Introduction to Sustainable Supply Chain Finance

Sustainable Supply Chain Finance (SSCF) is gaining prominence as businesses increasingly recognize the need for environmental and social responsibility throughout their value chains. It represents a significant evolution from traditional supply chain finance, incorporating sustainability considerations into financial instruments and processes. This approach allows companies to not only optimize their supply chains for efficiency but also to contribute to positive environmental and social outcomes.

Fundamental Principles of Sustainable Supply Chain Finance

SSCF operates on a set of core principles that guide its implementation. These principles are designed to ensure that financial decisions align with sustainability goals, fostering transparency and accountability.

- Integration of ESG Factors: SSCF incorporates Environmental, Social, and Governance (ESG) factors into the assessment of suppliers and the structuring of financial products. This means evaluating suppliers not just on financial metrics but also on their environmental impact, labor practices, and ethical conduct.

- Incentivization of Sustainable Practices: SSCF often provides financial incentives to suppliers who meet or exceed sustainability targets. This can include lower interest rates on financing, faster payment terms, or access to preferential financing options. The goal is to encourage suppliers to improve their sustainability performance.

- Transparency and Traceability: SSCF emphasizes transparency throughout the supply chain. This involves tracking the origin of materials, monitoring environmental impacts, and ensuring ethical sourcing practices. Technologies like blockchain are increasingly used to enhance traceability.

- Collaboration and Partnership: SSCF promotes collaboration among buyers, suppliers, and financial institutions. This collaborative approach is essential for implementing sustainability initiatives and sharing the costs and benefits.

- Risk Management: SSCF considers sustainability-related risks, such as climate change impacts or reputational damage from unethical practices, when assessing financial risk. This helps mitigate potential financial losses.

Definition of Sustainable Supply Chain Finance

Sustainable Supply Chain Finance (SSCF) can be concisely defined as the integration of environmental, social, and governance (ESG) criteria into supply chain finance (SCF) practices. It extends traditional SCF by focusing on the sustainability performance of suppliers and incentivizing environmentally and socially responsible behavior.

Sustainable Supply Chain Finance = Traditional Supply Chain Finance + ESG Criteria

Traditional supply chain finance primarily focuses on optimizing working capital, improving payment terms, and reducing financial risk within the supply chain. SSCF, on the other hand, expands this scope to include sustainability considerations. This means that the financial products and processes are structured to promote and reward environmentally and socially responsible practices throughout the supply chain. For instance, a buyer might offer preferential financing terms to a supplier who has achieved a high score on an ESG assessment.

Primary Objectives of Sustainable Supply Chain Finance

SSCF has several key objectives, all geared toward promoting sustainability and creating a positive impact. These objectives are interconnected and work together to drive change.

- Reducing Environmental Impact: One of the primary goals of SSCF is to reduce the environmental footprint of supply chains. This includes minimizing greenhouse gas emissions, reducing waste, conserving resources, and promoting the use of sustainable materials.

- Improving Social Responsibility: SSCF aims to improve social conditions within the supply chain. This includes ensuring fair labor practices, promoting worker safety, respecting human rights, and supporting local communities.

- Enhancing Governance: SSCF promotes good governance practices, such as transparency, ethical conduct, and accountability. This helps to mitigate risks related to corruption, fraud, and other unethical behaviors.

- Driving Sustainable Innovation: SSCF encourages innovation in sustainable practices. By providing financial incentives and support, SSCF helps suppliers adopt new technologies and processes that improve their sustainability performance.

- Building Resilient Supply Chains: SSCF aims to build more resilient supply chains. By incorporating sustainability considerations, SSCF helps to mitigate risks related to climate change, resource scarcity, and social unrest, making supply chains more robust and adaptable.

Benefits of Implementing SSCF

Sustainable Supply Chain Finance (SSCF) offers a multitude of advantages for businesses, extending beyond mere financial gains to encompass environmental, social, and governance (ESG) improvements. By integrating sustainability considerations into financial processes, companies can unlock new value streams, mitigate risks, and build more resilient and responsible supply chains. Implementing SSCF allows businesses to improve their financial performance, enhance their ESG profile, and foster stronger supplier relationships.

Financial Advantages for Businesses Adopting SSCF

SSCF provides several financial benefits, including improved working capital management, reduced financing costs, and enhanced access to capital. By incentivizing sustainable practices within the supply chain, companies can often negotiate more favorable terms with financial institutions, leading to tangible financial rewards.

- Improved Working Capital Management: SSCF can optimize cash flow by accelerating payments to suppliers. This reduces the Days Payable Outstanding (DPO) and frees up capital for other investments. For example, a company implementing SSCF might negotiate with a bank to offer early payment options to its suppliers based on their sustainability performance, improving its DPO.

- Reduced Financing Costs: Banks and other financial institutions often offer lower interest rates or preferential terms to companies with strong ESG performance and sustainable supply chains. This can translate into significant cost savings over time. A hypothetical example could be a manufacturing firm securing a 0.5% lower interest rate on a revolving credit facility due to its commitment to SSCF.

- Enhanced Access to Capital: As investors increasingly prioritize ESG factors, companies with strong sustainability credentials are often seen as less risky and more attractive investment opportunities. This can make it easier to secure financing and attract investors. Companies can showcase their commitment to sustainability, making it easier to access capital.

- Risk Mitigation: SSCF helps mitigate financial risks associated with supply chain disruptions. By supporting the financial stability of suppliers, companies reduce the likelihood of supplier failures and ensure the continuity of supply. For instance, a company using SSCF could provide early payment to a supplier impacted by a natural disaster, preventing the supplier’s financial collapse and securing future supply.

Improving a Company’s Environmental, Social, and Governance (ESG) Performance

SSCF directly supports a company’s ESG goals by integrating sustainability metrics into financial decision-making. This encourages suppliers to adopt more sustainable practices, leading to positive impacts across environmental, social, and governance dimensions.

- Environmental Benefits: SSCF can incentivize suppliers to reduce their environmental footprint. This might involve rewarding suppliers for reducing carbon emissions, conserving water, or implementing waste reduction programs. For example, a company could offer preferential payment terms to suppliers that use renewable energy sources.

- Social Benefits: SSCF can promote fair labor practices and improve working conditions within the supply chain. Companies can use SSCF to encourage suppliers to pay fair wages, provide safe working environments, and respect human rights. A company could, for instance, offer faster payments to suppliers who provide evidence of fair labor practices and worker safety certifications.

- Governance Benefits: SSCF helps strengthen governance by promoting transparency and accountability within the supply chain. This can involve requiring suppliers to disclose their sustainability performance and adhere to ethical business practices. For example, a company might link payment terms to a supplier’s compliance with anti-corruption regulations.

- Enhanced Brand Reputation: Demonstrating a commitment to sustainability through SSCF can enhance a company’s brand reputation and attract environmentally and socially conscious consumers and investors. A company using SSCF could promote its sustainable practices in its marketing materials, building brand loyalty.

Examples of How SSCF Fosters Stronger Relationships with Suppliers

SSCF fosters stronger supplier relationships by providing financial support and incentivizing sustainable practices. This can lead to increased trust, collaboration, and long-term partnerships.

- Early Payment Programs: SSCF allows businesses to offer early payment options to suppliers, improving their cash flow and financial stability. This can be particularly beneficial for small and medium-sized enterprises (SMEs) that often face cash flow challenges. A retailer, for instance, might offer early payment to a clothing manufacturer, allowing the manufacturer to invest in sustainable materials.

- Incentivizing Sustainability: SSCF can reward suppliers for achieving specific sustainability goals, such as reducing carbon emissions or improving labor practices. This creates a positive feedback loop, encouraging suppliers to invest in sustainable practices and improve their performance. A car manufacturer might offer better payment terms to suppliers that implement a recycling program for their materials.

- Capacity Building: SSCF can be used to provide financial support to suppliers to help them implement sustainable practices. This might involve providing access to financing for sustainability projects or offering training and technical assistance. A food processing company could provide a loan to a farm to help it transition to organic farming practices.

- Long-Term Partnerships: By fostering financial stability and promoting sustainable practices, SSCF helps build long-term, collaborative relationships with suppliers. This can lead to greater innovation, improved quality, and reduced supply chain risks. For example, a tech company could establish a long-term supply agreement with a supplier that demonstrates a commitment to ethical sourcing and sustainable manufacturing.

Comparing Traditional Supply Chain Finance with SSCF

The following table compares traditional supply chain finance with SSCF, highlighting the benefits and drawbacks of each approach.

| Feature | Traditional Supply Chain Finance | Sustainable Supply Chain Finance (SSCF) | Benefits | Drawbacks |

|---|---|---|---|---|

| Focus | Primarily on financial efficiency and cost reduction. | Integrates sustainability considerations into financial processes. | Improved cash flow, reduced financing costs. | Limited consideration for environmental and social impacts. |

| Incentives | Typically based on volume, payment terms, or creditworthiness. | Incentives tied to sustainability performance (e.g., ESG metrics). | Drives sustainable practices, enhances ESG performance. | May require additional upfront investment in sustainability initiatives. |

| Supplier Relationships | Can sometimes put pressure on suppliers to lower costs. | Fosters stronger, more collaborative relationships. | Improved supplier loyalty, enhanced brand reputation. | Requires careful design to avoid unintended consequences. |

| ESG Impact | Limited direct impact on environmental or social performance. | Directly supports ESG goals and sustainable practices. | Reduced environmental footprint, improved social outcomes. | May involve higher initial administrative costs. |

Key Components of SSCF

Sustainable Supply Chain Finance (SSCF) programs are multifaceted, integrating financial instruments, technological solutions, and data-driven insights to promote environmental and social responsibility within supply chains. A successful SSCF initiative requires a holistic approach, encompassing various key elements working in concert to achieve sustainability goals while optimizing financial performance.

Core Elements of SSCF Programs

SSCF programs are built upon several core components that collectively facilitate the integration of sustainability into financial practices. These elements ensure that financing decisions consider environmental and social impacts.

- Sustainability Assessment and Metrics: This involves establishing clear sustainability criteria and metrics to evaluate the environmental and social performance of suppliers. These metrics can include carbon footprint, water usage, waste management, labor practices, and ethical sourcing. Companies often use frameworks like the Global Reporting Initiative (GRI) or the Sustainability Accounting Standards Board (SASB) to guide their assessment. For example, a clothing retailer might assess its suppliers’ water usage in textile production, and their adherence to fair labor standards.

- Supplier Engagement and Capacity Building: Engaging suppliers and helping them improve their sustainability performance is crucial. This can involve providing training, technical assistance, and access to resources to help suppliers meet the required standards. A coffee company, for instance, might offer training to its smallholder farmers on sustainable farming practices, such as reducing pesticide use and improving soil health.

- Financial Incentives and Instruments: Designing financial instruments that reward sustainable practices is essential. This could include preferential interest rates for suppliers who meet certain sustainability targets, or financing options linked to the achievement of environmental goals.

- Risk Management and Due Diligence: Integrating sustainability considerations into risk management and due diligence processes is important. This includes assessing the environmental and social risks associated with suppliers and their operations. For instance, a food company would need to assess the risk of deforestation linked to palm oil sourcing.

- Transparency and Reporting: Transparency in the supply chain is vital. This involves tracking and reporting on sustainability performance, providing stakeholders with clear and reliable information about the environmental and social impacts of the supply chain.

Technology and Data Analytics in SSCF

Technology and data analytics are instrumental in enabling and supporting SSCF initiatives. They enhance the efficiency, transparency, and effectiveness of sustainability efforts within supply chains.

- Data Collection and Management: Technology facilitates the collection and management of vast amounts of data related to sustainability performance. This data can come from various sources, including supplier reports, environmental sensors, and third-party audits.

- Real-time Monitoring and Tracking: Real-time monitoring and tracking systems provide visibility into the environmental and social impacts of supply chain activities. This enables companies to identify and address issues promptly. For example, tracking the carbon emissions of shipments in real-time.

- Data Analytics and Reporting: Data analytics tools are used to analyze sustainability data, identify trends, and generate reports. This information can be used to improve decision-making, track progress, and demonstrate the impact of SSCF initiatives.

- Blockchain Technology: Blockchain technology can enhance transparency and traceability within supply chains. It allows for the secure and immutable tracking of products and materials, providing stakeholders with confidence in the authenticity and sustainability of goods.

- Artificial Intelligence (AI) and Machine Learning (ML): AI and ML algorithms can be used to predict potential risks, optimize supply chain operations, and identify opportunities for improvement in sustainability performance. For instance, an AI model can predict the likelihood of deforestation based on supplier locations and practices.

Financial Instruments Used in SSCF

Various financial instruments are employed in SSCF to incentivize sustainable practices and provide financial support to suppliers. These instruments are designed to align financial incentives with environmental and social goals.

- Green Loans: Green loans provide financing to suppliers based on their commitment to environmental sustainability. Interest rates are often tied to the achievement of specific environmental targets.

- Supply Chain Financing (SCF) with Sustainability Links: This instrument offers financing to suppliers, with preferential terms (e.g., lower interest rates, extended payment terms) linked to the supplier’s sustainability performance. The better the sustainability performance, the more favorable the financial terms.

- Sustainable Factoring: Factoring allows suppliers to sell their invoices to a third party at a discount. Sustainable factoring links the factoring rates to the supplier’s sustainability performance.

- Reverse Factoring with Sustainability Criteria: In reverse factoring, the buyer initiates the financing process. The buyer selects a financing provider to pay the supplier’s invoices, with the buyer ultimately responsible for repaying the financing provider. Sustainability criteria can be integrated into the terms of the reverse factoring agreement, incentivizing suppliers to improve their sustainability practices.

- Sustainability-Linked Bonds: These bonds are issued by companies with financial terms linked to the achievement of predefined sustainability targets. If the targets are met, the company may receive a lower interest rate.

- Grants and Subsidies: Government grants and subsidies can support suppliers in adopting sustainable practices. These financial incentives can help cover the costs of implementing sustainable technologies or processes.

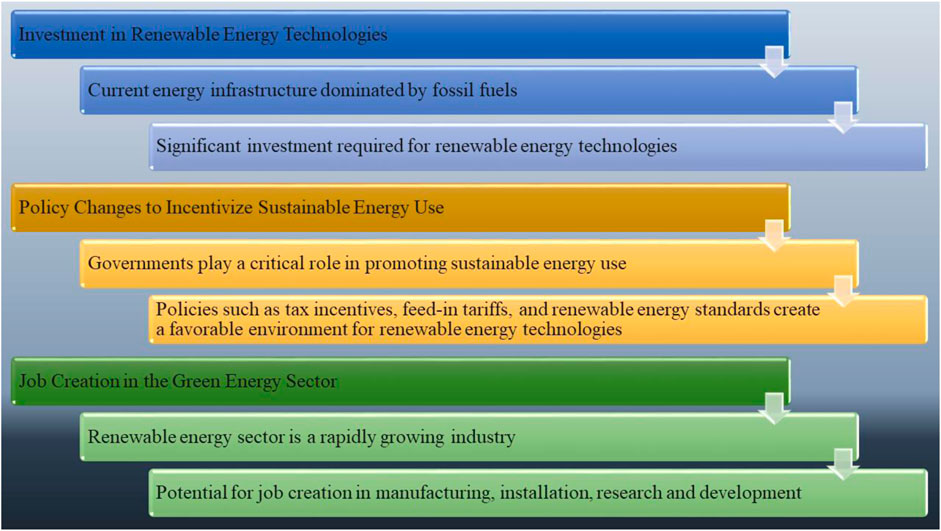

Environmental Sustainability in SSCF

Sustainable Supply Chain Finance (SSCF) plays a crucial role in fostering environmental responsibility throughout the supply chain. By integrating environmental considerations into financial processes, businesses can incentivize and support eco-friendly practices, leading to a significant reduction in their environmental footprint. This shift towards sustainability is not only beneficial for the planet but also enhances brand reputation, attracts investors, and mitigates risks associated with environmental regulations.

Supporting Environmentally Friendly Practices

SSCF actively supports environmentally friendly practices within the supply chain by providing financial incentives and reducing barriers to adoption. This can include offering preferential financing terms to suppliers who demonstrate strong environmental performance or investing in technologies that reduce waste and emissions. The financial support encourages suppliers to adopt more sustainable methods, creating a ripple effect throughout the entire supply chain.

Methods for Reducing Environmental Impact

Businesses can leverage SSCF in several ways to minimize their environmental impact. These methods include:

- Green Financing Programs: Implementing programs that offer lower interest rates or extended payment terms to suppliers who meet specific environmental criteria, such as using renewable energy, reducing water consumption, or minimizing waste generation. This incentivizes suppliers to invest in green technologies and processes.

- Supply Chain Transparency and Traceability: Utilizing technologies like blockchain to track the origin and environmental impact of materials throughout the supply chain. This enables businesses to identify and address areas of high environmental risk and ensure compliance with environmental regulations.

- Investment in Sustainable Technologies: Providing financial support to suppliers for the adoption of sustainable technologies, such as energy-efficient equipment, waste management systems, and sustainable packaging solutions. This can be achieved through direct investment or by facilitating access to financing.

- Carbon Footprint Reduction Initiatives: Linking financing to carbon reduction targets. Suppliers who achieve specific carbon emission reductions can receive financial rewards, encouraging them to actively manage and reduce their carbon footprint.

Illustration of a Sustainable Supply Chain

Imagine a supply chain for organic cotton clothing. The flow of materials and finance would look like this:

Materials Flow: Organic cotton is grown on farms using sustainable farming practices (e.g., no pesticides, water conservation). The cotton is then transported to a processing mill, where it is spun into yarn using energy-efficient machinery. The yarn is then sent to a fabric manufacturer, where it is woven into fabric using sustainable dyeing processes. The fabric is then transported to a garment factory, where it is sewn into clothing using fair labor practices. Finally, the finished clothing is distributed to retailers and consumers.

Finance Flow: A financial institution provides financing to the cotton farmers, based on their adherence to organic farming standards. The mill receives financing for its energy-efficient machinery, and the fabric manufacturer receives financing for its sustainable dyeing processes. The garment factory is provided with financing based on its commitment to fair labor practices and the use of sustainable materials. The retailers also receive financing to purchase the clothing. The entire process is tracked using blockchain technology to ensure transparency and traceability, and the financial institution uses SSCF to monitor and reward environmental performance at each stage.

This illustrative scenario highlights how finance can be strategically used to promote sustainability throughout the entire supply chain, from raw materials to the final product.

Case Study: Carbon Emission Reduction

A global apparel company implemented an SSCF program with its suppliers to reduce carbon emissions. The program provided financing to suppliers based on their ability to meet specific carbon reduction targets. Suppliers were required to adopt energy-efficient practices, use renewable energy sources, and reduce waste. As a result, the company reduced its supply chain carbon emissions by 15% within two years, leading to significant cost savings and improved brand reputation. This program demonstrated the direct link between SSCF and tangible environmental benefits, showcasing how financial incentives can drive sustainability in practice.

Social Responsibility in SSCF

Sustainable Supply Chain Finance (SSCF) extends its focus beyond environmental concerns to encompass social responsibility, ensuring ethical and equitable practices throughout the supply chain. This involves addressing labor standards, human rights, and community well-being, fostering a more just and sustainable global economy. By integrating social considerations, SSCF aims to create positive impacts for workers, local communities, and society at large.

Promoting Fair Labor Practices and Social Equity

SSCF actively promotes fair labor practices and social equity by incentivizing suppliers to adopt responsible labor standards. This often involves providing preferential financing terms to suppliers that demonstrate adherence to ethical labor practices. These terms can include lower interest rates, extended payment terms, or increased access to financing. This approach encourages suppliers to improve working conditions, pay fair wages, and respect workers’ rights. It can also foster a more equitable distribution of benefits across the supply chain, contributing to social equity.

Examples of SSCF Initiatives Addressing Human Rights and Ethical Sourcing

Numerous SSCF initiatives specifically address human rights and ethical sourcing. These initiatives often focus on specific industries or geographical regions where labor risks are high.

- Apparel Industry Initiatives: SSCF programs in the apparel industry might require suppliers to comply with codes of conduct that prohibit forced labor, child labor, and discrimination. They may also involve audits to verify compliance and provide training to suppliers on ethical sourcing practices. For example, a program might offer preferential financing to suppliers that participate in fair trade certification or implement worker empowerment programs.

- Food and Agriculture Initiatives: In the food and agriculture sector, SSCF can be used to support smallholder farmers and promote ethical sourcing of agricultural products. These programs might provide financing to farmers who adopt sustainable farming practices, ensure fair prices, and protect workers’ rights. For instance, a program could offer financing to coffee farmers who obtain Fairtrade certification, ensuring they receive a fair price for their beans and that workers are treated ethically.

- Electronics Industry Initiatives: SSCF programs in the electronics industry may focus on addressing issues such as conflict minerals and worker safety. These programs might require suppliers to source materials responsibly, avoid using conflict minerals, and ensure safe working conditions. An example includes providing financing to suppliers that participate in the Responsible Minerals Initiative (RMI) or implement worker safety programs.

The Role of Certification Programs in Ensuring Social Responsibility

Certification programs play a crucial role in ensuring social responsibility within SSCF. These programs provide a framework for assessing and verifying compliance with social and ethical standards. They offer assurance to buyers and investors that suppliers are meeting specific criteria related to labor practices, human rights, and ethical sourcing.

- Fairtrade: Fairtrade certification ensures that farmers and workers receive fair prices, decent working conditions, and community development. SSCF programs can incentivize suppliers to obtain Fairtrade certification, providing them with access to financing and market opportunities.

- SA8000: SA8000 is a leading social accountability standard that focuses on labor practices, including child labor, forced labor, health and safety, and freedom of association. SSCF can encourage suppliers to achieve SA8000 certification, demonstrating their commitment to ethical labor practices.

- Worldwide Responsible Accredited Production (WRAP): WRAP certification focuses on ethical manufacturing practices, including fair wages, safe working conditions, and environmental compliance. SSCF programs can support suppliers in achieving WRAP certification, promoting responsible production practices.

Key Social Indicators Measured in SSCF Programs

SSCF programs utilize various key social indicators to assess and monitor the social performance of suppliers. These indicators help to identify areas for improvement and track progress towards achieving social responsibility goals. The table below Artikels key social indicators commonly measured in SSCF programs.

| Indicator Category | Key Indicators | Measurement Methods | Examples |

|---|---|---|---|

| Labor Practices | Fair Wages, Working Hours, Freedom of Association, Discrimination | Supplier Self-Assessments, Worker Interviews, Audit Reports | Average wage compared to local living wage; compliance with legal working hour limits; existence of worker unions; policies against discrimination. |

| Human Rights | Forced Labor, Child Labor, Workplace Safety, Health and Safety | Supplier Audits, Site Inspections, Document Reviews | Verification that no forced labor is used; age verification of workers; availability of safety equipment; implementation of health and safety training programs. |

| Ethical Sourcing | Conflict Minerals, Supplier Code of Conduct Compliance, Traceability | Due Diligence Processes, Traceability Systems, Supplier Agreements | Verification of mineral sources; compliance with ethical sourcing guidelines; tracking of product origins. |

| Community Impact | Community Development, Local Employment, Environmental Impact | Community Engagement, Social Impact Assessments, Environmental Audits | Investment in community projects; percentage of local employees; impact on local water and air quality. |

Governance and Transparency in SSCF

Strong governance and unwavering transparency are fundamental pillars of Sustainable Supply Chain Finance (SSCF). They ensure the ethical and responsible operation of financial flows, safeguarding the integrity of the supply chain and fostering trust among all stakeholders. Without robust governance and clear visibility, the environmental and social benefits of SSCF are significantly diminished, potentially leading to unintended consequences and undermining the overall sustainability goals.

Importance of Strong Governance in SSCF

Effective governance in SSCF is crucial for several reasons. It provides the framework for ethical conduct, risk management, and compliance with relevant regulations and standards. It ensures that financial resources are used responsibly and contribute to the desired sustainability outcomes.

Achieving Transparency and Traceability in SSCF

Transparency and traceability are key to building trust and accountability in SSCF. They allow stakeholders to track the flow of goods and funds, identify potential risks, and verify compliance with sustainability standards.

One effective method is using blockchain technology. Blockchain provides an immutable and transparent record of transactions, making it possible to track goods and funds from origin to consumer. This technology is particularly useful in verifying the origin of raw materials, ensuring fair labor practices, and preventing fraud. Another example is the utilization of digital platforms. These platforms can aggregate data from various sources, such as suppliers, banks, and logistics providers, to provide a comprehensive view of the supply chain. This data can be used to monitor key performance indicators (KPIs) related to environmental and social sustainability, such as carbon emissions, waste generation, and worker safety.

Examples of Governance Structures Supporting Ethical Conduct in Supply Chains

Several governance structures can be implemented to promote ethical conduct in supply chains. These structures provide a framework for decision-making, accountability, and oversight, which can help mitigate risks and ensure compliance with sustainability standards.

* Supply Chain Codes of Conduct: These codes Artikel the ethical and environmental standards that suppliers are expected to adhere to. They typically cover issues such as fair labor practices, environmental protection, and anti-corruption.

* Independent Audits and Certifications: Third-party audits and certifications, such as those offered by the Fairtrade Foundation or the Forest Stewardship Council (FSC), provide independent verification of a company’s sustainability performance. These certifications can help build trust with stakeholders and demonstrate a commitment to ethical sourcing.

* Stakeholder Engagement: Engaging with stakeholders, including suppliers, customers, employees, and local communities, is essential for understanding their concerns and incorporating their perspectives into decision-making. This can involve regular communication, consultation, and feedback mechanisms.

* Risk Management Frameworks: These frameworks help identify, assess, and mitigate risks related to environmental and social sustainability. They can include processes for due diligence, supplier screening, and corrective action.

Methods to Improve Transparency in SSCF

Transparency is vital for the success of SSCF. Here are several methods to enhance it:

* Blockchain Technology: Implement blockchain to create an immutable and transparent record of transactions, tracking goods and funds from origin to consumer. This allows for verification of origin and ethical practices.

* Digital Platforms: Utilize digital platforms to aggregate data from suppliers, banks, and logistics providers. This provides a comprehensive view of the supply chain, enabling the monitoring of environmental and social KPIs.

* Standardized Data Formats: Adopt standardized data formats to ensure data interoperability and facilitate the sharing of information across the supply chain.

* Regular Reporting: Establish regular reporting mechanisms to disclose sustainability performance, including environmental impacts, social metrics, and financial data.

* Supplier Training and Capacity Building: Provide training and support to suppliers to improve their data collection and reporting capabilities, enhancing overall transparency.

* Third-Party Audits and Verification: Employ third-party audits to verify compliance with sustainability standards and provide independent assurance of the accuracy and reliability of reported data.

Challenges and Risks in SSCF: Sustainable Supply Chain Finance

Implementing Sustainable Supply Chain Finance (SSCF) presents several hurdles and potential pitfalls for businesses. Successfully navigating these challenges is crucial for realizing the benefits of SSCF and avoiding reputational damage or financial losses. This section Artikels common obstacles, associated risks, and mitigation strategies to ensure the integrity and effectiveness of SSCF programs.

Common Challenges in Implementing SSCF

SSCF adoption is not without its difficulties. Businesses often encounter operational, informational, and cultural barriers that can impede the successful implementation of SSCF initiatives.

- Data Availability and Quality: Accessing reliable and comprehensive environmental, social, and governance (ESG) data from suppliers can be challenging. Data gaps, inconsistencies, and the lack of standardized reporting frameworks can hinder accurate risk assessment and performance monitoring.

- Supplier Engagement and Capacity Building: Engaging suppliers, particularly small and medium-sized enterprises (SMEs), in SSCF programs requires significant effort. Suppliers may lack the resources, expertise, or willingness to adopt sustainable practices or provide the necessary data. Capacity-building initiatives, such as training programs and technical assistance, are often needed to support supplier participation.

- Complexity of Assessment and Verification: Evaluating the sustainability performance of suppliers can be complex, involving multiple criteria, assessment methodologies, and verification processes. The lack of standardized sustainability ratings and certifications can make it difficult to compare and assess suppliers objectively.

- Integration with Existing Systems: Integrating SSCF programs with existing financial and supply chain management systems can be technically challenging. Data integration, system compatibility, and process alignment require careful planning and execution.

- Cost and Resource Constraints: Implementing and managing SSCF programs can be resource-intensive, involving upfront investments in technology, data collection, and supplier engagement. Small businesses may face higher costs relative to their size.

- Lack of Standardized Metrics and Benchmarks: The absence of universally accepted metrics and benchmarks for measuring sustainability performance makes it difficult to compare suppliers, track progress, and set meaningful targets.

- Regulatory Uncertainty: Evolving regulations and standards related to sustainability reporting and disclosure can create uncertainty and increase compliance costs for businesses.

Potential Risks Associated with SSCF

SSCF initiatives are susceptible to several risks that can undermine their credibility and effectiveness. These risks include:

- Greenwashing: This involves falsely portraying a company’s or its suppliers’ practices as environmentally friendly or sustainable. Greenwashing can damage a company’s reputation and erode stakeholder trust.

- Fraud: Fraudulent activities, such as the falsification of sustainability data or the misrepresentation of supplier practices, can occur in SSCF programs. This can lead to financial losses and legal liabilities.

- Operational Risks: Inefficient processes, data errors, and system failures can disrupt SSCF programs and compromise their effectiveness.

- Reputational Risks: Negative publicity related to unsustainable practices within the supply chain can damage a company’s brand and reputation.

- Financial Risks: Poor supplier performance, such as late deliveries or product defects, can negatively impact a company’s financial results.

- Legal and Compliance Risks: Failure to comply with relevant environmental and social regulations can result in fines, lawsuits, and other penalties.

Mitigating Risks and Ensuring SSCF Integrity

To mitigate the risks associated with SSCF and ensure the integrity of these programs, businesses should implement a comprehensive risk management framework. This framework should include robust due diligence, verification processes, and ongoing monitoring.

- Due Diligence: Conduct thorough due diligence on suppliers to assess their sustainability performance, compliance with regulations, and risk profiles. This includes reviewing supplier policies, processes, and certifications.

- Verification: Implement verification processes to validate supplier data and claims. This may involve on-site audits, third-party certifications, and independent assessments.

- Data Quality Control: Establish data quality control measures to ensure the accuracy, completeness, and reliability of sustainability data. This includes data validation, error checking, and data governance policies.

- Transparency and Disclosure: Promote transparency by disclosing information about SSCF programs, supplier sustainability performance, and risk management practices.

- Supplier Engagement and Training: Engage suppliers in SSCF programs and provide them with training and support to improve their sustainability performance.

- Technology and Automation: Leverage technology and automation to streamline processes, improve data management, and enhance the efficiency of SSCF programs.

- Monitoring and Reporting: Continuously monitor supplier performance, track progress toward sustainability goals, and report on the results.

- Independent Audits: Conduct independent audits of SSCF programs to ensure their effectiveness and compliance with relevant standards.

Risk Mitigation Strategies in SSCF

The following table Artikels common risks in SSCF and corresponding mitigation strategies:

| Risk | Mitigation Strategy |

|---|---|

| Greenwashing | Implement robust verification processes, conduct independent audits, and promote transparency through clear and verifiable reporting. |

| Fraud | Establish strong internal controls, conduct regular audits, and implement data validation checks. |

| Operational Risks | Streamline processes, invest in reliable technology, and provide adequate training to personnel. |

| Reputational Risks | Conduct thorough due diligence, engage suppliers in sustainable practices, and address any issues promptly and transparently. |

Implementing SSCF: Step-by-Step Guide

Implementing a Sustainable Supply Chain Finance (SSCF) program requires a structured approach, encompassing assessments, technological integrations, and ongoing monitoring. The following sections detail the key steps businesses should take to successfully establish and manage an SSCF initiative.

Setting Up a SSCF Program: The Process

Setting up a robust SSCF program is a multifaceted process, demanding careful planning and execution. This process involves several key phases, from initial assessment to ongoing monitoring and improvement.

- Define Objectives and Scope: Clearly articulate the goals of the SSCF program. Determine which parts of the supply chain will be included and the specific sustainability metrics to be targeted (e.g., carbon emissions, labor practices, waste reduction). For instance, a company might aim to reduce Scope 3 emissions by 15% within three years, focusing initially on its top 20 suppliers.

- Supplier Engagement and Assessment: Identify and engage with key suppliers. Conduct thorough assessments of their sustainability performance, using questionnaires, audits, and data analysis. The assessment should cover environmental, social, and governance (ESG) factors.

- Develop a Sustainable Finance Framework: Establish a framework that aligns financial incentives with sustainability goals. This may involve offering preferential financing terms (e.g., lower interest rates, faster payment terms) to suppliers that meet or exceed predefined sustainability targets.

- Implement Technology and Data Systems: Integrate technology solutions to track and manage sustainability data. This includes implementing platforms for data collection, analysis, and reporting. Consider using blockchain for enhanced transparency and traceability.

- Establish Monitoring and Reporting Mechanisms: Implement ongoing monitoring and reporting mechanisms to track progress against sustainability targets. Regularly review performance data, identify areas for improvement, and make adjustments to the program as needed.

- Secure Stakeholder Buy-in: Ensure that all relevant stakeholders (suppliers, finance team, sustainability team, executive leadership) understand and support the SSCF program. This requires clear communication and training.

- Continuous Improvement: Regularly evaluate the effectiveness of the SSCF program and make improvements. This includes updating sustainability targets, refining assessment methods, and exploring new technologies.

Assessing a Supply Chain’s Sustainability Performance: Key Steps

Assessing a supply chain’s sustainability performance is crucial for the success of any SSCF program. It allows for the identification of areas for improvement and provides a basis for measuring progress. The following steps Artikel the assessment process.

- Define Sustainability Metrics: Determine the specific sustainability metrics to be assessed. These should align with the company’s overall sustainability goals and industry best practices. Examples include carbon footprint, water usage, waste generation, labor practices, and ethical sourcing.

- Select Assessment Tools: Choose appropriate assessment tools, such as questionnaires, audits, and third-party certifications. Consider using frameworks like the Sustainability Accounting Standards Board (SASB) or the Global Reporting Initiative (GRI).

- Engage Suppliers: Communicate with suppliers about the assessment process and expectations. Provide them with the necessary resources and support to participate effectively. This could include training sessions or templates for data collection.

- Collect Data: Gather data from suppliers through questionnaires, audits, and other means. Ensure that the data is accurate, complete, and reliable.

- Analyze Data: Analyze the collected data to identify areas of strength and weakness in the supply chain’s sustainability performance. Use data analytics tools to visualize trends and patterns.

- Provide Feedback: Share the assessment results with suppliers and provide them with feedback on their performance. This should include recommendations for improvement.

- Monitor Progress: Regularly monitor suppliers’ progress against their sustainability targets. Track key performance indicators (KPIs) and identify any areas where further support or intervention is needed.

Necessary Technology and Data Analytics Tools

Leveraging technology and data analytics is essential for effective SSCF implementation. These tools facilitate data collection, analysis, and reporting, enabling businesses to track sustainability performance and make informed decisions.

- Data Collection Platforms: Platforms for collecting sustainability data from suppliers. These may include online portals, surveys, and integrated systems that collect data from various sources.

- Data Analytics Software: Software to analyze sustainability data, identify trends, and generate insights. This can involve using dashboards, data visualization tools, and predictive analytics.

- Blockchain Technology: Blockchain for enhancing transparency and traceability in the supply chain. This can be used to track the movement of goods, verify certifications, and ensure data integrity.

- Supply Chain Management (SCM) Systems: Integrated SCM systems that incorporate sustainability metrics and enable real-time monitoring of supply chain performance.

- Reporting and Visualization Tools: Tools for generating reports and visualizing sustainability data. This allows for clear communication of progress and insights to stakeholders.

- Cloud-Based Solutions: Cloud-based platforms for storing and managing sustainability data, ensuring accessibility and scalability.

- Artificial Intelligence (AI) and Machine Learning (ML): AI and ML for automating data analysis, identifying potential risks, and optimizing supply chain processes for sustainability.

Steps for Businesses Implementing a SSCF Program

Businesses looking to implement an SSCF program should follow a structured approach. The following steps provide a practical guide for businesses.

- Conduct a Preliminary Assessment: Evaluate the company’s current supply chain sustainability performance. Identify key suppliers and assess their sustainability risks and opportunities.

- Define Sustainability Goals and Targets: Establish clear and measurable sustainability goals and targets. Align these with the company’s overall sustainability strategy.

- Select a SSCF Model: Choose a SSCF model that aligns with the company’s needs and resources. Consider options such as supply chain finance programs, green financing, or sustainability-linked loans.

- Develop a Supplier Engagement Strategy: Engage with suppliers to explain the SSCF program and its benefits. Provide them with the necessary resources and support to participate.

- Implement a Data Collection and Reporting System: Establish a system for collecting and reporting sustainability data from suppliers. This should include appropriate technology and processes.

- Establish Financial Incentives: Design financial incentives that reward suppliers for meeting or exceeding sustainability targets. This may include lower interest rates, faster payment terms, or other benefits.

- Monitor and Evaluate Performance: Regularly monitor the performance of the SSCF program and evaluate its effectiveness. Make adjustments as needed to improve results.

- Communicate Results: Communicate the results of the SSCF program to stakeholders, including suppliers, investors, and customers. Highlight the positive impact on sustainability performance.

Case Studies of Successful SSCF Implementation

Implementing Sustainable Supply Chain Finance (SSCF) can be complex, but the benefits, including enhanced financial performance, improved environmental sustainability, and strengthened social responsibility, are significant. Examining real-world case studies provides valuable insights into successful SSCF implementation, highlighting the strategies, results, and lessons learned. This section explores several examples of companies that have effectively integrated SSCF into their supply chains.

Successful Company Examples

Several organizations have successfully adopted SSCF, demonstrating its potential to drive positive change. These case studies showcase diverse approaches, results, and lessons applicable to various industries and supply chain structures.

- Unilever: Unilever, a global consumer goods company, has implemented SSCF to improve sustainability across its extensive supply chain. Their program focuses on providing financial incentives to suppliers who meet or exceed specific sustainability targets.

- IKEA: IKEA, the furniture retailer, has integrated SSCF to support its sustainable sourcing goals. The company offers preferential financing terms to suppliers that demonstrate environmental and social responsibility in their operations.

- Nestlé: Nestlé utilizes SSCF to promote sustainable agricultural practices within its cocoa and coffee supply chains. The company provides financial assistance and technical support to farmers who adhere to sustainable farming standards.

- Danone: Danone, a multinational food-products corporation, employs SSCF to support its regenerative agriculture program. The company offers financing and technical assistance to farmers adopting sustainable practices that enhance soil health and biodiversity.

Financial, Environmental, and Social Impact Results

The implementation of SSCF has yielded significant results across financial, environmental, and social dimensions. These impacts underscore the multifaceted benefits of integrating sustainability into supply chain financing.

- Financial Impact: Companies have experienced reduced financing costs due to improved credit ratings and risk profiles. SSCF also enhances supply chain efficiency, leading to lower operational costs and improved working capital management.

- Environmental Impact: SSCF initiatives have contributed to decreased carbon emissions, reduced water usage, and minimized waste generation. Suppliers are incentivized to adopt environmentally friendly practices, leading to a more sustainable supply chain.

- Social Impact: SSCF programs have improved labor conditions, promoted fair wages, and enhanced community development. The focus on social responsibility ensures that suppliers adhere to ethical standards and contribute to positive social outcomes.

Key Lessons Learned

The successful implementation of SSCF provides several key lessons applicable to organizations considering similar initiatives. These lessons emphasize the importance of strategic planning, stakeholder engagement, and continuous improvement.

- Clear Sustainability Goals: Define specific, measurable, achievable, relevant, and time-bound (SMART) sustainability goals to guide the SSCF program.

- Supplier Engagement: Actively involve suppliers in the design and implementation of the SSCF program. Build strong relationships based on trust and collaboration.

- Data and Transparency: Establish robust systems for data collection, monitoring, and reporting to track progress and ensure transparency.

- Financial Incentives: Offer attractive financial incentives, such as lower interest rates or faster payment terms, to motivate supplier participation.

- Capacity Building: Provide suppliers with the necessary training and support to adopt sustainable practices.

Case Study Summary, Sustainable supply chain finance

Sustainable supply chain finance – Example: Unilever’s Sustainable Sourcing Program. Unilever’s SSCF program provides financial incentives to suppliers based on their performance against sustainability targets. Suppliers are assessed on criteria such as deforestation, water usage, and labor practices. The program has resulted in a significant reduction in carbon emissions, improved water efficiency, and enhanced social conditions within the supply chain. This approach has strengthened Unilever’s relationships with its suppliers, improved its brand reputation, and contributed to its long-term sustainability goals. A critical element of the program’s success is the use of a digital platform for tracking supplier performance and providing transparent reporting. The program highlights the importance of aligning financial incentives with sustainability goals and actively engaging suppliers in the process.

The Future of SSCF

The evolution of Sustainable Supply Chain Finance (SSCF) is poised for significant transformation, driven by emerging trends, technological advancements, and increasing global awareness of sustainability. The future of SSCF will reshape how businesses manage their supply chains, fostering greater resilience, transparency, and positive environmental and social impacts. This section explores these critical aspects, offering insights into the dynamic landscape of SSCF.

Emerging Trends in Sustainable Supply Chain Finance

Several trends are shaping the future of SSCF, influencing its adoption and effectiveness. These trends are interconnected and mutually reinforcing, driving a holistic approach to supply chain sustainability.

- Increased Focus on Scope 3 Emissions: Companies are increasingly focusing on their Scope 3 emissions, which encompass indirect emissions across the value chain. This trend necessitates more sophisticated SSCF solutions that incorporate carbon accounting and incentivization mechanisms to reduce emissions from suppliers. For example, the Science Based Targets initiative (SBTi) is encouraging companies to set emission reduction targets across their entire value chains, which will further drive the need for SSCF solutions.

- Expansion of ESG Metrics: Beyond environmental considerations, SSCF is expanding to incorporate a broader range of Environmental, Social, and Governance (ESG) metrics. This includes labor standards, human rights, and ethical sourcing practices. This broader focus reflects the growing demand for a more comprehensive approach to sustainability.

- Rise of Blockchain Technology: Blockchain technology is playing a pivotal role in enhancing transparency and traceability within supply chains. By providing immutable records of transactions and product journeys, blockchain enables more accurate tracking of sustainability metrics and facilitates trust among stakeholders. For instance, platforms like IBM Food Trust are using blockchain to track food products from farm to table, ensuring food safety and verifying sustainable sourcing.

- Growing Importance of Circular Economy Principles: The shift towards a circular economy model is influencing SSCF. This involves designing out waste and pollution, keeping products and materials in use, and regenerating natural systems. SSCF can support this transition by financing initiatives that promote reuse, repair, and recycling within supply chains.

- Increased Integration with Fintech: Fintech companies are developing innovative SSCF solutions that leverage data analytics, AI, and machine learning to optimize financing, manage risks, and improve efficiency. These technologies enable faster and more cost-effective access to finance for suppliers, particularly small and medium-sized enterprises (SMEs).

Role of Innovation and Technology in Shaping the Future of SSCF

Innovation and technology are critical drivers in shaping the future of SSCF, enabling greater efficiency, transparency, and impact. These advancements are revolutionizing how supply chains are financed and managed.

- Data Analytics and AI: Data analytics and artificial intelligence (AI) are being used to assess supplier sustainability performance, identify risks, and optimize financing terms. AI-powered platforms can analyze vast amounts of data to provide insights into supplier behavior, environmental impact, and social responsibility. This allows for more informed decision-making and risk mitigation.

- Blockchain for Traceability: Blockchain technology provides a secure and transparent platform for tracking products and materials throughout the supply chain. This enhanced traceability enables companies to verify the origin and sustainability of their products, combat fraud, and build trust with consumers.

- Digital Platforms for Streamlined Processes: Digital platforms are simplifying and automating SSCF processes, reducing administrative burdens, and improving efficiency. These platforms connect buyers, suppliers, and financiers, facilitating seamless communication and transactions.

- IoT and Sensor Technology: The Internet of Things (IoT) and sensor technology are being used to monitor environmental conditions, track product movements, and collect data on resource consumption. This data can be used to improve supply chain efficiency, reduce waste, and verify sustainability claims. For example, sensors can monitor temperature and humidity during transportation to ensure product quality and reduce spoilage.

- Green Fintech Solutions: Fintech companies are developing specialized financial products and services that support sustainable practices. This includes green bonds, sustainability-linked loans, and carbon credit financing, which provide incentives for suppliers to adopt environmentally friendly practices.

Potential Impact of SSCF on Global Supply Chains

SSCF has the potential to transform global supply chains, driving positive environmental, social, and economic outcomes. Its impact extends beyond individual companies, influencing entire industries and the global economy.

- Enhanced Supply Chain Resilience: By promoting transparency, traceability, and collaboration, SSCF strengthens supply chain resilience. This enables companies to better manage risks, respond to disruptions, and adapt to changing market conditions.

- Reduced Environmental Footprint: SSCF incentivizes suppliers to adopt sustainable practices, reducing carbon emissions, waste, and resource consumption. This contributes to mitigating climate change and protecting the environment.

- Improved Social Responsibility: SSCF promotes fair labor practices, ethical sourcing, and human rights throughout the supply chain. This fosters a more equitable and just global economy.

- Increased Transparency and Traceability: SSCF enhances transparency and traceability, enabling companies to track products and materials throughout the supply chain. This builds trust with consumers and stakeholders and helps to combat fraud and unethical practices.

- Economic Growth and Development: SSCF can stimulate economic growth by providing access to finance for suppliers, particularly SMEs. This empowers suppliers to invest in sustainable practices, improve their competitiveness, and contribute to economic development.

Future Trends in the Evolution of SSCF

The evolution of SSCF will continue to be shaped by emerging trends, technological advancements, and evolving sustainability standards. The following is a list of future trends in the evolution of SSCF.

- Integration of Artificial Intelligence: AI will be used to automate sustainability assessments, risk analysis, and financing decisions.

- Increased Focus on Biodiversity: SSCF will incorporate metrics and incentives to protect biodiversity and promote sustainable land management practices.

- Expansion of Carbon Accounting: SSCF will become more sophisticated in measuring and managing carbon emissions across the supply chain.

- Development of Digital Green Bonds: Digital platforms will facilitate the issuance and trading of green bonds, providing access to capital for sustainable projects.

- Growth of Decentralized Finance (DeFi) in SSCF: DeFi platforms will offer innovative financing solutions and improve transparency and efficiency in supply chain finance.

Sustainable supply chain finance is increasingly important for businesses striving to improve their environmental and social impact. Considering this, the principles of sustainable finance can be applied to various aspects of a company’s operations, including vehicle management. This is where auto fleet financing becomes relevant, ensuring that a company’s vehicle fleet aligns with sustainable practices. Ultimately, a focus on sustainable supply chain finance helps drive responsible business practices.

Sustainable supply chain finance is evolving, with a growing emphasis on environmental and social responsibility. Exploring options for financing, businesses are now considering innovative models. One such model is the potential of serv financing to optimize cash flow within the supply chain, which can also indirectly support sustainability initiatives. Ultimately, the goal is to create more resilient and eco-conscious supply chains through smart financial strategies.