Overview of ASC 842 Finance Lease Criteria

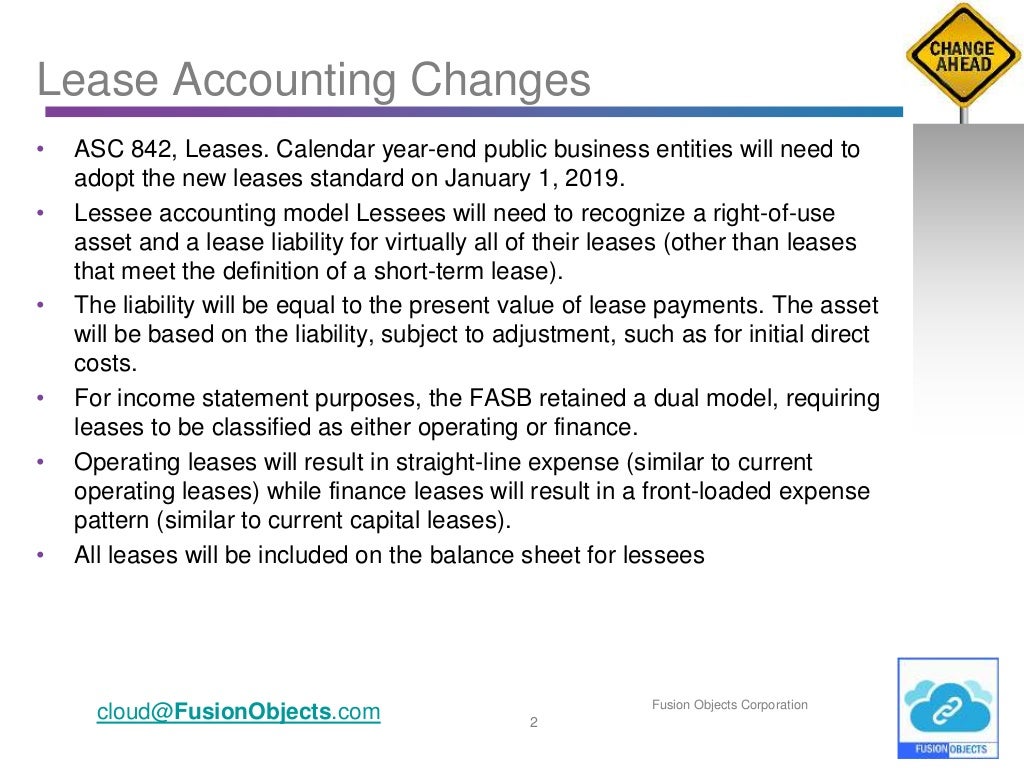

ASC 842, Leases, fundamentally changed the landscape of lease accounting, aiming to provide a more transparent and accurate representation of a company’s leasing activities. It requires lessees to recognize assets and liabilities for most leases, regardless of whether they are classified as operating or finance leases. This shift from the previous standard, ASC 840, which primarily focused on operating leases, brought lease accounting closer to the accounting for owned assets.

Core Principles of ASC 842

ASC 842 centers around the principle that a lease transfers the right to control the use of an identified asset for a period of time in exchange for consideration. The standard focuses on recognizing the economic substance of the lease transaction, rather than its legal form. This means both lessees and lessors must recognize lease assets and lease liabilities on their balance sheets for most leases. The implementation of this standard requires significant judgment and a thorough understanding of the lease agreement terms.

Objectives of ASC 842

The primary objective of ASC 842 is to increase transparency and comparability in financial reporting related to leases. It aims to provide financial statement users with a more complete picture of a company’s assets, liabilities, and financial performance. By requiring the recognition of lease assets and liabilities, the standard provides a more comprehensive view of a company’s obligations and the resources it controls. This enables investors and other stakeholders to make more informed decisions based on a more accurate reflection of a company’s financial position.

Fundamental Differences Between Finance Leases and Operating Leases under ASC 842

ASC 842 categorizes leases into two main types: finance leases and operating leases. The classification depends on whether the lease transfers substantially all the risks and rewards of ownership of an underlying asset. The accounting treatment differs significantly between the two classifications.

The criteria for classifying a lease as a finance lease are as follows:

- Transfer of Ownership: The lease transfers ownership of the asset to the lessee by the end of the lease term.

- Purchase Option: The lease grants the lessee an option to purchase the asset, and the lessee is reasonably certain to exercise that option.

- Lease Term Relative to Asset Life: The lease term is for the major part of the asset’s remaining economic life. A common benchmark is 75% or more of the economic life.

- Present Value of Lease Payments: The present value of the lease payments equals or exceeds substantially all of the asset’s fair value. A common benchmark is 90% or more of the asset’s fair value.

- Asset Specialization: The asset is of such a specialized nature that it is expected to have no alternative use to the lessor at the end of the lease term.

A lease that meets any of these criteria is classified as a finance lease. If a lease does not meet any of these criteria, it is classified as an operating lease.

Here’s a comparison of the key differences in accounting treatment:

| Feature | Finance Lease | Operating Lease |

|---|---|---|

| Lessee’s Accounting | Recognizes a right-of-use (ROU) asset and a lease liability. Amortizes the ROU asset and depreciates it over the lease term (or the asset’s useful life if ownership transfers). Recognizes interest expense on the lease liability. | Recognizes a right-of-use (ROU) asset and a lease liability. Recognizes lease expense, typically on a straight-line basis over the lease term. |

| Lessor’s Accounting | Removes the asset from its books and recognizes a net investment in the lease (lease receivable). Recognizes interest income over the lease term. | Continues to depreciate the asset. Recognizes lease income, typically on a straight-line basis over the lease term. |

For instance, consider a company leasing a piece of equipment. If the lease meets one or more of the finance lease criteria, the lessee will record the equipment as an asset and the lease obligation as a liability on its balance sheet. If the lease doesn’t meet the criteria, it is classified as an operating lease, and the lessee recognizes lease expense on the income statement. The accounting for operating leases is generally simpler than for finance leases, but the key is the impact on the balance sheet and how it presents the company’s overall financial position.

Identifying a Lease under ASC 842

Understanding what constitutes a lease under ASC 842 is fundamental to its application. This involves recognizing the specific criteria that define a lease agreement and differentiating it from other types of contracts. Accurate identification is crucial for correct accounting treatment.

Definition of a Lease under ASC 842

A lease, as defined by ASC 842, is a contract, or part of a contract, that conveys the right to control the use of an identified asset for a period of time in exchange for consideration. This definition centers on the concept of “control” and the “right to use” an identified asset. This right of use is recognized as a right-of-use (ROU) asset on the balance sheet. The ROU asset represents the lessee’s right to use the underlying asset for the lease term.

Key Elements of a Lease Agreement

Several key elements are essential to determine if a contract constitutes a lease under ASC 842. These elements are intertwined and must be present for a contract to be classified as a lease.

- An Identified Asset: The contract must involve a specifically identified asset. This could be a physical asset, such as a building or equipment, or a portion of an asset, such as a specific floor in a building. The asset must be explicitly specified in the contract. For example, a lease agreement might specify a particular model of a forklift, identified by its serial number, rather than simply describing a forklift.

- Right to Control the Use of the Asset: The lessee must have the right to control the use of the asset throughout the lease term. This includes the right to obtain substantially all of the economic benefits from the use of the asset and the right to direct the use of the asset. This means the lessee has the ability to dictate how and for what purpose the asset is used. For instance, if a company leases a delivery truck, it controls the use of that truck by deciding when, where, and how it is used for deliveries.

- Exchange of Consideration: There must be an exchange of consideration, typically in the form of lease payments, for the right to use the asset. The consideration is what the lessee pays the lessor in return for the use of the asset. This includes not only the base lease payments but also any other payments required by the lease agreement.

- A Period of Time: The contract must be for a defined period of time. This is the lease term, which can be a fixed period, a period that is terminable at the option of one or both parties, or a period that is determined by the occurrence of an event.

Scenarios Considered Leases or Not

Determining whether a contract is a lease can sometimes be complex. The following list provides examples of scenarios and their classification based on ASC 842, providing clarity on application.

- Considered a Lease:

- A company leases a warehouse to store its inventory. The warehouse is a specifically identified asset, the company has the right to control its use, and it pays rent.

- A business leases a fleet of vehicles for its sales team. The vehicles are identified by VIN or license plate, and the company controls their use.

- A company leases a portion of a server rack within a data center, specifically designating the servers and related hardware.

- Not Considered a Lease:

- A service contract where a company pays for cleaning services in its office. The company does not have the right to control a specific asset; the cleaning company uses its own equipment.

- A contract for the purchase of goods. The company purchases the goods and takes ownership; it does not have the right to use an asset for a period of time.

- A contract for software as a service (SaaS) where the customer accesses the software remotely without control over the underlying hardware.

Finance Lease Classification Criteria

The classification of a lease as a finance lease under ASC 842 is crucial, as it dictates how the lease is recognized and measured in the financial statements. Proper classification impacts the balance sheet and income statement, influencing key financial ratios and overall financial performance analysis. Understanding the criteria is essential for both lessees and lessors to accurately reflect the economic substance of the lease transaction.

Finance Lease Classification Criteria

A lease is classified as a finance lease if it meets any one of the following five criteria:

- The lease transfers ownership of the underlying asset to the lessee by the end of the lease term.

- The lessee has an option to purchase the underlying asset, and the lessee is reasonably certain to exercise that option.

- The lease term is for the major part of the remaining economic life of the underlying asset.

- The present value of the sum of the lease payments and any lessee-guaranteed residual value equals or exceeds substantially all of the underlying asset’s fair value.

- The underlying asset is of such a specialized nature that it is expected to have no alternative use to the lessor at the end of the lease term.

Finance Lease Classification Criteria Examples

The following table illustrates each finance lease criterion and provides examples of how they are applied in practice.

| Finance Lease Criterion | Description | Example | Application |

|---|---|---|---|

| Transfer of Ownership | The lease agreement explicitly transfers ownership of the asset to the lessee by the end of the lease term. | A company leases a piece of equipment with a lease term of five years, and the agreement states that ownership automatically transfers to the lessee at the end of the five-year period. | This criterion is straightforward. If the lease agreement guarantees ownership transfer, it is classified as a finance lease. The lessee records the asset and a corresponding liability on its balance sheet from the commencement date. |

| Option to Purchase (Reasonably Certain) | The lessee has an option to purchase the asset at the end of the lease term, and it is reasonably certain that the lessee will exercise the option. | A company leases a building with a lease term of ten years. The lease agreement includes a purchase option at the end of the term for a price significantly below the asset’s fair value. Market analysis and the company’s history indicate that the company is highly likely to exercise the purchase option. | Reasonable certainty is assessed based on the specific facts and circumstances. Factors to consider include the purchase price relative to the asset’s expected fair value at the option date, the lessee’s financial condition, and the asset’s intended use. If the purchase option is reasonably certain to be exercised, the lease is classified as a finance lease. |

| Lease Term for the Major Part of Economic Life | The lease term covers the major part of the remaining economic life of the asset. A common benchmark is 75% or more of the asset’s economic life. | A company leases a specialized manufacturing machine with an estimated economic life of ten years. The lease term is eight years. | This criterion requires an assessment of the asset’s economic life. If the lease term is 75% or more of the asset’s economic life, it is considered a finance lease. The 75% threshold is a practical guideline, and other factors can influence the classification. |

| Present Value of Payments and Guaranteed Residual Value | The present value of the lease payments and any lessee-guaranteed residual value equals or exceeds substantially all of the fair value of the asset. A common benchmark is 90% or more of the asset’s fair value. | A company leases a truck with a fair value of $100,000. The lease payments, discounted at the lessee’s incremental borrowing rate, have a present value of $92,000. The lessee guarantees a residual value of $5,000. | The lessee must calculate the present value of lease payments and any guaranteed residual value. If the present value is equal to or greater than 90% of the asset’s fair value, the lease is classified as a finance lease. The discount rate used is typically the lessee’s incremental borrowing rate. |

| Specialized Asset with No Alternative Use | The asset is of such a specialized nature that it is expected to have no alternative use to the lessor at the end of the lease term. | A company leases a custom-built, highly specialized piece of equipment designed solely for its specific manufacturing process. The equipment has no market and cannot be used by other companies. | This criterion focuses on the asset’s utility to the lessor at the end of the lease term. If the asset has no alternative use, it indicates that the lessee essentially controls the asset’s use for its entire economic life, justifying finance lease treatment. |

Transfer of Ownership Criterion

The transfer of ownership criterion is a critical element in classifying a lease under ASC 842. This criterion focuses on whether the lease agreement transfers ownership of the underlying asset to the lessee by the end of the lease term. If this transfer occurs, the lease is classified as a finance lease. Understanding this criterion is essential for proper accounting treatment, impacting how the lessee and lessor recognize assets, liabilities, and expenses.

Implications of Transferring Ownership

When a lease transfers ownership of the asset to the lessee by the end of the lease term, it signifies a finance lease. This classification has significant accounting implications for the lessee. The lessee effectively gains ownership of the asset, even though it was initially acquired through a lease agreement.

The lessee recognizes the asset and a corresponding liability at the commencement of the lease. The initial measurement of the asset and liability is generally based on the present value of the lease payments. The lessee then depreciates the asset over its useful life, which is typically the same as the lease term in this scenario. The lease payments are separated into interest expense and a reduction of the lease liability. This reflects the lessee’s investment in the asset and the associated financing cost.

Factors Considered for Transfer of Ownership Evaluation

Several factors are considered when evaluating whether a lease transfers ownership of the asset to the lessee. The lease agreement itself is the primary source of information. The key element is the presence of a clause stating that ownership will transfer at the end of the lease term.

- Explicit Transfer: The lease agreement explicitly states that the ownership of the asset transfers to the lessee at the end of the lease term. This is the most straightforward scenario and typically leads to a finance lease classification. For example, a lease agreement for a piece of equipment might include a clause that states, “Ownership of the equipment will transfer to the lessee upon the final lease payment.”

- Transfer Through Bargain Purchase Option: The lease may contain a bargain purchase option. A bargain purchase option allows the lessee to purchase the asset at the end of the lease term for a price significantly below its expected fair value at that time. This indicates that the lessee is almost certain to exercise the option, effectively transferring ownership.

- Asset’s Nature and Use: Although less direct, the nature of the asset and its use during the lease term can influence the evaluation. For example, a lease of a customized asset designed specifically for the lessee’s operations might indicate a transfer of ownership, especially if the asset has little value to anyone else at the end of the lease.

Impact on Lease Classification and Accounting

The transfer of ownership criterion directly impacts the lease classification and subsequent accounting treatment. If the criterion is met, the lease is classified as a finance lease. This classification triggers specific accounting requirements for both the lessee and the lessor.

For the lessee, as mentioned previously, the asset and a corresponding liability are recognized on the balance sheet at the commencement date. The asset is then depreciated over its useful life, and the lease payments are allocated between interest expense and a reduction of the lease liability. The interest expense is recognized over the lease term using the effective interest method.

For the lessor, a finance lease results in the derecognition of the leased asset and the recognition of a lease receivable. The lessor recognizes interest income over the lease term. The lease payments are allocated between the reduction of the lease receivable and the recognition of interest income. The accounting treatment reflects that the lessor has essentially financed the asset for the lessee, and the lessee has assumed the risks and rewards of ownership.

For instance, consider a company leasing a specialized manufacturing machine. The lease agreement explicitly states that ownership transfers to the lessee at the end of the five-year lease term for a nominal amount. This satisfies the transfer of ownership criterion. The lessee would recognize the machine as an asset and a corresponding lease liability on its balance sheet at the commencement date. The machine would be depreciated over its useful life, and the lease payments would be allocated between interest expense and the reduction of the lease liability.

Purchase Option Criterion

The purchase option criterion is a key aspect of ASC 842 that helps determine whether a lease should be classified as a finance lease. This criterion focuses on whether the lessee has a right to purchase the underlying asset at the end of the lease term, and if so, whether the lessee is reasonably certain to exercise that purchase option. The accounting treatment significantly differs depending on whether the lease is classified as a finance lease or an operating lease, making this criterion crucial for accurate financial reporting.

Purchase Option Defined

A purchase option grants the lessee the right, but not the obligation, to purchase the underlying asset at the end of the lease term for a specified price. This price is often a pre-determined amount, or it may be based on a formula or appraisal. The classification of the lease depends heavily on whether the lessee is deemed reasonably certain to exercise this option. If the lessee is reasonably certain, the lease is classified as a finance lease, reflecting the substance of a sale.

Conditions for Reasonable Certainty

Reasonable certainty is not defined with a bright-line test in ASC 842, but rather relies on professional judgment. This assessment should be made at the lease commencement date, considering all relevant facts and circumstances. The standard emphasizes that the lessee must be highly likely to exercise the option, not just that it is possible or probable.

Situations Indicating Reasonable Certainty

Several situations would indicate that a lessee is reasonably certain to exercise a purchase option. It is important to consider all relevant factors and circumstances when evaluating whether the lessee is reasonably certain to exercise the purchase option.

- Bargain Purchase Option: The exercise price is significantly below the expected fair value of the asset at the end of the lease term. This implies that purchasing the asset is economically advantageous for the lessee. For example, if the fair value of a piece of equipment at the end of the lease is estimated to be $100,000, and the purchase option allows the lessee to buy it for $10,000, the option is likely a bargain.

- Asset Improvements: The lessee has made significant leasehold improvements to the asset that would make it economically unfeasible for the lessee to move to a different asset at the end of the lease term. This is especially relevant when the improvements are not easily removable or transferable.

- Asset Customization: The asset is highly specialized or customized to the lessee’s specific needs, making it difficult or costly for the lessee to replace it with another asset. This indicates the lessee’s dependence on the asset and, therefore, a higher likelihood of exercising the purchase option.

- Economic Incentive: The lessee has an economic incentive to exercise the purchase option, such as maintaining a competitive advantage, securing a critical asset for operations, or avoiding significant costs associated with returning the asset to the lessor.

- Lease Term Proximity: The purchase option becomes exercisable only a short time before the end of the lease term. In this case, the lessee’s intent is to buy the asset.

Lease Term Criterion

Understanding the lease term is crucial for correctly classifying a lease under ASC 842. The lease term significantly influences the present value calculations and, consequently, the classification as either a finance lease or an operating lease. Accurate determination of the lease term is vital for compliance with the standard.

Calculation of the Lease Term

The lease term encompasses the period during which a lessee has the right to use an asset, plus any periods covered by an option to extend the lease if the lessee is reasonably certain to exercise that option, and any periods covered by an option to purchase the asset if the lessee is reasonably certain to exercise that option. The calculation hinges on establishing the commencement date and the lease period.

The commencement date is the date on which the lessor makes the underlying asset available for use by a lessee. The lease period refers to the duration of the lease, which begins on the commencement date and extends through the end of the lease term.

Effect of Renewal Options

Renewal options play a critical role in determining the lease term. If a lessee has an option to extend the lease, that extension period is included in the lease term if the lessee is reasonably certain to exercise the option. This assessment of “reasonable certainty” involves evaluating various factors, including economic incentives to exercise the option, such as the lease payments compared to market rates, and the lessee’s past practices.

To illustrate the concept, consider the following:

- If the lease agreement includes a renewal option at a below-market rate, the lessee is more likely to exercise the option, increasing the probability of its inclusion in the lease term.

- Conversely, if the renewal option is priced significantly above market rates, the lessee is less likely to exercise it, and the renewal period might not be included in the lease term.

Lease Term Calculation Example

Consider a lease agreement for equipment with the following terms: a non-cancellable lease term of 5 years, an option to extend the lease for an additional 3 years at a rate 10% below market value, and no option to purchase the asset. The lessee has a history of renewing leases under similar terms.

In this scenario, the lease term calculation is as follows:

Initial lease term: 5 years

Renewal option: 3 years (included because the lessee is reasonably certain to exercise the option due to the favorable pricing and historical behavior)

Total lease term: 8 years

Present Value Criterion

The present value criterion is a crucial aspect of ASC 842’s finance lease classification. This criterion determines whether a lease should be classified as a finance lease based on the economic substance of the transaction. It centers on comparing the present value of the lease payments to the fair value of the underlying asset. If the present value of the lease payments equals or exceeds a significant portion (generally, 90%) of the asset’s fair value, the lease is often classified as a finance lease. Understanding how to calculate this present value is essential for accurate lease accounting.

Calculating Present Value of Lease Payments

Calculating the present value of lease payments involves discounting all future lease payments back to their present value using a specific discount rate. This process reflects the time value of money, recognizing that money received today is worth more than the same amount received in the future. The present value calculation is a fundamental step in determining the lease classification under ASC 842.

The formula for calculating the present value (PV) of a single payment is:

PV = FV / (1 + r)^n

Where:

- FV = Future Value (the lease payment amount)

- r = Discount rate (interest rate)

- n = Number of periods (e.g., years)

To calculate the present value of a series of lease payments, the present value of each payment is calculated individually and then summed. For example, if the lease payments are an annuity (equal payments over equal periods), the following formula can be used:

PV = PMT * [1 – (1 + r)^-n] / r

Where:

- PMT = Periodic payment amount

- r = Discount rate

- n = Number of periods

Discount Rate Used in Present Value Calculation

The discount rate plays a critical role in the present value calculation. ASC 842 provides specific guidance on the appropriate discount rate to use.

The lessee should use the interest rate implicit in the lease if that rate is readily determinable. If the interest rate implicit in the lease is not readily determinable, the lessee should use its incremental borrowing rate. The incremental borrowing rate is the rate of interest that a lessee would have to pay to borrow, on a collateralized basis, over a similar term, an amount equal to the lease payments in a similar economic environment.

The lessor should use the interest rate implicit in the lease. This is the rate that causes the aggregate present value of (a) the lease payments from the lessee to the lessor and (b) any lessee-guaranteed residual value of the underlying asset to equal the sum of (a) the fair value of the underlying asset and (b) any initial direct costs of the lessor.

Detailed Example of Present Value Calculation

Let’s consider a lease agreement for equipment with the following terms:

- Fair Value of Equipment: $100,000

- Lease Term: 5 years

- Annual Lease Payments: $25,000 (paid at the end of each year)

- Lessee’s Incremental Borrowing Rate: 6%

To determine if this lease meets the 90% threshold for finance lease classification based on the present value criterion, we need to calculate the present value of the lease payments. We will use the annuity formula, assuming annual payments.

Here’s how the present value is calculated:

| Year | Lease Payment | Discount Factor (6%) | Present Value |

|—|—|—|—|

| 1 | $25,000 | 0.943 | $23,575 |

| 2 | $25,000 | 0.890 | $22,250 |

| 3 | $25,000 | 0.840 | $21,000 |

| 4 | $25,000 | 0.792 | $19,800 |

| 5 | $25,000 | 0.747 | $18,675 |

| Total | | | $105,300 |

The present value of the lease payments is $105,300. Since this amount exceeds 90% of the fair value of the equipment ($100,000 * 90% = $90,000), this lease would likely meet the present value criterion for classification as a finance lease. This calculation is critical for lessees and lessors to correctly account for the lease under ASC 842.

Asset’s Economic Life Criterion

The asset’s economic life criterion is a crucial aspect of ASC 842, determining whether a lease should be classified as a finance lease. This criterion focuses on the relationship between the lease term and the asset’s economic lifespan, aiming to capture situations where the lessee effectively obtains the economic benefits of the asset over a substantial portion of its useful life. Understanding this criterion is essential for accurate lease accounting and financial reporting.

Economic Life Definition

The economic life of an asset, for the purpose of lease classification, refers to the period over which the asset is expected to be economically usable by one or more users. It represents the duration for which the asset can generate economic benefits. This includes the period during which the asset can be used productively, generate revenue, or provide other economic value, even if the asset’s physical condition may deteriorate.

Factors Considered in Evaluating Asset’s Economic Life

Several factors are considered when evaluating an asset’s economic life to ensure proper lease classification under ASC 842. These factors provide a comprehensive understanding of the asset’s potential useful lifespan.

- Technological Obsolescence: Rapid technological advancements can significantly shorten an asset’s economic life. For example, computers or smartphones become obsolete as newer models with advanced features are released.

- Market Demand: Changes in market demand can impact an asset’s economic life. If demand for a specific product or service decreases, the asset used to produce it might become less valuable sooner.

- Physical Deterioration: The physical condition of the asset is a key factor. Assets that are subject to wear and tear, such as vehicles or machinery, have a limited lifespan based on their ability to function.

- Legal or Contractual Limitations: Legal or contractual restrictions can influence an asset’s economic life. Permits, licenses, or contractual agreements might limit the period the asset can be used.

- Maintenance and Upkeep: The level of maintenance and upkeep impacts the asset’s lifespan. Regular maintenance can extend the asset’s economic life, while lack of maintenance can shorten it.

- Usage Patterns: The intensity of asset usage is another important consideration. Assets used heavily, such as industrial equipment, may have a shorter economic life compared to those used less frequently.

Impact of the Economic Life Criterion on Lease Classification

The economic life criterion directly influences the classification of a lease as either a finance lease or an operating lease. If the lease term covers a significant portion of the asset’s economic life, it is more likely to be classified as a finance lease.

Asc 842 finance lease criteria – Significant Portion Threshold: ASC 842 defines a “major part” of the asset’s economic life as a threshold for finance lease classification. If the lease term equals or exceeds 75% of the asset’s economic life, the lease meets one of the criteria for finance lease classification.

Lease Term >= 75% of Asset’s Economic Life = Finance Lease Classification (if no other criteria are met, and no exceptions apply)

Illustrative Example:

Consider a piece of manufacturing equipment with an estimated economic life of 10 years. If the lease term is 8 years (80% of the economic life), the lease meets the economic life criterion, and is classified as a finance lease, provided no other criteria are met and exceptions are not applicable. This is because the lease term covers a significant portion (greater than 75%) of the equipment’s economic life.

Impact on Accounting:

The classification of a lease as a finance lease significantly impacts the accounting treatment. The lessee recognizes a right-of-use (ROU) asset and a lease liability on the balance sheet. The ROU asset is amortized over the lease term, and the lease liability is reduced with each lease payment. In contrast, an operating lease results in the lessee recognizing lease expense over the lease term.

Accounting for Finance Leases (Lessee)

Accounting for finance leases under ASC 842 requires lessees to recognize assets and liabilities on their balance sheets, reflecting the economic substance of the transaction. This differs significantly from the previous guidance, ASC 840, where operating leases were often kept off-balance sheet. The following sections detail the accounting treatment from the lessee’s perspective, covering initial and subsequent measurement, as well as illustrative journal entries.

Initial Measurement of the Right-of-Use Asset and Lease Liability for a Finance Lease

At the commencement date of a finance lease, the lessee must measure both the right-of-use (ROU) asset and the lease liability. These amounts are typically based on the present value of the lease payments.

The initial measurement process involves these key steps:

- Lease Liability: The lease liability is initially measured at the present value of the lease payments. The present value is calculated using the discount rate. If the rate implicit in the lease is readily determinable, the lessee should use that rate. Otherwise, the lessee uses its incremental borrowing rate.

- Right-of-Use Asset: The ROU asset is initially measured at the amount of the lease liability, plus any initial direct costs incurred by the lessee, less any lease incentives received.

The discount rate is a crucial element in this calculation.

The discount rate is the interest rate the lessee would pay to borrow an amount equal to the lease payments in a similar transaction. This rate reflects the lessee’s creditworthiness and the terms of the lease.

Subsequent Measurement of the Right-of-Use Asset and Lease Liability

After the initial recognition, both the ROU asset and the lease liability are subject to subsequent measurement. The accounting treatment for each differs.

Here’s how subsequent measurement is handled:

- Lease Liability: The lease liability is reduced as lease payments are made. Each payment is allocated between a reduction of the liability and interest expense. The interest expense is recognized over the lease term, using the effective interest method.

- Right-of-Use Asset: The ROU asset is amortized over the lease term. For a finance lease, the lessee depreciates the ROU asset in a manner consistent with its normal depreciation policy for similar assets owned.

This approach mirrors the accounting for an asset purchased with debt.

Detailed Example of Journal Entries for a Finance Lease (Lessee)

To illustrate the accounting for a finance lease, consider the following scenario:

- A company (Lessee) leases equipment for five years.

- The annual lease payment is $10,000, payable at the end of each year.

- The interest rate implicit in the lease is 5%.

- The present value of the lease payments (lease liability) is $43,295.

- Initial direct costs paid by the lessee: $1,000.

Here are the journal entries:

- At Lease Commencement:

- Debit: Right-of-Use Asset: $44,295 ($43,295 (Lease Liability) + $1,000 (Initial Direct Costs))

- Credit: Lease Liability: $43,295

- Credit: Cash: $1,000 (Initial Direct Costs)

- At the End of Year 1 (Payment and Interest):

- Interest Expense Calculation: $43,295 (Beginning Lease Liability) * 5% = $2,165

- Lease Payment Allocation: $10,000 – $2,165 = $7,835 (Principal Reduction)

- Journal Entries:

- Debit: Interest Expense: $2,165

- Debit: Lease Liability: $7,835

- Credit: Cash: $10,000

- Depreciation Expense: Assume the equipment is depreciated using the straight-line method over 5 years: $44,295 / 5 = $8,859

- Debit: Depreciation Expense: $8,859

- Credit: Accumulated Depreciation: $8,859

- At the End of Year 2: The process is repeated. The interest expense is calculated based on the remaining lease liability after the first payment.

- Beginning Lease Liability: $43,295 – $7,835 = $35,460

- Interest Expense Calculation: $35,460 * 5% = $1,773

- Lease Payment Allocation: $10,000 – $1,773 = $8,227 (Principal Reduction)

- Journal Entries:

- Debit: Interest Expense: $1,773

- Debit: Lease Liability: $8,227

- Credit: Cash: $10,000

- Depreciation Expense: $8,859

- Debit: Depreciation Expense: $8,859

- Credit: Accumulated Depreciation: $8,859

This example demonstrates the key accounting aspects of a finance lease for the lessee, including initial recognition, subsequent measurement of the lease liability and the right-of-use asset, and the related journal entries. The calculations and entries are repeated annually throughout the lease term, adjusting for interest and principal payments.

Accounting for Finance Leases (Lessor)

The accounting for finance leases from the lessor’s perspective differs significantly from that of the lessee. The lessor, in essence, is financing the lessee’s use of an asset. The accounting treatment reflects this economic substance, recognizing the lease as a form of financing or a sale. This involves recognizing interest income over the lease term and derecognizing the leased asset from the lessor’s books. The following sections detail the initial and subsequent measurement considerations for the lessor, along with illustrative journal entries.

Initial Measurement of the Net Investment in the Lease

The initial measurement of the net investment in a finance lease for the lessor is crucial, as it sets the stage for subsequent accounting. This net investment represents the present value of all lease payments plus any unguaranteed residual value accruing to the lessor. The lessor effectively replaces the asset with a receivable (the net investment in the lease) on its balance sheet. This receivable is then amortized over the lease term.

The net investment in the lease is calculated as follows:

Net Investment = Present Value of Lease Payments + Present Value of Unguaranteed Residual Value

Here’s a breakdown:

- Present Value of Lease Payments: This is the sum of the present values of all lease payments due from the lessee over the lease term. Each payment is discounted back to its present value using the interest rate implicit in the lease. If the implicit rate is not readily determinable, the lessor’s incremental borrowing rate is used.

- Present Value of Unguaranteed Residual Value: This is the present value of any residual value of the leased asset that is not guaranteed by the lessee or a third party. The unguaranteed residual value is the estimated value of the asset at the end of the lease term, which the lessor expects to recover.

Subsequent Measurement of the Net Investment in the Lease, Asc 842 finance lease criteria

After the initial measurement, the lessor accounts for the finance lease by recognizing interest income and reducing the net investment in the lease. The net investment in the lease is increased by the interest earned and decreased by the lease payments received. This process continues throughout the lease term.

Understanding ASC 842 finance lease criteria is crucial for accurate financial reporting. The complexities of lease accounting often mirror the intricacies of managing funds, a skill honed at institutions like tulane finance. Analyzing these criteria helps determine whether a lease should be classified as a finance lease, impacting how assets and liabilities are recognized on the balance sheet under ASC 842.

The interest income is recognized using the effective interest method. This method allocates the interest income over the lease term in a way that results in a constant rate of return on the net investment. The interest income is calculated by multiplying the net investment in the lease at the beginning of the period by the implicit interest rate (or the lessor’s incremental borrowing rate, if applicable).

Each lease payment received is allocated between a reduction of the net investment and the recognition of interest income. The portion of the lease payment that represents interest income is calculated as described above, and the remaining portion reduces the net investment in the lease. The asset is effectively written off over the lease term, as the lease payments are considered the return on the asset. The lessor will also need to account for any changes in the unguaranteed residual value if the estimate changes.

Detailed Example of Journal Entries for a Finance Lease (Lessor)

Let’s consider a simplified example. A lessor leases equipment to a lessee under a finance lease. The following data is available:

- Fair Value of Equipment: $100,000

- Lease Term: 5 years

- Annual Lease Payments: $26,380 (payable at the end of each year)

- Implicit Interest Rate: 10%

- Unguaranteed Residual Value: $10,000

First, we need to calculate the initial net investment. The present value of the lease payments is calculated using the present value of an annuity formula. The present value of the unguaranteed residual value is calculated by discounting the $10,000 back to its present value at a 10% discount rate.

Present Value of Lease Payments = $26,380 * PV of annuity due at 10% for 5 years = $26,380 * 3.7908 = $100,000 (approximately)

Present Value of Unguaranteed Residual Value = $10,000 / (1 + 0.10)^5 = $6,209 (approximately)

Net Investment in the Lease = $100,000 + $6,209 = $106,209

Here are the journal entries:

At Lease Commencement:

To record the lease inception:

Debit: Lease Receivable (Net Investment in the Lease) $106,209

Understanding ASC 842 finance lease criteria is crucial for accurate financial reporting. Companies evaluating their assets often consider various financing options, and for those looking to upgrade, financing for windows presents a practical solution. This helps to manage cash flow while meeting specific needs, however, proper classification under ASC 842 remains essential for transparency.

Credit: Equipment $100,000

Credit: Unearned Interest Income $6,209

This entry recognizes the lease receivable (net investment), removes the equipment from the books, and records the unearned interest income (difference between the fair value and the net investment).

At the End of Year 1:

To record the receipt of the first lease payment and the recognition of interest income:

Debit: Cash $26,380

Credit: Lease Receivable $16,380 (Principal Reduction)

Credit: Interest Income $10,000 (Interest Earned – $106,209 * 10%)

This entry records the cash received, reduces the lease receivable, and recognizes interest income. The $10,000 interest income represents the interest earned during the year.

At the End of Year 2:

To record the receipt of the second lease payment and the recognition of interest income. The calculation is as follows:

Beginning Balance: $106,209 – $16,380 = $89,829

Interest Income: $89,829 * 10% = $8,983 (approximately)

Reduction in Principal: $26,380 – $8,983 = $17,397 (approximately)

Debit: Cash $26,380

Credit: Lease Receivable $17,397 (Principal Reduction)

Credit: Interest Income $8,983

This process would continue for the remaining years of the lease term, with the interest income decreasing and the principal reduction increasing each year, based on the effective interest method. At the end of the lease term, the lease receivable balance should be equal to the unguaranteed residual value.

Disclosure Requirements for Finance Leases: Asc 842 Finance Lease Criteria

ASC 842 mandates comprehensive disclosures to provide financial statement users with a clear understanding of a company’s leasing activities. These disclosures aim to enhance transparency regarding the nature, extent, and financial effects of lease arrangements. The requirements differ depending on whether the company is the lessee or the lessor. This section details the specific disclosure requirements for finance leases, organized by the perspective of the lessee and the lessor.

Lessee Disclosure Requirements

Lessee disclosures are crucial for understanding the financial impact of lease obligations on a company’s financial position and performance. These disclosures provide insights into the assets and liabilities recognized due to finance leases.

To ensure clarity, here are the required disclosures for lessees:

- Amounts Recognized in the Statement of Financial Position: Lessees must disclose the right-of-use (ROU) assets and lease liabilities recognized on the balance sheet. This includes a description of the assets by class of underlying asset (e.g., real estate, vehicles).

- Amounts Recognized in the Statement of Income: Lessees must disclose the following amounts for each period:

- Amortization expense for the ROU assets.

- Interest expense on lease liabilities.

- Variable lease payments.

- Sublease income, if applicable.

- Cash Flows: Disclose the cash paid for leases, separated into operating and financing activities.

- Maturity Analysis of Lease Liabilities: A schedule of future lease payments, disaggregated by year, should be provided. This helps users understand the timing of future cash outflows related to lease obligations.

- Other Qualitative and Quantitative Information: This includes:

- The nature of the company’s leasing activities.

- Terms and conditions of lease agreements, including any options to extend or purchase the leased asset.

- Restrictions or covenants imposed by lease agreements.

- The total amount of lease assets.

Lessor Disclosure Requirements

Lessors also have specific disclosure requirements to provide users with information about their leasing activities. These disclosures help users assess the lessor’s financial performance and position related to its leasing business.

Here’s a breakdown of the required disclosures for lessors:

- Components of the Net Investment in the Lease: Lessors must disclose the components of the net investment in the lease, including:

- The gross investment in the lease.

- The unguaranteed residual asset.

- The present value of the lease payments receivable.

- Amounts Recognized in the Statement of Income: Lessors must disclose the following amounts for each period:

- Lease income.

- Variable lease payments.

- Selling profit or loss (for sales-type leases).

- Cash Flows: Disclose the cash received from leases, categorized into operating and investing activities.

- Maturity Analysis of Lease Payments: A schedule of future lease payments, disaggregated by year, should be provided.

- Other Qualitative and Quantitative Information: This includes:

- The nature of the company’s leasing activities.

- A general description of the lessor’s portfolio of lease assets.

- The accounting policies used for leases.

- Any significant assumptions used in measuring the net investment in the lease.

Hypothetical Example of a Finance Lease Disclosure Note

This example illustrates a simplified disclosure note for a lessee. Actual disclosures would be more detailed and specific to the company’s circumstances.

Note X: Leases

The Company leases various equipment and real estate under finance leases.

Right-of-Use Assets and Lease Liabilities

The Company’s right-of-use assets and lease liabilities as of December 31, 2023, are as follows:

| (In Thousands) | December 31, 2023 |

|---|---|

| Right-of-Use Assets: | |

| Equipment | $XXX |

| Real Estate | $XXX |

| Total Right-of-Use Assets | $XXX |

| Lease Liabilities: | |

| Current | $XXX |

| Non-Current | $XXX |

| Total Lease Liabilities | $XXX |

Lease Expense

For the year ended December 31, 2023, lease expense related to finance leases was:

- Amortization of Right-of-Use Assets: $XXX

- Interest Expense on Lease Liabilities: $XXX

Maturity of Lease Liabilities

Future minimum lease payments under finance leases as of December 31, 2023, are as follows:

| (In Thousands) | 2024 | 2025 | 2026 | 2027 | Thereafter | Total |

|---|---|---|---|---|---|---|

| Minimum Lease Payments | $XXX | $XXX | $XXX | $XXX | $XXX | $XXX |

| Less: Interest | ($XXX) | ($XXX) | ($XXX) | ($XXX) | ($XXX) | ($XXX) |

| Present Value of Lease Payments | $XXX | $XXX | $XXX | $XXX | $XXX | $XXX |

The Company has options to extend certain lease agreements. These options are not included in the lease liability calculation because they are not reasonably certain to be exercised.

Impact of ASC 842 on Financial Statements

ASC 842 significantly reshapes how finance leases are presented on a company’s financial statements. This shift affects the balance sheet, income statement, and statement of cash flows, leading to a more transparent and comprehensive view of a company’s financial obligations and asset utilization. Understanding these impacts is crucial for investors, creditors, and other stakeholders.

Effects on the Balance Sheet

The balance sheet reflects the assets and liabilities of a company at a specific point in time. Finance leases, under ASC 842, have a direct impact on this statement, increasing both assets and liabilities.

The primary effects are:

- Right-of-Use (ROU) Asset: A lessee recognizes an ROU asset, representing the right to use the leased asset over the lease term. This asset is initially measured at the present value of the lease payments. For example, if a company leases equipment and the present value of the lease payments is $100,000, the balance sheet will reflect an ROU asset of $100,000. The ROU asset is subsequently amortized over the lease term (or the asset’s useful life, if shorter).

- Lease Liability: A lessee also recognizes a lease liability, which represents the obligation to make lease payments. This liability is initially measured at the same amount as the ROU asset (the present value of the lease payments). In the example above, the lease liability would also be $100,000. The lease liability is reduced as lease payments are made.

- Impact on Total Assets and Liabilities: The recognition of ROU assets and lease liabilities increases both the total assets and total liabilities on the balance sheet. This can affect key financial ratios, as discussed later.

Effects on the Income Statement

The income statement reports a company’s financial performance over a specific period. Finance leases impact the income statement through depreciation expense and interest expense.

The key impacts are:

- Depreciation Expense: The lessee depreciates the ROU asset over the lease term (or the asset’s useful life, if shorter). This depreciation expense reduces net income. If the equipment mentioned earlier has a lease term of 5 years, the depreciation expense each year would be $20,000 (assuming straight-line depreciation).

- Interest Expense: The lessee recognizes interest expense on the lease liability. The interest expense is calculated based on the effective interest rate implicit in the lease. The interest expense decreases net income. As lease payments are made, the portion allocated to interest changes.

- Expense Recognition Pattern: Unlike operating leases (under ASC 840), where lease expense is recognized on a straight-line basis, finance leases result in a front-loaded expense pattern. The combination of depreciation and interest expense generally results in higher expenses in the earlier years of the lease term.

Effects on the Statement of Cash Flows

The statement of cash flows tracks the movement of cash in and out of a company. Finance leases affect the statement of cash flows differently than operating leases.

The key impacts are:

- Cash Payments for Lease: Lease payments are divided into two components: principal and interest. The principal portion of the lease payment is classified as a financing activity. The interest portion is classified as an operating activity.

- Depreciation Expense: Depreciation expense is a non-cash expense. It is added back to net income in the operating activities section to reconcile net income to cash flow from operations.

- Impact on Cash Flows: The classification of lease payments affects the presentation of cash flows. A significant portion of the lease payments, representing the principal, is classified under financing activities.

Comparison of Finance Leases versus Operating Leases

The accounting treatment of finance leases and operating leases differs significantly, leading to varying impacts on the financial statements.

Here’s a comparison:

| Feature | Finance Lease (ASC 842) | Operating Lease (ASC 842) |

|---|---|---|

| Balance Sheet | ROU asset and lease liability recognized | No ROU asset or lease liability recognized |

| Income Statement | Depreciation expense and interest expense recognized | Straight-line lease expense recognized |

| Cash Flow Statement | Principal portion of lease payments in financing activities, interest portion in operating activities | Entire lease payment in operating activities |

| Expense Recognition | Front-loaded expense pattern | Straight-line expense pattern |

Detailed Illustration of Impact on Financial Ratios

The recognition of finance leases significantly influences key financial ratios, potentially affecting a company’s perceived financial health. Let’s consider the impact on the following ratios:

- Debt-to-Equity Ratio: This ratio measures the proportion of debt a company uses to finance its assets relative to the amount of equity. The formula is:

- Return on Assets (ROA): This ratio measures how efficiently a company uses its assets to generate earnings. The formula is:

- Interest Coverage Ratio: This ratio measures a company’s ability to meet its interest obligations. The formula is:

Debt-to-Equity Ratio = Total Liabilities / Shareholders’ Equity

The recognition of a lease liability increases total liabilities, which would increase the debt-to-equity ratio. This could potentially signal higher financial risk to investors.

For example, if a company has $1,000,000 in total liabilities and $500,000 in shareholders’ equity, the debt-to-equity ratio is 2.0. If the company then enters into a finance lease with a lease liability of $100,000, the total liabilities become $1,100,000, and the debt-to-equity ratio increases to 2.2. (1,100,000 / 500,000).

Return on Assets = Net Income / Average Total Assets

The recognition of an ROU asset increases total assets. If net income remains the same (or doesn’t increase proportionately), the ROA decreases. This might suggest a less efficient use of assets, even though the company is simply using leased assets.

Continuing the earlier example, if the company’s net income is $100,000, and the total assets were $2,000,000, the ROA is 5%. With the new ROU asset of $100,000 (increasing total assets to $2,100,000) and assuming net income stays the same, the ROA would decrease to 4.76%. (100,000 / 2,100,000)

Interest Coverage Ratio = Earnings Before Interest and Taxes (EBIT) / Interest Expense

Finance leases increase interest expense, which can decrease the interest coverage ratio. A lower ratio might indicate a greater risk of default.

For instance, if a company has an EBIT of $200,000 and interest expense of $20,000, the interest coverage ratio is 10. If the finance lease results in an additional $5,000 in interest expense, the interest coverage ratio would decrease to 8 (200,000 / 25,000).

These examples highlight how ASC 842 can influence a company’s financial ratios. Understanding these effects is crucial for interpreting financial statements and assessing a company’s financial performance and risk profile. The change from operating lease treatment to finance lease treatment often requires analysts to adjust their models and calculations to accurately reflect a company’s financial position.