Overview of MyLab Finance

MyLab Finance is an online learning platform designed to support finance education, providing interactive tools and resources for students and instructors. It focuses on delivering a personalized and engaging learning experience, aiming to improve student understanding and performance in finance-related courses.

Definition and Primary Function

MyLab Finance primarily functions as a digital learning environment. It offers a comprehensive suite of tools and resources specifically tailored for finance courses. The platform’s main objective is to facilitate effective teaching and learning of financial concepts, offering features such as interactive tutorials, assessments, and personalized study plans. It aims to bridge the gap between theoretical knowledge and practical application, providing students with the necessary skills to succeed in their finance studies.

Target Audience

MyLab Finance caters to a diverse audience within the academic finance community. The platform is designed to serve the needs of several distinct user groups.

- Undergraduate Students: MyLab Finance provides foundational learning tools and practice exercises suitable for introductory finance courses. It helps students build a solid understanding of core concepts such as financial statements analysis, time value of money, and investment principles.

- Graduate Students: The platform offers advanced features and content relevant to graduate-level finance courses, including corporate finance, investments, and portfolio management. It provides access to sophisticated tools and simulations that support in-depth analysis and problem-solving.

- Instructors/Professors: MyLab Finance equips instructors with resources for course management, assessment creation, and performance tracking. They can leverage the platform to customize courses, assign homework, monitor student progress, and provide personalized feedback.

- High School Students: Some resources and materials may be suitable for high school students taking introductory personal finance or economics courses. This can help them to understand financial concepts early in their academic journey.

Core Features and Functionalities

MyLab Finance provides a range of features designed to enhance the learning experience. These functionalities are aimed at supporting both students and instructors in their respective roles.

- Interactive Tutorials and Simulations: The platform includes interactive tutorials and simulations that allow students to explore financial concepts in a dynamic and engaging manner. These tools often incorporate real-world scenarios and case studies to enhance understanding. For example, a simulation might allow students to manage a virtual portfolio, making investment decisions and tracking their performance over time.

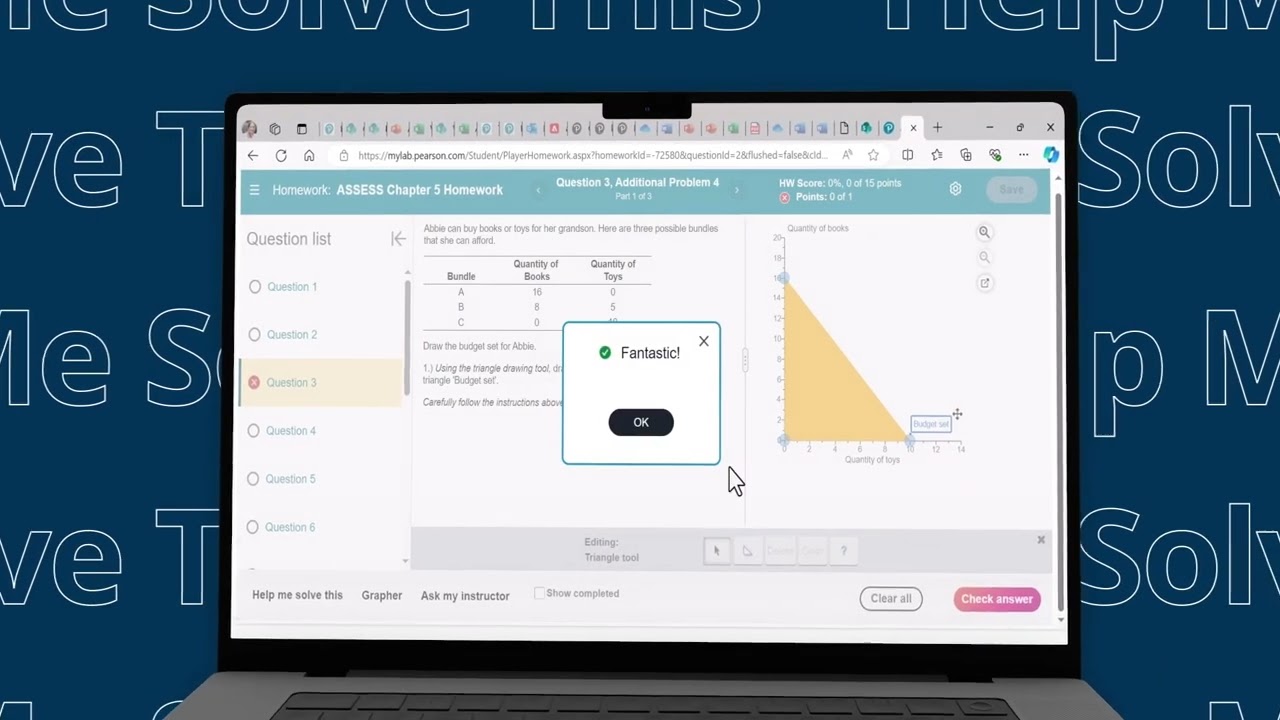

- Assessments and Quizzes: MyLab Finance offers a comprehensive assessment system, including quizzes, homework assignments, and exams. These assessments are designed to evaluate student understanding of key concepts. Instructors can create and customize assessments to align with their course objectives, and students receive immediate feedback on their performance.

- Personalized Study Plans: The platform often provides personalized study plans based on individual student performance. These plans identify areas where students need improvement and offer targeted resources to help them master the material. For instance, if a student struggles with the time value of money, the platform may provide additional practice problems and tutorials on that specific topic.

- Gradebook and Performance Tracking: MyLab Finance includes a gradebook that allows instructors to track student progress and performance. This feature provides insights into individual and overall class performance, enabling instructors to identify areas where students may need additional support. Students can also monitor their grades and track their progress over time.

- E-Textbooks and Supplementary Materials: The platform often integrates with e-textbooks and provides access to supplementary materials, such as videos, practice quizzes, and downloadable resources. This integration provides students with a comprehensive learning environment that supports different learning styles.

- Integration with Learning Management Systems (LMS): MyLab Finance often integrates with popular LMS platforms, such as Blackboard and Canvas, streamlining the course management process for instructors. This integration allows instructors to easily manage assignments, grades, and course materials within their existing LMS environment.

Core Financial Concepts Covered

MyLab Finance is designed to provide a comprehensive understanding of personal finance. It breaks down complex financial topics into manageable concepts, equipping users with the knowledge and skills to make informed decisions about their money. The platform emphasizes practical application, helping users translate theoretical knowledge into real-world financial strategies.

Budgeting and Financial Planning

Budgeting is a foundational element of personal finance. MyLab Finance provides tools and resources to help users create and manage budgets effectively. Understanding income, expenses, and the difference between needs and wants is crucial for financial planning.

- Budget Creation: The platform guides users through the process of creating a budget. Users learn to track their income sources, categorize expenses, and set financial goals. The process involves using tools to input income, fixed and variable expenses, and savings targets.

- Expense Tracking: MyLab Finance facilitates the tracking of expenses. Users can log their spending, categorize transactions, and monitor their spending patterns. Visual aids, such as charts and graphs, help users understand where their money is going.

- Goal Setting: MyLab Finance emphasizes the importance of setting financial goals. Users can define short-term and long-term objectives, such as saving for a down payment on a house, paying off debt, or planning for retirement. The platform allows users to set realistic timelines and track their progress toward achieving these goals.

- Budgeting Methods: The platform covers various budgeting methods, including the 50/30/20 rule. This rule suggests allocating 50% of income to needs, 30% to wants, and 20% to savings and debt repayment. Users can experiment with different methods to find one that suits their financial situation.

Saving and Debt Management

Effective saving and debt management are critical for financial stability. MyLab Finance provides resources and tools to help users develop sound strategies in these areas.

- Saving Strategies: The platform explores various saving strategies, including the importance of an emergency fund. An emergency fund provides a financial cushion for unexpected expenses. The platform recommends saving at least three to six months’ worth of living expenses.

- Debt Management: MyLab Finance covers different debt management strategies. Users learn about different types of debt, such as credit card debt, student loans, and mortgages. The platform provides guidance on creating a debt repayment plan, including strategies like the debt snowball and debt avalanche methods.

- Interest Rates and Fees: Understanding interest rates and fees is crucial for managing debt effectively. The platform explains how interest rates impact debt repayment and how fees can add to the overall cost of borrowing.

- Credit Score Management: MyLab Finance educates users on how to build and maintain a good credit score. A good credit score is essential for accessing loans, credit cards, and favorable interest rates. The platform provides tips on paying bills on time, keeping credit utilization low, and checking credit reports regularly.

Investing and Retirement Planning

Investing and retirement planning are essential components of long-term financial security. MyLab Finance introduces users to the basics of investing and provides guidance on retirement planning.

- Investment Basics: The platform introduces users to different investment options, including stocks, bonds, and mutual funds. Users learn about the risks and rewards associated with each type of investment.

- Risk Tolerance: MyLab Finance helps users assess their risk tolerance. Risk tolerance refers to an individual’s ability to handle potential losses in their investments. The platform provides tools to help users determine their risk profile and select investments that align with their risk tolerance.

- Diversification: The importance of diversification in a portfolio is discussed. Diversification involves spreading investments across different asset classes to reduce risk. The platform explains how diversification can help mitigate losses during market downturns.

- Retirement Planning: MyLab Finance provides resources for retirement planning. Users learn about retirement savings accounts, such as 401(k)s and IRAs. The platform helps users estimate their retirement needs and develop a savings plan.

Real-World Scenarios

MyLab Finance helps users navigate real-world financial scenarios through practical examples and case studies.

- Scenario: Buying a Car: The platform presents a scenario where a user is considering buying a car. The user learns about car loan interest rates, monthly payments, and the total cost of ownership. The platform guides the user through the process of comparing loan offers and making an informed decision.

- Scenario: Planning a Vacation: The platform provides guidance on planning a vacation. The user learns how to create a budget for the trip, save for travel expenses, and manage spending while on vacation.

- Scenario: Managing Student Loan Debt: The platform addresses the challenges of managing student loan debt. The user learns about different repayment options, such as income-driven repayment plans and loan consolidation.

- Scenario: Saving for a Down Payment on a House: The platform offers insights into saving for a down payment on a house. The user learns about the importance of setting a savings goal, creating a budget, and finding ways to reduce expenses.

Learning Methodology and Structure

MyLab Finance employs a multifaceted approach to financial education, designed to cater to diverse learning styles and ensure a comprehensive understanding of financial concepts. The platform integrates interactive elements, adaptive learning paths, and practical applications to facilitate knowledge retention and skill development. This methodology aims to move beyond rote memorization and promote active engagement with the material.

Pedagogical Approach

MyLab Finance utilizes a blend of pedagogical strategies to enhance the learning experience. This includes simulations, quizzes, and personalized feedback mechanisms.

- Simulations: These interactive scenarios allow students to apply financial concepts in realistic situations. For instance, a student might manage a virtual investment portfolio, making decisions about asset allocation, buying and selling stocks, and responding to market fluctuations. These simulations provide hands-on experience and foster critical thinking skills.

- Quizzes and Assessments: Regular quizzes and assessments are integrated throughout the modules to gauge understanding and provide immediate feedback. These assessments range from simple multiple-choice questions to more complex problem-solving scenarios. The platform often adapts the difficulty of subsequent questions based on the student’s performance, creating a personalized learning path.

- Adaptive Learning: The platform leverages adaptive learning technology to tailor the learning experience to each student’s needs. This means that the system analyzes a student’s performance and adjusts the content accordingly. For example, if a student struggles with a particular concept, the platform might provide additional explanations, practice problems, or alternative resources.

- Multimedia Content: MyLab Finance often incorporates a variety of multimedia elements, such as videos, animations, and interactive graphs, to make the learning process more engaging and accessible. These elements help to illustrate complex concepts and cater to different learning preferences.

Structure of Learning Modules and Courses

The structure of learning modules and courses within MyLab Finance is typically organized to provide a logical progression through financial topics. Modules are often broken down into smaller, manageable units, allowing students to learn at their own pace.

- Modular Design: Courses are usually divided into modules, each focusing on a specific financial topic. These modules may cover areas such as:

- Time Value of Money

- Investment Principles

- Personal Finance

- Corporate Finance

- Financial Markets

- Content Breakdown: Each module typically includes a combination of readings, videos, interactive exercises, and assessments. Readings provide foundational knowledge, while videos offer visual explanations and real-world examples. Interactive exercises allow students to practice what they have learned, and assessments measure their understanding.

- Course Navigation: The platform provides a clear and intuitive navigation system, allowing students to easily access and track their progress through the course. This includes features such as a progress bar, a syllabus, and a calendar of due dates.

- Resource Availability: Additional resources, such as practice quizzes, downloadable worksheets, and glossary of terms, are often available to support student learning. These resources provide opportunities for further study and reinforcement of concepts.

User Journey: From Onboarding to Completing a Financial Task

The user journey within MyLab Finance is designed to be intuitive and supportive, guiding students through the learning process from the initial onboarding to the completion of specific financial tasks. The following is a typical user journey.

- Onboarding and Account Setup: A new user first creates an account and enrolls in a specific course or module. This process typically involves providing basic information and accepting the terms of service.

- Module Introduction and Exploration: The user is then introduced to a module, which might begin with an overview of the topic, learning objectives, and a brief introductory video. The user explores the module’s content, which may include readings, interactive simulations, and multimedia elements.

- Interactive Engagement and Practice: The user actively engages with the content through interactive exercises, simulations, and practice quizzes. For example, a user learning about budgeting might use a simulation to create a personal budget, track expenses, and analyze their financial situation.

- Assessment and Feedback: The user completes assessments, such as quizzes or exams, to gauge their understanding. The platform provides immediate feedback on their performance, highlighting areas of strength and weakness.

- Application and Task Completion: The user applies the learned concepts to complete a specific financial task. For example, a user might use the platform’s tools to calculate the future value of an investment or create a financial plan.

- Progress Tracking and Review: The user tracks their progress through the course, reviewing completed modules and assessments. The platform provides tools to monitor their performance and identify areas for further study.

- Example: Calculating the Future Value of an Investment:

- Module Focus: Time Value of Money.

- Concept Introduction: The module introduces the concept of future value and explains how it is calculated.

- Interactive Exercise: The user works through an interactive exercise where they input the present value, interest rate, and time period to calculate the future value of an investment.

- Formula Application: The user applies the future value formula:

FV = PV (1 + r)^n

where FV is future value, PV is present value, r is the interest rate, and n is the number of periods.

- Real-World Example: The module provides a real-world example, such as calculating the future value of a $1,000 investment at a 5% annual interest rate for 10 years.

- Task Completion: The user completes a quiz or assessment that tests their understanding of future value calculations.

Key Features and Tools

MyLab Finance is designed to provide students with a dynamic and engaging learning experience. The platform incorporates a suite of interactive tools and personalized feedback mechanisms aimed at solidifying understanding and promoting mastery of financial concepts. These features move beyond passive learning, encouraging active participation and tailored guidance.

MyLab Finance provides students with a rich array of tools to support their learning journey. These resources are carefully designed to enhance understanding and application of financial principles.

Interactive Tools

MyLab Finance offers a variety of interactive tools designed to bring financial concepts to life. These tools allow students to experiment with different scenarios and visualize the impact of their decisions.

- Calculators: A comprehensive set of calculators is available, covering a wide range of financial calculations.

- Trackers: Tools that enable students to monitor their progress, budget effectively, and simulate investment scenarios.

These interactive tools provide practical applications of financial concepts.

Personalized Feedback Mechanisms

MyLab Finance utilizes personalized feedback mechanisms to guide students toward mastery. This feedback is designed to identify areas where students may be struggling and provide tailored support.

- Adaptive Learning: The platform adapts to each student’s performance, providing personalized recommendations for further study.

- Immediate Feedback: Students receive instant feedback on their work, allowing them to correct errors and reinforce understanding.

- Detailed Explanations: The platform provides in-depth explanations for both correct and incorrect answers, promoting deeper comprehension.

This personalized feedback helps students identify and address their weaknesses, leading to improved performance.

Tools Overview Table

The following table provides a detailed overview of the key features and tools available in MyLab Finance:

| Tool Name | Description | Functionality | User Benefit |

|---|---|---|---|

| Financial Calculators | A suite of calculators covering topics such as present value, future value, loan amortization, and investment returns. | Allows students to input variables and calculate financial outcomes, facilitating “what-if” scenarios. | Enhances understanding of financial concepts by providing concrete examples and visualizing the impact of different variables. |

| Budgeting Tool | A tool that helps students create and manage personal budgets. | Enables students to track income and expenses, set financial goals, and analyze spending patterns. | Provides practical skills in financial planning and management, improving financial literacy. |

| Investment Simulator | A simulation tool that allows students to make investment decisions and track their portfolio performance. | Students can allocate funds across different asset classes, monitor market fluctuations, and analyze investment returns. | Provides a hands-on experience in investment strategies, risk management, and portfolio diversification. |

| Adaptive Practice | A personalized practice system that adjusts to each student’s skill level. | Provides targeted practice questions and problems based on the student’s performance. | Improves student performance by focusing on areas where they need the most help. |

| Progress Tracking | A dashboard that visualizes student progress through the course. | Tracks scores on assignments, identifies areas of strength and weakness, and shows progress towards course objectives. | Motivates students by showing their achievements and provides insights for improvement. |

The tools are designed to create an engaging and effective learning environment.

Content Delivery and Accessibility

MyLab Finance employs a multifaceted approach to content delivery, ensuring that students receive information in a variety of engaging and effective formats. This approach caters to different learning styles and preferences, enhancing comprehension and knowledge retention. Furthermore, the platform is designed with accessibility in mind, providing features that support users with disabilities.

Content Formats

MyLab Finance utilizes diverse content formats to facilitate effective learning. This includes a combination of visual, auditory, and interactive elements.

- Videos: Short, focused videos explain complex financial concepts. These videos often feature animations, real-world examples, and expert commentary to make the material more relatable and easier to understand. For example, a video might illustrate the concept of compound interest with a visual representation of how an initial investment grows over time.

- Text-Based Content: Core concepts are presented in clearly written text, organized into modules and chapters. The text is designed to be accessible and easy to navigate, with clear headings, subheadings, and concise explanations.

- Interactive Exercises and Simulations: These activities allow students to apply what they’ve learned in a practical setting. Students can work through financial scenarios, such as creating a budget or analyzing an investment portfolio.

- Quizzes and Assessments: Regular quizzes and assessments provide opportunities for students to test their understanding of the material and receive immediate feedback. These assessments are often adaptive, adjusting the difficulty level based on student performance.

- Downloadable Resources: Students can download supplementary materials, such as worksheets, study guides, and practice problems, for offline study and review.

Accessibility Features

MyLab Finance incorporates several features to ensure the platform is accessible to users with disabilities.

- Screen Reader Compatibility: The platform is designed to be compatible with screen readers, allowing visually impaired users to access the content. This includes providing alternative text for images and using proper HTML structure for navigation.

- Keyboard Navigation: Users can navigate the platform using a keyboard, without relying on a mouse. This feature is crucial for users with mobility impairments.

- Closed Captions and Transcripts: All videos include closed captions and transcripts, making the content accessible to users who are deaf or hard of hearing. The transcripts also benefit users who prefer to read the material.

- Adjustable Font Sizes and Color Contrast: Users can customize the font size and color contrast to improve readability. This is particularly important for users with visual impairments.

- Alternative Formats: Content is often available in alternative formats, such as downloadable PDFs, which can be used with assistive technologies.

Key Definitions

Understanding core financial terms is fundamental. The platform incorporates blockquotes to highlight crucial definitions.

Compound Interest: The interest earned on both the initial principal and the accumulated interest from previous periods.

Diversification: A risk management technique that mixes a wide variety of investments within a portfolio.

Benefits for Students and Educators

MyLab Finance offers a robust suite of tools and resources designed to benefit both students seeking to improve their financial literacy and educators aiming to deliver engaging and effective instruction. The platform’s comprehensive approach provides a dynamic learning environment that fosters understanding and mastery of financial concepts.

Student Benefits: Enhanced Financial Literacy

MyLab Finance significantly improves students’ financial literacy by providing a personalized and interactive learning experience. This approach ensures that students not only understand the theory behind financial concepts but also can apply them in practical scenarios.

- Personalized Learning Paths: The platform’s adaptive learning technology identifies each student’s strengths and weaknesses. Based on this assessment, it creates customized learning paths that focus on areas where the student needs the most support. This personalized approach ensures students spend their time efficiently, mastering concepts at their own pace.

- Interactive Exercises and Simulations: MyLab Finance incorporates interactive exercises and simulations to bring financial concepts to life. These tools allow students to experiment with different financial scenarios, such as investing in the stock market or managing a budget, in a risk-free environment. This hands-on experience fosters a deeper understanding of how financial decisions impact real-world outcomes. For example, a simulation might allow students to see how compound interest grows over time with different investment strategies.

- Real-World Application: The platform connects theoretical concepts to real-world scenarios. Students learn to apply financial principles to personal finance decisions, such as managing debt, saving for retirement, and understanding insurance. This practical focus empowers students to make informed financial choices throughout their lives.

- Immediate Feedback and Assessment: MyLab Finance provides instant feedback on student performance. This immediate feedback helps students identify and correct errors quickly, reinforcing their understanding of the material. The platform also offers various assessment tools, such as quizzes and practice exams, that allow students to gauge their progress and prepare for assessments.

- Accessibility and Flexibility: The platform is accessible anytime, anywhere, allowing students to learn at their convenience. This flexibility is particularly beneficial for students with busy schedules or those who prefer to learn at their own pace. MyLab Finance’s mobile-friendly design ensures students can access learning materials on various devices.

Educator Advantages: Streamlined Teaching and Enhanced Engagement

MyLab Finance offers educators a comprehensive set of tools to streamline teaching and enhance student engagement. The platform provides educators with the resources they need to create a dynamic and effective learning environment.

- Content Organization and Customization: Educators can easily access and organize a vast library of content, including pre-built courses, assignments, and assessments. They can also customize the platform to align with their specific course objectives and teaching style.

- Automated Grading and Reporting: MyLab Finance automates grading and provides detailed performance reports. This saves educators time and allows them to focus on providing personalized feedback and support to their students. The platform’s reporting features provide insights into student performance, allowing educators to identify areas where students may be struggling and adjust their teaching accordingly.

- Interactive Teaching Tools: The platform offers interactive teaching tools, such as simulations, videos, and multimedia presentations, to enhance student engagement. These tools make learning more dynamic and memorable, helping students grasp complex concepts more easily. For example, an educator might use a stock market simulation to demonstrate the impact of different investment strategies on portfolio performance.

- Communication and Collaboration Features: MyLab Finance facilitates communication and collaboration between educators and students. Educators can use the platform to post announcements, send messages, and create discussion forums. These features foster a sense of community and encourage students to interact with each other and with their instructors.

- Integration with Learning Management Systems (LMS): MyLab Finance integrates seamlessly with popular LMS platforms, such as Canvas and Blackboard. This integration simplifies course management and allows educators to easily manage assignments, grades, and student data.

Comparative Analysis: MyLab Finance vs. Competitors

MyLab Finance distinguishes itself from similar platforms through its comprehensive features, adaptive learning technology, and focus on practical application. While other platforms may offer some of these features, MyLab Finance combines them into a cohesive and user-friendly experience.

| Feature | MyLab Finance | Competitor A | Competitor B |

|---|---|---|---|

| Adaptive Learning | Yes, highly personalized learning paths | Limited adaptive features | Basic adaptive features |

| Interactive Simulations | Extensive, covering various financial scenarios | Some simulations available | Limited or no simulations |

| Real-World Application | Strong emphasis on practical financial decision-making | Moderate emphasis | Limited emphasis |

| Content Customization | High degree of customization for educators | Moderate customization options | Limited customization |

| Integration with LMS | Seamless integration with major LMS platforms | Varies by platform | Varies by platform |

MyLab Finance’s adaptive learning capabilities are a key differentiator. The platform’s ability to personalize learning paths based on individual student needs ensures that students receive targeted instruction and support. The extensive library of interactive simulations provides students with hands-on experience, allowing them to experiment with different financial scenarios and learn from their mistakes in a risk-free environment. The platform’s focus on real-world application equips students with the knowledge and skills they need to make informed financial decisions in their lives.

Integration with Educational Institutions

MyLab Finance is designed to seamlessly integrate into the educational ecosystem, providing institutions with robust tools and features to enhance the teaching and learning experience. This integration focuses on flexibility, ease of use, and comprehensive data analysis to support both educators and students.

Learning Management System (LMS) Integration

MyLab Finance offers robust integration with popular Learning Management Systems (LMS) like Canvas, Blackboard, and Moodle. This integration streamlines the course management process and provides a unified learning experience for students.

- Single Sign-On (SSO): Students and instructors can access MyLab Finance directly from their LMS platform using their existing login credentials, eliminating the need for separate usernames and passwords. This simplifies access and reduces the administrative burden.

- Grade Synchronization: Grades from MyLab Finance assignments and assessments are automatically synchronized with the LMS gradebook. This ensures that student performance data is readily available within the familiar LMS environment, saving instructors time and effort.

- Content Linking: Instructors can easily link to MyLab Finance content, such as assignments, quizzes, and tutorials, directly within their LMS course. This creates a cohesive learning path and makes it easy for students to navigate the resources.

- Calendar Integration: Assignment due dates and other important deadlines from MyLab Finance can be automatically displayed in the LMS calendar, helping students stay organized and manage their time effectively.

Reporting and Assessment Features for Instructors

MyLab Finance provides instructors with powerful reporting and assessment tools to track student progress, identify areas for improvement, and tailor their teaching approach.

- Comprehensive Performance Data: Instructors have access to detailed reports on student performance, including individual scores, assignment completion rates, and time spent on tasks. This data allows for a granular understanding of student engagement and comprehension.

- Class Analytics: MyLab Finance offers class-level analytics, providing insights into overall class performance, identifying common areas of difficulty, and highlighting trends in student learning. This data informs instructional decisions and helps instructors address specific learning gaps.

- Assignment Customization: Instructors can customize assignments, quizzes, and tests to align with their course objectives and learning outcomes. They can select from a wide range of question types, set due dates, and adjust point values to meet their specific needs.

- Gradebook Management: The integrated gradebook allows instructors to easily manage student grades, track progress, and provide feedback. They can also export grade data for use in other systems.

- Reporting Dashboard: A centralized dashboard provides a quick overview of key performance indicators, allowing instructors to monitor student progress at a glance.

Example of Course Curriculum Incorporation

An example of how an institution might incorporate MyLab Finance into a course curriculum can be seen in a Financial Accounting course.

In a Financial Accounting course, MyLab Finance can be used to provide students with a comprehensive learning experience that integrates theory and practice.

Mylab Finance offers various financial tools, but it’s crucial to evaluate all options. Many users also consider alternative platforms. A common question is, considering the market, is resolve finance legit ? This highlights the need for due diligence when choosing financial services, something that applies equally when evaluating mylab finance’s offerings.

- Week 1-4: Foundational Concepts. Students are introduced to basic accounting principles, the accounting cycle, and financial statements. MyLab Finance can be used to provide interactive tutorials, practice problems, and quizzes to reinforce these foundational concepts.

- Week 5-8: Accounting for Assets and Liabilities. Students learn about accounting for various assets (e.g., cash, accounts receivable, inventory) and liabilities (e.g., accounts payable, notes payable). MyLab Finance can provide case studies and simulations that allow students to apply these concepts to real-world scenarios. For example, a simulation might involve a small business managing its inventory and accounts receivable.

- Week 9-12: Accounting for Equity and Revenue Recognition. Students delve into equity accounting and revenue recognition principles. MyLab Finance can offer exercises on preparing the statement of cash flows.

- Assessment. Throughout the course, instructors can use MyLab Finance’s assessment tools to evaluate student understanding. Quizzes and exams can be created and graded automatically. The gradebook integration simplifies the management of grades.

This integrated approach provides students with a dynamic and engaging learning experience, enabling them to master the concepts of financial accounting effectively.

Mylab Finance offers various financial solutions, but understanding concepts is key. One such concept is level financing, which involves structured repayment plans, essentially defining how payments are made over time. To grasp this better, it’s crucial to know what is level financing and how it impacts your overall financial strategy, especially when using MyLab Finance services.

Support and Resources

MyLab Finance provides comprehensive support and resources to ensure students and educators can effectively utilize the platform. This commitment to support aims to maximize the learning experience and facilitate successful implementation within educational settings. The support system is designed to be accessible, informative, and readily available.

Types of Support Offered to Users

MyLab Finance offers a multi-faceted support system catering to the diverse needs of its users. This comprehensive support network ensures students and educators can easily navigate the platform and resolve any issues they may encounter.

- Frequently Asked Questions (FAQs): A comprehensive FAQ section addresses common questions regarding account setup, platform navigation, assignment submission, grading, and technical troubleshooting. These FAQs are categorized for easy access and searchability, providing immediate answers to frequently asked queries.

- Tutorials and Guides: Step-by-step tutorials and user guides are available in various formats, including text, video, and interactive simulations. These resources cover all aspects of the platform, from basic navigation to advanced features. They provide clear instructions and visual aids to enhance understanding.

- Help Desk/Technical Support: A dedicated help desk provides personalized assistance to users experiencing technical difficulties or requiring more in-depth support. Users can submit support tickets through the platform, and a team of technical experts responds promptly to address specific issues. The help desk also offers phone and email support during specified hours.

- Live Chat Support: Real-time support is accessible via live chat, allowing users to connect with support representatives directly for immediate assistance with urgent issues. This feature is particularly useful for quick troubleshooting and resolving time-sensitive problems.

- Accessibility Support: MyLab Finance adheres to accessibility guidelines, providing resources and support for users with disabilities. This includes screen reader compatibility, keyboard navigation, and alternative text for images.

Resources Available for Educators

Educators are provided with a range of resources to facilitate effective course management and teaching. These resources are designed to simplify the integration of MyLab Finance into the curriculum and maximize its pedagogical impact.

- Instructor Manuals: Detailed instructor manuals provide guidance on setting up courses, assigning activities, grading student work, and utilizing the platform’s features. These manuals include pedagogical recommendations and best practices for effective teaching.

- Training Materials: Training materials, including webinars, recorded training sessions, and interactive modules, are available to help educators familiarize themselves with the platform’s features and functionalities. These materials offer in-depth training on various aspects of course management and content delivery.

- Customizable Course Content: Educators can customize pre-built content, including assignments, quizzes, and assessments, to align with their specific course objectives and learning outcomes. This allows for flexibility and personalization of the learning experience.

- Assessment and Analytics Tools: Tools for assessing student performance and analyzing data are provided, allowing educators to track student progress, identify areas where students struggle, and tailor their instruction accordingly. These tools offer valuable insights into student learning patterns.

- Integration Support: Assistance is provided to integrate MyLab Finance with existing learning management systems (LMS), such as Canvas, Blackboard, and Moodle. This streamlines course management and simplifies the integration process.

User Scenario: Student Assistance

Consider a student, Sarah, who is having difficulty understanding a complex financial concept in her MyLab Finance course. Sarah encounters a problem while working on a homework assignment related to bond valuation.

- Problem Encountered: Sarah struggles with a specific calculation involving the present value of future cash flows. She is unsure how to apply the formula correctly.

- Support Access: Sarah first consults the platform’s built-in resources. She reviews the relevant tutorial on bond valuation, which provides a step-by-step explanation and worked examples.

- Further Assistance: Despite reviewing the tutorial, Sarah still has questions. She then accesses the FAQ section and searches for answers related to present value calculations.

- Help Desk Escalation: If the FAQ and tutorials do not resolve the issue, Sarah can submit a support ticket to the help desk, providing details of the problem, the steps she has taken, and any error messages she has encountered.

- Support Response: Within a reasonable timeframe, a support representative responds to Sarah’s ticket. The representative provides a clear explanation of the formula, clarifies the calculation steps, and offers additional examples to help her understand the concept. They may also provide a link to a relevant video tutorial.

- Resolution: With the assistance of the support representative, Sarah understands the concept and successfully completes the homework assignment. She appreciates the prompt and helpful support provided by the platform.

Comparison with Competitors: Mylab Finance

MyLab Finance, like any leading educational platform, operates within a competitive landscape. Understanding how it stacks up against its rivals is crucial for both educators and students. This section delves into a comparative analysis of MyLab Finance with its main competitors, highlighting key differences in features, pricing, and overall value proposition.

Platform Comparison

The financial education market boasts several strong contenders. We’ll compare MyLab Finance with two prominent platforms: Connect Financial Accounting (McGraw Hill) and Aplia (Cengage). This comparison focuses on key features that impact the learning experience.

- Connect Financial Accounting (McGraw Hill): Connect offers a comprehensive suite of resources, including interactive tutorials, practice quizzes, and assessment tools. It emphasizes a blended learning approach, often integrating textbooks and digital content. Connect Financial Accounting tends to be tightly integrated with McGraw Hill textbooks, which can be both an advantage and a disadvantage. The platform’s strength lies in its vast content library and alignment with established accounting curricula.

- Aplia (Cengage): Aplia is another widely used platform, particularly for economics and finance courses. It provides a variety of activities, including simulations, case studies, and homework assignments. Aplia is known for its adaptive learning features, which personalize the learning path based on student performance. Cengage, similar to McGraw Hill, offers a strong textbook integration.

- MyLab Finance (Pearson): MyLab Finance focuses on a user-friendly interface and personalized learning pathways. It features interactive exercises, video tutorials, and real-world case studies. MyLab Finance’s strength lies in its adaptive learning technology, its strong focus on student engagement, and its integration with Pearson’s extensive library of financial resources.

Pricing Models and Subscription Options

Pricing and subscription models are critical factors for institutions and individual students. These can vary significantly between platforms.

- MyLab Finance (Pearson): MyLab Finance typically employs a subscription-based model. Students gain access to the platform and its resources for a specified period, often aligned with the duration of the course (e.g., a semester or academic year). Pricing is often tied to the specific course and content included. Access can be bundled with a textbook purchase or purchased separately. Pearson frequently offers various options to accommodate different budgets, including temporary access or inclusive access programs that provide digital materials at a reduced cost.

- Connect Financial Accounting (McGraw Hill): Connect generally follows a similar subscription model. Access to the platform is granted through a subscription that aligns with the course’s duration. Bundling options with McGraw Hill textbooks are common, which can be a cost-effective choice for students. McGraw Hill also offers various purchase options and payment plans.

- Aplia (Cengage): Aplia’s pricing structure is also subscription-based, with options tailored to course length. Bundling with Cengage textbooks is a frequent practice. Cengage provides a range of access options, including standalone subscriptions and packages that may include digital and physical materials. Cengage Unlimited is a subscription service that offers access to all Cengage digital products for a flat fee.

Advantages and Disadvantages

Each platform has its own set of strengths and weaknesses, impacting its suitability for different learning environments and student needs.

- MyLab Finance Advantages: MyLab Finance excels in its user-friendly interface, making it easier for students to navigate and engage with the content. Its personalized learning pathways, driven by adaptive learning technology, allow students to focus on areas where they need the most support. The integration with Pearson’s extensive financial resources provides a rich and diverse learning experience. The focus on real-world case studies and interactive exercises keeps students engaged and helps them apply financial concepts to practical situations.

- MyLab Finance Disadvantages: Depending on the course, the reliance on Pearson’s textbooks might limit the flexibility for educators who prefer other materials. While the interface is generally user-friendly, some users might find the sheer volume of content overwhelming at times. The cost of the subscription can be a barrier for some students, although various access options are available.

- Connect Financial Accounting Advantages: Connect provides a comprehensive suite of resources, including a vast content library aligned with many accounting curricula. The blended learning approach, integrating textbooks and digital content, appeals to a broad audience. McGraw Hill’s established reputation in educational publishing often lends credibility to the platform.

- Connect Financial Accounting Disadvantages: The interface may not be as intuitive as some competitors. Integration with McGraw Hill textbooks is a potential disadvantage if educators prefer alternative resources. The sheer volume of content can be overwhelming for some students.

- Aplia Advantages: Aplia’s adaptive learning features offer personalized learning experiences. The platform includes a variety of engaging activities, such as simulations and case studies. The focus on real-world applications helps students connect theory with practice.

- Aplia Disadvantages: The user interface may not be as visually appealing or as intuitive as MyLab Finance. The content library may be less extensive than some competitors. The adaptive learning algorithms, while beneficial, may not always perfectly align with individual learning styles.

Future Developments and Updates

MyLab Finance is committed to continuous improvement, striving to remain at the forefront of educational technology. This dedication involves ongoing development and updates to enhance the user experience, incorporate new pedagogical approaches, and reflect the evolving landscape of financial education. The platform’s future is shaped by both internal innovation and, crucially, by user feedback.

Potential Future Enhancements and New Features

MyLab Finance’s development pipeline includes a variety of planned enhancements and new features. These are designed to address emerging needs in financial education and improve the platform’s effectiveness.

- Advanced Analytics and Reporting: Future versions will provide more in-depth analytics for both students and instructors. For students, this could involve personalized performance dashboards that highlight areas of strength and weakness, track progress over time, and offer targeted recommendations for improvement. Instructors will gain access to more granular data on student performance, allowing for better identification of common misconceptions and more effective classroom interventions.

- Gamification and Interactive Simulations: Increased integration of gamified elements and interactive simulations is planned. This includes incorporating more real-world financial scenarios, such as managing a budget, making investment decisions, or dealing with debt. The aim is to make learning more engaging and relevant. For example, a simulation could allow students to experience the impact of different financial decisions on their virtual credit score, offering immediate feedback on their choices.

- Enhanced Mobile Learning: Expanding the mobile learning experience is a key priority. This involves optimizing the platform for mobile devices, creating dedicated mobile apps, and offering offline access to key content. This is particularly important for reaching students who may not have consistent access to a desktop computer.

- Integration with External Financial Tools: Future updates could include integrations with external financial tools and resources. This could involve linking to budgeting apps, investment platforms, or personal finance websites. Such integrations will provide students with a seamless experience as they apply their knowledge to real-world scenarios.

- Artificial Intelligence (AI)-Powered Tutoring: AI-powered tutoring features are under development to provide personalized support and feedback. This could include intelligent chatbots that answer student questions, provide hints, and offer customized learning paths. These tools will analyze student performance and adapt the learning experience accordingly.

The Role of User Feedback in Shaping Platform Development, Mylab finance

User feedback is a crucial component of MyLab Finance’s development process. The platform actively solicits input from students, instructors, and administrators to inform its updates and new features. This feedback loop ensures that the platform remains relevant, effective, and aligned with the needs of its users.

- Surveys and Questionnaires: Regular surveys and questionnaires are distributed to users to gather feedback on their experiences with the platform. These surveys cover various aspects, including ease of use, content quality, and the effectiveness of learning tools.

- Focus Groups: Focus groups are conducted with students and instructors to gather in-depth feedback on specific features and areas for improvement. These sessions allow for a more detailed understanding of user needs and preferences.

- User Testing: User testing is performed to evaluate the usability and effectiveness of new features and updates before they are released. This process involves observing users as they interact with the platform and gathering feedback on their experiences.

- Feedback Forms and Support Channels: Feedback forms and support channels are available for users to submit suggestions, report bugs, and provide general comments. This feedback is reviewed and used to prioritize development efforts.

- Iterative Development: MyLab Finance follows an iterative development approach, releasing updates and new features based on user feedback. This allows for continuous improvement and ensures that the platform remains responsive to user needs.

Descriptive Scenario of a New Feature Implementation

Consider a scenario where MyLab Finance implements an AI-powered financial advisor feature. This feature, tentatively called “FinWise,” would provide personalized guidance and support to students.

The New Feature: FinWise, an AI-powered financial advisor, analyzes student performance, tracks their progress through the course material, and offers personalized recommendations.

Implementation: FinWise would be integrated throughout the platform, providing real-time feedback and guidance. It would analyze student responses to quizzes and exercises, identifying areas where students struggle. Based on this analysis, FinWise would offer targeted recommendations, such as suggesting additional practice problems, providing links to relevant video tutorials, or directing students to specific sections of the textbook.

Impact on Users:

- Students: Students would receive personalized learning experiences, with FinWise adapting to their individual needs and learning styles. This would lead to improved comprehension and increased engagement with the material. For example, a student struggling with compound interest would receive specific recommendations to review the relevant concept, practice calculations, and take a short quiz to assess their understanding.

- Instructors: Instructors would gain access to detailed insights into student performance, enabling them to identify common areas of difficulty and tailor their instruction accordingly. The AI could also help instructors by automating some of the grading and feedback processes, freeing up their time to focus on other tasks, such as providing individual support to students.

Example: A student consistently misses questions on the time value of money. FinWise detects this pattern and automatically suggests a review of the concept, providing a link to an interactive simulation demonstrating the impact of interest rates and time on investments. The student completes the simulation, practices a few related problems, and then retakes the quiz, showing improved performance. This scenario illustrates how FinWise provides personalized support and enhances the learning experience.