Overview of Concur Finance

Concur Finance, a cloud-based solution by SAP Concur, streamlines and automates financial processes for businesses. It provides a centralized platform for managing expenses, travel, and invoices, aiming to improve efficiency, reduce costs, and enhance financial visibility. Concur Finance integrates various financial operations, providing real-time insights and control over spending.

Definition and Primary Function of Concur Finance

Concur Finance is a comprehensive financial management software designed to automate and integrate key financial processes. Its primary function is to provide a centralized system for managing and controlling business expenses, travel arrangements, and invoice processing. This system helps businesses gain better control over spending, improve compliance, and streamline financial workflows.

Core Services Offered by Concur Finance

Concur Finance offers a suite of core services that cater to various financial management needs. These services are designed to work together, providing a holistic approach to managing finances.

- Expense Management: This service allows employees to easily submit expense reports, capture receipts digitally, and track spending. It automates expense reporting, policy enforcement, and approval workflows. This feature is especially helpful for businesses with employees who travel frequently.

- Travel Booking: Concur’s travel booking feature enables employees to book flights, hotels, and rental cars within company-approved policies. This integration helps control travel spending and ensures compliance with corporate travel guidelines. The system often integrates with travel agencies and airline booking systems.

- Invoice Processing: This service automates the processing of vendor invoices, from receipt to payment. It includes features such as invoice scanning, data extraction, approval workflows, and payment processing. This streamlines the accounts payable process and reduces manual data entry.

Target Audience and Industries Where Concur Finance is Most Prevalent

Concur Finance is designed for businesses of all sizes, from small to large enterprises, that need to manage their finances more efficiently. The software is particularly valuable for companies with a significant volume of travel expenses, complex approval processes, and a need for greater financial visibility.

The industries where Concur Finance is most prevalent include:

- Technology: Tech companies often have significant travel and expense needs due to client meetings, conferences, and employee travel. Concur Finance helps manage these expenses effectively.

- Consulting: Consulting firms rely heavily on expense tracking and project-based cost management, making Concur Finance a valuable tool.

- Healthcare: Healthcare organizations use Concur Finance to manage travel, expenses, and invoice processing within the constraints of budgets and regulatory compliance.

- Financial Services: Financial institutions use Concur Finance to streamline expense reporting and improve financial control.

- Manufacturing: Manufacturing companies use Concur to manage expenses related to operations, travel, and supply chain management.

Key Features and Functionality

Concur Finance streamlines financial processes, offering a suite of tools designed to manage expenses, travel, and invoices. This section delves into the core functionalities of Concur’s key modules, exploring their features and integration capabilities. The goal is to provide a clear understanding of how these features contribute to efficient financial management within an organization.

Feature Comparison: Concur Expense, Concur Travel, and Concur Invoice

Concur Finance offers a comprehensive suite of solutions, each tailored to specific financial management needs. The following table provides a comparative overview of the main features across Concur Expense, Concur Travel, and Concur Invoice.

| Feature | Concur Expense | Concur Travel | Concur Invoice |

|---|---|---|---|

| Expense Reporting | Automated expense report creation, receipt scanning, and policy enforcement. | N/A | N/A |

| Travel Booking | N/A | Integrated travel booking platform for flights, hotels, and car rentals; policy compliance. | N/A |

| Invoice Management | N/A | N/A | Automated invoice processing, approval workflows, and payment management. |

| Receipt Management | Mobile receipt capture, OCR technology for data extraction. | N/A | Receipt capture and attachment to invoices. |

| Policy Compliance | Automated policy checks and flagging of non-compliant expenses. | Travel policy enforcement during booking and expense reporting. | Invoice policy enforcement and validation. |

| Approval Workflows | Customizable approval routing based on spending limits and roles. | Expense report approval workflows after travel. | Automated routing based on invoice details and approver roles. |

| Reporting and Analytics | Real-time expense data analysis and reporting capabilities. | Travel spend analysis and reporting. | Invoice spend analysis and reporting. |

| Integration | Seamless integration with accounting systems and other enterprise applications. | Integration with travel management companies and expense reporting. | Integration with ERP systems and accounting software. |

Integration Capabilities of Concur Finance

Concur Finance excels in its ability to integrate with various enterprise systems, facilitating a cohesive and efficient financial ecosystem. This integration minimizes data silos, reduces manual data entry, and enhances overall financial visibility.

- Enterprise Resource Planning (ERP) Systems: Concur Finance seamlessly integrates with leading ERP systems like SAP, Oracle NetSuite, and Microsoft Dynamics 365. This integration enables the automatic transfer of financial data, such as expenses, invoices, and payments, directly into the ERP system, streamlining accounting processes and ensuring data consistency.

- Accounting Software: Concur Finance offers robust integration capabilities with popular accounting software packages, including QuickBooks, Xero, and Sage Intacct. This integration automates the flow of financial data between Concur and the accounting software, simplifying tasks such as journal entries, reconciliation, and financial reporting.

- Human Resource Management Systems (HRMS): Integration with HRMS allows for the synchronization of employee data, such as employee names, departments, and job titles, ensuring accurate expense reporting and approval workflows.

- Travel Management Companies (TMCs): Concur Travel integrates with various TMCs, enabling organizations to book travel through their preferred travel agencies while maintaining policy compliance and expense tracking within the Concur platform.

- Corporate Credit Card Providers: Concur Expense integrates with corporate credit card providers, allowing for the automatic import of transactions and simplifying expense reconciliation. This integration eliminates the need for manual data entry and reduces the risk of errors.

Mobile App Features of Concur Finance

The Concur Finance mobile app enhances user experience and streamlines financial processes by providing convenient access to key features on the go. The mobile app enables employees to manage expenses, travel, and invoices from their smartphones or tablets, improving efficiency and productivity.

- Expense Reporting: The mobile app allows users to create and submit expense reports directly from their mobile devices. Features include receipt scanning using optical character recognition (OCR) technology, which automatically captures data from receipts, and automated expense categorization.

- Travel Booking: Concur Travel’s mobile app enables employees to book flights, hotels, and car rentals while adhering to company travel policies. The app provides real-time access to travel options, pricing, and policy compliance information.

- Invoice Management: The mobile app allows users to view, approve, and manage invoices. Features include the ability to review invoice details, attach receipts, and route invoices through the approval workflow.

- Receipt Capture: The mobile app includes receipt capture functionality, allowing users to photograph receipts and automatically extract key information. This eliminates the need for manual data entry and ensures that all receipts are properly documented.

- Approval Workflows: Approvers can review and approve expense reports and invoices directly from their mobile devices. The app provides notifications and alerts to ensure timely approvals and efficient financial management.

Benefits of Using Concur Finance

Concur Finance offers a multitude of advantages for businesses of all sizes, streamlining financial processes and providing significant cost savings. Implementing this platform can lead to increased efficiency, improved compliance, and reduced risk. This section will delve into the specific benefits, highlighting how Concur Finance can transform financial operations.

Advantages for Businesses of Different Sizes

Concur Finance provides tailored solutions that cater to the diverse needs of small businesses, medium-sized enterprises, and large corporations. The platform’s scalability ensures it can adapt to evolving business requirements.

- Small Businesses: Concur Finance simplifies expense reporting, making it easier for small businesses to manage employee spending. The automated processes reduce manual data entry, saving time and minimizing errors. Integration with accounting software streamlines reconciliation and provides real-time financial visibility. This can be particularly beneficial for startups and small teams with limited accounting resources.

- Medium-Sized Enterprises: For growing businesses, Concur Finance offers robust features to manage complex financial processes. The platform supports multiple currencies, expense policies, and approval workflows. This allows for better control over spending and improved compliance with company policies. The ability to generate detailed reports provides valuable insights for financial planning and decision-making.

- Large Enterprises: Concur Finance provides the scalability and sophisticated features needed to manage the financial operations of large organizations. The platform integrates seamlessly with existing ERP systems, providing a centralized view of all financial data. Advanced analytics capabilities enable in-depth reporting and forecasting, allowing for data-driven decision-making. Concur Finance helps large enterprises maintain control over vast amounts of data and ensure compliance across multiple departments and geographies.

Cost Savings Realized Through Concur Finance

Implementing Concur Finance can lead to substantial cost savings through various means. These savings stem from reduced manual effort, improved expense management, and better vendor negotiations.

- Reduced Manual Effort: Automation of expense reporting and approval processes significantly reduces the time employees spend on administrative tasks. By eliminating manual data entry and paper-based processes, businesses can free up valuable time for employees to focus on more strategic activities. For example, a study by SAP Concur showed that companies using the platform experienced a reduction of up to 50% in the time spent processing expense reports.

- Improved Expense Management: Concur Finance provides greater visibility into spending patterns, enabling businesses to identify areas where costs can be reduced. Features such as pre-trip approvals and policy enforcement help to control expenses before they are incurred. Real-time data analysis allows for prompt identification of overspending or policy violations.

- Better Vendor Negotiations: By tracking spending with vendors, businesses can leverage this data to negotiate more favorable pricing and terms. The platform provides detailed insights into vendor performance and spending, empowering businesses to make informed decisions about vendor relationships. For instance, if a company identifies a significant spend with a particular vendor, it can use this information to negotiate volume discounts or improved service level agreements.

- Specific Examples of Cost Savings:

- Reduced Processing Costs: Automating expense reports can reduce the cost per report by as much as 60%. This includes savings on labor, paper, and postage.

- Improved Compliance: By enforcing expense policies, companies can reduce the risk of non-compliant spending and associated penalties.

- Enhanced Data Accuracy: Automated processes reduce the errors associated with manual data entry, leading to more accurate financial reporting and decision-making.

Compliance Improvement and Fraud Risk Reduction

Concur Finance significantly improves compliance with company policies and regulatory requirements, simultaneously reducing the risk of fraudulent activities. The platform’s built-in features and robust reporting capabilities are crucial in achieving these goals.

- Policy Enforcement: Concur Finance allows businesses to define and enforce expense policies, ensuring that employees adhere to company guidelines. The platform automatically flags non-compliant expenses, preventing them from being approved. This reduces the risk of accidental or intentional policy violations.

- Audit Trails: The platform maintains detailed audit trails of all expense transactions, providing a complete record of spending. This makes it easier to track down and investigate any suspicious activity. Auditors can quickly access the information needed to verify compliance.

- Fraud Detection: Concur Finance incorporates features designed to detect and prevent fraud. The platform can identify unusual spending patterns, such as duplicate expense claims or expenses that violate company policies. Advanced analytics and machine learning capabilities can further enhance fraud detection.

- Examples of Compliance and Fraud Reduction:

- Automated Policy Checks: The system can automatically flag expenses that exceed per diem rates or violate travel policies, preventing unauthorized spending.

- Real-Time Reporting: Provides real-time visibility into spending, enabling companies to quickly identify and address any potential fraud or policy violations.

- Integration with Corporate Cards: Integration with corporate credit cards can automate expense reporting, reduce the risk of fraudulent charges, and provide accurate data for reconciliation.

Implementation and Setup

Implementing Concur Finance effectively requires careful planning and execution. This section provides a comprehensive guide to help you successfully integrate and utilize the platform. From initial setup to data migration and reporting configuration, we will explore the key steps involved in maximizing the value of Concur Finance for your organization.

Setting Up Concur Expense for a New User

Setting up Concur Expense for a new user is a straightforward process that ensures they can efficiently manage their expenses. This process involves several key steps, ensuring that the user is properly configured and ready to submit expense reports.

- Account Creation and Activation: The first step involves creating a user account within the Concur system. This typically involves the administrator providing the user with a unique username and temporary password. The user will then be prompted to change the password upon their first login.

- Profile Configuration: Once logged in, the user should configure their profile. This includes entering personal information, such as their name, email address, and contact details. It also involves setting up their preferred currency and language.

- Bank Account Information: Users need to enter their bank account details for reimbursement purposes. This typically includes the bank name, account number, and routing number. Concur securely stores this information.

- Credit Card Association: If the user has a company credit card, they will need to associate it with their Concur profile. This enables the automatic import of transactions from the credit card provider.

- Expense Preferences Setup: Users can customize their expense preferences, such as default expense types and mileage rates. This streamlines the expense reporting process.

- Mobile App Installation and Setup: The Concur mobile app allows users to manage expenses on the go. The user should download the app and log in using their Concur credentials. The mobile app facilitates receipt capture and expense report submission.

- Training and Familiarization: New users should familiarize themselves with the Concur Expense platform. This may involve reviewing training materials, such as user guides and video tutorials, or attending a training session.

- Testing and Validation: After completing the setup, the user should test the system by creating and submitting a sample expense report. This allows them to identify any issues and ensure that the system is functioning correctly.

Data Migration Process from a Legacy System

Migrating data from a legacy system to Concur Finance is a crucial step in the implementation process. A well-planned data migration ensures that historical financial information is accurately transferred, allowing for continuity and informed decision-making. This involves several key considerations.

- Planning and Assessment: Begin by thoroughly assessing the legacy system’s data structure, identifying the data fields to be migrated, and determining the data cleansing and transformation requirements. This involves mapping data fields between the legacy system and Concur Finance.

- Data Extraction: Extract the required data from the legacy system. This might involve using data export tools or custom scripts. Ensure that the data is extracted in a format compatible with Concur Finance. Common formats include CSV and Excel files.

- Data Cleansing and Transformation: Cleanse and transform the extracted data to ensure accuracy and consistency. This involves addressing data quality issues, such as missing values, incorrect formats, and duplicate entries. This also involves standardizing data to align with Concur Finance’s data structure.

- Data Mapping: Map the data fields from the legacy system to the corresponding fields in Concur Finance. This mapping ensures that data is correctly imported into the new system. This mapping should be documented.

- Data Loading: Load the transformed data into Concur Finance. This may involve using Concur’s import tools or custom integrations. During the loading process, validate the data to ensure that it meets the required standards.

- Data Validation and Testing: Validate the imported data to ensure its accuracy and completeness. This involves comparing the data in Concur Finance with the data in the legacy system. Conduct thorough testing to identify and resolve any discrepancies.

- Historical Data Archiving: After the data migration is complete, archive the historical data from the legacy system. This ensures that the legacy system is no longer used for ongoing financial reporting.

Configuring Reporting and Analytics within Concur Finance

Configuring reporting and analytics within Concur Finance is essential for gaining insights into financial performance and making data-driven decisions. Concur Finance provides robust reporting and analytics capabilities.

- Report Customization: Concur Finance allows users to customize standard reports and create custom reports tailored to their specific needs. This involves selecting the data fields to be included in the report, defining the report’s layout, and setting the report’s filters.

- Report Scheduling: Schedule reports to be automatically generated and delivered at regular intervals. This automates the reporting process and ensures that stakeholders receive timely information.

- Report Distribution: Distribute reports to the relevant stakeholders, such as managers, finance teams, and executives. Reports can be delivered via email or accessed through the Concur Finance platform.

- Dashboard Creation: Create dashboards that provide a visual overview of key financial metrics. Dashboards can include charts, graphs, and tables that summarize important financial data.

- Data Visualization: Utilize data visualization tools to create compelling charts and graphs that effectively communicate financial information. This helps stakeholders understand complex data quickly and easily.

- Data Filtering and Segmentation: Apply filters and segmentation to analyze data from different perspectives. This allows users to drill down into the data and identify trends, patterns, and anomalies.

- Integration with Business Intelligence Tools: Integrate Concur Finance with business intelligence (BI) tools to perform advanced analytics and gain deeper insights. This integration enables users to leverage the full power of their financial data.

Expense Management with Concur: Concur Finance

Concur Expense streamlines the often-complex process of managing employee expenses, providing a centralized platform for tracking, submitting, and approving spending. This module significantly reduces manual effort, improves accuracy, and offers valuable insights into company spending patterns.

Submitting an Expense Report with Concur Expense

Submitting an expense report in Concur Expense is a straightforward process, designed for ease of use. The following steps Artikel the procedure:

- Accessing the System: Employees begin by logging into the Concur Expense system through their company’s designated portal.

- Creating a New Report: Once logged in, the user initiates a new expense report, typically by clicking a “Create Report” or similar button. They will need to select the appropriate report template, if multiple options are available.

- Adding Expenses: The core of the process involves adding individual expenses. Users can do this in several ways:

- Manual Entry: For expenses not captured automatically, users manually input details such as the date, vendor, expense type, amount, and payment method.

- Receipt Scanning/Upload: Concur Expense allows users to upload digital images of receipts. This can be done via a mobile app by taking a picture of the receipt or uploading a scanned document.

- Importing from Credit Card Transactions: If the user’s corporate credit card is linked to Concur, transactions are automatically imported. Users then match these transactions with their receipts and categorize them.

- Categorizing Expenses: Each expense must be categorized. Concur provides a list of expense types, which are often customizable to match a company’s specific needs.

- Adding Notes and Attachments: Users can add notes to explain specific expenses and attach any supporting documentation, such as meeting agendas or detailed invoices.

- Reviewing the Report: Before submitting, users review the entire report to ensure accuracy and completeness. This includes verifying amounts, expense types, and attached receipts.

- Submitting the Report: Once satisfied, the user submits the report. This triggers the approval workflow, sending the report to the designated approver(s).

Types of Expenses Tracked in Concur Expense

Concur Expense supports the tracking of a wide variety of expense types, offering comprehensive coverage for various business expenditures. Here’s a look at some of the common categories:

- Travel Expenses: This category includes costs associated with business travel.

- Airfare: Costs for flights, including basic fares, upgrades, and baggage fees.

- Hotel: Expenses for lodging, including room rates, taxes, and incidental charges.

- Rental Cars: Costs for renting vehicles, including the rental fee, insurance, and fuel.

- Transportation: Expenses for local transportation such as taxis, ride-sharing services (e.g., Uber, Lyft), public transit, and parking fees.

- Meals and Entertainment: This covers expenses related to client meetings, business lunches, and other forms of entertainment.

- Meals: Costs for meals, including restaurants, catering, and takeout.

- Entertainment: Expenses for entertaining clients or business partners, such as tickets to events, golf outings, or other activities.

- Office Supplies and Equipment: This category covers costs related to maintaining the office environment.

- Office Supplies: Expenses for pens, paper, and other general office supplies.

- Equipment: Costs for purchasing or renting office equipment, such as printers or projectors.

- Mileage: Expenses for using personal vehicles for business purposes, typically calculated based on mileage driven.

- Other Expenses: This is a catch-all category for expenses that don’t fit into the above categories, such as:

- Training and Education: Costs for professional development courses and seminars.

- Telephone and Internet: Expenses for business-related communication costs.

- Software Subscriptions: Costs for using various software applications.

Approving Expense Reports in Concur Finance

The approval process within Concur Finance is designed to be efficient and transparent, ensuring accountability and compliance with company policies.

- Notification: Once an employee submits an expense report, the designated approver(s) receive a notification, typically via email and within the Concur system.

- Reviewing the Report: The approver accesses the report within Concur. They can view all expense details, including receipts, notes, and any supporting documentation.

- Policy Compliance Check: The system automatically checks the report against company expense policies. This includes verifying that expenses are within allowed limits, are correctly categorized, and adhere to other policy rules.

- Approving or Rejecting Expenses: The approver can take one of several actions:

- Approve: If the report is compliant, the approver can approve it.

- Reject: If there are issues, the approver can reject individual expenses or the entire report, providing comments to the employee explaining the reason for rejection.

- Request Clarification: The approver can request additional information or clarification from the employee regarding specific expenses.

- Audit Trail: Concur maintains a complete audit trail of the approval process, documenting who approved the report, when it was approved, and any comments or changes made.

- Integration with Accounting Systems: Once approved, the expense report is typically integrated with the company’s accounting system (e.g., SAP, NetSuite) for reimbursement and financial reporting. This integration streamlines the payment process and provides a clear record of expenses.

Travel Booking with Concur

Concur Travel streamlines the entire travel booking process, offering employees a centralized platform to book flights, hotels, car rentals, and other travel-related services. This integration ensures compliance with company travel policies and provides real-time visibility into travel expenses. The system is designed to be user-friendly, allowing employees to quickly and easily manage their travel arrangements while giving finance teams better control over travel spending.

Process of Booking Travel Arrangements Using Concur Travel

Booking travel through Concur Travel is a relatively straightforward process. It typically involves the following steps:

- Initiating a New Trip: Employees begin by initiating a new trip within the Concur Travel interface. They provide essential details such as the trip’s purpose, dates, and destination.

- Searching for Travel Options: Once the trip details are entered, the system searches for available flights, hotels, and car rentals. The search results are displayed based on the user’s preferences and the company’s travel policies.

- Selecting and Booking Travel: Employees can then review the search results and select their preferred travel options. The system displays pricing information, availability, and any relevant policy restrictions. Once the selections are made, the employee can proceed with booking the travel.

- Confirmation and Itinerary: After the booking is complete, the employee receives a confirmation email and a detailed itinerary. This itinerary includes all travel arrangements, such as flight times, hotel addresses, and car rental information.

- Integration with Expense Reporting: The travel booking information is automatically integrated with the employee’s expense report. This eliminates the need for manual data entry and ensures that travel expenses are accurately recorded.

Features Available for Managing Travel Policies and Preferred Vendors within Concur Travel

Concur Travel provides robust features for managing travel policies and preferred vendors, allowing companies to control travel spending and ensure compliance.

- Travel Policy Configuration: Companies can define and enforce their travel policies within Concur Travel. These policies can cover various aspects of travel, such as preferred vendors, class of service, spending limits, and approval workflows.

- Preferred Vendor Management: Concur Travel allows companies to designate preferred vendors for flights, hotels, and car rentals. This can include negotiated rates, which helps to reduce travel costs.

- Automated Policy Enforcement: The system automatically enforces travel policies during the booking process. If an employee attempts to book travel that violates a policy, the system will alert them and may require approval from a manager.

- Approval Workflows: Concur Travel supports approval workflows to ensure that travel bookings are reviewed and approved by the appropriate personnel. This can help to prevent unauthorized spending and ensure compliance with company policies.

- Reporting and Analytics: The platform offers reporting and analytics capabilities, allowing companies to track travel spending, identify trends, and monitor policy compliance.

Examples of How Concur Travel Integrates with Expense Reporting, Concur finance

Concur Travel seamlessly integrates with Concur Expense to streamline expense reporting.

- Automatic Data Transfer: When an employee books travel through Concur Travel, the booking information is automatically transferred to their expense report. This includes details such as the vendor, date, cost, and trip purpose.

- Pre-populated Expense Reports: The expense report is pre-populated with the travel expenses, reducing the need for manual data entry. This saves time and reduces the risk of errors.

- Receipt Capture and Matching: Concur Expense allows employees to capture and attach receipts to their expense reports. The system can automatically match receipts to the corresponding travel expenses.

- Expense Categorization: Travel expenses are automatically categorized based on the booking information. This simplifies the expense reporting process and ensures that expenses are accurately classified.

- Policy Compliance Checks: The system checks for policy violations and flags any non-compliant expenses. This helps to ensure that all travel expenses are in accordance with company policies. For instance, if a hotel expense exceeds the daily allowance specified in the travel policy, the system will flag it for review.

Invoice Processing with Concur

Concur Invoice streamlines the invoice management process, offering businesses a centralized platform to receive, process, and pay invoices efficiently. This automation helps reduce manual effort, minimize errors, and improve overall financial control. By integrating invoice processing with other Concur solutions, such as expense management and travel booking, companies can achieve a holistic view of their spending and improve compliance.

Workflow for Processing Invoices Using Concur Invoice

The Concur Invoice workflow is designed to be intuitive and efficient, automating many of the manual tasks associated with traditional invoice processing. This workflow typically encompasses several key stages, from invoice receipt to payment.

Here’s a breakdown of the standard workflow:

* Invoice Submission: Invoices can be submitted to Concur Invoice through various methods, including email, direct upload, or integration with vendor portals.

* Data Capture and Extraction: Concur Invoice utilizes Optical Character Recognition (OCR) technology to automatically extract data from invoices, such as vendor name, invoice number, invoice date, and line-item details.

* Routing and Approval: Once the invoice data is captured, the system automatically routes the invoice to the appropriate approvers based on pre-defined rules and approval workflows. These rules can be configured based on various criteria, such as invoice amount, vendor, or department.

* Approval Process: Approvers can review the invoice details, add comments, and approve or reject the invoice. The system tracks the approval status and provides notifications to approvers.

* Coding and Accounting: Before approval, invoices are often coded with the appropriate general ledger accounts, cost centers, and other financial dimensions. This ensures accurate accounting and reporting.

* Payment Processing: Once approved, the invoice is ready for payment. Concur Invoice integrates with various payment systems, allowing for automated payment processing.

* Archiving and Reporting: Concur Invoice automatically archives all invoices and related documents, providing a centralized repository for easy access and audit trails. It also offers robust reporting capabilities, allowing businesses to track invoice spending, identify trends, and improve financial planning.

Automation Capabilities of Concur Invoice

Concur Invoice offers a range of automation features designed to streamline invoice processing and reduce manual intervention. This automation not only saves time and resources but also minimizes the risk of human error.

Here’s a closer look at some of the key automation capabilities:

* Automated Invoice Data Capture: Using OCR technology, Concur Invoice automatically extracts data from invoices, eliminating the need for manual data entry. This includes capturing vendor information, invoice numbers, dates, line-item details, and amounts.

* Intelligent Data Validation: The system validates extracted data against predefined rules and data sources, such as vendor databases and general ledger accounts. This helps ensure data accuracy and consistency.

* Automated Routing and Approval Workflows: Concur Invoice automatically routes invoices to the appropriate approvers based on pre-defined rules. This eliminates the need for manual routing and speeds up the approval process.

* Integration with Payment Systems: The platform integrates with various payment systems, enabling automated payment processing. This reduces the risk of late payments and improves vendor relationships.

* Automated Reminders and Notifications: Concur Invoice sends automated reminders to approvers and other stakeholders, ensuring timely invoice processing.

* Vendor Portal Integration: Concur Invoice integrates with vendor portals, enabling vendors to submit invoices electronically. This simplifies the invoice submission process and reduces paper consumption.

* Real-time Reporting and Analytics: Concur Invoice provides real-time reporting and analytics on invoice processing, allowing businesses to track spending, identify trends, and make data-driven decisions.

Stages of Invoice Approval in Concur Invoice

The invoice approval process in Concur Invoice is designed to be flexible and configurable to meet the specific needs of each business. The stages typically involve a series of steps, each representing a different stage of the approval workflow. The table below details these stages:

| Stage | Description | Actions |

|---|---|---|

| Invoice Submission & Data Extraction | The invoice is received by the system and data is automatically captured. | Invoice upload, OCR processing, and data validation. |

| Approval Routing | The invoice is automatically routed to the designated approvers based on pre-defined rules. | System determines approvers based on invoice amount, vendor, or department. |

| Approval & Coding | Approvers review the invoice details, add comments, and approve or reject the invoice. Financial coding is also performed. | Review invoice details, add comments, approve/reject, and allocate to general ledger accounts. |

| Payment Processing | Once approved, the invoice is ready for payment. | Payment is scheduled and processed through integrated payment systems. |

| Archiving | The invoice and all related documents are archived for audit purposes. | Documents are stored securely for easy access and compliance. |

Security and Compliance

Concur Finance prioritizes the security of user data and adherence to industry regulations. This commitment ensures the confidentiality, integrity, and availability of financial information processed within the platform. Concur employs a multi-layered approach to security, combined with comprehensive compliance measures, to provide a secure environment for businesses.

Data Security Measures

Concur Finance implements several security measures to protect user data. These measures are designed to prevent unauthorized access, use, disclosure, disruption, modification, or destruction of information.

- Data Encryption: Data is encrypted both in transit and at rest. This means that when data is being transferred between a user’s device and Concur’s servers, and when it is stored on Concur’s servers, it is encrypted using strong encryption algorithms like AES-256. This encryption renders the data unreadable to anyone who does not have the proper decryption key.

- Access Controls: Role-based access control (RBAC) is implemented to restrict access to sensitive data based on user roles and responsibilities. This ensures that employees only have access to the information they need to perform their job functions. For example, an expense report approver would have access to expense reports, but not necessarily to vendor payment information.

- Network Security: Concur employs firewalls, intrusion detection and prevention systems, and regular vulnerability scanning to protect its network infrastructure from unauthorized access and cyber threats. These systems monitor network traffic, detect malicious activity, and prevent unauthorized access to sensitive data.

- Physical Security: Concur’s data centers are physically secured with measures such as biometric access controls, surveillance, and 24/7 monitoring. These measures ensure that only authorized personnel can access the physical infrastructure where data is stored.

- Regular Security Audits and Penetration Testing: Concur conducts regular security audits and penetration testing to identify and address potential vulnerabilities. These audits are performed by both internal teams and third-party security experts to ensure the effectiveness of security measures.

- Incident Response Plan: Concur has a comprehensive incident response plan in place to address security incidents and data breaches. This plan Artikels the steps to be taken in the event of a security incident, including containment, eradication, recovery, and notification.

Compliance Certifications and Regulations

Concur Finance adheres to various compliance certifications and regulations to ensure the security and privacy of user data. These certifications and regulations demonstrate Concur’s commitment to meeting industry standards and legal requirements.

- SOC 1 and SOC 2 Compliance: Concur undergoes regular SOC 1 and SOC 2 audits. SOC 1 reports focus on internal controls over financial reporting, while SOC 2 reports focus on the security, availability, processing integrity, confidentiality, and privacy of customer data. These audits are conducted by independent third-party auditors and provide assurance to customers about the security and reliability of the Concur platform.

- GDPR Compliance: Concur is compliant with the General Data Protection Regulation (GDPR), which sets out requirements for the protection of personal data of individuals within the European Union. This includes requirements for data privacy, data security, and data subject rights. Concur provides tools and features to help customers comply with GDPR, such as data access and deletion capabilities.

- CCPA Compliance: Concur also adheres to the California Consumer Privacy Act (CCPA), which grants California residents certain rights regarding their personal information. This includes the right to know, the right to delete, and the right to opt-out of the sale of personal information.

- Other Regulatory Adherence: Concur also complies with other relevant regulations and standards, such as PCI DSS (Payment Card Industry Data Security Standard) for payment processing, and various industry-specific regulations depending on the region and the services offered.

Audit Trails and Reporting Features

Concur Finance provides robust audit trails and reporting features to support compliance efforts. These features allow organizations to track financial transactions, monitor user activity, and generate reports for compliance and auditing purposes.

- Comprehensive Audit Trails: Concur maintains detailed audit trails of all user activities, including expense report submissions, approvals, and modifications. These audit trails capture information such as the user, the date and time of the activity, and the specific actions taken.

- Reporting Capabilities: Concur offers a wide range of reporting capabilities that enable organizations to generate reports on various aspects of their financial data. These reports can be customized to meet specific compliance requirements and can be used to identify potential risks and vulnerabilities.

- User Activity Monitoring: The platform allows for monitoring user activity to detect suspicious behavior or potential security breaches. This includes tracking user logins, failed login attempts, and unusual activity patterns.

- Data Retention Policies: Concur allows organizations to define data retention policies to meet their compliance requirements. This includes specifying how long data should be stored and when it should be archived or deleted.

- Workflow Tracking: Concur tracks the workflow of expense reports and invoices, providing a clear audit trail of the approval process. This helps in demonstrating compliance with internal policies and regulations.

Integration with Other Systems

Concur Finance’s strength lies not only in its core functionalities but also in its ability to integrate seamlessly with various other systems. This interoperability is crucial for businesses looking to streamline their financial processes, improve data accuracy, and gain a holistic view of their financial operations. Integration capabilities allow for automated data transfer, reducing manual effort and the potential for errors.

Popular ERP Systems Integration

Concur Finance is designed to integrate with a wide range of Enterprise Resource Planning (ERP) systems. These integrations allow for the smooth flow of financial data, such as expense reports, invoices, and travel expenses, between Concur and the company’s central financial management system.

- SAP: SAP is a leading ERP provider, and Concur offers robust integration capabilities with various SAP solutions, including SAP S/4HANA and SAP ECC. This integration enables organizations to automate expense reporting, invoice processing, and travel management, reducing manual data entry and improving financial control.

- Oracle NetSuite: Concur integrates with NetSuite, a popular cloud-based ERP system. This integration allows businesses to synchronize expense data, invoices, and other financial information between the two systems.

- Microsoft Dynamics 365: Concur provides integration options with Microsoft Dynamics 365, another widely used ERP platform. This integration facilitates the exchange of financial data, improving the accuracy and efficiency of financial reporting and analysis.

- Sage Intacct: Concur integrates with Sage Intacct, a cloud-based accounting and financial management software. This integration enables businesses to streamline their expense management and invoice processing workflows.

- Other ERP Systems: Concur also offers integration options with other ERP systems, including Workday, Infor, and others, through custom integrations or partnerships.

Process of Integrating with Accounting Software

Integrating Concur Finance with a company’s accounting software involves several key steps. This process typically requires collaboration between the finance team, IT department, and, potentially, the accounting software vendor.

- Planning and Assessment: The initial step involves defining the integration goals, identifying the data to be transferred, and assessing the current IT infrastructure. This also includes choosing the integration method, such as pre-built connectors, APIs, or custom integrations.

- Configuration: This step involves configuring both Concur Finance and the accounting software to enable data exchange. This includes mapping data fields, setting up user access, and defining data synchronization schedules.

- Testing and Validation: Rigorous testing is crucial to ensure the integration functions correctly. This involves testing data transfer, verifying data accuracy, and resolving any issues that arise.

- Deployment and Training: Once testing is complete, the integration is deployed. Training is provided to users on how to use the integrated system and address any changes in their workflows.

- Ongoing Maintenance and Monitoring: After deployment, the integration needs to be maintained and monitored to ensure its continued functionality. This includes monitoring data synchronization, addressing any issues that arise, and making updates as needed.

Data Flow Diagram

The following diagram illustrates the data flow between Concur Finance and other integrated systems.

Concur finance – Diagram Description:

Concur Finance streamlines expense management, but complex financial decisions often require expert guidance. To navigate intricate financial landscapes and maximize returns, consider leveraging the expertise of corporate finance advisors , who can provide strategic insights. Ultimately, integrating Concur Finance with sound financial advice ensures optimal financial performance and robust control.

The diagram shows the flow of data between Concur Finance and several integrated systems. At the center is Concur Finance, depicted as a box. Arrows indicate the direction of data flow. The diagram shows the following:

- Expense Data: Data from Expense Management in Concur flows to the ERP System and Accounting Software. This includes details such as employee expenses, receipts, and expense reports.

- Invoice Data: Data from Invoice Processing in Concur flows to the ERP System and Accounting Software. This includes details such as vendor invoices, payment information, and invoice approvals.

- Travel Data: Data from Travel Booking in Concur flows to the ERP System and Accounting Software. This includes details such as travel expenses, travel itineraries, and travel bookings.

- Data Synchronization: Data flows bidirectionally between Concur Finance and the ERP system and accounting software, showing data can be shared both ways. For instance, vendor information can be synced from the accounting software to Concur for invoice processing.

- External Systems: The diagram also indicates integrations with external systems such as corporate credit card providers, which provide transaction data to Concur, and bank accounts, for payment processing.

Pricing and Plans

Understanding the cost structure of Concur Finance is crucial for businesses looking to implement expense, travel, and invoice management solutions. Concur offers a range of pricing plans designed to accommodate various business sizes and needs. The specific pricing details are not always publicly available, as they are often customized based on factors like the number of users, the features required, and the complexity of the implementation. However, we can explore the general structure and the factors that influence the overall cost.

Pricing Plan Overview

Concur Finance’s pricing structure typically involves a subscription-based model. The plans are generally tiered, with different levels of functionality and features available at different price points. While specific names and features may vary, here’s a general overview of what you might expect:

- Basic Plan: This plan is often designed for smaller businesses or those with more straightforward needs. It typically includes core expense management features, basic reporting, and limited integration capabilities.

- Standard Plan: This plan caters to medium-sized businesses and offers a more comprehensive set of features. It often includes advanced reporting and analytics, more robust integration options, and potentially features like travel booking and invoice processing.

- Premium Plan: This plan is designed for larger enterprises with complex needs. It includes all the features of the Standard plan, plus advanced functionality like enhanced security features, more extensive customization options, and dedicated support.

Features Included in Each Pricing Plan

The features included in each plan vary, but here’s a breakdown of what you might find:

- Expense Management: All plans typically include expense reporting and tracking. However, the Basic plan might offer limited automation and customization options. The Standard and Premium plans often include more advanced features like receipt scanning, automated expense categorization, and policy enforcement.

- Travel Booking: Travel booking functionality may be limited or absent in the Basic plan. The Standard and Premium plans usually include travel booking capabilities, allowing users to book flights, hotels, and car rentals within the Concur platform.

- Invoice Processing: Invoice processing features may be included in the Standard and Premium plans. These features allow for automated invoice capture, approval workflows, and integration with accounting systems.

- Reporting and Analytics: The level of reporting and analytics capabilities often increases with each plan. The Basic plan might offer basic reporting, while the Standard and Premium plans provide advanced analytics, customizable dashboards, and the ability to generate detailed financial reports.

- Integration: Integration capabilities with other systems, such as accounting software and HR systems, are often more limited in the Basic plan. The Standard and Premium plans usually offer more robust integration options, including pre-built connectors and APIs for custom integrations.

- Support: The level of support offered may also vary. The Premium plan typically includes dedicated support and priority assistance.

Factors Influencing the Cost of Implementation

Several factors can significantly impact the overall cost of implementing Concur Finance:

- Number of Users: The number of users who will be using the system is a primary factor in determining the cost. Larger organizations with more users will typically pay a higher subscription fee.

- Features and Functionality: The specific features and functionality required will influence the price. Implementing travel booking and invoice processing features will generally increase the cost compared to a plan that only includes expense management.

- Customization and Configuration: The level of customization and configuration needed can affect the implementation cost. Complex configurations, such as custom workflows and integrations, will require more time and resources.

- Implementation Services: The cost of implementation services, such as training, data migration, and system setup, is an additional factor. These services can be provided by Concur or by a third-party implementation partner.

- Integration with Other Systems: The complexity of integrating Concur Finance with other systems, such as accounting software, will impact the cost. The need for custom integrations can increase the implementation time and cost.

- Data Migration: The volume and complexity of the data that needs to be migrated from existing systems can also affect the implementation cost.

- Training: Training costs for users and administrators are an essential part of the implementation process. The level of training required will depend on the complexity of the system and the user’s familiarity with similar software.

It is important to request a customized quote from Concur or a certified implementation partner to get an accurate understanding of the costs associated with implementing Concur Finance for your specific business needs. Consider the total cost of ownership, including subscription fees, implementation costs, and ongoing maintenance, when evaluating different pricing plans.

Concur Finance streamlines expense management for businesses, offering solutions that simplify financial processes. Many businesses are now exploring options for significant investments, and one such area is property improvements. Specifically, understanding how to secure roof financing can be crucial. By leveraging Concur Finance’s reporting capabilities, companies can efficiently track and manage expenses related to these projects, ensuring financial clarity.

User Experience and Interface

Concur Finance prioritizes a user-friendly experience, streamlining financial processes and making them accessible to users with varying levels of technical expertise. The interface is designed to be intuitive and efficient, promoting user adoption and reducing the learning curve. The goal is to empower employees to manage their expenses, travel, and invoices effectively, contributing to overall financial efficiency within an organization.

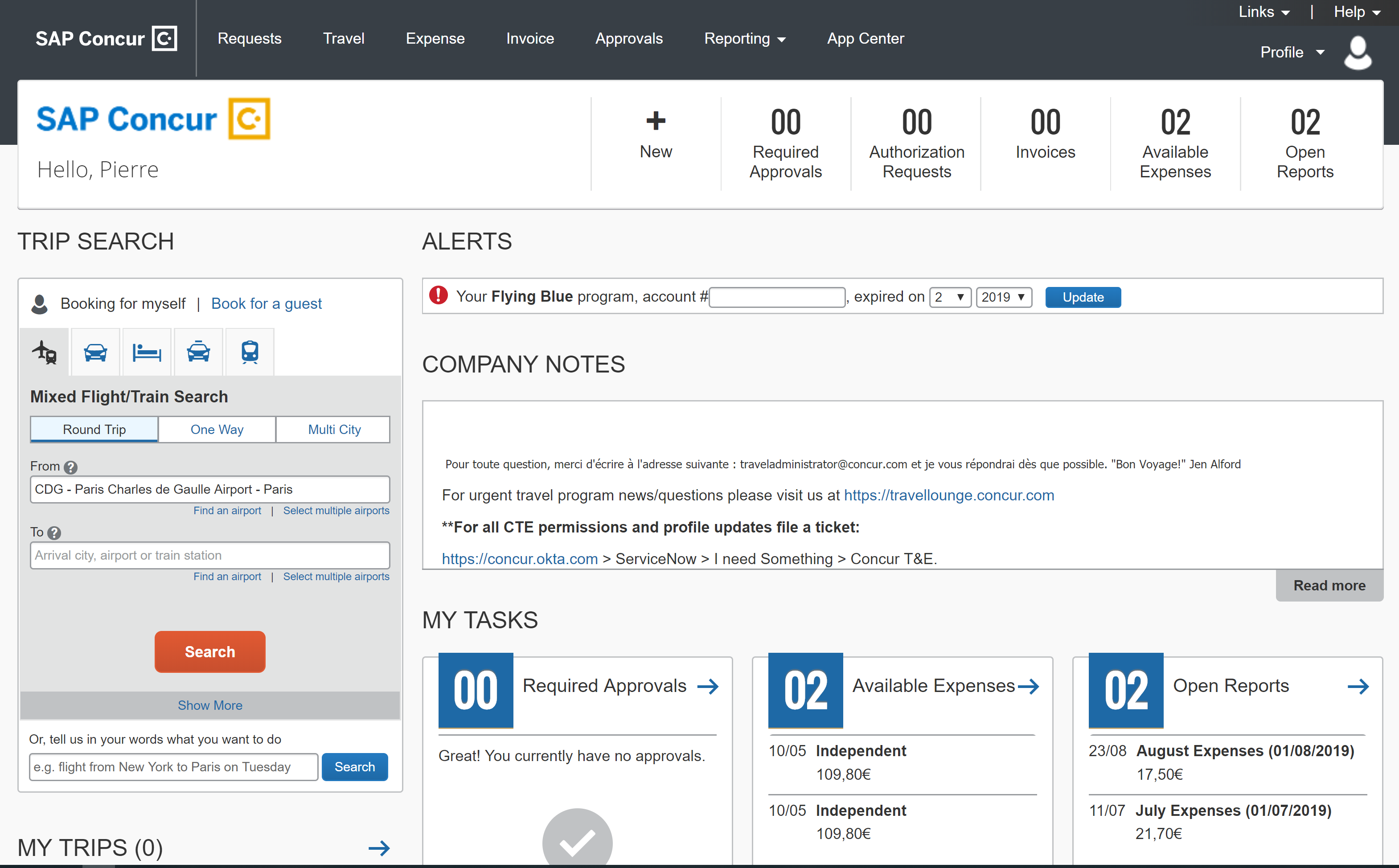

User Interface of Concur Finance: Ease of Use

Concur Finance’s user interface is designed with simplicity and ease of use in mind. The platform utilizes a clean and uncluttered design, minimizing distractions and allowing users to focus on the task at hand. Navigation is straightforward, with clear labeling and logical organization of features. The system employs visual cues, such as icons and color-coding, to enhance usability and aid in quick identification of important information. The responsive design ensures optimal viewing and functionality across various devices, including desktops, tablets, and smartphones, providing a consistent experience regardless of the access point. The platform’s accessibility features also comply with accessibility standards, ensuring usability for users with disabilities.

Navigation Features of Concur Finance

Effective navigation is crucial for efficient use of any financial software. Concur Finance offers a variety of navigation features to help users quickly find what they need.

- Dashboard: The dashboard provides a centralized overview of key financial information, including expense reports, travel requests, and invoice approvals. It is customizable to display the most relevant data for each user.

- Main Menu: The main menu provides access to all major modules and features, such as expense entry, travel booking, invoice management, and reporting. The menu is typically located at the top or side of the screen and is always accessible.

- Search Functionality: A powerful search function allows users to quickly locate specific transactions, reports, or invoices by s, dates, or other criteria.

- Breadcrumbs: Breadcrumbs indicate the user’s current location within the application, making it easy to navigate back to previous screens.

- Contextual Help: Contextual help is available throughout the application, providing users with guidance and support at the point of need. This includes tooltips, FAQs, and links to relevant documentation.

- Notifications: Notifications alert users to important events, such as pending approvals or overdue reports.

Customization of the Interface to Suit User Roles and Preferences

Concur Finance allows for a high degree of customization, enabling administrators to tailor the interface to specific user roles and individual preferences. This personalization enhances the user experience and promotes efficiency.

- Role-Based Permissions: Administrators can define user roles and assign specific permissions to control access to different features and data. This ensures that users only see the information and functionality relevant to their job responsibilities. For example, an approver might have access to a different set of features than an employee submitting an expense report.

- Customizable Dashboards: Users can customize their dashboards to display the information most important to them, such as pending approvals, recent expenses, or travel requests. This allows users to quickly access the data they need without navigating through multiple screens.

- Configurable Fields: Administrators can configure the fields displayed in expense reports, travel requests, and invoices to meet the specific needs of the organization. This includes adding custom fields, renaming existing fields, and making fields required or optional.

- Theme Customization: The interface allows for some degree of theme customization, such as the ability to choose a color scheme that aligns with the organization’s branding.

- Language and Regional Settings: Users can select their preferred language and regional settings to ensure a comfortable and localized experience.

Tips and Tricks for Concur Users

Concur Finance offers a powerful suite of tools, but maximizing its potential requires understanding its nuances. This section provides actionable tips and tricks to help users streamline their Concur experience, boosting efficiency and accuracy across expense reporting, travel booking, and invoice processing. Implementing these strategies can significantly reduce administrative burdens and ensure compliance.

Optimizing Expense Reporting in Concur

Expense reporting can be time-consuming, but with the right approach, it can become a much smoother process. This section details strategies to make expense reports efficient and accurate.

- Leverage the Mobile App: The Concur mobile app is a key tool for efficient expense reporting. Use it to capture receipts immediately after a purchase. The app’s Optical Character Recognition (OCR) feature automatically populates expense details from receipts, saving significant time. For instance, a user can take a photo of a restaurant receipt, and the app will automatically extract the date, vendor, and amount, reducing manual data entry.

- Utilize Expense Templates: Create expense templates for frequently recurring expenses, such as monthly internet or phone bills. This pre-fills expense report fields, streamlining the process. Users can customize templates with categories, amounts, and payment types, significantly reducing repetitive data entry.

- Understand and Use Expense Types Correctly: Concur’s expense types are pre-defined categories. Selecting the correct expense type is crucial for accurate reporting and compliance. Ensure to familiarize yourself with the organization’s specific expense policies related to each expense type to avoid rejections or delays.

- Batch Expenses: Instead of submitting individual expenses, batch related expenses together into a single report. This reduces the number of reports to manage and simplifies the approval process. For example, a business trip with multiple expenses like airfare, hotel, meals, and transportation should be included in a single expense report for that trip.

- Track Mileage Accurately: For users who drive for business, accurately tracking mileage is essential. Use the mileage tracking feature within Concur. Enter the starting and ending locations, and the system calculates the mileage and the reimbursable amount. The integration with mapping services makes this process easier.

- Review and Proofread: Before submitting an expense report, carefully review all entries for accuracy. Check the amounts, expense types, and attached receipts. Proofreading can prevent errors that can lead to rejection or delays in reimbursement.

Useful Shortcuts and Features for Concur Travel

Concur Travel offers features to simplify the travel booking process. Here are some useful shortcuts and features that can save time and improve the travel experience.

- Profile Completion: Ensure your travel profile is fully completed. This includes personal information, preferred travel vendors, and loyalty program details. A complete profile allows for more personalized booking recommendations and streamlines the booking process.

- Use the Trip Request Feature: Before booking travel, use the trip request feature. This creates a record of the trip and obtains necessary approvals before booking. This also helps in budgeting and compliance with travel policies.

- Leverage Preferred Vendors: Concur often integrates with preferred vendors, which can offer negotiated rates and streamlined booking. When booking, prioritize these vendors to maximize cost savings and simplify expense reporting.

- Mobile Booking and Management: Use the Concur mobile app for booking flights, hotels, and car rentals on the go. The app provides real-time updates and allows users to manage their travel itineraries easily.

- Automated Itinerary Updates: Concur automatically updates travel itineraries with flight changes, gate information, and other relevant details. Enable notifications to stay informed about any disruptions or changes to travel plans.

- Integration with Calendar: Sync travel itineraries with a calendar. This helps to keep track of travel dates, meetings, and other appointments.

Strategies for Maximizing the Use of Concur Invoice

Concur Invoice is designed to streamline invoice processing. Here are some strategies to help users maximize its capabilities.

- Automated Invoice Submission: Encourage vendors to submit invoices electronically. Concur supports various methods of electronic invoice submission, including email and direct upload. This eliminates manual data entry and reduces the risk of errors.

- Invoice Routing Rules: Configure invoice routing rules to automate the approval process. Set up rules based on vendor, amount, or other criteria. This ensures that invoices are routed to the correct approvers without manual intervention.

- Custom Fields and Reporting: Utilize custom fields to capture additional information needed for reporting and analysis. This can include project codes, department codes, or any other relevant data. Use Concur’s reporting capabilities to generate insights into spending patterns and vendor performance.

- Invoice Matching: Utilize invoice matching features to automatically match invoices with purchase orders and receipts. This ensures accuracy and helps prevent duplicate payments.

- Payment Automation: Integrate Concur Invoice with the organization’s payment system to automate payment processing. This reduces manual effort and ensures timely payments to vendors.

- Vendor Portal: If available, encourage vendors to use the Concur Vendor Portal. This allows vendors to track the status of their invoices, submit invoices, and manage their profiles.

Alternatives to Concur Finance

Concur Finance, while a robust expense management solution, isn’t the only player in the game. Businesses have a plethora of options, each with its own strengths and weaknesses, catering to diverse needs and budgets. Evaluating these alternatives is crucial for finding the best fit for a company’s specific requirements, considering factors like company size, industry, and existing accounting infrastructure.

Comparing Concur Finance with Other Expense Management Solutions

Concur Finance excels in its comprehensive feature set and integration capabilities, particularly for large enterprises. However, several alternatives offer compelling features, often at a lower price point or with a more user-friendly interface, particularly for small to medium-sized businesses (SMBs). These alternatives may also specialize in specific areas, such as mileage tracking or international expense management, providing a more tailored solution.

Strengths and Weaknesses of Alternative Solutions

Evaluating the strengths and weaknesses of alternative solutions helps businesses make informed decisions. Consider the following:

- User-Friendliness: Some solutions prioritize ease of use with intuitive interfaces and mobile applications, making expense reporting simpler for employees. This contrasts with Concur’s more complex interface, which, while powerful, can have a steeper learning curve.

- Pricing: Pricing models vary significantly. Some offer per-user fees, while others have tiered pricing based on features or transaction volume. Concur’s pricing is often considered higher, potentially making alternatives more attractive for budget-conscious businesses.

- Integration Capabilities: While Concur boasts extensive integration capabilities, some alternatives offer seamless integration with specific accounting software or payment systems that a business might already use, streamlining the financial workflow.

- Mobile Functionality: Robust mobile apps are crucial for expense management. Some alternatives may offer superior mobile experiences with features like offline access or advanced receipt scanning capabilities.

- Reporting and Analytics: The depth and sophistication of reporting features differ. Some solutions provide more customizable reports or advanced analytics dashboards, offering deeper insights into spending patterns.

- Customer Support: The quality and responsiveness of customer support can vary significantly. Businesses should consider the level of support offered, including availability and response times.

Main Features of Different Expense Management Software Alternatives

The following table Artikels the key features of several expense management software alternatives, providing a comparative overview:

| Software | Key Features | Strengths | Weaknesses |

|---|---|---|---|

| Zoho Expense | Expense tracking, receipt scanning, mileage tracking, multi-currency support, custom approval workflows, and integration with Zoho CRM and accounting software. | Affordable pricing, user-friendly interface, excellent integration with Zoho ecosystem, and strong mobile app. | Limited features compared to Concur, less robust reporting capabilities for complex financial analysis. |

| Expensify | Receipt scanning, automatic expense categorization, mileage tracking, travel booking, corporate card reconciliation, and integration with various accounting software. | Automated expense reporting, user-friendly interface, strong mobile app, and real-time expense tracking. | Pricing can become expensive for larger companies, limited customization options for complex workflows. |

| SAP Concur (Smaller Businesses) | Core expense management, invoice processing, and travel booking. | Offers many of the same features as Concur, but with a more streamlined approach. | Still can be more complex than smaller business solutions, and may have a higher price point. |

| Divvy | Corporate cards, budgeting tools, expense tracking, and real-time expense monitoring. | Offers a comprehensive solution for managing spend, budgeting, and tracking. | Can be expensive for some companies, and some users find the interface to be less intuitive. |

Support and Resources

Concur Finance users have access to a comprehensive suite of support and resources designed to assist them in effectively utilizing the platform. These resources range from direct customer support channels to extensive training materials and self-service options, ensuring users can quickly resolve issues, learn new features, and optimize their Concur Finance experience. Accessing these resources is crucial for maximizing the value derived from the platform and maintaining smooth financial operations.

Customer Support Options

Concur Finance provides various customer support options to cater to different user needs and preferences. These options ensure that users can receive timely and effective assistance whenever they encounter issues or require guidance.

- Online Support Portal: The primary support channel is the online support portal, which is accessible 24/7. Users can submit support tickets, track the status of their requests, and access a vast knowledge base.

- Phone Support: Depending on the specific plan and contract, phone support may be available during business hours. This provides direct access to support representatives for urgent issues.

- Live Chat: Live chat support is often available, enabling users to receive real-time assistance from support agents. This is particularly useful for quick questions and troubleshooting.

- Implementation Support: During the initial setup and implementation phase, dedicated support is provided to ensure a smooth transition to Concur Finance. This may include project managers, technical consultants, and training specialists.

- Account Management: Larger organizations may have a dedicated account manager who serves as a primary point of contact for support, strategic guidance, and ongoing optimization.

Training Resources

Concur Finance offers extensive training resources to help users understand and effectively use the platform’s features. These resources cater to different learning styles and skill levels, ensuring that users can easily access the information they need.

- Online Courses: Concur provides a library of online courses covering various aspects of the platform, from basic navigation to advanced functionalities. These courses are typically self-paced and accessible on-demand.

- User Guides and Documentation: Comprehensive user guides and documentation are available, providing detailed explanations of features, functionalities, and best practices. These resources are available in various formats, including PDFs and online help.

- Webinars and Training Sessions: Concur regularly hosts webinars and training sessions to introduce new features, share best practices, and answer user questions. These sessions may be live or recorded.

- Quick Reference Guides: Concise quick reference guides are available for specific tasks and features, providing users with quick access to essential information.

- Community Forums: Concur may offer community forums where users can connect with each other, share tips, and ask questions. These forums provide a collaborative environment for learning and support.

Relevant Support Articles and FAQs

To facilitate self-service and quick problem-solving, Concur Finance provides a wealth of support articles and frequently asked questions (FAQs). These resources are designed to address common issues and provide users with immediate solutions.

- Knowledge Base Articles: The knowledge base contains a vast collection of articles covering various topics, including troubleshooting tips, feature explanations, and best practices. These articles are typically searchable and categorized for easy access.

- FAQs: Frequently Asked Questions (FAQs) are available to address common queries and provide quick answers to common issues. These FAQs are organized by topic and are regularly updated.

- Troubleshooting Guides: Troubleshooting guides are available to help users diagnose and resolve common issues they may encounter. These guides often include step-by-step instructions and visual aids.

- Release Notes: Release notes provide information about new features, updates, and bug fixes. Users can review these notes to stay informed about the latest changes to the platform.

- System Status Page: A system status page is available to provide real-time information about the platform’s performance and any ongoing issues. This helps users stay informed about the availability of the platform.

Future Trends and Developments

The landscape of expense management is constantly evolving, driven by technological advancements and shifting business needs. Concur Finance, as a leading platform, is poised to adapt and integrate these trends to maintain its competitive edge. This section explores potential future developments in expense management technology and how Concur Finance might evolve to meet these demands, focusing on the impact of emerging technologies.

Potential Future Developments in Expense Management Technology

The future of expense management is likely to be shaped by several key trends, all geared toward automation, enhanced user experience, and improved data analysis. These developments promise to streamline processes and provide greater insights for businesses.

- Artificial Intelligence (AI) and Machine Learning (ML): AI and ML will continue to automate tasks such as receipt scanning, expense categorization, and fraud detection. These technologies can learn from historical data to identify patterns and anomalies, improving accuracy and efficiency. For example, AI-powered systems can automatically flag suspicious expenses, such as those exceeding company policy limits or those exhibiting unusual spending behavior.

- Robotic Process Automation (RPA): RPA can automate repetitive tasks like data entry and invoice processing. This frees up finance teams to focus on more strategic activities, such as financial analysis and decision-making. RPA bots can be programmed to extract data from invoices, match them with purchase orders, and route them for approval, significantly reducing processing times.

- Blockchain Technology: Blockchain could enhance security and transparency in expense management. It can create an immutable ledger of transactions, making it difficult to alter or manipulate data. This technology can be used to verify the authenticity of receipts and prevent fraud.

- Mobile-First Approach: Expense management will become increasingly mobile-centric, with users able to manage expenses and submit reports from anywhere, at any time. This includes improved mobile app interfaces, integration with mobile payment systems, and enhanced offline capabilities.

- Integration with the Internet of Things (IoT): The integration of expense management systems with IoT devices, such as smart cars and connected devices, will allow for automated tracking of expenses like mileage and fuel costs. This could significantly reduce manual data entry and improve accuracy.

- Predictive Analytics: Expense management systems will increasingly use predictive analytics to forecast future spending, identify cost-saving opportunities, and improve budgeting accuracy. This enables businesses to make more informed financial decisions.

Evolution of Concur Finance to Meet Future Industry Demands

To remain competitive, Concur Finance will likely need to evolve to incorporate these future trends. This will involve continuous innovation and strategic partnerships.

- Enhanced AI Capabilities: Concur will likely invest heavily in AI and ML to improve its core functionalities. This includes developing more sophisticated fraud detection algorithms, automated expense categorization, and personalized recommendations for users. For example, the system could proactively suggest expense categories based on the merchant or transaction type.

- Improved User Experience: The user interface will become more intuitive and user-friendly, with a focus on mobile accessibility and personalized dashboards. Concur may adopt features like voice-activated expense reporting and AI-powered chatbots for user support.

- Increased Automation: Concur will continue to automate more processes, such as invoice processing, payment reconciliation, and travel booking. This could involve integrating RPA bots to handle repetitive tasks and reduce manual intervention.

- Expanded Integration: Concur will likely expand its integration capabilities with other business systems, such as ERP, CRM, and HR systems. This will enable seamless data flow and improve overall efficiency. Partnerships with payment providers and travel agencies will also be crucial.

- Data Security and Compliance: Concur will prioritize data security and compliance, incorporating advanced security features like multi-factor authentication and blockchain-based transaction verification. This ensures the integrity and confidentiality of financial data.

- Customization and Flexibility: Concur will offer more customization options, allowing businesses to tailor the platform to their specific needs and workflows. This includes configurable dashboards, custom reporting, and the ability to integrate with third-party applications.

Impact of Emerging Technologies on Concur Finance

Emerging technologies, particularly AI and machine learning, are poised to have a transformative impact on Concur Finance. These technologies will not only streamline existing processes but also enable new functionalities and insights.

- AI-Powered Expense Reporting: AI can automate the entire expense reporting process, from receipt scanning to report generation. This includes features like automatic expense categorization, fraud detection, and policy compliance checks. For instance, AI could automatically identify and flag expenses that violate company travel policies, such as excessive per diem allowances or unauthorized expenses.

- Predictive Analytics for Cost Optimization: Machine learning can analyze historical expense data to identify trends, predict future spending, and optimize costs. This allows businesses to make informed decisions about budgeting, resource allocation, and cost-saving initiatives. The system can provide recommendations on areas where costs can be reduced, such as negotiating better rates with travel vendors.