practical skills necessary for entry-level positions in the field. The curriculum focuses on developing a blend of technical expertise and soft skills, preparing graduates to contribute effectively to various financial roles. This section Artikels the specific skills and knowledge acquired during the program.

Practical Skills Developed

Finance associate degrees emphasize the development of practical skills crucial for success in the industry. These skills enable graduates to perform essential financial tasks and contribute to the efficient operation of financial institutions and businesses.

- Financial Statement Analysis: Students learn to interpret financial statements, including balance sheets, income statements, and cash flow statements. They understand how to assess a company’s financial health, identify trends, and make informed decisions based on the data. This involves calculating key financial ratios like the current ratio (current assets / current liabilities) and debt-to-equity ratio (total debt / shareholder’s equity).

- Budgeting and Forecasting: Students acquire the ability to create and manage budgets, as well as forecast future financial performance. This includes understanding budgeting methodologies, variance analysis, and forecasting techniques. They learn to project revenues, expenses, and profits, enabling them to make sound financial planning decisions.

- Investment Analysis: The curriculum covers the fundamentals of investment analysis, including understanding different investment vehicles, such as stocks, bonds, and mutual funds. Students learn to evaluate investment opportunities, assess risk, and make recommendations based on their analysis. This often involves calculating the net present value (NPV) and internal rate of return (IRR) of potential investments.

- Risk Management: Students are introduced to risk management principles and techniques. They learn to identify, assess, and mitigate financial risks. This involves understanding different types of risks, such as market risk, credit risk, and operational risk, and implementing strategies to minimize their impact.

- Banking Operations: Students gain insights into banking operations, including understanding different banking products and services, such as loans, mortgages, and deposit accounts. They learn about regulatory requirements and the operational processes involved in banking.

Software and Tools Commonly Used

Finance professionals rely on various software and tools to perform their duties efficiently. Associate degree programs often incorporate training on these tools to ensure graduates are well-prepared for the workforce.

- Spreadsheet Software (e.g., Microsoft Excel): Excel is a fundamental tool for financial analysis, modeling, and reporting. Students learn to use Excel for tasks such as creating financial statements, performing calculations, building financial models, and generating charts and graphs. This includes mastering functions like VLOOKUP, SUMIF, and pivot tables.

- Accounting Software (e.g., QuickBooks, Xero): These software packages are used for managing financial transactions, tracking income and expenses, and generating financial reports. Students learn to use these tools to perform accounting tasks, such as bookkeeping, accounts payable and receivable management, and bank reconciliation.

- Financial Planning Software: Programs like Quicken or specialized financial planning software help in creating budgets, tracking investments, and planning for retirement. Students learn to use these tools to assist clients in their financial planning needs.

- Data Analysis Tools: Some programs introduce students to basic data analysis tools like Tableau or Power BI, which are used for visualizing and interpreting financial data. These tools help in identifying trends and patterns in financial data, aiding in decision-making.

Students typically learn these tools through hands-on exercises, case studies, and simulations. Instructors often use real-world examples and data sets to provide practical experience.

Communication and Problem-Solving Skills

Effective communication and problem-solving skills are crucial for success in finance. Finance programs place a significant emphasis on developing these skills.

- Written Communication: Students learn to write clear and concise financial reports, memos, and presentations. They develop the ability to communicate complex financial information effectively to both technical and non-technical audiences. This involves learning to structure reports logically, use appropriate financial terminology, and present data in a visually appealing manner.

- Verbal Communication: Students practice presenting financial information and ideas to colleagues, clients, and stakeholders. They learn to articulate their analyses, recommendations, and conclusions in a confident and persuasive manner. This includes developing active listening skills and the ability to answer questions effectively.

- Problem-Solving: The curriculum includes case studies and real-world scenarios that require students to analyze financial problems, identify potential solutions, and make informed decisions. Students develop critical thinking skills and the ability to apply financial principles to solve complex issues.

- Teamwork: Many finance programs incorporate group projects and collaborative assignments. Students learn to work effectively in teams, share responsibilities, and contribute to a common goal. This fosters collaboration, communication, and the ability to leverage diverse perspectives.

Career Opportunities

An Associate Degree in Finance opens doors to various entry-level positions within the financial sector. These roles provide a solid foundation for career growth and can lead to more advanced opportunities with further education and experience. The skills and knowledge gained through this degree program are highly valued by employers in diverse industries.

Entry-Level Finance Positions

A wide array of entry-level positions are accessible to graduates with an Associate Degree in Finance. These roles often serve as stepping stones to more specialized and senior positions.

- Financial Clerk: Performs a variety of routine financial tasks, such as processing invoices, managing accounts payable and receivable, and maintaining financial records.

- Accounting Clerk: Assists with maintaining financial records, preparing financial reports, and processing transactions. They often work under the supervision of accountants.

- Bookkeeper: Responsible for recording financial transactions, managing accounts, and preparing financial statements for small businesses or specific departments within larger organizations.

- Loan Clerk: Assists loan officers with processing loan applications, verifying information, and maintaining loan records.

- Teller: Provides customer service at a bank or credit union, processing transactions, handling cash, and assisting customers with their financial needs.

- Payroll Clerk: Processes employee payroll, calculates wages, and maintains payroll records.

- Budget Analyst (Entry-Level): Assists in the preparation and analysis of budgets, tracking expenditures, and providing financial reports.

Typical Salary Ranges for Entry-Level Positions

Salary ranges for entry-level finance positions vary based on factors such as location, industry, and the specific responsibilities of the role. However, there are general salary expectations for these positions. Data from the U.S. Bureau of Labor Statistics and other salary reporting websites provides a broad overview. Keep in mind that these are approximate figures and can fluctuate.

Associate degree in finance – Note: Salary data is based on the most recent available information and can vary depending on the source and specific job requirements.

An associate degree in finance provides a solid foundation in financial principles. This knowledge is directly applicable to various specializations, including the increasingly important area of fleet vehicle financing , where understanding loan structures and asset management is key. Individuals with this degree can analyze and manage the financial aspects of vehicle fleets, a valuable skill in today’s market, and further enhance their career prospects with advanced certifications.

- Financial Clerk: The median annual salary for financial clerks is typically in the range of $35,000 to $45,000.

- Accounting Clerk: The median annual salary for accounting clerks generally falls between $38,000 and $48,000.

- Bookkeeper: Bookkeepers can expect to earn a median annual salary between $36,000 and $46,000.

- Loan Clerk: Loan clerks often have a salary range between $34,000 and $44,000 annually.

- Teller: Tellers typically earn a median annual salary in the range of $30,000 to $40,000.

- Payroll Clerk: Payroll clerks often earn a median annual salary between $40,000 and $50,000.

- Budget Analyst (Entry-Level): Entry-level budget analysts may find their salaries in the range of $50,000 to $60,000.

Responsibilities of Different Finance Roles, Associate degree in finance

The responsibilities of finance roles vary significantly depending on the specific position. Understanding these differences is crucial for career planning.

- Financial Clerk: Focuses on day-to-day financial tasks, such as processing invoices, managing accounts payable and receivable, and maintaining financial records. They ensure the accuracy and completeness of financial transactions.

- Accounting Clerk: Supports accountants by maintaining financial records, preparing financial reports, and processing transactions. They may also assist with reconciling accounts and preparing journal entries.

- Bookkeeper: Manages the financial records of a business, including recording transactions, managing accounts, and preparing financial statements. They often work independently and are responsible for the overall financial health of a business.

- Loan Clerk: Assists loan officers by processing loan applications, verifying information, and maintaining loan records. They may also handle customer inquiries and prepare loan documentation.

- Teller: Provides customer service at a bank or credit union, processing transactions, handling cash, and assisting customers with their financial needs. They are the face of the bank and must provide excellent customer service.

- Payroll Clerk: Processes employee payroll, calculates wages, and maintains payroll records. They must be familiar with payroll regulations and ensure that employees are paid accurately and on time.

- Budget Analyst (Entry-Level): Assists in the preparation and analysis of budgets, tracking expenditures, and providing financial reports. They may also conduct research and analysis to support budget decisions.

A Day in the Life of a Financial Clerk

A typical day for a financial clerk involves a variety of tasks related to managing financial records and processing transactions. This role is essential for maintaining the financial stability of an organization.

The financial clerk arrives at the office and begins by checking emails and reviewing any urgent tasks or deadlines. They may start by processing invoices, verifying accuracy, and entering them into the accounting system. This involves matching invoices with purchase orders and receiving documents. The clerk then manages accounts payable and receivable, ensuring timely payments to vendors and following up on outstanding invoices. They may also reconcile bank statements, ensuring that all transactions are accurately recorded. Throughout the day, the clerk responds to inquiries from vendors and internal departments, providing information and resolving issues. They may also assist with preparing financial reports and maintaining financial records. The day concludes with a review of completed tasks and preparation for the next day’s activities.

An associate degree in finance provides a solid foundation in financial principles, preparing students for entry-level roles. Many graduates seek practical experience, and that’s where a finance intern position becomes invaluable, allowing them to apply their knowledge. Completing an associate degree in finance also offers a pathway to further education and career advancement in the financial sector.

Choosing a Finance Program

Selecting the right associate degree program in finance is a crucial step in establishing a strong foundation for your career. This decision impacts not only your immediate educational experience but also your long-term career prospects and earning potential. Careful consideration of various factors and thorough research are essential to ensure the chosen program aligns with your individual goals and aspirations.

Factors to Consider When Selecting a Finance Associate Degree Program

Several elements should be carefully evaluated when choosing a finance associate degree program. These considerations help in identifying a program that offers the best fit for your needs and career ambitions.

- Accreditation: Accreditation signifies that a program meets specific quality standards established by recognized accrediting agencies. Accreditation ensures that the program’s curriculum, faculty, resources, and student support services are of a certain quality. This is vital because accredited programs are often recognized by employers and may be prerequisites for certifications or advanced degree programs. Look for accreditation from organizations like the Accreditation Council for Business Schools and Programs (ACBSP) or the Association of Collegiate Business Schools and Programs (ACBSP).

- Curriculum: The curriculum’s relevance to your career goals is paramount. Evaluate the courses offered to ensure they cover essential finance topics such as financial accounting, corporate finance, investments, and financial markets. The curriculum should provide a balance of theoretical knowledge and practical skills. Consider whether the program includes hands-on learning opportunities like case studies, simulations, or internships.

- Faculty: The quality of the faculty significantly impacts your learning experience. Research the faculty’s credentials, experience, and teaching styles. Look for instructors with industry experience and advanced degrees. A faculty that is actively engaged in research or professional practice can provide valuable insights and real-world perspectives.

- Program Flexibility: Consider the program’s flexibility, especially if you have work or family commitments. Determine whether the program offers online courses, evening classes, or accelerated formats. This flexibility allows you to balance your studies with other responsibilities.

- Cost and Financial Aid: Assess the program’s tuition fees and associated costs, such as textbooks and materials. Explore financial aid options, including scholarships, grants, and loans. Compare the total cost of attendance for different programs and evaluate the availability of financial assistance.

- Career Services: A strong career services department can significantly enhance your job prospects. Inquire about the program’s career services, including resume writing assistance, interview preparation, and job placement support. A program with established connections with employers in the finance industry can provide valuable networking opportunities.

- Location and Accessibility: Consider the program’s location and accessibility. Determine whether the campus is conveniently located and easily accessible. If the program offers online courses, ensure that you have reliable internet access and a suitable learning environment.

Questions to Ask When Evaluating Different Programs

Asking the right questions is essential when evaluating finance associate degree programs. This helps to gather the information needed to make an informed decision.

- What is the program’s accreditation status? Determine whether the program is accredited by a recognized accrediting agency. Accreditation ensures the program meets specific quality standards.

- What specific finance topics are covered in the curriculum? Understand the course content and whether it aligns with your career interests.

- What are the qualifications and experience of the faculty? Evaluate the faculty’s credentials and industry experience.

- Does the program offer online or flexible learning options? Determine whether the program’s schedule fits your needs.

- What is the total cost of the program, including tuition, fees, and materials? Assess the financial implications of attending the program.

- What financial aid options are available? Inquire about scholarships, grants, and loans.

- What career services are provided by the program? Understand the support available for job placement and career development.

- What is the program’s placement rate for graduates? Gain insights into the program’s success in helping graduates find employment.

- Are there opportunities for internships or practical experience? Understand the program’s practical learning opportunities.

- What is the student-to-faculty ratio? Determine the level of interaction and support you can expect.

How to Find Accredited Finance Programs

Identifying accredited finance programs is crucial for ensuring quality and recognition. Several resources can help you locate these programs.

- Search Accrediting Agency Websites: Visit the websites of recognized accrediting agencies, such as the Accreditation Council for Business Schools and Programs (ACBSP) or the Association of Collegiate Business Schools and Programs (ACBSP). These websites often have directories of accredited programs.

- Check College and University Websites: Explore the websites of colleges and universities that offer finance associate degree programs. Look for information about accreditation status in the program description or the academic catalog.

- Use Online Program Search Tools: Utilize online program search tools and databases that allow you to filter results based on accreditation status. These tools can help you narrow your search and identify programs that meet your criteria.

- Contact the Program Directly: If you are unsure about a program’s accreditation status, contact the program directly. Ask the admissions office or the program coordinator for confirmation of accreditation.

- Verify Accreditation: Always verify the accreditation status with the accrediting agency. Some programs may claim accreditation, but it’s essential to confirm this information with the agency itself.

Benefits of an Associate Degree

An associate degree in finance offers significant advantages in the competitive job market. It provides a foundation of financial knowledge and skills, opening doors to entry-level positions and serving as a pathway to further education and career advancement. This section will delve into the specific benefits of earning an associate degree in finance.

Advantages Over Not Having a Degree

Obtaining an associate degree in finance provides a distinct advantage over individuals without any formal education in the field. This advantage stems from the specialized knowledge, practical skills, and increased credibility the degree confers.

- Enhanced Job Prospects: An associate degree demonstrates a commitment to professional development and equips graduates with the foundational skills employers seek. According to the Bureau of Labor Statistics, individuals with postsecondary education, including associate degrees, typically have lower unemployment rates compared to those with only a high school diploma. This degree allows you to gain entry-level positions such as a bank teller or loan officer.

- Higher Earning Potential: While starting salaries may be modest, an associate degree in finance can lead to higher earning potential compared to those without a degree. Graduates possess a more in-depth understanding of financial concepts, which allows them to perform more complex tasks and, consequently, earn more. Data from the U.S. Department of Labor indicates a correlation between higher levels of education and increased lifetime earnings.

- Improved Skills and Knowledge: The curriculum of an associate degree program in finance is designed to equip students with essential skills such as financial analysis, budgeting, and investment strategies. This enhanced skill set provides a solid foundation for a successful career in finance. Courses also cover accounting principles, economic concepts, and financial planning.

- Increased Credibility and Professionalism: Holding an associate degree signals a level of competence and professionalism to potential employers. It demonstrates that the individual has completed a structured program of study and has been assessed on their knowledge and skills.

Potential for Career Advancement

An associate degree in finance is not just a starting point; it also serves as a stepping stone for career advancement. While entry-level positions may be the initial focus, the skills and knowledge gained can lead to promotions and opportunities for growth within the financial industry.

- Promotion Opportunities: Employees with an associate degree in finance often have a better chance of being promoted to supervisory or management positions compared to those without the degree. This is because they have a deeper understanding of financial operations and can make informed decisions.

- Specialization Options: With experience, graduates can specialize in areas such as financial planning, credit analysis, or investment banking. The associate degree provides the foundation for acquiring specialized certifications and skills relevant to these areas. For example, a graduate might pursue the Certified Financial Planner (CFP) designation.

- Increased Responsibilities: As individuals gain experience and demonstrate competence, they are often given more responsibilities. This might include managing financial accounts, overseeing budgeting processes, or advising clients on investment strategies.

- Networking Opportunities: Associate degree programs often provide opportunities to network with professionals in the financial industry. These connections can be invaluable for career advancement, providing access to job opportunities and mentorship.

Stepping Stone to a Bachelor’s Degree

An associate degree in finance is often a strategic starting point for individuals aiming to obtain a bachelor’s degree. Many associate degree programs are designed to transfer credits to four-year universities, making it easier to continue education without starting from scratch.

- Credit Transferability: Many colleges and universities have agreements with community colleges and other institutions, allowing students to transfer credits earned in an associate degree program towards a bachelor’s degree. This can significantly reduce the time and cost required to obtain a four-year degree.

- Foundation for Advanced Studies: An associate degree provides a solid foundation in financial concepts and skills, making the transition to a bachelor’s degree program smoother. Students are already familiar with fundamental principles, allowing them to focus on more advanced topics.

- Career Flexibility: A bachelor’s degree in finance can open doors to more advanced career opportunities, such as financial analyst, financial manager, or investment banker. It also provides a broader understanding of financial markets and business operations.

- Cost and Time Savings: Completing an associate degree before pursuing a bachelor’s degree can sometimes save money. Community colleges often have lower tuition costs than four-year universities. Additionally, some students find that they can work in the finance field while pursuing their bachelor’s degree, gaining valuable experience.

Comparison with Other Degrees

An associate degree in finance provides a solid foundation for a career in the financial sector, but it’s essential to understand how it stacks up against other related degrees. Comparing the curriculum, career paths, and earning potential helps prospective students make informed decisions aligned with their long-term goals. Understanding these differences can significantly influence career trajectory and professional development.

Comparison of Career Paths and Earning Potential

The choice of degree significantly impacts career paths and earning potential. While an associate degree in finance can lead to entry-level positions, other degrees often unlock more advanced roles and higher salaries. For example, a bachelor’s degree in finance typically opens doors to financial analyst positions, which often have higher earning potential compared to entry-level roles accessible with an associate degree. Similarly, a degree in accounting might lead to roles such as a certified public accountant (CPA), potentially offering even greater earning potential.

Here’s a comparison of potential career paths and average salaries, according to the Bureau of Labor Statistics (BLS) and other reliable sources (Salary data is based on recent averages and may vary based on location, experience, and employer):

- Associate Degree in Finance: Entry-level positions such as loan clerk, financial clerk, or teller. The median annual salary can range from $35,000 to $45,000, depending on the specific role and location.

- Bachelor’s Degree in Finance: Financial analyst, financial advisor, or investment banker. The median annual salary for financial analysts is approximately $85,660, as of May 2023, according to the BLS. Experienced financial advisors can earn significantly more.

- Bachelor’s Degree in Accounting: Accountant, auditor, or CPA. The median annual salary for accountants and auditors was $77,250 in May 2023, according to the BLS. CPAs often command higher salaries due to their advanced certifications.

- Bachelor’s Degree in Business Administration: Business operations manager, management analyst, or marketing manager. The median annual salary for business operations managers was $104,240 in May 2023, according to the BLS.

Curriculum Focus Differences

The curriculum focus varies significantly across different degrees, shaping the skills and knowledge acquired by students. Understanding these differences is crucial for choosing the right degree to match specific career aspirations. The curriculum differences impact the skill sets developed, which, in turn, influence career options.

Here’s a table highlighting the curriculum differences between an associate degree in finance, accounting, and business administration:

| Degree | Curriculum Focus | Key Courses |

|---|---|---|

| Associate Degree in Finance | Provides a foundational understanding of financial principles and practices. Focuses on financial analysis, investments, and banking. | Financial Accounting, Principles of Finance, Investments, Banking and Financial Institutions, Business Law, Microeconomics. |

| Bachelor’s Degree in Accounting | Emphasizes accounting principles, financial reporting, auditing, and taxation. Prepares students for careers in accounting and related fields. | Financial Accounting, Managerial Accounting, Auditing, Taxation, Cost Accounting, Accounting Information Systems. |

| Bachelor’s Degree in Business Administration | Offers a broad overview of business operations, including finance, marketing, management, and human resources. Provides a general understanding of business principles. | Principles of Management, Marketing, Financial Management, Business Law, Organizational Behavior, Operations Management. |

Cost and Financial Aid

Pursuing an associate degree in finance involves a financial commitment. Understanding the costs associated with the program and exploring available financial aid options is crucial for prospective students. This section details the average costs, available aid, and the application process.

Average Cost of an Associate Degree in Finance

The cost of an associate degree in finance varies based on several factors. These include the type of institution (public versus private), location, and whether the student attends full-time or part-time. Generally, public community colleges offer the most affordable options.

- Public Community Colleges: Tuition costs at public community colleges are typically lower than those at private institutions. The average tuition and fees for in-district students are often significantly less than out-of-state or private college costs. For example, in the 2022-2023 academic year, the average tuition and fees for in-district students at public two-year colleges were around $3,860.

- Private Institutions: Private colleges and universities usually have higher tuition rates. These institutions often offer a wider range of programs and resources, which can contribute to increased costs. The average tuition and fees at private, non-profit four-year institutions for the 2022-2023 academic year were approximately $39,400.

- Additional Expenses: Beyond tuition, students should budget for additional expenses. These include books, supplies, transportation, and living costs (room and board). These costs can vary considerably based on the student’s living situation and spending habits. The College Board estimates that the average student spends several hundred to a thousand dollars per year on books and supplies.

Financial Aid Options

Several financial aid options are available to help students finance their associate degree in finance. Understanding these options and how to apply for them is essential.

- Grants: Grants are a form of financial aid that does not need to be repaid. They are typically awarded based on financial need. The most well-known grant is the Federal Pell Grant, which is awarded to undergraduate students with exceptional financial need. The maximum Pell Grant award for the 2023-2024 award year is $7,395. Other grants may be available from state governments and individual colleges or universities.

- Scholarships: Scholarships are another form of gift aid that does not require repayment. They are often awarded based on academic merit, specific skills, or other criteria. Students can find scholarships through various sources, including the college they plan to attend, private organizations, and online scholarship databases.

- Loans: Student loans are borrowed funds that must be repaid, typically with interest. There are two main types of student loans: federal loans and private loans. Federal student loans usually offer more favorable terms and conditions, such as lower interest rates and flexible repayment plans. Private loans are offered by banks and other financial institutions and may have higher interest rates and stricter repayment terms.

Applying for Financial Aid

The process for applying for financial aid involves several steps. It’s important to understand the deadlines and requirements to maximize the chances of receiving aid.

- Complete the Free Application for Federal Student Aid (FAFSA): The FAFSA is the primary application for federal student aid. It collects information about the student’s and their family’s financial situation to determine eligibility for federal grants, loans, and work-study programs. The FAFSA application opens on October 1st each year for the upcoming academic year.

- Complete the CSS Profile (if required): Some private colleges and universities require the College Scholarship Service (CSS) Profile in addition to the FAFSA. The CSS Profile provides more detailed financial information and is used to determine eligibility for institutional financial aid.

- Explore State Aid Programs: Many states offer their own financial aid programs. Students should research the specific requirements and deadlines for their state’s programs.

- Search for Scholarships: Students should actively search for scholarships through various sources. This includes the college’s financial aid office, online scholarship databases, and organizations related to their field of study.

- Review Award Letters: Once financial aid applications are processed, students will receive award letters from the colleges they’ve been accepted to. These letters Artikel the types and amounts of financial aid offered. Students should carefully review the award letters and compare the aid packages offered by different institutions.

The deadline for the FAFSA is typically in the spring for the upcoming academic year, but it’s best to apply as early as possible. Some state and institutional aid is awarded on a first-come, first-served basis.

Online vs. On-Campus Programs

Choosing between an online and an on-campus associate degree in finance is a crucial decision, significantly impacting your learning experience and career trajectory. Both formats offer unique advantages and disadvantages, requiring careful consideration of your individual needs and circumstances. Understanding these differences will empower you to make an informed choice that aligns with your goals.

Advantages and Disadvantages of Each Program Type

The format of your finance degree, whether online or on-campus, shapes your learning experience. It’s important to weigh the benefits and drawbacks of each to determine which best suits your learning style, schedule, and career aspirations.

- On-Campus Programs:

- Advantages: Offer direct interaction with professors and classmates, fostering a collaborative learning environment. This can lead to richer discussions, immediate feedback, and stronger networking opportunities. Students benefit from in-person access to campus resources like libraries, career services, and tutoring centers. The structured schedule can also provide a strong sense of routine and discipline, which is especially helpful for students who thrive in a traditional classroom setting.

- Disadvantages: Require physical presence, limiting flexibility for students with work, family, or other commitments. Commuting and adhering to a fixed schedule can be challenging. The cost, including tuition, fees, and living expenses, is often higher than online programs. The pace of learning is typically set for the entire class, which may not suit all learning styles.

- Online Programs:

- Advantages: Provide unparalleled flexibility, allowing students to study anytime, anywhere. This is ideal for working professionals, parents, or individuals with geographical limitations. Online programs often offer self-paced learning, enabling students to progress at their own speed. The cost can be lower, with reduced tuition fees and no commuting expenses. Access to a broader range of programs and institutions is a significant benefit.

- Disadvantages: Require self-discipline and time management skills, as students are responsible for their own learning schedule. Interaction with professors and classmates is primarily virtual, which may not suit all learning styles. The lack of in-person campus resources can be a drawback. The quality of online programs can vary, making it crucial to choose a reputable and accredited institution. Networking opportunities might be limited compared to on-campus programs.

Importance of Accreditation for Online Programs

Accreditation is a critical factor when evaluating an online finance program. It signifies that the program meets specific quality standards and provides assurance that the education received is recognized and valuable. Choosing an accredited program is essential for several reasons.

- Recognition by Employers: Employers often prioritize candidates with degrees from accredited institutions. Accreditation validates the program’s quality and credibility, increasing your chances of securing employment.

- Transferability of Credits: Credits earned from accredited programs are more likely to be transferable to other institutions if you decide to pursue a bachelor’s degree or further education.

- Eligibility for Financial Aid: Accreditation is a requirement for students to receive federal financial aid, including grants and loans.

- Quality Assurance: Accrediting bodies evaluate programs based on criteria such as curriculum, faculty qualifications, student support services, and program outcomes. This ensures that the program meets certain educational standards.

Note: Reputable accrediting bodies for finance programs include the Accreditation Council for Business Schools and Programs (ACBSP) and the Association to Advance Collegiate Schools of Business (AACSB). Verify the accreditation status of any online program before enrolling.

Resources for Finding Online Finance Programs

Numerous resources are available to help you locate and evaluate online finance programs. These resources provide valuable information, including program details, accreditation status, and student reviews.

- University and College Websites: Start by exploring the websites of universities and colleges that offer associate degrees in finance. Look for dedicated sections on online programs, including program descriptions, admission requirements, and tuition costs.

- Online Education Platforms: Platforms such as Coursera, edX, and Udemy may offer introductory finance courses or even entire associate degree programs.

- College Ranking Websites: Websites like U.S. News & World Report and Niche.com provide rankings and reviews of online programs, helping you compare different options. These rankings often consider factors like graduation rates, student-faculty ratio, and student satisfaction.

- Accrediting Body Websites: Visit the websites of accrediting bodies like ACBSP and AACSB to search for accredited online programs. These sites often provide a directory of accredited institutions.

- Financial Aid Websites: Explore websites like the U.S. Department of Education’s Federal Student Aid website to learn about financial aid options for online programs.

- Professional Organizations: Organizations like the CFA Institute (for Chartered Financial Analyst designation) and the CFP Board (for Certified Financial Planner designation) may provide information about finance programs.

Continuing Education and Certifications: Associate Degree In Finance

An Associate Degree in Finance provides a solid foundation for a career in the financial sector. However, the financial landscape is constantly evolving, with new regulations, technologies, and market trends emerging regularly. To stay competitive and advance their careers, finance professionals need to continuously update their knowledge and skills through continuing education and professional certifications. These credentials demonstrate a commitment to professional development and enhance credibility with employers and clients.

Professional Certifications for Finance Professionals

Obtaining professional certifications is a strategic way for finance professionals to specialize in a particular area, validate their expertise, and increase their earning potential. These certifications often require passing rigorous exams and meeting specific experience requirements, signaling a high level of proficiency.

- Certified Financial Planner (CFP): This certification is highly respected and focuses on comprehensive financial planning, including retirement planning, investment management, estate planning, and insurance. The CFP certification is offered by the Certified Financial Planner Board of Standards, Inc.

- Chartered Financial Analyst (CFA): The CFA designation is globally recognized and is ideal for those pursuing careers in investment management, portfolio management, and financial analysis. The CFA Program is administered by the CFA Institute and requires passing three levels of exams.

- Certified Public Accountant (CPA): CPAs are licensed professionals who specialize in accounting, auditing, and taxation. This certification is essential for those seeking careers in public accounting, corporate accounting, and financial management. CPA exams are administered by the American Institute of Certified Public Accountants (AICPA).

- Certified Management Accountant (CMA): The CMA certification focuses on management accounting and financial planning, analysis, and control. It is ideal for professionals working in corporate finance and accounting roles. The Institute of Management Accountants (IMA) awards the CMA certification.

- Financial Risk Manager (FRM): This certification is designed for professionals working in risk management roles within financial institutions. The Global Association of Risk Professionals (GARP) administers the FRM exam.

- Series 7 and Series 63 Licenses: These licenses are required for individuals who sell securities. The Series 7 license allows professionals to sell a wide range of securities products, while the Series 63 license allows them to solicit orders for securities in a specific state. These licenses are administered by FINRA.

How to Pursue These Certifications

The process for obtaining professional certifications typically involves several key steps. Each certification has its own specific requirements, but the general process is similar.

- Education and Prerequisites: Most certifications require a bachelor’s degree, although some may accept relevant work experience in lieu of a degree. Before registering for the exams, candidates must meet the specific educational and experience requirements Artikeld by the certification provider.

- Exam Preparation: Preparing for certification exams typically involves dedicated study time. Candidates often use study materials such as textbooks, practice exams, and online courses.

- Exam Registration and Examination: Candidates must register for the exams through the certification provider. Exams are often offered at specific times and locations.

- Experience Requirements: Many certifications require candidates to gain a certain amount of relevant work experience before they can become fully certified. This experience requirement ensures that candidates have practical knowledge and can apply their skills in real-world situations.

- Continuing Education: Once certified, professionals are typically required to complete continuing education courses to maintain their certification. This helps them stay current with industry trends and best practices.

Preparing for a Career in Finance

Entering the finance industry requires more than just academic qualifications; it demands a proactive approach to building experience and establishing connections. Successfully navigating this landscape involves strategic planning, consistent effort, and a commitment to professional development. This section Artikels key steps for individuals seeking to establish a robust foundation for a successful career in finance.

Gaining Practical Experience Through Internships and Volunteering

Practical experience is invaluable in finance, providing real-world application of theoretical knowledge. Internships and volunteering opportunities offer crucial avenues to gain this experience, allowing individuals to develop essential skills and build a professional network. These experiences often serve as stepping stones to full-time employment.

- Internships: Internships provide structured opportunities to work within financial institutions, such as banks, investment firms, or insurance companies. They typically involve working on projects, assisting senior professionals, and gaining exposure to various aspects of the business. For example, an investment banking intern might assist with financial modeling, market analysis, or deal preparation.

- Types of Internships: Internships can be found in various areas, including investment banking, asset management, corporate finance, and financial planning.

- Finding Internship Opportunities: Websites like LinkedIn, Indeed, and company career pages are excellent resources for finding internship postings. Attending career fairs and networking events can also yield valuable leads.

- Maximizing Internship Experience: Actively seek challenging assignments, ask questions, and build relationships with colleagues. Demonstrate a strong work ethic and a willingness to learn.

- Volunteering: Volunteering in finance-related roles, even if unpaid, can provide valuable experience and demonstrate a commitment to the field. This could involve assisting a non-profit organization with its financial management or providing pro bono financial advice.

- Examples of Volunteering: Opportunities can include assisting with budgeting, bookkeeping, or financial literacy programs.

- Benefits of Volunteering: Volunteering can help develop practical skills, build a professional network, and demonstrate a commitment to the community.

Detailing the Importance of Networking in the Finance Industry

Networking is crucial for career advancement in finance. The industry thrives on relationships, and building a strong network can open doors to job opportunities, mentorship, and valuable insights. Networking allows individuals to learn from experienced professionals and stay informed about industry trends.

- Networking as a Career Catalyst: Networking provides access to the hidden job market, where many opportunities are not publicly advertised.

- Benefits of Networking: Networking can lead to job referrals, career advice, mentorship, and access to industry insights.

- Building Relationships: Building strong relationships involves being genuine, reliable, and helpful. It’s about offering value to others and maintaining contact over time.

Designing a Strategy for Building a Professional Network

A proactive and well-planned approach is essential for effective networking. This involves identifying key individuals, attending relevant events, and consistently engaging with contacts. Building a professional network is an ongoing process that requires time, effort, and a strategic mindset.

- Identifying Target Contacts: Determine the types of professionals you want to connect with, such as those in your desired field or at companies you admire.

- Attending Industry Events: Conferences, seminars, and workshops provide excellent opportunities to meet professionals and learn about industry trends.

- Utilizing Online Platforms: Platforms like LinkedIn are essential tools for connecting with professionals, joining industry groups, and sharing content.

- LinkedIn Best Practices: Maintain an updated profile, actively engage with content, and reach out to connect with relevant professionals.

- Following Up and Maintaining Contact: After meeting someone, follow up with a personalized message and stay in touch regularly. This can be done through email, phone calls, or social media.

- Offering Value: Provide value to your network by sharing relevant information, offering assistance, and being a supportive contact.

Illustrative Examples

Understanding financial concepts can often be enhanced through visual aids. This section provides detailed descriptions of illustrative examples, including a chart depicting investment growth, a flowchart outlining the loan application process, and a graph illustrating the relationship between interest rates and inflation. These examples aim to clarify complex topics and provide a practical understanding of key financial principles.

Growth of a Financial Investment Over Time

A line chart provides a clear visualization of investment growth. The x-axis represents time, typically measured in years or months, and the y-axis represents the investment’s value, measured in dollars or another currency. The chart displays a single line that illustrates the investment’s performance over the specified period.

The line begins at the initial investment value, also known as the principal. As time progresses, the line either rises or falls, reflecting the investment’s gains or losses. The slope of the line indicates the rate of return; a steeper upward slope suggests a higher rate of growth, while a downward slope indicates a loss in value. The chart may also include key milestones, such as significant market events or investment decisions, to provide context for the investment’s performance.

For instance, consider an initial investment of $10,000. Over a 10-year period, the chart might show the investment growing steadily, with some fluctuations. The line might initially rise gradually, reflecting a conservative investment strategy. Later, the line might increase more rapidly during a period of market growth, and then experience a temporary dip during an economic downturn. Ultimately, the chart would show the investment growing to, say, $20,000 or more, depending on the investment’s performance and the prevailing market conditions.

Steps Involved in a Loan Application Process

A flowchart is a visual representation of the loan application process. It uses various shapes and arrows to depict the sequence of steps involved, from the initial application to the final disbursement of funds. The flowchart ensures a clear understanding of the process and the requirements at each stage.

The flowchart typically begins with the applicant’s initiation of the loan application. This step is usually represented by an oval shape, indicating the start of the process. The subsequent steps are then shown using rectangular boxes, which represent actions or decisions. Arrows indicate the flow of the process from one step to the next.

The typical steps in a loan application process include:

- Application Submission: The applicant completes and submits the loan application form, providing personal and financial information.

- Document Verification: The lender verifies the information provided in the application, checking income, credit history, and other relevant documents.

- Credit Check: The lender conducts a credit check to assess the applicant’s creditworthiness.

- Underwriting: The lender’s underwriting department reviews the application and assesses the risk associated with the loan.

- Approval/Rejection: Based on the underwriting process, the lender either approves or rejects the loan application.

- Loan Agreement: If approved, the lender prepares a loan agreement, outlining the terms and conditions of the loan.

- Disbursement: The lender disburses the loan funds to the borrower.

Decision points, where the process branches based on certain criteria, are usually represented by diamond-shaped boxes. For example, after the credit check, a diamond shape might indicate a decision: “Does the applicant meet the credit score requirements?”. If the answer is “yes,” the process continues to the next step; if “no,” the application is rejected.

Relationship Between Interest Rates and Inflation

A graph effectively illustrates the relationship between interest rates and inflation. The graph typically uses two lines to represent the trends of interest rates and inflation over a specific period. The x-axis represents time, typically measured in years or months, and the y-axis represents the percentage values of both interest rates and inflation.

The graph shows how these two economic indicators are often correlated. Generally, when inflation rises, central banks tend to increase interest rates to curb spending and reduce inflationary pressures. Conversely, when inflation falls, central banks may lower interest rates to stimulate economic activity. The graph clearly demonstrates this inverse relationship.

For example, a graph could show that during a period of rising inflation (e.g., 2021-2023), the interest rates also increased. In contrast, during a period of declining inflation, the interest rates might decrease or remain stable. However, it is important to note that the relationship is not always perfect, as other factors can influence interest rates. Other factors include economic growth, unemployment, and government policies.

The graph allows for a clear understanding of the impact of monetary policy on the economy and how changes in interest rates can influence inflation.