Finance Major and CPA: Can A Finance Major Get A Cpa

For finance majors considering career advancement, obtaining a Certified Public Accountant (CPA) license is a significant decision. This section provides an overview of the educational path, the CPA designation, and the benefits of pursuing this credential. It will clarify the relationship between a finance major and the CPA, and highlight the advantages of becoming a CPA for finance professionals.

Educational Path of a Finance Major

A finance major’s educational journey typically involves a Bachelor of Science in Finance (BSF) or a Bachelor of Business Administration with a concentration in Finance (BBA-Finance). The curriculum focuses on financial principles and practices.

- Core Coursework: Students study accounting, economics, statistics, and management. These courses provide a foundation for understanding financial concepts.

- Finance-Specific Courses: They delve into corporate finance, investments, financial markets and institutions, and portfolio management. These courses equip students with specialized knowledge in financial analysis, valuation, and decision-making.

- Quantitative Skills: A strong emphasis is placed on quantitative analysis, including the use of financial modeling and data analysis techniques. This is critical for making informed financial decisions.

- Electives: Students often take electives to specialize in areas like financial planning, real estate finance, or international finance. This allows them to tailor their education to their career interests.

Definition and Significance of a Certified Public Accountant (CPA)

A Certified Public Accountant (CPA) is a licensed accounting professional who has met specific education, examination, and experience requirements. The CPA designation is a mark of professional competence and ethical conduct in the accounting field.

- Licensing Requirements: CPAs must pass the Uniform CPA Examination, meet education requirements (typically 150 credit hours, including specific accounting coursework), and fulfill a state’s experience requirements.

- Responsibilities: CPAs provide a range of services, including auditing financial statements, preparing tax returns, and offering financial consulting. They play a crucial role in ensuring the accuracy and reliability of financial information.

- Professional Standards: CPAs adhere to strict ethical standards and are committed to upholding the integrity of the financial system.

Differences Between Finance Major Curriculum and CPA Exam Requirements

While a finance major provides a solid foundation, the curriculum differs from the specific requirements of the CPA exam. The CPA exam emphasizes accounting principles and practices.

- Accounting Focus: The CPA exam primarily assesses knowledge of financial accounting and reporting, auditing, regulation, and business environment and concepts.

- Coursework Gap: Finance majors may need to take additional accounting courses to meet the educational requirements for the CPA exam. This often includes courses in financial accounting, auditing, taxation, and cost accounting.

- Exam Content: The CPA exam covers topics like financial statement analysis, internal controls, and U.S. federal tax law. These are often not the primary focus of a finance major’s curriculum.

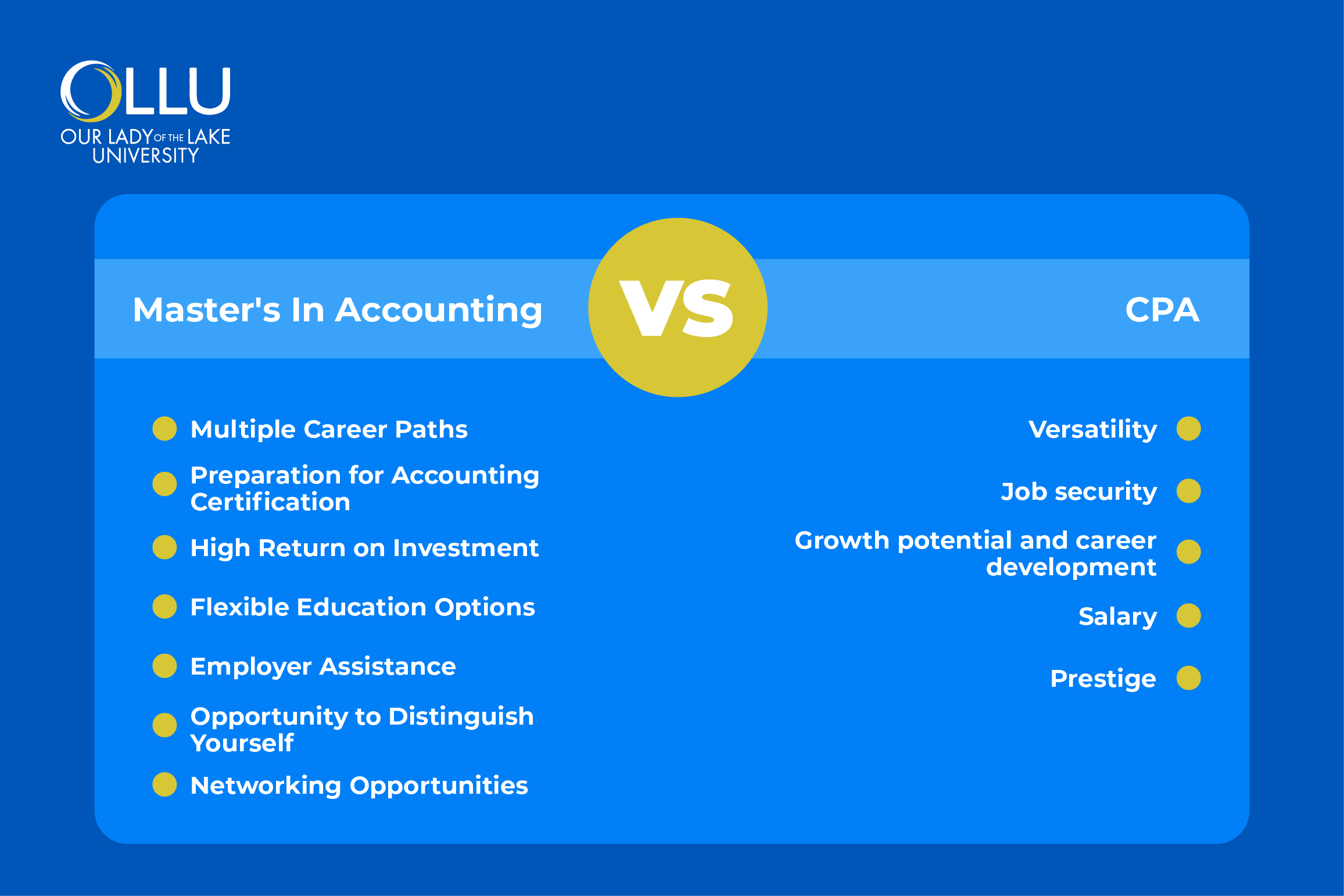

Benefits of CPA Certification for Finance Professionals

Obtaining a CPA certification offers numerous advantages for finance professionals, enhancing their career prospects and earning potential.

- Enhanced Credibility: The CPA designation signals a high level of competence and ethical standards, increasing credibility with clients and employers.

- Career Advancement: CPAs are often sought after for leadership roles in finance, such as CFO, controller, and financial manager.

- Increased Earning Potential: CPAs generally earn higher salaries than non-certified professionals in similar roles. The specific increase depends on experience, location, and industry.

- Expanded Job Opportunities: A CPA license opens doors to a wider range of job opportunities, including roles in public accounting, corporate finance, government, and non-profit organizations.

- Networking Opportunities: CPAs have access to a professional network through organizations like the AICPA (American Institute of Certified Public Accountants) and state CPA societies.

CPA Exam Eligibility for Finance Majors

The path to becoming a Certified Public Accountant (CPA) is often pursued by finance majors, but it requires meeting specific educational and experience requirements. Understanding these prerequisites is crucial for finance graduates aspiring to a CPA license. This section details the eligibility criteria finance majors must satisfy to sit for the CPA exam and ultimately achieve licensure.

Specific Educational Requirements for the CPA Exam, Can a finance major get a cpa

Finance majors must fulfill specific educational criteria to be eligible to take the CPA exam. These requirements are primarily dictated by the state or jurisdiction in which the candidate intends to be licensed. While requirements vary slightly, the core components typically include a minimum number of credit hours and specific course content.

- Minimum Credit Hours: Most jurisdictions require candidates to have completed a bachelor’s degree, typically 120-150 credit hours. However, many states now mandate 150 credit hours to be eligible for licensure, aligning with the expectation of additional coursework beyond a bachelor’s degree.

- Accounting Coursework: A significant portion of the required credit hours must be in accounting-related subjects. This typically includes courses in financial accounting, auditing, taxation, and cost accounting. The exact number of accounting credits varies by state.

- Business and General Education Courses: In addition to accounting coursework, candidates must complete a certain number of credit hours in business-related subjects, such as finance, economics, business law, and management. General education courses in areas like communications and humanities are also often required.

- Ethics Coursework: Many jurisdictions require a specific course in professional ethics for accountants. This course covers ethical principles and standards of conduct relevant to the accounting profession.

Common State-Specific Requirements for CPA Licensure

Beyond the educational prerequisites, aspiring CPAs must also comply with state-specific requirements for licensure. These vary by state and encompass factors like residency, experience, and passing the Uniform CPA Examination. Finance majors need to be aware of these differences to navigate the licensing process effectively.

- Residency Requirements: Some states require candidates to be residents or have a principal place of business in the state. This requirement might impact where a finance major can apply for licensure.

- Examination: Candidates must pass the Uniform CPA Examination, a rigorous four-part exam administered by the AICPA. The exam covers auditing and attestation, financial accounting and reporting, regulation, and business environment and concepts.

- Experience: Most states mandate a certain amount of work experience under the supervision of a licensed CPA. The specific requirements vary, including the type of experience (e.g., public accounting, industry, government) and the duration.

- Ethics Examination: Some states require candidates to pass a separate ethics examination in addition to the Uniform CPA Examination.

- Continuing Professional Education (CPE): After obtaining a CPA license, professionals must complete CPE to maintain their license. This involves completing a certain number of credit hours in continuing education courses.

Common Credit Hour Requirements in Different Subject Areas

The following table provides a general overview of the credit hour requirements in different subject areas for CPA exam eligibility. Note that specific requirements vary by state, so candidates should consult the licensing board in their desired jurisdiction for the most accurate information.

| Subject Area | Typical Credit Hours Required | Examples of Courses | Importance for Finance Majors |

|---|---|---|---|

| Accounting | 24-30+ | Financial Accounting, Auditing, Taxation, Cost Accounting, Accounting Information Systems | Provides the core knowledge necessary to pass the CPA exam and practice as a CPA. |

| Business | 24+ | Finance, Economics, Business Law, Management, Marketing | Provides a broad understanding of business operations and decision-making, which is essential for the CPA exam. |

| Ethics | 1-3 | Professional Ethics for Accountants | Ensures candidates understand the ethical responsibilities and standards of conduct in the accounting profession. |

| General Education | Varies | Communications, Humanities, Social Sciences | Provides a well-rounded education and enhances communication and critical thinking skills. |

Potential for Additional Coursework to Meet CPA Exam Eligibility

Finance majors may need to complete additional coursework beyond their bachelor’s degree to meet the eligibility requirements for the CPA exam. This is particularly true if their undergraduate program does not include the necessary number of accounting credits or the required courses in specific subject areas.

- Bridging Programs: Many universities and colleges offer bridging programs or post-baccalaureate accounting programs designed specifically for individuals with non-accounting degrees. These programs provide the necessary coursework to meet the CPA exam requirements.

- Community College Courses: Taking accounting courses at a community college is another option for fulfilling the credit hour requirements. This can be a cost-effective way to gain the required knowledge.

- Online Courses: Online courses and programs are available, offering flexibility for working professionals. These courses can be used to fulfill the necessary credit hours and course content requirements.

- Specific Course Deficiencies: Finance majors may need to take courses in auditing, taxation, or cost accounting if these were not included in their undergraduate curriculum.

The CPA Exam

The Uniform CPA Examination is a rigorous assessment designed to evaluate the knowledge and skills necessary for a licensed Certified Public Accountant. It’s a standardized test administered by the AICPA (American Institute of Certified Public Accountants) and the licensing boards of the 55 U.S. jurisdictions. Passing the CPA Exam is a critical step in becoming a CPA, opening doors to a wide range of career opportunities in accounting and finance. This section will detail the exam’s structure, content, and scoring system.

The Four Sections of the CPA Exam

The CPA Exam is divided into four sections, each focusing on a distinct area of accounting and business knowledge. Each section requires candidates to demonstrate a comprehensive understanding of specific topics.

- Auditing and Attestation (AUD): This section covers the auditing process, including planning, risk assessment, internal controls, evidence gathering, and reporting. It assesses a candidate’s ability to perform audits of financial statements and other engagements. Primary topics include:

- Auditing standards and professional responsibilities

- Risk assessment and internal controls

- Audit procedures and evidence

- Reporting

- Business Environment and Concepts (BEC): BEC covers a broad range of business concepts, including corporate governance, economics, information technology, and financial management. It assesses a candidate’s understanding of the business environment in which accounting operates. Primary topics include:

- Corporate governance

- Economics

- Information technology

- Financial management

- Financial statement analysis

- Financial Accounting and Reporting (FAR): This section focuses on the principles and practices of financial accounting and reporting for business entities. It assesses a candidate’s understanding of U.S. GAAP (Generally Accepted Accounting Principles) and the preparation of financial statements. Primary topics include:

- Conceptual framework and standard-setting

- Financial statement presentation

- Specific transactions and events (e.g., revenue recognition, leases, pensions)

- State and local government accounting

- Regulation (REG): REG covers federal taxation, business law, and ethics. It assesses a candidate’s ability to apply tax laws and regulations and understand the legal and ethical considerations relevant to the accounting profession. Primary topics include:

- Federal taxation of individuals

- Federal taxation of businesses (e.g., corporations, partnerships)

- Property transactions

- Business law

Finance-Related Topics in the CPA Exam

Finance majors often possess a solid foundation in several areas covered by the CPA Exam. This existing knowledge can be a significant advantage when preparing for the exam.

- Financial Management (BEC): Finance majors typically have a strong grasp of financial management concepts, including capital budgeting, cost of capital, working capital management, and financial statement analysis.

- Financial Statement Analysis (BEC): Understanding financial ratios, trend analysis, and the interpretation of financial statements is a core skill for finance professionals.

- Economics (BEC): Macroeconomic and microeconomic principles, often studied in finance programs, are essential for understanding the business environment.

- Business Law (REG): Finance majors often take business law courses, providing a basic understanding of contracts, agency, and other legal concepts.

- Taxation (REG): Although the focus is on tax accounting, finance majors may have encountered some tax concepts in their studies, particularly related to investments and corporate finance.

CPA Exam Format and Time Constraints

The CPA Exam utilizes a combination of question types and is administered in four separate sections. Understanding the exam format is crucial for effective preparation and time management.

- Question Types: The exam includes three main question types:

- Multiple-Choice Questions (MCQs): These questions assess a candidate’s knowledge of fundamental concepts.

- Task-Based Simulations (TBSs): TBSs require candidates to apply their knowledge to real-world scenarios, often involving research, calculations, and written communication.

- Written Communication Tasks (BEC only): These tasks assess a candidate’s ability to communicate effectively in a business context.

- Exam Structure and Time Allotment: Each section of the exam is approximately four hours long. The time is divided between MCQs and TBSs/Written Communication Tasks. The exact allocation varies by section. Candidates must manage their time effectively to complete all questions within the allotted time.

For example, the Auditing and Attestation (AUD) section is divided into two testlets, each with multiple-choice questions and task-based simulations. The Financial Accounting and Reporting (FAR) section follows a similar format. The Business Environment and Concepts (BEC) section includes multiple-choice questions and written communication tasks. Regulation (REG) also includes multiple-choice questions and task-based simulations.

Scoring System and Passing Score

The CPA Exam utilizes a scaled scoring system to ensure fairness and consistency across different exam administrations. Understanding the scoring system and the passing requirements is essential for candidates.

- Scoring Method: The AICPA uses a scaled scoring method to account for differences in the difficulty of the exam versions. Each section is graded independently, and the scores are scaled to a standard scale.

- Passing Score: The passing score for each section is 75. Candidates must achieve a score of 75 or higher on each of the four sections to pass the exam.

- Score Release: The AICPA releases exam scores to candidates. Score release dates vary, but candidates typically receive their scores a few weeks after taking the exam.

- Exam Attempts: Candidates can retake sections they fail. There is no limit to the number of times a candidate can attempt the exam.

Preparation Strategies for Finance Majors

Finance majors possess a strong foundation in accounting principles, financial reporting, and business law, making them well-positioned to tackle the CPA exam. However, the exam’s breadth and depth require a structured approach and dedicated preparation. This section Artikels a comprehensive strategy for finance majors to successfully navigate the CPA exam.

Step-by-Step Guide for Finance Majors Preparing for the CPA Exam

The CPA exam demands a strategic, well-organized approach. This step-by-step guide provides a roadmap for finance majors to maximize their preparation and increase their chances of success.

- Assess Your Baseline Knowledge. Before diving into study materials, evaluate your existing understanding of the exam’s core topics. Review your finance coursework, identify areas of strength and weakness, and pinpoint topics needing more attention.

- Choose a CPA Review Course. Select a CPA review course that aligns with your learning style, budget, and schedule. Research different providers, compare their features, and read reviews from other finance majors. Consider courses that offer adaptive learning technology and personalized support.

- Create a Realistic Study Schedule. Develop a detailed study plan that allocates sufficient time for each exam section. Break down each section into manageable modules, setting specific goals and deadlines. Account for your personal commitments and create a schedule you can realistically maintain.

- Master the Core Concepts. Focus on understanding the underlying principles and concepts. Don’t just memorize facts; strive to grasp the “why” behind the “what.” Use textbooks, lectures, and supplemental materials to build a solid conceptual foundation.

- Practice, Practice, Practice. Regularly practice multiple-choice questions and simulations. Work through practice exams under timed conditions to simulate the actual exam environment. Analyze your performance to identify areas needing improvement and adjust your study plan accordingly.

- Seek Support and Resources. Utilize available resources, such as study groups, online forums, and instructor support. Connect with other candidates to share knowledge, exchange tips, and stay motivated. Don’t hesitate to ask for help when you need it.

- Take Practice Exams. Regularly take full-length practice exams to assess your readiness. Simulate exam conditions by adhering to time constraints and avoiding distractions. Review your performance carefully, focusing on areas where you struggled and identifying areas for improvement.

- Review and Refine. Review all study materials and practice questions before the exam. Focus on areas where you feel less confident.

- Manage Exam Day Stress. Plan for exam day logistics, including travel, parking, and check-in procedures. Get a good night’s sleep, eat a healthy meal, and arrive at the testing center early to minimize stress.

Effective Study Methods and Resources for Finance Majors

Effective study methods and the right resources are crucial for success. The following methods and resources can help finance majors prepare effectively for the CPA exam.

- Active Recall. Instead of passively rereading material, actively recall information from memory. Use flashcards, practice quizzes, and self-testing to reinforce your understanding.

- Spaced Repetition. Review material at increasing intervals to improve retention. Use spaced repetition software or create your own schedule to revisit concepts over time.

- Teach Others. Explain concepts to others or teach the material. This method forces you to organize your thoughts and identify any gaps in your knowledge.

- Use a Variety of Resources. Supplement your primary study materials with textbooks, online videos, practice questions, and simulations. Diversifying your resources can enhance your understanding and engagement.

- Focus on Conceptual Understanding. Concentrate on grasping the underlying principles rather than memorizing facts. Understand the “why” behind the “what” to apply your knowledge effectively.

- Utilize Practice Questions and Simulations. Practice multiple-choice questions and simulations under timed conditions to familiarize yourself with the exam format and test your problem-solving skills.

- Join Study Groups or Forums. Collaborate with other candidates in study groups or online forums to discuss challenging topics, share insights, and stay motivated.

- Seek Guidance from Instructors or Mentors. Reach out to instructors or experienced CPAs for guidance and support. Ask questions, seek clarification on complex topics, and learn from their expertise.

Comparison of CPA Review Courses

Different CPA review courses offer varying features and approaches. Understanding their strengths and weaknesses can help finance majors choose the right one.

Can a finance major get a cpa – Becker CPA Review: Known for its comprehensive content, extensive practice questions, and experienced instructors. It offers a structured curriculum and a high pass rate. Its strength lies in its robust question bank and simulation practice. A potential weakness is its higher price point.

Wiley CPAexcel: Provides a flexible, adaptive learning platform with video lectures, practice questions, and progress tracking. Its strength lies in its affordability and adaptable format. A potential weakness is that the content may not be as comprehensive as other courses.

A finance major certainly has a strong foundation for pursuing a CPA. Their coursework in accounting and financial analysis is highly relevant. However, even if you’re not a finance expert, there are options, such as whether can you finance foundation repair , as many financial solutions exist. Ultimately, the path to becoming a CPA requires specific coursework and passing the exam, regardless of your major, but finance offers a significant advantage.

Roger CPA Review: Offers an engaging and energetic approach with dynamic video lectures and a focus on memory techniques. Its strength lies in its motivational teaching style and easy-to-understand explanations. A potential weakness is that the course may not be suitable for all learning styles.

UWorld Roger CPA Review: UWorld Roger CPA Review provides a comprehensive and engaging approach to CPA exam preparation. It offers a combination of video lectures, practice questions, and simulations. Its strength lies in its motivational teaching style and user-friendly platform. A potential weakness is that it may not be suitable for all learning styles.

Gleim CPA Review: Emphasizes a large question bank and detailed explanations. Its strength lies in its extensive practice material and its ability to test candidates with a variety of questions. A potential weakness is that the course material may feel dry.

Absolutely, a finance major can definitely pursue a CPA! While the path involves specific exams and requirements, the financial background provides a strong foundation. Thinking about finances also makes you wonder, for example, who accepts bread financing , which is an interesting query on its own. Ultimately, with dedication and hard work, a finance major can successfully earn their CPA and excel in the accounting field.

Estimated Time Commitment for Each Exam Section

The time needed to prepare for each CPA exam section varies based on individual factors, such as prior knowledge, learning style, and study habits. The following table provides an estimated time commitment for each section.

| Exam Section | Estimated Study Hours | Typical Study Timeframe | Key Topics for Finance Majors |

|---|---|---|---|

| Auditing and Attestation (AUD) | 80-100 hours | 6-8 weeks | Audit reports, internal controls, audit procedures, and professional responsibilities. |

| Business Environment and Concepts (BEC) | 70-90 hours | 5-7 weeks | Corporate governance, economics, IT, financial management, and strategic planning. |

| Financial Accounting and Reporting (FAR) | 100-120 hours | 8-10 weeks | Financial statement preparation, accounting for assets, liabilities, and equity, and governmental accounting. |

| Regulation (REG) | 80-100 hours | 6-8 weeks | Federal taxation, business law, and ethics. |

Bridging the Gap

The transition from a finance major to a Certified Public Accountant (CPA) involves more than just passing an exam. While a finance background provides a solid foundation, specific knowledge gaps often exist. This section focuses on identifying these areas, outlining effective study strategies, and illustrating how finance concepts are tested on the CPA exam.

Knowledge Gaps for Finance Majors

Finance majors often possess a strong understanding of financial markets, investments, and corporate finance. However, the CPA exam covers a broader scope, including areas that may be less emphasized in a finance curriculum.

- Financial Accounting: Finance majors typically have a good grasp of financial statements. However, the CPA exam delves into detailed accounting standards, including revenue recognition, leases, and consolidations. A deep understanding of Generally Accepted Accounting Principles (GAAP) and International Financial Reporting Standards (IFRS) is crucial.

- Auditing: While finance students may have exposure to auditing principles, the CPA exam places a significant emphasis on audit procedures, internal controls, and the auditor’s role. Understanding the audit process, risk assessment, and audit reports is vital.

- Taxation: Finance curricula often touch on taxation, but the CPA exam requires a comprehensive understanding of federal income tax laws, including individual, corporate, and partnership taxation. This involves detailed knowledge of deductions, credits, and tax planning strategies.

- Regulation: The Regulation (REG) section of the CPA exam covers business law, ethics, and federal tax. Finance majors need to develop a strong understanding of legal principles, professional ethics, and the regulatory environment impacting businesses.

- Cost Accounting: While some finance programs cover cost accounting, the CPA exam tests this area in detail, including cost allocation methods, budgeting, and variance analysis.

Study Strategies to Address Knowledge Gaps

Effectively bridging the knowledge gaps requires a strategic approach to studying. Finance majors can leverage their existing strengths while focusing on areas where they need improvement.

- Targeted Review: Identify specific areas where your knowledge is weak. Use CPA exam review courses to focus on these areas. Most review courses provide diagnostic assessments to pinpoint weaknesses.

- Practice Questions: Consistent practice is key. Work through numerous multiple-choice questions (MCQs) and task-based simulations (TBSs) to apply your knowledge and build problem-solving skills. Focus on questions related to financial accounting, auditing, and taxation.

- Supplemental Study Materials: Supplement your review course with additional resources, such as textbooks, online articles, and professional journals. This provides alternative explanations and perspectives on complex topics.

- Focus on Memorization: Certain areas, such as tax law and accounting standards, require memorization. Use flashcards, mnemonic devices, and practice questions to commit key information to memory.

- Mock Exams: Take full-length mock exams under exam conditions to simulate the CPA exam experience. This helps you manage time, identify areas of weakness, and build confidence.

Finance Concepts Tested on the CPA Exam

The CPA exam frequently incorporates finance concepts within the context of financial accounting, auditing, and taxation. Understanding how these concepts are tested is crucial for success.

- Financial Statement Analysis: The exam tests the ability to analyze financial statements to assess a company’s financial performance and position. This includes calculating financial ratios, evaluating profitability, and assessing solvency.

- Valuation Techniques: Candidates are expected to understand valuation techniques, such as discounted cash flow analysis and relative valuation, to assess the fair value of assets and liabilities.

- Investment Decisions: The exam may include questions on capital budgeting, investment analysis, and the cost of capital.

- Risk Management: Understanding risk management principles, including hedging strategies and derivatives, is important.

- Corporate Finance: Knowledge of corporate finance topics, such as capital structure, dividend policy, and mergers and acquisitions, may be tested.

Hypothetical Exam Question:

A company is considering a capital investment project with an initial outlay of $500,000. The project is expected to generate annual cash inflows of $150,000 for five years. The company’s cost of capital is 10%.

What is the project’s Net Present Value (NPV)?

A. $28,400

B. $56,865

C. $73,300

D. $92,500

Explanation: This question tests the candidate’s ability to apply the Net Present Value (NPV) formula, a core concept in corporate finance. The NPV is calculated by discounting the future cash flows to their present value and subtracting the initial investment. In this case, the present value of the cash inflows is $568,610 (using a present value of an annuity factor for 5 years at 10%), and the NPV is $68,610 ($568,610 – $500,000). The correct answer is B. This question assesses the candidate’s ability to apply financial concepts to evaluate an investment opportunity, a skill essential for CPAs.

Career Paths and Opportunities

The intersection of finance and accounting offers a diverse landscape of career opportunities, significantly enhanced by the acquisition of a Certified Public Accountant (CPA) certification. This section explores the various career paths available to finance majors with a CPA, compares their earning potential, and highlights specific roles where the CPA credential provides a distinct advantage.

Career Paths for Finance Majors with a CPA

A CPA certification opens doors to a wide array of career options for finance majors. These roles leverage both financial expertise and accounting knowledge, providing a solid foundation for professional growth.

- Public Accounting: This path involves providing accounting, auditing, and tax services to clients. CPAs in public accounting can specialize in areas like auditing, tax, or advisory services.

- Corporate Accounting: Within corporations, CPAs manage financial reporting, budgeting, forecasting, and internal controls. Roles include accounting manager, controller, and chief financial officer (CFO).

- Financial Planning and Analysis (FP&A): CPAs in FP&A roles analyze financial data, develop financial models, and provide insights to support strategic decision-making.

- Government and Non-profit Accounting: CPAs can work in government agencies or non-profit organizations, managing financial resources, ensuring compliance, and preparing financial statements.

- Investment Banking: Some CPAs transition to investment banking, leveraging their financial and analytical skills to advise clients on mergers and acquisitions, capital raising, and other financial transactions.

- Forensic Accounting: This specialized area involves investigating financial crimes, fraud, and disputes.

Salary Ranges for Finance Professionals with a CPA

Salary expectations vary depending on the role, experience level, and location. However, a CPA certification often commands a higher salary compared to similar roles without the credential.

The following salary ranges are based on national averages, and actual salaries can vary.

- Staff Accountant: Entry-level roles typically range from $55,000 to $75,000 per year.

- Senior Accountant: With a few years of experience, salaries often range from $70,000 to $95,000 per year.

- Accounting Manager: These roles can earn between $85,000 and $120,000 per year.

- Controller: Controllers, who oversee accounting functions, often earn $100,000 to $175,000 or more, depending on the size and complexity of the organization.

- CFO: Chief Financial Officers can command salaries ranging from $150,000 to several million dollars, depending on the company’s size and performance.

Career Opportunities: CPA vs. Non-CPA Finance Majors

The CPA certification significantly impacts career opportunities, particularly in roles requiring a high degree of trust and technical expertise.

The comparison highlights the differences in career progression and earning potential.

- Career Advancement: CPAs often have a faster career progression, especially in roles requiring a deep understanding of accounting principles and financial reporting. They are more likely to be considered for leadership positions.

- Job Security: The CPA credential is highly respected and sought after, providing greater job security and flexibility in the job market.

- Earning Potential: CPAs generally earn higher salaries compared to non-CPAs in similar roles. The premium reflects the additional education, examination, and experience required to obtain the certification.

- Professional Recognition: The CPA designation is a mark of professional competence and ethical conduct, enhancing credibility with clients, employers, and colleagues.

Finance Role Where a CPA Certification is Highly Advantageous

The role of a Corporate Controller is a prime example where a CPA certification is exceptionally valuable.

The Corporate Controller role demands a comprehensive understanding of accounting principles, financial reporting, and internal controls. A CPA certification enhances the candidate’s credibility and demonstrates a commitment to professional standards.

- Responsibilities: The Corporate Controller is responsible for overseeing all accounting operations, including financial reporting, budgeting, forecasting, and internal controls. This includes:

- Preparing and analyzing financial statements in accordance with Generally Accepted Accounting Principles (GAAP).

- Managing the general ledger and ensuring accurate and timely financial record-keeping.

- Developing and maintaining internal controls to safeguard company assets and prevent fraud.

- Overseeing the budgeting and forecasting processes.

- Managing the accounting team and ensuring compliance with tax regulations.

- Required Skills: The Corporate Controller role requires a combination of technical accounting skills and leadership abilities:

- Technical Accounting Knowledge: A thorough understanding of GAAP, financial reporting standards, and tax regulations.

- Financial Analysis: The ability to analyze financial data, identify trends, and provide insights to management.

- Leadership and Management: Strong leadership skills to manage and motivate the accounting team.

- Communication Skills: Excellent written and verbal communication skills to communicate financial information to various stakeholders.

- Problem-Solving: The ability to identify and resolve accounting issues and implement effective solutions.

- CPA Advantage: A CPA certification is highly advantageous in this role because it demonstrates:

- Technical Expertise: The CPA exam covers a broad range of accounting topics, ensuring the candidate has a strong foundation in accounting principles and practices.

- Professional Ethics: CPAs are bound by a code of ethics, which enhances their credibility and trustworthiness.

- Regulatory Compliance: CPAs are well-versed in accounting standards and regulations, ensuring the company complies with all applicable laws and regulations.

- Career Advancement: A CPA certification is often a prerequisite for advancement to the CFO position.

Success Stories and Real-World Examples

The journey of a finance major to becoming a Certified Public Accountant (CPA) is often paved with hard work and strategic career choices. Numerous finance professionals leverage the CPA certification to enhance their skills, open doors to advanced roles, and ultimately, achieve significant career success. This section highlights real-world examples and provides insights into how the CPA designation contributes to a finance professional’s achievements.

Successful Finance Professional: Case Study

Consider Sarah Chen, a finance major who graduated with honors. After graduation, Sarah began her career in corporate finance, initially working as a financial analyst. Recognizing the value of a CPA, she began studying for the exam while working full-time. She successfully passed all four sections of the CPA exam within a year. Sarah’s background in finance provided a strong foundation for understanding the accounting principles tested in the exam. Her commitment to the CPA exam, combined with her finance expertise, helped her stand out.

Sarah’s career trajectory demonstrates the benefits of a CPA for finance majors. Initially, Sarah’s role was focused on financial modeling, budgeting, and forecasting. After obtaining her CPA, she was promoted to a senior financial analyst position, where she took on additional responsibilities, including:

- Leading the preparation of the company’s financial statements.

- Overseeing the budgeting process for a specific business unit.

- Conducting variance analysis and reporting on key performance indicators (KPIs).

Later, Sarah transitioned into a managerial role as a finance manager, where she was responsible for a team of analysts. Her CPA certification provided the credibility and technical knowledge necessary to manage complex financial operations. Sarah’s story is a testament to the power of the CPA designation in the finance field.

Benefits of CPA Certification for Finance Majors

The CPA certification offers tangible advantages for finance majors in their careers. These benefits often manifest in increased job opportunities, higher earning potential, and enhanced career advancement prospects.

- Enhanced Credibility: The CPA designation is a globally recognized symbol of professional competence and integrity. It signals to employers, clients, and colleagues that the holder has met rigorous educational, examination, and experience requirements. This credibility is particularly valuable in roles that involve financial reporting, auditing, and tax planning.

- Expanded Career Opportunities: A CPA certification opens doors to a wider range of job opportunities, including roles in public accounting, corporate finance, government, and non-profit organizations. Finance majors with a CPA can pursue positions such as audit manager, controller, chief financial officer (CFO), tax manager, and financial consultant.

- Increased Earning Potential: CPA-certified professionals typically earn higher salaries than their non-certified counterparts. According to a recent survey by the AICPA (American Institute of Certified Public Accountants), CPAs earn significantly more than non-CPAs in similar roles.

- Improved Technical Skills: The CPA exam covers a comprehensive range of accounting, auditing, and tax topics. Preparing for the exam helps finance majors develop a deep understanding of these areas, which is essential for success in many finance roles.

- Networking Opportunities: The CPA designation provides access to a valuable professional network. CPAs can connect with other professionals through the AICPA, state CPA societies, and industry events. This network can be a source of mentorship, career advice, and business opportunities.

Specific Skills and Knowledge Gained Through the CPA Exam in Finance Roles

The CPA exam equips finance majors with specialized skills and knowledge that are directly applicable in various finance roles. These skills enhance their ability to perform tasks effectively and contribute to organizational success.

- Financial Statement Analysis: The CPA exam emphasizes the ability to analyze financial statements, including the balance sheet, income statement, and statement of cash flows. This skill is critical for evaluating a company’s financial performance, identifying trends, and making informed investment decisions.

- Auditing and Assurance: The exam covers auditing standards and procedures, which are essential for understanding how financial statements are verified and validated. Finance professionals with this knowledge can contribute to internal control improvements and risk management efforts.

- Tax Planning and Compliance: The CPA exam includes a section on taxation, covering individual, corporate, and partnership tax laws. This knowledge is crucial for minimizing tax liabilities and ensuring compliance with tax regulations.

- Cost Accounting and Management Accounting: The exam covers cost accounting principles, which are essential for understanding how costs are allocated and managed within an organization. This knowledge is valuable for budgeting, forecasting, and performance evaluation.

- Business Law: The CPA exam includes a section on business law, which covers topics such as contracts, business structures, and regulations. This knowledge is essential for understanding the legal and regulatory environment in which businesses operate.

Typical Workday of a CPA in Finance

A finance professional’s workday, particularly one holding a CPA, is diverse and dynamic. The tasks and responsibilities vary depending on the specific role and industry, but the CPA certification often influences the types of tasks performed and the level of responsibility.

Consider the example of a finance manager at a manufacturing company:

- Morning: The day typically begins with reviewing the previous day’s financial reports, including sales figures, production costs, and inventory levels. The finance manager may also attend a morning meeting with the executive team to discuss financial performance and address any issues.

- Mid-day: The finance manager might spend the mid-day reviewing and approving invoices, preparing journal entries, and reconciling bank accounts. They may also work on the monthly financial statements, ensuring accuracy and compliance with accounting standards. The CPA certification provides the technical expertise needed for these tasks.

- Afternoon: The afternoon could involve working on the annual budget, analyzing variances, and preparing financial projections. The finance manager might also meet with the audit team to discuss the company’s internal controls and financial reporting processes. The CPA certification enhances the finance manager’s ability to communicate effectively with auditors and stakeholders.

- Ongoing: Throughout the day, the finance manager is responsible for ensuring compliance with tax regulations, staying updated on changes in accounting standards, and providing financial advice to other departments. The CPA designation provides the credibility and knowledge to fulfill these responsibilities effectively.