Introduction to Asset Finance

Asset finance is a financial solution that enables businesses to acquire assets without using their own capital. It allows companies to spread the cost of an asset over its useful life, improving cash flow and freeing up capital for other investments. This financing option is a versatile tool for businesses of all sizes, helping them to access the equipment and resources they need to grow and operate efficiently.

Definition and Core Function

Asset finance, at its core, provides funding for the acquisition of assets. The core function is to facilitate the purchase or lease of equipment, machinery, vehicles, and other business assets. This is achieved by the finance provider purchasing the asset and allowing the business to use it in exchange for regular payments, or by providing a loan secured against the asset.

Types of Assets Commonly Financed

A wide range of assets can be financed through asset finance agreements. The specific assets eligible for financing vary depending on the lender and the type of agreement.

- Equipment and Machinery: This includes a broad category, from manufacturing equipment like CNC machines and robotic arms to construction machinery like excavators and bulldozers. It also covers office equipment such as computers, printers, and servers.

- Vehicles: Commercial vehicles, including trucks, vans, and trailers, are frequently financed. Passenger vehicles used for business purposes are also common subjects of asset finance agreements.

- Technology: Software licenses, IT hardware, and other technological assets are often financed, allowing businesses to stay up-to-date with the latest technology without significant upfront costs.

- Property: While typically associated with mortgages, some asset finance providers offer funding for commercial property acquisition or improvement. This can be useful for expanding business premises.

- Other Assets: Depending on the lender and the industry, other assets like aircraft, medical equipment, and renewable energy installations can also be financed.

Key Benefits of Utilizing Asset Finance for Businesses

Asset finance offers several advantages that can significantly benefit businesses, influencing financial performance and operational efficiency.

- Improved Cash Flow: By spreading the cost of an asset over time, asset finance reduces the immediate financial burden on a business. This allows companies to conserve cash, which can then be used for other purposes, such as working capital, marketing, or expansion.

- Access to Assets: Asset finance makes it easier for businesses to acquire the assets they need, even if they don’t have the capital to purchase them outright. This is particularly beneficial for startups and small to medium-sized enterprises (SMEs) that may not have access to large amounts of capital.

- Tax Efficiency: Depending on the type of asset finance agreement and the jurisdiction, businesses may be able to claim tax deductions on the payments made. This can reduce the overall cost of the asset and improve profitability.

- Budgeting and Predictability: Asset finance agreements typically involve fixed monthly payments, making it easier for businesses to budget and forecast their expenses. This predictability can help businesses manage their finances more effectively.

- Protection Against Obsolescence: Leasing agreements, in particular, can protect businesses from the risk of technological obsolescence. At the end of the lease term, the business can upgrade to newer equipment, ensuring that they are always using the latest technology.

- Preservation of Credit Lines: Utilizing asset finance allows businesses to preserve their existing credit lines with banks and other lenders. This can be crucial for accessing working capital or other forms of financing when needed.

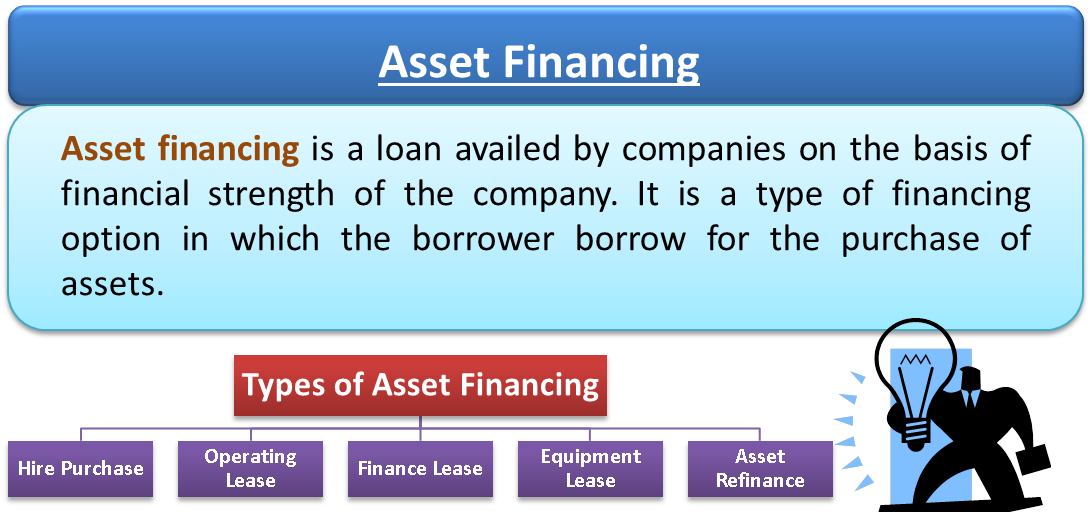

Types of Asset Finance

Asset finance provides businesses with various options to acquire assets without upfront capital expenditure. These options cater to diverse needs, from short-term equipment usage to long-term ownership. Understanding the different types of asset finance is crucial for making informed decisions that align with a company’s financial strategy and operational requirements.

Leasing

Leasing allows businesses to use an asset for a specified period in exchange for regular payments. The ownership of the asset remains with the lessor (the finance provider).

- Operating Lease: This type of lease is typically used for assets that are subject to rapid technological advancements or have a shorter lifespan. The lessee (the business using the asset) pays rentals for the use of the asset, but does not own it at the end of the lease term. The lessor bears the risk of obsolescence and usually handles maintenance and disposal.

- Finance Lease (Capital Lease): A finance lease transfers substantially all the risks and rewards of ownership to the lessee. The lessee essentially owns the asset for accounting purposes, and the lease payments are treated as a form of debt. At the end of the lease term, the lessee may have the option to purchase the asset at a predetermined price or a fair market value.

Advantages of leasing include:

- Reduced upfront capital outlay.

- Predictable monthly payments, aiding in budgeting.

- Potential tax benefits (lease payments are often tax-deductible).

- Access to the latest technology or equipment without the burden of ownership.

- Reduced risk of obsolescence, especially with operating leases.

Disadvantages of leasing include:

- No ownership of the asset at the end of the lease term (in operating leases).

- Total cost may exceed the purchase price over the asset’s lifespan.

- Restrictions on the use or modification of the asset.

- Potential penalties for early termination of the lease.

Hire Purchase

Hire purchase enables businesses to acquire ownership of an asset over time. The asset is effectively purchased in installments, with ownership transferring to the buyer once all payments are made.

- The buyer gains immediate use of the asset.

- Ownership is transferred after the final payment.

- Interest is charged on the outstanding balance.

Advantages of hire purchase include:

- Immediate use of the asset.

- Ownership at the end of the payment term.

- Fixed payment schedules, simplifying budgeting.

- Potential tax benefits (depreciation of the asset).

Disadvantages of hire purchase include:

- Higher overall cost compared to cash purchase due to interest charges.

- The asset is security for the finance agreement.

- The asset is not owned until all payments are made.

- May require a down payment.

Asset Refinance

Asset refinance involves obtaining a new loan to pay off an existing asset finance agreement. This can be done to secure better terms, release equity, or free up cash flow.

- Businesses can refinance an existing asset to obtain more favorable terms.

- It allows businesses to free up capital tied up in assets.

- Refinancing can reduce monthly payments or change the payment structure.

Advantages of asset refinance include:

- Potentially lower interest rates.

- Improved cash flow.

- Release of equity for other business purposes.

- Consolidation of debt.

Disadvantages of asset refinance include:

- Fees associated with refinancing.

- May extend the repayment term.

- Could increase the overall cost if interest rates are higher.

- Requires creditworthiness to qualify.

Contract Hire

Contract hire is similar to an operating lease, but it often includes additional services, such as maintenance, insurance, and breakdown cover.

- This option is often used for vehicles.

- The provider takes on the responsibility for managing the asset.

Advantages of contract hire include:

- Fixed monthly costs.

- Maintenance and servicing included.

- Reduced administrative burden.

- Access to a new asset regularly.

Disadvantages of contract hire include:

- No ownership of the asset.

- Mileage restrictions may apply.

- Early termination penalties.

- Potentially higher monthly costs than other options.

Comparison Table of Asset Finance Products

The following table summarizes the key features of each asset finance product, highlighting the key differences and providing a comparison for easier decision-making.

| Feature | Leasing | Hire Purchase | Asset Refinance | Contract Hire |

|---|---|---|---|---|

| Ownership | Lessor (unless finance lease with purchase option) | Transferred to buyer after all payments | Depends on the underlying asset ownership | Lessor |

| Upfront Payment | Typically none or a small deposit | May require a down payment | Depends on the refinancing agreement | Typically none or a small deposit |

| Monthly Payments | Fixed, based on asset usage and lease terms | Fixed, includes principal and interest | Variable, depending on new loan terms | Fixed, includes usage, maintenance, and other services |

| Maintenance & Repairs | Lessor (operating lease), Lessee (finance lease) | Lessee | Depends on the asset and the agreement | Lessor (usually included) |

| Tax Implications | Lease payments often tax-deductible | Depreciation of the asset | Interest payments often tax-deductible | Contract hire payments are often tax-deductible |

| End of Term | Return asset, or purchase option (finance lease) | Ownership transferred | Existing asset remains under new financing | Return asset |

Asset Finance vs. Other Financing Options

Asset finance offers a specialized approach to funding, differing significantly from other financing methods in terms of structure, collateral, and risk assessment. Understanding these differences is crucial for businesses seeking the most suitable financing option for their specific needs and circumstances. This section delves into the comparisons between asset finance and traditional bank loans, as well as equity financing, to provide a comprehensive overview of their respective advantages and disadvantages.

Asset Finance Compared to Traditional Bank Loans

Traditional bank loans and asset finance, while both providing access to capital, operate under fundamentally different frameworks. Bank loans typically involve a broader assessment of a borrower’s creditworthiness, financial history, and overall business performance. Asset finance, on the other hand, primarily focuses on the value of the asset being financed.

The key distinctions are as follows:

- Collateral: Bank loans often require a wide range of collateral, including real estate, inventory, or accounts receivable. Asset finance, conversely, uses the financed asset itself as the primary collateral. This can be advantageous for businesses that may lack other forms of collateral.

- Risk Assessment: Banks conduct extensive due diligence, evaluating the borrower’s financial statements, credit score, and business plan. Asset finance providers concentrate on the asset’s market value, lifespan, and potential resale value, which simplifies the application process.

- Loan Purpose: Bank loans can be used for various purposes, such as working capital, expansion, or acquisitions. Asset finance is specifically designed for acquiring assets, such as equipment, vehicles, or machinery.

- Interest Rates and Fees: Interest rates on bank loans can be influenced by the borrower’s creditworthiness, market conditions, and the type of loan. Asset finance interest rates may be competitive, but the overall cost can be affected by the asset’s depreciation and the financing structure.

- Flexibility: Bank loans may offer greater flexibility in terms of repayment schedules and loan terms. Asset finance agreements often have fixed terms aligned with the asset’s useful life.

For example, a construction company seeking to purchase a fleet of new excavators might find asset finance more appealing due to the excavators themselves serving as collateral, whereas a traditional bank loan might require additional collateral, such as the company’s real estate, which they may be hesitant to pledge.

Asset Finance Compared to Equity Financing

Equity financing and asset finance represent entirely different approaches to funding. Equity financing involves selling a portion of a company’s ownership to investors in exchange for capital. Asset finance, in contrast, involves borrowing funds to acquire assets, without diluting ownership.

Here’s a comparison:

- Ownership: Equity financing dilutes ownership, meaning the existing owners own a smaller percentage of the company. Asset finance does not affect ownership. The business retains full control.

- Cost: Equity financing can be expensive because investors expect a return on their investment, often in the form of dividends or capital appreciation. Asset finance involves interest payments and fees, but the cost is typically predictable.

- Risk: Equity financing places the risk on the investors, who share in the company’s profits and losses. Asset finance places the risk on the borrower, who is responsible for repaying the loan, regardless of the company’s performance.

- Use of Funds: Equity financing can be used for any purpose, including funding operations, research and development, or acquisitions. Asset finance is restricted to acquiring specific assets.

- Control: Equity financing can lead to investors having a say in the company’s management and decision-making. Asset finance typically does not involve any loss of control for the business owner.

For a startup needing capital for research and development, equity financing might be the best option. A mature manufacturing business looking to upgrade its machinery would be better served by asset finance, preserving ownership and avoiding the complexities of equity dilution.

Situations Where Asset Finance is the Preferred Financing Method

Asset finance is a particularly suitable option in several scenarios. This financing method is frequently chosen when acquiring specific assets is a priority, and other financing options may not be as readily available or advantageous.

The following situations highlight the advantages of asset finance:

- Acquisition of Specific Assets: When a business needs to acquire equipment, vehicles, or machinery, asset finance offers a direct and efficient funding solution.

- Limited Collateral: Businesses with limited collateral beyond the asset itself can benefit from asset finance, which relies on the asset as security.

- Cash Flow Management: Asset finance can structure payments to align with the asset’s revenue generation, aiding cash flow management.

- Preserving Working Capital: By financing assets, businesses can conserve their working capital for other operational needs.

- Tax Benefits: In some jurisdictions, asset finance may offer tax advantages, such as depreciation deductions, that can reduce the overall cost of ownership.

- Rapid Growth: Companies experiencing rapid growth can use asset finance to acquire assets quickly, supporting expansion without diluting ownership or tying up existing capital.

For example, a small delivery service looking to expand its fleet of vans could utilize asset finance. The vans serve as collateral, and the payment schedule can be structured to coincide with the revenue generated from deliveries. This ensures that the business can expand without straining its existing capital or facing the complex requirements of a traditional bank loan.

The Asset Finance Process

Obtaining asset finance involves a structured process that both the borrower and lender must follow. This process ensures that the asset is appropriately assessed, the financing terms are agreed upon, and the agreement is legally sound. Understanding these steps is crucial for businesses seeking to acquire assets through financing.

Typical Steps in Obtaining Asset Finance

The asset finance process is generally standardized, although specific requirements may vary based on the lender, the asset type, and the amount of financing requested. The following steps Artikel the typical process:

- Application: The borrower submits an application to the lender. This typically includes information about the business, the asset to be financed, and the desired financing terms. The application form requires detailed financial information, including financial statements (balance sheets, income statements, cash flow statements), and business plans.

- Credit Assessment and Due Diligence: The lender assesses the borrower’s creditworthiness. This involves reviewing the borrower’s financial history, credit score, and ability to repay the loan. This is followed by due diligence, which includes verifying the asset’s value and condition.

- Offer and Negotiation: If the application is approved, the lender issues a formal offer, outlining the terms of the financing, including the interest rate, repayment schedule, and any fees. The borrower can then negotiate these terms.

- Documentation: Once the terms are agreed upon, the lender prepares the necessary legal documentation, including the asset finance agreement. This agreement details the terms of the financing, the asset’s ownership, and the borrower’s obligations.

- Asset Acquisition: The borrower uses the funds to acquire the asset. The lender may directly pay the vendor, or the funds may be disbursed to the borrower.

- Security Registration: The lender registers a security interest in the asset to protect its investment. This typically involves registering the asset with the relevant authorities.

- Repayment: The borrower makes regular repayments according to the agreed-upon schedule. This includes both principal and interest payments.

Due Diligence Process Lenders Undertake

Lenders conduct thorough due diligence to mitigate risk and ensure the asset’s value and the borrower’s ability to repay the financing. This process involves several key areas of investigation:

- Creditworthiness Assessment: This evaluates the borrower’s financial stability and repayment capacity. Lenders analyze credit reports, financial statements, and historical payment behavior. They also assess the borrower’s industry, market position, and overall business performance.

- Asset Valuation: The lender verifies the asset’s value. This may involve an independent appraisal, particularly for high-value assets like real estate or specialized equipment. The appraisal considers the asset’s condition, age, and market value.

- Legal and Compliance Checks: The lender ensures the asset’s ownership is clear and free of any encumbrances. They conduct searches to verify the asset’s legal status and compliance with relevant regulations. This may include checks for liens, security interests, and other claims against the asset.

- Verification of Information: The lender verifies the information provided in the application. This includes checking the borrower’s identity, business registration, and other supporting documents. They may contact references and conduct site visits to confirm the asset’s existence and condition.

Calculating the Total Cost of Asset Finance

The total cost of asset finance comprises several components, including the principal amount, interest, and various fees. Understanding these costs is crucial for borrowers to make informed decisions.

The total cost of asset finance can be calculated using the following formula:

Total Cost = Principal + (Interest + Fees)

Let’s break down each component:

- Principal: The initial amount of money borrowed to acquire the asset.

- Interest: The cost of borrowing the money, expressed as a percentage of the principal. Interest rates can be fixed or variable.

- Fees: Additional charges associated with the asset finance, which can include:

- Origination fees: Charged by the lender for processing the loan application.

- Management fees: Ongoing fees for managing the finance agreement.

- Early repayment fees: Penalties for paying off the finance early.

- Documentation fees: Costs associated with preparing the finance documents.

Example:

A company borrows $100,000 to finance a piece of equipment. The interest rate is 6% per annum, and the term of the loan is 5 years. The fees include a 1% origination fee and a $250 annual management fee.

First, calculate the total interest paid over the 5 years. This will depend on the repayment structure (e.g., equal installments or a balloon payment). For simplicity, assuming equal monthly installments:

* Annual interest = $100,000 * 6% = $6,000

* Total interest over 5 years = $6,000 * 5 = $30,000

Next, calculate the total fees:

* Origination fee = $100,000 * 1% = $1,000

* Total annual management fees = $250 * 5 = $1,250

Therefore, the total cost of the asset finance is:

* Principal = $100,000

* Interest = $30,000

* Fees = $1,000 + $1,250 = $2,250

* Total Cost = $100,000 + $30,000 + $2,250 = $132,250

This calculation demonstrates that the total cost of asset finance exceeds the principal amount due to interest and fees.

Asset Valuation and Risk Assessment

Asset valuation and risk assessment are critical components of asset finance, influencing the terms, interest rates, and overall viability of a financing agreement. Lenders must accurately determine the asset’s value and assess the associated risks to protect their investment and ensure a profitable transaction. This involves employing various valuation methodologies and carefully considering factors that could impact the asset’s value and the borrower’s ability to repay the financing.

Methods for Determining Asset Value

Determining the value of an asset for financing purposes requires a comprehensive approach, considering the asset’s current condition, market demand, and potential for future use. Several methods are employed to arrive at an accurate valuation, each with its own strengths and limitations.

- Market Comparison Approach: This method involves comparing the asset to similar assets that have recently been sold or leased in the market. The value is determined by analyzing the prices of comparable assets, considering factors such as age, condition, specifications, and location. This approach is particularly useful for assets with an active and transparent market, such as vehicles, machinery, and real estate. For example, when financing a fleet of used trucks, a lender might consult industry publications like the “Used Truck Guide” or online marketplaces to determine the average selling price of similar trucks. Adjustments are then made based on the specific truck’s mileage, maintenance history, and any unique features.

- Cost Approach: The cost approach estimates the asset’s value based on the cost to reproduce or replace it. This method considers the original cost of the asset, less accumulated depreciation. It is often used for specialized or unique assets where market data is limited. For instance, if a company is financing a custom-built piece of manufacturing equipment, the lender might calculate the asset’s value based on the cost of raw materials, labor, and manufacturing overhead, less accumulated depreciation. This approach can be more complex as it requires detailed cost information and accurate depreciation calculations.

- Income Approach: This method focuses on the income-generating potential of the asset. It estimates the asset’s value based on the present value of the future income it is expected to generate. This approach is particularly relevant for assets that produce income, such as rental properties or income-producing equipment. For example, when financing a commercial property, the lender might analyze the property’s rental income, operating expenses, and vacancy rates to estimate its net operating income. This income is then capitalized at an appropriate capitalization rate to determine the property’s value.

- Residual Value Approach: In asset finance, especially in leasing, the residual value is the estimated value of the asset at the end of the financing term. This approach is critical for determining the lease payments and the overall cost of the financing. The residual value is often based on market research, industry data, and the asset’s expected lifespan and depreciation. The lender or lessor may use expert opinions, such as from certified appraisers or specialized valuation services, to determine this value.

Factors Considered in Risk Assessment, Asset finance

Lenders meticulously assess various risks associated with asset finance to determine the creditworthiness of the borrower and the potential for asset depreciation. This assessment informs the financing terms, including interest rates, repayment schedules, and collateral requirements.

- Borrower’s Creditworthiness: The lender assesses the borrower’s credit history, financial stability, and repayment capacity. This includes reviewing credit reports, financial statements, and business plans. A strong credit profile, with a history of timely payments and solid financial performance, reduces the lender’s risk and may result in more favorable financing terms.

- Asset Type and Condition: The type of asset being financed significantly influences the risk assessment. The lender considers the asset’s age, condition, market demand, and potential for obsolescence. Assets with high market liquidity and low depreciation rates are generally considered less risky. For example, financing a new, well-maintained vehicle is typically less risky than financing an older, specialized piece of equipment with limited resale value.

- Asset Usage and Location: The intended use of the asset and its location impact the risk assessment. The lender considers the asset’s operating environment, potential for wear and tear, and exposure to risks such as theft or damage. For instance, a vehicle used in a harsh industrial environment may be considered riskier than a vehicle used primarily for office commuting.

- Market Conditions: The lender assesses the overall market conditions for the asset, including supply and demand, technological advancements, and economic trends. A strong market with high demand for the asset reduces the risk of depreciation and increases the likelihood of recovering the asset’s value if the borrower defaults.

- Guarantees and Collateral: The presence of guarantees or additional collateral can mitigate the lender’s risk. Personal guarantees from the borrower or other parties provide an additional layer of security. Other collateral, such as real estate or other assets, can be used to secure the financing.

“Depreciation significantly impacts asset finance terms. Accelerated depreciation, where the asset loses value quickly, leads to higher financing costs and shorter repayment periods to mitigate the lender’s risk. Conversely, assets with slower depreciation rates can often secure longer repayment terms and potentially lower interest rates, reflecting the lower risk of value loss.”

Legal and Regulatory Aspects of Asset Finance

Asset finance operates within a complex legal and regulatory environment designed to protect both financiers and borrowers. Understanding these aspects is crucial for navigating the industry successfully and mitigating potential risks. This section will explore the legal framework, regulatory bodies, and key contractual clauses that govern asset finance transactions.

Legal Framework Governing Asset Finance Agreements

The legal framework for asset finance varies depending on the jurisdiction and the type of asset involved. However, several key legal principles and statutes commonly apply.

The legal basis for asset finance agreements often stems from contract law, which governs the formation, interpretation, and enforcement of contracts. Key elements include offer, acceptance, consideration, and the intention to create legal relations. Breaching a contract can lead to legal action, including claims for damages.

In many jurisdictions, specific legislation addresses security interests, which are crucial in asset finance. These laws define the rights of the financier (the secured party) in the event of the borrower’s default. For example, the Uniform Commercial Code (UCC) in the United States provides a comprehensive framework for secured transactions, including asset-based lending. The Personal Property Securities Act (PPSA) in countries like Australia and Canada serves a similar function. These laws establish rules for perfecting security interests (e.g., through registration), which determines the priority of claims in case of insolvency.

Furthermore, consumer protection laws play a significant role, especially in consumer asset finance. These laws often impose disclosure requirements on lenders, regulate interest rates, and provide borrowers with rights to cancel agreements or seek redress for unfair practices.

Intellectual property law may be relevant in cases where the asset is a copyrighted work, a patent, or a trademark. For example, if a company is financing the acquisition of software licenses, the legal aspects of intellectual property rights must be considered.

The insolvency laws of a jurisdiction are also critical. These laws determine how assets are distributed among creditors in the event of a borrower’s bankruptcy or liquidation. Understanding the priority of secured creditors is essential for asset financiers.

Role of Regulatory Bodies in Overseeing the Asset Finance Industry

Regulatory bodies play a crucial role in supervising the asset finance industry, ensuring fair practices, and protecting the interests of both consumers and businesses. The specific regulatory bodies vary by country, but their functions are generally consistent.

Regulatory bodies often focus on prudential supervision, ensuring that financial institutions involved in asset finance maintain sufficient capital and liquidity to manage risks. This helps to maintain the stability of the financial system. For example, banking regulators like the Federal Reserve System in the United States and the European Central Bank (ECB) in Europe oversee the asset finance activities of banks and other financial institutions.

Consumer protection is another primary function. Regulatory bodies establish and enforce rules to protect consumers from unfair or deceptive lending practices. This includes regulating interest rates, fees, and disclosure requirements. The Consumer Financial Protection Bureau (CFPB) in the United States, for instance, actively monitors and regulates consumer lending practices.

Anti-money laundering (AML) and counter-terrorism financing (CTF) regulations are also enforced by regulatory bodies. Asset finance transactions can be vulnerable to misuse for illicit purposes, and regulators require financial institutions to implement measures to prevent money laundering and terrorist financing.

Market conduct regulation aims to ensure fair competition and transparency in the asset finance market. Regulatory bodies monitor the activities of lenders and other market participants to prevent anti-competitive behavior and ensure that borrowers have access to clear and accurate information.

Some regulatory bodies may also be responsible for licensing and supervising asset finance companies, setting standards for their operations, and conducting regular audits to ensure compliance with regulations.

Key Clauses Typically Found in Asset Finance Contracts

Asset finance contracts are complex legal documents that Artikel the terms and conditions of the financing arrangement. Several key clauses are typically included to protect the interests of both the financier and the borrower.

A description of the asset is crucial, specifying the exact type, model, and any unique identifying features of the asset being financed. This ensures clarity and prevents disputes about the asset’s identity.

Payment terms are explicitly defined, including the amount of each payment, the frequency of payments, the interest rate, and the total amount payable over the term of the agreement.

Security provisions detail the security interest granted to the financier. This clause Artikels the financier’s rights to the asset if the borrower defaults on the payments. This often includes the right to repossess and sell the asset.

Representations and warranties are statements made by the borrower about the asset and its intended use. These may include warranties about the asset’s condition, ownership, and compliance with relevant laws.

Covenants are promises made by the borrower to maintain the asset, keep it insured, and comply with other obligations. These covenants are designed to protect the financier’s investment.

Events of default specify the circumstances under which the financier can declare the borrower in default, such as failure to make payments, breach of covenants, or insolvency.

Remedies Artikel the actions the financier can take in the event of a default, such as repossession of the asset, acceleration of the debt, and legal action to recover outstanding amounts.

Governing law and jurisdiction clauses specify the laws that will govern the contract and the jurisdiction where any disputes will be resolved.

Insurance requirements mandate that the borrower maintains adequate insurance coverage on the asset to protect against loss or damage.

Early termination clauses may allow the borrower to pay off the finance agreement early, potentially subject to fees or penalties.

Industries Utilizing Asset Finance

Asset finance provides a flexible and accessible funding solution for businesses across a wide range of sectors. Its adaptability allows it to be tailored to the specific needs and challenges of each industry, making it a crucial tool for growth and operational efficiency. From transportation to healthcare, asset finance enables companies to acquire the equipment and assets necessary to operate and expand without tying up significant capital.

Industries Frequently Using Asset Finance

Several industries rely heavily on asset finance to acquire essential equipment and vehicles. These sectors benefit from the ability to spread the cost of assets over their useful lifespan, preserving cash flow and enabling investment in other areas of the business.

- Transportation and Logistics: This industry uses asset finance extensively for acquiring vehicles such as trucks, trailers, and ships. It helps businesses manage cash flow and upgrade fleets to meet regulatory requirements and enhance operational efficiency.

- Construction: Construction companies often utilize asset finance to obtain heavy machinery like excavators, bulldozers, and cranes. This allows them to bid on projects without the upfront capital outlay, improving competitiveness.

- Manufacturing: Manufacturers commonly employ asset finance to purchase machinery, production lines, and other specialized equipment. This allows them to invest in the latest technology and maintain a competitive edge.

- Healthcare: Healthcare providers frequently use asset finance to acquire expensive medical equipment such as MRI machines, X-ray equipment, and patient monitoring systems. This ensures access to advanced technology and improves patient care.

- Technology: Technology companies may leverage asset finance to acquire IT equipment, servers, and software licenses. This enables them to stay current with rapidly evolving technology and maintain a modern infrastructure.

- Agriculture: Farmers and agricultural businesses often utilize asset finance for tractors, harvesters, and other farming equipment. This supports productivity and modernization in the agricultural sector.

Tailoring Asset Finance to Sector Needs

Asset finance is not a one-size-fits-all solution; instead, it’s adapted to the specific needs of each industry. Lenders consider the industry’s specific requirements, the asset’s lifespan, and the typical usage patterns when structuring the finance agreement.

- Transportation and Logistics: Finance options such as hire purchase or leasing are common for vehicles. Terms are often structured to align with the vehicle’s depreciation and operational lifespan. Seasonal fluctuations in demand may also influence the repayment schedule.

- Construction: Finance agreements often include balloon payments or flexible repayment schedules that accommodate project-based income. This allows construction companies to align their payments with project milestones.

- Manufacturing: Longer-term financing options are often preferred to match the longer lifespan of manufacturing equipment. Maintenance and service agreements may be included in the financing package.

- Healthcare: Financing for medical equipment may involve specialized lease agreements that cover equipment upgrades and maintenance. This ensures that the healthcare provider has access to the latest technology.

- Technology: Lease agreements are popular, allowing for regular upgrades to the latest equipment and software. This keeps the business competitive in a fast-changing technological landscape.

- Agriculture: Financing may be structured to align with the agricultural cycle, with payments adjusted based on harvest seasons and cash flow.

Case Study: Successful Asset Finance Utilization

A real-world example showcases the benefits of asset finance.

Asset finance – Company: Green Harvest Farms, a mid-sized agricultural business specializing in organic produce.

Challenge: Green Harvest Farms needed to replace its aging fleet of tractors and harvesters to improve efficiency and reduce operational costs. The upfront cost of new equipment was a significant barrier.

Solution: The company opted for a five-year hire purchase agreement for three new tractors and two combine harvesters. The financing was provided by a specialized agricultural finance company. The terms included a fixed interest rate, allowing for predictable monthly payments. The agreement covered the full cost of the equipment, including maintenance and service packages.

Asset finance involves funding the acquisition of assets, a crucial aspect of business growth. Aspiring finance professionals often pursue advanced degrees, and those interested in the field might consider a program like masters in finance california , which can provide specialized knowledge. This education can significantly enhance one’s understanding and capabilities within asset finance, leading to better investment decisions and financial strategies.

Terms: The hire purchase agreement was structured with monthly payments spread over five years. The interest rate was competitive, and the agreement included a balloon payment at the end of the term, which allowed the company to potentially own the equipment outright.

Outcomes:

Asset finance provides crucial funding for businesses to acquire equipment and other assets. Understanding financial instruments is key, and for individuals, exploring options like the tarjeta financiera bienestar en estados unidos can offer insights into managing finances. Ultimately, the principles of sound financial management learned through these methods are essential for effective asset financing and overall business success.

- Increased Efficiency: The new equipment significantly improved harvesting efficiency, reducing the time required to harvest crops by 30%.

- Reduced Costs: The new, more fuel-efficient tractors and harvesters reduced fuel consumption and maintenance costs.

- Improved Cash Flow: The hire purchase agreement allowed Green Harvest Farms to preserve its cash flow, enabling investment in other areas of the business.

- Enhanced Productivity: The upgraded equipment increased overall productivity and allowed Green Harvest Farms to expand its operations.

Asset Finance and Business Growth

Asset finance plays a crucial role in fueling business growth by providing access to essential assets without requiring large upfront capital expenditures. It enables companies to invest in resources that drive expansion, improve operational efficiency, and ultimately, increase profitability. This section explores how asset finance facilitates business expansion, enhances cash flow management, and supports investment in new equipment and technology.

Facilitating Business Expansion

Asset finance allows businesses to scale operations and enter new markets. Instead of tying up valuable capital in asset purchases, companies can utilize asset finance to acquire the necessary equipment, vehicles, or machinery to support growth initiatives. This frees up cash flow for other critical areas like marketing, research and development, or hiring new personnel. For example, a construction company can use asset finance to acquire a fleet of new trucks and excavators to bid on larger projects, expanding its service offerings and geographic reach.

Improving Cash Flow Management

Asset finance significantly improves cash flow management by spreading the cost of assets over their useful life. This structure reduces the immediate financial burden compared to outright purchase. Instead of a large, one-time payment, businesses make regular, predictable payments, which helps with budgeting and forecasting. This predictability allows businesses to better manage their working capital and invest in other growth opportunities.

Supporting Investment in New Equipment and Technology

Asset finance is a key enabler for businesses seeking to upgrade or acquire new equipment and technology. Businesses can leverage asset finance to invest in assets that drive growth.

- Access to Latest Technology: Asset finance enables businesses to access the most up-to-date equipment and technology. This is particularly beneficial in industries where technology evolves rapidly, such as manufacturing or IT. Businesses can avoid the risk of obsolescence by upgrading assets regularly through finance agreements.

- Increased Productivity and Efficiency: New equipment often leads to increased productivity and operational efficiency. For instance, a manufacturing company can acquire advanced machinery through asset finance, increasing its output and reducing production costs. This can result in higher profit margins and enhanced competitiveness.

- Reduced Maintenance Costs: New assets typically come with warranties and require less maintenance compared to older equipment. This can translate to lower operational costs and reduced downtime.

- Enhanced Competitive Advantage: Investing in modern equipment and technology can give businesses a significant competitive advantage. Improved efficiency, higher quality products, and faster turnaround times can all contribute to a stronger market position.

- Flexibility and Scalability: Asset finance provides flexibility in terms of asset acquisition. Businesses can scale their operations by acquiring additional assets as needed without being constrained by their capital budget.

- Tax Benefits: Depending on the asset finance structure, businesses may be able to claim tax deductions for the finance payments or depreciation of the asset. This can reduce the overall cost of ownership.

Key Players in the Asset Finance Market

The asset finance market involves a complex network of participants, each playing a crucial role in facilitating the acquisition of assets by businesses. Understanding the key players and their respective functions is essential for navigating the asset finance landscape. This section details the different types of financial institutions, intermediaries, and vendors involved in the asset finance process.

Financial Institutions Providing Asset Finance

Various financial institutions provide asset finance, each with its own strengths and target markets. These institutions offer different products and services, catering to diverse asset types and borrower profiles.

- Banks: Banks are a primary source of asset finance, offering a wide range of products, including loans, leases, and hire purchase agreements. They often cater to larger businesses and provide competitive interest rates due to their access to capital and established risk management frameworks. For example, major commercial banks such as JPMorgan Chase and Bank of America have dedicated asset finance divisions that specialize in financing assets like aircraft, ships, and large equipment.

- Specialist Asset Finance Companies: These companies focus exclusively on asset finance, providing expertise and flexibility that banks may not offer. They often specialize in specific asset classes or industry sectors, such as construction equipment or healthcare technology. Specialist companies may be more willing to finance assets with higher risk profiles or offer tailored financing solutions. Examples include companies like DLL and Siemens Financial Services.

- Captive Finance Companies: Captive finance companies are subsidiaries of manufacturers or vendors. Their primary function is to provide financing for the parent company’s products. This allows manufacturers to boost sales by offering attractive financing options to customers. For example, Caterpillar Financial Services provides financing options for Caterpillar’s construction and mining equipment.

- Non-Bank Lenders: These include finance companies, credit unions, and other non-banking institutions that offer asset finance solutions. They often cater to small and medium-sized enterprises (SMEs) and can provide more flexible terms than traditional banks. They might specialize in niche areas like used equipment financing.

- Institutional Investors: Institutional investors, such as pension funds and insurance companies, can also participate in the asset finance market, typically through the purchase of asset-backed securities (ABS). These securities are backed by a pool of asset finance contracts, providing investors with a stream of income.

Roles of Brokers and Intermediaries in Asset Finance

Brokers and intermediaries act as crucial links between borrowers and lenders in the asset finance market. They provide expertise, market knowledge, and support throughout the financing process.

- Asset Finance Brokers: Brokers act as independent advisors, helping businesses find the most suitable asset finance options. They have extensive knowledge of the market, including the various lenders, their products, and their lending criteria. They can negotiate terms and conditions on behalf of their clients, ensuring the best possible deal. For instance, a broker might help a construction company find financing for a fleet of new excavators, comparing offers from different lenders to secure the most favorable terms.

- Finance Brokers: These brokers typically have a broader scope, assisting businesses with various financing needs, including asset finance. They might offer advice on different types of financing and help businesses navigate the application process. They often have established relationships with multiple lenders, allowing them to access a wider range of options.

- Independent Financial Advisors (IFAs): IFAs can also play a role in asset finance, particularly for high-net-worth individuals and businesses. They provide financial planning advice and can incorporate asset finance into a broader financial strategy. They might recommend asset finance as part of a tax-efficient investment strategy.

Relationship Between Manufacturers, Vendors, and Asset Finance Providers

Manufacturers and vendors often collaborate with asset finance providers to facilitate sales and offer attractive financing options to their customers. This collaboration benefits all parties involved.

- Manufacturers/Vendors: They are the suppliers of the assets being financed. They benefit from asset finance by increasing sales, as financing makes their products more accessible to customers. They often partner with captive finance companies or other lenders to offer financing packages. For example, a software vendor might partner with a finance company to offer leasing options for its software licenses.

- Asset Finance Providers: They provide the financing for the assets. They benefit from the relationship by gaining access to a steady stream of deals and potentially reducing their risk by financing assets with strong residual values. They often work closely with manufacturers to understand the asset’s value and lifecycle.

- Collaboration and Partnerships: Manufacturers and vendors frequently establish formal partnerships with asset finance providers. These partnerships can involve co-marketing efforts, joint training programs, and streamlined application processes. This collaborative approach enhances the customer experience and drives sales. For instance, a car manufacturer might partner with a bank to offer competitive financing rates and promotions to customers.

Future Trends in Asset Finance

The asset finance landscape is constantly evolving, driven by technological advancements, shifting economic conditions, and the emergence of new asset classes. Understanding these trends is crucial for businesses and financiers to remain competitive and capitalize on emerging opportunities. The future of asset finance promises significant shifts in how businesses acquire and utilize assets, impacting various industries and business models.

Emerging Trends in the Asset Finance Landscape

Several key trends are reshaping the asset finance industry. These trends reflect a broader shift towards greater efficiency, accessibility, and sustainability.

- Increased Focus on Sustainability: Environmental, Social, and Governance (ESG) considerations are becoming increasingly important. This is leading to a rise in green financing options, where asset finance is used to support sustainable assets like renewable energy projects, electric vehicles, and energy-efficient equipment. For example, we are seeing a surge in financing for solar panel installations for businesses and homes, driven by government incentives and growing environmental awareness.

- Growth of Digital Platforms and Fintech: Fintech companies are disrupting traditional asset finance models by offering online platforms for asset financing. These platforms often provide faster approvals, lower costs, and greater accessibility, particularly for small and medium-sized enterprises (SMEs). These platforms utilize sophisticated algorithms and data analytics to assess creditworthiness and streamline the application process.

- Expansion of Asset-as-a-Service (AaaS) Models: The AaaS model, where businesses pay for the use of an asset rather than owning it, is gaining traction. This model is particularly relevant for technology and equipment, such as software, servers, and machinery. This shifts the focus from ownership to operational efficiency and reduces upfront capital expenditure.

- Rise of Alternative Asset Classes: The definition of “asset” is expanding. Asset finance is increasingly being used for unconventional assets, such as intellectual property, data, and even human capital. This diversification reflects a broader trend towards recognizing the value of intangible assets in the modern economy.

- Greater Use of Data Analytics and AI: Data analytics and artificial intelligence (AI) are being used to improve risk assessment, asset valuation, and fraud detection. AI algorithms can analyze vast amounts of data to identify patterns and predict potential risks, leading to more informed lending decisions.

Impact of Technological Advancements on Asset Finance

Technological advancements are revolutionizing the asset finance process, from origination to asset management. These changes are creating new opportunities for efficiency, transparency, and risk management.

- Blockchain Technology: Blockchain can improve transparency and security in asset finance transactions. Smart contracts can automate processes like payments and asset transfers, reducing the need for intermediaries and minimizing the risk of fraud. This technology can create a more secure and efficient ecosystem for asset financing.

- Internet of Things (IoT): IoT devices embedded in assets can provide real-time data on asset usage, performance, and maintenance needs. This data can be used to optimize asset utilization, predict maintenance requirements, and improve risk management. For example, sensors on a fleet of trucks can provide data on mileage, fuel consumption, and potential mechanical issues, enabling proactive maintenance and reducing downtime.

- Artificial Intelligence (AI) and Machine Learning (ML): AI and ML algorithms are used to automate tasks, improve credit scoring, and detect fraud. These technologies can analyze large datasets to identify patterns and predict potential risks, leading to more informed lending decisions. AI-powered chatbots can also provide customer service and support, improving the overall user experience.

- Cloud Computing: Cloud-based platforms provide scalability, flexibility, and cost-effectiveness for asset finance providers. They enable easier access to data, improved collaboration, and streamlined operations. Cloud computing facilitates remote access to data and applications, enabling more efficient operations.

- Robotic Process Automation (RPA): RPA automates repetitive tasks, such as data entry and invoice processing, freeing up human employees to focus on more strategic activities. RPA can significantly improve efficiency and reduce operational costs.

The Future of Asset Finance: A Vision

Imagine a future where asset finance is seamlessly integrated into the fabric of business operations. New asset classes, fueled by innovation, become commonplace, and financing models evolve to meet the changing needs of businesses.

The process of acquiring assets will be significantly streamlined. Businesses can instantly access financing through AI-powered platforms, which analyze real-time data on their needs and financial health. Asset valuations will be dynamically updated using IoT data and sophisticated analytics, providing accurate insights into asset performance and risk. New asset classes, like intellectual property and data streams, will be readily financed, unlocking significant value for businesses. “Digital twins” of physical assets will allow for predictive maintenance and optimized utilization, leading to increased efficiency and reduced downtime. The AaaS model will be dominant, enabling businesses to focus on their core competencies without the burden of asset ownership. The entire process will be governed by transparent and secure blockchain-based systems, reducing fraud and ensuring compliance. Sustainable financing will be the norm, with green assets and projects receiving preferential terms. Asset finance will no longer be a separate function but an integral part of a business’s strategic planning and operational efficiency, driven by data-driven insights and a commitment to sustainability.