Introduction: Understanding Personal Finance and QuickBooks

Personal finance involves managing your money effectively to achieve your financial goals. This encompasses budgeting, saving, investing, and debt management. Understanding these components is crucial for long-term financial well-being.

QuickBooks is a popular accounting software designed primarily for businesses. It provides tools for tracking income and expenses, managing invoices, generating financial reports, and handling payroll. While powerful, its application to personal finance requires understanding its core functionalities and adapting them to individual needs.

Defining Personal Finance and Its Key Components

Personal finance encompasses the management of an individual’s or household’s financial resources. It’s a holistic approach, focusing on various aspects to ensure financial stability and achieve financial aspirations.

Key components of personal finance include:

- Budgeting: Creating a plan to track income and expenses. This involves allocating funds for different categories like housing, food, transportation, and entertainment. The goal is to control spending and ensure that expenses do not exceed income. For example, a person might allocate 30% of their income to housing, 15% to food, and 10% to savings.

- Saving: Setting aside a portion of income for future use. This can be for short-term goals, such as a vacation, or long-term goals, such as retirement. Various savings vehicles are available, including savings accounts, certificates of deposit (CDs), and high-yield savings accounts.

- Investing: Using savings to generate income or grow wealth over time. Investments can include stocks, bonds, mutual funds, and real estate. Investing involves risk, but it also offers the potential for higher returns than traditional savings accounts. A common strategy is diversification, spreading investments across different asset classes to reduce risk.

- Debt Management: Handling existing debts and avoiding excessive borrowing. This involves paying off high-interest debts, such as credit card debt, and managing loan payments. Strategies include debt consolidation, balance transfers, and creating a debt repayment plan.

- Insurance: Protecting against financial losses due to unexpected events. Insurance covers risks such as health problems, property damage, and death. Different types of insurance include health insurance, life insurance, auto insurance, and homeowners insurance.

Core Functionalities of QuickBooks: An Accounting Perspective

QuickBooks offers a comprehensive suite of accounting features designed to help businesses manage their finances. These features can be adapted for personal use, but understanding their primary purpose is crucial.

The core functionalities of QuickBooks include:

- Income and Expense Tracking: Recording all financial transactions, including income (sales, services rendered) and expenses (costs of goods sold, operating expenses). This involves categorizing transactions to understand where money is coming from and where it’s going. For example, a business might categorize expenses as rent, utilities, salaries, and marketing costs.

- Invoice Management: Creating and sending invoices to customers, tracking payments received, and managing accounts receivable. This is essential for businesses that sell goods or services on credit. QuickBooks automates much of the invoicing process, making it easier to get paid on time.

- Bank Reconciliation: Comparing bank statements with QuickBooks records to ensure accuracy. This helps identify discrepancies and errors in financial data. Regular reconciliation is crucial for maintaining accurate financial records.

- Financial Reporting: Generating financial statements, such as the profit and loss statement (income statement), balance sheet, and cash flow statement. These reports provide insights into a business’s financial performance and position. For example, the profit and loss statement shows a company’s revenue, expenses, and net profit or loss over a specific period.

- Payroll Management: Calculating and processing employee wages, withholding taxes, and generating payroll reports. QuickBooks offers payroll features to streamline this process. For example, a small business might use QuickBooks to calculate employees’ gross pay, deduct taxes, and issue paychecks.

Key Differences: Personal Finance vs. Business Accounting

While both personal finance and business accounting deal with money management, they differ significantly in their scope, objectives, and complexities. Recognizing these differences is crucial when considering using QuickBooks for personal finance.

The primary differences are:

- Objective: Personal finance aims to manage individual or household finances to achieve personal financial goals. Business accounting aims to track and report financial performance and position for business decision-making and compliance with regulations.

- Scope: Personal finance typically involves simpler transactions and fewer accounts. Business accounting involves more complex transactions, multiple revenue streams, and various expense categories.

- Complexity: Personal finance usually requires less technical knowledge and fewer regulatory requirements. Business accounting requires a deeper understanding of accounting principles and compliance with tax laws and accounting standards.

- Reporting Needs: Personal finance focuses on tracking income, expenses, and net worth. Business accounting requires generating detailed financial statements, such as income statements, balance sheets, and cash flow statements, for stakeholders.

- Software Adaptation: Adapting business accounting software, such as QuickBooks, for personal finance requires tailoring the software to fit individual needs. Business software is often designed for a broader scope of financial operations than the typical personal financial situation.

Suitability of QuickBooks for Personal Use

While QuickBooks is primarily designed for business accounting, its capabilities extend to personal finance management, although with certain caveats. Understanding these pros and cons is crucial to determining whether QuickBooks is the right tool for managing your personal finances. It’s important to consider your individual needs and the complexity of your financial situation before making a decision.

Pros and Cons of Using QuickBooks for Personal Financial Management

Using QuickBooks for personal finance offers several advantages, but also presents some drawbacks compared to dedicated personal finance software. Consider these points before committing to QuickBooks for your personal financial needs.

- Pros:

- Robust Features: QuickBooks offers comprehensive features, including budgeting, expense tracking, bank reconciliation, and reporting. This allows for detailed financial analysis and control.

- Familiarity for Business Owners: If you already use QuickBooks for your business, using it for personal finance provides a consistent interface and reduces the learning curve. You’re already familiar with the software.

- Scalability: QuickBooks can handle complex financial situations. It’s suitable if you have multiple income streams, investments, or a need for detailed tracking of assets and liabilities.

- Customization: QuickBooks allows for significant customization. You can tailor the chart of accounts, reports, and other features to match your specific financial needs and preferences.

- Cons:

- Complexity: QuickBooks can be overwhelming for users unfamiliar with accounting principles. The software’s features, designed for businesses, might be unnecessary and confusing for basic personal finance needs.

- Cost: QuickBooks subscriptions can be expensive, especially compared to free or low-cost personal finance software. This cost might not be justified if your financial needs are relatively simple.

- Learning Curve: Mastering QuickBooks requires time and effort. Even with online tutorials, it takes time to understand all the features and how to apply them to personal finance.

- Limited Personal Finance Focus: QuickBooks isn’t specifically designed for personal finance. Features like debt management, financial goal planning, and investment tracking are less intuitive than in dedicated personal finance software.

Types of Personal Financial Activities QuickBooks Can Effectively Manage

QuickBooks can effectively manage various personal financial activities, especially those that require detailed tracking and reporting. The software’s accounting principles allow for a high level of detail and organization.

- Budgeting: QuickBooks enables users to create and track budgets. You can categorize income and expenses, set budget targets, and monitor spending against those targets. This feature is useful for controlling cash flow and identifying areas for potential savings.

- Expense Tracking: The software facilitates detailed expense tracking. You can categorize expenses, track them by date, and generate reports to analyze spending patterns. This is crucial for understanding where your money goes.

- Bank Reconciliation: QuickBooks allows you to reconcile your bank accounts. This process ensures that your records match your bank statements, helping you identify any discrepancies or errors.

- Reporting: QuickBooks generates various reports, including income statements, balance sheets, and cash flow statements. These reports provide a comprehensive overview of your financial situation.

- Tracking Investments: While not as intuitive as dedicated investment tracking software, QuickBooks can track investments, including stocks, bonds, and real estate. You can record transactions, track gains and losses, and monitor the value of your investments.

- Managing Assets and Liabilities: QuickBooks allows you to track your assets (e.g., property, vehicles) and liabilities (e.g., loans, credit card debt). This provides a complete picture of your net worth.

Comparison of QuickBooks to Dedicated Personal Finance Software

Comparing QuickBooks to dedicated personal finance software reveals key differentiators in terms of features, user experience, and cost. These differences significantly impact the suitability of each option for managing personal finances.

- User Interface and Ease of Use: Dedicated personal finance software typically offers a more user-friendly interface designed specifically for personal finance needs. QuickBooks, while powerful, can have a steeper learning curve.

- Features: Dedicated software often includes features such as debt management tools, financial goal planning, and investment tracking. QuickBooks has these features but they might not be as intuitive or comprehensive.

- Cost: Many personal finance software options offer free or low-cost versions. QuickBooks has a subscription-based pricing model that can be more expensive.

- Automation: Dedicated software often automates tasks like transaction importing and categorization. QuickBooks offers similar automation but may require more setup.

- Reporting and Analysis: Both types of software provide reporting capabilities, but dedicated personal finance software may offer more tailored reports and visualizations for personal financial analysis. QuickBooks offers more in-depth reports that are more relevant for businesses.

- Integration: Dedicated personal finance software integrates seamlessly with banks and financial institutions. QuickBooks also integrates, but the process might not be as smooth.

Setting Up QuickBooks for Personal Finance

Setting up QuickBooks for personal finance requires a systematic approach to ensure accurate tracking of income and expenses. This section will guide you through the necessary steps, from account creation to bank integration, to effectively manage your personal finances.

Designing a Step-by-Step Guide to Setting Up a QuickBooks Account for Personal Use

Setting up a QuickBooks account for personal use involves several straightforward steps. These steps ensure a solid foundation for effective financial management.

- Choose Your QuickBooks Version: QuickBooks offers different versions. For personal use, QuickBooks Self-Employed or QuickBooks Online Simple Start are typically suitable. Compare features and pricing to determine the best fit for your needs. Consider the features like the ability to track mileage, which is useful for self-employed individuals.

- Create an Account: Visit the QuickBooks website and create an account. Provide your personal information, including your name, email address, and payment details.

- Select Your Subscription: Choose the subscription plan that aligns with your financial needs. Consider the number of transactions you anticipate, the features you require (e.g., invoicing, reporting), and your budget.

- Set Up Your Company File: After subscribing, you’ll be prompted to set up your company file. Although it’s for personal use, QuickBooks requires this step. Enter details such as your name and business type (you can choose “Individual” or “Sole Proprietor”).

- Customize Your Chart of Accounts: The chart of accounts is the backbone of your financial organization. You can customize the default chart of accounts to match your personal income and expense categories.

- Enter Opening Balances: If you’re starting mid-year, enter the balances of your assets (e.g., checking accounts, savings accounts) and liabilities (e.g., credit card balances) as of the start date. This ensures an accurate financial picture from the beginning.

- Connect Your Bank Accounts and Credit Cards: Linking your bank accounts and credit cards allows QuickBooks to automatically import transactions, saving you time and reducing the risk of manual data entry errors.

- Explore the Interface and Features: Familiarize yourself with the QuickBooks interface, including the dashboard, transaction entry, and reporting features. This will help you navigate the software effectively.

- Set Up Budgets (Optional): Create budgets to track your spending and identify areas where you can save money.

- Run Reports: Regularly review reports, such as the Profit and Loss statement and the Balance Sheet, to monitor your financial performance.

Creating a Detailed Explanation of How to Categorize Personal Income and Expenses Within QuickBooks

Categorizing income and expenses is crucial for understanding where your money comes from and where it goes. Accurate categorization enables effective budgeting, financial planning, and informed decision-making.

Can i use quickbooks for personal finance – Here’s a detailed guide on how to categorize your personal income and expenses:

- Understand the Chart of Accounts: The chart of accounts is a list of all your financial accounts. QuickBooks provides a default chart of accounts, but you’ll likely need to customize it to fit your personal finances.

- Income Categories: Common income categories include:

- Salary/Wages: Income from your primary job.

- Interest Income: Income earned from savings accounts or investments.

- Investment Income: Income from dividends, capital gains, or other investment activities.

- Freelance Income: Income from freelance work or side hustles.

- Rental Income: Income from renting out property.

- Other Income: Any other sources of income.

- Expense Categories: Categorize expenses into meaningful groups:

- Housing: Rent/Mortgage, property taxes, homeowner’s insurance.

- Utilities: Electricity, gas, water, internet, phone.

- Transportation: Car payments, insurance, gas, public transportation.

- Food: Groceries, dining out.

- Healthcare: Health insurance premiums, medical expenses.

- Personal Care: Haircuts, toiletries, cosmetics.

- Entertainment: Movies, concerts, subscriptions.

- Travel: Flights, hotels, car rentals.

- Debt Payments: Credit card payments, student loans.

- Savings and Investments: Contributions to savings accounts, retirement accounts, and investment portfolios.

- Education: Tuition, books, supplies.

- Gifts and Donations: Charitable contributions, gifts.

- Other Expenses: Any other expenses that don’t fit into the above categories.

- Categorizing Transactions: When entering transactions, select the appropriate category from the chart of accounts. For example, if you buy groceries, categorize the transaction under “Food.”

- Using Subcategories: You can create subcategories within main categories for more detailed tracking. For example, under “Transportation,” you could create subcategories like “Gas,” “Car Insurance,” and “Car Maintenance.”

- Reviewing and Adjusting Categories: Regularly review your categorized transactions to ensure accuracy. Make adjustments as needed. This will also help you to identify spending patterns.

- Using Rules: QuickBooks allows you to set up rules to automatically categorize recurring transactions. This can save you time and effort. For example, you can set a rule to automatically categorize your rent payment every month.

- Example: Suppose you paid $100 for a car repair. You would categorize this transaction under “Transportation” -> “Car Maintenance.”

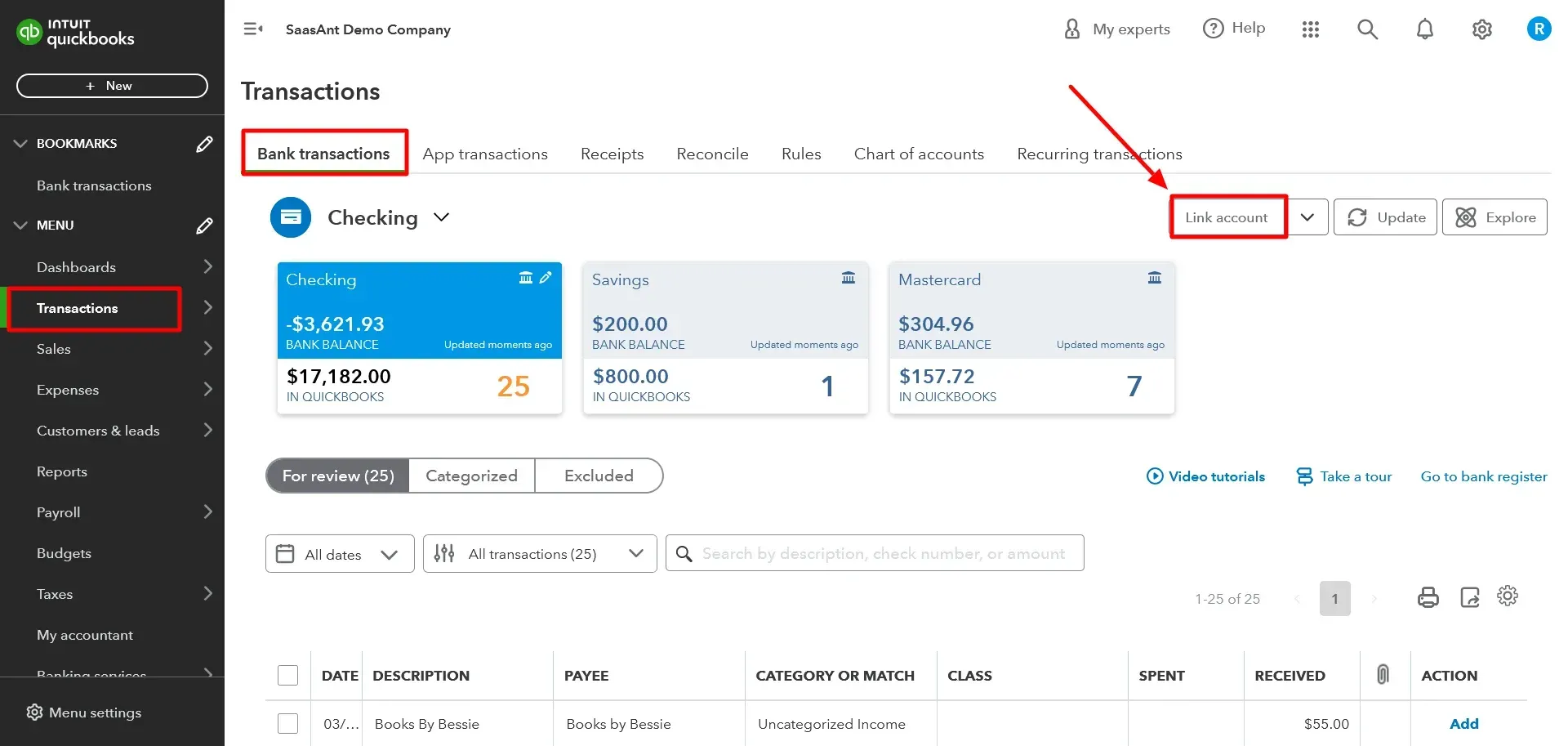

Organizing a Procedure for Linking Bank Accounts and Credit Cards to QuickBooks

Linking bank accounts and credit cards to QuickBooks automates transaction imports, reducing manual data entry and improving accuracy. This integration is a crucial step in streamlining personal finance management.

Here’s a procedure for linking your bank accounts and credit cards:

- Navigate to the Banking Section: In QuickBooks Online, click on “Banking” in the left-hand navigation menu.

- Add Account: Click on “Add Account.”

- Search for Your Bank: In the search bar, type the name of your bank or credit card provider. QuickBooks supports thousands of financial institutions.

- Enter Your Login Credentials: You will be prompted to enter your online banking username and password. QuickBooks uses this information to securely connect to your bank.

- Select Accounts to Connect: Choose the bank accounts and credit cards you want to link to QuickBooks. You can select multiple accounts.

- Import Transactions: Once connected, QuickBooks will automatically download your recent transactions.

- Categorize Transactions: Review the imported transactions and categorize them into the appropriate accounts.

- Set Up Rules (Optional): Create rules to automatically categorize recurring transactions.

- Review and Approve Transactions: Before finalizing the transactions, review them to ensure they are accurately categorized.

- Automatic Updates: QuickBooks will automatically update your transactions periodically, typically once a day.

- Security Measures: QuickBooks employs robust security measures to protect your financial data, including encryption and multi-factor authentication.

- Troubleshooting: If you encounter any issues, such as connection errors, contact QuickBooks support or your bank’s customer service for assistance.

Features and Functionality for Personal Finance: Can I Use Quickbooks For Personal Finance

QuickBooks offers robust features that extend beyond business accounting, making it a viable option for managing personal finances. Its reporting capabilities, budgeting tools, and asset tracking features can help individuals gain better control over their financial lives. Understanding and utilizing these features effectively can lead to improved financial decision-making and a clearer picture of one’s financial health.

Generating Reports for Tracking Personal Spending Habits

Generating reports is crucial for understanding where your money is going. QuickBooks allows you to customize reports to track various spending categories and identify areas where you might be overspending. This provides valuable insights into your financial behavior.

To generate reports in QuickBooks to track personal spending habits:

- Navigate to the “Reports” menu.

- Select “Report Center.”

- Choose a relevant report template, such as “Profit & Loss” or “Transaction List by Date.”

- Customize the report by setting the date range to cover the period you want to analyze (e.g., monthly, quarterly, or annually).

- Filter the report to include specific accounts or categories related to your spending. For example, you might filter for “Groceries,” “Entertainment,” or “Utilities.”

- Review the report to identify spending patterns and trends. QuickBooks visually represents the data in charts and graphs, making it easy to interpret. For example, a pie chart might show the percentage of your spending allocated to different categories.

- Save or export the report for future reference or sharing.

For example, a user might generate a “Profit & Loss” report for a specific month, filtering it to show only expenses. This report would then clearly display the total spent on each expense category, revealing whether they are within budget.

Budgeting Personal Finances with QuickBooks

Budgeting is a cornerstone of financial management, and QuickBooks provides tools to create and monitor budgets effectively. By setting up a budget, you can proactively manage your spending, track your progress, and identify areas where you can save money.

To use QuickBooks to budget personal finances:

- Go to the “Banking” menu and select “Budget.”

- Click “Create New Budget.”

- Select the “Fiscal Year” for your budget.

- Choose whether to create a budget from scratch or copy from a previous budget.

- Enter your budgeted amounts for each income and expense category for each month. You can use the amounts from your previous reports as a starting point.

- Set budget alerts to receive notifications when you exceed your budget in a specific category.

- Regularly review your budget and compare it to your actual spending to see if you’re on track. QuickBooks automatically tracks your actual spending against your budget, providing a clear picture of your financial performance.

For instance, a user could set a monthly budget of $500 for groceries. As they enter their transactions, QuickBooks will automatically compare the actual grocery expenses to the $500 budget. If the user spends $550, QuickBooks will highlight the overspending, helping them identify areas to adjust their spending habits.

Tracking Investments and Assets Using QuickBooks

QuickBooks can be used to track investments and other assets, offering a centralized view of your financial holdings. While not as comprehensive as specialized investment tracking software, it provides a basic level of asset management.

To detail the process of tracking investments and assets using QuickBooks:

- Create new accounts in QuickBooks to represent your investments and assets. This could include brokerage accounts, savings accounts, real estate, or other valuable possessions. Go to “Chart of Accounts” to create new accounts.

- Categorize your investment transactions. For example, when you purchase stock, categorize the transaction under “Investments” and use the appropriate account for the brokerage.

- Track the value of your assets. While QuickBooks doesn’t automatically update asset values, you can manually enter the current market value of your investments periodically (e.g., monthly or quarterly).

- Record any income generated from your investments, such as dividends or interest, as income.

- Generate reports to monitor the performance of your investments and the overall value of your assets. You can create a “Balance Sheet” report to view the current value of all your assets.

For example, if an individual owns a stock portfolio, they would create a “Brokerage Account” in QuickBooks. When they purchase shares, they would record the transaction, debiting the brokerage account and crediting the cash account. Periodically, they would update the value of the brokerage account to reflect the current market value of the stocks. This allows them to track the overall growth or decline of their investments.

Advanced Uses and Customization

QuickBooks, while designed for business accounting, offers significant flexibility for personal finance management through advanced features and customization options. These tools allow users to tailor the software to their specific financial goals and integrate it with other platforms for a comprehensive view of their finances.

Creating Custom Reports for Specific Financial Goals

QuickBooks’ reporting capabilities extend beyond basic financial summaries. Users can create custom reports tailored to specific financial goals, such as tracking progress towards retirement, monitoring investment performance, or analyzing spending patterns.

To create a custom report, users typically navigate to the “Reports” section within QuickBooks. From there, they can:

- Select a Report Type: Choose a base report type that aligns with the goal (e.g., Profit & Loss, Balance Sheet, Transaction Detail).

- Customize Columns and Rows: Modify the report’s structure by adding or removing columns and rows to display relevant data. For example, to track retirement savings, columns could include contributions, investment returns, and total balance.

- Apply Filters: Use filters to narrow the report’s scope. Filters can be based on date ranges, account types, or specific transactions. For instance, to analyze investment performance over a specific period, filter transactions by date and investment account.

- Add Calculations: Implement calculations to derive meaningful insights. Users can add calculated fields to show the growth of an investment portfolio, calculate savings rates, or determine the percentage of income allocated to different expense categories.

- Save and Schedule Reports: Save the customized report for future use and schedule it to run automatically at regular intervals. This ensures consistent monitoring of financial progress.

For example, consider a user aiming to track progress toward a down payment on a house. They could create a custom report that:

- Includes all transactions related to savings for the down payment, such as transfers to a high-yield savings account.

- Calculates the total savings accumulated over time.

- Displays the progress toward the down payment goal, comparing the current savings to the target amount.

By leveraging these customization features, users can gain a granular understanding of their financial standing and make data-driven decisions to achieve their goals.

Customizing QuickBooks to Match Personal Financial Needs

QuickBooks offers various customization options that allow users to tailor the software to their unique financial circumstances and preferences. This adaptability is a key advantage, allowing users to create a system that aligns perfectly with their needs.

Key customization areas include:

- Chart of Accounts: Users can modify the chart of accounts, which categorizes all financial transactions. This allows for the creation of specific accounts to track unique expenses, such as subscriptions, hobbies, or charitable donations.

- Transaction Templates: Create custom transaction templates for recurring expenses or income sources. This simplifies data entry and ensures consistency in tracking.

- Classes and Locations: Use classes and locations to categorize transactions based on different criteria. Classes can represent different expense categories or projects, while locations can be used to track financial activities across different properties or departments.

- Custom Fields: Add custom fields to transactions to capture additional information relevant to personal financial tracking. For instance, a user might add a custom field to track the purpose of each expense or the source of each income.

- Preferences: Adjust various preferences to customize the software’s behavior. These preferences include date formats, decimal precision, and display settings.

For instance, a user who is a freelancer might customize their chart of accounts to include separate income accounts for each client and expense accounts for specific project-related costs. This level of detail allows for a more accurate analysis of profitability for each project.

Another example involves a user with multiple rental properties. They can use classes to track income and expenses for each property, enabling them to easily compare the financial performance of each investment.

By taking advantage of these customization options, users can create a personalized financial management system that effectively reflects their individual needs and goals.

Integrating QuickBooks with Other Financial Tools or Platforms

Integrating QuickBooks with other financial tools and platforms enhances its functionality and provides a more comprehensive view of personal finances. This integration streamlines data flow and allows users to leverage the strengths of different applications.

Methods for integrating QuickBooks include:

- Bank Feed Integration: QuickBooks can connect directly to bank accounts and credit cards, automatically importing transactions. This eliminates the need for manual data entry and reduces the risk of errors.

- Third-Party Apps: QuickBooks integrates with a variety of third-party applications through its App Center. These apps can provide additional features such as budgeting tools, investment tracking, and expense management.

- Import/Export Features: Users can import and export data in various formats (e.g., CSV, Excel) to share information with other applications. This allows for the integration of data from external sources.

- API Integration: For more advanced users, QuickBooks provides an API (Application Programming Interface) that allows for custom integrations with other platforms. This enables developers to build custom solutions that connect QuickBooks with other financial tools.

For example, a user could integrate QuickBooks with a budgeting app to automatically track spending against a budget. The budgeting app would import transaction data from QuickBooks, allowing the user to monitor their spending in real-time and receive alerts if they exceed their budget.

Another example involves integrating QuickBooks with an investment tracking platform. The investment platform could import transaction data from QuickBooks, such as contributions to investment accounts and dividends received, providing a consolidated view of the user’s investments.

These integration capabilities enable users to create a seamless and efficient personal finance management system that combines the power of QuickBooks with other valuable financial tools.

Data Entry and Management

Effective data entry and management are crucial for accurately tracking your personal finances within QuickBooks. This section details the processes for entering transactions, reconciling bank statements, and safeguarding your financial data. Proper data management ensures the integrity and reliability of your financial reports, providing a clear picture of your financial health.

Manual Transaction Entry in QuickBooks

Manually entering transactions is the foundation of using QuickBooks for personal finance. This process allows you to record every income and expense, ensuring a complete and accurate financial record.

To manually enter a transaction, follow these steps:

- Navigate to the Transaction Entry Section: In QuickBooks, this is often accessed through the “Banking” or “Transactions” menu, depending on your QuickBooks version. Look for options like “Enter Transactions,” “Write Checks,” or “Enter Credit Card Charges.”

- Select the Appropriate Account: Choose the bank account or credit card account where the transaction occurred.

- Enter the Transaction Details: This involves filling in the following fields:

- Date: The date the transaction took place.

- Payee/Payer: The person or business involved in the transaction (e.g., “Grocery Store,” “Landlord”).

- Payment Method: How the transaction was paid (e.g., check, cash, debit card).

- Amount: The amount of the transaction (positive for income, negative for expenses).

- Memo: A brief description of the transaction (e.g., “Groceries for the week”).

- Category: The expense or income category the transaction belongs to (e.g., “Groceries,” “Rent,” “Salary”). This is crucial for reporting.

- Save the Transaction: Click “Save & New” to enter another transaction, or “Save & Close” to return to the main QuickBooks screen.

For example, if you paid $75 for groceries on May 15th using your debit card, you would: select your checking account, enter May 15th as the date, “Grocery Store” as the payee, “-$75” as the amount, “Weekly Groceries” as the memo, and “Groceries” as the category. This process needs to be repeated for every single transaction to ensure that your data is accurate.

Reconciling Bank Statements in QuickBooks

Reconciling your bank statements in QuickBooks is essential for verifying the accuracy of your financial records. This process compares the transactions you’ve entered in QuickBooks with the transactions listed on your bank statement. It helps identify any discrepancies and ensures that your records accurately reflect your financial activity.

Here’s how to reconcile your bank statement:

- Gather Your Bank Statement: Obtain your most recent bank statement from your bank.

- Start the Reconciliation Process: In QuickBooks, go to the “Banking” menu and select “Reconcile.”

- Select the Account: Choose the bank account you want to reconcile.

- Enter the Statement Ending Date and Ending Balance: Enter the date and the ending balance from your bank statement.

- Mark Cleared Transactions: Compare the transactions in QuickBooks with those on your bank statement. Check off each transaction in QuickBooks that appears on your statement.

- Identify Discrepancies: The difference between the QuickBooks balance and the statement balance should be zero after you’ve marked all cleared transactions. If there’s a difference, review the unchecked transactions and look for errors. Common discrepancies include:

- Unentered Transactions: Transactions that are on your bank statement but haven’t been entered into QuickBooks.

- Incorrect Amounts: Transactions where the amount entered in QuickBooks is different from the amount on the bank statement.

- Duplicate Transactions: Transactions entered more than once.

- Resolve Discrepancies: Correct any errors and enter any missing transactions.

- Complete the Reconciliation: Once the difference is zero, click “Reconcile Now.”

Consider a scenario where your bank statement shows an ending balance of $1,000, and QuickBooks shows a balance of $950. After reviewing the transactions, you realize that you forgot to enter a $50 ATM withdrawal. Entering this transaction and marking it as cleared will reconcile the accounts, bringing the balances into agreement.

Backing Up and Securing Personal Financial Data in QuickBooks

Protecting your financial data is critical. Regular backups and secure storage are essential to prevent data loss due to hardware failure, software corruption, or other unforeseen events.

Here’s how to back up and secure your data:

- Create Regular Backups: QuickBooks allows you to create backups of your data. Schedule these backups to occur frequently (e.g., weekly or monthly), depending on the frequency of your financial activity.

- Back Up to Multiple Locations: Store your backups in multiple locations. This could include:

- Local Storage: Save a copy of your backup on your computer’s hard drive or an external hard drive.

- Cloud Storage: Utilize cloud storage services (e.g., Google Drive, Dropbox, OneDrive) to store a copy of your backup. Cloud storage provides an offsite backup, protecting your data from physical damage to your computer.

- Encrypt Your Data: If your QuickBooks version supports it, enable password protection and encryption for your backup files. This prevents unauthorized access to your financial information.

- Secure Your Backup Media: If you’re using external hard drives or other physical storage, store them in a secure location, such as a locked drawer or safe.

- Test Your Backups: Regularly test your backups to ensure they are working correctly. Restore a backup file to verify that the data can be successfully retrieved.

For example, if your computer’s hard drive fails and you only have a backup stored locally, you could lose all your financial data. However, if you have backups stored on a cloud service and an external hard drive, you can restore your data from either location, minimizing the impact of the hardware failure.

Common Challenges and Solutions

While QuickBooks offers robust features for managing personal finances, users may encounter various hurdles. Understanding these challenges and knowing how to address them is crucial for maximizing the software’s effectiveness. This section Artikels common issues and provides practical solutions to ensure a smoother experience.

Data Import and Synchronization Problems

Data import and synchronization issues can disrupt the smooth tracking of finances. These problems might arise when importing transactions from banks or credit cards or when syncing data across multiple devices.

To address these challenges:

- Verify Bank Connectivity: Ensure your bank or credit card provider is compatible with QuickBooks. Sometimes, banks update their security protocols, which can disrupt connectivity. Check QuickBooks’ online banking support page for a list of supported institutions and any known issues.

- Review Import Settings: Carefully review the import settings, such as the date range and account selection, to ensure accurate data retrieval.

- Manually Correct Errors: After importing, meticulously review the transactions for errors. QuickBooks may misinterpret some transactions, leading to incorrect categorization or amounts. Manually correct these errors to maintain accurate financial records.

- Troubleshoot Synchronization: If syncing across devices fails, ensure all devices are logged in with the same QuickBooks account and have a stable internet connection. Try manually syncing the data to resolve any inconsistencies.

Categorization and Reporting Difficulties

Categorizing transactions and generating meaningful reports are essential for effective financial management. Users might struggle with categorizing expenses correctly or creating reports that provide actionable insights.

To overcome these difficulties:

- Develop a Consistent Categorization System: Establish a clear and consistent categorization system that aligns with your financial goals. For example, differentiate between “Housing,” “Transportation,” and “Entertainment.”

- Customize the Chart of Accounts: Tailor the chart of accounts to reflect your specific financial needs. Add, edit, or delete categories as needed to ensure accurate tracking.

- Utilize Reporting Features: Explore QuickBooks’ reporting features, such as the Profit and Loss report and the Budget vs. Actual report, to gain insights into your spending habits.

- Create Custom Reports: If the standard reports do not meet your needs, create custom reports to analyze specific financial aspects, such as tracking spending on specific categories over time.

Budgeting and Forecasting Challenges

Effective budgeting and forecasting are vital for financial planning. Users may face challenges in creating realistic budgets or predicting future financial outcomes.

To tackle these challenges:

- Set Realistic Budget Goals: Base your budget on your historical spending patterns and financial goals. Avoid setting overly ambitious or unrealistic targets.

- Use QuickBooks Budgeting Tools: Utilize QuickBooks’ budgeting tools to create and track your budget. Regularly review your budget and make adjustments as needed.

- Monitor Budget Performance: Track your spending against your budget to identify areas where you are overspending or underspending.

- Incorporate Forecasting: Leverage QuickBooks’ forecasting features to predict future income and expenses. This can help you anticipate potential financial challenges and plan accordingly.

Security and Data Protection Concerns

Protecting sensitive financial data is paramount. Users may worry about the security of their information within QuickBooks.

To mitigate these concerns:

- Use Strong Passwords: Create a strong, unique password for your QuickBooks account.

- Enable Two-Factor Authentication: Activate two-factor authentication to add an extra layer of security.

- Keep Software Updated: Ensure your QuickBooks software is up to date to benefit from the latest security patches and features.

- Back Up Your Data: Regularly back up your QuickBooks data to protect against data loss. Consider using cloud-based backups or external hard drives.

Troubleshooting Tips for Common Issues

Users may encounter a range of technical issues while using QuickBooks. Having troubleshooting tips readily available can help resolve these problems efficiently.

- Restart the Software: Closing and reopening QuickBooks often resolves minor glitches.

- Update the Software: Ensure you are using the latest version of QuickBooks to address potential bugs and security vulnerabilities.

- Check Internet Connection: A stable internet connection is essential for online banking, data synchronization, and accessing QuickBooks’ online features.

- Contact QuickBooks Support: If you encounter persistent issues, contact QuickBooks support for assistance. They can provide technical support and help you troubleshoot complex problems.

- Consult the QuickBooks Help Center: The QuickBooks Help Center provides a wealth of information, including FAQs, tutorials, and troubleshooting guides.

Table Comparing QuickBooks versions for personal finance.

Choosing the right QuickBooks version for personal finance is crucial. Understanding the differences between QuickBooks Online, QuickBooks Desktop, and other options allows users to select the software that best fits their needs and budget. This comparison focuses on pricing, features, ease of use, and overall user experience.

Pricing Structures for Each Version

The pricing of QuickBooks varies significantly depending on the version and subscription plan. Understanding the costs associated with each option is essential for budgeting and making an informed decision.

| QuickBooks Version | Pricing Structure | Notes |

|---|---|---|

| QuickBooks Online (QBO) | Subscription-based, with different tiers: Simple Start, Essentials, Plus, and Advanced. Prices vary monthly. | Pricing typically ranges from approximately $30 to $200+ per month, depending on the plan and any promotional offers. Offers discounts for the first few months. |

| QuickBooks Desktop (QBD) | One-time purchase, with options like Pro, Premier, and Enterprise. Annual subscription for payroll and other services. | The cost for a one-time purchase can range from around $300 to $1,500+, depending on the edition. Additional fees apply for payroll and other add-ons. |

| Other Versions (e.g., Self-Employed) | Subscription-based, specifically designed for freelancers and sole proprietors. | Pricing is usually lower than QBO’s other tiers, often starting around $20 per month. Features are more limited, focusing on income and expense tracking. |

Features and Functionalities of Each Version

The features available in each QuickBooks version directly impact its suitability for personal finance. Different versions offer varying levels of functionality, from basic expense tracking to advanced budgeting and reporting.

- QuickBooks Online: QBO provides a comprehensive suite of features accessible from anywhere with an internet connection.

- Expense Tracking: Automatically categorize expenses and track spending.

- Income Tracking: Record and categorize income from various sources.

- Reporting: Generate financial reports, such as profit and loss statements and balance sheets.

- Banking Integration: Connect to bank accounts to automatically import transactions.

- Budgeting: Create and manage budgets to track financial goals.

- Mobile App: Access data and manage finances on the go.

- QuickBooks Desktop: QBD offers robust features and more control, particularly for users who prefer desktop software.

- Detailed Reporting: Generate in-depth financial reports with advanced customization options.

- Inventory Management: Track inventory levels (available in higher tiers).

- Customization: Tailor the software to specific financial needs.

- Offline Access: Work on financial data without an internet connection.

- Other Versions (e.g., Self-Employed): These versions are tailored to freelancers and sole proprietors.

- Mileage Tracking: Track business mileage for tax deductions.

- Invoice Management: Create and send invoices to clients.

- Simplified Reporting: Generate basic reports for income and expenses.

Ease of Use and User Experience of Each Version

The user experience of each QuickBooks version varies. Ease of use is crucial for personal finance, as it directly affects how efficiently users can manage their finances.

- QuickBooks Online: QBO generally offers a user-friendly interface, making it accessible to users with varying levels of accounting experience. The web-based interface is intuitive, and the mobile app enhances accessibility.

- Pros: Accessible from anywhere, easy-to-use interface, automatic bank feeds.

- Cons: Requires an internet connection, can be slower than desktop versions.

- QuickBooks Desktop: QBD provides a more traditional desktop experience, offering greater control and customization. However, the interface can be more complex for beginners.

- Pros: Robust features, detailed reporting, offline access.

- Cons: Steeper learning curve, requires software installation and updates.

- Other Versions (e.g., Self-Employed): These versions prioritize simplicity, with a streamlined interface designed for ease of use.

- Pros: Simple interface, tailored for freelancers, easy expense tracking.

- Cons: Limited features, not suitable for complex financial needs.

Bullet Points Illustrative Examples of Personal Finance Scenarios in QuickBooks.

:max_bytes(150000):strip_icc()/GettyImages-1331485921-1946d0d50b7b48cb8929f15da0e93090.jpg)

QuickBooks can be effectively used for various personal finance scenarios, offering a centralized platform to manage different aspects of your financial life. The following bullet points illustrate how QuickBooks can be utilized for specific personal finance tasks, providing concrete examples of its application.

Tracking Mortgage Payments in QuickBooks

Managing mortgage payments within QuickBooks involves setting up accounts, entering transactions, and generating reports to monitor your progress. This process ensures accurate tracking of principal and interest payments, facilitating informed financial decision-making.

- Setting up the Mortgage Account: Create a liability account in QuickBooks to represent your mortgage. Enter the initial loan balance as the opening balance. Specify the interest rate and loan term for accurate amortization calculations.

- Recording Mortgage Payments: Each time you make a mortgage payment, record it as a transaction. Allocate the payment between the principal reduction and interest expense. The interest portion is an expense, and the principal portion reduces the mortgage liability.

- Creating an Amortization Schedule: While QuickBooks doesn’t have a built-in amortization schedule generator, you can create one separately using a spreadsheet program (like Excel or Google Sheets) or utilize online amortization calculators. This schedule will help you break down each payment’s principal and interest components over the loan’s life. You can then use these figures to properly allocate your mortgage payments in QuickBooks.

- Reconciling with the Bank Statement: Regularly reconcile your mortgage account with your bank statements to ensure accuracy. This involves comparing the transactions recorded in QuickBooks with those on your bank statement and identifying any discrepancies.

- Generating Reports: Use QuickBooks’ reporting features to generate reports on your mortgage payments. You can view the total interest paid, the remaining principal balance, and the breakdown of payments over a specific period.

Managing Student Loan Repayments Using QuickBooks

Student loan repayment tracking in QuickBooks mirrors the mortgage payment process, with a focus on managing loan balances, interest expenses, and payment schedules. This approach helps individuals stay organized and monitor their progress in paying off student debt.

- Establishing Student Loan Liability: Similar to the mortgage, create a liability account for each student loan. Input the initial loan balance, interest rate, and loan terms.

- Entering Loan Payments: When making student loan payments, record them as transactions, splitting the payment between principal and interest. Interest is an expense, and principal reduces the loan balance.

- Utilizing Amortization Schedules: Use amortization schedules (created separately or provided by your loan servicer) to accurately allocate payments between principal and interest. This ensures precise tracking of interest expenses and loan reduction.

- Reconciling Payments: Reconcile your student loan accounts with your loan statements to ensure accuracy. Compare the transactions in QuickBooks with the loan statements and address any discrepancies.

- Generating Reports: Use QuickBooks reports to track your total interest paid, remaining loan balances, and the breakdown of payments over time. This information is crucial for tax purposes and financial planning.

Demonstrating Tracking of Investment Income and Expenses in QuickBooks

Tracking investment income and expenses in QuickBooks allows for detailed monitoring of investment performance, including dividends, interest, capital gains, and related costs. This information is essential for tax reporting and evaluating investment strategies.

- Setting up Investment Accounts: Create asset accounts for each type of investment (stocks, bonds, mutual funds, etc.). For each investment, record the initial purchase details, including the purchase price, date, and number of shares or units.

- Recording Investment Income: Record investment income, such as dividends and interest, as income transactions. Categorize these under appropriate income accounts (e.g., Dividend Income, Interest Income).

- Tracking Capital Gains and Losses: When you sell investments, record the sale details, including the sale price, date, and cost basis. Calculate the capital gain or loss and categorize it accordingly (Capital Gains Income or Capital Losses Expense).

- Managing Investment Expenses: Track investment-related expenses, such as brokerage fees, investment advisory fees, and management fees. Categorize these as expenses in your QuickBooks account.

- Generating Investment Reports: Utilize QuickBooks reports to generate investment summaries. These reports should include details of income, expenses, gains, losses, and the current value of your investments.

Providing an Example for Tracking Charitable Donations Using QuickBooks

Tracking charitable donations within QuickBooks ensures accurate records for tax purposes and provides a clear overview of your philanthropic contributions. This involves setting up accounts, entering transactions, and generating reports to document donations.

- Setting up a Charitable Giving Account: Create an expense account specifically for charitable donations. This helps you easily categorize and track all your donations in one place.

- Recording Donations: When you make a donation, record it as an expense transaction. Include the date, amount, and the name of the charity. If you receive a receipt, attach it to the transaction for record-keeping.

- Categorizing Donations: Categorize each donation under the charitable giving expense account. For more detailed tracking, you can create sub-accounts for different types of charities (e.g., Religious Organizations, Educational Institutions).

- Using Tags or Classes (Optional): QuickBooks Online allows for using tags or classes. This allows you to categorize donations by type (e.g., cash, goods), or by the specific cause you are supporting.

- Generating Donation Reports: Use QuickBooks reports to generate a summary of your charitable donations. This report should include the total amount donated, the dates of donations, and the names of the charities. This report is crucial for tax preparation.

Blockquote Examples of Financial Reporting and Analysis in QuickBooks.

Financial reporting and analysis are crucial for understanding your financial health. QuickBooks allows you to generate various reports that provide insights into your income, expenses, assets, and liabilities. These reports enable you to track your financial progress, make informed decisions, and identify areas for improvement. Here are examples of how QuickBooks can be used to create financial reports for personal finance.

These examples use simplified figures for illustrative purposes. Real-world scenarios will involve more complex data and transactions.

Sample Profit and Loss Report

A Profit and Loss (P&L) report, also known as an Income Statement, summarizes your income and expenses over a specific period. It helps you determine your net profit or loss. QuickBooks can generate a P&L report that is tailored to your personal financial needs.

Sample Profit and Loss Report (Monthly)

Income:

- Salary: $5,000

- Investment Income: $100

Total Income: $5,100

Expenses:

- Rent: $1,500

- Utilities: $200

- Groceries: $500

- Transportation: $300

- Entertainment: $100

- Debt Payments (Credit Card): $200

Total Expenses: $2,800

Net Profit (Income – Expenses): $2,300

This simplified P&L report shows that, in this example, the individual has a net profit of $2,300 for the month. This indicates that their income exceeds their expenses, providing a surplus for savings or other financial goals.

Sample Balance Sheet

A Balance Sheet provides a snapshot of your assets, liabilities, and equity at a specific point in time. It adheres to the fundamental accounting equation: Assets = Liabilities + Equity. QuickBooks helps you create a balance sheet to assess your financial position.

Sample Balance Sheet (As of December 31, 2024)

Assets:

- Checking Account: $1,000

- Savings Account: $5,000

- Investments: $10,000

- Personal Car (Estimated Value): $15,000

Total Assets: $31,000

Liabilities:

- Credit Card Debt: $1,000

- Student Loan: $8,000

Total Liabilities: $9,000

Equity (Assets – Liabilities): $22,000

This balance sheet shows the individual’s assets, liabilities, and equity. Equity represents the net worth, indicating the value of what they own after deducting what they owe. This provides a picture of the individual’s overall financial health.

Sample Cash Flow Statement, Can i use quickbooks for personal finance

A Cash Flow Statement tracks the movement of cash in and out of your accounts over a period. It categorizes cash flows into operating, investing, and financing activities. QuickBooks can be used to generate a cash flow statement, which is vital for managing liquidity.

Sample Cash Flow Statement (Monthly)

Cash Flow from Operating Activities:

- Cash Inflows:

- Salary: $5,000

- Investment Income: $100

- Cash Outflows:

- Rent: ($1,500)

- Utilities: ($200)

- Groceries: ($500)

- Transportation: ($300)

- Entertainment: ($100)

- Debt Payments: ($200)

- Net Cash Flow from Operating Activities: $2,200

Cash Flow from Investing Activities:

- Purchase of Investments: ($500)

- Sale of Investments: $200

- Net Cash Flow from Investing Activities: ($300)

Cash Flow from Financing Activities:

- Loan Payments: ($100)

- Net Cash Flow from Financing Activities: ($100)

Net Increase in Cash: $1,800

Cash at Beginning of Period: $1,000

Cash at End of Period: $2,800

This Cash Flow Statement illustrates how cash moves in and out of the individual’s accounts. The statement provides insights into where cash is being generated and how it’s being used, enabling informed financial decisions.

While QuickBooks is primarily designed for businesses, it can be adapted for personal finance, though perhaps not as intuitively. However, if you’re seeking a more structured approach to financial education, especially if you’re a student, exploring resources like tulane finance might offer valuable insights into budgeting and money management. Ultimately, whether you choose QuickBooks or another method for your personal finances, understanding your spending is key.

Wondering if QuickBooks is right for your personal finances? While designed for businesses, it’s a bit overkill for simple budgeting. Instead of QuickBooks, you might find that exploring options like por finance , which focuses on personal finance, is a better fit. Ultimately, whether you use QuickBooks or another tool depends on your specific needs when managing your personal finances.