Overview of Wisetack Financing

Wisetack provides consumer financing solutions, streamlining the payment process for businesses and their customers. This enables businesses to offer flexible payment options, potentially increasing sales and customer satisfaction, while also helping customers manage their expenses. The platform integrates seamlessly into existing business workflows, simplifying the application and approval process.

Core Function of Wisetack in Consumer Financing

Wisetack’s primary function is to facilitate point-of-sale (POS) financing. This allows customers to split their purchases into manageable monthly payments. The platform handles the complexities of loan origination, underwriting, and servicing, freeing up businesses to focus on their core operations. It essentially acts as a bridge between the customer and the lending institution.

Services Offered to Businesses

Wisetack offers a suite of services designed to simplify and enhance the financing experience for businesses. These services include:

- Integration: Seamless integration with existing point-of-sale systems and business software.

- Application Process: A streamlined application process for customers, typically taking only a few minutes.

- Loan Management: Wisetack handles loan servicing, including payment processing and customer support.

- Risk Management: Sophisticated underwriting and fraud prevention tools to minimize risk for businesses.

- Marketing Support: Resources to help businesses promote their financing options to customers.

Types of Businesses Utilizing Wisetack Financing

Wisetack caters to a diverse range of businesses, primarily those offering services or products with a moderate to high price point. These businesses often find that offering financing increases sales and customer satisfaction.

- Home Services: Companies providing services such as HVAC installation and repair, plumbing, electrical work, and roofing often use Wisetack. For example, a homeowner needing a new air conditioning system might choose to finance the purchase through Wisetack.

- Healthcare: Dental practices, vision care providers, and cosmetic surgery clinics frequently utilize Wisetack to offer payment plans for expensive procedures.

- Auto Repair: Auto repair shops can provide financing for significant repairs, helping customers avoid unexpected large expenses.

- Home Improvement: Businesses specializing in remodeling, landscaping, and other home improvement projects find Wisetack useful.

- Other Service-Based Businesses: Other service businesses like veterinary clinics, legal services, and educational institutions can also benefit from offering Wisetack financing.

Wisetack’s Financing Process

Wisetack simplifies the financing process for both businesses and their customers. It offers a streamlined application experience, enabling customers to secure financing quickly and easily. This section Artikels the key steps involved in a customer applying for Wisetack financing and the role businesses play in the process.

Customer Application Steps

The customer application process with Wisetack is designed to be straightforward and efficient. Here’s a breakdown of the steps involved:

- Initiation of the Application: The process typically begins when a customer receives a quote or invoice from a business that offers Wisetack financing. The business provides a link or QR code, which the customer uses to initiate the application.

- Application Completion: The customer is directed to a secure online application form. They are prompted to provide necessary information.

- Credit Check: Wisetack performs a soft credit check to assess the customer’s creditworthiness. This does not negatively impact the customer’s credit score.

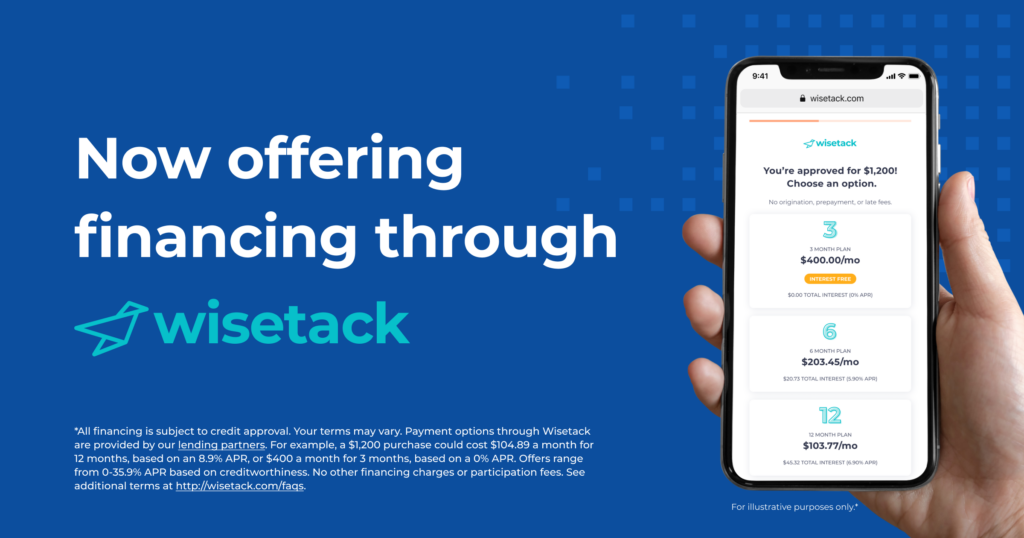

- Financing Offers: Based on the customer’s creditworthiness, Wisetack presents various financing options, including loan amounts, interest rates, and repayment terms.

- Selection and Acceptance: The customer reviews the offers and selects the option that best suits their needs. Upon acceptance, they digitally sign the loan agreement.

- Fund Disbursement: Once the loan agreement is signed, Wisetack disburses the funds directly to the business. The business then proceeds with the service or product delivery.

Business’s Role in the Financing Process

Businesses play a crucial role in facilitating the Wisetack financing process. Their involvement ensures a smooth and integrated experience for their customers.

- Integration and Setup: The business integrates Wisetack into their existing systems, such as their point-of-sale (POS) system or invoicing software. This integration allows for seamless financing options during the checkout process.

- Application Initiation: Businesses provide customers with the means to access the financing application, typically through a link or QR code. This is usually included on invoices, quotes, or directly at the point of sale.

- Transparency and Communication: Businesses are responsible for clearly communicating the availability of Wisetack financing to their customers. They also help customers understand the terms and conditions.

- Service/Product Delivery: After the funds are disbursed, the business delivers the service or product as agreed upon. They are responsible for fulfilling their end of the transaction.

- Support and Troubleshooting: Businesses provide initial customer support regarding the financing process, directing customers to Wisetack’s support resources if necessary.

Information Required from the Customer

During the Wisetack application process, customers are required to provide specific information to facilitate the credit check and loan approval. The type of information requested is typical for a loan application.

- Personal Information: This includes the customer’s full name, address, date of birth, and contact information (phone number and email address).

- Financial Information: Customers are asked to provide information about their income, employment status, and sometimes, the source of their income.

- Identity Verification: To verify their identity, customers might be asked to provide their Social Security number or upload a copy of a government-issued ID.

- Service/Purchase Details: The application will include details about the service or product the customer is purchasing, including the total cost and the business providing the service.

- Banking Information: For repayment purposes, customers must provide their bank account details, including the account number and routing number. This allows Wisetack to set up automatic payments.

Benefits of Using Wisetack for Businesses

Offering Wisetack financing to customers provides a significant advantage for businesses looking to improve their sales, customer satisfaction, and overall growth. By providing flexible payment options, businesses can attract more customers and close more deals. This section explores the key benefits Wisetack offers to businesses.

Increased Sales Conversions with Wisetack

Wisetack significantly boosts sales conversions by removing price as the primary barrier to purchase. Customers are more likely to proceed with a purchase when they have access to manageable payment plans.

The impact on sales conversion can be substantial. For instance, a plumbing company offering a $2,000 repair service might see fewer customers accept the full payment upfront. However, by offering Wisetack financing with options like 12-month or 24-month payment plans, they can make the service more accessible. This approach often results in a higher conversion rate, as customers are more willing to commit when the cost is spread out over time.

* Reduced Price Sensitivity: Financing mitigates sticker shock, making services and products appear more affordable.

* Increased Average Order Value (AOV): Customers are more likely to upgrade to premium services or purchase add-ons when financing is available.

* Faster Sales Cycles: Approvals are often instant, allowing businesses to close deals quickly.

* Competitive Advantage: Offering financing sets a business apart from competitors who do not provide similar options.

Impact of Wisetack on Customer Satisfaction and Loyalty

Customer satisfaction and loyalty are directly correlated with the payment options available. Wisetack improves the customer experience, leading to higher satisfaction levels and increased repeat business.

Customers appreciate the flexibility and convenience of financing. A recent study by the Harvard Business Review found that customers who use financing options report higher levels of satisfaction compared to those who pay upfront. This satisfaction translates into increased loyalty and positive word-of-mouth referrals.

* Enhanced Customer Experience: Providing financing demonstrates a commitment to customer needs.

* Improved Affordability: Making services and products more accessible broadens the customer base.

* Positive Word-of-Mouth: Satisfied customers are more likely to recommend a business to others.

* Higher Customer Retention Rates: Customers who use financing are more likely to return for future services or purchases.

Benefits of Using Wisetack for Consumers: Wisetack Financing

Wisetack offers significant advantages for consumers seeking financing for various services and purchases. It provides a streamlined and transparent financing experience, often with more favorable terms than traditional options. This approach makes necessary expenses more manageable and accessible.

Advantages for Customers Choosing Wisetack Financing

Wisetack provides several key benefits for consumers. These advantages contribute to a more positive and accessible financing experience.

- Transparent and Easy Application Process: Wisetack’s application process is typically straightforward and doesn’t involve lengthy paperwork. Customers can often apply directly through the service provider’s website or in-person. The process is designed to be quick and easy, with decisions often provided promptly.

- Flexible Payment Plans: Wisetack offers a variety of payment plans to suit different budgets and financial situations. These plans often include options for fixed monthly payments and different repayment terms, allowing customers to choose a plan that best fits their needs.

- No Hidden Fees: Wisetack prides itself on transparency. Customers can expect clear terms and conditions, with no hidden fees or surprises. This clarity helps customers make informed decisions about their financing options.

- Seamless Integration: Wisetack integrates seamlessly with the service provider’s checkout process. This means that customers can apply for financing and complete their purchase without having to leave the service provider’s platform or navigate to a separate website.

- Potential for 0% APR: In some cases, Wisetack offers promotional periods with 0% APR (Annual Percentage Rate). This can significantly reduce the overall cost of the purchase, making it even more affordable.

Examples of Purchases Wisetack Can Be Used For

Wisetack is versatile and can be used for a wide range of services and purchases, making it a valuable option for various consumer needs.

- Home Improvement Projects: Wisetack is commonly used for financing home improvement projects, such as roof repairs, HVAC system installations, kitchen renovations, and bathroom upgrades. This allows homeowners to make necessary improvements without depleting their savings or taking on a large upfront cost. For example, a homeowner could finance a $10,000 HVAC system installation with Wisetack, spreading the payments over several months.

- Vehicle Repairs: Unexpected vehicle repairs can be costly. Wisetack provides a convenient way to finance these expenses. This includes repairs to engines, transmissions, brakes, and other essential components. For instance, a car owner could finance a $2,500 engine repair, avoiding the need to pay the full amount immediately.

- Healthcare Services: Wisetack can be used for financing various healthcare services, including dental work, vision care, and elective procedures. This allows patients to receive necessary treatments without delaying care due to financial constraints. For example, a patient could finance a $3,000 dental implant procedure.

- Professional Services: Wisetack extends to professional services such as legal fees, accounting services, and other business-related expenses. This allows customers to manage the cost of these services more effectively.

- Other Services: Beyond the examples above, Wisetack can be used for a variety of other services, including pet care, landscaping, and appliance repairs. This makes it a flexible financing option for various consumer needs.

Comparison of Wisetack’s Payment Plans to Other Financing Options

Comparing Wisetack’s payment plans to other financing options reveals its competitive advantages for consumers. The key areas of comparison are APR, fees, and application process.

- Credit Cards: Compared to credit cards, Wisetack often offers lower APRs, especially during promotional periods. Credit cards may have higher interest rates, and the risk of accumulating high-interest debt is greater. Additionally, Wisetack often has no hidden fees, while credit cards may charge annual fees, late payment fees, and cash advance fees.

- Personal Loans: Wisetack’s application process is often simpler and faster than traditional personal loans, which can involve more paperwork and a longer approval process. While personal loans may offer competitive interest rates, Wisetack’s integration with service providers makes the process more convenient.

- Buy Now, Pay Later (BNPL) Services: Compared to BNPL services, Wisetack often provides higher financing limits. BNPL services typically have lower spending limits. Wisetack offers more flexibility in terms of payment plans and the types of purchases it can be used for.

- Store Credit Cards: Store credit cards are limited to purchases within a specific store or brand. Wisetack, on the other hand, is more versatile, as it can be used for a wider range of services and purchases. Store credit cards may also have high APRs.

Wisetack’s Integration and Technology

Wisetack’s success hinges not only on its financing solutions but also on its seamless integration capabilities and robust technology infrastructure. This section delves into the various integration options available to businesses, the user-friendliness of its interface, and the security measures employed to safeguard user data. The aim is to provide a comprehensive understanding of how Wisetack’s technology facilitates easy access to financing while prioritizing data protection.

Integration Methods for Businesses

Wisetack offers several integration methods, allowing businesses to incorporate its financing options into their existing systems with varying degrees of technical complexity. This flexibility ensures that businesses of all sizes and technical capabilities can leverage Wisetack’s services.

Businesses can choose from the following integration methods:

- API Integration: This is the most flexible and customizable integration method. It allows businesses to directly integrate Wisetack’s financing options into their websites, mobile apps, or internal systems. This method requires technical expertise but offers the greatest control over the user experience. The API provides a range of functionalities, including loan application submission, status tracking, and payment processing.

- Platform Integrations: Wisetack offers pre-built integrations with various popular business platforms, such as point-of-sale (POS) systems and customer relationship management (CRM) software. These integrations streamline the process by eliminating the need for custom development. For example, a business using a supported POS system can enable Wisetack financing directly within their checkout process.

- Payment Links: Businesses can generate and share payment links that include a Wisetack financing option. This method is suitable for businesses that don’t require deep integration but still want to offer financing to their customers. The links can be sent via email, SMS, or embedded on a website.

- Manual Application: In certain situations, businesses can facilitate loan applications manually through the Wisetack platform. This is often used for phone sales or in-person transactions where a direct integration is not feasible. The business representative guides the customer through the application process using Wisetack’s interface.

User Interface and Ease of Use

Wisetack’s user interface is designed with simplicity and ease of use in mind. The platform aims to provide a streamlined experience for both businesses and their customers, minimizing friction and maximizing efficiency. The interface is intuitive and straightforward, making it easy for users to navigate and complete transactions.

Key features contributing to the user-friendly design include:

- Clear and Concise Application Process: The loan application process is designed to be quick and easy to understand. Customers are guided through each step with clear instructions and minimal required information.

- Mobile-Responsive Design: The platform is fully responsive and accessible on various devices, including smartphones and tablets. This ensures a consistent user experience regardless of the device used.

- Real-Time Status Updates: Both businesses and customers can track the status of loan applications and payments in real-time. This transparency helps keep everyone informed and reduces potential confusion.

- Dedicated Support: Wisetack provides dedicated customer support to assist businesses and customers with any questions or issues they may encounter. This support is available through various channels, including phone, email, and online chat.

Security Measures for User Data Protection

Protecting user data is a top priority for Wisetack. The company employs a comprehensive set of security measures to safeguard sensitive information and ensure the privacy of its users. This commitment to security helps build trust and confidence in the platform.

The security measures implemented include:

- Data Encryption: All sensitive data transmitted and stored within the Wisetack platform is encrypted using industry-standard encryption protocols. This ensures that data is protected from unauthorized access.

- Compliance with Industry Standards: Wisetack adheres to all relevant industry standards and regulations, including PCI DSS compliance. This ensures that the platform meets the highest security requirements for handling financial data.

- Fraud Prevention: Wisetack employs sophisticated fraud detection and prevention mechanisms to identify and prevent fraudulent activities. These mechanisms include real-time monitoring, transaction analysis, and identity verification.

- Regular Security Audits: The platform undergoes regular security audits by independent third parties to ensure the ongoing effectiveness of its security measures. These audits help identify and address any potential vulnerabilities.

- Secure Data Storage: User data is stored in secure data centers with multiple layers of protection, including physical security, access controls, and redundancy.

Eligibility and Requirements for Wisetack

Understanding the criteria for both businesses and consumers is crucial for effectively utilizing Wisetack financing. This section details the specific requirements and financial aspects involved in offering and using Wisetack.

Requirements for Businesses to Offer Wisetack Financing

Businesses must meet certain criteria to be eligible to offer Wisetack financing to their customers. These requirements ensure that Wisetack partners with reputable and financially stable businesses.

The key eligibility criteria for businesses include:

- Business Type and Industry: Wisetack typically partners with businesses that offer services in home improvement, healthcare, automotive, and other consumer-focused sectors. The specific industries eligible may vary, so businesses should verify their eligibility directly with Wisetack.

- Business History: A proven track record of operating a legitimate business is essential. This usually involves a minimum operational period, often several months or years, to demonstrate stability and financial responsibility.

- Financial Standing: Businesses must demonstrate a sound financial standing. This may involve providing financial statements or undergoing a credit check. Wisetack assesses a business’s ability to manage finances responsibly and repay the loans they facilitate.

- Legal Compliance: Businesses must comply with all applicable federal, state, and local laws and regulations. This includes licensing, permits, and consumer protection laws. Compliance ensures that businesses operate legally and ethically.

- Integration Capabilities: Businesses need to integrate Wisetack’s platform into their existing systems. This may involve using APIs or other integration methods to facilitate the financing process seamlessly.

Credit Score and Other Criteria for Consumer Approval

Consumers applying for Wisetack financing are evaluated based on a variety of factors. These criteria determine their creditworthiness and ability to repay the loan.

Key factors considered for consumer approval include:

- Credit Score: A consumer’s credit score is a primary factor in determining eligibility. Wisetack considers credit scores from major credit bureaus. While the exact minimum credit score requirement can vary, a higher credit score generally increases the chances of approval and may result in more favorable terms.

- Credit History: A consumer’s credit history, including payment history, outstanding debts, and the length of their credit history, is carefully examined. A positive credit history, demonstrating responsible credit management, is viewed favorably.

- Debt-to-Income Ratio (DTI): The DTI, which is the percentage of a consumer’s gross monthly income that goes toward debt payments, is also assessed. A lower DTI indicates a better ability to manage debt and increases the likelihood of approval.

- Income Verification: Wisetack may require income verification to ensure that the consumer has sufficient income to repay the loan. This may involve providing pay stubs, tax returns, or other documentation.

- Loan Amount and Purpose: The amount of financing requested and the purpose of the loan (e.g., home improvement, medical expenses) can also influence the approval decision.

Fees and Interest Rates Associated with Wisetack Financing

Understanding the fees and interest rates is crucial for both businesses and consumers. These financial aspects impact the overall cost of using Wisetack financing.

The following are important considerations:

- Interest Rates: Interest rates on Wisetack loans vary based on the consumer’s creditworthiness, the loan amount, and the terms of the loan. Interest rates can be fixed or variable. Higher credit scores typically qualify for lower interest rates.

- Origination Fees: Wisetack may charge origination fees, which are fees charged to the borrower when the loan is originated. These fees can vary depending on the loan amount and the terms. The origination fees are typically added to the total loan amount.

- Late Payment Fees: Late payment fees may be assessed if a consumer fails to make a payment by the due date. These fees are designed to incentivize timely payments.

- Merchant Discount Rate: Businesses pay a merchant discount rate on each transaction facilitated through Wisetack. This rate covers the cost of processing the loan and providing the financing platform. The specific rate depends on various factors, including the business’s industry and the loan volume.

- APR (Annual Percentage Rate): The APR represents the total cost of the loan, including interest and fees, expressed as an annual rate. Consumers should carefully review the APR to understand the true cost of borrowing.

Wisetack’s Pricing and Fees

Understanding the financial aspects of Wisetack is crucial for both businesses and consumers. This section delves into the fee structure for businesses, the interest rates and repayment terms for consumers, and a comparison of Wisetack’s offerings against those of other financing providers. This information is essential for making informed decisions about utilizing Wisetack’s services.

Fee Structure for Businesses, Wisetack financing

Wisetack’s pricing for businesses is designed to be straightforward and transparent. Businesses are charged a fee for each transaction processed through the platform.

The fee structure typically involves:

- A percentage of the total transaction amount. This percentage varies depending on factors such as the industry, the size of the loan, and the risk profile of the business.

- There are no upfront costs or hidden fees for businesses to get started with Wisetack.

- Businesses only pay a fee when a customer successfully finances a purchase through Wisetack.

The exact percentage is determined during the application process and is communicated clearly to the business. It’s important for businesses to consider this fee when calculating their overall costs and profitability.

Interest Rates and Repayment Terms for Consumers

Wisetack offers consumers a range of financing options with varying interest rates and repayment terms. These terms are determined based on the consumer’s creditworthiness and the amount of the loan.

Consumers can expect the following:

- Interest Rates: Interest rates are competitive and vary based on the consumer’s credit score, the loan amount, and the repayment term. Wisetack aims to provide consumers with access to affordable financing options.

- Repayment Terms: Repayment terms are flexible, typically ranging from a few months to several years. This allows consumers to choose a repayment schedule that aligns with their financial situation.

- Loan Amounts: Wisetack offers financing for a variety of services and projects, with loan amounts varying from a few hundred to tens of thousands of dollars, depending on the specific service and the business providing the service.

Consumers are provided with clear and concise information about the interest rates and repayment terms before accepting a loan.

Comparison of Wisetack’s Fees to Other Financing Providers

Comparing Wisetack’s fees to those of other financing providers is essential for businesses and consumers to assess the value and suitability of the platform. Several factors are relevant in this comparison.

Here’s a comparative analysis:

- Transparency: Wisetack typically offers a transparent fee structure, clearly outlining the costs associated with using the platform. Other financing providers may have more complex fee structures, including hidden fees or additional charges.

- Interest Rates: Wisetack aims to provide competitive interest rates for consumers. However, rates can vary depending on creditworthiness and the specific financing product. Comparing interest rates with other providers is crucial for consumers.

- Flexibility: Wisetack offers flexible repayment terms, which may vary among different financing providers. Consumers should compare the available repayment options to find the most suitable one for their needs.

- Industry-Specific Focus: Wisetack specializes in financing for home services, automotive repair, and healthcare, among other areas. Some other financing providers may offer broader financing options across various industries.

- Ease of Use: Wisetack is known for its user-friendly platform and streamlined application process, which can be a significant advantage over some competitors.

Businesses and consumers should conduct thorough research and compare the fees, interest rates, and terms of different financing providers to make informed decisions that best suit their financial needs.

Industry Use Cases of Wisetack

Wisetack’s flexible financing solutions are designed to integrate seamlessly across a variety of industries, providing businesses with a powerful tool to increase sales and improve customer satisfaction. By offering convenient payment options, Wisetack empowers businesses to close deals more easily and attract a wider customer base. This section explores specific industry applications, highlighting the benefits and advantages of using Wisetack.

Home Improvement Business Applications

Home improvement projects often involve significant upfront costs, which can be a barrier for many homeowners. Wisetack directly addresses this challenge by offering flexible financing options, making projects more accessible and manageable.

- Increased Sales Conversions: By providing financing, home improvement businesses can convert more leads into paying customers. The ability to spread payments over time reduces the immediate financial burden, encouraging customers to proceed with projects they might otherwise postpone or abandon.

- Higher Average Transaction Values: Customers are often willing to undertake larger projects or add extra features when financing is available. This leads to higher average transaction values and increased revenue for the business.

- Enhanced Customer Satisfaction: Offering financing demonstrates a commitment to customer convenience and satisfaction. This can lead to positive reviews, referrals, and increased customer loyalty.

- Competitive Advantage: In a competitive market, offering financing can differentiate a business from its competitors. It provides a clear advantage by making services more accessible and appealing to potential customers.

Healthcare Sector Applications

Wisetack is also making inroads in the healthcare sector, providing patients with convenient payment options for various medical services. This helps patients manage their healthcare expenses while allowing providers to get paid faster and more reliably.

Wisetack financing – Here’s a table showcasing Wisetack’s use in the healthcare sector:

| Service Area | Benefit for Patients | Benefit for Providers | Example |

|---|---|---|---|

| Dental Care | Allows patients to afford comprehensive dental treatments like root canals or cosmetic procedures without immediate upfront payments. | Improves cash flow and reduces the risk of delayed payments or non-payment. | A patient can finance a $5,000 dental implant procedure over several months, making it more manageable. |

| Vision Care | Facilitates the purchase of expensive eyewear or vision correction procedures like LASIK. | Increases patient volume by making services more affordable and appealing. | A patient can finance the cost of LASIK eye surgery, which can be several thousand dollars. |

| Veterinary Care | Helps pet owners manage the costs of unexpected veterinary emergencies or ongoing treatments. | Provides a reliable payment option, ensuring timely compensation for services. | A pet owner can finance the cost of emergency surgery for their pet, avoiding the need to make a large upfront payment. |

| Hearing Care | Makes hearing aids and related services more accessible and affordable. | Attracts more patients by making the cost of hearing aids and services more manageable. | A patient can finance the cost of a pair of hearing aids, which can cost several thousand dollars. |

Wisetack vs. Competitors

Understanding how Wisetack stacks up against its competitors is crucial for businesses and consumers alike. This comparison will illuminate Wisetack’s strengths and weaknesses in the consumer financing landscape, providing a clearer picture of its value proposition. By examining key features, benefits, and financial terms, we can determine how Wisetack distinguishes itself and where it might fall short compared to other financing platforms.

Wisetack financing streamlines the process for businesses, offering flexible payment options. This is particularly beneficial when considering the purchase of essential tools, such as for start up equipment financing , which can be a significant investment. By using Wisetack, companies can alleviate the financial burden and better manage cash flow, making expansion and growth more attainable.

Comparing Wisetack to Other Consumer Financing Platforms

Several consumer financing platforms compete with Wisetack, each offering unique features and target audiences. These platforms include Affirm, Klarna, Afterpay, and Bread. While they all aim to facilitate installment payments, their specific offerings, target markets, and integration capabilities vary. This comparison will focus on the key differentiators that businesses and consumers should consider when choosing a financing option.

Contrasting the Features and Benefits of Wisetack with Its Main Competitors

Wisetack’s core strength lies in its focus on home services and automotive repair. Its competitors often have a broader reach, encompassing retail and travel, but they may not offer the same level of specialization. Wisetack’s integration process, often seamless with existing business systems, is a significant advantage. Consider these key differentiators:

- Target Market: Wisetack is specifically designed for home services, auto repair, and healthcare. Competitors often cater to a wider range of industries, including e-commerce, travel, and general retail.

- Integration: Wisetack’s integration with existing business software is typically streamlined, minimizing disruption. Competitors’ integration processes can vary in complexity.

- Loan Amounts and Terms: Wisetack generally offers loans tailored to the specific needs of its target industries, with loan amounts and repayment terms reflecting those needs. Competitors’ loan options vary.

- Merchant Fees: Wisetack’s merchant fees are often competitive. Fees are determined by factors like transaction volume and risk profile.

Providing a Table Comparing the Interest Rates, Fees, and Terms of Wisetack and Its Competitors

The following table provides a general comparison of interest rates, fees, and terms for Wisetack and its main competitors. Note that these figures are approximate and subject to change based on individual creditworthiness, merchant agreements, and platform policies. It’s essential to consult the specific terms and conditions of each platform for the most accurate information.

Wisetack financing offers a convenient way to manage expenses for various services. However, for larger investments in equipment, businesses might explore alternatives. A potential option to consider is us bancorp equipment finance , which caters specifically to equipment needs. Ultimately, understanding both Wisetack financing and specialized equipment financing allows for informed financial decisions.

| Feature | Wisetack | Affirm | Klarna | Afterpay |

|---|---|---|---|---|

| Target Industries | Home Services, Auto Repair, Healthcare | E-commerce, Travel, Retail | E-commerce, Retail | E-commerce, Retail |

| Interest Rates | 0% APR or based on creditworthiness | 0% APR or based on creditworthiness (often higher than Wisetack) | 0% APR or based on creditworthiness | 0% APR (typically short-term) |

| Fees (for Consumers) | Potentially late fees if applicable | Potentially late fees if applicable | Potentially late fees if applicable | Potentially late fees if applicable |

| Fees (for Merchants) | Merchant Discount Rate (varies) | Merchant Discount Rate (varies) | Merchant Discount Rate (varies) | Merchant Discount Rate (varies) |

| Loan Terms | Typically up to 60 months, depending on the loan amount and merchant agreement. | Typically up to 36 months, depending on the loan amount and merchant agreement. | Typically up to 36 months, depending on the loan amount and merchant agreement. | Typically short-term (e.g., 6 weeks) |

| Loan Amounts | Dependent on merchant agreements and customer creditworthiness. | Dependent on merchant agreements and customer creditworthiness. | Dependent on merchant agreements and customer creditworthiness. | Typically lower limits, dependent on merchant agreements and customer creditworthiness. |

Risks and Considerations of Wisetack

(1)-p-1080.png)

Wisetack, like any financial tool, presents potential risks for both businesses and consumers. Understanding these risks is crucial for responsible utilization and informed decision-making. Careful consideration of these factors helps mitigate potential downsides and ensures a positive experience with the platform.

Risks for Businesses Using Wisetack

Businesses utilizing Wisetack face several potential risks that require careful management. These risks can impact profitability, operational efficiency, and customer relationships.

- Credit Risk and Default: Businesses assume the risk of customer default. While Wisetack handles the financing, the business is ultimately responsible for the services or goods provided. If a customer defaults on their Wisetack loan, the business does not receive payment. This risk is mitigated to some extent by Wisetack’s credit checks, but it’s not entirely eliminated.

- Increased Administrative Burden: While Wisetack aims to streamline the financing process, it still introduces administrative overhead. Businesses need to integrate Wisetack into their existing systems, track financing applications, and potentially manage customer inquiries related to their financing plans. This can increase workload, especially for smaller businesses with limited resources.

- Reputational Risk: If a customer has a negative experience with Wisetack (e.g., high interest rates, confusing terms), it can reflect poorly on the business offering the financing. Customers may associate the business with the negative experience, potentially damaging its reputation and customer relationships.

- Dependency on Wisetack: Over-reliance on Wisetack for financing can make a business vulnerable. If Wisetack’s terms change (e.g., higher fees, stricter eligibility requirements), or if the platform experiences technical issues, it could disrupt the business’s ability to offer financing to customers.

- Compliance with Regulations: Businesses must ensure they comply with all applicable regulations related to offering financing, even if Wisetack handles the loan origination. This includes adhering to consumer protection laws, truth-in-lending requirements, and data privacy regulations.

Risks for Consumers Using Wisetack

Consumers also face potential risks when using Wisetack. It is essential to understand these risks to make informed financial decisions.

- High Interest Rates: Wisetack offers financing, and this financing comes with interest rates. The interest rates offered can vary depending on the consumer’s creditworthiness and the specific terms of the loan. Consumers should carefully compare the interest rates offered by Wisetack with other financing options to ensure they are getting the best possible deal.

- Debt Accumulation: Using Wisetack to finance purchases can lead to debt accumulation. Consumers might be tempted to make purchases they otherwise couldn’t afford, potentially leading to an unsustainable level of debt. This can strain personal finances and impact financial well-being.

- Hidden Fees and Charges: While Wisetack aims for transparency, it’s crucial for consumers to carefully review all terms and conditions, including any potential fees or charges associated with the loan. This includes late payment fees, origination fees, or other charges that could increase the overall cost of the financing.

- Impact on Credit Score: Failing to make timely payments on a Wisetack loan can negatively impact a consumer’s credit score. This can make it more difficult to obtain credit in the future, such as for a mortgage, car loan, or other financing options.

- Lack of Negotiation Power: Consumers may have limited ability to negotiate the terms of the financing with Wisetack. The interest rates and loan terms are typically pre-set, leaving consumers with little flexibility to adjust the terms to their specific needs.

Importance of Responsible Lending and Borrowing with Wisetack

Responsible lending and borrowing are critical for both businesses and consumers when using Wisetack. It promotes financial stability and protects both parties from potential harm.

- For Businesses: Businesses should carefully assess a customer’s ability to repay the loan before offering Wisetack financing. This can involve reviewing the customer’s credit history, income, and other relevant financial information. Businesses should also provide clear and transparent information about the financing terms, including interest rates, fees, and repayment schedules. Furthermore, businesses must avoid predatory lending practices.

- For Consumers: Consumers should carefully review the terms of the Wisetack loan before accepting it. This includes understanding the interest rates, fees, and repayment schedule. Consumers should only borrow what they can reasonably afford to repay. They should create a budget and factor the loan payments into their overall financial plan.

- Promoting Financial Literacy: Both businesses and consumers benefit from increased financial literacy. Businesses should educate themselves about responsible lending practices and the potential risks of offering financing. Consumers should educate themselves about personal finance, credit management, and the implications of taking on debt.

- Transparency and Communication: Open and honest communication is crucial. Wisetack, businesses, and consumers should communicate clearly about the terms of the financing, potential risks, and any changes to the loan. Transparency helps build trust and fosters a positive financial relationship.

- Seeking Professional Advice: Both businesses and consumers may benefit from seeking professional financial advice. A financial advisor can provide guidance on responsible lending and borrowing practices, debt management, and other financial matters.

Customer Support and Resources

Wisetack recognizes the importance of robust customer support and readily available resources for both businesses and consumers. Providing effective support and clear information is crucial for ensuring a positive experience and fostering trust in the financing process. This section Artikels the various support channels and resources available to users of Wisetack.

Customer Support Options for Businesses

Wisetack offers several support options tailored to the needs of businesses using its financing platform. These resources are designed to assist with onboarding, managing financing options, and resolving any issues that may arise.

Businesses can access support through the following channels:

- Dedicated Account Management: Wisetack provides dedicated account managers for many businesses, particularly those with high transaction volumes or complex needs. These managers offer personalized support, assist with platform optimization, and help businesses maximize the benefits of using Wisetack.

- Email Support: Businesses can contact Wisetack’s support team via email for assistance with inquiries, troubleshooting, and general questions. Response times typically vary depending on the complexity of the issue, but Wisetack strives to provide timely and helpful responses.

- Phone Support: Depending on the business’s agreement with Wisetack, phone support may be available. This allows for direct communication with a support representative for urgent matters or complex issues requiring immediate attention.

- Online Knowledge Base and FAQs: Wisetack provides an online knowledge base and a comprehensive frequently asked questions (FAQ) section on its website. These resources offer answers to common questions about the platform, its features, and its functionality, enabling businesses to quickly find solutions to their inquiries.

Resources Available to Consumers

Consumers utilizing Wisetack also have access to various resources to support them throughout the financing process. These resources aim to provide clarity, transparency, and assistance whenever needed.

Consumers can utilize the following resources:

- Customer Support: Wisetack provides customer support channels for consumers to address their inquiries and resolve any issues related to their financing agreements.

- Online Account Management: Consumers can manage their financing accounts online, where they can view payment schedules, make payments, and access account statements.

- Educational Materials: Wisetack may provide educational materials, such as blog posts or articles, to help consumers understand the financing process, the terms of their agreements, and their rights and responsibilities.

- Contact Information: Wisetack provides clear and accessible contact information for consumers to reach out for assistance, including phone numbers and email addresses.

How to Contact Wisetack’s Customer Service

Contacting Wisetack’s customer service is designed to be straightforward and accessible for both businesses and consumers. The specific contact methods may vary depending on the user’s role and the nature of the inquiry.

Here’s how to contact Wisetack’s customer service:

- Email: For general inquiries or support requests, users can typically contact Wisetack via email. The email address is often provided on the Wisetack website or within the platform.

- Phone: Phone support may be available for specific issues or for urgent matters. The phone number is usually listed on the Wisetack website or in the user’s account information.

- Website and Help Center: Wisetack’s website typically features a help center or a dedicated support section with FAQs, troubleshooting guides, and other helpful resources.

- In-App Support: For users interacting with Wisetack through an integrated platform, in-app support options may be available, such as chat or direct messaging.

Future of Wisetack and the Financing Landscape

The financial technology (fintech) landscape is constantly evolving, and point-of-sale (POS) financing, like that offered by Wisetack, is poised for significant growth. Understanding the future of Wisetack requires considering both the company’s potential developments and the broader trends shaping the consumer financing industry. This section explores these aspects, providing insights into the trajectory of Wisetack and the future of POS financing.

Potential Future Developments for Wisetack

Wisetack, as a fintech company, has several avenues for growth and innovation. These developments could further solidify its position in the market and enhance its offerings for both businesses and consumers.

- Expansion of Service Categories: Wisetack could broaden its reach by partnering with businesses in new sectors. For example, they might expand into healthcare, education, or other service-based industries. This would involve tailoring financing solutions to the specific needs of each industry.

- Product Diversification: Wisetack could introduce new financial products beyond installment loans. This might include offering lines of credit, subscription-based financing, or even insurance products related to the services being financed.

- Technological Advancements: Leveraging artificial intelligence (AI) and machine learning (ML) could enhance Wisetack’s capabilities. AI could be used for more accurate credit scoring, fraud detection, and personalized loan offers. ML could optimize the loan application process and improve customer service.

- Geographic Expansion: While currently operating in the United States, Wisetack could consider expanding its services internationally. This would involve adapting its offerings to comply with local regulations and meet the financing needs of businesses and consumers in new markets.

- Strategic Partnerships: Forming partnerships with other fintech companies, banks, or payment processors could provide Wisetack with access to new distribution channels, technologies, and resources. This could include integrations with existing POS systems or collaborations on co-branded financing products.

- Enhanced Data Analytics: Improving data analytics capabilities would allow Wisetack to gain deeper insights into customer behavior, market trends, and the performance of its financing products. This data could be used to refine its offerings, improve risk management, and optimize marketing efforts.

Trends in the Consumer Financing Industry

The consumer financing industry is undergoing significant transformations, driven by technological advancements, changing consumer preferences, and evolving regulatory landscapes.

- Growth of Embedded Finance: Embedded finance, the integration of financial services into non-financial platforms, is a key trend. This means that consumers can access financing directly within the context of a purchase, such as on a business’s website or app. Wisetack exemplifies this trend by offering financing at the point of sale.

- Rise of Buy Now, Pay Later (BNPL): BNPL has gained significant popularity, particularly among younger consumers. While Wisetack focuses on installment loans, it is important to note the impact of BNPL on the broader market. Companies like Klarna and Affirm have shown how attractive and easy-to-use BNPL can be. This trend has pushed other lenders to offer more flexible payment options.

- Focus on Transparency and Simplicity: Consumers are increasingly demanding transparency in financial products. They want to understand the terms and conditions clearly and easily. Simplicity in the application and approval process is also crucial. Wisetack’s emphasis on clear terms and a streamlined application process aligns with this trend.

- Increasing Mobile Usage: Mobile devices are becoming the primary way consumers interact with financial services. Companies are investing heavily in mobile-first experiences, offering seamless application processes, account management, and customer support through mobile apps.

- Regulatory Scrutiny: The consumer financing industry is subject to increasing regulatory scrutiny, particularly concerning issues such as interest rates, fees, and data privacy. Companies must comply with evolving regulations to ensure consumer protection and maintain market access.

- Personalization and Customization: Consumers expect personalized financial experiences. Lenders are using data analytics and AI to tailor loan offers, payment plans, and customer service to individual needs and preferences.

Descriptive Illustration: The Future of Point-of-Sale Financing

The future of POS financing will be characterized by seamless integration, advanced technology, and a customer-centric approach. Imagine a scenario where a homeowner needs to replace their HVAC system. The entire process, from initial consultation to financing, is integrated and frictionless.

Here’s a descriptive illustration of the future of POS financing, focusing on technological advancements:

Scene: A homeowner, Sarah, is consulting with an HVAC technician, Mark, on a tablet during an in-home assessment. Mark is using a POS system integrated with Wisetack.

- Smart Assessment: Mark uses the tablet to assess Sarah’s home, automatically generating a quote based on the system’s needs and local pricing data. The system suggests financing options via Wisetack directly within the quote.

- Instant Approval: Sarah selects a financing option and clicks to apply. The application process is streamlined, pre-filled with information from the initial assessment and Sarah’s existing credit profile. AI-powered algorithms analyze Sarah’s data (with her consent) in real-time, providing an instant credit decision.

- Personalized Offers: Sarah is presented with several financing plans, each tailored to her financial profile and the project’s cost. The system uses AI to suggest the best options based on her credit score, income, and preferences, with clear explanations of terms and interest rates.

- Seamless Integration: Once Sarah selects a plan, the financing details are automatically integrated into the contract and the HVAC installation schedule. The system also handles the payment processing, ensuring Mark is paid promptly and Sarah’s payments are automated.

- Ongoing Management: Sarah can manage her loan through a user-friendly mobile app. She can view her payment history, make payments, and access customer support. The app also provides helpful resources and tips related to HVAC maintenance and energy efficiency.

- Proactive Support: The system uses AI to provide proactive support. For instance, if Sarah consistently misses payments, the system might offer options to adjust the payment schedule or provide a temporary payment holiday.

Key Technological Elements in this Future Scenario:

- AI-Powered Credit Scoring: AI algorithms analyze vast datasets to assess creditworthiness more accurately and quickly.

- Seamless API Integrations: POS systems are seamlessly integrated with financing platforms, enabling real-time data exchange and automated workflows.

- Mobile-First Experiences: Consumers and businesses have access to intuitive mobile apps for all aspects of the financing process.

- Data Analytics and Personalization: Data analytics provide insights into consumer behavior, enabling personalized offers and tailored customer experiences.

- Blockchain and Security: Blockchain technology enhances security and transparency in transactions.

Impact: This future of POS financing streamlines the entire process, making it easier and more convenient for both businesses and consumers. Businesses can close deals faster, while consumers gain access to flexible and affordable financing options. This will lead to increased sales for businesses and greater financial accessibility for consumers.