Program Overview: Columbia University’s MSc in Finance: Columbia Msc Finance

The Master of Science in Finance (MSc in Finance) program at Columbia University provides a rigorous and comprehensive education in financial theory and practice. It’s designed for individuals seeking to develop advanced analytical and problem-solving skills essential for careers in various finance-related fields. The program emphasizes a global perspective, reflecting the international nature of the financial markets.

Core Curriculum

The core curriculum provides a foundational understanding of finance. Students are required to complete a set of core courses that cover fundamental concepts and analytical tools. This ensures a strong base for more specialized coursework.

- Corporate Finance: This course focuses on financial decision-making within corporations, including capital budgeting, capital structure, and dividend policy. The objective is to equip students with the ability to evaluate investment opportunities and manage corporate finances effectively.

- Financial Accounting: This course covers the principles and practices of financial accounting, including the preparation and analysis of financial statements. It aims to provide students with the skills to understand and interpret financial information.

- Investments: This course explores the principles of investment management, including portfolio theory, asset pricing models, and the analysis of financial instruments. Students learn how to construct and manage investment portfolios.

- Derivatives: This course covers the theory and application of financial derivatives, such as options, futures, and swaps. Students learn how to price and use derivatives for hedging and speculation.

- Econometrics: This course introduces statistical methods and their application to financial data. Students learn how to analyze financial data and build econometric models.

- Fixed Income Securities: This course focuses on the valuation and analysis of fixed income securities, including bonds and other debt instruments. Students learn about interest rate risk and credit risk.

Program Structure

The MSc in Finance program is structured to provide a focused and intensive learning experience. Students benefit from a curriculum designed to prepare them for a variety of careers in finance.

- Duration: The program typically takes 12 months to complete, spanning three semesters.

- Credit Requirements: Students must complete a total of 36 credit hours. This includes core courses, elective courses, and any required capstone projects or thesis.

- Academic Calendar: The academic calendar follows a traditional semester structure, with fall, spring, and summer semesters. The fall semester typically begins in late August or early September, and the spring semester concludes in late April or early May. The summer semester may include optional courses or internships.

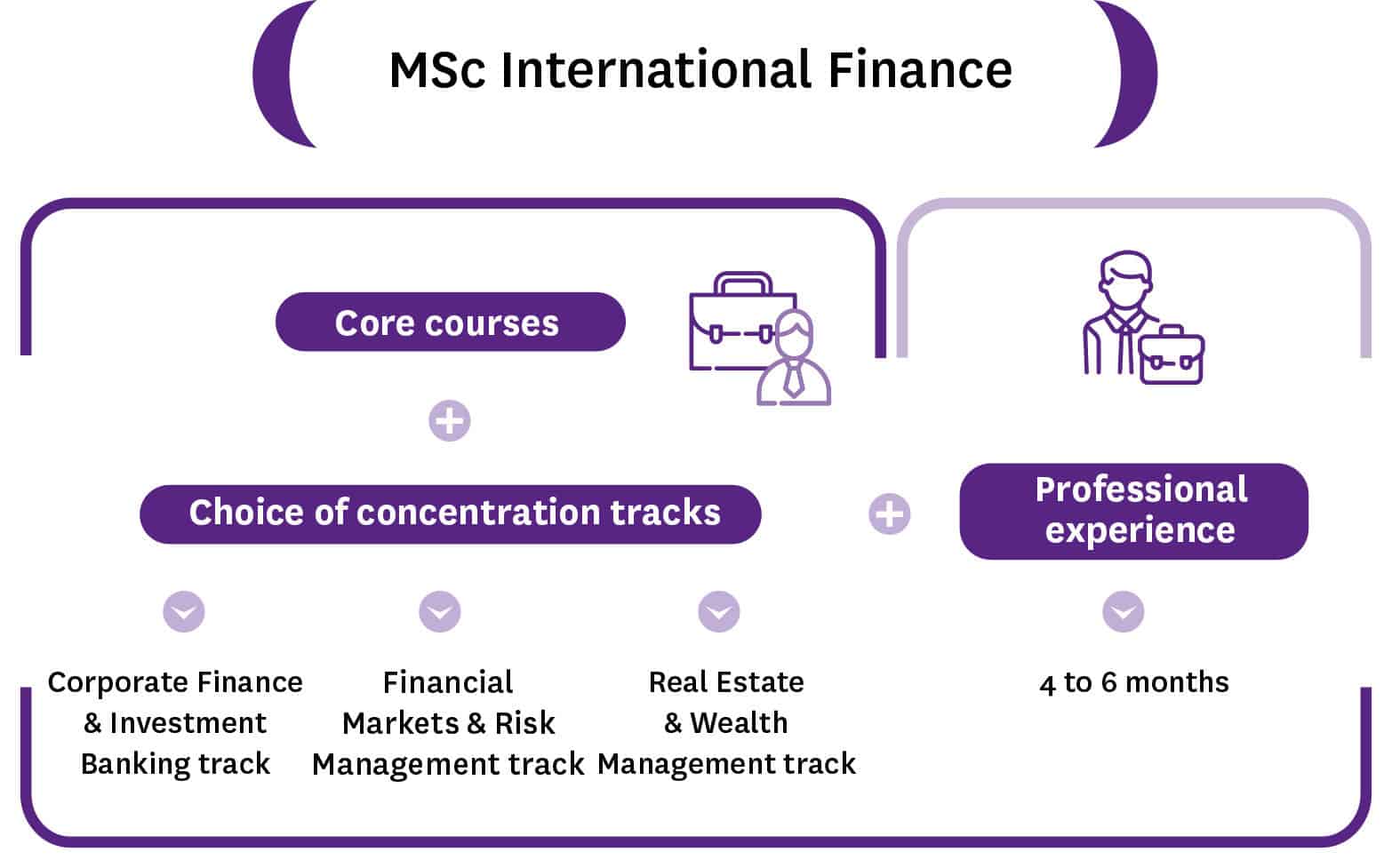

Specializations and Concentrations

Columbia’s MSc in Finance program offers various specializations to allow students to focus on specific areas of finance. This allows students to tailor their studies to their career interests.

| Specialization | Focus | Career Paths |

|---|---|---|

| Corporate Finance | Financial decision-making within corporations, including capital budgeting, mergers and acquisitions, and corporate restructuring. | Investment Banking, Corporate Development, Financial Planning and Analysis |

| Investment Management | Portfolio construction, asset allocation, and investment strategies. | Portfolio Manager, Investment Analyst, Wealth Management |

| Financial Engineering | Quantitative methods, derivatives pricing, and risk management. | Quantitative Analyst (Quant), Risk Manager, Structurer |

| Asset Pricing | Theories and models for valuing financial assets, including equities, fixed income, and derivatives. | Investment Strategist, Portfolio Manager, Research Analyst |

| Fintech | The intersection of finance and technology, including blockchain, artificial intelligence, and data analytics. | Fintech Analyst, Data Scientist, Product Manager (Fintech) |

Admission Requirements and Application Process

Gaining admission to Columbia University’s MSc in Finance program is a competitive process. Prospective students need to meet specific requirements and navigate a structured application process. Success hinges on a comprehensive application package that highlights academic excellence, professional experience, and a strong understanding of finance.

Specific Requirements for Admission

Meeting the admission requirements is crucial for consideration. The program assesses candidates holistically, considering a variety of factors.

- GPA: A strong undergraduate GPA is a primary indicator of academic ability. While there is no minimum GPA, successful applicants typically have a GPA of 3.5 or higher. Competitive candidates often have GPAs closer to 3.7 or above. Demonstrating a consistent academic record is vital.

- Standardized Test Scores (GRE/GMAT): Applicants must submit either GRE or GMAT scores. There is no preference between the two exams. The average GMAT score for admitted students is typically around 720, while the average GRE score is around 325. The score is a key element, so candidates should prepare thoroughly.

- Work Experience: While not always a mandatory requirement, relevant work experience is highly valued. The program welcomes candidates with diverse backgrounds. However, experience in finance-related fields, such as investment banking, asset management, or consulting, is highly beneficial. Applicants with little to no work experience can still be considered, especially if they have strong academic credentials and relevant extracurricular activities.

- Prerequisites: Applicants are expected to have a strong foundation in quantitative subjects. This typically includes coursework in calculus, linear algebra, statistics, and microeconomics. Candidates without these prerequisites may be required to complete bridging courses.

- English Language Proficiency: International applicants whose native language is not English must provide proof of English language proficiency through TOEFL or IELTS scores. Specific score requirements are listed on the program’s website.

Application Timeline

Understanding the application timeline is crucial for a smooth application process. Missing deadlines can result in an application being rejected.

- Application Deadlines: Columbia’s MSc in Finance program typically has two or three application rounds, each with a specific deadline. These deadlines usually fall in the fall and winter months. Check the program website for the exact dates for the upcoming admissions cycle. Applying early can sometimes be advantageous, as spots in the program may fill up.

- Notification Dates: Applicants are typically notified of admission decisions within a few weeks after the application deadline. These notifications are usually sent via email. The program will also inform applicants of scholarship decisions at this time.

Components of a Successful Application

A successful application showcases a candidate’s potential for academic and professional success. Each component of the application requires careful attention.

- Essays: Essays are a critical part of the application. They provide an opportunity for applicants to showcase their personality, experiences, and motivations. Essays should articulate why the applicant is interested in the program, their career goals, and how the program will help them achieve those goals. Applicants should also highlight their unique skills and experiences. Essays should be well-written, concise, and free of grammatical errors.

- Letters of Recommendation: Strong letters of recommendation from professors or employers are essential. Recommenders should be able to speak to the applicant’s academic abilities, work ethic, and potential for success in the finance industry. Applicants should provide recommenders with their resume, transcripts, and any other relevant information to help them write a compelling letter.

- Resume Preparation: A well-crafted resume highlights relevant work experience, academic achievements, and extracurricular activities. It should be clear, concise, and easy to read. Use action verbs to describe accomplishments and quantify results whenever possible. Tailor the resume to emphasize skills and experiences relevant to the finance industry.

- Transcripts: Official transcripts from all undergraduate and graduate institutions attended are required. These transcripts must be submitted directly from the issuing institution.

Common Mistakes and How to Avoid Them

Avoiding common mistakes can significantly improve an applicant’s chances of admission. Attention to detail is key throughout the application process.

- Poorly Written Essays: Essays that are poorly written, lack focus, or contain grammatical errors can hurt an application. To avoid this, proofread essays carefully and seek feedback from trusted sources.

- Weak Letters of Recommendation: Letters that are generic or do not provide specific examples of the applicant’s abilities are not effective. Provide recommenders with ample time and information to write a strong letter.

- Incomplete Applications: Missing any required documents or failing to meet deadlines can result in an application being rejected. Double-check the application checklist and submit all materials on time.

- Lack of Research: Applicants who do not demonstrate a clear understanding of the program or the finance industry may struggle. Research the program thoroughly and tailor the application to reflect that knowledge.

- Inflated or Misleading Information: Honesty and transparency are crucial. Providing inaccurate information or exaggerating accomplishments can damage an applicant’s credibility.

Faculty and Research Opportunities

Columbia University’s MSc in Finance program offers unparalleled opportunities for students to engage with leading academics and contribute to cutting-edge financial research. The program’s faculty are renowned experts in their fields, actively involved in research that shapes the financial landscape. Students benefit from direct interaction with these scholars, accessing a wealth of knowledge and mentorship. This section details the prominent faculty, research opportunities, and industry engagement available to MSc in Finance students.

Prominent Faculty Members and Research Interests

The Finance Department at Columbia Business School boasts a distinguished faculty, each contributing significantly to financial research. Their expertise spans various areas, providing students with a broad and deep understanding of the discipline.

- Professor David Backus: Professor Backus is a leading expert in international finance and macroeconomics. His research focuses on asset pricing, exchange rates, and international business cycles. He has published extensively in top-tier academic journals, including the Journal of Political Economy and the Review of Financial Studies. His work often examines how global economic shocks impact financial markets.

- Professor Jonathan Berk: Professor Berk is known for his work in asset pricing and investment management. His research explores topics such as mutual fund performance, market efficiency, and the behavior of institutional investors. He co-authored the influential textbook, “Corporate Finance,” a widely used resource in finance education.

- Professor Harrison Hong: Professor Hong’s research focuses on behavioral finance and market microstructure. He examines how psychological biases and investor sentiment affect asset prices and trading activity. His publications appear in leading journals such as the Journal of Finance and the Econometrica.

- Professor Marcin Kacperczyk: Professor Kacperczyk’s research interests include corporate finance, financial intermediation, and banking. He studies the role of financial institutions in the economy and the impact of regulatory policies. He has published in the American Economic Review and the Review of Economic Studies.

- Professor Robert Jarrow: Professor Jarrow is a distinguished scholar specializing in financial economics, derivatives pricing, and credit risk modeling. He is known for his pioneering work in developing the Heath-Jarrow-Morton (HJM) model, a widely used framework for pricing interest rate derivatives. His contributions have significantly impacted the understanding and management of financial risk.

Research Opportunities Available to Students

Columbia’s MSc in Finance program provides numerous avenues for students to engage in research, fostering their intellectual curiosity and enhancing their analytical skills. These opportunities include research centers, faculty collaborations, and independent projects.

- The Paul Milstein Center for Real Estate: The Center provides research opportunities focused on real estate finance and investment. Students can participate in research projects, attend seminars, and network with industry professionals.

- The Center on Global Brand Leadership: Students interested in marketing and brand finance can engage with the Center’s research on brand valuation, consumer behavior, and marketing strategy.

- Faculty Research Projects: Students are encouraged to collaborate with faculty members on their research projects. This offers invaluable experience in data analysis, model building, and academic writing. Examples include projects on algorithmic trading strategies, the impact of ESG factors on portfolio performance, and the valuation of fintech companies.

- Independent Study and Thesis Options: Students can pursue independent research projects under the guidance of a faculty advisor. This allows them to delve deeper into specific areas of interest and develop their research skills. A thesis option is available, providing an opportunity to produce a substantial piece of original research.

Guest Lectures, Industry Speakers, and Workshops

The program enriches students’ learning experiences by offering a variety of events that connect them with industry professionals and expose them to real-world applications of finance.

- Guest Lectures: Leading practitioners from various financial institutions, such as investment banks, hedge funds, and asset management firms, regularly give guest lectures. These lectures provide insights into current market trends, career paths, and the practical application of financial theories.

- Industry Speakers: The program hosts industry speakers who share their experiences, expertise, and perspectives on specific topics. Speakers often discuss topics like private equity investing, risk management, and fintech innovations.

- Workshops: Workshops are offered on topics such as financial modeling, data analysis, and programming languages used in finance (e.g., Python, R). These workshops equip students with the technical skills necessary for success in the financial industry.

- Career Development Events: The program organizes career development workshops, including resume writing, interview preparation, and networking events, to help students prepare for their job search. These events provide opportunities to connect with recruiters and alumni.

Career Prospects and Placement

Columbia University’s MSc in Finance program is renowned for its strong career placement record, providing graduates with excellent opportunities in the financial industry. The program’s curriculum, combined with the university’s extensive network and career services, equips students with the skills and connections needed to succeed in competitive job markets. Graduates are highly sought after by leading financial institutions worldwide, leading to diverse career paths and competitive compensation packages.

Career Paths Pursued by Graduates

Graduates of the Columbia MSc in Finance program pursue a variety of careers across different sectors of the financial industry. These roles often leverage the program’s focus on financial modeling, valuation, and investment analysis. The specific paths chosen depend on individual interests, skills, and career goals.

- Investment Banking: Many graduates secure positions in investment banking, working as analysts or associates. They advise companies on mergers and acquisitions (M&A), initial public offerings (IPOs), and other financial transactions. This path often involves long hours and demanding work but offers significant career progression and high earning potential.

- Asset Management: Graduates also find opportunities in asset management firms, managing portfolios of stocks, bonds, and other investments. Roles include portfolio manager, research analyst, and trader. The goal is to generate returns for clients, requiring strong analytical and decision-making skills.

- Hedge Funds: Hedge funds offer another career avenue, where graduates can work as analysts, portfolio managers, or traders. These firms often employ sophisticated investment strategies and offer the potential for high rewards, although the competition is intense.

- Private Equity: Private equity firms also recruit MSc in Finance graduates. They invest in and manage private companies, seeking to improve their performance and eventually sell them for a profit. Roles include analyst and associate positions, focusing on financial modeling, due diligence, and deal execution.

- Corporate Finance: Some graduates opt for corporate finance roles within non-financial companies, managing financial planning, capital budgeting, and treasury functions. This path offers a more stable work-life balance compared to some other areas but still provides opportunities for career advancement.

- Sales and Trading: Positions in sales and trading involve buying and selling financial instruments on behalf of clients or the firm. Graduates can work with stocks, bonds, derivatives, and other assets. This role requires strong communication and quick decision-making skills.

Typical Salaries and Compensation Packages

The compensation packages for Columbia MSc in Finance graduates vary based on their role, location, and experience level. However, the program’s strong reputation and the high demand for its graduates generally translate into competitive salaries.

- Entry-Level Salaries: Entry-level positions, such as analyst roles in investment banking or asset management, typically offer base salaries ranging from $100,000 to $150,000 per year. These figures can be higher depending on the location and the specific firm.

- Bonus Structures: In addition to base salaries, graduates often receive substantial bonuses, particularly in investment banking and hedge funds. Bonuses are typically performance-based and can significantly increase total compensation.

- Location-Based Variations: Salaries in major financial centers like New York City, London, and Hong Kong tend to be higher than in other locations due to the higher cost of living and the concentration of financial firms.

- Benefits: Compensation packages often include comprehensive benefits, such as health insurance, retirement plans, and paid time off. Some firms also offer additional perks, such as signing bonuses, relocation assistance, and professional development opportunities.

Career Services Offered by the University

Columbia University’s career services play a crucial role in assisting MSc in Finance students in their job search. The university offers a range of resources and programs designed to enhance students’ career readiness and connect them with potential employers.

- Career Counseling: Students have access to career counselors who provide personalized guidance on career planning, resume writing, interviewing skills, and job search strategies. Counselors help students identify their strengths and interests and develop effective career goals.

- Resume Workshops: The university hosts resume workshops to help students create compelling resumes that highlight their skills and experience. These workshops provide feedback and guidance on formatting, content, and tailoring resumes to specific job applications.

- Interview Preparation: Career services offer interview preparation sessions, including mock interviews and practice questions. Students learn how to answer common interview questions, present themselves effectively, and showcase their skills and knowledge.

- Networking Events: The university organizes networking events, such as career fairs, industry panels, and alumni events, to connect students with potential employers and industry professionals. These events provide opportunities to build relationships and learn about job openings.

- Job Postings and Recruiting: Career services maintain a database of job postings and facilitate on-campus recruiting events. They connect students with employers actively seeking to hire MSc in Finance graduates.

Top Employers of Columbia MSc Finance Graduates

The following table illustrates some of the top employers of Columbia MSc in Finance graduates, representing a diverse range of industries and roles.

| Employer | Industry | Location | Role |

|---|---|---|---|

| Goldman Sachs | Investment Banking | New York, London, Hong Kong | Analyst, Associate |

| JPMorgan Chase | Investment Banking | New York, London, Hong Kong | Analyst, Associate |

| Morgan Stanley | Investment Banking | New York, London, Hong Kong | Analyst, Associate |

| BlackRock | Asset Management | New York, London | Analyst, Portfolio Manager |

| Citadel | Hedge Fund | Chicago, New York, London | Analyst, Portfolio Manager, Trader |

| Bridgewater Associates | Hedge Fund | Westport, CT | Analyst, Portfolio Manager |

| Two Sigma | Hedge Fund | New York | Analyst, Researcher |

| PIMCO | Asset Management | Newport Beach, CA | Analyst, Portfolio Manager |

| KKR | Private Equity | New York | Analyst, Associate |

| Bain & Company | Management Consulting | Various | Consultant |

Cost of Attendance and Financial Aid

Navigating the financial aspects of the MSc in Finance program at Columbia University is crucial for prospective students. This section provides a comprehensive overview of the associated costs, including tuition, living expenses, and other potential expenditures. It also details the available financial aid options and the application process. Understanding these elements allows applicants to plan their finances effectively and make informed decisions about their education.

Tuition Fees and Associated Costs

The primary expense for the MSc in Finance program is tuition. However, several other costs contribute to the overall financial commitment.

The current tuition fee for the MSc in Finance program at Columbia Business School is substantial. It is essential to consult the official Columbia Business School website for the most up-to-date figures, as these fees are subject to change annually. Beyond tuition, students should budget for the following:

- Living Expenses: These include accommodation, food, transportation, and personal expenses. Accommodation costs in New York City can be significant, ranging from on-campus housing to off-campus apartments. The choice of living arrangements heavily influences the overall cost.

- Books and Course Materials: The program requires various textbooks, software, and other materials. These costs vary depending on the courses selected.

- Health Insurance: Columbia University mandates health insurance coverage for all students. The cost of the university’s health insurance plan is included in the total expenses. Students may also choose to waive this coverage if they have comparable insurance.

- Student Fees: Various student fees cover services such as access to the library, recreational facilities, and other campus resources.

- Personal Expenses: This category includes costs for entertainment, travel, and other personal needs.

Financial Aid Options

Columbia University offers various financial aid options to help students manage the cost of the MSc in Finance program. These options include scholarships, fellowships, and loans.

- Scholarships: Columbia Business School offers merit-based and need-based scholarships. Merit-based scholarships are awarded based on academic excellence, professional experience, and leadership potential. Need-based scholarships are awarded based on demonstrated financial need. The availability and amounts of scholarships vary each year.

- Fellowships: Certain fellowships may be available, particularly for students with specific backgrounds or interests. Information on these fellowships is often provided on the Columbia Business School website or through external sources.

- Loans: Students can apply for federal and private loans to finance their education. Federal loans typically have lower interest rates and more flexible repayment terms than private loans. Private loans are available from various financial institutions.

- External Funding: Students are encouraged to explore external funding opportunities, such as scholarships and grants offered by private organizations and foundations.

Financial Aid Application Process and Deadlines

The application process for financial aid at Columbia University involves specific steps and deadlines.

The process usually involves the following:

- Completing the FAFSA (Free Application for Federal Student Aid): U.S. citizens and eligible non-citizens must complete the FAFSA to determine eligibility for federal student aid.

- Completing the CSS Profile (College Scholarship Service Profile): International students and some U.S. citizens may be required to complete the CSS Profile, which provides Columbia with information about their financial circumstances.

- Submitting Supporting Documentation: Applicants may be required to submit supporting documentation, such as tax returns, bank statements, and other financial documents.

- Meeting Application Deadlines: Strict deadlines apply for financial aid applications. It is crucial to adhere to these deadlines to ensure timely consideration for aid. The deadlines are usually available on the Columbia Business School website.

The deadlines for financial aid applications typically align with the admission application deadlines. Prospective students should check the official Columbia Business School website for specific deadlines. Late applications may not be considered.

For example, the deadline for the FAFSA and CSS Profile applications is often in the spring, before the start of the academic year. Failing to meet these deadlines can significantly impact the availability of financial aid.

Student Life and Campus Environment

Columbia University’s MSc in Finance program offers a vibrant student life experience, enriched by a dynamic campus environment and the unparalleled opportunities of New York City. Students benefit from a supportive academic community, diverse extracurricular activities, and access to extensive resources designed to foster both personal and professional growth. The program encourages students to immerse themselves in the university’s culture and take advantage of the many avenues for networking, learning, and socializing.

Campus Environment and Student Life

The Morningside Heights campus provides a stimulating and intellectually engaging environment. The campus is known for its historic architecture, green spaces, and the constant buzz of academic and social activity. Students can easily access various facilities, including libraries, dining halls, and athletic centers. Student life is characterized by a strong sense of community, fostered through various clubs, organizations, and social events. These activities provide opportunities to connect with peers, pursue interests outside of academics, and build lasting relationships.

- Clubs and Organizations: The university boasts a wide array of student-run clubs and organizations, catering to diverse interests. Finance students can join the Finance and Economics Society, the Columbia Investment Management Association, or other relevant groups. These clubs often host guest speakers, workshops, and networking events, providing valuable practical experience and industry insights.

- Social Events: Social events are regularly organized, including orientation events, welcome receptions, and end-of-semester celebrations. These events allow students to unwind, socialize, and build connections with classmates and faculty outside of the classroom. The program also encourages participation in university-wide events, such as concerts, theatrical performances, and sporting events.

- Diversity and Inclusion: Columbia University emphasizes diversity and inclusion, fostering a welcoming environment for students from all backgrounds. The university has numerous cultural and identity-based organizations that promote understanding and celebrate diversity. The program actively encourages students to participate in these initiatives and contribute to a more inclusive campus community.

Resources Available to Students

Columbia University offers a comprehensive suite of resources designed to support students throughout their academic journey and beyond. These resources cover various aspects of student life, from academic support to career development and personal well-being. Students are encouraged to take full advantage of these services to enhance their overall experience.

- Libraries: The university’s extensive library system provides access to a vast collection of academic resources, including books, journals, and databases. The main Butler Library and the Business Library are particularly valuable for finance students, offering specialized collections and research support. Librarians are available to assist students with research and information retrieval.

- Career Services: The university’s Career Services office is a crucial resource for finance students. It offers career counseling, resume workshops, interview preparation, and job placement assistance. Career Services also hosts career fairs and networking events, connecting students with potential employers. The office has a strong track record of placing graduates in leading financial institutions.

- Health Services: The university provides comprehensive health services, including medical care, mental health counseling, and wellness programs. The health center offers primary care, specialized medical services, and a range of mental health support options. These services are designed to promote the physical and mental well-being of students.

- Other Resources: Additional resources include academic advising, tutoring services, and writing centers. These services help students excel in their coursework and develop essential academic skills. The university also offers various student support programs, such as disability services and international student services, to cater to the diverse needs of the student population.

Benefits of Being Located in New York City for Finance Students

New York City provides unparalleled opportunities for finance students. The city is a global financial hub, offering access to leading financial institutions, networking opportunities, and a dynamic professional environment. This location is a significant advantage for students pursuing careers in finance.

- Proximity to Financial Institutions: New York City is home to Wall Street and a multitude of financial institutions, including investment banks, hedge funds, asset management firms, and private equity firms. Students can easily access these institutions for internships, networking events, and job opportunities. The proximity facilitates interactions with industry professionals and provides a real-world understanding of the financial industry.

- Networking Opportunities: The city hosts numerous finance-related events, conferences, and seminars. Students can attend these events to network with industry professionals, learn about the latest trends, and build relationships that can lead to career opportunities. The program also facilitates networking through guest speakers, industry visits, and alumni events.

- Internship and Job Opportunities: New York City offers a vast array of internship and job opportunities in finance. The program’s location provides students with a competitive edge in securing internships and full-time positions. Many companies actively recruit from Columbia’s MSc in Finance program due to its reputation and the city’s concentration of financial firms.

- Access to Industry Insights: The city provides students with unparalleled access to industry insights and real-world experience. Students can visit financial institutions, attend industry events, and interact with professionals. This exposure helps students develop a deeper understanding of the financial markets and the skills required for success.

- Cultural and Social Experiences: Beyond academics and career opportunities, New York City offers a rich cultural and social experience. Students can explore world-class museums, theaters, and restaurants. The city’s diverse communities and vibrant social scene provide a stimulating and enriching environment, contributing to a well-rounded student experience.

Program Comparison

The Columbia University MSc in Finance program stands out among its peers, offering a rigorous curriculum and a strong focus on practical application. However, prospective students should carefully consider how it aligns with their career goals by comparing it to similar programs at other top universities. Understanding the nuances of each program, including curriculum, career services, and cost, is crucial for making an informed decision.

Comparative Analysis with Competitor Programs

Several top-tier universities offer Master of Science in Finance programs. Evaluating Columbia’s program alongside these alternatives reveals its unique strengths and potential trade-offs. The following analysis focuses on two prominent competitors, providing a detailed comparison across key areas.

Columbia msc finance – The following table highlights key differences between Columbia’s program and two other top programs, focusing on curriculum, career services, and cost.

Columbia’s MSc in Finance is a highly sought-after program, equipping graduates with a strong foundation in financial principles. However, the practical application of these skills is key. For those looking to leverage their financial expertise, understanding the landscape of firms like american finance llc , which offer diverse financial services, can be beneficial. Ultimately, success in Columbia’s program hinges on bridging theory with real-world financial strategies.

| Feature | Columbia University MSc in Finance | Competitor A (e.g., MIT Sloan MS in Finance) | Competitor B (e.g., London Business School Masters in Finance) |

|---|---|---|---|

| Curriculum Focus | Offers a comprehensive curriculum with a strong emphasis on quantitative finance, investment management, and corporate finance. Allows for specialization through electives. Strong industry connections providing practical applications. | Emphasizes quantitative methods and financial engineering. Often includes a significant technology component. Focuses on developing analytical skills. | Focuses on a blend of theoretical knowledge and practical application, with an emphasis on global finance. Offers specializations like corporate finance, investment management, and financial markets. |

| Curriculum Structure | Typically a 12-18 month program, depending on the start date and course load. Offers a highly flexible elective structure allowing for customization. | Usually a 12-month program, offering a more structured curriculum. Strong emphasis on core courses. | Generally a 10-18 month program. Offers flexibility in choosing electives, with a focus on a global perspective. |

| Career Services | Provides extensive career services, including career counseling, resume workshops, interview preparation, and access to a wide network of alumni and recruiters in New York City and globally. | Offers strong career services with a focus on technology and quantitative finance roles. Benefits from MIT’s extensive industry network. | Provides career support with a focus on international finance, banking, and consulting. Leverages the school’s global alumni network. |

| Career Placement | Strong placement rates in investment banking, asset management, hedge funds, and corporate finance, particularly in New York City and major financial centers. Graduates often find roles in high-paying positions. | High placement rates in quantitative roles at financial institutions, hedge funds, and tech companies. Graduates are often sought after for their technical expertise. | Strong placement rates in investment banking, consulting, and asset management, with a focus on international roles. Graduates often find employment across various geographies. |

| Cost of Attendance (Approximate) | Tuition and fees: ~$90,000 – $110,000. Living expenses in New York City are significant. | Tuition and fees: ~$85,000 – $100,000. Living expenses in the Boston area. | Tuition and fees: ~$75,000 – $95,000 (depending on the program length). Living expenses in London are high. |

| Financial Aid | Offers limited need-based financial aid and merit-based scholarships. Students often rely on student loans. | Offers some need-based financial aid and merit-based scholarships. Student loans are common. | Offers some need-based financial aid and merit-based scholarships. Student loans are a common source of funding. |

| Location Advantage | Located in New York City, providing unparalleled access to financial institutions, networking opportunities, and internships. Proximity to major employers is a key advantage. | Located in the Boston area, close to a strong tech and finance hub. | Located in London, providing access to a global financial center and European markets. |

Program Preparation

Preparing for the MSc in Finance at Columbia University is crucial for a successful academic experience. Proactive preparation can significantly ease the transition into the demanding curriculum and enhance the overall learning journey. This involves acquiring foundational knowledge, developing essential skills, and building a strong professional network.

Recommended Readings and Skills to Develop

Before commencing the program, certain readings and skill development initiatives can provide a solid base for the coursework. This pre-program preparation will help students grasp complex concepts more efficiently and adapt to the fast-paced learning environment.

- Core Finance Concepts: Familiarity with fundamental finance principles is essential. Students should review concepts such as time value of money, financial statement analysis, portfolio theory, and derivatives pricing.

- Textbook Recommendations:

- “Investment Analysis and Portfolio Management” by Frank K. Reilly and Keith C. Brown: This book offers a comprehensive overview of investment principles and portfolio management techniques.

- “Corporate Finance” by Ross, Westerfield, and Jordan: Provides a thorough understanding of corporate financial decision-making.

- Textbook Recommendations:

- Quantitative Skills: A strong quantitative background is vital for success in the program. This includes proficiency in mathematics, statistics, and programming.

- Mathematics: Review calculus, linear algebra, and probability theory.

- Resources: “Mathematics for Economists” by Carl P. Simon and Lawrence E. Blume offers a rigorous treatment of the mathematical tools used in finance.

- Statistics: Understand statistical concepts such as hypothesis testing, regression analysis, and time series analysis.

- Resources: “Introduction to the Theory of Statistics” by Alexander M. Mood, Franklin A. Graybill, and Duane C. Boes is a standard reference for statistical theory.

- Programming: Learn programming languages like Python or R.

- Resources: Online courses on platforms like Coursera, edX, and DataCamp offer excellent introductory and advanced programming courses.

- Mathematics: Review calculus, linear algebra, and probability theory.

- Financial Modeling: Develop financial modeling skills using software like Microsoft Excel.

- Skills to Develop: Build financial models, conduct sensitivity analysis, and understand valuation techniques.

- Resources: Online courses and tutorials on financial modeling are readily available.

- Skills to Develop: Build financial models, conduct sensitivity analysis, and understand valuation techniques.

Guidance on Networking with Current Students and Alumni

Building a strong network is an invaluable asset for career advancement and academic success. Engaging with current students and alumni provides opportunities for mentorship, information sharing, and potential job prospects.

- Leveraging University Resources:

- Alumni Events: Attend events organized by the university and the program to connect with alumni.

- Example: The Columbia Business School hosts regular networking events where students can interact with alumni from various finance roles.

- Career Services: Utilize the career services offered by the university to access alumni databases and mentorship programs.

- Example: The Career Management Center at Columbia Business School provides resources for connecting with alumni for career advice and job opportunities.

- Alumni Events: Attend events organized by the university and the program to connect with alumni.

- Online Platforms:

- LinkedIn: Connect with current students and alumni on LinkedIn.

- Strategy: Join relevant groups, engage in discussions, and reach out to individuals for informational interviews.

- LinkedIn: Connect with current students and alumni on LinkedIn.

- Networking Etiquette:

- Professionalism: Maintain a professional demeanor in all interactions.

- Tip: Prepare thoughtful questions, show genuine interest, and follow up with thank-you notes.

- Professionalism: Maintain a professional demeanor in all interactions.

Detailed Study Plan to Follow Before Arriving on Campus

A structured study plan before the program’s commencement will help students establish a strong foundation and prepare for the demanding curriculum. This plan should cover the core finance concepts, quantitative skills, and financial modeling techniques.

- Months Before Arrival (3-6 Months):

- Finance Fundamentals: Dedicate time to reviewing core finance concepts.

- Activities: Read the recommended textbooks, and complete online courses on financial accounting, corporate finance, and investments.

- Example: Spend 2-3 hours per day, 5 days a week, for the first month on these readings.

- Quantitative Skills: Begin reviewing mathematics and statistics.

- Activities: Complete online courses or self-study materials covering calculus, linear algebra, and probability.

- Example: Allocate 1-2 hours per day, 5 days a week, for the second month to these subjects.

- Finance Fundamentals: Dedicate time to reviewing core finance concepts.

- Months Before Arrival (1-3 Months):

- Programming and Financial Modeling: Start learning Python or R and develop financial modeling skills.

- Activities: Take online programming courses and practice building financial models in Excel.

- Example: Dedicate 2-3 hours per day, 5 days a week, for programming and modeling exercises.

- Networking: Initiate networking efforts with current students and alumni.

- Activities: Connect on LinkedIn, attend virtual events, and reach out for informational interviews.

- Example: Schedule at least one informational interview per week.

- Programming and Financial Modeling: Start learning Python or R and develop financial modeling skills.

- Weeks Before Arrival (1-4 Weeks):

- Review and Practice: Consolidate knowledge and practice problem-solving.

- Activities: Review all materials, practice case studies, and work through practice problems from textbooks.

- Example: Dedicate 4-5 hours per day to review and practice.

- Prepare for Orientation: Familiarize yourself with the program structure and course materials.

- Activities: Review the program syllabus, understand the course requirements, and prepare any required pre-reading assignments.

- Review and Practice: Consolidate knowledge and practice problem-solving.

Program’s Reputation and Rankings

The reputation and rankings of the Columbia University MSc in Finance program are critical factors for prospective students, shaping their career prospects and providing a benchmark of academic excellence. These rankings, published by various reputable sources, offer insights into the program’s standing within the global financial landscape and are often a key consideration during the application process. Understanding the significance of these rankings and the program’s overall reputation is essential for making informed decisions about graduate studies in finance.

Significance of Program Rankings, Columbia msc finance

Program rankings serve as a valuable tool for prospective students. They provide a comparative analysis of different programs, helping applicants assess factors such as academic quality, faculty expertise, career services, and the overall student experience. These rankings, published by organizations like the Financial Times, U.S. News & World Report, and QS World University Rankings, employ specific methodologies that evaluate various aspects of the program.

- Benchmarking Excellence: Rankings offer a way to benchmark the program against its peers, allowing prospective students to assess its strengths and weaknesses relative to other top-tier institutions.

- Career Impact: High rankings often correlate with better career prospects, as employers often use them as a proxy for the quality of graduates and the program’s network.

- Global Recognition: Rankings contribute to the program’s global recognition, increasing its appeal to international students and employers.

- Faculty and Resources: Rankings can reflect the quality of faculty, research output, and the resources available to students, such as career services and access to industry professionals.

Global Recognition of the Program

The Columbia University MSc in Finance program enjoys substantial global recognition, attracting students and employers from around the world. This recognition stems from several factors, including the university’s overall prestige, the program’s rigorous curriculum, the quality of its faculty, and the success of its graduates. The program’s location in New York City, a global financial hub, further enhances its international appeal and provides unparalleled access to industry professionals and opportunities.

- International Student Body: The program attracts a diverse cohort of students from various countries, creating a multicultural learning environment.

- Global Employer Network: Graduates are recruited by top financial institutions and corporations worldwide, demonstrating the program’s global reach.

- Research and Publications: Faculty members are actively involved in research, publishing in leading academic journals and contributing to the advancement of financial knowledge.

- Alumni Network: The extensive alumni network, spanning across continents and industries, provides valuable connections and mentorship opportunities for current students and graduates.

Reputation and Impact on Graduates

The reputation of the Columbia MSc in Finance program significantly impacts the career trajectories of its graduates. The program’s strong reputation opens doors to competitive job opportunities, enhances earning potential, and provides a platform for long-term career success. Graduates are often highly sought after by leading financial institutions, investment firms, and consulting companies.

- Career Opportunities: Graduates are frequently hired by top-tier investment banks, asset management firms, hedge funds, and consulting companies, such as Goldman Sachs, Morgan Stanley, BlackRock, and McKinsey & Company.

- Salary and Compensation: The program’s graduates typically command high starting salaries and enjoy significant earning potential throughout their careers. The specific compensation varies based on the role, location, and the candidate’s experience. For example, a recent graduate joining an investment bank in New York City could expect a base salary significantly higher than the industry average.

- Networking and Mentorship: The program provides extensive networking opportunities through alumni events, industry speakers, and career services, facilitating connections with potential employers and mentors.

- Professional Development: The program’s curriculum and career services equip graduates with the skills and knowledge necessary to succeed in their chosen fields, including financial modeling, valuation, portfolio management, and risk management.

Columbia’s MSc in Finance is a highly competitive program, known for its rigorous curriculum and strong industry connections. Students often seek practical applications of their knowledge, and understanding a solid finance solution is crucial for success in the field. Ultimately, graduates from Columbia’s program are well-equipped to navigate the complexities of the financial world and excel in various roles.