Overview of Convertible Note Financing

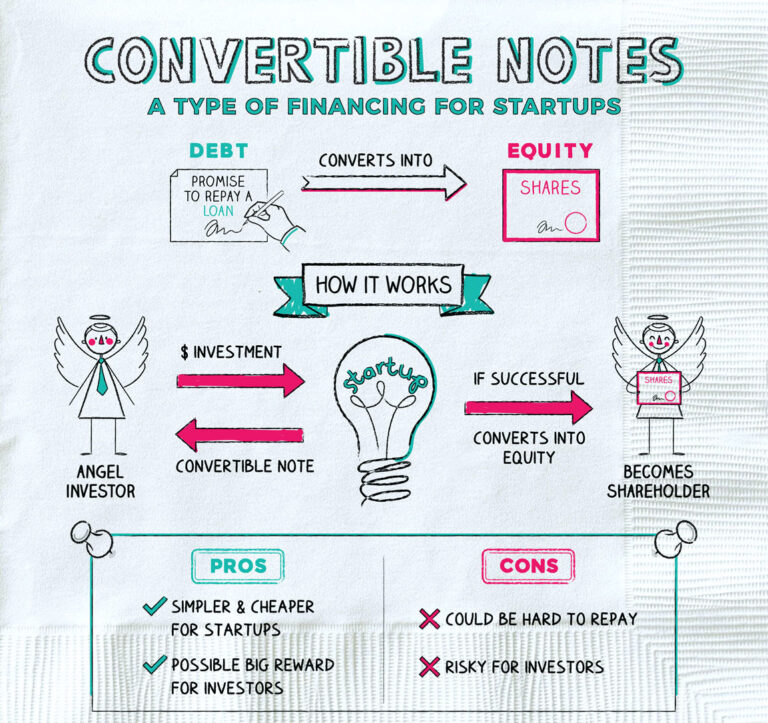

Convertible note financing represents a popular method for startups to raise early-stage capital. It offers a streamlined approach compared to traditional equity financing, often favored for its speed and simplicity. This section delves into the mechanics, history, and advantages of convertible notes, providing a comprehensive understanding of this financing tool.

Basic Structure of a Convertible Note

A convertible note is essentially a short-term debt instrument that converts into equity at a later date, typically during a future equity financing round. This structure allows investors to provide capital to a company without immediately determining the company’s valuation.

The key components of a convertible note include:

- Principal Amount: The initial amount of money the investor lends to the company.

- Interest Rate: The annual interest rate the company pays on the principal. This interest accrues until the note converts or matures.

- Maturity Date: The date when the note becomes due if it hasn’t converted into equity.

- Conversion Trigger: The event that triggers the conversion of the note into equity, most commonly a qualified equity financing round (e.g., a Series A round).

- Discount Rate: A percentage discount the noteholder receives when converting the note into equity. This compensates the investor for the risk they took by investing early.

- Valuation Cap: A maximum valuation at which the note will convert. This protects the investor from a very high valuation in the future equity round, ensuring they receive a reasonable ownership stake.

The formula for calculating the number of shares the noteholder receives upon conversion is:

Shares = (Principal + Accrued Interest) / (Equity Valuation / (1 + Discount Rate) or Valuation Cap, whichever is lower)

The mechanics involve the investor providing funds to the startup. The startup uses these funds for operations and growth. When a qualified financing round occurs, the note converts into equity based on the terms Artikeld in the note, including the discount rate and valuation cap. If the qualified financing does not occur before the maturity date, the noteholders may be repaid or negotiate an extension.

Brief History of Convertible Note Usage in Startup Funding

Convertible notes gained prominence in the late 20th and early 21st centuries as a practical solution for early-stage financing. Before convertible notes, startups often struggled to secure funding due to the complexities of valuing nascent companies. Traditional equity financing, requiring an immediate valuation, could be time-consuming and difficult, particularly for pre-revenue or pre-product companies.

The rise of convertible notes offered a simpler alternative. Investors could provide capital based on the expectation of future growth and valuation, deferring the complex valuation process until a later, more established stage of the company’s development. This approach gained popularity in the technology sector, particularly among venture capitalists investing in software and internet companies.

The structure allowed founders to raise capital quickly without the dilution and negotiation required for immediate equity rounds. As the startup ecosystem matured, convertible notes became a standard instrument for early-stage investments, evolving and adapting to meet the needs of both investors and startups.

Key Advantages of Convertible Note Financing for Investors and Companies

Convertible note financing presents several advantages for both investors and companies, contributing to its widespread adoption.

For investors, the benefits include:

- Simplicity and Speed: Convertible notes are generally less complex and quicker to execute than equity financing, allowing investors to deploy capital more efficiently.

- Downside Protection: The discount rate and valuation cap offer investors some protection against a lower valuation in the future equity round, providing a favorable conversion rate.

- Potential for Higher Returns: The discount rate and the potential for equity ownership provide investors with the opportunity for significant returns if the company succeeds.

- Reduced Dilution in Early Stages: Compared to an immediate equity round, investors’ ownership is initially less diluted.

For companies, the advantages include:

- Faster Fundraising: Convertible notes can be closed more quickly than equity rounds, allowing companies to secure funding faster.

- Deferred Valuation: The valuation is deferred until a later equity round, which is beneficial for early-stage companies that may not have a clear valuation.

- Lower Legal Costs: Convertible notes typically involve lower legal and administrative costs compared to equity financing.

- Flexibility: Convertible notes can be tailored to meet the specific needs of both the company and the investors, allowing for negotiation on terms such as the interest rate, discount rate, and valuation cap.

An example illustrating the benefit of a valuation cap: Imagine a startup raises $1 million via a convertible note with a $10 million valuation cap. In a subsequent Series A round, the company is valued at $20 million. The noteholders would convert at the $10 million valuation cap, effectively receiving a more favorable conversion rate than if the valuation cap did not exist. This ensures that the early investors benefit from their initial risk.

Key Terms and Concepts

Understanding the core terminology is crucial for navigating convertible note financing. These terms define the relationship between the investor and the company, and ultimately dictate the terms of conversion into equity. Careful consideration of these elements is essential for both the investor and the company.

Valuation Cap

The valuation cap sets a maximum pre-money valuation for the company at the time of the next equity financing. This protects the investor from excessive dilution.

The valuation cap is a crucial term because it limits the price per share the noteholder will pay when the note converts into equity. It’s essentially a safety net for the investor, ensuring they receive a favorable conversion price.

For example, if an investor provides a convertible note with a $5 million valuation cap, and the next equity financing values the company at $10 million, the investor’s conversion price will be based on the $5 million cap, not the $10 million valuation. This means the investor will receive more shares than they would have otherwise.

Discount Rate

The discount rate is a percentage applied to the conversion price, offering the noteholder a discount on the price per share compared to the price paid by new investors in the equity financing.

The discount rate incentivizes investors for the risk they take by investing early. It rewards them for providing capital at a time when the company is still developing and faces greater uncertainty.

For example, if the discount rate is 20% and the price per share in the equity financing is $1.00, the noteholder would convert their note into equity at a price of $0.80 per share ($1.00 * (1 – 0.20)). This results in the noteholder receiving more shares than if they had invested in the equity round directly.

Conversion Event Mechanics

A conversion event is the trigger that causes the convertible note to convert into equity. This typically happens when the company raises a qualified equity financing, meaning a financing round of a specific size.

The mechanics of a conversion event are straightforward. When a qualified equity financing occurs, the note converts into equity. The number of shares the noteholder receives is determined by the valuation cap and/or the discount rate, depending on the specific terms of the note.

For instance, imagine a note with a $5 million valuation cap and a 20% discount rate. If the company raises $2 million in a Series A round at a $10 million pre-money valuation, the note will convert. The investor will likely receive shares based on the $5 million cap (since it’s more favorable than the $10 million valuation discounted by 20%). If the note doesn’t have a valuation cap, then the investor receives shares based on the 20% discount.

Common Terms and Their Impact

Here is a table summarizing common terms, their definitions, and their impact on the noteholder:

| Term | Definition | Impact on Noteholder |

|---|---|---|

| Valuation Cap | The maximum pre-money valuation used to determine the conversion price. | Limits the conversion price, potentially resulting in more shares for the noteholder. |

| Discount Rate | A percentage discount on the price per share compared to the price paid by new investors in the equity financing. | Reduces the conversion price, resulting in more shares for the noteholder. |

| Conversion Event | The event that triggers the conversion of the note into equity, usually a qualified equity financing. | Initiates the process of converting the debt into equity, allowing the noteholder to become an equity holder. |

| Maturity Date | The date the note becomes due if not converted. | If no conversion event occurs, the noteholder can demand repayment, or the note can be extended or converted based on agreed-upon terms. |

| Interest Rate | The annual interest rate on the note. | Provides the noteholder with a return on their investment while waiting for conversion. |

Parties Involved

Convertible note financing involves several key players, each with distinct roles and responsibilities. Understanding these roles is crucial for a successful financing round. The primary parties include the company, its founders, investors (both angel investors and venture capitalists), and potentially legal and financial advisors.

Company Founders’ Roles and Responsibilities

The founders are at the heart of the company and bear significant responsibility in a convertible note financing. They are not only the driving force behind the business but also the primary points of contact for investors.

The founders’ responsibilities include:

- Business Operations and Strategy: Maintaining the day-to-day operations of the business and executing the company’s business plan. This involves making strategic decisions about product development, marketing, sales, and other key aspects of the business.

- Fundraising: Leading the fundraising efforts, including preparing the pitch deck, negotiating the terms of the convertible note, and communicating with potential investors.

- Financial Management and Reporting: Managing the company’s finances, providing regular financial reports to investors, and ensuring compliance with the terms of the convertible note.

- Equity Dilution Awareness: Understanding the implications of equity dilution resulting from the eventual conversion of the note into equity. Founders should be prepared to discuss the impact on their ownership and the overall capitalization of the company.

- Investor Relations: Building and maintaining strong relationships with investors, providing updates on the company’s progress, and addressing any concerns.

Angel Investors’ Considerations

Angel investors are typically individuals who invest their own capital in early-stage companies. Their considerations in convertible note financing differ from those of venture capitalists, often due to their different risk tolerance and investment horizons.

Angel investors typically consider:

- Valuation: Angel investors are concerned about the pre-money valuation of the company. They want to ensure that the valuation is reasonable and reflects the company’s current stage and potential.

- Discount Rate: The discount rate is a crucial term in a convertible note. It provides angel investors with a return for taking on early-stage risk. A higher discount rate means a greater return at conversion.

- Interest Rate: Angel investors will evaluate the interest rate on the note. While not as significant as the discount rate, it still provides a return while the note is outstanding.

- Maturity Date: The maturity date defines when the note becomes due. Angel investors want to ensure the company can repay the note or that conversion will occur before the maturity date.

- Conversion Trigger: They pay attention to the conditions under which the note converts, such as a qualified financing round. They want to ensure that the trigger is clearly defined and that their investment will convert into equity at a reasonable valuation.

- Liquidation Preference: The liquidation preference determines the order in which investors are repaid in the event of a liquidation. Angel investors want to understand the liquidation preference terms to assess their potential returns.

- Information Rights: They seek information rights to stay informed about the company’s performance and progress.

- Voting Rights: Angel investors might negotiate for certain voting rights, particularly on significant decisions.

Venture Capitalists’ Perspective

Venture capitalists (VCs) are professional investors who manage funds and invest in high-growth companies. Their approach to convertible note financing often involves a more structured and rigorous due diligence process than that of angel investors.

Venture capitalists consider the following:

- Deal Terms: VCs scrutinize the terms of the convertible note, including the discount rate, valuation cap, and interest rate. They are very focused on achieving favorable terms to protect their investment and maximize their returns.

- Company Performance: VCs conduct extensive due diligence on the company’s financial performance, market opportunity, and management team. They want to see strong growth potential and a clear path to profitability.

- Market Opportunity: They assess the size and potential of the market in which the company operates. VCs seek companies with the potential to disrupt large markets and generate significant returns.

- Management Team: VCs evaluate the experience, skills, and track record of the management team. They look for a team with a strong vision, execution capabilities, and the ability to attract and retain talent.

- Alignment of Interests: VCs want to ensure that the founders’ interests are aligned with their own. They will look for mechanisms to incentivize founders and ensure they are motivated to build a successful company.

- Follow-on Funding: VCs assess the company’s ability to raise follow-on funding rounds. They want to ensure the company has the resources to execute its business plan and achieve its goals.

- Legal and Financial Due Diligence: VCs conduct comprehensive legal and financial due diligence. They will investigate any potential legal or financial risks.

- Valuation Cap: The valuation cap is an important term for VCs. It sets a maximum valuation at which the note will convert into equity. VCs will carefully negotiate the valuation cap to ensure they receive a favorable equity stake.

Structuring the Note

Structuring a convertible note involves several key decisions that significantly impact both the investor and the company. These elements, including the valuation cap, discount rate, and interest rate (if applicable), directly affect the economics of the investment and the eventual equity ownership. Carefully considering these factors ensures a fair and mutually beneficial agreement.

Determining the Appropriate Valuation Cap

The valuation cap represents the maximum valuation at which the convertible note will convert into equity during the next priced financing round. Setting the right cap is crucial; it balances the investor’s risk and potential return with the company’s need to attract funding.

- Understanding the Purpose: The valuation cap protects the investor from a down round or a low valuation in the future equity round. It ensures the investor receives a favorable conversion price, reflecting the risk they took at an early stage.

- Factors to Consider: Several factors influence the appropriate valuation cap.

- Company Stage: Earlier-stage companies typically have lower valuations and thus lower caps. Seed-stage companies often have lower caps than those in Series A rounds.

- Market Conditions: Overall market sentiment and the availability of capital impact valuations. During periods of high investment activity, valuations, and therefore caps, tend to be higher. Conversely, during downturns, caps might be lower.

- Comparable Companies: Researching the valuations of similar companies at the same stage of development can provide a benchmark.

- Negotiation: The valuation cap is often a point of negotiation between the company and the investor. Both parties will have their own perspectives on the company’s potential.

- Example: Consider a seed-stage startup with a promising product but limited revenue. An investor might agree to a $5 million valuation cap, reflecting the risk and the potential for future growth. If the next round values the company at $10 million, the note converts at the $5 million cap. If the next round values the company at $3 million, the note still converts based on the $5 million cap.

- Avoiding Overvaluation: Setting an excessively high valuation cap can deter future investors and make it difficult to raise subsequent rounds. It’s important to find a cap that reflects a reasonable expectation of the company’s future value.

Calculating the Discount Rate

The discount rate is a percentage reduction in the price per share the investor receives upon conversion. This compensates the investor for the risk of investing early and provides an incentive to invest in the company’s early stages.

- Purpose of the Discount Rate: The discount rate rewards the investor for the time value of money and the inherent risks associated with early-stage investments.

- Factors Influencing the Discount Rate: The discount rate depends on the company’s stage, the perceived risk, and market conditions.

- Company Stage: Early-stage companies typically warrant higher discount rates than companies closer to profitability.

- Risk Profile: Higher-risk companies (e.g., those in unproven markets or with uncertain technology) will justify a higher discount rate.

- Market Standards: Prevailing market norms and the competitive landscape influence the discount rate.

- Calculating the Conversion Price: The conversion price is calculated by applying the discount rate to the price per share of the next priced round.

Conversion Price = (Price Per Share in Next Round) * (1 – Discount Rate)

- Example: An investor provides a convertible note with a 20% discount rate. In the next priced round, the company sells shares at $1.00 per share. The investor’s conversion price would be: $1.00 * (1 – 0.20) = $0.80 per share. This means the investor receives shares at a 20% discount to the new round’s price.

Structuring the Interest Rate, if Applicable

While not always included, an interest rate on a convertible note provides the investor with a return on their investment before the conversion to equity. This is a way to compensate for the time value of money and can make the note more attractive.

- Purpose of Interest: Interest accrues over the term of the note and is usually paid out at the time of conversion or maturity.

- Factors Determining the Interest Rate: The interest rate is influenced by several factors:

- Market Interest Rates: Prevailing interest rates in the market are a significant benchmark.

- Risk Profile: Higher-risk companies may offer higher interest rates to compensate for the increased risk.

- Negotiation: The interest rate is a negotiated term between the company and the investor.

- Interest Rate Calculation: Interest is typically calculated on a simple or compound basis.

- Simple Interest: Interest is calculated only on the principal amount.

- Compound Interest: Interest is calculated on the principal amount plus any accumulated interest.

- Example: A convertible note has a principal of $100,000 and an annual interest rate of 5%. If the note converts after two years, the simple interest earned would be $10,000 ($100,000 * 0.05 * 2). The total amount due at conversion would be $110,000.

Comparing Different Interest Rate Structures, Convertible note financing

The choice of interest rate structure significantly impacts the economics of the convertible note. Here’s a comparison of different interest rate structures:

| Interest Rate Structure | Description | Implications for Investor | Implications for Company |

|---|---|---|---|

| Fixed Interest Rate | A set percentage of the principal is paid over the life of the note. |

|

|

| Variable Interest Rate | The interest rate fluctuates based on a benchmark, such as the prime rate or LIBOR (or its successor). |

|

|

| Zero Interest Rate | No interest is accrued on the note. |

|

|

| Interest Accrual | Interest accrues over the life of the note and is added to the principal, typically paid out at the time of conversion or maturity. |

|

|

Negotiation and Due Diligence

The negotiation and due diligence phases are critical in convertible note financing. These processes determine the terms of the investment and ensure both the company and the investor are comfortable with the arrangement. Successful navigation of these stages requires careful consideration of various factors, from valuation to legal compliance.

Negotiation Process Between Company and Investor

The negotiation process involves a series of discussions between the company and the potential investor to finalize the terms of the convertible note. Both parties aim to achieve a mutually beneficial agreement, balancing the company’s need for capital with the investor’s desire for a favorable return.

The negotiation typically involves several key areas:

- Valuation Cap: The valuation cap sets a maximum valuation at which the note will convert into equity. Investors use this to limit their downside risk. The company wants to set a higher cap, and the investor a lower one.

- Discount Rate: The discount rate provides a discount on the price per share at the time of conversion. This rewards the investor for the risk they take early on.

- Interest Rate: The interest rate on the note is another area for negotiation. It compensates the investor for the time value of money and the risk associated with the investment.

- Maturity Date: The maturity date determines when the note becomes due if it hasn’t converted into equity. A longer maturity date gives the company more time to achieve milestones.

- Conversion Trigger: The trigger for conversion (e.g., a qualified financing round) is carefully negotiated. The company wants the trigger to be set at a higher funding amount to maintain control.

Due Diligence Process Investors Undertake Before Investing

Due diligence is a comprehensive investigation conducted by investors to verify the information provided by the company and assess the risks associated with the investment. The scope of due diligence can vary depending on the size of the investment, the stage of the company, and the investor’s specific requirements.

Due diligence typically involves several steps:

- Financial Review: Investors analyze the company’s financial statements, including income statements, balance sheets, and cash flow statements. They assess the company’s financial health, revenue trends, and expense management.

- Legal Review: This involves examining the company’s legal documents, such as articles of incorporation, bylaws, contracts, and intellectual property. Investors identify any legal risks or liabilities.

- Market Analysis: Investors evaluate the company’s market, including its size, growth potential, and competitive landscape. They assess the company’s market position and potential for success.

- Management Team Assessment: Investors assess the experience, skills, and track record of the company’s management team. They determine whether the team is capable of executing the company’s business plan.

- Technology and Product Review: For technology-focused companies, investors may assess the company’s technology, product development, and intellectual property protection.

Legal Considerations Involved in Drafting a Convertible Note Agreement

Drafting a convertible note agreement involves several legal considerations to ensure the agreement is legally sound, protects the interests of both parties, and complies with all applicable laws and regulations.

Key legal aspects to consider include:

- Compliance with Securities Laws: The agreement must comply with federal and state securities laws, including registration requirements and exemptions.

- Accurate and Complete Disclosure: The agreement should include accurate and complete disclosure of all material information about the company and the investment.

- Definition of Key Terms: Clearly define all key terms, such as the valuation cap, discount rate, interest rate, maturity date, and conversion trigger.

- Governing Law and Jurisdiction: Specify the governing law and jurisdiction for any disputes arising from the agreement.

- Representations and Warranties: Include representations and warranties from the company to assure the investor about the company’s financial health, legal compliance, and other relevant matters.

Convertible note financing – Example Negotiation Points for Valuation Cap and Discount Rate:

Scenario: A seed-stage startup is seeking $500,000 in convertible note financing.

- Valuation Cap:

- Investor’s Perspective: The investor might propose a valuation cap of $3 million, based on comparable early-stage company valuations and the perceived risk.

- Company’s Perspective: The company might counter with a $5 million valuation cap, arguing for its growth potential and market opportunity.

- Discount Rate:

- Investor’s Perspective: The investor might propose a 20% discount rate to compensate for the early-stage risk.

- Company’s Perspective: The company might negotiate for a 15% discount rate, arguing that the lower risk profile of the investment warrants a smaller discount.

Convertible note financing provides early-stage funding, often converting to equity in the future. Understanding the broader financial landscape is crucial, and that includes exploring specialty financing options that might offer tailored solutions. While these options exist, convertible notes remain a popular choice for their flexibility in the initial stages of a startup’s journey, and it’s a crucial part of early funding.

Convertible note financing is a popular early-stage funding mechanism, but it’s not always the best fit. For businesses with predictable revenue streams, exploring options like revenue based finance could be a smarter move, as it aligns repayment with actual earnings. Ultimately, whether a convertible note or another financing method is chosen, careful consideration of the company’s specific financial profile is essential.

>Conversion Scenarios

Conversion scenarios are critical junctures in convertible note financing, defining when and how the note transforms into equity. These events trigger the conversion process, impacting both investors and the company’s founders. Understanding these scenarios is crucial for both parties to anticipate potential outcomes and plan accordingly.

Conversion Triggers

Conversion triggers initiate the conversion of the note into equity. These triggers are explicitly defined in the note’s terms and conditions.

- Qualified Equity Financing: This is the most common trigger. It occurs when the company raises a subsequent equity financing round, typically a Series A or later round, meeting a pre-defined minimum size. For example, a note might convert upon a $2 million Series A financing.

- Change of Control: This trigger is activated by events like the acquisition of the company by another entity or a merger. The note converts into equity, often at a pre-negotiated price, or is repaid.

- Maturity Date: If the company hasn’t raised a qualified financing or experienced a change of control by the note’s maturity date, the note converts, often at a pre-determined discount and valuation cap. This provides a backstop for investors if the company doesn’t achieve its financing goals.

- Optional Conversion: The noteholder might have the option to convert the note into equity, even if no other trigger has been met. This could be a strategic move by the investor, based on their assessment of the company’s progress.

- Material Breach: If the company violates the terms of the note, such as failing to make interest payments or maintain certain financial ratios, the investor might have the right to trigger conversion, often at a disadvantageous price for the company.

Conversion Process in Different Scenarios

The conversion process varies depending on the triggering event. Understanding the mechanics of each scenario is vital.

- Equity Round Conversion: When a qualified equity financing round occurs, the note converts into equity, usually at a discount to the price per share offered to new investors in the round. The discount rate and valuation cap, if applicable, are key factors in determining the conversion price. For example, if a company raises a Series A at $10 per share and the note has a 20% discount, the note converts at $8 per share. If a valuation cap of $5 million is in place, and the Series A valuation is higher, the investor will use the lower valuation cap to determine the conversion price.

- Acquisition Conversion: In an acquisition scenario, the note typically converts into equity just before the acquisition closes. The conversion price is often based on the acquisition price, the note’s terms, and any pre-negotiated provisions. For instance, if the acquisition price is $15 per share and the note has a valuation cap of $10 million, the noteholders may convert based on that valuation cap. Another option is for the acquiring company to assume the note or repay it in cash.

- Maturity Date Conversion: If the note hasn’t converted through another trigger by the maturity date, it converts into equity, often at the pre-negotiated discount and valuation cap. The specific terms of conversion are Artikeld in the note agreement.

Potential Outcomes for Investors and Founders

Conversion events significantly impact both investors and founders. The outcomes can vary widely based on the specific terms of the note, the company’s performance, and the nature of the triggering event.

- Investor Outcomes:

- Equity Ownership: Investors receive equity in the company, becoming shareholders. The percentage of ownership depends on the note’s principal amount, the conversion price, and any applicable discount or valuation cap.

- Return on Investment: Conversion can lead to a return on investment, especially if the company is acquired or goes public at a higher valuation than the conversion price.

- Potential Dilution: Investors are subject to dilution in subsequent financing rounds, as new shares are issued.

- Founder Outcomes:

- Ownership Dilution: Founders’ ownership is diluted when the note converts into equity. The extent of dilution depends on the amount of the note and the conversion price.

- Control Implications: Significant note conversions can affect founder control, especially if investors acquire a large percentage of the company’s equity.

- Increased Accountability: Founders are accountable to the noteholders, who become shareholders with a vested interest in the company’s success.

Possible Conversion Outcomes

Conversion can result in several different outcomes, depending on the circumstances.

- Successful Conversion at a Favorable Valuation: The company raises a successful equity round at a high valuation, allowing the note to convert at a discounted price, providing a good return for investors and validating the company’s progress.

- Conversion at Valuation Cap: The company’s valuation is lower than the valuation cap, so the note converts at the pre-negotiated capped valuation, providing investors with a better return than if the company’s valuation was even lower.

- Conversion at Discount: The company successfully raises a subsequent round, and the note converts at a discount to the price per share in that round, offering a benefit to the noteholders.

- Acquisition at a Premium: The company is acquired at a price higher than the conversion price, resulting in a profitable outcome for the investors.

- Acquisition at a Lower Valuation: The company is acquired at a valuation lower than the conversion price or valuation cap, potentially resulting in a lower return or even a loss for the investors.

- Maturity Date Conversion with Limited Return: The company fails to raise subsequent funding and converts at the maturity date, potentially resulting in a less favorable outcome for investors due to the discount and valuation cap provisions.

- Failure to Convert: If the company struggles and fails to trigger a conversion event (e.g., no equity round or acquisition), investors may not receive a return, or they may have to pursue legal options.

Risks and Challenges

Convertible note financing, while offering flexibility, presents inherent risks and challenges for both investors and companies. Understanding these potential pitfalls is crucial for informed decision-making and successful execution of this financing strategy. This section Artikels the key risks for investors, challenges for companies, and strategies for mitigating these issues.

Investor Risks

Investors in convertible notes face several risks that can impact their potential return and the overall success of their investment.

- Down Round Risk: A down round occurs when a company raises subsequent funding at a lower valuation than the previous round. This can dilute the investor’s ownership and reduce the value of their convertible note. For example, if an investor provides a $100,000 convertible note with a valuation cap of $1 million, and the next equity round is at a $500,000 valuation, the investor’s ownership percentage will be higher than initially anticipated, but their per-share price will be lower. This directly impacts the investor’s potential return.

- Liquidity Risk: Convertible notes are typically illiquid investments. Investors cannot easily sell their notes before conversion or maturity. If the company fails or experiences significant delays in raising subsequent funding, the investor may be locked into their investment for an extended period, potentially losing the opportunity to invest in other ventures.

- Company Failure Risk: If the company fails to achieve its milestones or experiences financial difficulties, the investor may not receive a return on their investment. The note may become worthless, or the investor may only receive a fraction of their investment during liquidation, potentially after other creditors.

- Valuation Uncertainty: Determining the fair market value of a pre-revenue or early-stage company is inherently difficult. Valuation caps and discounts can be complex and may not accurately reflect the company’s future prospects. This uncertainty can lead to disputes between investors and the company during conversion.

- Maturity Date Risk: If the company does not secure a qualified financing event or is not acquired before the maturity date, the investor may have to negotiate an extension, potentially on unfavorable terms, or demand repayment, which can put significant strain on the company’s finances.

Company Challenges

Companies utilizing convertible note financing also face several challenges that can impact their long-term success.

- Debt Burden: Convertible notes represent debt, and this can burden the company’s balance sheet. While the intention is to convert to equity, if conversion doesn’t happen, the company is obligated to repay the principal plus interest, which can strain cash flow, especially if the company is not yet generating revenue.

- Dilution: While convertible notes are designed to avoid immediate dilution, they eventually convert into equity, diluting the ownership of existing shareholders. This dilution can be significant, particularly if the company raises multiple rounds of convertible notes before a priced equity round.

- Negotiation Complexity: Negotiating the terms of a convertible note, including the valuation cap, discount rate, and interest rate, can be complex and time-consuming. Companies must carefully balance the needs of investors with their own long-term goals.

- Valuation Cap Risk: Setting the valuation cap too high can deter investors in future rounds. Conversely, setting the cap too low can result in excessive dilution for the founders and early investors. This requires careful consideration of market conditions and the company’s projected growth.

- Management Time and Focus: Raising capital, including convertible note financing, consumes significant management time and focus. This can distract the team from core business operations, potentially hindering the company’s growth and development.

Mitigating Risks

Both investors and companies can take steps to mitigate the risks associated with convertible note financing.

- Due Diligence: Investors should conduct thorough due diligence to assess the company’s business model, market opportunity, team, and financial projections. This involves reviewing financial statements, understanding the company’s competitive landscape, and evaluating the management team’s experience.

- Legal Counsel: Both investors and companies should seek legal counsel to ensure that the terms of the convertible note are clearly defined and protect their respective interests. This includes reviewing the conversion mechanics, anti-dilution provisions, and other key terms.

- Realistic Valuation: Companies should strive for realistic valuations that reflect their current stage of development and future potential. Investors should carefully evaluate the valuation cap and discount rate to ensure they are fair and reasonable.

- Clear Communication: Maintaining open and transparent communication between the company and investors is crucial. This includes regular updates on the company’s progress, financial performance, and any significant changes to the business plan.

- Financial Planning: Companies should develop detailed financial projections and cash flow forecasts to anticipate future funding needs and manage their debt obligations. This includes planning for potential down rounds and the impact of conversion on ownership.

Common Pitfalls to Avoid

Several common pitfalls can undermine the success of convertible note financing.

- Unrealistic Valuation Caps: Setting valuation caps that are too high can make it difficult to attract subsequent investors and can lead to down rounds.

- Lack of Due Diligence: Investors who fail to conduct thorough due diligence may be unaware of potential risks and may end up investing in a failing company.

- Ignoring Legal Counsel: Both companies and investors should seek legal counsel to ensure that the terms of the convertible note are clearly defined and protect their respective interests.

- Poor Communication: Lack of communication between the company and investors can lead to misunderstandings, disputes, and a breakdown in the relationship.

- Inadequate Financial Planning: Companies that fail to develop detailed financial projections and cash flow forecasts may be unprepared for future funding needs and may struggle to manage their debt obligations.

Alternatives to Convertible Notes

Understanding the alternatives to convertible notes is crucial for founders seeking early-stage funding. Choosing the right financing instrument can significantly impact a startup’s trajectory, influencing ownership, valuation, and future fundraising prospects. This section explores various financing options, comparing and contrasting them to convertible notes to help founders make informed decisions.

Comparing Early-Stage Funding Options

Early-stage funding options vary significantly in their structure, terms, and implications. The optimal choice depends on the startup’s stage, funding needs, and the founders’ long-term goals. Evaluating the pros and cons of each alternative is essential for making the right decision.

Equity Financing Versus Convertible Notes: A Comparison

Equity financing and convertible notes represent two primary approaches to early-stage funding, each with distinct advantages and disadvantages. The choice between them often hinges on the startup’s current valuation, the founders’ willingness to relinquish equity, and the investors’ risk tolerance.

- Equity Financing: This involves selling shares of the company to investors in exchange for capital. Equity financing is a straightforward transaction where investors immediately become shareholders, gaining ownership and voting rights. The valuation of the company is determined at the time of the investment, usually through negotiation and due diligence.

- Pros: Provides immediate capital, establishes a clear valuation, and aligns investor and founder interests from the outset.

- Cons: Requires a formal valuation process, can be dilutive to founders’ ownership, and is more complex and expensive to set up than convertible notes.

- Convertible Notes: These are short-term debt instruments that convert into equity at a later date, typically during a future priced round of financing. Convertible notes defer the valuation process until the conversion event, offering flexibility and speed in raising capital.

- Pros: Faster and less expensive to implement than equity financing, defers valuation, and allows for potential discounts and caps that can benefit investors.

- Cons: Creates debt, which must be repaid if no conversion occurs, can be complex to negotiate, and may lead to less favorable terms for founders if the company’s valuation declines.

Comparing Convertible Notes, SAFE Notes, and Traditional Equity Financing

The following table provides a comparative analysis of convertible notes, SAFE notes, and traditional equity financing, highlighting their key features and differences.

| Feature | Convertible Note | SAFE Note | Traditional Equity Financing |

|---|---|---|---|

| Type | Debt | Equity (but legally considered an “uncertificated security”) | Equity |

| Interest Rate | Yes (typically) | No | |

| Maturity Date | Yes | No | |

| Valuation | Deferred until conversion | Deferred until conversion | Determined at the time of investment |

| Discount Rate | Yes (often) | Yes (often) | No |

| Valuation Cap | Yes (often) | Yes (often) | No |

| Security | Can be secured or unsecured | Unsecured | Equity shares |

| Complexity | Moderate | Low | High |

| Legal Fees | Moderate | Low | High |

| Investor Rights | Negotiable, similar to debt holders | Limited, similar to equity holders upon conversion | Extensive, including voting rights, information rights, etc. |

Deciding Between a Convertible Note and a Priced Round

The decision between a convertible note and a priced round (equity financing) depends on several factors, including the startup’s stage, valuation, and fundraising goals. A priced round requires a formal valuation and typically involves more due diligence, leading to higher legal costs.

- When to Choose a Convertible Note:

- Early Stage: When the startup is pre-revenue or has limited financial history, making valuation challenging.

- Speed and Efficiency: When the founders need capital quickly and want to minimize legal and administrative overhead.

- Bridge Financing: When the startup needs a short-term funding solution before a larger priced round.

- When to Choose a Priced Round:

- Later Stage: When the startup has a proven business model, revenue, and a clear valuation.

- Larger Funding Needs: When the startup requires a substantial amount of capital.

- Investor Preference: When investors prefer the immediate ownership and governance rights of equity.

Legal and Regulatory Considerations

Navigating the legal and regulatory landscape is crucial for a successful convertible note financing. Both investors and companies must understand the implications of securities laws and tax regulations to structure the deal effectively and avoid potential pitfalls. This section provides a comprehensive overview of these critical considerations.

Securities Regulations Impacting Convertible Note Financing

Convertible notes are subject to federal and state securities regulations. The primary concern is whether the offering of the note constitutes a “security” and, if so, whether it is exempt from registration requirements. Failure to comply with these regulations can lead to significant penalties, including rescission of the note and lawsuits.

The Securities Act of 1933 and the Securities Exchange Act of 1934 are the primary federal laws governing securities offerings. Most convertible note offerings are structured to qualify for exemptions from registration under these acts. Common exemptions include:

* Regulation D: This is a popular exemption, particularly Rule 506(b) and Rule 506(c), which allow companies to raise capital from accredited investors without registering the offering with the Securities and Exchange Commission (SEC). Rule 506(b) permits sales to an unlimited number of accredited investors and up to 35 non-accredited investors. Rule 506(c) allows for general solicitation and advertising, but all investors must be accredited.

* Regulation A+: This allows companies to raise a limited amount of capital through a simplified registration process. It is often used for offerings to both accredited and non-accredited investors. There are two tiers, each with different fundraising limits.

* Intrastate Offerings (Rule 147): This exemption applies to offerings made solely within a single state. The company must be incorporated in that state, and all investors must reside there.

States also have their own “blue sky” laws regulating securities offerings. Companies must comply with the laws of the states where they are offering or selling the convertible notes. This often involves filing notices or registering the offering with state regulators.

Tax Implications for Investors and Companies

Tax considerations are significant for both investors and companies involved in convertible note financing. These implications can affect the valuation, structuring, and ultimate return on investment. Understanding these aspects is crucial for making informed financial decisions.

For Investors:

* Interest Income: Interest payments received by the investor are generally treated as ordinary income and are subject to federal and state income taxes.

* Conversion to Equity: When the note converts to equity, the tax implications depend on the fair market value (FMV) of the shares at the time of conversion. If the FMV is greater than the investor’s cost basis (the principal amount of the note plus accrued interest), the investor may recognize capital gain. If the FMV is less than the cost basis, the investor may recognize a capital loss.

* Sale of Equity: If the investor later sells the equity shares, any profit is subject to capital gains tax. The holding period of the note before conversion and the shares after conversion determines whether the gain is short-term or long-term. Long-term capital gains are taxed at lower rates than ordinary income.

For Companies:

* Interest Expense Deduction: The company can generally deduct interest payments made on the convertible note as a business expense, reducing its taxable income.

* Original Issue Discount (OID): If the note is issued at a discount, the company may be required to amortize the discount over the life of the note and deduct the amortized amount as interest expense.

* Conversion to Equity: When the note converts to equity, the company does not recognize any taxable gain or loss. The company’s equity increases, and the debt is extinguished.

* Future Dilution: Issuing equity through conversion dilutes the ownership of existing shareholders.

Tax laws and regulations can be complex, and they are subject to change. Both investors and companies should consult with qualified tax advisors to understand the specific tax implications of their convertible note financing.

Importance of Legal Counsel in Structuring a Convertible Note

Engaging experienced legal counsel is essential for structuring a convertible note financing. A lawyer specializing in securities law and venture capital can help ensure compliance with all applicable regulations, negotiate favorable terms, and protect the interests of both the company and the investors.

Legal counsel provides several key services:

* Due Diligence: Conducting thorough due diligence on the company and the proposed financing structure.

* Document Preparation: Drafting and reviewing all legal documents, including the convertible note agreement, related ancillary agreements, and disclosure documents.

* Negotiation: Representing the client in negotiations with other parties, ensuring the terms are favorable and protecting their interests.

* Compliance: Advising on compliance with federal and state securities laws, including registration requirements and exemptions.

* Risk Mitigation: Identifying and mitigating potential legal risks associated with the financing.

A lawyer can also advise on the various clauses that must be included in the convertible note agreement to protect both parties.

Key Clauses That Must Be Included in the Convertible Note Agreement

The convertible note agreement is a legally binding contract that Artikels the terms of the financing. Several key clauses are essential to include in the agreement to protect the interests of both the company and the investor.

* Principal Amount and Interest Rate: This clause specifies the amount of money the investor is lending to the company and the interest rate the company will pay on the loan.

* Maturity Date: This clause sets the date when the principal amount of the note is due to be repaid.

* Conversion Feature: This clause describes the terms under which the note can be converted into equity, including the conversion price or valuation cap, discount rate, and any triggering events.

* Valuation Cap: This clause sets a maximum valuation for the company at the time of conversion, protecting the investor from excessive dilution.

* Discount Rate: This clause provides the investor with a discount on the price per share at the time of conversion, typically between 10% and 25%.

* Events of Default: This clause Artikels the events that would constitute a default under the note, such as failure to pay interest or principal, or breach of other covenants.

* Protective Provisions: These provisions give the investor certain rights to protect their investment, such as the right to approve major corporate actions or to receive information about the company’s performance.

* Prepayment Provisions: This clause defines the conditions under which the company can repay the note before the maturity date.

* Governing Law: This clause specifies the state law that will govern the interpretation and enforcement of the agreement.

* Anti-Dilution Protection: This clause protects the investor from dilution of their ownership stake in the event of future financings.

These clauses are critical in defining the relationship between the company and the investor and ensuring a smooth and legally sound financing process. Consulting with legal counsel is vital to tailor these clauses to the specific needs and circumstances of the deal.

Real-World Examples: Convertible Note Financing

Understanding how convertible notes function in practice is crucial for anyone considering this financing method. Examining real-world examples allows us to see the impact of different note terms and how valuation caps and discount rates influence outcomes. This section delves into specific case studies to illustrate these points.

Successful Companies Utilizing Convertible Note Financing

Many successful companies have leveraged convertible note financing to fuel their growth. These companies demonstrate the versatility and effectiveness of convertible notes in various industries and stages of development.

- Dropbox: Dropbox raised several rounds of convertible notes in its early stages. This allowed them to secure funding quickly and efficiently while delaying the valuation process until they had a more established product and user base. This strategy enabled them to focus on product development and user acquisition.

- Twitter: Before its Series A round, Twitter utilized convertible notes. This approach helped the company attract early investors and secure capital to build its platform. The notes provided flexibility during a period of rapid growth and allowed the company to negotiate more favorable terms in subsequent funding rounds.

- Snap Inc. (Snapchat): Snapchat employed convertible notes to raise initial funding. These notes provided a bridge to their Series A financing, allowing them to experiment and refine their product before a full valuation. The convertible note structure was instrumental in attracting early investors who believed in the vision of the company.

Case Studies: Impact of Different Note Terms

The specific terms of a convertible note significantly impact the outcome for both the company and the investors. Analyzing different scenarios highlights the importance of careful negotiation and understanding the implications of each term.

- Case Study 1: High Valuation Cap, Low Discount Rate: A startup raises $500,000 with a $10 million valuation cap and a 10% discount rate. The company’s Series A valuation is $20 million. The investors convert their notes at the discounted valuation of $18 million ($20 million – 10%). This results in a smaller ownership stake for the investors compared to a scenario with a lower valuation cap. The founders retain a larger percentage of the company.

- Case Study 2: Low Valuation Cap, High Discount Rate: Another startup raises $1 million with a $5 million valuation cap and a 20% discount rate. At Series A, the company’s valuation is $15 million. The investors convert at the lower of the valuation cap or the discounted valuation. Since the discounted valuation is $12 million ($15 million – 20%), the investors convert at the valuation cap of $5 million, giving them a more significant ownership stake. This benefits the investors but dilutes the founders’ ownership.

- Case Study 3: No Valuation Cap, Moderate Discount Rate: A company raises $750,000 with no valuation cap and a 15% discount rate. The Series A valuation is $25 million. The investors convert at a discounted valuation of $21.25 million ($25 million – 15%). This scenario highlights the importance of considering the potential for substantial dilution if the company achieves a high valuation at the time of conversion.

Impact of Valuation Caps and Discount Rates

Valuation caps and discount rates are key terms in convertible note financing, directly influencing the conversion price and the investors’ ownership stake. The interplay between these two terms is critical.

- Valuation Caps: The valuation cap sets a maximum valuation at which the note will convert. This protects investors by limiting the price per share they pay, particularly if the company’s valuation at the Series A round is higher than the cap. A lower cap is generally more favorable for investors.

- Discount Rates: The discount rate provides a discount on the price per share at the time of conversion. This compensates investors for the risk they take by investing early. A higher discount rate leads to a lower conversion price, increasing the investors’ ownership stake.

- Interaction: The valuation cap and discount rate work together. If the Series A valuation is below the cap, the discount rate is applied. If the Series A valuation exceeds the cap, the investors convert at the capped valuation. The choice of these terms represents a balancing act between attracting investors and minimizing dilution for the founders.

Formula: Conversion Price = (Series A Valuation – Discounted Amount) OR Valuation Cap, whichever is lower.

Example:

- Series A Valuation: $10 Million

- Valuation Cap: $8 Million

- Discount Rate: 20%

- Conversion Price = $8 Million (due to the valuation cap)

Example:

- Series A Valuation: $10 Million

- Valuation Cap: $12 Million

- Discount Rate: 20%

- Conversion Price = $8 Million ($10 Million – 20%)

Example:

- Series A Valuation: $20 Million

- Valuation Cap: No Cap

- Discount Rate: 20%

- Conversion Price = $16 Million ($20 Million – 20%)

Example:

- Series A Valuation: $5 Million

- Valuation Cap: No Cap

- Discount Rate: 20%

- Conversion Price = $4 Million ($5 Million – 20%)

Example:

- Series A Valuation: $5 Million

- Valuation Cap: $4 Million

- Discount Rate: 20%

- Conversion Price = $4 Million (due to the valuation cap)

Image Description

The illustration is a horizontal timeline depicting a successful convertible note financing journey. The timeline begins with the “Convertible Note Financing” phase, showing the initial funding round with key players like the founders and investors. Arrows indicate the flow of funds and agreements. Following this, the timeline progresses through “Product Development & User Acquisition” and “Milestone Achievement,” with graphics representing these stages, like a growing bar graph to depict user base. Key milestones, such as “Product Launch,” “User Growth,” and “Revenue Generation,” are clearly marked. The next phase is “Series A Funding,” with a graphic representing the equity round and the conversion of the notes. The illustration concludes with “Exit (Acquisition or IPO),” representing the successful outcome. The entire timeline emphasizes a clear progression from initial investment to a positive outcome for both the company and the investors.