Introduction to Short-Term Finance

Effective financial management is critical for the survival and success of any business. Short-term finance, a crucial aspect of this management, deals with the financial needs of a business over a relatively short period, typically within one year. Understanding and skillfully managing these short-term financial resources is essential for maintaining liquidity, covering operational expenses, and seizing opportunities for growth.

Defining Short-Term Finance

Short-term finance encompasses the strategies and financial instruments businesses use to meet their immediate financial needs. It provides the necessary capital to cover day-to-day operations, such as purchasing inventory, paying salaries, and managing accounts payable. This differs significantly from long-term financing, which focuses on funding major investments, expansions, and other long-range projects. The key distinction lies in the time horizon and the purpose of the funds.

Objectives of Short-Term Financial Management

Businesses prioritize several key objectives when managing their short-term finances. These objectives collectively contribute to the financial health and operational efficiency of the company.

- Maintaining Liquidity: This involves ensuring the business has sufficient cash and readily convertible assets to meet its short-term obligations as they come due. Adequate liquidity prevents financial distress and allows the business to capitalize on opportunities.

- Optimizing Working Capital: Working capital, calculated as current assets minus current liabilities, represents the funds available for day-to-day operations. Efficient working capital management aims to minimize the investment in current assets while maximizing profitability.

- Managing Cash Flow: Effective cash flow management involves monitoring the inflows and outflows of cash to ensure the business has enough cash to meet its obligations. It includes forecasting cash needs and managing the timing of payments and receipts.

- Controlling Costs: Businesses actively work to control costs associated with short-term financing, such as interest expenses on short-term loans or fees related to credit facilities. This helps improve profitability.

- Maximizing Returns: While ensuring liquidity and managing costs, businesses also seek to maximize returns on their short-term financial resources. This can involve investing excess cash in short-term, low-risk securities to generate income.

For instance, a retail business might use short-term financing to purchase inventory for the holiday season, expecting to repay the loan from the revenue generated during that period. Effective management of this financing ensures the business can meet customer demand, maintain a positive cash flow, and achieve its sales targets.

Trade Credit as a Source

Trade credit represents a significant and often overlooked source of short-term financing for businesses. It involves a supplier allowing a buyer to purchase goods or services and pay for them at a later date. This arrangement effectively provides the buyer with a short-term loan, enabling them to manage cash flow and invest in operations before paying their suppliers. Understanding trade credit’s mechanics, advantages, disadvantages, and the factors influencing its availability is crucial for effective financial management.

Trade Credit Concept and Function

Trade credit is a common form of short-term financing where a supplier extends credit to a customer, allowing them to delay payment for goods or services received. This is a core component of business-to-business (B2B) transactions, providing a crucial financial lifeline, especially for small and medium-sized enterprises (SMEs). The supplier essentially acts as a lender, allowing the buyer to use the goods or services immediately while deferring payment for a specified period.

The process typically works as follows: a buyer places an order with a supplier; the supplier delivers the goods or services; the supplier sends an invoice with payment terms (e.g., net 30, meaning payment is due within 30 days); the buyer uses the goods or services to generate revenue; and the buyer pays the invoice according to the agreed-upon terms. This creates a timing difference between receiving goods/services and making payment, which is the essence of trade credit’s financing function.

Advantages and Disadvantages of Using Trade Credit

Trade credit offers several advantages and disadvantages for businesses seeking short-term financing. A thorough understanding of both sides is vital for making informed financial decisions.

The advantages include:

- Convenience and Accessibility: Trade credit is often easier to obtain than other forms of financing, especially for new or smaller businesses. The process is usually straightforward, and suppliers are often willing to extend credit to established customers.

- Flexibility: Trade credit terms can be negotiated to meet the specific needs of the buyer, allowing for customized payment schedules. This flexibility can be particularly helpful during periods of cash flow constraints.

- No Explicit Interest Costs: Unlike bank loans or lines of credit, trade credit may not have explicit interest charges. The cost is often embedded in the price of the goods or services. However, buyers must be aware of potential discounts for early payment.

- Preservation of Cash: Trade credit allows businesses to conserve cash, which can be used for other operational needs, investments, or to take advantage of unexpected opportunities.

- Relationship Building: Using trade credit can strengthen the relationship between the buyer and the supplier, potentially leading to more favorable terms and a better understanding of each other’s businesses.

The disadvantages include:

- Cost: While there may not be explicit interest charges, the price of goods or services may be higher compared to cash purchases. Furthermore, missing out on early payment discounts effectively increases the cost.

- Loss of Discounts: Suppliers often offer discounts for early payment. Forgoing these discounts can be a costly consequence of using trade credit.

- Supplier Dependence: Relying heavily on a single supplier for trade credit can make a business vulnerable if the supplier experiences financial difficulties or changes its credit terms.

- Potential for Restrictive Terms: Suppliers may impose restrictive terms, such as requiring collateral or limiting the amount of credit available, particularly for less creditworthy buyers.

- Impact on Credit Rating: While not always directly reported, late payments to suppliers can negatively impact a business’s credit rating, making it more difficult to obtain other forms of financing in the future.

Factors Influencing a Supplier’s Decision to Offer Trade Credit

A supplier’s decision to offer trade credit is influenced by various factors, including the buyer’s creditworthiness, the industry’s norms, and the supplier’s financial position. Assessing these factors allows suppliers to mitigate risk and ensure timely payments.

Key considerations include:

- Buyer’s Creditworthiness: This is the most critical factor. Suppliers assess a buyer’s creditworthiness by reviewing their credit history, financial statements, payment history with other suppliers, and industry reputation.

- Buyer’s Financial Stability: Suppliers examine the buyer’s financial statements (balance sheet, income statement, and cash flow statement) to assess their ability to meet their payment obligations.

- Industry Practices: Industry norms and competition influence credit terms. For instance, industries with high-profit margins may offer more generous credit terms than those with low margins.

- Supplier’s Financial Position: The supplier’s own financial health affects its willingness to extend credit. A financially strong supplier is more likely to offer favorable credit terms than a supplier facing cash flow challenges.

- Order Size and Frequency: Suppliers may offer more favorable terms to buyers who place large or frequent orders. This incentivizes repeat business and strengthens the relationship.

- Length of Relationship: Suppliers are more likely to extend credit to established customers with a proven track record of timely payments.

- Economic Conditions: Economic conditions, such as recession or inflation, can affect a supplier’s credit policy. During economic downturns, suppliers may become more cautious about extending credit.

Comparison of Trade Credit Terms

Different trade credit terms can significantly impact a business’s cash flow and financing costs. Understanding the nuances of each term is crucial for making informed financial decisions. The following table compares several common trade credit terms:

| Credit Term | Description | Discount | Net Period | Effective Interest Rate (approximate) |

|---|---|---|---|---|

| 2/10 net 30 | 2% discount if paid within 10 days, otherwise the full amount is due in 30 days. | 2% | 30 days | 36.7% (calculated as: (Discount / (100 – Discount)) * (365 / (Net Period – Discount Period))) |

| 1/10 net 30 | 1% discount if paid within 10 days, otherwise the full amount is due in 30 days. | 1% | 30 days | 18.25% |

| Net 30 | Full amount due in 30 days. No discount offered. | 0% | 30 days | 0% |

| Net 60 | Full amount due in 60 days. No discount offered. | 0% | 60 days | 0% |

This table demonstrates the significant impact of early payment discounts. For instance, if a company uses the terms “2/10 net 30” but does not pay within the 10-day discount period, it effectively pays a high implicit interest rate for the 20 extra days of credit. Conversely, if a company takes advantage of the discount, it reduces its effective cost of goods.

Bank Overdrafts

Bank overdrafts provide businesses with a flexible short-term financing solution, allowing them to draw more funds than are available in their current account. This can be a crucial tool for managing cash flow and covering temporary shortfalls. Understanding the mechanics, costs, and applications of overdrafts is essential for effective financial management.

Structure and Mechanism of Bank Overdrafts

A bank overdraft functions as a pre-arranged credit facility linked to a current account. It allows a business to temporarily overdraw its account up to a pre-agreed limit. The bank effectively lends the business money when the account balance falls below zero.

The mechanism works as follows:

- Agreement: The business and the bank agree on an overdraft limit and the terms, including interest rates and fees.

- Overdrawing: When the business makes a payment or withdrawal that exceeds its account balance, the overdraft is activated.

- Repayment: The business repays the overdraft, along with accrued interest and fees, typically when funds are deposited into the account.

- Interest Calculation: Interest is usually charged daily on the overdrawn amount.

The overdraft limit is typically determined by the bank based on the business’s creditworthiness, financial history, and relationship with the bank.

Typical Interest Rates and Fees Associated with Bank Overdrafts

Bank overdrafts come with various costs, including interest and fees. These costs vary depending on the bank, the size of the overdraft, and the business’s credit profile.

Here’s a breakdown of the common costs:

- Interest Rates: Interest rates on overdrafts are usually higher than those on other forms of short-term financing, such as term loans. The rate can be fixed or variable, often tied to the base rate.

- Arrangement Fees: Banks may charge an arrangement fee when setting up the overdraft facility. This is a one-time fee.

- Usage Fees: Some banks charge a fee each time the overdraft is used, or for maintaining the facility.

- Overdraft Fees: If the business exceeds the agreed overdraft limit, the bank may charge an over-limit fee.

- Interest Calculation: Interest is usually calculated daily on the overdrawn balance. For example, if a business overdraws by $10,000 at a 10% annual interest rate, the daily interest would be approximately $2.74.

It is crucial for businesses to compare the terms and conditions of different banks before choosing an overdraft facility.

Scenarios Where a Bank Overdraft Would Be a Suitable Choice

Bank overdrafts are best suited for specific short-term financing needs. They provide flexibility and can be a cost-effective solution in the right circumstances.

Here are some scenarios where a bank overdraft is a suitable choice:

- Managing Cash Flow Fluctuations: Businesses with seasonal sales or irregular payment cycles can use overdrafts to cover temporary shortfalls. For example, a retail business might use an overdraft to cover payroll expenses before a large influx of sales revenue arrives.

- Bridging Gaps in Payments: If a business is waiting for payments from customers, an overdraft can bridge the gap until the funds are received.

- Covering Unexpected Expenses: Overdrafts can be used to cover unexpected expenses, such as equipment repairs or emergency supplies.

- Short-Term Working Capital Needs: Overdrafts can provide short-term working capital to fund inventory purchases or meet immediate operational needs.

For example, a small business owner anticipates a large payment from a client in two weeks but needs to make a payment to a supplier immediately. An overdraft can cover the supplier payment until the client’s payment is received.

Process of Applying for and Securing a Bank Overdraft

Securing a bank overdraft involves a process that requires a business to demonstrate its financial stability and creditworthiness to the bank.

The application process typically includes the following steps:

- Application: The business submits an application to the bank, providing financial information, including bank statements, profit and loss statements, and balance sheets.

- Credit Assessment: The bank assesses the business’s creditworthiness, reviewing its financial history, credit score, and overall financial health.

- Negotiation: The bank and the business negotiate the terms of the overdraft, including the limit, interest rate, and fees.

- Agreement: If approved, the bank and the business sign an agreement outlining the terms of the overdraft facility.

- Activation: Once the agreement is in place, the overdraft facility is activated, and the business can begin to use it.

Banks often require collateral or guarantees, especially for larger overdraft facilities or for businesses with a less established credit history. A detailed business plan and a clear understanding of how the overdraft will be used are also essential.

Short-Term Bank Loans

Short-term bank loans represent a crucial source of financing for businesses needing capital for immediate operational needs. These loans offer flexibility and can be tailored to meet specific financial requirements. They are essential for managing cash flow, funding inventory purchases, or covering short-term expenses.

Characteristics of Short-Term Bank Loans

Short-term bank loans are characterized by their relatively short repayment periods, typically lasting from a few months up to a year. They are designed to provide quick access to funds for immediate financial needs. Interest rates on these loans can be fixed or variable, often tied to a benchmark interest rate like the Prime Rate or LIBOR. The interest rate and terms of the loan are influenced by the borrower’s creditworthiness, the loan amount, and the prevailing market conditions. Collateral may be required, depending on the lender’s risk assessment and the size of the loan.

Comparison of Short-Term Bank Loans with Other Financing Options

Businesses have various financing options to choose from, each with its own set of advantages and disadvantages. Understanding the differences between these options is crucial for making informed financial decisions.

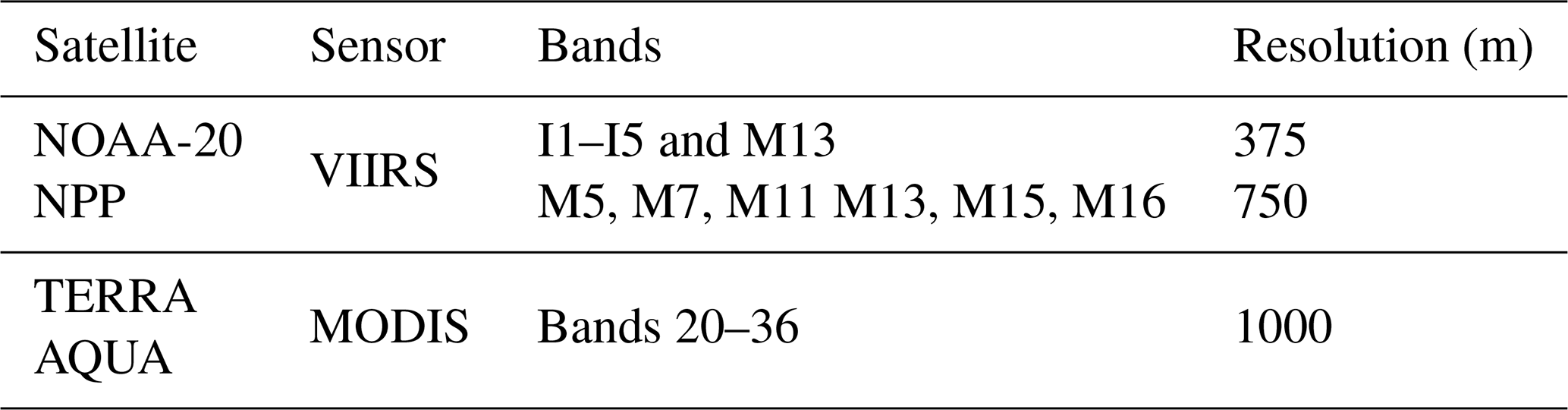

Sources of short term finance – Here’s a comparison of short-term bank loans with other financing options:

- Trade Credit: Trade credit is offered by suppliers who allow businesses to purchase goods or services and pay later. The main advantage is its ease of access, as it often doesn’t require collateral or extensive documentation. However, trade credit can be more expensive than bank loans, with potential discounts lost for early payments. Additionally, it is limited to purchases from suppliers, unlike a bank loan that can be used for a wider range of purposes.

- Bank Overdrafts: Bank overdrafts allow businesses to temporarily overdraw their checking accounts up to a predetermined limit. They offer immediate access to funds and flexibility in repayment. However, overdrafts typically have higher interest rates than short-term loans and are intended for short-term needs. Their use is limited to the funds available in the checking account.

- Factoring: Factoring involves selling accounts receivable to a factoring company at a discount. This provides immediate cash flow and eliminates the risk of non-payment from customers. However, factoring is often the most expensive financing option due to the fees charged by factoring companies. It can also damage customer relationships if the factoring company is not professional in its dealings.

- Short-Term Bank Loans: Short-term bank loans provide access to a significant amount of capital, offering lower interest rates than options like overdrafts or factoring. They can be used for various business needs, providing flexibility. However, securing a bank loan requires more documentation and a strong credit profile. Collateral may also be required, which can pose a risk to the business.

Documentation and Requirements for Securing a Short-Term Bank Loan

Securing a short-term bank loan typically involves providing comprehensive documentation to the lender. The lender assesses the borrower’s creditworthiness and financial stability before approving the loan.

The following documentation and requirements are generally needed:

- Loan Application: A formal application form provided by the bank, including the loan amount, purpose of the loan, and repayment terms.

- Business Plan: A detailed plan outlining the business’s objectives, strategies, and financial projections.

- Financial Statements: This includes balance sheets, income statements, and cash flow statements for the past few years to demonstrate the business’s financial performance and stability.

- Tax Returns: Business and personal tax returns for the past few years to verify income and tax compliance.

- Credit History: A credit report for the business and the business owners to assess creditworthiness.

- Collateral (if required): Documentation of assets pledged as collateral, such as property, equipment, or accounts receivable.

- Legal Documents: Articles of incorporation, partnership agreements, or other legal documents relevant to the business structure.

Different Types of Short-Term Bank Loans, Sources of short term finance

Banks offer various types of short-term loans designed to meet specific business needs. Understanding the different options available allows businesses to choose the most suitable financing solution.

Here are several types of short-term bank loans:

- Line of Credit: A revolving credit facility that allows businesses to borrow, repay, and borrow again up to a predetermined credit limit. Interest is paid only on the amount borrowed.

- Term Loan: A loan with a fixed term and repayment schedule, typically used for specific purposes such as purchasing equipment or inventory.

- Bridge Loan: A short-term loan used to cover expenses until longer-term financing is secured.

- Seasonal Loan: A loan designed to help businesses manage fluctuations in cash flow due to seasonal demand. For example, a retail business might use a seasonal loan to increase inventory before the holiday season.

- Inventory Financing: A loan secured by the borrower’s inventory, providing funds for purchasing and storing inventory.

- Accounts Receivable Financing: A loan secured by the borrower’s accounts receivable, allowing businesses to borrow against the value of their outstanding invoices.

Commercial Paper

Commercial paper is a crucial source of short-term financing for large corporations. It represents unsecured promissory notes issued by companies to raise short-term funds, typically for periods ranging from a few days to 270 days. This financing tool provides an alternative to traditional bank loans and offers competitive interest rates, making it an attractive option for businesses with strong credit ratings.

Role and Function of Commercial Paper

Commercial paper functions as a short-term debt instrument used by corporations to finance a variety of short-term needs. It essentially acts as a promise to pay a specified amount on a specific date.

- Raising Capital: Companies issue commercial paper to obtain funds for working capital, inventory financing, or bridging short-term cash flow gaps.

- Alternative to Bank Loans: It provides a flexible alternative to traditional bank loans, often at a lower cost, particularly for companies with high creditworthiness.

- Marketable Security: Commercial paper is a marketable security, meaning it can be bought and sold in the secondary market before its maturity date. This provides liquidity to investors.

- Interest Rate Benchmark: The rates on commercial paper are often used as a benchmark for other short-term interest rates.

Eligibility Criteria for Issuing Commercial Paper

Only companies with strong credit ratings and a solid financial standing are typically eligible to issue commercial paper. These criteria help to assure investors of the issuer’s ability to repay the debt.

- Credit Rating: A high credit rating from recognized credit rating agencies, such as Moody’s, Standard & Poor’s, or Fitch, is essential. Generally, companies need a rating of at least A-2/P-2 or equivalent to issue commercial paper.

- Financial Stability: The issuer must demonstrate a stable financial position, including consistent profitability, manageable debt levels, and adequate cash flow.

- Minimum Issue Size: There is usually a minimum issue size for commercial paper offerings, which can vary depending on market conditions and the issuer’s needs.

- Legal Compliance: Issuers must comply with all relevant regulations and legal requirements related to the issuance of commercial paper. This includes registration requirements with regulatory bodies.

Risks and Benefits of Investing in Commercial Paper

Investing in commercial paper offers both potential benefits and risks. Understanding these aspects is crucial for investors considering this asset class.

- Benefits:

- Higher Yields: Commercial paper typically offers higher yields compared to other short-term, low-risk investments, such as Treasury bills.

- Liquidity: Commercial paper is highly liquid, as it can be easily traded in the secondary market.

- Diversification: It allows investors to diversify their portfolios across a range of issuers and industries.

- Risks:

- Credit Risk: The primary risk is the issuer’s inability to repay the debt at maturity. This risk is mitigated by credit ratings.

- Interest Rate Risk: Changes in interest rates can affect the value of commercial paper in the secondary market.

- Market Risk: Economic downturns or financial crises can reduce the demand for commercial paper, leading to liquidity issues.

Example of a Company Utilizing Commercial Paper

Many large corporations across various sectors utilize commercial paper to manage their short-term financing needs.

Example: A well-known company, such as a major retailer like Walmart, might issue commercial paper to finance its seasonal inventory buildup before the holiday shopping season. The company, possessing a strong credit rating (e.g., A1/P1), can issue short-term notes, typically 30 to 90 days in duration, at a competitive interest rate. Investors, such as money market funds and institutional investors, purchase these notes, providing Walmart with the necessary funds. When the notes mature, Walmart repays the principal plus interest. This allows the retailer to efficiently manage its working capital requirements without relying solely on bank loans. The interest rates on the commercial paper are usually lower than the prime rate.

Factoring of Accounts Receivable

Factoring represents a significant short-term financing option, offering businesses a way to convert their accounts receivable into immediate cash. This method is particularly useful for companies experiencing cash flow challenges or seeking to accelerate their access to funds tied up in outstanding invoices. It’s a transaction where a business sells its invoices to a third party (the factor) at a discount.

Factoring Concept and Process

Factoring involves the outright sale of a company’s accounts receivable to a factoring company, also known as a factor. The factor then takes responsibility for collecting the payments from the customers.

The factoring process generally unfolds as follows:

- The business (client) sells its invoices to the factor.

- The factor verifies the invoices and the creditworthiness of the customers.

- The factor advances a percentage (typically 70-90%) of the invoice value to the client.

- The factor notifies the customers of the invoice assignment and directs them to make payments to the factor.

- Once the customers pay the invoices, the factor remits the remaining balance (less fees) to the client.

For example, a small business has $100,000 in outstanding invoices. They decide to factor these invoices with a factor who advances 80% of the value. The factor charges a fee of 3% of the invoice value. The business receives $80,000 upfront. When the customers pay the $100,000 invoices, the factor deducts its fee ($3,000) and remits the remaining $17,000 to the business.

Advantages of Factoring

Factoring provides several benefits for businesses:

- Improved Cash Flow: Factoring accelerates the conversion of accounts receivable into cash, providing businesses with immediate access to funds.

- Reduced Credit Risk: The factor assumes the credit risk of the customers, shielding the business from potential bad debts.

- Efficient Credit Management: The factor handles the collection process, freeing up the business’s resources and time.

- Simplified Bookkeeping: The factor manages the accounts receivable, reducing the administrative burden on the business.

- Scalability: Factoring can grow with the business. As sales increase, the factoring facility can be expanded.

Disadvantages of Factoring

Despite its advantages, factoring also has drawbacks:

- Cost: Factoring fees can be relatively high compared to other financing options, potentially impacting profitability.

- Loss of Customer Relationship: Customers may perceive the factoring arrangement negatively, potentially affecting the business’s relationship with them.

- Lack of Confidentiality: Factoring can signal financial difficulties to customers and competitors.

- Credit Approval: The factor must approve the customers’ credit, which may restrict the business’s ability to sell to certain customers.

- Dilution of Profit: The discount applied by the factor reduces the overall profit margin on the factored invoices.

Comparison with Other Short-Term Financing Options

Factoring differs from other short-term financing options in several ways. Here’s a comparison:

| Financing Option | Key Features | Advantages | Disadvantages |

|---|---|---|---|

| Trade Credit | Suppliers extend credit terms to the business. | Simple to obtain, often interest-free. | Limited availability, can be costly if early payment discounts are missed. |

| Bank Overdrafts | Allows the business to overdraw its current account up to a pre-agreed limit. | Flexible, provides short-term liquidity. | High interest rates, can be withdrawn on demand. |

| Short-Term Bank Loans | Loans with a repayment period of less than a year. | Can provide substantial funding. | Requires collateral, can be difficult to obtain for small businesses. |

| Commercial Paper | Unsecured promissory notes issued by large corporations. | Lower interest rates than bank loans. | Limited to large, creditworthy corporations. |

| Factoring | Sale of accounts receivable to a factor. | Improved cash flow, reduced credit risk. | High fees, potential loss of customer relationship. |

Factoring Process Flowchart

The factoring process can be visually represented through a flowchart. The flowchart would depict the following steps:

1. Start: The business has outstanding invoices.

2. Application and Agreement: The business applies to a factor and enters into a factoring agreement.

3. Invoice Submission: The business submits invoices to the factor.

4. Credit Check and Verification: The factor verifies the invoices and checks the customers’ creditworthiness.

5. Advance Payment: The factor advances a percentage of the invoice value to the business.

6. Customer Notification: The factor notifies the customers of the invoice assignment.

7. Payment Collection: The factor collects payments from the customers.

8. Remittance of Balance: The factor remits the remaining balance (less fees) to the business.

9. End: The factoring process is complete for those specific invoices.

The flowchart clearly shows the sequential steps, beginning with the business’s need for cash and concluding with the factor’s payment to the business, illustrating the key stages of the factoring transaction.

Inventory Financing: Sources Of Short Term Finance

Inventory financing provides businesses with short-term capital to purchase and manage their inventory. This type of financing is particularly crucial for companies with significant inventory needs, allowing them to maintain adequate stock levels to meet customer demand without tying up large amounts of working capital. Effective inventory management can lead to increased sales and profitability.

Types of Inventory Financing Options

Several inventory financing options exist, each designed to cater to specific business needs and risk profiles. Understanding these options is crucial for businesses seeking to optimize their inventory management and financial strategies.

- Inventory Loans: These are short-term loans secured by the borrower’s inventory. The lender assesses the value and marketability of the inventory to determine the loan amount. The loan is typically repaid as the inventory is sold. An example is a clothing retailer securing a loan to purchase seasonal merchandise.

- Floor Planning: Primarily used in industries like automobile, appliance, and furniture sales, floor planning allows businesses to finance the purchase of inventory from a manufacturer or supplier. The lender holds a security interest in the inventory, and the business repays the loan as each item is sold. This allows a car dealership to stock its lot with vehicles without using its own cash.

- Warehouse Receipts Financing: In this method, inventory is stored in a bonded warehouse controlled by a third party. The lender receives a warehouse receipt as collateral. This is a common option for commodities and bulk goods. For instance, a grain merchant might use warehouse receipts financing to secure a loan against stored wheat.

- Consignment Financing: The supplier retains ownership of the inventory until it is sold by the retailer. The retailer pays the supplier only when the goods are sold. This reduces the financial burden on the retailer. A classic example is an art gallery selling paintings on consignment.

- Purchase Order Financing: This type of financing covers the cost of goods that a business has ordered from a supplier but has not yet received. The lender pays the supplier directly, and the borrower repays the loan once the goods are sold to the end customer. This is helpful for businesses with large customer orders.

Advantages of Inventory Financing

Inventory financing offers several benefits that can significantly improve a company’s financial position and operational efficiency. These advantages make it an attractive option for businesses looking to manage their working capital effectively.

- Improved Cash Flow: Inventory financing frees up cash that would otherwise be tied up in inventory purchases, allowing businesses to use their funds for other operational needs or investments.

- Increased Sales: By ensuring adequate inventory levels, businesses can meet customer demand promptly, leading to increased sales and revenue.

- Reduced Risk: Inventory financing can mitigate the risk of stockouts and lost sales, especially during peak seasons or periods of high demand.

- Flexibility: Various inventory financing options provide businesses with flexibility in terms of repayment schedules and loan amounts, tailoring solutions to specific needs.

- Scalability: As a business grows, inventory financing can be scaled to accommodate increased inventory needs, supporting expansion and market share growth.

Disadvantages of Inventory Financing

Despite the advantages, inventory financing also comes with certain drawbacks that businesses must consider before opting for this type of funding. Understanding these limitations is crucial for making informed financial decisions.

- Cost: Inventory financing typically involves interest charges and fees, increasing the overall cost of inventory.

- Collateral Requirements: Most inventory financing options require collateral, which can be the inventory itself or other assets of the business. If the business defaults, the lender can seize the collateral.

- Inventory Management: Borrowers must maintain accurate inventory records and adhere to the lender’s requirements for inventory control, which can be time-consuming.

- Risk of Obsolescence: If the inventory becomes obsolete or loses value, the business may still be responsible for repaying the loan, potentially leading to financial losses.

- Dependency: Relying heavily on inventory financing can make a business vulnerable to changes in interest rates or the availability of credit.

Role of Collateral in Inventory Financing

Collateral plays a crucial role in inventory financing, serving as security for the lender. The type and value of collateral significantly impact the terms and conditions of the financing agreement.

The primary function of collateral is to mitigate the lender’s risk. In the event of default, the lender can seize and sell the collateral to recover the outstanding loan amount.

The specific collateral requirements vary depending on the type of inventory financing. For example, in floor planning, the inventory itself (e.g., cars, appliances) serves as collateral. In warehouse receipts financing, the warehouse receipt, which represents ownership of the stored goods, is used as collateral.

Exploring sources of short-term finance is crucial for any business. Understanding options like trade credit or short-term loans is key. This knowledge is also relevant when considering career paths, as aspiring finance professionals often seek opportunities like summer internship finance roles to gain practical experience. Ultimately, a solid grasp of these financial instruments will aid in the smart decisions around short-term funding needs.

The value of the collateral is assessed by the lender, and the loan amount is often a percentage of the collateral’s value. The percentage, or the loan-to-value ratio (LTV), varies based on the type of inventory, its marketability, and the lender’s risk assessment. A highly liquid and marketable inventory might have a higher LTV than less marketable goods.

Businesses often utilize various sources of short-term finance to manage immediate cash flow needs. These can include things like trade credit or short-term loans. An interesting application of this is seen in consumer purchases, such as when considering nectar mattress financing , allowing customers to spread payments. Ultimately, understanding diverse short-term finance options is crucial for financial stability.

Accurate inventory valuation and record-keeping are essential for maintaining collateral value. Lenders often require borrowers to provide regular inventory reports and may conduct periodic inspections to ensure the collateral’s condition and value.

Common Inventory Financing Methods

Inventory financing methods offer various ways for businesses to secure funding for their inventory needs. The best choice depends on the specific business, the type of inventory, and the lender’s requirements.

- Inventory Loans: Short-term loans secured by inventory.

- Floor Planning: Financing for inventory purchased from manufacturers or suppliers, often used for vehicles and appliances.

- Warehouse Receipts Financing: Financing secured by inventory stored in a bonded warehouse.

- Consignment Financing: Supplier retains ownership until the goods are sold.

- Purchase Order Financing: Financing for goods ordered from suppliers.

Accruals as a Source

Accruals represent expenses that a company has incurred but hasn’t yet paid. They are a crucial component of short-term financing, offering a form of interest-free credit. Effective management of accruals can significantly influence a company’s cash flow position, providing a valuable source of working capital.

How Accrued Expenses Contribute to Short-Term Financing

Accrued expenses, by their nature, represent a delay in cash outflow. This delay provides a company with a temporary source of financing. Instead of immediately paying for expenses like salaries, utilities, or interest, the company holds onto the cash for a period. This retained cash can then be used for other operational needs, effectively providing a short-term loan from the company’s creditors. The longer the payment terms, the greater the implied financing benefit.

Impact of Effective Accruals Management on Cash Flow

Effective accruals management directly improves a company’s cash flow. By strategically managing payment terms and recognizing expenses accurately, a company can optimize its cash position.

- Improved Liquidity: Delaying payments allows a company to hold onto cash for a longer period, increasing its liquidity. This can be particularly beneficial during periods of high operating expenses or unexpected financial demands.

- Reduced Need for External Financing: By utilizing accruals, companies can reduce their reliance on more expensive forms of short-term financing, such as bank loans or factoring.

- Enhanced Financial Flexibility: A well-managed accruals system provides greater flexibility in managing cash outflows, enabling companies to respond more effectively to changing market conditions or investment opportunities.

Examples of Common Accrued Expenses

Various types of expenses are typically accrued, representing obligations incurred but not yet paid. Understanding these categories is key to effective accruals management.

- Salaries and Wages: This includes the compensation owed to employees for work performed but not yet paid out. The accrual period typically aligns with the pay cycle (e.g., bi-weekly or monthly).

- Utilities: Expenses for services like electricity, water, and gas used during a period, but for which the bills haven’t yet been received or paid.

- Interest Expense: The interest accrued on outstanding debt obligations (e.g., bonds or loans) but not yet paid.

- Rent Expense: Rent owed for the use of property, usually accrued over the rental period until payment is due.

- Taxes Payable: Accrued taxes, such as property taxes or income taxes, which are owed but not yet paid.

Demonstrating How to Calculate the Implied Financing from Accrued Expenses

The implied financing from accrued expenses is the difference between the accrued expense and the actual cash outflow. This calculation provides insight into the short-term financing benefit.

For example, consider a company with the following:

- Accrued Salaries: $50,000

- Payment Terms: Paid every two weeks.

The implied financing from accrued salaries is essentially $50,000 for the period the salaries remain unpaid. If the company can negotiate slightly longer payment terms, the implied financing increases.

To quantify the impact, consider the following:

- Scenario 1: Accrued salaries are paid every two weeks.

- Scenario 2: The company negotiates payment terms to pay the salaries every four weeks.

In Scenario 2, the implied financing benefit is doubled compared to Scenario 1, demonstrating the importance of managing payment terms.

The calculation can be simplified as the amount of the accrued expense itself, representing the funds the company can utilize until payment is due.

Other Sources of Short-Term Finance

Beyond the commonly utilized methods of short-term finance, several less conventional options exist. These alternatives offer businesses flexibility and can be particularly beneficial in specific circumstances or industries. Understanding these sources allows for a more comprehensive approach to managing short-term funding needs.

Other Financing Options

A range of financing options cater to specific needs and situations. Each has its own set of advantages and disadvantages, and suitability varies based on the business’s industry, financial health, and the nature of its operations.

- Securitization of Receivables: This involves pooling together a company’s receivables and selling them as securities to investors. It is different from factoring as the receivables are sold to a special purpose entity (SPE), which then issues securities backed by these receivables.

Securitization provides immediate cash flow and removes the receivables from the balance sheet, improving financial ratios. It is commonly used in industries with a high volume of receivables, such as credit card companies, auto finance, and mortgage companies. However, it can be complex and expensive to set up, and the company loses control over the collection of receivables. - Supplier Financing Programs: Large companies sometimes offer financing programs to their suppliers, providing them with early payment on invoices. This can be a win-win situation, as the supplier receives faster payment, and the buyer can negotiate better terms or ensure a stable supply chain.

This approach is most common in industries with strong buyer-supplier relationships, like automotive manufacturing or retail. The advantages include improved supplier relationships and potentially lower procurement costs. The disadvantage is that it can tie up significant capital for the buyer. - Revenue-Based Financing: Businesses, particularly those with recurring revenue models, can obtain financing based on a percentage of their future revenue. Lenders receive a share of the company’s revenue until the loan is repaid, plus interest.

This financing option is popular among SaaS (Software as a Service) companies, subscription-based businesses, and other recurring revenue models. The advantages include flexible repayment terms aligned with revenue streams, and less equity dilution compared to venture capital. The disadvantages are the potential for high interest rates and the impact on future revenue. - Merchant Cash Advance (MCA): An MCA provides a lump sum of cash to a business in exchange for a percentage of its future credit card sales. Repayments are typically deducted daily or weekly from the business’s credit card transactions.

MCAs are most common for small businesses that process a high volume of credit card transactions, such as restaurants and retail stores. The advantages include quick access to funds and minimal paperwork. However, MCAs often have very high effective interest rates and can be detrimental to cash flow if sales decline. - Equipment Financing: Companies can obtain short-term financing specifically to purchase equipment. This can take the form of a loan or a lease. The equipment itself often serves as collateral.

Equipment financing is useful for businesses in industries that require significant capital investments in equipment, such as manufacturing, construction, and transportation. The advantages are that the equipment provides immediate utility and the financing is tailored to a specific asset. The disadvantages are that the business is locked into a specific asset and the equipment may become obsolete. - Government Grants and Subsidies: In some instances, businesses can secure short-term funding through government grants or subsidies. These are often available to support specific industries or initiatives, such as research and development or export promotion.

These are most applicable to businesses in specific sectors or those involved in projects that align with government priorities. The advantages are that the funds are often non-repayable or offer favorable terms. The disadvantages are that the application process can be competitive and time-consuming, and the funds may be restricted to specific uses. - Crowdfunding: Businesses can raise short-term funds through online crowdfunding platforms. This can take various forms, including rewards-based crowdfunding (where backers receive a product or service), equity crowdfunding (where backers receive equity in the company), or debt crowdfunding (where backers lend money to the company).

Crowdfunding is often used by startups and small businesses to launch new products or services. The advantages include access to a large pool of potential investors and the opportunity to build brand awareness. The disadvantages are that it can be time-consuming, the funding may be insufficient, and there’s a risk of failing to meet campaign goals.

Managing Short-Term Finance

Effectively managing short-term finance is crucial for a company’s financial health and operational success. It involves a proactive approach to overseeing current assets and liabilities to ensure sufficient liquidity, minimize financing costs, and optimize cash flow. Sound management of short-term finances enables a business to meet its short-term obligations, capitalize on opportunities, and withstand unexpected financial challenges.

Strategies for Effective Short-Term Finance Management

A robust strategy for managing short-term finance incorporates several key elements to ensure financial stability and efficiency. These strategies focus on optimizing working capital, controlling costs, and proactively managing cash flow.

- Cash Flow Forecasting: Implementing accurate cash flow forecasting allows businesses to anticipate future cash needs and surpluses. This enables proactive planning for borrowing, investment, and expense management.

- Working Capital Management: Optimizing the components of working capital (accounts receivable, inventory, and accounts payable) is critical. This includes strategies to accelerate collections, manage inventory levels efficiently, and negotiate favorable payment terms with suppliers.

- Cost Control: Rigorous cost control measures, including expense monitoring and budgeting, are essential for managing short-term finances. Businesses should identify and eliminate unnecessary expenses to improve profitability and cash flow.

- Negotiating Favorable Terms: Actively negotiating favorable terms with suppliers and lenders can significantly reduce financing costs. This includes seeking extended payment terms from suppliers and securing competitive interest rates on short-term loans.

- Diversifying Funding Sources: Relying on a diverse range of short-term financing sources reduces the risk of being overly dependent on a single source. This provides flexibility and helps mitigate potential disruptions.

- Monitoring and Analysis: Regular monitoring and analysis of key financial metrics, such as the current ratio, quick ratio, and cash conversion cycle, provide valuable insights into financial performance. This enables timely corrective actions and informed decision-making.

The Importance of Cash Flow Forecasting

Cash flow forecasting is a critical tool for financial planning and management, providing a forward-looking view of a company’s cash inflows and outflows. Accurate cash flow forecasts enable businesses to make informed decisions regarding investments, financing, and operational activities.

- Predicting Cash Needs: Cash flow forecasting helps businesses predict when they will need additional financing and the amount required.

- Identifying Potential Shortfalls: By identifying potential cash shortfalls in advance, companies can proactively secure financing or adjust their spending plans.

- Optimizing Investment Decisions: Cash flow forecasts inform investment decisions by highlighting periods of excess cash, allowing businesses to invest in short-term instruments or other opportunities.

- Improving Operational Efficiency: Cash flow forecasting can help businesses identify areas where they can improve operational efficiency, such as accelerating collections or managing inventory levels.

- Supporting Strategic Planning: Accurate cash flow forecasts support strategic planning by providing a realistic assessment of a company’s financial resources.

Techniques for Minimizing Financing Costs

Minimizing financing costs is a key objective in short-term finance management. Implementing several techniques can significantly reduce the expenses associated with borrowing and optimize a company’s financial performance.

- Negotiating Competitive Interest Rates: Actively negotiating with lenders to secure the lowest possible interest rates on short-term loans is a primary strategy. Businesses should compare rates from multiple lenders and leverage their creditworthiness to obtain favorable terms.

- Optimizing the Use of Trade Credit: Taking full advantage of trade credit, including negotiating extended payment terms with suppliers, can provide a cost-effective source of short-term financing.

- Accelerating Collections: Reducing the time it takes to collect accounts receivable can improve cash flow and reduce the need for external financing. This can be achieved through measures like offering early payment discounts and implementing efficient collection processes.

- Managing Inventory Levels: Efficient inventory management minimizes the amount of capital tied up in inventory, reducing the need for financing. This involves techniques such as just-in-time inventory management and careful demand forecasting.

- Using Factoring or Discounting Receivables: Factoring accounts receivable or discounting them can provide immediate access to cash, but businesses should carefully consider the associated costs and fees.

- Avoiding Unnecessary Borrowing: Implementing strict cost controls and optimizing working capital can reduce the need for borrowing, thereby minimizing financing costs.

Model for a Cash Flow Statement

A cash flow statement is a financial statement that summarizes the cash inflows and outflows of a company over a specific period. The statement is divided into three main sections: operating activities, investing activities, and financing activities. A well-structured cash flow statement provides valuable insights into a company’s financial health and its ability to generate cash.

The following is a simplified model for a cash flow statement:

| Cash Flow Statement | Amount |

|---|---|

| Cash Flow from Operating Activities | |

| Net Income | $XXX |

| Depreciation and Amortization | $XXX |

| Changes in Working Capital | |

| Increase (Decrease) in Accounts Receivable | ($XXX) |

| Increase (Decrease) in Inventory | ($XXX) |

| Increase (Decrease) in Accounts Payable | $XXX |

| Net Cash from Operating Activities | $XXX |

| Cash Flow from Investing Activities | |

| Purchase of Property, Plant, and Equipment (PP&E) | ($XXX) |

| Sale of PP&E | $XXX |

| Net Cash from Investing Activities | $XXX |

| Cash Flow from Financing Activities | |

| Proceeds from Borrowing | $XXX |

| Repayment of Borrowings | ($XXX) |

| Payment of Dividends | ($XXX) |

| Net Cash from Financing Activities | $XXX |

| Net Increase (Decrease) in Cash | $XXX |

| Cash at Beginning of Period | $XXX |

| Cash at End of Period | $XXX |

- Operating Activities: This section reflects the cash generated or used by the company’s core business operations. Key elements include net income, adjustments for non-cash items (such as depreciation), and changes in working capital.

- Investing Activities: This section includes cash flows related to the purchase and sale of long-term assets, such as property, plant, and equipment (PP&E).

- Financing Activities: This section covers cash flows related to debt, equity, and dividends. Key elements include proceeds from borrowing, repayment of borrowings, and payment of dividends.