Understanding BMI Travel Insurance

BMI travel insurance provides financial protection for unforeseen events during your trip. It safeguards you against medical emergencies, trip cancellations, and other disruptions, offering peace of mind for a smooth and worry-free journey. This comprehensive overview delves into the various aspects of BMI travel insurance, from its core features to the factors influencing its cost.

BMI travel insurance is designed to mitigate the financial risks associated with international travel. It offers a safety net for unexpected events, ensuring that you are covered in case of medical emergencies, trip cancellations, or lost luggage.

Types of BMI Travel Insurance

BMI travel insurance plans are categorized to cater to diverse needs. Single-trip policies cover a specific journey, while multi-trip policies offer protection for multiple trips within a defined period. Annual plans provide comprehensive coverage for all travel undertaken within a year. The selection of the appropriate policy type hinges on individual travel patterns and frequency.

Coverage Options for Medical Emergencies and Cancellations

BMI travel insurance typically includes coverage for medical emergencies, including hospitalizations, surgeries, and necessary medical evacuations. Specific amounts and limits for medical expenses are Artikeld in the policy details. Cancellation coverage is also a key feature, offering reimbursement for pre-paid expenses in case of unforeseen circumstances preventing the trip. The extent of coverage varies between different policy types and providers. For instance, some policies may cover cancellations due to illness or injury, while others may also cover cancellations resulting from natural disasters or other unforeseen circumstances.

Factors Influencing the Cost of BMI Travel Insurance

Several factors influence the cost of BMI travel insurance. Destination, trip duration, traveler’s age and health, and the chosen level of coverage are crucial considerations. A trip to a high-cost medical region will naturally command a higher premium than a trip to a more affordable region. Similarly, a longer trip usually means higher premiums compared to shorter ones. Medical conditions and pre-existing health issues may result in higher premiums. Comprehensive coverage will generally cost more than a policy with limited coverage.

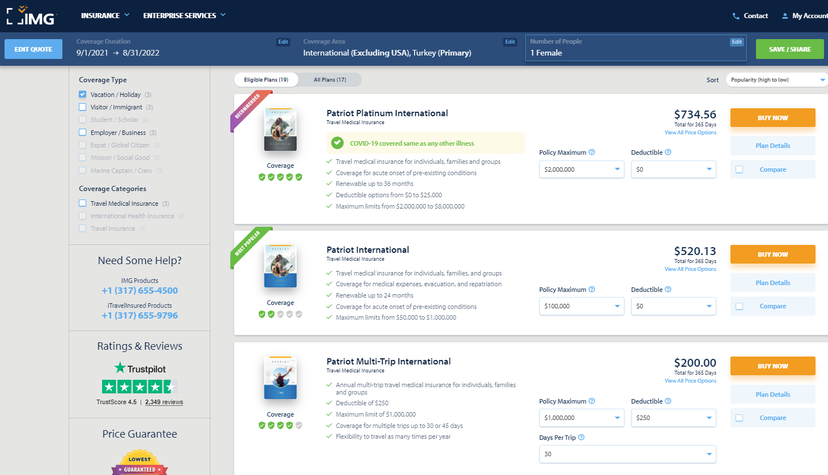

Comparison of BMI Travel Insurance Providers

| Insurance Provider | Features | Pricing | Customer Reviews |

|---|---|---|---|

| BMI Travel Insurance Company A | Comprehensive medical coverage, wide range of cancellation options, 24/7 assistance, and multilingual support. | Moderate, comparable to industry standards. | Generally positive, with customers highlighting responsive customer service and comprehensive coverage. |

| BMI Travel Insurance Company B | Focuses on budget-friendly options, but may have limited coverage in certain areas. Good for travelers on a tight budget. | Lower than average. | Mixed reviews, with some customers praising the affordability but others noting gaps in coverage. |

| BMI Travel Insurance Company C | Specializes in adventure travel and includes coverage for extreme sports and activities. | Higher than average, depending on the chosen coverage. | Positive reviews from adventure travelers, but potentially not suitable for basic travelers. |

The table above presents a simplified comparison. Specific details and pricing should be verified directly with the insurance providers. Customer reviews are valuable but should be considered alongside the policy’s specific terms and conditions.

Eligibility Criteria for BMI Travel Insurance

Navigating the world of travel insurance can feel like a maze, but understanding the eligibility criteria is key to finding a policy that fits your needs. BMI travel insurance, like other providers, has specific requirements to ensure coverage for travelers. This section details the general requirements, specific health conditions that may affect eligibility, pre-existing conditions, the application process, and potential variations across different BMI providers.

Understanding these criteria helps you make informed decisions about your travel plans and ensures you’re adequately protected during your adventures.

General Requirements

BMI travel insurance, like most providers, typically has general requirements for purchase. These often include the applicant’s age, as well as their overall health status. Generally, travelers must be of a specific age range to qualify for coverage. For example, policies might exclude travelers above a certain age or offer different premium rates for different age brackets. Additionally, a basic health assessment might be required to gauge overall health. These factors are vital to determining the level of risk and appropriate coverage for each applicant.

Specific Health Conditions

Certain pre-existing medical conditions might impact eligibility for BMI travel insurance or require additional documentation. Conditions like heart disease, respiratory issues, or severe allergies might necessitate a medical questionnaire or even a consultation with a medical professional to assess the level of risk involved. The specific requirements for these conditions will vary depending on the policy and the severity of the condition.

Pre-existing Medical Conditions

BMI travel insurance policies often handle pre-existing medical conditions in a similar way to other providers. A thorough understanding of the policy’s terms is crucial. Often, pre-existing conditions are covered, but limitations or exclusions may apply. This is usually clearly Artikeld in the policy documents. For example, a policy might cover a pre-existing condition, but exclude coverage for complications arising directly from that condition. It is crucial to carefully review the policy details and understand these exclusions.

Application Process and Required Documentation

The application process for BMI travel insurance typically involves completing an online form or using a dedicated application portal. The specific documentation required varies depending on the policy and the individual’s circumstances. This documentation might include details about your medical history, travel plans, and financial information. The application often requests details about pre-existing conditions and any health issues that may require special consideration.

Comparison of Eligibility Criteria Across BMI Providers, Bmi travel insurance

Different BMI travel insurance providers may have slightly varying eligibility criteria. Some might offer broader coverage for specific conditions, while others may have more stringent requirements. For example, one provider might offer coverage for travelers with certain pre-existing conditions, while another provider might not. Comparison of different providers is essential to finding the best fit for your individual needs. A careful evaluation of different policies, including those from various providers, will help identify the optimal coverage. A thorough review of the specific policy documents from different BMI providers is highly recommended.

Coverage Details of BMI Travel Insurance

BMI Travel Insurance offers a comprehensive range of coverage designed to protect you during your trips. Understanding the specifics of medical expenses, trip disruptions, and baggage protection is crucial for making informed decisions. This section dives deep into the details of these protections.

Medical Expense Coverage

Medical expenses are a significant concern when traveling. BMI Travel Insurance provides coverage for unexpected illnesses or injuries sustained during your trip. The scope of this coverage includes essential medical treatments, hospitalization, and ambulance services. Crucially, it often covers pre-existing conditions, though this depends on the specific policy and exclusions.

Examples of Covered Medical Expenses

- Emergency dental procedures due to an accident.

- Treatment for a sudden onset of illness requiring hospitalization.

- Evacuation to a hospital in another country if necessary.

- Prescriptions for necessary medications, including those for chronic conditions.

Claiming Medical Expenses During Travel

The claims process for medical expenses is typically straightforward. You need to contact BMI’s customer service immediately and follow the specific instructions Artikeld in your policy documents. Detailed records of medical bills and receipts are crucial for a smooth claim process. Many policies require reporting the incident promptly and providing necessary documentation to the insurer.

Trip Cancellation, Delay, and Interruption Coverage

BMI Travel Insurance often includes coverage for trip disruptions, including cancellations, delays, and interruptions. This coverage is usually triggered by unforeseen circumstances like natural disasters, flight cancellations, or severe illness. The specific terms and conditions regarding the extent of coverage for each event must be reviewed in the policy documents.

Lost Luggage or Personal Belongings

Lost or damaged luggage and personal belongings during travel are covered by certain provisions in the insurance policy. This coverage typically provides compensation for replacement costs, although specific limits apply. It is important to carefully read the policy details, including the maximum amount of compensation and the documentation required for filing a claim.

Common Exclusions in BMI Travel Insurance

| Category | Description |

|---|---|

| Pre-existing Conditions (with limitations) | While some policies cover pre-existing conditions, specific conditions and limitations may apply. Policies often Artikel the required waiting periods or exclusions for pre-existing conditions. |

| Intentional Self-Harm | Acts of intentional self-harm or recklessness are typically excluded from coverage. |

| War or Terrorism | Events related to war or acts of terrorism are generally excluded from coverage. |

| Certain Activities | Activities considered high-risk, such as extreme sports or activities with high-risk profiles, may not be covered. |

| Pre-Trip Medical Conditions | Conditions that develop before the trip and are not treated or diagnosed are often excluded from coverage. |

Comparing BMI Travel Insurance with Other Options

Choosing the right travel insurance is crucial for a smooth and worry-free trip. Beyond BMI, various options exist, each with its own strengths and weaknesses. Understanding the different types and their nuances will empower you to make an informed decision tailored to your specific needs and budget. This section delves into comparing BMI with other providers, highlighting factors to consider and offering insights into reducing costs.

Comparison with Other Travel Insurance Providers

Different travel insurance providers cater to diverse needs and budgets. Factors such as coverage levels, exclusions, and pricing vary significantly. Understanding these differences is vital in making the best choice for your travel plans. Some providers may specialize in adventure travel, while others might offer comprehensive protection for a wider range of activities and destinations. BMI, like other major players, offers a spectrum of options, each with specific benefits and drawbacks.

Factors to Consider When Choosing Travel Insurance

Several key factors influence the optimal travel insurance selection. Evaluating these factors ensures you choose a policy that aligns with your trip’s specifics and personal circumstances. These factors include the destination, the duration of your trip, the type of activities you plan to undertake, and your pre-existing medical conditions. The level of coverage, including medical expenses, trip cancellations, and baggage loss, is another crucial consideration. Finally, the financial stability of the insurer is vital, as it assures your claim will be addressed promptly and fairly.

Benefits and Drawbacks of Different Travel Insurance Types

Travel insurance comes in various forms, each with its own set of advantages and disadvantages. Understanding these distinctions is key to choosing the most suitable plan. Comprehensive plans often provide broad coverage, but might come with higher premiums. Budget-friendly options often have limited coverage, making them suitable for short trips with minimal risks. Specialty plans, such as adventure travel insurance, may offer specialized coverage for high-risk activities. Evaluating the benefits and drawbacks against your planned trip will guide your decision.

Reducing Travel Insurance Costs

Minimizing travel insurance costs is a common goal for travelers. Several strategies can help lower premiums without compromising essential coverage. Travel insurance providers frequently offer discounts for those traveling in groups, booking in advance, or possessing specific travel profiles. These discounts can significantly reduce costs, enabling you to allocate more of your budget to other travel essentials.

Table Comparing Travel Insurance Providers

This table provides a comparative overview of key features and pricing from various travel insurance providers, including BMI. Note that pricing can fluctuate based on factors such as travel dates and destinations.

| Insurance Provider | Coverage Highlights | Average Price (USD) – 14 Days Europe | Additional Notes |

|---|---|---|---|

| BMI | Comprehensive coverage for medical emergencies, trip cancellations, and lost baggage. Wide range of options for different travel styles. | $150 – $300 | Known for customer service and claims processing efficiency. |

| Company A | Focus on adventure travel with specific coverage for outdoor activities. | $180 – $400 | Excellent for hikers and climbers. |

| Company B | Budget-friendly option with limited coverage, primarily for medical emergencies and trip interruptions. | $75 – $150 | Suitable for short trips with minimal risk. |

| Company C | Extensive coverage for pre-existing conditions and specialized activities. | $250 – $500 | Ideal for travelers with chronic health issues. |

Claiming Procedures and FAQs

Navigating the process of filing a travel insurance claim can sometimes feel daunting. However, understanding the steps and requirements can make the process smoother and less stressful. This section Artikels the procedures for filing a claim with BMI Travel Insurance, along with frequently asked questions to address common concerns.

Claim Filing Steps for Medical Expenses

The claim process for medical expenses typically involves several steps. First, you should contact your insurance provider as soon as possible to report the incident. Next, you’ll need to gather necessary documentation, which will be detailed later. After providing the required documents, the insurance company will assess the claim and notify you of their decision.

Claim Filing Steps for Trip Cancellations

Filing a claim for trip cancellations requires documentation demonstrating the unforeseen circumstances leading to the cancellation. The insurance provider will evaluate the validity of the reason for cancellation. The claim will be processed based on the specific terms and conditions of your policy.

Required Documentation for Claims

Thorough documentation is crucial for a smooth claim process. For medical expenses, this typically includes medical bills, doctor’s notes, and a police report if applicable. For trip cancellations, evidence such as flight confirmations, official cancellation notices, and supporting documentation for the reason for cancellation are necessary.

Claim Processing Timeframes

The claim processing timeframes depend on the type of claim and the insurance provider’s internal procedures. Medical expense claims often take several weeks, and trip cancellation claims can take a similar duration. Factors like the complexity of the claim and the completeness of the submitted documentation can influence the processing time.

Common Claim Situations

- A traveler suffers a serious injury during a trip requiring hospitalization. This would necessitate a claim for medical expenses, potentially involving extensive treatment and related costs.

- A traveler’s flight is unexpectedly canceled due to unforeseen weather conditions. This may warrant a claim for trip cancellation, including pre-paid accommodation and travel expenses.

- A traveler contracts a serious illness during their trip requiring immediate medical attention. This would necessitate a claim for medical expenses, potentially involving emergency medical treatment and repatriation.

- A traveler’s pre-booked accommodation is unexpectedly unavailable due to unforeseen circumstances. This may warrant a claim for accommodation expenses and possible alternative arrangements.

FAQ

| Question | Answer |

|---|---|

| How do I know if my claim is valid? | Validity of a claim is determined by the specific terms and conditions of your insurance policy. The insurance provider will evaluate the submitted documentation and the circumstances to determine eligibility. |

| What if I don’t have all the required documentation? | Contact the insurance provider immediately to discuss the missing documentation and explore options for providing it. Early communication can help avoid delays in processing the claim. |

| What happens if my claim is denied? | If a claim is denied, the insurance provider will provide a detailed explanation of the reason for denial. Review the explanation and explore options for appeal, if available, based on the policy terms. |

| How can I expedite the claim process? | Providing all required documentation promptly and communicating clearly with the insurance provider can expedite the claim process. |

Tips for Choosing the Right BMI Travel Insurance

Navigating the world of travel insurance can feel overwhelming, with a multitude of options and intricate details. Understanding the nuances of different policies is crucial for securing the right coverage for your trip. This guide provides actionable steps to help you choose a BMI travel insurance plan that aligns with your specific needs and preferences.

Choosing the right travel insurance is more than just finding a policy; it’s about proactive preparation for potential unforeseen circumstances. A well-considered plan can offer peace of mind, protecting your financial investments and ensuring a smooth journey.

Evaluating Policy Coverage

BMI travel insurance offers various coverage options. Carefully reviewing the policy details is essential to ensure comprehensive protection. This includes understanding the scope of medical expenses covered, the extent of baggage protection, and any specific limitations on trip interruptions or cancellations. Understanding these specifics ensures that you’re not caught off guard by unexpected situations.

Comparing Policies and Understanding Details

Comparing policies from different providers, including BMI, is vital. Scrutinize the specific terms and conditions for each policy. Look for similarities and differences in coverage limits, exclusions, and the claims process. This comprehensive comparison will help you determine which policy best fits your budget and needs.

Considering Personal Travel Needs and Preferences

Your personal travel style and preferences play a significant role in choosing the right policy. Consider the duration of your trip, the destination’s safety and healthcare infrastructure, and your personal health conditions. If you have pre-existing medical conditions, a policy with broader coverage for medical emergencies is essential.

Understanding Exclusions and Fine Print

Thoroughly reviewing the fine print and exclusions is critical. Exclusions might relate to specific activities, destinations, or pre-existing conditions. Understanding these details beforehand prevents surprises and potential claim denials. For example, certain adventurous activities like extreme sports might be excluded from coverage. Comprehending these details will safeguard you from potential financial setbacks.

Assessing Value and Cost-Effectiveness

Evaluating the value proposition of different travel insurance policies is crucial. Factor in the premium cost against the total potential coverage amount. Consider whether the added value of the policy outweighs the cost. This approach will ensure you’re not overpaying for coverage you may not need. Compare the total coverage with the price of the insurance. A well-informed comparison will help you make an informed decision.

Seeking Professional Advice (Optional but Recommended)

Consulting with a travel advisor or financial professional can provide valuable insights. They can help you evaluate your specific needs and guide you through the process of selecting the most suitable travel insurance. This is especially beneficial for complex or high-value travel plans. This external perspective can be valuable in understanding the implications of your travel plans.

Illustrative Scenarios and Case Studies

Navigating the world of travel can be unpredictable. From unforeseen medical emergencies to cancelled flights, travel insurance acts as a safety net, offering peace of mind and financial protection. Understanding how these policies work in real-world scenarios is crucial for making informed decisions. This section will explore several situations where BMI Travel Insurance can provide significant support.

Benefits of BMI Travel Insurance in Medical Emergencies

BMI Travel Insurance provides financial assistance for unexpected medical expenses during trips. This can range from routine check-ups to serious medical conditions. A crucial aspect of the policy is its ability to cover a broad spectrum of medical needs.

- Scenario 1: A sudden illness abroad. A tourist visiting a tropical destination experiences a sudden bout of food poisoning. This leads to severe dehydration and requires hospitalization for several days. BMI Travel Insurance can cover the associated medical bills, including doctor’s fees, hospital stays, and medications, easing the financial burden during a stressful time.

- Scenario 2: Pre-existing condition complications. A traveler with a pre-existing condition experiences a sudden exacerbation during their trip. BMI Travel Insurance often covers medical treatment related to pre-existing conditions if the policy terms and conditions are met. This could involve emergency consultations, procedures, and medications, ensuring that the traveler receives the necessary medical care.

Successful Medical Claim Example

A policyholder, Sarah, booked a hiking trip to the Himalayas. While on her trek, she suffered a severe ankle sprain requiring immediate medical attention. The local hospital’s treatment costs were substantial. Sarah’s BMI Travel Insurance covered a significant portion of her medical expenses, including hospital bills, physiotherapy, and transportation back to her home country. The claim process was smooth and efficient, thanks to the clear documentation and prompt communication from BMI’s claims team.

Customer Case Study: Trip Cancellation

Mr. David booked a business trip to Japan, but due to unforeseen circumstances, he had to cancel his trip shortly before the departure date. He submitted a claim to BMI Travel Insurance for the cancellation of non-refundable expenses, including flights and accommodation. BMI Travel Insurance processed his claim in a timely manner, refunding the majority of his non-refundable trip costs. This experience highlighted the value of the policy’s trip cancellation provisions.

Trip Delay Scenario

A family’s flight to Bali was delayed by several hours due to severe weather conditions. This resulted in lost time and the inability to partake in pre-booked activities. While BMI Travel Insurance might not cover lost leisure time, it might offer some coverage for additional accommodation or meals incurred due to the delay, as long as the delay was beyond their control and covered under the policy’s terms and conditions.

Claim Denial Scenario and Reasons

A policyholder, Emily, attempted to claim for lost luggage during her trip to Europe. Her claim was denied because she failed to report the loss of her luggage to the airline immediately upon arrival. The policy clearly stated that failure to report the loss promptly to the airline within 24 hours of arrival would void the claim. This highlighted the importance of adhering to the policy’s specific terms and conditions.

Thinking about BMI travel insurance for my upcoming road trip? I’m planning a pit stop at the Broken Bow Choctaw Travel Plaza, a great spot for snacks and fuel , and I’m making sure my insurance is up to scratch. Having reliable coverage is key when you’re on the open road, especially when dealing with unexpected issues, so I’m feeling confident that BMI travel insurance will provide the protection I need.

Thinking about booking a trip? BMI travel insurance is a great way to protect yourself against unforeseen circumstances, but finding the right travel agent can make all the difference. For example, a travel agent like rosewood elite travel agent can help you navigate the complexities of travel insurance, ensuring you get the best possible coverage for your needs.

Ultimately, BMI travel insurance gives you peace of mind, especially when you’re working with a knowledgeable travel expert.