Introduction to RPA in Finance

Robotic Process Automation (RPA) is revolutionizing the finance sector, offering significant opportunities to streamline operations, reduce costs, and improve accuracy. By automating repetitive, rule-based tasks, RPA frees up human employees to focus on more strategic and value-added activities. This shift not only boosts efficiency but also allows financial institutions to enhance their customer service and gain a competitive edge.

Basic Concept of RPA and Its Application in Finance

Robotic Process Automation involves using software “robots” or “bots” to automate tasks that are typically performed by humans. These bots are configured to mimic human actions, such as data entry, data extraction, and system navigation, within existing IT infrastructure. In the finance sector, RPA is deployed to automate a wide range of processes, including invoice processing, reconciliation, and reporting. The bots work tirelessly, 24/7, without errors, leading to significant improvements in speed and accuracy.

Examples of Repetitive Tasks in Finance Suited for RPA

Several repetitive tasks within the finance sector are particularly well-suited for automation with RPA. These tasks often involve high volumes of data, are rule-based, and are prone to human error.

- Invoice Processing: Automating the extraction of data from invoices, matching them with purchase orders, and routing them for approval. This process can significantly reduce processing times and minimize errors. For example, a large multinational company reduced its invoice processing time by 60% and saved approximately $200,000 annually by implementing RPA.

- Account Reconciliation: Matching and reconciling transactions between different systems, such as bank statements and general ledger entries. This includes identifying discrepancies and initiating corrective actions. Automating this process reduces the risk of errors and speeds up the reconciliation cycle.

- Financial Reporting: Generating financial reports, such as balance sheets and income statements, by extracting data from various systems and consolidating it into the required format. RPA ensures accuracy and timely reporting. A study showed that organizations using RPA for financial reporting saw a 30% reduction in report generation time.

- Know Your Customer (KYC) Compliance: Automating the verification of customer identities and screening against regulatory lists. RPA helps financial institutions comply with KYC regulations more efficiently and consistently.

- Fraud Detection: Identifying suspicious transactions and patterns by analyzing large datasets. RPA bots can flag potential fraudulent activities in real-time, improving the effectiveness of fraud prevention measures.

- Data Entry and Validation: Automating the entry of data from various sources, such as customer applications and vendor invoices, into financial systems. This includes validating data against predefined rules and ensuring accuracy.

Potential Benefits of Implementing RPA in Finance

The implementation of RPA in finance offers a multitude of benefits, contributing to improved efficiency, reduced costs, and enhanced accuracy. These advantages make RPA a compelling investment for financial institutions looking to optimize their operations.

- Cost Reduction: RPA can significantly reduce operational costs by automating labor-intensive tasks. The automation of tasks leads to reduced headcount requirements and decreased error rates, resulting in lower expenses. A recent study by Deloitte revealed that RPA can reduce operational costs by up to 75% in certain finance functions.

- Improved Accuracy: RPA bots are programmed to follow predefined rules, minimizing human error. This leads to increased accuracy in data processing and reporting, reducing the risk of financial misstatements and regulatory penalties.

- Increased Efficiency: RPA automates tasks around the clock, without breaks or errors. This leads to faster processing times, improved throughput, and increased overall efficiency. This allows finance teams to handle higher volumes of transactions and data with the same or fewer resources.

- Enhanced Compliance: RPA helps financial institutions comply with regulations by automating compliance-related tasks, such as KYC and AML checks. RPA ensures that these tasks are performed consistently and accurately, reducing the risk of non-compliance and associated penalties.

- Improved Employee Satisfaction: By automating repetitive and mundane tasks, RPA frees up human employees to focus on more strategic and value-added activities. This can lead to increased job satisfaction and improved employee morale.

Specific RPA Applications in Finance

Robotic Process Automation (RPA) offers transformative potential within finance, streamlining operations, reducing costs, and improving accuracy. This section delves into specific applications, showcasing how RPA is revolutionizing key financial processes. The following sections will illustrate practical examples and workflows, emphasizing the benefits of implementing RPA in various financial domains.

Common Finance Processes Automatable with RPA

RPA’s versatility allows it to automate a wide range of financial processes, freeing up human employees to focus on more strategic tasks. These automations improve efficiency and reduce the likelihood of errors.

- Accounts Payable (AP): Automating invoice processing, payment approvals, and vendor management.

- Accounts Receivable (AR): Automating invoice generation, payment application, and collections follow-up.

- Financial Reporting: Automating data extraction, consolidation, and report generation.

- General Ledger (GL) Reconciliation: Automating the matching of transactions between sub-ledgers and the general ledger.

- Budgeting and Forecasting: Automating data collection, analysis, and report creation for budget planning.

- Audit Support: Automating data extraction and preparation for audits, reducing manual effort.

- Fixed Asset Management: Automating the tracking, depreciation, and disposal of fixed assets.

- Tax Compliance: Automating the collection and submission of tax-related data.

Automating Invoice Processing with RPA

Invoice processing, a traditionally labor-intensive process, can be significantly streamlined with RPA. Automation reduces manual data entry, accelerates processing times, and minimizes errors.

- Data Extraction: RPA bots use Optical Character Recognition (OCR) and Intelligent Document Processing (IDP) to extract data from invoices. This data includes vendor information, invoice number, date, line items, and amounts. The bots are configured to identify and extract specific data points from various invoice formats.

- Data Validation: The extracted data is then validated against predefined rules and databases. For instance, the bot checks if the vendor is in the approved vendor list, if the invoice amount exceeds the purchase order amount, or if the invoice date is within the acceptable timeframe. Any discrepancies trigger alerts for manual review.

- Workflow Routing and Approval: Once validated, the invoice is routed to the appropriate approvers based on predefined rules (e.g., invoice amount, department, or vendor). RPA can automatically trigger email notifications or workflow tasks for approvals.

- Posting to Accounting System: Upon approval, the RPA bot automatically posts the invoice data into the accounting system, such as SAP, Oracle, or NetSuite. This includes creating journal entries and updating the general ledger.

- Payment Processing: RPA can also initiate payments based on the invoice due date and payment terms. The bot can integrate with banking systems to automate payment execution.

An example of the time saved through RPA implementation: A large manufacturing company reduced its invoice processing time from an average of 10 days to just 2 days after implementing RPA, leading to significant cost savings and improved vendor relationships.

Designing a Workflow for Bank Reconciliation with RPA

Bank reconciliation is another process ripe for RPA automation. By automating this process, financial institutions can improve accuracy, reduce manual effort, and ensure timely reconciliation.

- Data Extraction: The RPA bot extracts transaction data from the bank statement (e.g., in a CSV or PDF format) and from the internal accounting system. This data includes transaction dates, amounts, descriptions, and reference numbers.

- Data Matching: The bot automatically matches transactions from the bank statement with corresponding transactions in the accounting system. This is typically done using a combination of matching criteria, such as transaction date, amount, and description.

- Exception Handling: The RPA bot identifies unmatched transactions, which require manual review. It flags these exceptions for human intervention, providing details about the discrepancy.

- Reconciliation Reporting: The bot generates a reconciliation report, highlighting the matched and unmatched transactions, and any identified discrepancies.

- Workflow Integration: The RPA solution integrates with the accounting system, automatically updating the general ledger with reconciled transactions.

A real-world example demonstrates that a mid-sized bank automated its bank reconciliation process using RPA, achieving a 60% reduction in manual reconciliation time and a 20% improvement in accuracy.

Using RPA to Improve Fraud Detection and Prevention

RPA can play a crucial role in enhancing fraud detection and prevention within financial institutions by automating repetitive tasks and identifying anomalies.

- Transaction Monitoring: RPA bots can continuously monitor transactions for suspicious activities, such as unusual transaction amounts, frequent transactions to high-risk countries, or transactions outside of normal business hours. The bot can flag these transactions for review.

- Duplicate Payment Detection: RPA can identify and flag duplicate payments by comparing payment data across various systems. This helps prevent fraudulent payments.

- Vendor Fraud Detection: RPA can analyze vendor data to identify potential fraud, such as vendors with multiple bank accounts or vendors with addresses in high-risk locations.

- Account Takeover Detection: RPA can monitor account activity for signs of account takeover, such as changes in account information or unauthorized transactions.

- Data Validation and Integrity Checks: RPA can automate data validation processes, ensuring data integrity and preventing fraudulent data entry. For instance, it can verify employee information against a database.

- Automated Reporting: RPA can generate reports on suspicious activities, providing insights into potential fraud patterns and trends.

A financial institution implemented RPA to monitor for fraudulent transactions. The system automatically flagged suspicious transactions, resulting in a 30% increase in fraud detection and a significant reduction in financial losses.

Benefits of RPA Implementation in Finance

Implementing Robotic Process Automation (RPA) in finance departments offers a multitude of advantages, streamlining operations and significantly improving efficiency. These benefits extend beyond simple automation, impacting cost reduction, data accuracy, process speed, and employee satisfaction.

Reducing Operational Costs with RPA in Finance

RPA’s ability to automate repetitive tasks directly translates into substantial cost savings for financial departments. By minimizing the need for manual labor, RPA reduces the expenses associated with salaries, benefits, and training.

The following illustrate the specific cost-saving benefits:

- Reduced Labor Costs: RPA bots can work around the clock, eliminating the need for overtime pay and reducing the overall headcount required for routine tasks. For instance, a study by Deloitte showed that companies using RPA in finance could achieve a 20-50% reduction in operational costs.

- Lower Error Rates: Automated processes are far less prone to human error, minimizing the costs associated with correcting mistakes, re-doing work, and avoiding penalties.

- Improved Resource Allocation: By freeing up human employees from mundane tasks, RPA allows them to focus on more strategic, value-added activities, such as financial analysis and decision-making.

- Scalability: RPA solutions can be easily scaled up or down to meet changing business demands, avoiding the need for costly investments in additional human resources during peak periods.

Improving Accuracy of Financial Data and Reducing Errors

One of the most significant benefits of RPA is its ability to enhance the accuracy of financial data. By automating data entry, processing, and reconciliation, RPA minimizes the risk of human error, leading to more reliable and trustworthy financial information.

Key aspects of RPA in improving data accuracy include:

- Automated Data Entry: RPA bots can extract data from various sources (e.g., invoices, bank statements) and enter it into financial systems with perfect accuracy, eliminating manual data entry errors.

- Automated Reconciliation: RPA can automate the reconciliation of accounts, such as bank reconciliations and intercompany reconciliations, identifying and resolving discrepancies quickly and efficiently. For example, a company can automate the matching of thousands of transactions between their accounting system and their bank statements, reducing the time spent on this task from days to hours.

- Real-Time Data Validation: RPA can be programmed to validate data in real-time, ensuring that data meets predefined criteria and flagging any anomalies for immediate attention.

- Improved Compliance: RPA can help ensure compliance with regulatory requirements by automating processes and generating audit trails, reducing the risk of non-compliance penalties.

Accelerating Financial Processes and Improving Turnaround Times

RPA significantly accelerates financial processes, leading to faster turnaround times and improved overall efficiency. Automation streamlines workflows, reduces bottlenecks, and allows for quicker completion of financial tasks.

Here’s how RPA accelerates financial processes:

- Faster Invoice Processing: RPA can automate the entire invoice processing cycle, from receiving invoices to making payments, reducing processing times and improving vendor relationships.

- Quicker Month-End Closing: RPA can automate many of the tasks involved in month-end closing, such as journal entries and account reconciliations, allowing for faster and more accurate financial reporting.

- Expedited Reporting: RPA can automate the generation of financial reports, such as income statements and balance sheets, providing timely and accurate information to stakeholders.

- Improved Cash Flow Management: By automating processes related to accounts receivable and accounts payable, RPA can improve cash flow management and optimize working capital.

Impact of RPA on Employee Productivity and Job Satisfaction in Finance

RPA transforms the work environment for finance professionals, leading to increased productivity and higher job satisfaction. By automating tedious and repetitive tasks, RPA frees up employees to focus on more strategic and fulfilling activities.

The impact of RPA on employees includes:

- Increased Productivity: RPA allows employees to accomplish more in less time by automating routine tasks, leading to increased overall productivity.

- Enhanced Skill Development: With RPA handling the mundane tasks, employees can focus on developing higher-level skills, such as data analysis, financial modeling, and strategic decision-making.

- Improved Job Satisfaction: By eliminating repetitive and monotonous tasks, RPA can significantly improve job satisfaction and reduce employee burnout.

- Better Work-Life Balance: RPA can help finance professionals achieve a better work-life balance by reducing the need for overtime and freeing up time for personal pursuits.

Challenges of RPA Implementation in Finance: Rpa Finance

Implementing Robotic Process Automation (RPA) in finance, while promising significant benefits, presents several challenges. Overcoming these hurdles is crucial for a successful RPA deployment and realizing its full potential. This section Artikels the key obstacles and provides practical strategies to mitigate them.

Potential Challenges and Obstacles in RPA Implementation

RPA implementation in finance can encounter various challenges that can hinder its effectiveness and lead to project delays or failures. These challenges range from technical issues to organizational resistance. Understanding these potential roadblocks is essential for proactive planning and risk management.

- Data Quality and Availability: RPA relies on clean and accessible data. Poor data quality, including inconsistencies, errors, and incomplete information, can lead to automation failures. Furthermore, data silos and lack of integration between different financial systems can restrict data accessibility, making it difficult for robots to perform tasks effectively.

- Process Complexity and Standardization: Complex and poorly documented financial processes are difficult to automate. If processes are not standardized and streamlined, the automation efforts can be significantly more complex and time-consuming. Identifying and documenting these processes is crucial before automation.

- Integration with Legacy Systems: Many financial institutions rely on legacy systems that may not be easily integrated with RPA tools. Integrating RPA with these systems can be technically challenging and may require significant customization or workarounds.

- Security and Compliance Concerns: Financial data is highly sensitive and subject to strict regulatory requirements. Ensuring the security and compliance of RPA implementations is paramount. Data breaches or non-compliance can have severe consequences.

- Employee Resistance to Change: The introduction of RPA can lead to employee concerns about job security and changes in roles. Resistance to change can hinder the adoption and success of RPA initiatives.

- Lack of Skilled Resources: Implementing and managing RPA requires specialized skills, including process analysis, RPA development, and change management. A shortage of skilled resources can delay or limit the scope of RPA projects.

- Cost and ROI Considerations: The initial investment in RPA tools, implementation, and training can be significant. Organizations must carefully assess the potential return on investment (ROI) to justify the investment and ensure the long-term sustainability of RPA initiatives.

Addressing Data Security and Compliance Concerns

Data security and compliance are critical considerations when implementing RPA in finance. Financial institutions handle sensitive customer data and are subject to stringent regulations such as GDPR, CCPA, and industry-specific standards. A robust approach to data security and compliance is essential to protect data, maintain customer trust, and avoid penalties.

- Data Encryption and Access Controls: Implement robust data encryption to protect sensitive financial data both in transit and at rest. Enforce strict access controls, including role-based access control (RBAC) and multi-factor authentication (MFA), to limit access to data to authorized personnel and RPA bots.

- Compliance with Regulatory Requirements: Ensure that RPA implementations comply with all relevant financial regulations, such as GDPR, CCPA, SOX, and industry-specific standards. This includes implementing appropriate data privacy measures, obtaining necessary consents, and maintaining audit trails.

- Secure Bot Credentials Management: Implement a secure system for managing bot credentials, such as password vaults and key management systems. Avoid hardcoding credentials in bot scripts and regularly rotate passwords.

- Data Masking and Anonymization: Use data masking and anonymization techniques to protect sensitive data during testing and development. This involves replacing sensitive data with fictitious or anonymized values.

- Regular Security Audits and Vulnerability Assessments: Conduct regular security audits and vulnerability assessments to identify and address potential security risks. This includes penetration testing, code reviews, and vulnerability scanning.

- Data Loss Prevention (DLP) Measures: Implement data loss prevention (DLP) measures to prevent sensitive data from leaving the organization. This includes monitoring data movement, blocking unauthorized data transfers, and encrypting sensitive data.

- Audit Trails and Logging: Implement comprehensive audit trails and logging to track all RPA activities, including bot actions, data access, and system changes. This enables organizations to monitor compliance, investigate security incidents, and provide evidence of compliance.

Managing Resistance to Change from Employees

Introducing RPA can lead to employee concerns about job security, changes in roles, and the need for new skills. Addressing these concerns proactively is crucial to gain employee buy-in and ensure a smooth transition. Successful change management strategies can mitigate resistance and foster a positive work environment.

- Transparent Communication: Communicate openly and honestly with employees about the reasons for implementing RPA, the benefits it will bring, and the impact it will have on their roles. Provide regular updates and address employee concerns promptly.

- Employee Involvement: Involve employees in the RPA implementation process, such as by seeking their input on process improvements and providing opportunities for them to participate in bot development or testing.

- Training and Upskilling Opportunities: Provide employees with training and upskilling opportunities to help them develop the skills needed to work alongside RPA bots. This can include training on RPA tools, process analysis, and data analysis.

- Focus on Value-Added Tasks: Emphasize that RPA will automate repetitive and mundane tasks, freeing up employees to focus on more strategic and value-added activities, such as problem-solving, decision-making, and customer service.

- Demonstrate Successes: Highlight the successes of RPA implementations, such as improvements in efficiency, accuracy, and customer satisfaction. Share success stories to build confidence and demonstrate the benefits of RPA.

- Address Job Security Concerns: Be transparent about the potential impact of RPA on jobs. Provide assurances that the organization is committed to supporting employees through the transition, such as by offering retraining, redeployment opportunities, or early retirement packages.

- Foster a Culture of Innovation: Create a culture of innovation where employees are encouraged to embrace new technologies and processes. Encourage employees to identify opportunities for RPA and reward those who contribute to the success of RPA initiatives.

Checklist for Selecting the Right RPA Vendor and Tools for Finance Applications

Choosing the right RPA vendor and tools is critical for the success of RPA implementation in finance. The selection process should be based on a thorough assessment of the organization’s needs, the capabilities of different vendors, and the specific requirements of finance applications.

- Define Business Requirements: Clearly define the business processes to be automated, the desired outcomes, and the key performance indicators (KPIs) to be measured.

- Assess Vendor Capabilities: Evaluate the capabilities of different RPA vendors based on their product features, scalability, security, integration capabilities, and customer support.

- Consider Integration Capabilities: Ensure that the RPA tools can integrate with existing financial systems, such as ERP, accounting software, and banking platforms.

- Evaluate Security Features: Prioritize vendors that offer robust security features, such as data encryption, access controls, and audit trails.

- Assess Scalability and Flexibility: Choose a vendor that can scale to meet future needs and that offers flexible deployment options, such as on-premise, cloud-based, or hybrid.

- Evaluate Ease of Use: Consider the ease of use of the RPA tools, including the development environment, user interface, and bot management capabilities.

- Assess Vendor Support and Training: Evaluate the vendor’s support and training offerings, including documentation, online resources, and training programs.

- Conduct Proof of Concept (POC): Conduct a proof of concept (POC) to test the RPA tools on a pilot project and evaluate their performance, ease of use, and integration capabilities.

- Consider Total Cost of Ownership (TCO): Evaluate the total cost of ownership (TCO), including software licensing fees, implementation costs, training costs, and ongoing maintenance costs.

- Check Vendor Reputation and References: Research the vendor’s reputation and obtain references from other finance organizations that have implemented RPA solutions.

Technologies and Tools for RPA in Finance

Implementing Robotic Process Automation (RPA) in finance necessitates leveraging specific technologies and tools. These technologies enable automation of repetitive tasks, integration with existing systems, and efficient management of financial processes. Understanding these components is crucial for successful RPA deployment.

Key Technologies and Tools Used for RPA Implementation in Finance

The core of RPA implementation relies on a combination of technologies and tools. These elements work together to enable automation, integration, and monitoring of financial processes.

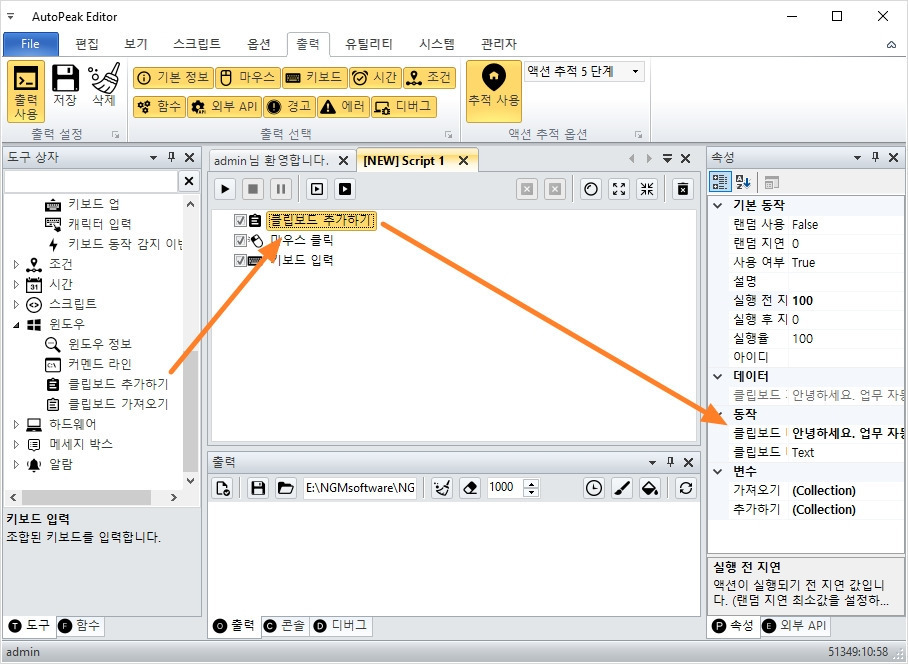

- RPA Software Platforms: These platforms are the central components of RPA implementations. They provide the environment for designing, deploying, and managing software robots. Examples include UiPath, Automation Anywhere, and Blue Prism. These platforms offer features like drag-and-drop interfaces, pre-built connectors, and monitoring dashboards.

- Optical Character Recognition (OCR): OCR technology converts scanned documents and images into machine-readable text. This is essential for automating tasks that involve processing invoices, receipts, and other paper-based documents.

- Artificial Intelligence (AI) and Machine Learning (ML): Integrating AI and ML capabilities enhances RPA’s abilities. For instance, AI can be used for intelligent document processing (IDP) to extract data from unstructured documents, and ML can be used for predictive analytics in financial forecasting.

- Process Mining Tools: These tools analyze existing processes to identify bottlenecks, inefficiencies, and areas ripe for automation. Process mining helps to understand the current state of a process before automating it.

- Workflow Automation Tools: Workflow automation tools help manage the flow of tasks and data within an organization. They ensure that processes are executed in a defined sequence, making them suitable for integration with RPA.

- API Integration: Application Programming Interfaces (APIs) enable RPA bots to communicate with various applications and systems. This is vital for integrating RPA with existing finance systems such as ERP, CRM, and accounting software.

- Security and Compliance Tools: Security is paramount in finance. Tools like secure credential management, access control, and audit trails are essential for protecting sensitive financial data and ensuring compliance with regulations such as GDPR and SOX.

Integrating RPA with Existing Finance Systems and Applications

Integrating RPA with existing finance systems is a crucial aspect of successful implementation. This integration allows RPA bots to interact with various applications, access data, and execute tasks within the existing IT infrastructure.

Rpa finance – Successful integration requires a well-defined strategy. It’s not just about connecting tools, but also ensuring seamless data flow and compatibility with existing processes.

RPA in finance streamlines tedious tasks, boosting efficiency. As businesses explore automation, the benefits of integrating with solutions such as consumer finance software become clear, offering enhanced insights. This ultimately allows finance teams to make better decisions, driving growth and improving the bottom line through robotic process automation.

- API Integration: APIs act as bridges between RPA bots and finance systems. They allow bots to interact with applications like ERP systems (e.g., SAP, Oracle), accounting software (e.g., QuickBooks, Xero), and other financial applications. This integration enables bots to retrieve data, update records, and trigger actions within these systems. For example, a bot can use an API to automatically post invoices to an accounting system after they are processed.

- Database Integration: RPA bots can directly interact with databases to read and write data. This is useful for tasks like data extraction, data validation, and report generation. Bots can connect to databases through standard database drivers (e.g., ODBC, JDBC) or through custom connectors provided by the RPA platform.

- User Interface (UI) Automation: In situations where APIs are not available, RPA bots can interact with applications through their user interfaces. This involves automating actions like clicking buttons, entering data into fields, and navigating through screens. UI automation is often used for legacy systems that do not have readily available APIs.

- Workflow Integration: RPA can be integrated with workflow management systems to automate end-to-end processes. For example, a purchase order process can start with a request in a workflow system, trigger an RPA bot to validate the request against internal policies, and then submit the order to the ERP system.

- Data Mapping and Transformation: Data often needs to be mapped and transformed between different systems. RPA bots can perform these tasks to ensure that data is correctly formatted and compatible with the target system. This involves defining data mappings, applying data transformations (e.g., data cleansing, data enrichment), and validating data before it is passed to another system.

- Security Considerations: Secure integration is crucial. This includes using secure connections (e.g., HTTPS), managing credentials securely, and implementing proper access controls. RPA platforms often provide features for managing credentials and ensuring secure access to systems.

Popular RPA Software Vendors and Their Specific Offerings for Finance

Several RPA software vendors offer specialized solutions tailored for finance. These vendors provide tools and features designed to address the unique challenges and requirements of financial processes.

- UiPath: UiPath is a leading RPA vendor with a strong presence in the finance sector. It offers a comprehensive platform that includes features for process discovery, robot development, and orchestration. UiPath’s finance-specific offerings include pre-built activities for common financial tasks, AI-powered document understanding, and integration with popular finance systems.

- Automation Anywhere: Automation Anywhere provides an enterprise-grade RPA platform that is widely used in finance. It offers features such as intelligent automation, cognitive automation, and a strong emphasis on security. Their finance solutions include pre-built bots for tasks like invoice processing, reconciliation, and financial reporting.

- Blue Prism: Blue Prism is known for its robust and secure RPA platform, suitable for large enterprises. It offers features for process automation, digital workforce management, and compliance. Blue Prism’s finance-specific offerings include pre-built solutions for areas such as accounts payable, accounts receivable, and financial close processes.

- Microsoft Power Automate: Microsoft Power Automate (formerly Microsoft Flow) provides a low-code/no-code RPA solution. It is well-integrated with other Microsoft products and services, making it suitable for organizations already using the Microsoft ecosystem. It includes connectors for various finance applications and offers features for automating workflows and tasks.

- WorkFusion: WorkFusion specializes in intelligent automation and provides a platform that combines RPA with AI and machine learning. Their finance-specific offerings include solutions for fraud detection, anti-money laundering (AML), and customer onboarding.

- Kryon: Kryon offers full-cycle automation solutions, combining RPA with process discovery and monitoring. Their finance-specific offerings include solutions for invoice processing, bank reconciliation, and compliance.

Comparison Table of Different RPA Tools

The following table provides a comparison of popular RPA tools, highlighting their features, pricing models, and suitability for various finance tasks.

| RPA Tool | Key Features | Pricing Model (Approximate) | Suitability for Finance Tasks |

|---|---|---|---|

| UiPath | Process mining, AI-powered document understanding, pre-built activities, strong community support. | Subscription-based (per robot/attended/unattended), varies based on features and usage. | Invoice processing, reconciliation, financial reporting, compliance, and customer onboarding. |

| Automation Anywhere | Intelligent automation, cognitive automation, security-focused, enterprise-grade platform. | Subscription-based (per bot/user), custom pricing based on features and scale. | Invoice processing, reconciliation, financial reporting, compliance, and fraud detection. |

| Blue Prism | Robust and secure platform, digital workforce management, compliance-focused, enterprise-grade. | Subscription-based (per robot/license), custom pricing based on features and usage. | Accounts payable, accounts receivable, financial close processes, compliance, and risk management. |

| Microsoft Power Automate | Low-code/no-code platform, integrated with Microsoft ecosystem, connectors for finance applications. | Subscription-based (per user/flow), various plans available based on features and usage. | Automating workflows, data extraction, data entry, and simple finance tasks. |

| WorkFusion | Intelligent automation, combines RPA with AI and ML, focus on end-to-end automation. | Custom pricing, based on specific solution and features. | Fraud detection, AML, customer onboarding, and other complex financial processes. |

| Kryon | Full-cycle automation, process discovery, process monitoring, pre-built solutions. | Subscription-based, custom pricing based on features and usage. | Invoice processing, bank reconciliation, compliance, and other operational finance tasks. |

RPA Implementation Strategies for Finance

Implementing Robotic Process Automation (RPA) in finance requires a strategic approach to ensure successful integration and realize the promised benefits. A well-defined implementation plan, encompassing pilot projects, phased rollouts, and ongoing maintenance, is crucial for navigating the complexities of automating financial processes. This section Artikels the key steps, best practices, and future-proofing strategies for RPA implementation in the finance sector.

Key Steps in Planning and Executing an RPA Implementation Project in Finance, Rpa finance

Successful RPA implementation hinges on a methodical approach, beginning with careful planning and culminating in ongoing monitoring and optimization. This involves several key stages.

- Assessment and Process Selection: Identify and analyze existing financial processes to determine their suitability for automation. Prioritize processes based on factors like high volume, repetitive tasks, error-proneness, and potential for significant ROI. For instance, accounts payable (invoice processing, vendor payments) and accounts receivable (invoicing, cash application) are often prime candidates.

- Process Design and Documentation: Meticulously document the selected processes, mapping out each step, decision point, and data input/output. This detailed documentation serves as the blueprint for bot development.

- RPA Tool Selection: Choose an RPA platform that aligns with the organization’s specific needs, technical infrastructure, and budget. Evaluate factors such as ease of use, scalability, integration capabilities, and vendor support. Consider platforms like UiPath, Automation Anywhere, and Blue Prism, among others.

- Bot Development and Testing: Develop the RPA bots based on the documented processes. Rigorous testing is crucial to ensure accuracy, reliability, and compliance with regulatory requirements. This includes unit testing, integration testing, and user acceptance testing (UAT).

- Deployment and Monitoring: Deploy the bots into the production environment and establish robust monitoring mechanisms to track performance, identify errors, and measure ROI. Implement dashboards and alerts to proactively address any issues.

- Governance and Change Management: Establish a governance framework to manage the RPA program, including roles and responsibilities, change control procedures, and security protocols. Effective change management is essential to ensure user adoption and minimize disruption.

- Ongoing Optimization and Maintenance: Continuously monitor bot performance, identify opportunities for improvement, and update bots as needed to adapt to changing business requirements. Regularly review and refine processes to maximize efficiency and ROI.

Phased Approach to RPA Implementation: Pilot Projects and Gradual Scaling

A phased approach to RPA implementation minimizes risk and allows organizations to gradually build expertise and confidence. This typically involves starting with pilot projects before scaling up to broader deployments.

The phased approach often follows this structure:

- Phase 1: Pilot Projects. Select a small number of low-complexity, high-impact processes for automation. This allows the organization to gain experience with the RPA platform, refine the implementation process, and demonstrate the value of RPA. Examples include automating bank statement reconciliation or generating basic financial reports.

- Phase 2: Expansion and Scaling. Based on the success of the pilot projects, expand RPA to additional processes and departments. This may involve automating more complex processes or deploying bots across multiple business units.

- Phase 3: Enterprise-Wide Automation. Automate a wider range of processes across the entire finance function. This may involve integrating RPA with other technologies, such as AI and machine learning, to enhance automation capabilities.

- Phase 4: Continuous Improvement and Optimization. Establish a culture of continuous improvement and optimization. Regularly review and refine automated processes to maximize efficiency, reduce costs, and improve accuracy. Explore new RPA capabilities and technologies to further enhance automation efforts.

Best Practices for Managing and Maintaining RPA Bots in a Finance Environment

Maintaining the integrity and effectiveness of RPA bots is crucial for long-term success. This requires adherence to several best practices.

- Robust Security Measures: Implement stringent security protocols to protect sensitive financial data. This includes secure credential management, access controls, and regular security audits.

- Version Control and Change Management: Establish a robust version control system to track changes to bots and ensure that all updates are properly documented and tested. Implement a change management process to manage bot updates and minimize disruption.

- Monitoring and Alerting: Implement comprehensive monitoring and alerting systems to proactively identify and address bot errors, performance issues, and security breaches.

- Documentation and Training: Maintain thorough documentation of all bots, including process flows, code, and troubleshooting guides. Provide comprehensive training to bot developers, business users, and IT staff.

- Regular Audits and Compliance Checks: Conduct regular audits and compliance checks to ensure that bots are operating in accordance with regulatory requirements and internal policies.

- Performance Analysis and Optimization: Regularly analyze bot performance data to identify opportunities for improvement. Optimize bot processes to maximize efficiency and minimize errors.

- Backup and Disaster Recovery: Implement a robust backup and disaster recovery plan to ensure business continuity in the event of a bot failure or system outage.

Roadmap for Integrating RPA with Other Technologies to Enhance Finance Processes

Integrating RPA with other technologies, such as AI and machine learning (ML), can significantly enhance finance processes. This roadmap Artikels the integration opportunities.

The integration involves the following aspects:

- AI-Powered Data Extraction: Integrate RPA with AI-powered optical character recognition (OCR) and natural language processing (NLP) to automate data extraction from unstructured documents, such as invoices, contracts, and emails. This eliminates manual data entry and reduces errors. For example, automating the extraction of invoice details from PDFs.

- ML-Driven Predictive Analytics: Combine RPA with ML to build predictive models for forecasting, fraud detection, and risk management. This enables proactive decision-making and improves financial performance. Example: Using ML to predict potential late payments.

- Intelligent Process Automation (IPA): Develop IPA solutions that combine RPA with AI and ML to automate end-to-end finance processes. This can automate complex tasks that require decision-making and judgment. Example: Automating the entire procure-to-pay process, from purchase requisition to invoice payment.

- Chatbots for Finance: Implement chatbots to provide automated support to employees and customers for common finance inquiries. This improves efficiency and reduces the workload on finance staff. Example: Chatbots for expense report inquiries or account balance inquiries.

- Robotic Process Mining: Use process mining to analyze existing finance processes and identify opportunities for RPA implementation and process optimization. This data-driven approach ensures that RPA efforts are focused on the areas with the greatest potential for ROI.

- Real-Time Monitoring and Reporting: Integrate RPA with business intelligence (BI) tools to create real-time dashboards and reports that provide insights into financial performance. This enables finance teams to make data-driven decisions.

Measuring the Success of RPA in Finance

Assessing the effectiveness of Robotic Process Automation (RPA) in finance is crucial for justifying investments, optimizing processes, and ensuring long-term success. This involves a multifaceted approach that encompasses defining key performance indicators (KPIs), calculating return on investment (ROI), monitoring bot performance, and implementing continuous improvement strategies. A comprehensive measurement framework allows finance departments to understand the true impact of RPA and make data-driven decisions.

Key Performance Indicators (KPIs) Used to Measure the Success of RPA Implementation in Finance

Several KPIs are essential for evaluating the performance of RPA initiatives in finance. These metrics provide insights into various aspects, including efficiency gains, cost reductions, and error rate improvements. Regularly tracking these KPIs enables organizations to gauge the effectiveness of their RPA implementations and make necessary adjustments.

- Process Cycle Time Reduction: This KPI measures the time taken to complete a specific financial process before and after RPA implementation. Significant reductions in cycle time indicate improved efficiency. For example, the time to process an invoice might be reduced from 2 days to 2 hours.

- Cost Savings: RPA can automate repetitive tasks, leading to significant cost savings. This KPI tracks the reduction in operational expenses, including labor costs, associated with automated processes. A common example is the reduction in headcount needed for data entry.

- Error Reduction: RPA bots are programmed to execute tasks with high accuracy, leading to a decrease in human errors. This KPI tracks the number of errors made in financial processes, such as incorrect data entry or miscalculations, before and after RPA implementation. A reduction in errors leads to cost savings and improved compliance.

- Full-Time Equivalent (FTE) Reduction: RPA automates tasks previously performed by human employees, potentially reducing the need for manual labor. This KPI measures the number of FTEs redeployed or reduced due to automation. For instance, if RPA automates accounts payable, it may allow the finance team to handle a larger volume of invoices without hiring additional staff.

- Compliance Rate Improvement: RPA can help ensure adherence to regulatory requirements and internal policies. This KPI tracks the percentage of processes compliant with regulations, such as SOX or GDPR, after RPA implementation. RPA bots can be programmed to follow compliance rules consistently.

- Throughput Increase: This KPI measures the volume of transactions or tasks completed within a specific timeframe after RPA implementation. An increase in throughput demonstrates the efficiency gains achieved through automation. For example, a finance department can process a higher volume of transactions.

- Customer Satisfaction: While not directly financial, improved efficiency and accuracy often lead to better customer experiences. This KPI measures customer satisfaction through surveys or feedback mechanisms. For instance, faster invoice processing can lead to better vendor relationships.

Examples of How to Calculate the Return on Investment (ROI) of RPA Projects in Finance

Calculating the ROI of RPA projects in finance requires quantifying both the costs and benefits associated with the implementation. A well-defined ROI calculation provides a clear understanding of the financial impact and helps justify further investments in automation.

ROI Calculation Formula:

ROI = ((Net Benefits – Total Costs) / Total Costs) * 100

Example 1: Accounts Payable Automation

Costs:

- RPA Software License: $50,000

- Implementation and Training: $30,000

Benefits (Annual):

- Labor Cost Savings: $80,000 (Reduction of 2 FTEs at $40,000 each)

- Error Reduction Savings: $10,000 (Reduced penalties and rework)

- Process Time Savings: $5,000 (Faster invoice processing)

Calculations:

- Total Costs: $50,000 + $30,000 = $80,000

- Net Benefits (Annual): $80,000 + $10,000 + $5,000 = $95,000

- ROI = (($95,000 – $80,000) / $80,000) * 100 = 18.75%

In this example, the ROI for the first year is 18.75%. This suggests a positive return on investment, indicating the project is generating financial benefits.

Example 2: General Ledger Reconciliation Automation

Costs:

- RPA Software License: $40,000

- Implementation and Training: $20,000

Benefits (Annual):

- Labor Cost Savings: $60,000 (Reduction of 1.5 FTEs at $40,000 each)

- Error Reduction Savings: $8,000 (Reduced audit costs and penalties)

- Faster Month-End Close: $7,000 (Faster reconciliation)

Calculations:

- Total Costs: $40,000 + $20,000 = $60,000

- Net Benefits (Annual): $60,000 + $8,000 + $7,000 = $75,000

- ROI = (($75,000 – $60,000) / $60,000) * 100 = 25%

The ROI of 25% demonstrates a good return on investment. The general ledger reconciliation automation is a successful initiative.

Demonstrating How to Monitor and Track the Performance of RPA Bots to Ensure They Are Meeting Their Objectives

Monitoring and tracking RPA bot performance is critical to ensure that automated processes are functioning correctly and delivering the expected benefits. This involves establishing a robust monitoring framework and regularly reviewing bot activity. Continuous monitoring enables proactive identification and resolution of issues, ensuring optimal performance and maximizing the value of RPA investments.

- Real-time Dashboards: Create dashboards that provide real-time visibility into bot performance. These dashboards should display key metrics, such as the number of transactions processed, error rates, and processing times. Data visualization tools can provide a clear overview of bot activity.

- Alerting and Notifications: Implement alerts and notifications to inform relevant stakeholders of any issues, such as bot failures, high error rates, or performance degradation. This enables prompt intervention and troubleshooting. Automated alerts ensure that problems are addressed immediately.

- Log Analysis: Regularly analyze bot logs to identify errors, bottlenecks, and opportunities for improvement. Logs provide detailed information about bot actions and any issues encountered during process execution. Detailed log analysis can uncover the root cause of problems.

- Performance Reporting: Generate regular reports summarizing bot performance, including key metrics, trends, and insights. These reports should be shared with relevant stakeholders to communicate the value of RPA and identify areas for optimization. Reports offer insights into the effectiveness of RPA initiatives.

- Process Mining: Utilize process mining tools to analyze the end-to-end processes automated by RPA bots. Process mining helps identify inefficiencies, bottlenecks, and deviations from the intended process flow. It can help identify areas where RPA can be further optimized.

- Regular Audits: Conduct periodic audits of bot configurations and processes to ensure compliance and adherence to best practices. Audits help maintain the integrity and security of RPA implementations. Regular audits ensure compliance and security.

Sharing Methods for Continuous Improvement and Optimization of RPA Processes in Finance

Continuous improvement is essential to maximize the value of RPA in finance. This involves identifying areas for optimization, refining bot configurations, and implementing new automation opportunities. Continuous improvement ensures that RPA processes remain efficient, effective, and aligned with the evolving needs of the finance department.

- Process Re-engineering: Review and re-engineer processes to eliminate inefficiencies before automating them. Automating poorly designed processes can perpetuate existing problems. Streamlining processes beforehand leads to better results.

- Bot Performance Reviews: Conduct regular reviews of bot performance to identify areas for improvement. Analyze bot logs, monitor key metrics, and gather feedback from stakeholders to identify opportunities for optimization. Performance reviews help refine bot operations.

- Configuration Updates: Regularly update bot configurations to adapt to changes in business rules, regulations, and system interfaces. Keep bots aligned with changing requirements.

- Process Mining and Analysis: Use process mining tools to identify bottlenecks, inefficiencies, and deviations from the intended process flow. Process mining provides insights into process performance.

- Automation of New Processes: Identify and prioritize new processes that can be automated to further increase efficiency and reduce costs. Explore new automation opportunities.

- User Feedback: Gather feedback from finance staff who interact with RPA bots to identify areas for improvement and ensure that the automated processes meet their needs. Incorporate user feedback to improve automation effectiveness.

- Training and Skill Development: Provide training and skill development opportunities for finance staff to improve their understanding of RPA and their ability to manage and optimize automated processes. Promote staff knowledge to enhance automation capabilities.

Future Trends in RPA and Finance

The finance industry is on the cusp of a significant transformation driven by the rapid evolution of Robotic Process Automation (RPA). As RPA technology matures and integrates with other advanced technologies, its impact on financial operations, strategy, and innovation will become even more profound. This section explores the emerging trends, the role of AI and machine learning, and the transformative potential of RPA within the finance function, providing a glimpse into the next five years.

Emerging Trends in RPA and its Impact on the Finance Industry

RPA is no longer a novelty; it is rapidly evolving. Several key trends are reshaping its application in finance, driving efficiency, and creating new possibilities.

- Hyperautomation: This trend involves the strategic combination of RPA with other technologies like AI, machine learning (ML), and business process management (BPM) to automate a wider range of complex processes. Hyperautomation allows for end-to-end automation, encompassing discovery, analysis, design, automation, measurement, and monitoring. For example, a finance department might use hyperautomation to automate invoice processing, from receipt to payment, integrating RPA with AI-powered OCR (Optical Character Recognition) to extract data, ML for fraud detection, and BPM for workflow orchestration.

- Low-Code/No-Code RPA Platforms: These platforms are becoming increasingly popular, empowering business users with little to no coding experience to build and deploy RPA bots. This democratization of automation accelerates implementation cycles, reduces reliance on IT departments, and fosters greater agility. A finance professional could, for example, use a low-code RPA platform to automate the reconciliation of bank statements, eliminating the need for manual data entry and significantly reducing processing time.

- Intelligent Document Processing (IDP): IDP is an evolution of OCR, incorporating AI and ML to extract, classify, and interpret data from unstructured documents like invoices, contracts, and emails. This enhances RPA’s ability to handle complex, data-rich processes. A finance team could use IDP to automatically extract key information from a high volume of invoices, validating data, and triggering automated payment processes.

- Cloud-Based RPA: Cloud-based RPA solutions offer scalability, flexibility, and cost-effectiveness. They allow finance organizations to deploy and manage RPA bots without significant upfront investments in infrastructure. This approach also facilitates easier integration with other cloud-based financial applications. Consider a company using cloud-based RPA to automate its month-end closing processes, allowing for faster, more accurate financial reporting.

- RPA-as-a-Service (RaaS): RaaS provides organizations with access to RPA capabilities without the need to build and maintain their own RPA infrastructure. This model offers a pay-as-you-go approach, reducing the barriers to entry and enabling organizations to scale their automation efforts as needed. A small to medium-sized business might utilize RaaS to automate its accounts payable processes, achieving efficiency gains without significant capital expenditure.

The Role of AI and Machine Learning in the Future of RPA for Finance

The integration of Artificial Intelligence (AI) and Machine Learning (ML) is crucial for the evolution of RPA in finance. AI and ML enhance RPA’s capabilities, allowing for more intelligent, adaptable, and efficient automation.

- Enhanced Decision-Making: AI-powered RPA bots can analyze large datasets to identify patterns, predict outcomes, and make more informed decisions. For example, in fraud detection, ML algorithms can be trained to identify suspicious transactions and flag them for review, improving the accuracy and speed of fraud prevention.

- Improved Process Automation: ML enables RPA bots to learn from experience, adapt to changing conditions, and handle more complex tasks. For example, in accounts receivable, an AI-powered bot can learn to predict which invoices are likely to be paid late, allowing the finance team to prioritize collection efforts.

- Natural Language Processing (NLP): NLP allows RPA bots to understand and process human language, enabling them to interact with emails, chat logs, and other unstructured data sources. This is particularly useful for automating tasks such as customer service inquiries and compliance reporting. For instance, an NLP-enabled bot can automatically analyze customer emails to identify billing issues and initiate the appropriate resolution process.

- Predictive Analytics: ML models can be used to predict future financial outcomes, such as cash flow, revenue, and expenses. This enables finance teams to make more informed decisions and proactively manage risks. For example, a finance department can use predictive analytics to forecast cash flow, ensuring sufficient funds are available to meet upcoming obligations.

- Robotic Process Mining: This combines RPA with process mining techniques to identify bottlenecks, inefficiencies, and opportunities for automation within existing processes. By analyzing process data, robotic process mining helps finance teams optimize their automation strategies and maximize the value of their RPA investments.

Potential of RPA to Transform the Finance Function and Create New Opportunities

RPA has the potential to revolutionize the finance function, creating new opportunities for strategic value creation and innovation.

- Increased Efficiency and Productivity: RPA automates repetitive, manual tasks, freeing up finance professionals to focus on more strategic and value-added activities. This leads to increased productivity and a reduction in operational costs.

- Improved Accuracy and Compliance: RPA reduces human error and ensures consistent execution of processes, improving the accuracy of financial data and strengthening compliance with regulations.

- Enhanced Decision-Making: By providing real-time access to accurate data and insights, RPA empowers finance teams to make better-informed decisions.

- Faster Reporting and Analysis: RPA automates data extraction, processing, and reporting, enabling finance teams to generate financial reports more quickly and efficiently.

- New Business Models: RPA can be used to create new business models and revenue streams, such as offering automated financial services to customers.

- Creation of New Roles: The implementation of RPA creates new roles within the finance function, such as RPA developers, bot managers, and process analysts, leading to new career opportunities.

Forecast of the Evolving Landscape of RPA in Finance Over the Next Five Years

Over the next five years, the landscape of RPA in finance will undergo significant changes, driven by technological advancements, evolving business needs, and the increasing adoption of automation.

- Wider Adoption and Integration: RPA will become more widely adopted across all areas of finance, including accounting, financial planning and analysis (FP&A), treasury, and tax. Integration with other technologies, such as AI, ML, and cloud platforms, will become more seamless.

- Increased Focus on Hyperautomation: Hyperautomation will become the norm, with finance organizations leveraging a combination of RPA, AI, ML, and other technologies to automate entire end-to-end processes.

- Rise of Citizen Developers: Low-code/no-code RPA platforms will empower business users to build and deploy their own bots, accelerating the pace of automation and reducing reliance on IT departments.

- Greater Emphasis on Data-Driven Decision-Making: AI and ML will play a more prominent role in RPA, enabling finance teams to make more data-driven decisions and gain deeper insights into their operations.

- Focus on Scalability and Agility: Cloud-based RPA and RaaS will become increasingly popular, allowing finance organizations to scale their automation efforts quickly and efficiently.

- Transformation of the Finance Workforce: The finance workforce will evolve, with a greater emphasis on skills such as data analysis, process optimization, and RPA development.

RPA in finance streamlines repetitive tasks, boosting efficiency and accuracy. While RPA automates financial processes, businesses must also consider broader operational excellence. This is where the insights from understanding beyond finance better business bureau come into play, helping to create a more robust and trustworthy business environment. Ultimately, a holistic approach, integrating RPA with other best practices, is key to successful RPA finance implementations.