Church Budgeting and Planning: Church And Finances

Effective church budgeting and planning are crucial for the financial health and sustainability of any religious organization. A well-crafted budget provides a roadmap for allocating resources, achieving ministry goals, and ensuring long-term financial stability. It also fosters transparency and accountability, building trust within the congregation. Planning involves not only managing current finances but also anticipating future needs and opportunities, allowing the church to adapt to changing circumstances and fulfill its mission effectively.

Essential Components of a Church Budget

A comprehensive church budget typically encompasses several key components, each playing a vital role in financial management. These components work together to provide a clear picture of the church’s financial standing and guide decision-making.

The core elements of a church budget include:

- Income Projections: This involves estimating all sources of revenue, such as tithes, offerings, donations, and any other income streams (e.g., rental income, fundraising events). Accurate income projections are essential for realistic budgeting.

- Expense Allocations: This involves categorizing and allocating funds for various operational and ministry expenses. Categories typically include salaries and benefits, ministry programs, building maintenance, utilities, outreach, and administrative costs.

- Designated Funds: These are funds set aside for specific purposes, such as building funds, mission trips, or special projects. They are managed separately from the general operating fund.

- Contingency Fund: A reserve fund to cover unexpected expenses or shortfalls in income. The size of the contingency fund should be determined based on the church’s financial stability and risk tolerance.

- Debt Service: If the church has any outstanding debts (e.g., mortgage, loans), the budget must include payments for principal and interest.

- Capital Expenditures: Planning for significant investments in assets like buildings, equipment, or major renovations. These are often planned separately from the operational budget.

Budgeting Methods Used by Churches

Churches employ various budgeting methods, each with its own advantages and disadvantages. The choice of method depends on the church’s size, complexity, and financial philosophy.

Here are some common budgeting methods:

- Zero-Based Budgeting: This method starts with a “zero” budget each year, requiring the church to justify every expense. Every line item must be re-evaluated and approved.

- Pros: Promotes careful spending, identifies areas for cost savings, and ensures all expenses align with the church’s priorities.

- Cons: Time-consuming, requires detailed planning, and can be challenging for larger churches with numerous programs.

- Incremental Budgeting: This method uses the previous year’s budget as a base and adjusts it based on anticipated changes in income and expenses.

- Pros: Simple to implement, requires less time and effort than zero-based budgeting, and is easy to understand.

- Cons: May perpetuate inefficiencies from the previous year, can be less responsive to changing needs, and may not align spending with the church’s current priorities.

- Program-Based Budgeting: This method focuses on funding specific ministry programs or initiatives. The budget is structured around program goals and objectives.

- Pros: Aligns spending with ministry priorities, helps evaluate the effectiveness of programs, and promotes accountability.

- Cons: Can be more complex to implement, requires careful planning and coordination, and may be less flexible.

- Rolling Budgeting: A budget that is continuously updated, typically on a monthly or quarterly basis. As one period ends, a new period is added, providing a forward-looking view of finances.

- Pros: Offers flexibility, adapts to changing circumstances, and provides more up-to-date financial information.

- Cons: Requires ongoing monitoring and adjustments, can be time-consuming, and may be more complex to manage.

Hypothetical Church Budget

The following is a sample church budget, illustrating common income and expense categories. This example uses a responsive HTML table to ensure readability across various devices.

| Category | Projected Income | Projected Expenses | Notes |

|---|---|---|---|

| Income | |||

| Tithes and Offerings | $250,000 | Based on prior year giving, adjusted for anticipated growth. | |

| Special Donations | $10,000 | Includes funds for specific projects or needs. | |

| Other Income (e.g., rentals) | $5,000 | Income from renting church facilities. | |

| Total Income | $265,000 | ||

| Expenses | |||

| Salaries and Benefits | $120,000 | Includes pastor’s salary, staff salaries, and benefits. | |

| Ministry Programs | $40,000 | Includes children’s ministry, youth group, and adult programs. | |

| Building Maintenance | $20,000 | Covers repairs, upkeep, and utilities. | |

| Outreach | $15,000 | Funds for community outreach activities and missions. | |

| Administrative Costs | $10,000 | Includes office supplies, insurance, and other administrative expenses. | |

| Debt Service | $10,000 | Payments on any outstanding loans or mortgages. | |

| Contingency Fund | $5,000 | Funds for unexpected expenses. | |

| Total Expenses | $220,000 | ||

| Net Income (Surplus) | $45,000 |

The “Net Income (Surplus)” line at the bottom demonstrates the financial outcome of the budget. A surplus indicates that projected income exceeds projected expenses, allowing the church to save, invest, or allocate additional funds to ministry programs.

Importance of Financial Forecasting in Church Planning

Financial forecasting is the process of estimating future financial performance, such as income and expenses. It is an essential component of church planning, providing valuable insights for decision-making and strategic planning.

The significance of financial forecasting includes:

- Strategic Planning: Forecasting helps churches anticipate future financial needs, allowing them to develop long-term plans for ministry growth, capital projects, and staffing.

- Resource Allocation: By projecting future income and expenses, churches can make informed decisions about how to allocate resources effectively, ensuring that funds are directed to the most impactful areas.

- Risk Management: Forecasting helps churches identify potential financial risks, such as fluctuations in giving or unexpected expenses, allowing them to develop contingency plans to mitigate those risks.

- Decision-Making: Financial forecasts provide a basis for making informed decisions about investments, program expansions, and other strategic initiatives.

- Fundraising: Accurate financial forecasts can be used to support fundraising efforts by demonstrating the church’s financial needs and providing a clear picture of how donated funds will be used.

For example, a church might forecast a decline in giving due to economic uncertainty. This forecast could prompt the church to reduce expenses, increase fundraising efforts, or build up its contingency fund. Conversely, if a church forecasts significant growth in giving, it might plan to expand its ministry programs or hire additional staff.

Fundraising Strategies for Churches

Churches, like any non-profit organization, rely heavily on fundraising to support their ministries, community outreach programs, and operational expenses. Developing a diverse and well-planned fundraising strategy is crucial for financial stability and the ability to fulfill the church’s mission. This section will explore various fundraising activities, successful campaign examples, ethical considerations, and a guide to organizing successful fundraising events.

Common Fundraising Activities

Churches employ a wide array of fundraising activities to engage their congregations and the wider community. These activities vary in their complexity, resource requirements, and target audience.

- Tithe and Offering: The cornerstone of church fundraising, tithes and offerings are regular contributions from members. This involves promoting the importance of giving, providing convenient giving methods (online, mobile, and in-person), and transparently reporting how funds are used.

- Special Appeals: Churches often conduct special appeals for specific needs, such as building renovations, mission trips, or disaster relief efforts. These appeals are typically time-bound and involve a clear call to action.

- Events: Fundraising events are popular for their ability to engage the community and generate revenue. Examples include:

- Bake Sales: Selling homemade baked goods, a classic fundraising activity.

- Raffles: Offering prizes in exchange for tickets.

- Auctions: Silent or live auctions of donated items.

- Dinners and Banquets: Hosting meals to raise funds, often featuring guest speakers or entertainment.

- Concerts and Performances: Organizing musical or theatrical events.

- Sales: Churches sell various items to raise funds, including:

- Craft Fairs: Selling handmade crafts created by church members or local artisans.

- Book Sales: Offering books, especially religious texts or related literature.

- Merchandise: Selling branded items like t-shirts, mugs, or other church-related merchandise.

- Grant Writing: Seeking grants from foundations and government agencies to fund specific projects or programs. This requires skilled grant writers and a strong understanding of grant requirements.

- Planned Giving: Encouraging members to include the church in their wills or estate plans. This involves providing information about planned giving options and working with financial advisors.

- Partnerships: Collaborating with local businesses or other organizations for sponsorships or joint fundraising initiatives.

- Matching Gifts: Encouraging employees of companies with matching gift programs to donate, as the company will match the donation.

Successful Fundraising Campaigns

Successful fundraising campaigns often share common characteristics, including clear goals, compelling messaging, and effective engagement strategies. Here are some examples:

- Building Fund Campaign: A church needed to raise $500,000 for a new building. They launched a multi-faceted campaign that included:

- A Vision Video: A professionally produced video showcasing the vision for the new building and its impact on the community.

- Pledge Cards: Members were encouraged to make multi-year pledges.

- Matching Gift Challenge: A generous donor offered to match all donations up to a certain amount.

- Special Events: A fundraising dinner and a golf tournament were organized.

The campaign successfully exceeded its goal, raising $550,000.

- Mission Trip Fundraising: A youth group planned a mission trip to a developing country. They implemented several strategies:

- Individual Fundraising Pages: Each participant created a personalized fundraising page with their story and goal.

- Community Service Projects: Participants volunteered their time for local projects, soliciting donations for their efforts.

- Car Wash: A car wash was organized at a busy intersection.

- Benefit Concert: A local band volunteered to perform at a concert to raise funds.

The group successfully raised enough money to cover travel, accommodation, and project expenses.

- Disaster Relief Appeal: Following a natural disaster, a church launched an appeal to provide aid to affected communities.

- Immediate Response: Funds were collected to provide immediate relief, such as food, water, and shelter.

- Partnerships: The church partnered with other organizations to ensure efficient distribution of aid.

- Transparency: Regular updates were provided on how funds were being used.

The appeal generated significant donations, enabling the church to provide critical support to those in need.

Ethical Considerations in Church Fundraising

Ethical considerations are paramount in church fundraising to maintain trust and integrity. Churches must adhere to the highest standards of transparency, accountability, and stewardship.

- Transparency: Churches must be transparent about how funds are used, providing clear and accurate financial reports to donors. This includes detailing the purpose of the fundraising campaign, how the funds will be spent, and regular updates on progress.

- Accountability: Establishing clear procedures for managing donations and ensuring accountability for all funds raised. This includes internal controls, audits, and independent oversight.

- Honesty and Integrity: Fundraising materials and appeals should be honest and truthful, avoiding exaggeration or misrepresentation. Donors should be informed about the specific needs and how their donations will make a difference.

- Respect for Donors: Treat all donors with respect and gratitude, regardless of the size of their donation. Acknowledge all gifts promptly and express sincere appreciation.

- Stewardship: Demonstrate responsible stewardship of all funds raised, ensuring that donations are used effectively and efficiently to fulfill the church’s mission.

- Compliance: Comply with all relevant legal and regulatory requirements, including tax laws and fundraising regulations.

Organizing a Successful Church Fundraising Event

Organizing a successful fundraising event requires careful planning, execution, and follow-up. Here is a step-by-step guide:

- Define Goals and Objectives: Clearly define the purpose of the event and the fundraising goal. What specific needs will the funds address? How much money needs to be raised?

- Form a Planning Committee: Assemble a dedicated team with diverse skills and experience, including individuals with expertise in event planning, marketing, finance, and volunteer management.

- Choose an Event Type: Select an event type that aligns with the church’s values, the target audience, and the fundraising goals. Consider the resources required and the potential for success.

- Develop a Budget: Create a detailed budget that Artikels all anticipated expenses and revenue sources. Ensure that the budget is realistic and that the event is financially viable.

- Set a Timeline: Establish a realistic timeline for planning and executing the event, including deadlines for key tasks.

- Promote the Event: Develop a comprehensive marketing plan to promote the event to the target audience. Utilize various channels, such as the church bulletin, website, social media, email, and local media.

- Recruit Volunteers: Recruit and train volunteers to assist with various tasks, such as event setup, registration, food service, and cleanup.

- Secure Sponsorships: Seek sponsorships from local businesses or individuals to help offset event costs and increase revenue.

- Execute the Event: Ensure that the event runs smoothly and that all planned activities are executed effectively.

- Thank Donors and Volunteers: Express sincere gratitude to all donors, volunteers, and sponsors. Send thank-you notes and acknowledge their contributions.

- Evaluate the Event: Conduct a post-event evaluation to assess the success of the event, identify areas for improvement, and gather feedback for future events. Analyze the financial results and the overall impact.

Following these steps will help churches plan and execute successful fundraising events that support their ministries and outreach efforts.

Stewardship and Giving

Understanding stewardship and fostering a culture of generosity are fundamental to a church’s financial health and its ability to fulfill its mission. This section explores the concept of stewardship within a church context, provides practical methods for encouraging consistent giving, demonstrates how to calculate tithes and offerings, and compares different giving platforms.

The Concept of Stewardship in a Church Context

Stewardship, in a church context, is the understanding that everything we have – our time, talents, and resources – belongs to God. It’s about recognizing God as the owner and ourselves as managers or caretakers of these gifts. This includes not just financial resources but also the time, abilities, and opportunities we are given. Stewardship is more than just giving; it’s a way of life that reflects our gratitude and commitment to God and His work. It’s about managing God’s resources responsibly and using them to further His Kingdom. It is a spiritual practice that involves a commitment to living a generous life.

Methods for Encouraging Consistent Giving within a Congregation

Encouraging consistent giving is crucial for the financial stability of a church and its ability to serve its community. Here are some methods to promote generosity:

* Education on Biblical Giving: Regularly teach and preach about the biblical principles of giving, including tithing, offering, and generosity. Emphasize the spiritual benefits of giving and the importance of a cheerful heart.

* Sharing Impact Stories: Highlight the positive impact of the church’s ministries and outreach programs. Share stories of lives changed and needs met, demonstrating how donations are used effectively.

* Providing Giving Options: Offer various ways for people to give, including online giving platforms, mobile apps, text-to-give options, and traditional methods like offering envelopes.

* Automated Giving: Encourage members to set up recurring donations through online platforms or automatic bank transfers. This ensures consistent giving and simplifies the process.

* Annual Giving Campaigns: Launch annual giving campaigns with specific goals and objectives. Clearly communicate the church’s financial needs and how donations will be used.

* Transparency and Accountability: Be transparent about how donations are used. Provide regular financial reports and demonstrate responsible stewardship of funds.

* Expressing Gratitude: Regularly thank donors for their generosity, whether publicly or privately. Acknowledge gifts and express appreciation for their support.

* Offering Financial Education: Provide resources and workshops on personal finance and budgeting. Help members develop healthy financial habits that allow them to give generously.

* Lead by Example: Church leaders, including pastors and elders, should model generous giving. Their example can inspire others to give.

* Focus on Relationships: Cultivate relationships with members and understand their financial situations. This can help the church tailor its approach to encouraging giving.

Calculating Tithes and Offerings

Calculating tithes and offerings is a fundamental aspect of Christian giving. The Bible teaches that a tithe (meaning “tenth”) is a tenth of one’s income. Offerings are gifts given above and beyond the tithe.

“Bring the whole tithe into the storehouse, that there may be food in my house. Test me in this,” says the Lord Almighty, “and see if I will not throw open the floodgates of heaven and pour out so much blessing that there will not be room enough to store it.” – Malachi 3:10 (NIV)

Here’s how to calculate tithes and offerings:

* Calculating the Tithe: Determine your gross income (income before taxes and other deductions). Multiply your gross income by 10% (0.10) to calculate the tithe.

* *Example:* If your gross monthly income is $4,000, your tithe would be $4,000 x 0.10 = $400.

* Calculating Offerings: Offerings are given above and beyond the tithe. The amount of the offering is determined by the individual’s generosity and willingness to give. There is no set percentage for offerings.

* *Example:* A person could choose to give an offering of $50, $100, or any amount they feel led to give.

It’s important to note that the specific application of tithing and offering can vary among different denominations and churches. Some churches may also have specific guidelines for how tithes and offerings should be used.

Comparing Different Giving Platforms Used by Churches

Churches utilize various giving platforms to facilitate donations. The choice of platform can significantly impact the ease of giving and the church’s financial management. The following table compares some common features of different giving platforms:

| Platform | Transaction Fees | Features | Ease of Use |

|---|---|---|---|

| Pushpay | Varies by plan, typically a percentage of each transaction. | Mobile app, text-to-give, online giving, event registration, member management. | User-friendly interface for both givers and administrators; robust mobile app. |

| Subsplash Giving | Varies based on the plan, with a percentage of each transaction. | Integrated with Subsplash media platform, custom branding, recurring giving, and reporting. | Seamless integration with the Subsplash platform, easy for both givers and administrators. |

| Tithe.ly | Percentage-based fees per transaction. | Online giving, mobile app, text-to-give, event registration, and giving analytics. | Simple and intuitive interface, easy to set up and manage. |

| Planning Center Giving | Fees per transaction, with varying rates depending on the plan selected. | Integrated with Planning Center’s suite of church management tools, online giving, recurring giving, and reporting. | Offers a streamlined experience with the Planning Center ecosystem. |

The table provides a general overview, and specific features and fees may vary. Churches should research and compare platforms based on their needs, budget, and the preferences of their congregation.

Financial Transparency and Accountability

Financial transparency and accountability are fundamental pillars for building trust and fostering a healthy environment within a church. They ensure that members have confidence in how their contributions are managed and utilized, promoting responsible stewardship and strengthening the overall integrity of the church’s mission. This commitment is not just an ethical imperative; it’s a crucial component for long-term sustainability and the ability to effectively serve the community.

Importance of Financial Transparency

Transparency builds trust, and trust is the bedrock of any thriving church community. When members understand how funds are received, allocated, and spent, they are more likely to give generously and participate actively in the church’s mission. Conversely, a lack of transparency can lead to suspicion, decreased giving, and ultimately, damage the church’s reputation and ability to operate effectively. Openness in financial matters also protects the church from potential mismanagement, fraud, and legal issues.

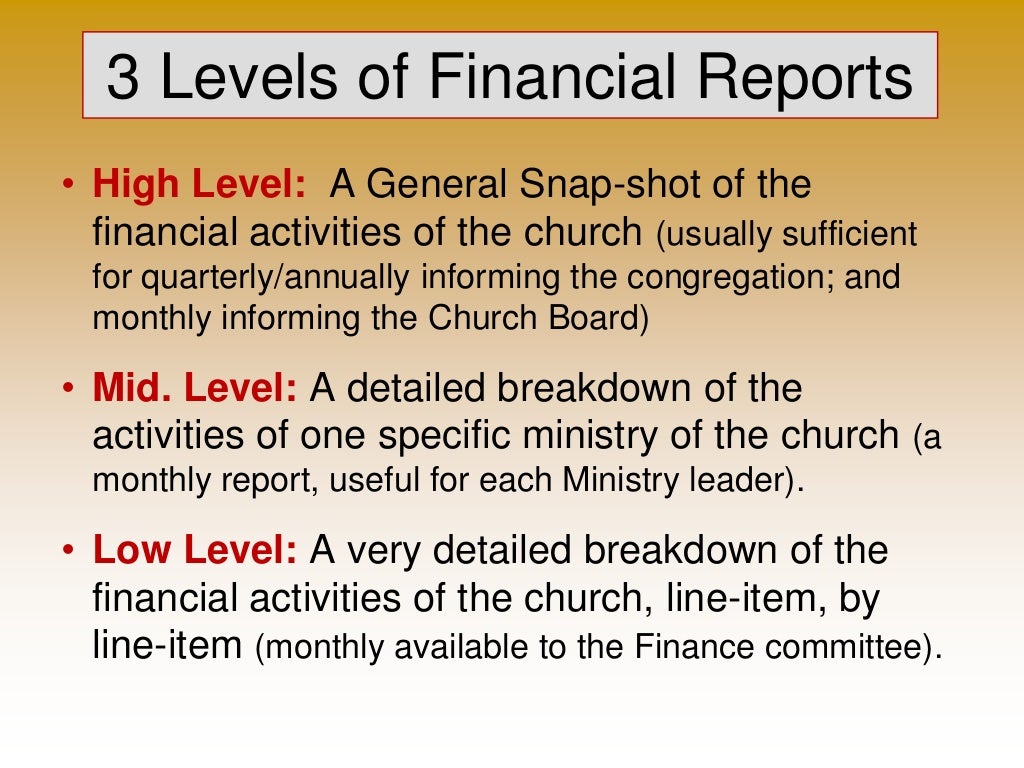

Best Practices for Financial Reporting

Effective financial reporting provides clarity and enables informed decision-making. Implementing these best practices can significantly enhance financial transparency:

- Regular Financial Statements: Prepare and distribute financial statements (income statement, balance sheet, and cash flow statement) at least quarterly, and ideally monthly. These statements should be clear, concise, and easy to understand, even for those without a financial background.

- Detailed Budgeting: Develop a comprehensive annual budget that is presented to the congregation for approval. The budget should clearly Artikel anticipated income and expenses, with specific line items for all major categories.

- Independent Audits: Conduct an independent audit of the church’s financial records annually by a qualified Certified Public Accountant (CPA). This provides an unbiased assessment of the financial health and ensures compliance with accounting standards.

- Online Giving Platforms: Utilize secure and transparent online giving platforms that provide donors with immediate confirmation of their contributions and access to their giving history.

- Annual Reports: Publish an annual report that summarizes the church’s financial performance, ministry activities, and future plans. This report should be accessible to all members.

- Open Access to Financial Records: Make financial records, such as budgets and financial statements, available to members upon request, within reasonable limits and following established policies.

- Clear Communication: Regularly communicate financial updates to the congregation through various channels, such as newsletters, bulletins, and website postings.

Role of the Finance Committee, Church and finances

The finance committee or a similar body plays a critical role in overseeing the church’s financial health and ensuring accountability. This committee is typically composed of church members with financial expertise, such as accountants, business owners, or individuals with experience in financial management. Their responsibilities include:

- Budget Development and Oversight: Assisting in the development of the annual budget and monitoring actual performance against the budget throughout the year.

- Financial Reporting Review: Reviewing financial statements and reports to ensure accuracy and compliance with accounting standards.

- Internal Controls: Establishing and maintaining internal controls to safeguard assets and prevent fraud. This may include segregation of duties, authorization procedures, and regular reconciliations.

- Investment Management: Overseeing the church’s investments and ensuring that funds are managed prudently and in accordance with the church’s investment policy.

- Risk Management: Identifying and mitigating financial risks, such as insurance coverage and fraud prevention.

- Policy Development: Developing and reviewing financial policies and procedures to ensure compliance with legal and ethical standards.

- Recommendation to Leadership: Making recommendations to the church leadership (e.g., the pastor, the church council) on financial matters.

Potential Red Flags in Church Finances and How to Address Them

Recognizing and addressing potential red flags in church finances is crucial for preventing financial mismanagement and protecting the church’s resources.

- Unexplained Fund Transfers: Large or frequent transfers of funds between accounts without clear documentation or justification can be a sign of potential misappropriation. Address: Implement strong internal controls, including dual signatures on checks and regular reconciliation of bank statements. Investigate any unexplained transfers immediately.

- Lack of Budgeting and Variance Analysis: Failure to create and adhere to a budget, or to analyze significant variances between budgeted and actual figures, can indicate poor financial planning and control. Address: Develop a comprehensive annual budget and regularly compare actual results to the budget, investigating any significant discrepancies.

- Unexplained Increases in Expenses: A sudden or sustained increase in expenses without a corresponding increase in ministry activities or giving can be a cause for concern. Address: Carefully review expense reports and invoices, seeking explanations for any unusual increases. Implement a system for approving all expenses.

- Conflicts of Interest: Financial transactions that benefit church leaders or their family members can indicate a conflict of interest. Address: Establish a clear policy on conflicts of interest and require disclosure of any potential conflicts. Ensure all financial transactions are properly documented and reviewed.

- Inadequate Record Keeping: Poorly maintained financial records make it difficult to track income and expenses and can increase the risk of errors or fraud. Address: Implement a robust accounting system and ensure all financial transactions are properly recorded and documented. Regular audits can help to identify issues.

- Lack of Independent Oversight: Absence of an independent audit or review by a qualified professional leaves the church vulnerable to financial mismanagement. Address: Engage a CPA to conduct an annual audit and provide an independent assessment of the church’s financial health.

- High Levels of Unrestricted Cash: Holding excessive amounts of cash without a clear plan for its use may indicate poor financial planning or a lack of investment strategy. Address: Develop a financial plan that Artikels the church’s long-term goals and investment strategy. Consider investing excess cash in interest-bearing accounts or other appropriate investments.

Managing Church Assets

Managing church assets is a critical aspect of responsible stewardship and financial health. It involves not only acquiring property and resources but also ensuring their long-term care, protection, and strategic use to support the church’s mission. Effective asset management safeguards the church’s investments, fosters trust within the congregation, and provides a solid foundation for ministry.

Acquiring and Managing Church Property

The process of acquiring and managing church property involves several key steps, from initial assessment to ongoing maintenance. Churches should approach property acquisition with careful planning and due diligence.

The acquisition of church property typically begins with identifying a need, such as a new worship space, educational facilities, or land for future expansion. Once the need is established, the following steps are generally involved:

* Needs Assessment: Evaluate the church’s current and future needs, considering factors like membership growth, program requirements, and community outreach initiatives.

* Site Selection: Research potential locations, considering factors like accessibility, zoning regulations, cost, and community demographics. Conduct a thorough analysis of each property.

* Due Diligence: Conduct a thorough investigation of the property, including title searches, environmental assessments, and surveys. Consult with legal and financial professionals.

* Negotiation and Purchase: Negotiate the terms of the purchase agreement with the seller. Secure financing, if needed. Close the transaction and take ownership of the property.

* Ongoing Management: Once the property is acquired, ongoing management is essential. This includes:

* Developing and implementing a property management plan.

* Maintaining the property in good condition.

* Paying property taxes and insurance premiums.

* Ensuring compliance with all applicable regulations.

Maintaining Church Buildings and Facilities

A comprehensive maintenance plan is essential for preserving church buildings and facilities. This plan should encompass both routine maintenance and preventative measures. A well-maintained facility reflects positively on the church and protects its investment. Below is a sample table outlining the elements of a building maintenance plan.

“`html

| Maintenance Task | Frequency | Responsible Party | Notes |

|---|---|---|---|

| Roof Inspection | Annually (or after severe weather) | Facilities Committee/Contractor | Check for leaks, damage, and debris. |

| HVAC System Maintenance | Quarterly (filter changes) / Annually (professional servicing) | Facilities Committee/Contractor | Ensure proper functioning and energy efficiency. |

| Plumbing Inspection | Semi-annually | Facilities Committee/Contractor | Check for leaks, clogs, and potential problems. |

| Electrical System Inspection | Annually | Facilities Committee/Contractor | Check for code compliance and safety. |

| Exterior Painting/Repairs | As Needed (every 5-7 years) | Facilities Committee/Contractor | Maintain the building’s appearance and protect it from the elements. |

| Landscaping and Groundskeeping | Weekly/Monthly | Volunteers/Contractor | Maintain the appearance and safety of the grounds. |

| Fire Safety System Inspection | Annually | Contractor | Test and maintain fire alarms, extinguishers, and sprinkler systems. |

| Cleaning and Janitorial Services | Weekly/Daily | Volunteers/Contractor | Maintain cleanliness and hygiene. |

“`

Regular inspections and prompt repairs are crucial for preventing small issues from escalating into costly problems.

Importance of Insurance for Churches

Insurance is a vital component of protecting a church’s assets and mitigating financial risks. Adequate insurance coverage safeguards the church against potential losses resulting from various events.

The following types of insurance are essential for churches:

* Property Insurance: Protects the church’s buildings and contents from damage or loss due to fire, theft, vandalism, and other covered perils.

* Liability Insurance: Provides coverage for claims arising from bodily injury or property damage sustained by others on church property or during church-sponsored activities.

* Workers’ Compensation Insurance: Covers medical expenses and lost wages for employees who are injured on the job.

* Directors and Officers (D&O) Liability Insurance: Protects the church’s leaders from lawsuits alleging wrongful acts in their capacity as directors and officers.

* Commercial Auto Insurance: Covers vehicles owned or used by the church.

* Cyber Liability Insurance: Protects against financial losses from cyberattacks, data breaches, and other technology-related risks.

Churches should regularly review their insurance policies to ensure that coverage is adequate and up-to-date. Working with an insurance professional who specializes in church insurance can help ensure the church has the appropriate coverage to meet its specific needs.

Selling Church Assets

Selling church assets should be a carefully considered decision, guided by the church’s mission and financial needs. A transparent and well-documented process is crucial to maintain trust within the congregation and comply with legal requirements.

The steps involved in selling church assets include:

* Decision to Sell: The church leadership, typically the church council or board, should make a formal decision to sell the asset, based on a clear understanding of the reasons for the sale. These reasons might include a change in ministry focus, financial constraints, or the need to reinvest in other areas.

* Appraisal and Valuation: Obtain a professional appraisal to determine the fair market value of the asset. This will inform the asking price and ensure a fair transaction.

* Legal and Financial Review: Consult with legal counsel and financial advisors to ensure compliance with all applicable laws and regulations. This includes reviewing the church’s bylaws, state laws, and any restrictions on the asset.

* Congregational Approval: Present the proposal to sell the asset to the congregation for approval. Transparency and open communication are essential during this process. Provide clear explanations of the reasons for the sale and the intended use of the proceeds.

* Marketing and Sale: Market the asset through appropriate channels, such as real estate brokers, online listings, and direct outreach to potential buyers. Negotiate the terms of the sale with potential buyers.

* Closing the Sale: Finalize the sale transaction, including the transfer of ownership and distribution of proceeds. Document the entire process thoroughly. The proceeds from the sale should be used in accordance with the church’s approved plan, often for ministry purposes, debt reduction, or reinvestment in other assets.

Legal and Tax Implications

Understanding the legal and tax landscape is crucial for churches to maintain their tax-exempt status and operate ethically and responsibly. Churches must navigate a complex web of regulations to ensure financial compliance and avoid potential legal issues. This section provides a comprehensive overview of these critical aspects.

Tax-Exempt Status of Churches

Churches are generally recognized as tax-exempt organizations under Section 501(c)(3) of the Internal Revenue Code. This exemption from federal income tax is a significant benefit, but it comes with specific obligations. Churches must adhere to certain guidelines to maintain their tax-exempt status.

- Eligibility Criteria: To qualify for tax-exempt status, a church must meet specific criteria, including being organized and operated exclusively for religious purposes. This involves activities like worship, religious education, and the promotion of religious doctrines.

- Exemptions from Income Tax: Churches are typically exempt from federal income tax on their revenue, including tithes, offerings, and other contributions. However, this exemption is not absolute.

- Unrelated Business Income Tax (UBIT): Churches may be subject to UBIT if they engage in business activities that are not substantially related to their religious purposes. For example, if a church operates a for-profit bookstore, the profits from the bookstore may be subject to UBIT.

- Political Activities: Churches are prohibited from directly or indirectly participating in, or intervening in, any political campaign on behalf of (or in opposition to) any candidate for public office. Violating this prohibition can result in the loss of tax-exempt status.

- Lobbying Activities: Churches can engage in some lobbying activities, but they must adhere to specific limits. Substantial lobbying can jeopardize their tax-exempt status.

Legal Considerations Related to Church Finances

Churches face various legal considerations in managing their finances. Understanding these considerations is essential for preventing legal disputes and ensuring responsible stewardship.

- Formation of a Legal Entity: Churches should establish a legal entity, such as a non-profit corporation, to protect the personal assets of church leaders and members. This separation of the church as an entity from its members offers liability protection.

- Bylaws and Governance: Clear bylaws that Artikel the church’s governance structure, financial policies, and decision-making processes are crucial. These bylaws should address areas like financial management, conflict of interest, and the roles and responsibilities of church leaders.

- Contracts and Agreements: Churches frequently enter into contracts for various services, such as construction, maintenance, and staffing. These contracts should be reviewed by legal counsel to ensure they are fair, enforceable, and protect the church’s interests.

- Employment Law: Churches must comply with employment laws, including those related to wages, hours, and non-discrimination. Proper classification of employees versus independent contractors is critical to avoid legal issues.

- Property Ownership: Churches need to manage their property carefully. This includes understanding property rights, zoning regulations, and insurance requirements.

- Fundraising Regulations: Churches that conduct fundraising activities must comply with state and federal regulations, including those related to charitable solicitations. Transparency in fundraising practices is essential.

Responsibilities of Church Leaders Regarding Financial Compliance

Church leaders have a significant responsibility to ensure financial compliance. This responsibility extends to various areas of financial management, including budgeting, record-keeping, and reporting.

- Financial Oversight: Church leaders, often including the pastor, treasurer, and members of the finance committee, must exercise diligent financial oversight. This involves reviewing financial statements, approving budgets, and monitoring financial performance.

- Record-Keeping: Accurate and complete financial records are essential for compliance. This includes maintaining records of all income and expenses, donations, and other financial transactions. Records should be kept for a minimum of three to seven years, depending on the type of record and applicable regulations.

- Internal Controls: Implementing internal controls, such as segregating duties and requiring multiple signatures on checks, can help prevent fraud and errors. Regular audits, whether internal or external, can also provide assurance of financial accuracy.

- Reporting Requirements: Churches may be required to file various tax forms with the IRS, such as Form 990 (Return of Organization Exempt From Income Tax) if their gross receipts typically exceed $50,000. They may also need to file state-specific reports.

- Transparency and Communication: Church leaders should promote transparency by communicating financial information to church members regularly. This can include providing financial reports, budget updates, and information on how funds are being used.

- Training and Education: Church leaders should receive training and education on financial management and compliance to understand their responsibilities and stay up-to-date on changing regulations.

Importance of Obtaining Professional Financial Advice

Seeking professional financial advice is crucial for churches to navigate the complexities of financial management and compliance. Consulting with qualified professionals can help churches make informed decisions and avoid potential pitfalls.

- Certified Public Accountants (CPAs): CPAs can provide expert advice on accounting, tax planning, and financial reporting. They can help churches prepare accurate financial statements, file tax returns, and understand their tax obligations.

- Financial Advisors: Financial advisors can help churches with investment management, retirement planning for staff, and long-term financial goals. They can provide guidance on how to manage assets and grow financial resources.

- Legal Counsel: An attorney specializing in non-profit law can provide legal advice on a variety of issues, including contracts, employment law, and tax compliance. They can also help churches navigate legal disputes and ensure they are in compliance with all applicable laws.

- Insurance Professionals: Insurance professionals can help churches assess their insurance needs and obtain appropriate coverage for property, liability, and other risks.

- Benefits of Professional Advice:

- Expertise: Professionals have specialized knowledge and experience in financial management and compliance.

- Objectivity: Professionals can provide unbiased advice and help churches make informed decisions.

- Compliance: Professionals can help churches comply with all applicable laws and regulations.

- Risk Management: Professionals can help churches identify and mitigate financial risks.

- Efficiency: Professionals can help churches streamline their financial processes and improve efficiency.

Technology and Finances

Technology has revolutionized nearly every aspect of modern life, and church finances are no exception. Embracing technology can significantly streamline financial processes, improve accuracy, enhance security, and free up valuable time for ministry. This shift allows churches to operate more efficiently, making the most of their resources and better serving their congregations.

Streamlining Church Financial Processes with Technology

Implementing technology can transform how a church manages its finances, leading to greater efficiency and accuracy. Automated systems reduce manual data entry, minimizing errors and saving time. Online giving platforms make donating easier for members, increasing contribution rates. Cloud-based solutions allow for remote access to financial data, enabling church leaders to monitor finances from anywhere. These technological advancements also facilitate better reporting and analysis, providing valuable insights for informed decision-making. For example, a church that switches from manual spreadsheets to accounting software can see a reduction in data entry time by as much as 50%, freeing up the finance team to focus on other crucial tasks.

Software Solutions for Church Accounting and Giving

A variety of software solutions are available to assist churches with their financial management needs. Choosing the right tools depends on the size and specific requirements of the church. The following are some of the most popular and effective options:

- Church Accounting Software:

- QuickBooks Online: A widely used, cloud-based accounting software that is adaptable to the needs of various churches. It offers features like expense tracking, budgeting, and reporting.

- Aplos: Specifically designed for nonprofits, including churches. It provides robust accounting, fundraising, and donor management tools.

- Shelby Systems: Offers a comprehensive suite of church management software, including accounting, membership, and event management.

- ACS Technologies: Another comprehensive solution that offers a variety of church management tools, including accounting, giving, and membership.

- Online Giving Platforms:

- Pushpay: A mobile-first giving platform that integrates with church management software. It offers features like recurring giving, text-to-give, and event registration.

- Tithe.ly: A user-friendly platform that allows churches to accept online donations and manage giving. It offers features like recurring giving, event ticketing, and mobile giving.

- Givelify: A mobile-first giving platform that focuses on ease of use and integrates with various church management systems.

- Planning Center Giving: Integrated with Planning Center’s suite of church management tools, offering seamless giving and donor management.

Security Considerations of Online Giving Platforms

Online giving platforms must prioritize security to protect sensitive financial information. Churches should ensure that the platforms they use employ robust security measures, including encryption, secure data storage, and compliance with industry standards like PCI DSS (Payment Card Industry Data Security Standard). Churches should also educate their members about online security best practices, such as using strong passwords and being cautious of phishing attempts. Regularly reviewing and updating security protocols is crucial.

“Data breaches can have severe consequences, including financial loss and reputational damage. Therefore, churches must choose platforms that prioritize security and implement best practices to protect their donors’ information.”

Designing a Guide for Implementing New Financial Software

Implementing new financial software requires careful planning and execution. A well-designed implementation guide can help ensure a smooth transition and minimize disruptions.

- Needs Assessment: Determine the church’s specific financial needs and the features required in the new software. Consider the church’s size, budget, and existing processes.

- Software Selection: Research and compare different software options, considering features, pricing, and user reviews. Select the software that best meets the church’s needs.

- Data Migration: Plan how to transfer existing financial data from the old system to the new one. Ensure data integrity and accuracy during the migration process.

- Training: Provide comprehensive training to staff and volunteers who will be using the new software. Offer ongoing support and resources.

- Implementation Timeline: Create a detailed implementation timeline, including key milestones and deadlines.

- Testing and Validation: Test the new software thoroughly before going live. Validate that all features are working correctly and that data is accurate.

- Go-Live and Support: Officially launch the new software and provide ongoing support to users. Address any issues promptly and monitor performance.

By following these steps, a church can successfully implement new financial software, improving its financial management capabilities and enhancing its overall operations. For instance, a church can allocate a dedicated “implementation team” composed of finance staff, tech-savvy volunteers, and potentially an external consultant to facilitate each step, ensuring a smooth and successful transition.

Financial Challenges Faced by Churches

Churches, regardless of size or denomination, often navigate a complex landscape of financial challenges. These challenges can significantly impact a church’s ability to fulfill its mission, provide essential services, and maintain its facilities. Understanding these difficulties and implementing effective strategies for financial management is crucial for the long-term sustainability and growth of any church.

Common Financial Challenges Faced by Churches of Different Sizes

Churches encounter various financial hurdles. The nature and severity of these challenges often correlate with the church’s size, location, and the demographics of its congregation.

- Declining or Stagnant Giving: A consistent challenge is maintaining or increasing financial contributions from members. This can be influenced by economic downturns, changes in individual financial circumstances, and shifts in giving habits. Smaller churches may experience a more significant impact from the loss of a few major donors. Larger churches might face challenges in sustaining giving levels as membership demographics evolve.

- Maintaining Facilities: The costs associated with maintaining church buildings and grounds are substantial. These include routine maintenance, repairs, utilities, and insurance. Older buildings often require more frequent and costly upkeep. Churches in areas with high property values or extreme weather conditions face heightened financial pressures.

- Staffing Costs: Salaries, benefits, and payroll taxes for pastors, ministry staff, and administrative personnel constitute a significant portion of church budgets. Smaller churches may struggle to afford full-time staff, while larger churches may face challenges in managing increasing personnel costs.

- Ministry Program Expenses: Funding for various ministry programs, such as youth activities, missions, outreach, and educational initiatives, requires careful budgeting. Churches must balance the desire to expand their ministries with the financial realities of their resources.

- Debt Management: Churches may carry debt from building projects, renovations, or other capital expenditures. Managing this debt, including interest payments, can strain financial resources.

- Unexpected Expenses: Unforeseen events, such as natural disasters, equipment failures, or legal issues, can create significant financial burdens. Churches need to have emergency funds and appropriate insurance coverage to mitigate these risks.

- Competition for Donations: Churches compete with various non-profit organizations for charitable giving. This competition can make it more challenging to raise funds, especially during economic downturns.

Strategies for Overcoming Financial Difficulties

Churches can implement several strategies to address financial challenges and improve their financial health. These strategies should be carefully considered and adapted to the specific circumstances of each church.

- Develop a Realistic Budget: Creating a detailed and accurate budget is fundamental. This involves forecasting income, estimating expenses, and regularly monitoring financial performance against the budget. A well-defined budget helps identify potential financial shortfalls early.

- Implement Financial Planning: Churches should develop a long-term financial plan that Artikels their goals and strategies for achieving financial stability. This plan should include projections for income, expenses, and investments.

- Enhance Stewardship Education: Regularly educate the congregation on the importance of giving and the impact of their contributions. This can involve sermons, workshops, and informational materials.

- Diversify Revenue Streams: Explore alternative sources of income beyond regular giving. This might include fundraising events, rental of church facilities, or income-generating ministries.

- Control Expenses: Review all expenses and identify areas where costs can be reduced without compromising essential services. This may involve negotiating with vendors, seeking competitive bids, and implementing energy-saving measures.

- Build an Emergency Fund: Establishing an emergency fund to cover unexpected expenses is crucial. This fund should be sufficient to cover several months of operating expenses.

- Manage Debt Wisely: Churches should carefully manage their debt and avoid taking on more debt than they can reasonably afford. Refinancing debt at lower interest rates can also be beneficial.

- Improve Financial Transparency: Communicate regularly with the congregation about the church’s financial situation. This builds trust and encourages responsible giving. Publish financial reports regularly.

- Seek Professional Advice: Consult with financial advisors, accountants, and legal professionals to gain expert guidance on financial matters.

Examples of How Churches Have Adapted to Changing Economic Conditions

Churches have demonstrated remarkable adaptability in response to changing economic landscapes. These examples highlight various approaches churches have taken to overcome financial hurdles and continue their ministries.

- Increased Focus on Online Giving: Many churches have adopted online giving platforms, providing members with convenient options for making contributions. During the COVID-19 pandemic, this became crucial for maintaining giving levels when in-person services were restricted.

- Reduced Staffing Costs: Some churches have adjusted staffing levels by implementing part-time positions or sharing staff resources with other organizations.

- Deferred Maintenance Projects: Churches sometimes postpone non-essential maintenance projects to conserve financial resources during economic downturns.

- Renting Out Church Facilities: Several churches have found that renting their facilities to community groups, businesses, or other organizations can provide a consistent stream of income.

- Community Outreach Programs: Many churches have expanded their community outreach programs, such as food banks or clothing drives, to address the needs of their members and the wider community during economic hardship. This builds goodwill and can attract new members.

- Collaborative Partnerships: Churches collaborate with other churches or organizations to share resources and expertise. This can include joint fundraising efforts or shared ministry programs.

Elaboration on the Impact of Economic Downturns on Church Finances

Economic downturns can significantly impact church finances, leading to decreased giving, increased expenses, and greater financial strain. Understanding the potential consequences of economic fluctuations allows churches to prepare proactively and mitigate the negative effects.

- Reduced Giving: During economic downturns, individuals and families may experience job losses, reduced incomes, and increased financial stress. This often results in a decrease in charitable giving, as people prioritize their basic needs.

- Increased Demand for Assistance: Churches often provide financial assistance and support to their members and the wider community. During economic downturns, the demand for these services increases, placing additional strain on church resources.

- Decreased Investment Income: Churches may have investments that generate income. Economic downturns can lead to declines in investment values and reduced income from these sources.

- Rising Expenses: Inflation can increase the cost of goods and services, including utilities, insurance, and maintenance. Churches may face higher operating costs during economic downturns.

- Impact on Building Projects: Economic downturns can make it more challenging to secure financing for building projects or renovations. Churches may need to postpone or scale back these projects.

- Staffing Challenges: Churches may need to make difficult decisions about staffing levels or salaries during economic downturns.

- Increased Need for Financial Planning: During economic downturns, churches must implement more rigorous financial planning and budgeting to manage their resources effectively.

Church and finances – Churches, like any organization, navigate the complexities of finances, requiring careful stewardship of resources. Understanding financial management is crucial, and for those in Neosho, Missouri, exploring options like empire finance neosho mo could offer valuable insights into fiscal strategies. Ultimately, sound financial practices are essential to support the church’s mission and its ability to serve the community effectively, impacting everything from outreach programs to building maintenance.

Managing church finances often involves complex budgeting and stewardship. While the church may not leverage it directly, the principles of efficient resource allocation are akin to the strategies explored in ai in corporate finance , where AI streamlines financial modeling and forecasting. Ultimately, the church’s commitment to transparency and responsible financial practices mirrors the corporate world’s drive for optimized financial performance, fostering trust and sustainability.