Understanding Washer Dryer Financing for Individuals with Less-Than-Perfect Credit

Financing a washer and dryer can be a necessity, but it presents challenges for individuals with bad credit. Navigating the world of financing with a less-than-stellar credit history requires understanding the hurdles and exploring available options. This section delves into the specifics of washer and dryer financing for those with less-than-perfect credit, providing insights into eligibility, interest rates, denial reasons, and alternative solutions.

Typical Eligibility Requirements for Washer Dryer Financing

Lenders assess a variety of factors to determine eligibility for washer and dryer financing. These requirements are more stringent for applicants with bad credit.

- Credit Score: This is a primary factor. Lenders use credit scores to gauge the risk of lending. A lower credit score significantly reduces the chances of approval.

- Income Verification: Lenders require proof of income to ensure the applicant can afford the monthly payments. This typically involves pay stubs, tax returns, or bank statements. A stable income is crucial, especially for those with poor credit.

- Debt-to-Income Ratio (DTI): DTI compares an applicant’s monthly debt payments to their gross monthly income. A high DTI indicates that the applicant is already overextended financially, making them a higher risk for lenders.

- Employment History: Consistent employment history demonstrates stability and reliability. Lenders prefer applicants with a steady employment record.

- Down Payment: Some lenders may require a down payment, particularly for applicants with bad credit, to reduce the risk.

- Residency: Proof of residency, such as a utility bill or lease agreement, is often required.

Individuals with bad credit often face more scrutiny regarding these requirements. They may need to provide more documentation or meet higher income thresholds compared to those with good credit.

Impact of Credit Scores on Interest Rates and Loan Terms

Credit scores directly influence the terms of washer and dryer financing, particularly interest rates and loan lengths.

Washer dryer financing bad credit –

Lenders categorize borrowers based on their credit scores, assigning them to different tiers. Each tier corresponds to a specific interest rate. For example:

- Excellent Credit (720+): May qualify for the lowest interest rates, sometimes as low as 0% for promotional periods. They might also have access to longer loan terms, reducing monthly payments.

- Good Credit (680-719): Will likely receive competitive interest rates, although slightly higher than those with excellent credit.

- Fair Credit (620-679): Interest rates will be higher, and loan terms may be shorter.

- Poor Credit (Below 620): Face the highest interest rates and the shortest loan terms. They might also be required to pay additional fees.

The difference in interest rates can significantly impact the total cost of the washer and dryer over the loan’s lifespan.

Consider a scenario where a washer and dryer set costs $1,500.

| Credit Score | Interest Rate | Loan Term | Monthly Payment | Total Paid |

|---|---|---|---|---|

| Excellent (720+) | 5% | 36 months | $44.81 | $1,613.16 |

| Poor (Below 620) | 20% | 12 months | $138.83 | $1,665.96 |

This illustrates how a higher interest rate, driven by poor credit, dramatically increases the total cost of the purchase, even with a shorter loan term.

Primary Reasons for Denial of Washer Dryer Financing

Lenders deny washer and dryer financing applications for several key reasons, particularly for those with bad credit.

- Low Credit Score: A low credit score is the most common reason for denial. It signals a higher risk of default.

- High Debt-to-Income Ratio (DTI): A high DTI indicates that the applicant is already overextended, making it difficult to manage additional debt.

- Insufficient Income: Lenders may deny an application if the applicant’s income is deemed insufficient to cover the monthly payments.

- Negative Credit History: This includes late payments, defaults, bankruptcies, and other negative marks on the credit report. These indicate a history of not managing debt responsibly.

- Lack of Credit History: A thin credit file (a lack of established credit) can also lead to denial, as lenders have insufficient information to assess risk.

- Inconsistent Employment History: Frequent job changes or periods of unemployment raise concerns about the applicant’s ability to repay the loan.

Lenders evaluate these factors to determine the applicant’s ability to repay the loan. Poor credit history is often a major red flag.

Alternative Options to Mitigate Risk Associated with Bad Credit

Lenders offer alternative options to mitigate the risk associated with lending to individuals with bad credit.

- Cosigner: A cosigner with good credit agrees to be responsible for the loan if the primary applicant defaults. This significantly reduces the lender’s risk. The cosigner’s creditworthiness becomes a key factor.

- Larger Down Payment: A larger down payment reduces the amount the applicant needs to finance, thereby lowering the lender’s risk. This also shows a commitment to the purchase.

- Secured Loans: Some lenders offer secured loans, where the washer and dryer serve as collateral. If the borrower defaults, the lender can repossess the appliances.

- Credit Builder Loans: These loans are specifically designed to help build or repair credit. The loan amount is placed in a savings account, and the borrower makes regular payments.

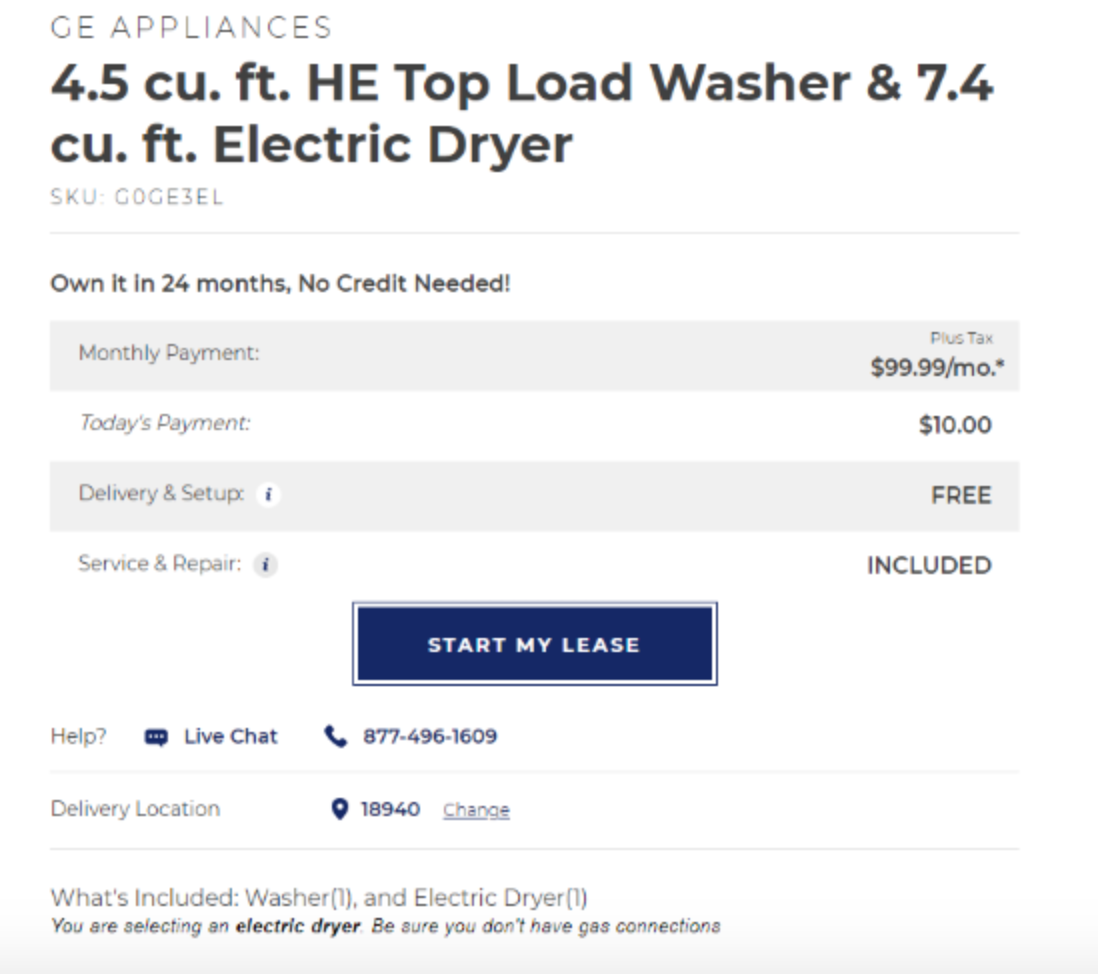

- Rent-to-Own Agreements: These agreements allow individuals to acquire the washer and dryer through monthly payments, with the option to own the appliances at the end of the term. While they don’t always involve a credit check, they often come with higher overall costs.

These alternatives help lenders manage their risk while still providing financing options to individuals with less-than-perfect credit. The availability and terms of these options vary depending on the lender and the applicant’s specific financial situation.

Types of Washer Dryer Financing Options Available

Securing financing for a washer and dryer when your credit isn’t perfect requires understanding the available options. Each method has its own structure, benefits, and drawbacks. Choosing the right financing solution necessitates careful consideration of interest rates, fees, and the overall impact on your credit score.

Installment Loans for Washer Dryers

Installment loans represent a common method of financing appliance purchases. These loans provide a fixed amount of money that is repaid over a set period through regular, equal payments.

- Advantages: Installment loans can offer lower interest rates compared to some other financing options, particularly if the borrower has a slightly better credit profile. They provide a clear repayment schedule, making budgeting easier. The fixed payments remain consistent throughout the loan term.

- Disadvantages: Securing an installment loan with bad credit often means higher interest rates. Late payments can severely damage your credit score. Furthermore, some installment loans may come with origination fees or prepayment penalties.

Rent-to-Own Programs

Rent-to-own programs provide an alternative to traditional financing. These programs allow consumers to acquire a washer and dryer through a rental agreement, with the option to eventually own the appliance.

- Advantages: Rent-to-own agreements often do not require a credit check, making them accessible to individuals with bad or no credit. They typically offer flexible payment options, such as weekly or monthly installments. Ownership is transferred once all payments are completed.

- Disadvantages: Rent-to-own agreements are typically the most expensive financing option. The total cost of the appliance, including interest and fees, can be significantly higher than the retail price. There is no ownership until the final payment is made. Early termination often involves penalties, and the appliance can be repossessed if payments are missed.

Store Credit Cards for Appliances

Store credit cards are another option, frequently offered by retailers that sell appliances. These cards function like traditional credit cards but are typically limited to purchases at the specific store.

- Advantages: Store credit cards can offer promotional financing options, such as 0% interest for a limited time. They sometimes provide rewards programs, like points or discounts on future purchases. They can help build credit if managed responsibly.

- Disadvantages: Store credit cards often have high interest rates. Credit limits may be lower than general-purpose credit cards. Late payments can result in significant penalties and damage your credit score. Promotional financing periods are temporary, and interest rates can jump significantly after the promotional period ends.

Comparison of Financing Options

The table below provides a side-by-side comparison of the financing options discussed, highlighting their pros, cons, and the impact on credit scores.

| Option | Pros | Cons | Credit Score Impact |

|---|---|---|---|

| Installment Loans | Potentially lower interest rates than other options; predictable payment schedule. | Higher interest rates for bad credit; late payments damage credit score; may have fees. | On-time payments build credit; late payments negatively impact credit. |

| Rent-to-Own | No credit check required; flexible payment options. | Highest total cost; no ownership until final payment; penalties for early termination. | No direct impact if payments are made on time, but no credit building. |

| Store Credit Cards | Promotional financing offers; rewards programs; can build credit. | High interest rates; lower credit limits; late payments and penalties. | On-time payments build credit; late payments severely damage credit. |

Improving Your Chances of Approval

Securing washer dryer financing with bad credit requires a proactive approach. While credit history is a significant factor, there are steps you can take to improve your approval odds and secure more favorable loan terms. This section Artikels strategies for boosting your creditworthiness, preparing your application, and negotiating with lenders.

Improving Your Credit Score Before Applying

Boosting your credit score before applying for financing significantly improves your chances of approval and can lead to lower interest rates. This involves addressing existing credit issues and demonstrating responsible financial behavior.

- Review Your Credit Reports: Obtain copies of your credit reports from all three major credit bureaus (Equifax, Experian, and TransUnion). Review them carefully for any errors, such as incorrect information, accounts you don’t recognize, or inaccurate payment history. Dispute any errors with the credit bureaus immediately. Correcting errors can quickly improve your score.

- Pay Bills on Time: Consistently paying all bills on time is the single most impactful factor in improving your credit score. Even a single late payment can negatively affect your score. Set up automatic payments or reminders to ensure you never miss a due date.

- Reduce Credit Card Debt: High credit utilization (the amount of credit you’re using compared to your total available credit) can lower your score. Aim to keep your credit utilization below 30% on each credit card. Paying down balances significantly improves your score, and ideally, strive for less than 10% utilization.

- Avoid Opening New Credit Accounts: Opening new credit accounts shortly before applying for financing can lower your average account age and potentially hurt your score. Focus on improving your existing credit profile before applying for new credit.

- Become an Authorized User: If possible, become an authorized user on a credit card with a good payment history and low credit utilization. This can help build your credit history, but ensure the primary cardholder manages the account responsibly.

- Consider a Secured Credit Card: A secured credit card requires a security deposit, making it easier to get approved, even with bad credit. Using a secured card responsibly (paying on time and keeping utilization low) can rebuild your credit over time.

Preparing Application Documents

Organizing and preparing the necessary documents demonstrates your financial responsibility and streamlines the application process. Having these readily available can also expedite the approval process.

- Proof of Income: Provide recent pay stubs, W-2 forms, or tax returns to verify your income. Lenders want to see a consistent income stream to ensure you can repay the loan. If you are self-employed, provide bank statements, profit and loss statements, and your most recent tax return (Schedule C).

- Proof of Address: Include a utility bill, bank statement, or lease agreement that confirms your current address. This verifies your residency and helps lenders assess risk.

- Identification: Provide a government-issued photo ID, such as a driver’s license or passport. This verifies your identity.

- Bank Account Information: Have your bank account details ready for automatic payments or direct deposit. This includes your account number and routing number.

- Employment Verification: Be prepared to provide your employer’s contact information. Some lenders may contact your employer to verify your employment.

- References: Provide references, such as previous landlords or other financial institutions. This demonstrates responsibility.

Negotiating Loan Terms

If you are approved for financing but the terms are unfavorable, you can negotiate. This involves understanding the loan terms and being prepared to make a case for better conditions.

- Understand the Offer: Carefully review the loan offer, including the interest rate, loan term, and fees. Make sure you understand all the terms before negotiating.

- Negotiate the Interest Rate: If the interest rate is high, try to negotiate it down. Provide evidence of a recent improvement in your credit score, such as proof of recent on-time payments or a lower credit utilization ratio.

- Negotiate the Loan Term: Consider the loan term. A shorter term may result in higher monthly payments but lower overall interest paid. A longer term may result in lower monthly payments but higher overall interest paid.

- Ask for a Lower Down Payment: If the lender requires a down payment, try to negotiate a lower amount. A smaller down payment can make the financing more accessible.

- Be Prepared to Walk Away: If the terms are unacceptable, be prepared to walk away from the deal. Explore other financing options or save up to purchase the washer and dryer outright.

- Counteroffer with Confidence: Present a counteroffer based on your research and understanding of the market. Be polite but firm in your request for better terms.

Managing Debt Responsibly

Responsible debt management is crucial for maintaining good credit and improving your creditworthiness over time. This involves budgeting, prioritizing payments, and avoiding excessive debt.

- Create a Budget: Develop a detailed budget that tracks your income and expenses. This helps you understand where your money is going and identify areas where you can save.

- Prioritize Debt Payments: Prioritize paying your bills on time, especially those with high interest rates or that are reported to credit bureaus. Consider the “debt snowball” or “debt avalanche” methods for paying down debt.

- Avoid Taking on Excessive Debt: Be cautious about taking on more debt than you can comfortably manage. Only borrow what you need and can afford to repay.

- Monitor Your Credit Report Regularly: Regularly check your credit report for any errors or fraudulent activity. This helps you stay informed about your credit health.

- Set Financial Goals: Set short-term and long-term financial goals, such as saving for a down payment on a house or paying off student loans. This provides motivation and direction for your financial decisions.

- Seek Professional Advice: If you’re struggling with debt, consider seeking advice from a credit counselor or financial advisor. They can help you create a debt management plan and improve your financial situation.

Rent-to-Own Programs: A Closer Look

Rent-to-own programs provide an alternative route to acquiring a washer and dryer, especially for individuals with bad credit. However, it’s crucial to understand the financial and legal implications before entering into such an agreement. This section delves into the specifics of rent-to-own, comparing it with other financing options and highlighting important considerations.

Total Cost Comparison: Rent-to-Own vs. Loan vs. Cash Purchase

The total cost of a washer and dryer through a rent-to-own program is often significantly higher than purchasing the same appliances outright. This is primarily due to the accumulated rental payments, which include interest and fees.

Let’s illustrate this with a hypothetical scenario:

* Appliance: Standard washer and dryer set

* Retail Price: \$1,000

* Scenario 1: Cash Purchase: The total cost is \$1,000 plus any applicable sales tax.

* Scenario 2: Loan (with Bad Credit): Assume a loan with a 24-month term and a 20% annual percentage rate (APR). Using a loan calculator, the monthly payment would be approximately \$53.22, resulting in a total cost of \$1,277.28 (excluding any origination fees).

* Scenario 3: Rent-to-Own: Assume a rent-to-own agreement with weekly payments of \$20 over 104 weeks (2 years). The total cost would be \$2,080. This represents a significant markup over the retail price.

The total cost in the rent-to-own scenario is significantly higher than the loan or cash purchase options due to the accumulation of rental payments and fees.

This comparison clearly demonstrates the financial implications of each option. While rent-to-own offers immediate access, it comes at a considerably higher cost in the long run.

Legal Aspects of Rent-to-Own Agreements

Rent-to-own agreements are legally binding contracts that specify the terms of the rental and eventual ownership of the appliance. Understanding the legal aspects is vital to protect your rights.

Here are key legal considerations:

* Ownership Rights: Initially, the rent-to-own company retains ownership of the washer and dryer. The renter gains the right to use the appliance and the option to purchase it at the end of the rental period.

* Purchase Option: The agreement Artikels the terms for purchasing the appliance, typically including the total amount to be paid, which may vary depending on the payment schedule.

* Late Payment Penalties: Agreements detail penalties for late payments, which can include late fees and potential repossession of the appliance.

* Early Purchase Options: Some agreements allow for early purchase, often with a discounted price based on the amount already paid.

* Termination Clauses: The agreement specifies the circumstances under which the contract can be terminated, either by the renter or the rent-to-own company. This may include failure to make payments or damage to the appliance.

* State Laws: Rent-to-own agreements are regulated by state laws, which vary. These laws often cover aspects like interest rates, disclosure requirements, and repossession procedures. Always review the specific state regulations before signing an agreement.

Reputable Rent-to-Own Companies and Their Offerings

Several rent-to-own companies operate nationwide. Comparing their offerings is essential to finding the best terms.

Here are examples of reputable rent-to-own companies and their general offerings:

* Aaron’s: Aaron’s offers a wide selection of appliances, including washers and dryers. They typically require an initial payment and offer flexible payment plans. Their agreements often include options for early purchase and damage waivers. They may offer services like delivery and setup.

* Rent-A-Center: Rent-A-Center provides a range of appliances and offers various payment plans, including weekly, bi-weekly, or monthly options. They often feature “same as cash” promotions, allowing customers to purchase the appliance within a specific timeframe without incurring interest charges. They also provide services like repair and replacement.

* Conn’s HomePlus: Conn’s HomePlus provides rent-to-own options alongside traditional financing and cash purchases. They offer a wide selection of appliances and often have promotions that reduce the overall cost. They also provide services like delivery, installation, and repair.

* Buddy’s Home Furnishings: Buddy’s offers a selection of washers and dryers with flexible payment options. They emphasize their no-credit-check policy, making them accessible to individuals with bad credit. They provide services such as delivery and maintenance.

It is important to carefully compare the terms of each company, including the total cost, payment schedule, late fees, and purchase options, before making a decision.

Returning a Washer Dryer in a Rent-to-Own Agreement

Understanding the process of returning a washer and dryer in a rent-to-own agreement is crucial, as it can affect your financial obligations.

Here’s what you should know:

* Reasons for Return: You may return the appliance if you can no longer afford the payments or if the appliance malfunctions and cannot be repaired.

* Notification: You typically need to notify the rent-to-own company of your intention to return the appliance.

* Condition of the Appliance: The agreement usually requires the appliance to be in reasonable condition, considering normal wear and tear. Damage beyond normal use may result in fees.

* Pick-up or Drop-off: The company may arrange for pick-up or require you to return the appliance to a designated location.

* Fees and Penalties: Returning the appliance does not always absolve you of all financial obligations. You may be responsible for outstanding payments, late fees, or damage charges.

* Termination of the Agreement: Once the appliance is returned and all outstanding fees are settled, the agreement is typically terminated.

* Documentation: Always obtain written confirmation of the return and any outstanding balance to avoid future disputes.

Familiarize yourself with the specific terms of your agreement regarding returns to avoid unexpected fees or penalties.

Evaluating Financing Offers

Choosing the right financing option for a washer and dryer is crucial for managing your finances effectively. It’s not just about finding a way to get the appliances; it’s about understanding the terms, comparing options, and avoiding pitfalls. This section will equip you with the knowledge to navigate the complexities of financing agreements and make informed decisions.

Reading the Fine Print in Financing Agreements

Carefully reviewing the fine print is essential when considering any financing offer. This section clarifies the key elements to scrutinize within a financing agreement.

- Interest Rates: The interest rate is the cost of borrowing money, expressed as a percentage. It significantly impacts the total cost of the washer and dryer.

For example, if you finance a $1,000 washer and dryer at a 10% annual percentage rate (APR) over three years, you’ll pay significantly more than if the APR is 5%. A higher APR means you’ll pay more in interest over the loan term.

Finding financing for a washer dryer with bad credit can be tough, but options exist. While navigating these challenges, consider exploring alternatives. One such avenue is nuvo finance , which might offer more flexible terms. Ultimately, understanding your credit situation and exploring various financing solutions is crucial when seeking a washer dryer with bad credit.

- Fees: Finance agreements often include various fees that can add to the overall cost. These can include origination fees, late payment fees, and prepayment penalties.

Origination fees are charged upfront to cover the cost of processing the loan. Late payment fees are applied if you miss a payment, and prepayment penalties are charged if you pay off the loan early. Understand all fees to avoid unexpected charges.

- Payment Schedules: Payment schedules dictate the frequency and amount of your payments. They can be weekly, bi-weekly, or monthly.

Consider your budget and cash flow when evaluating payment schedules. Choosing a payment schedule that aligns with your income ensures you can make payments on time and avoid late fees or damage to your credit score. For instance, if you receive a paycheck bi-weekly, a bi-weekly payment schedule might be more convenient than a monthly one.

Calculating the Total Cost of a Washer Dryer Financed

Determining the total cost involves more than just the price of the appliance. It requires a comprehensive calculation that considers interest, fees, and the loan’s duration.

To calculate the total cost, you need to understand the formula for calculating the total amount paid, which considers the principal (the price of the washer and dryer), the interest rate, the loan term (in months), and any fees.

Total Cost = Principal + (Principal * Interest Rate * Loan Term) + Fees

Example: If you finance a $800 washer and dryer at a 15% APR over 24 months with a $50 origination fee, the calculation would be as follows:

- Calculate the interest paid: ($800 * 0.15 * 2) = $240

- Add the origination fee: $240 + $50 = $290

- Add the principal: $800 + $290 = $1090

- Therefore, the total cost of the washer and dryer would be $1090.

Comparing Different Financing Offers

Comparing financing offers requires a systematic approach. It involves evaluating multiple factors to identify the most advantageous terms.

Create a comparison table to assess different offers side-by-side. This allows for a clear visualization of the key features of each offer.

| Feature | Offer 1 | Offer 2 | Offer 3 |

|---|---|---|---|

| Appliance Price | $X | $X | $X |

| Interest Rate (APR) | X% | X% | X% |

| Loan Term | X months | X months | X months |

| Monthly Payment | $X | $X | $X |

| Fees | $X | $X | $X |

| Total Cost | $X | $X | $X |

By using this table, you can clearly see which offer has the lowest total cost, the most manageable monthly payments, and the fewest fees.

Spotting and Avoiding Predatory Lending Practices

Predatory lending preys on vulnerable borrowers. Recognizing these practices is crucial to protect yourself.

- High Interest Rates and Fees: Predatory lenders often charge exorbitant interest rates and fees.

Be wary of offers with APRs significantly higher than the average for similar financing options. Excessive fees, such as hidden origination fees or high late payment fees, are red flags.

- Unfavorable Loan Terms: Short loan terms with high payments can lead to default.

Avoid loans with extremely short repayment periods that require large monthly payments you can’t afford. Consider the loan term in relation to your income and expenses to ensure affordability.

- Lack of Transparency: Vague or unclear terms and conditions are a sign of predatory lending.

Always request and carefully review the loan agreement. If the terms are difficult to understand or if the lender is evasive about providing information, consider it a warning sign.

- Pressure Tactics: Aggressive sales tactics or pressure to sign immediately are often used by predatory lenders.

Never feel rushed into a decision. Take the time to review the offer, compare it with others, and seek advice if needed. A legitimate lender will allow you time to make an informed decision.

Finding washer dryer financing with bad credit can feel daunting, but options exist. Similar to navigating the complexities of personal finances, understanding how to finance british airways requires careful planning. Ultimately, whether you’re booking flights or buying appliances, responsible financial management is key to securing the best terms for your washer dryer financing, even with a less-than-perfect credit history.

Alternatives to Financing

Acquiring a washer and dryer doesn’t always necessitate financing. Exploring alternative acquisition methods can provide significant cost savings and avoid the complexities of credit checks and interest rates. These options are especially valuable for individuals with bad credit.

Buying Used Appliances

Purchasing used washer and dryer units presents a viable alternative to financing. The used appliance market offers a range of options, from individual sellers to appliance stores specializing in pre-owned equipment.

The benefits of buying used appliances include:

- Lower Purchase Price: Used appliances are significantly cheaper than new ones, often costing a fraction of the original price.

- Avoidance of Financing Costs: Buying used eliminates the need for loans and associated interest payments.

- Wide Availability: Used appliances are readily available through various channels, including online marketplaces, local classifieds, and specialized appliance stores.

Consider these factors when purchasing a used washer and dryer:

- Inspection: Thoroughly inspect the appliance before purchasing. Check for signs of wear and tear, rust, and proper functionality. Run a test cycle if possible.

- Warranty: Inquire about any remaining warranty or the possibility of an extended warranty. Some sellers offer limited warranties on used appliances.

- Transportation: Factor in the cost and logistics of transporting the appliance. You may need to rent a truck or hire movers.

Comparing the costs and benefits:

| Feature | New Washer and Dryer | Used Washer and Dryer |

|---|---|---|

| Cost | Higher (includes initial purchase price, potential financing costs, and taxes) | Lower (typically a fraction of the cost of a new unit) |

| Warranty | Full manufacturer’s warranty | Limited or no warranty (though some sellers may offer warranties) |

| Lifespan | Potentially longer, depending on the model and usage | Potentially shorter, depending on the appliance’s age and condition |

| Reliability | Generally higher | Can vary depending on the appliance’s history and maintenance |

Seeking Assistance from Family and Friends

Asking for assistance from family and friends can be a beneficial option for acquiring a washer and dryer. This approach can alleviate financial strain and eliminate the need for credit checks or interest payments.

The advantages of seeking assistance include:

- No Financial Costs: Family and friends may be willing to gift the appliance or offer a loan without interest.

- Flexibility: You can often negotiate payment terms or repayment schedules that suit your budget.

- Personal Support: This option can provide emotional support during a difficult financial situation.

Before seeking assistance, consider these points:

- Clear Communication: Clearly communicate your needs and expectations to family and friends.

- Repayment Plan: If a loan is involved, establish a clear repayment plan, including the amount, payment schedule, and interest rate (if any).

- Respect Boundaries: Be mindful of your family and friends’ financial situations and avoid putting undue pressure on them.

Appliance Repair Services

Utilizing appliance repair services to extend the life of an existing washer and dryer is a cost-effective alternative to replacing them. Repairing a malfunctioning appliance can often be cheaper than purchasing a new one, especially if the issue is minor.

The benefits of appliance repair include:

- Cost Savings: Repairs are usually less expensive than buying a new appliance.

- Extended Lifespan: Repairing a malfunctioning appliance can significantly extend its lifespan.

- Environmental Benefits: Repairing appliances reduces waste and promotes sustainability.

When considering appliance repair, keep these factors in mind:

- Diagnose the Problem: Identify the root cause of the malfunction before seeking repair services.

- Obtain Estimates: Get quotes from multiple repair technicians to compare prices and services.

- Consider the Cost-Effectiveness: Evaluate whether the repair cost is justified, especially if the appliance is old or frequently malfunctions.

Community Resources and Programs

Community resources and programs often offer assistance with acquiring appliances, providing a safety net for individuals and families facing financial hardship. These programs may include financial assistance, appliance donation programs, or subsidized appliance sales.

Here are some examples of community resources and programs:

- Local Charities: Organizations like the Salvation Army, Goodwill, and St. Vincent de Paul may offer assistance with acquiring appliances.

- Government Assistance Programs: Some government programs, such as those administered by local social services agencies, may provide financial aid or vouchers for essential household items, including appliances.

- Community Action Agencies: These agencies often provide a range of services, including assistance with utility bills and essential household needs.

- Appliance Donation Programs: Some organizations accept donated appliances and distribute them to individuals and families in need.

To find available resources:

- Research Local Organizations: Search online for charities, non-profits, and government agencies in your area that provide assistance with household needs.

- Contact Social Services: Contact your local social services agency to inquire about available programs and eligibility requirements.

- Check Online Databases: Utilize online databases and directories that list community resources and programs.

Avoiding Scams and Fraud

Navigating the world of washer and dryer financing, especially with bad credit, requires vigilance. Scammers and fraudulent practices are unfortunately prevalent, preying on individuals seeking financial assistance. Understanding these threats and implementing preventative measures is crucial to protecting your finances and personal information. This section aims to equip you with the knowledge to identify and avoid common pitfalls.

Common Washer Dryer Financing Scams

Several scams target individuals looking for financing. These schemes often involve promises that are too good to be true or pressure tactics designed to rush you into a decision. Recognizing these red flags can help you avoid becoming a victim.

- Guaranteed Approval Scams: Scammers often advertise “guaranteed approval” regardless of credit score. Legitimate lenders assess creditworthiness, and such promises are a major red flag.

- Upfront Fee Scams: Beware of lenders requiring upfront fees before approving a loan. Legitimate lenders typically deduct fees from the loan proceeds, not collect them beforehand.

- Phishing Scams: Phishing attempts involve fraudulent emails or websites that mimic legitimate lenders. These aim to steal personal and financial information.

- Identity Theft: Scammers may steal your identity to apply for financing or open credit accounts in your name. This can lead to significant financial damage and credit score issues.

- Rent-to-Own Scams: Some rent-to-own companies may employ deceptive practices, such as inflating the price of the appliance or hiding fees in the fine print.

Fraudulent Practices to Watch Out For

Beyond general scams, specific fraudulent practices target those seeking washer and dryer financing. Being aware of these tactics can help you make informed decisions and protect yourself.

- Unlicensed Lenders: Unlicensed lenders operate outside the law and may not adhere to consumer protection regulations. Always verify a lender’s license with your state’s regulatory agency.

- Predatory Lending Practices: Predatory lenders charge exorbitant interest rates, fees, and terms, often targeting vulnerable borrowers. Be cautious of loans with extremely high APRs.

- Hidden Fees: Scammers may conceal fees within the financing agreement. Always read the fine print carefully and ask for clarification on any unclear terms.

- Misleading Advertising: Fraudulent lenders may use misleading advertising to lure in borrowers, such as false claims about low payments or easy approval.

- Pressure Tactics: Scammers often use pressure tactics, such as deadlines or threats, to force you into making a quick decision.

Verifying the Legitimacy of a Lender

Verifying a lender’s legitimacy is essential before providing any personal or financial information. Take the following steps to ensure you are dealing with a reputable company.

- Check for Licensing and Registration: Verify that the lender is licensed and registered with your state’s regulatory agency. You can typically find this information on the lender’s website or by contacting the agency directly.

- Research Online Reviews and Ratings: Search online for reviews and ratings from other borrowers. Check sites like the Better Business Bureau (BBB) for complaints and ratings.

- Review the Lender’s Website: A legitimate lender will have a professional website with clear contact information, terms and conditions, and privacy policies.

- Look for Contact Information: Verify the lender’s contact information, including a physical address and phone number. Be wary of lenders who only provide a PO box or mobile phone number.

- Avoid Unsolicited Offers: Be cautious of unsolicited offers, especially those that seem too good to be true.

Protecting Personal Information

Protecting your personal information is crucial when applying for financing, whether online or in person. Implementing these safeguards can reduce the risk of identity theft and financial fraud.

- Use Secure Websites: When applying online, ensure the website uses HTTPS encryption. Look for the padlock icon in the address bar.

- Create Strong Passwords: Use strong, unique passwords for all online accounts.

- Be Wary of Phishing Emails: Do not click on links or open attachments in suspicious emails. Verify the sender’s email address and the legitimacy of the request.

- Protect Your Social Security Number (SSN): Do not share your SSN unless absolutely necessary. Be cautious of requests for your SSN from unknown sources.

- Review Your Credit Report Regularly: Regularly check your credit report for any unauthorized activity or accounts. You can obtain a free credit report from each of the three major credit bureaus annually.

- Shred Sensitive Documents: Shred any documents containing personal or financial information before discarding them.

Impact of Financing on Credit Report: Washer Dryer Financing Bad Credit

Understanding how washer dryer financing affects your credit report is crucial for responsible financial management. This section will delve into the mechanics of credit reporting, explaining how on-time and late payments impact your score, the duration of negative marks, and steps to rectify errors. We’ll also explore how responsible use of financing can lead to credit score improvement.

On-Time Payments and Missed Payments

Your payment history is a significant factor in your credit score. Lenders report your payment behavior to credit bureaus, and this information directly influences your creditworthiness.

On-time payments are reported positively and demonstrate responsible credit management. Consistent on-time payments contribute to a higher credit score over time. This builds a positive payment history, which is a key component of a healthy credit profile.

Missed payments, conversely, negatively affect your credit score. They signal to lenders that you may be a higher-risk borrower. The severity of the impact depends on how late the payment is and the number of missed payments.

Timeline of Negative Information on a Credit Report, Washer dryer financing bad credit

Negative information remains on your credit report for a specific duration, influencing your credit score for a period. Understanding these timelines is important for managing your credit effectively.

- Late Payments: Late payments typically remain on your credit report for seven years from the date of the original delinquency.

- Charge-offs: A charge-off occurs when a lender deems a debt uncollectible. Charge-offs also remain on your credit report for seven years from the date of the original delinquency.

- Bankruptcy: Bankruptcy filings can stay on your credit report for seven to ten years, depending on the type of bankruptcy. Chapter 7 bankruptcies generally remain for ten years, while Chapter 13 bankruptcies remain for seven years.

Disputing Errors on a Credit Report

Credit reports are not always error-free. Mistakes can occur, and it’s essential to review your credit reports regularly and dispute any inaccuracies.

The process of disputing errors typically involves the following steps:

- Obtain your credit reports: You are entitled to a free credit report from each of the three major credit bureaus (Equifax, Experian, and TransUnion) annually at AnnualCreditReport.com.

- Identify errors: Carefully review your reports and identify any inaccuracies, such as incorrect account information, accounts that don’t belong to you, or incorrect payment statuses.

- Gather supporting documentation: Collect any documentation that supports your claim, such as account statements, payment records, or evidence of identity theft.

- Submit a dispute: Contact the credit bureau and the creditor reporting the inaccurate information. You can typically dispute errors online, by mail, or by phone. Provide detailed information about the error and include copies of your supporting documentation.

- Investigation and resolution: The credit bureau is required to investigate the dispute within a reasonable timeframe, typically 30-45 days. They will contact the creditor to verify the information. If the error is confirmed, the credit bureau will update your credit report.

Scenario: Improving Credit Score Through Responsible Financing

Let’s illustrate how responsible use of washer dryer financing can positively impact your credit score.

Scenario:

Sarah has a credit score of 580 (considered fair). She finances a washer and dryer for $1,000 with a 24-month payment plan.

Timeline:

* Month 1-6: Sarah makes all her payments on time. This builds a positive payment history, demonstrating to lenders her ability to manage credit responsibly.

* Month 7-12: Sarah continues to make all her payments on time. This consistent positive payment history further strengthens her credit profile.

* Month 13-18: Sarah continues her on-time payments. Due to her responsible credit use, her credit score slowly starts to increase.

* Month 19-24: Sarah successfully completes the financing agreement, making all payments on time. Her credit score has likely increased due to a positive payment history and responsible credit management.

Outcome:

Over the 24-month period, Sarah’s credit score is expected to increase. While the exact increase will vary depending on other factors in her credit history, the on-time payments on the washer and dryer financing will significantly contribute to improving her score. This improved credit score may make it easier for Sarah to obtain credit in the future, such as for a car loan or a mortgage, and potentially secure better interest rates.

This scenario highlights the importance of responsible credit use.