Understanding Roof Financing

Roof financing provides homeowners with a way to pay for a new roof or roof repairs over time. This can be a crucial option, as roof replacements and significant repairs can be costly. It allows homeowners to avoid a large upfront payment and manage expenses through manageable monthly installments.

What Roof Financing Entails

Roof financing involves borrowing money to cover the cost of a roofing project. The homeowner then repays the borrowed amount, plus interest, over a set period. This process can be secured or unsecured, depending on the type of loan. The terms of the loan, including the interest rate, repayment schedule, and total cost, will vary depending on the lender and the borrower’s creditworthiness.

Types of Roof Financing Options

Several financing options are available to homeowners needing a new roof. Each option has its own set of advantages and disadvantages.

- Home Equity Loans: Home equity loans use the homeowner’s existing home equity as collateral. This means the loan is secured by the value of the home.

Credit score needed for roof financing – Advantages: Home equity loans often come with lower interest rates compared to personal loans, because they are secured. The interest paid may also be tax-deductible, depending on the use of the funds and IRS regulations. Generally, larger loan amounts are available.

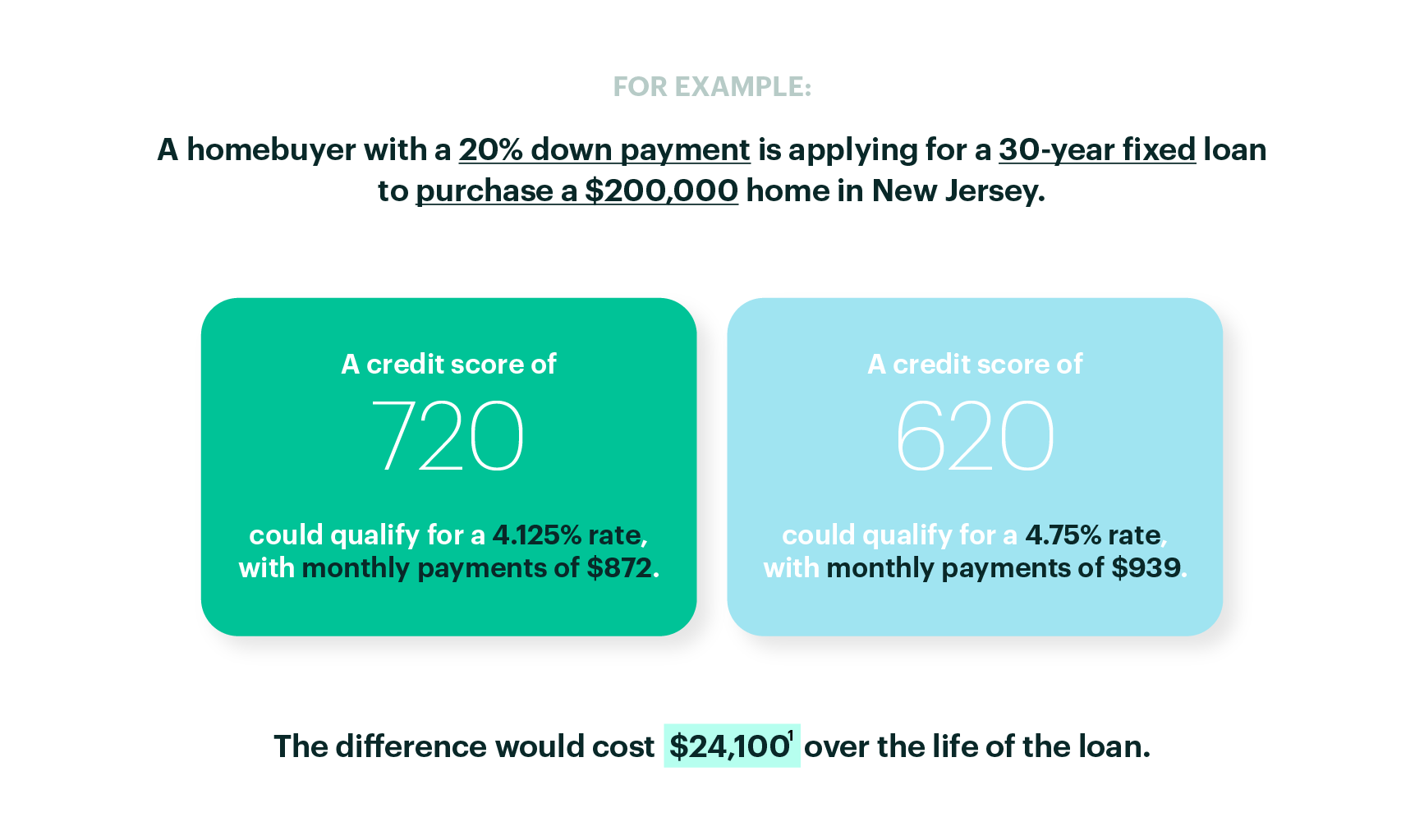

Securing roof financing often hinges on your credit score, as lenders assess your creditworthiness. Understanding the financial aspects of such a project is crucial, and it’s similar to how you’d approach project management finance ; careful planning and budgeting are key. A strong credit score typically unlocks better interest rates and loan terms, ultimately impacting the overall cost of your new roof.

Disadvantages: The homeowner’s home is at risk if they default on the loan. The approval process can be lengthy and may involve an appraisal of the home. Fees, such as origination fees, may be charged.

- Home Equity Line of Credit (HELOC): A HELOC is similar to a home equity loan, but it functions more like a credit card. Homeowners can borrow money as needed, up to a certain credit limit.

Advantages: Provides flexible access to funds. Interest is only paid on the amount borrowed. The interest paid may be tax-deductible.

Disadvantages: The interest rate is often variable, which can fluctuate. The home is used as collateral, so there is a risk of foreclosure if the homeowner defaults. Fees may apply.

- Personal Loans: Personal loans are unsecured loans, meaning they do not require collateral.

Advantages: Easier and faster to obtain compared to home equity loans. No risk to the homeowner’s home. The approval process is typically quicker.

Disadvantages: Interest rates are typically higher than those of secured loans. Loan amounts may be smaller than with other financing options. The loan term may be shorter.

Securing roof financing often hinges on a good credit score, as lenders assess your ability to repay. However, if you’re facing credit challenges, alternatives exist. While securing a roof loan might be tough, you could explore options like tv financing no credit check for other purchases. Ultimately, improving your credit score is key for favorable terms on roof financing down the line.

- Specialized Roofing Loans: Some roofing companies and lenders offer specialized loans specifically for roofing projects.

Advantages: Designed specifically for roofing projects, which can simplify the application process. Sometimes offer competitive interest rates and flexible repayment terms. May have partnerships with specific roofing contractors.

Disadvantages: Interest rates and terms can vary widely depending on the lender. May require using a specific roofing contractor. May have limited availability depending on location.

- Credit Cards: Using a credit card can be a quick way to finance a roof, especially for smaller projects.

Advantages: Provides quick access to funds. Rewards programs may offer incentives like cash back or points. The application process is often straightforward.

Disadvantages: High-interest rates, especially if the balance is carried over. May have limited credit limits, which might not cover the entire cost of the roof. Using a credit card can negatively affect credit utilization, potentially lowering the credit score.

Advantages and Disadvantages of Each Financing Option

The best financing option depends on the homeowner’s individual financial situation, credit score, and the scope of the roofing project.

- Comparing Interest Rates: The interest rate is a critical factor. A lower interest rate means lower overall costs. Home equity loans often have the lowest rates, while credit cards typically have the highest. Personal loans and specialized roofing loans fall in between.

- Considering Loan Terms: The loan term is the length of time the homeowner has to repay the loan. Longer terms mean lower monthly payments but higher overall interest paid. Shorter terms mean higher monthly payments but less interest paid overall.

- Evaluating Credit Score Impact: Taking out a loan can affect the credit score. Timely payments improve the score, while late payments can damage it. Using a credit card to finance a roof can increase credit utilization, which can negatively impact the score if the balance is high.

- Assessing Collateral Requirements: Home equity loans and HELOCs require the homeowner’s home as collateral. This poses a risk of foreclosure if the homeowner defaults. Personal loans and credit cards are unsecured, so they do not require collateral.

Factors Influencing Approval

Securing roof financing involves a thorough evaluation by lenders, assessing various factors to determine the risk associated with providing funds. Understanding these elements is crucial for applicants seeking approval. Lenders scrutinize financial stability, property value, and the applicant’s ability to repay the loan.

Primary Factors Considered by Lenders

Lenders employ a multifaceted approach when evaluating roof financing applications. They analyze several key aspects to assess the likelihood of loan repayment.

- Credit History: A significant factor, credit history reveals an applicant’s past financial behavior. Lenders examine payment history, outstanding debts, and the presence of any bankruptcies or foreclosures. A positive credit history demonstrates responsible financial management.

- Income and Employment: Lenders assess the applicant’s ability to repay the loan based on their income and employment stability. They verify employment, income sources, and the consistency of earnings. Consistent employment history and sufficient income are crucial for approval.

- Debt-to-Income Ratio (DTI): DTI compares an applicant’s monthly debt obligations to their gross monthly income. A lower DTI indicates a greater ability to manage debt and repay the loan. Lenders use this ratio to gauge the applicant’s financial capacity.

- Property Value: The value of the property being re-roofed is a crucial consideration. Lenders assess the property’s current market value to determine the collateral for the loan. A higher property value provides greater security for the lender.

- Loan Amount and Terms: The size of the loan and the repayment terms also influence the approval process. Lenders evaluate the requested loan amount in relation to the property value and the applicant’s financial capacity. Longer repayment terms may result in higher interest paid over the loan’s life.

Influence of Credit History on Approval

Credit history is a critical component of the approval process for roof financing. It provides lenders with a snapshot of an applicant’s financial responsibility.

- Credit Score Impact: A higher credit score generally increases the chances of approval and may lead to more favorable interest rates. A low credit score can result in loan rejection or higher interest rates.

- Payment History Analysis: Lenders review payment history to assess whether the applicant has consistently paid bills on time. Late payments, missed payments, or defaults negatively impact the credit score and decrease the likelihood of approval.

- Outstanding Debt: High levels of outstanding debt can signal financial instability, making it harder to secure financing. Lenders evaluate the applicant’s existing debt obligations to determine their ability to manage additional debt.

- Credit Utilization Ratio: This ratio measures the amount of credit used compared to the total available credit. A high credit utilization ratio can negatively impact credit scores.

Role of Debt-to-Income Ratio in Securing Roof Financing, Credit score needed for roof financing

The debt-to-income ratio (DTI) plays a pivotal role in assessing an applicant’s ability to repay a roof financing loan. Lenders use this metric to evaluate financial stability.

- Calculation and Formula: DTI is calculated by dividing an applicant’s total monthly debt payments by their gross monthly income.

DTI = (Total Monthly Debt Payments / Gross Monthly Income) * 100

- Impact of a High DTI: A high DTI indicates that a significant portion of the applicant’s income is already allocated to debt payments, potentially making it difficult to manage additional debt. This increases the risk for lenders.

- Impact of a Low DTI: A low DTI suggests that the applicant has more disposable income and a greater ability to manage debt. This increases the likelihood of approval and may lead to more favorable loan terms.

- Lender Thresholds: Lenders typically have DTI thresholds that applicants must meet to qualify for roof financing. These thresholds vary depending on the lender and the loan program. A DTI below 43% is generally considered acceptable by most lenders.

Impact of Property Value on Financing Approval

The value of the property significantly impacts the approval process for roof financing, as it serves as collateral for the loan.

- Collateral Security: The property acts as collateral, providing lenders with a means to recover their investment if the borrower defaults on the loan. Higher property values offer greater security.

- Loan-to-Value Ratio (LTV): Lenders use the LTV ratio to assess the risk associated with a loan. LTV is calculated by dividing the loan amount by the property’s appraised value.

LTV = (Loan Amount / Property Value) * 100

A lower LTV indicates less risk for the lender.

- Appraisal Process: Lenders typically require an appraisal to determine the property’s current market value. The appraisal ensures the property’s value supports the loan amount.

- Property Condition: The condition of the property, including its existing roof, can influence the appraisal and the lender’s decision. A well-maintained property with a sound structure typically receives a higher valuation.

Improving Creditworthiness

Building a strong credit profile is crucial for securing favorable roof financing terms. A higher credit score often translates to lower interest rates and more flexible repayment options. Improving your creditworthiness requires a proactive approach, focusing on responsible financial habits and addressing any existing credit issues. This section Artikels actionable steps to enhance your credit score and increase your chances of approval for roof financing.

Steps for Enhancing Credit Score

Improving your credit score is an ongoing process that involves consistent financial discipline. By implementing the following strategies, you can steadily improve your creditworthiness.

- Review Your Credit Reports Regularly: Obtain copies of your credit reports from all three major credit bureaus (Equifax, Experian, and TransUnion) at least annually. You can access them for free at AnnualCreditReport.com. Scrutinize each report for errors, such as incorrect account information, inaccurate payment history, or fraudulent activity.

- Pay Bills on Time, Every Time: Payment history is the most significant factor in determining your credit score. Set up automatic payments for all your bills, or create reminders to ensure you never miss a due date. Even a single late payment can significantly damage your credit score.

- Keep Credit Card Balances Low: Maintain low credit utilization, which is the percentage of your available credit you’re using. Aim to keep your credit utilization below 30% on each credit card. For example, if you have a credit card with a $1,000 limit, try to keep your balance below $300. Ideally, keep it even lower, such as below 10%.

- Avoid Opening Too Many New Accounts: Opening several new credit accounts in a short period can negatively impact your credit score. It can signal to lenders that you are a higher credit risk. Only apply for credit when you genuinely need it.

- Become an Authorized User: If you have a friend or family member with excellent credit, ask to be added as an authorized user on their credit card. This can help build your credit history, provided the primary account holder manages their account responsibly. However, it’s important to note that if the primary account holder defaults, it could negatively affect your credit.

- Dispute Inaccuracies Promptly: If you find any errors on your credit report, dispute them immediately with the credit bureau and the creditor.

Managing and Reducing Debt

Effectively managing and reducing debt is essential for improving your creditworthiness and increasing your chances of roof financing approval. A well-structured debt management plan demonstrates financial responsibility to lenders.

- Assess Your Current Debt: Compile a list of all your debts, including credit card balances, loans, and other outstanding obligations. Note the interest rates, minimum payments, and total amounts owed for each debt.

- Create a Budget: Develop a detailed budget to track your income and expenses. Identify areas where you can cut back on spending to free up funds for debt repayment.

- Choose a Debt Repayment Strategy: Two popular strategies are the debt snowball and the debt avalanche methods.

- Debt Snowball Method: Focus on paying off the smallest debts first, regardless of their interest rates. This provides a psychological boost and motivates you to continue.

- Debt Avalanche Method: Prioritize paying off the debts with the highest interest rates first. This strategy saves you the most money in the long run.

- Consider Debt Consolidation: If you have multiple high-interest debts, consider consolidating them into a single loan with a lower interest rate. This can simplify your payments and potentially save you money.

- Negotiate with Creditors: Contact your creditors and try to negotiate lower interest rates or payment plans. Some creditors may be willing to work with you, especially if you have a good payment history.

- Avoid Taking on New Debt: While paying off existing debt, avoid taking on new debt unless absolutely necessary. This will help you focus on reducing your overall debt burden.

Addressing Negative Marks on a Credit Report

Negative marks, such as late payments, collections, and bankruptcies, can significantly lower your credit score. Addressing these marks is crucial for improving your creditworthiness.

- Understand the Impact of Negative Marks: Recognize that negative marks can remain on your credit report for up to seven years, and bankruptcies can stay for up to ten years.

- Prioritize Paying Off Delinquent Accounts: If you have any delinquent accounts, bring them current as soon as possible. Even if you cannot pay the full amount immediately, making consistent payments can show lenders you are taking steps to rectify the situation.

- Negotiate with Collection Agencies: If you have accounts in collections, try to negotiate a “pay-for-delete” agreement, where the collection agency agrees to remove the negative mark from your credit report in exchange for payment.

- Request a “Goodwill Adjustment”: If you have a late payment due to unforeseen circumstances (e.g., a medical emergency), write a “goodwill letter” to the creditor explaining the situation and requesting that they remove the negative mark. There is no guarantee, but it may be worth the effort.

- Consider a Credit Counseling Service: If you are struggling with debt, consider seeking help from a non-profit credit counseling agency. They can provide guidance and assistance with debt management and credit repair.

Disputing Errors on a Credit Report

Errors on your credit report can negatively impact your credit score. Promptly disputing these errors is essential for ensuring the accuracy of your credit information.

- Gather Supporting Documentation: Collect any documentation that supports your dispute, such as copies of bills, payment records, or statements.

- Contact the Credit Bureau: Contact the credit bureau (Equifax, Experian, or TransUnion) that issued the report containing the error. You can typically dispute errors online, by mail, or by phone.

- File a Formal Dispute: Submit a formal dispute, providing all relevant information and documentation. Clearly explain the error and why you believe it is incorrect.

- Contact the Creditor: Simultaneously, contact the creditor who reported the information and inform them of the dispute. Provide them with the same documentation you sent to the credit bureau.

- Follow Up on the Dispute: The credit bureau is required to investigate the dispute and respond within 30 days. Follow up on the dispute to ensure it is being processed.

- Review the Updated Credit Report: Once the investigation is complete, review your updated credit report to ensure the error has been corrected. If the error persists, continue to dispute it until it is resolved.

Finding the Right Lender

Securing roof financing is a crucial step in protecting your home. Choosing the right lender can significantly impact the terms, interest rates, and overall experience. Careful research and comparison are essential to finding a financing option that fits your financial situation and project needs. This section guides you through the process of identifying and evaluating potential lenders.

Researching and Comparing Lenders

Finding the best roof financing requires thorough research and comparison. Different lenders offer varying terms, interest rates, and loan options. Taking the time to compare these factors can save you money and ensure you get the most favorable financing available.

- Online Research: Start by searching online for lenders specializing in roof financing. Many banks, credit unions, and specialized finance companies offer these loans. Websites like LendingTree, Credit Karma, and NerdWallet provide comparison tools and lender directories.

- Local Credit Unions and Banks: Check with local credit unions and banks. They often offer competitive rates and personalized service, and may be more flexible with their lending criteria.

- Home Improvement Loan Websites: Explore websites that focus on home improvement loans. These sites often have lists of lenders and resources to help you understand the loan process.

- Read Reviews: Read online reviews and testimonials from other homeowners. This can provide valuable insights into a lender’s customer service, loan processing speed, and overall satisfaction levels. Websites like the Better Business Bureau (BBB) offer information on a lender’s reputation and any complaints filed against them.

- Compare Interest Rates: Interest rates are a primary factor. Compare the Annual Percentage Rate (APR) offered by different lenders. The APR reflects the total cost of the loan, including interest and fees.

- Compare Loan Terms: Consider the loan term (the repayment period). Shorter terms typically have higher monthly payments but lower overall interest costs. Longer terms have lower monthly payments but you will pay more interest over the life of the loan.

- Check Loan Types: Find out what type of loans they offer. Options may include secured loans (using your home as collateral), unsecured loans, or government-backed loans (like those offered by the Federal Housing Administration).

Information to Gather for Quotes

When requesting quotes from potential lenders, gathering the right information will help you compare offers accurately and efficiently. This preparation streamlines the process and ensures you receive tailored loan options.

- Roofing Project Details: Provide detailed information about your roofing project. This includes the type of roof, the square footage, materials, and the estimated cost of the project. A detailed project scope helps lenders assess the loan amount needed.

- Credit Score and History: Be prepared to share your credit score and credit history. Lenders will use this information to assess your creditworthiness and determine your interest rate. Obtaining your credit report from the three major credit bureaus (Experian, Equifax, and TransUnion) before applying can help you understand your credit standing.

- Income and Employment Verification: Lenders will require proof of income and employment. This typically includes pay stubs, W-2 forms, and tax returns. This information helps lenders verify your ability to repay the loan.

- Debt-to-Income Ratio (DTI): Be ready to share your current debt obligations, including mortgage payments, car loans, and credit card debt. Lenders calculate your DTI to assess your ability to manage additional debt. A lower DTI is generally more favorable.

- Down Payment: Determine if you can make a down payment. Some loans require a down payment, while others do not. The down payment amount can impact the loan terms and interest rate.

- Project Timeline: Provide an estimated timeline for the roofing project. This helps lenders understand when the loan funds will be needed.

Key Questions to Ask Potential Lenders

Asking the right questions is essential to fully understanding the terms and conditions of a roof financing agreement. This proactive approach ensures you make an informed decision and avoid any surprises down the line.

- What is the APR? The APR is the most important figure, as it reflects the total cost of the loan, including interest and fees.

- What are the loan terms? Clarify the repayment period, and the monthly payment amount. Understanding the loan terms allows you to plan your budget and manage your finances effectively.

- Are there any fees associated with the loan? Inquire about origination fees, prepayment penalties, late payment fees, and any other charges.

- What is the minimum credit score required? Ensure your credit score meets the lender’s requirements.

- What are the funding timelines? Find out how long it takes to get approved and receive the funds.

- Is the interest rate fixed or adjustable? Understand whether the interest rate will remain constant or fluctuate over time.

- What are the prepayment penalties, if any? Determine if there are any fees for paying off the loan early.

- What is the process for loan disbursement? Understand how the funds will be disbursed to the roofing contractor.

- What if I have trouble making payments? Ask about options for hardship assistance or loan modification.

Checklist for Evaluating Loan Agreements

Before signing a roof financing agreement, it’s crucial to carefully review the terms and conditions. Use a checklist to ensure you understand all aspects of the loan and are comfortable with the agreement.

- Interest Rate and APR: Confirm that the interest rate and APR align with the lender’s initial quote.

- Loan Term: Verify the repayment period and ensure it fits your budget and financial goals.

- Monthly Payment: Ensure you can comfortably afford the monthly payments.

- Fees and Charges: Review all fees, including origination fees, prepayment penalties, and late payment fees.

- Payment Schedule: Understand the payment due dates and methods.

- Loan Amount: Confirm the loan amount matches the estimated cost of the roofing project.

- Disbursement Terms: Understand how the funds will be disbursed to the roofing contractor. Some lenders disburse funds in stages as the project progresses.

- Prepayment Penalties: Determine if there are any penalties for paying off the loan early.

- Default Terms: Review the consequences of defaulting on the loan, including potential foreclosure.

- Escrow Information (if applicable): If the loan includes an escrow account for property taxes or insurance, understand the terms.

Alternatives to Traditional Financing

Securing financing for a new roof doesn’t always require going through a bank or credit union. Several alternatives exist, offering different terms, interest rates, and eligibility requirements. Exploring these options can significantly broaden your possibilities and potentially lead to more favorable financing terms.

Manufacturer Financing

Manufacturer financing involves obtaining a loan directly from the roofing material manufacturer. Some manufacturers partner with financial institutions to provide financing options for their products.

The advantages of using manufacturer financing include:

- Potentially lower interest rates: Manufacturers might offer promotional rates or incentives to encourage the use of their products.

- Convenience: The application process might be streamlined if the manufacturer has a pre-existing relationship with the contractor or financial institution.

- Product-specific financing: Financing might be specifically tailored to cover the cost of the manufacturer’s materials, ensuring that your loan aligns with your roofing project.

The disadvantages of using manufacturer financing include:

- Limited product selection: Financing is typically restricted to the manufacturer’s products, potentially limiting your choice of materials.

- Eligibility requirements: Qualification criteria may still apply, and approval is not guaranteed.

- Potential for higher overall costs: While initial rates may be attractive, the loan terms and conditions should be carefully reviewed to avoid hidden fees or unfavorable terms.

For example, a homeowner looking to install a specific type of tile roof might find financing options offered by the tile manufacturer. However, they would be limited to using only that manufacturer’s tiles. If they prefer a different material or manufacturer, this option wouldn’t be suitable.

Contractor Financing

Contractor financing involves arranging financing directly with the roofing contractor. Some contractors offer in-house financing or partner with financial institutions to provide payment plans to their customers.

The benefits of contractor financing can include:

- Flexibility: Contractors may be more flexible with payment terms and requirements compared to traditional lenders.

- Convenience: The financing process can be simplified, as it is handled directly with the contractor.

- Potentially easier approval: Contractors might be more willing to work with customers who have less-than-perfect credit.

The risks of contractor financing can include:

- Higher interest rates: Contractors might charge higher interest rates to offset the risk of lending.

- Limited transparency: The terms and conditions of the financing agreement might not be as transparent as those offered by traditional lenders.

- Potential for predatory lending practices: It’s crucial to research the contractor and ensure they are reputable and operate ethically.

It is crucial to carefully review the terms and conditions of any contractor financing agreement before signing.

Negotiating Payment Plans with Roofing Contractors

Negotiating a payment plan with a roofing contractor can be a viable alternative to traditional financing, especially if you have a good relationship with the contractor or have a solid payment history. Here are some examples of how to approach negotiations:

- Down Payment: Offering a substantial down payment can demonstrate your commitment and reduce the amount to be financed. This could also lead to a lower overall project cost.

- Payment Schedule: Propose a payment schedule that aligns with your budget and income. Consider making payments in installments tied to project milestones (e.g., after material delivery, after the old roof removal, after installation).

- Interest Rates: Inquire about interest rates. If the contractor charges interest, try to negotiate a reasonable rate, comparing it to rates offered by other financing options.

- Written Agreement: Always insist on a written agreement that clearly Artikels the payment terms, including the total project cost, the payment schedule, any interest charges, and late payment penalties.

- References: If possible, ask for references from previous clients who have used similar payment plans with the contractor.

For instance, a homeowner with a solid credit score and a good relationship with a roofing contractor might negotiate a payment plan that includes a 25% down payment, followed by three equal installments spread over six months. This would allow the homeowner to spread the cost of the roof over time while avoiding high-interest rates. Another example involves a homeowner who has a lower credit score and can’t get approved for a loan. The contractor might agree to a payment plan with a higher down payment and slightly higher monthly payments to offset the increased risk.

The Application Process

Navigating the roof financing application process can seem daunting, but understanding the steps involved and preparing the necessary documentation can significantly streamline the process. This section provides a step-by-step guide to the application process, Artikels the required documents, and emphasizes the importance of careful review of the financing agreement.

Step-by-Step Guide to the Roof Financing Application Process

The application process typically involves several key stages, from initial inquiry to final approval and funding. Understanding these stages helps applicants manage their expectations and prepare accordingly.

- Initial Inquiry and Pre-qualification: The process often begins with an inquiry to a lender. Some lenders offer pre-qualification, which provides an initial assessment of your eligibility based on basic information, without a hard credit check. This can give you a sense of the loan amount you might be approved for.

- Application Submission: Once you’ve chosen a lender and financing option, you’ll submit a formal application. This involves providing detailed financial information and documentation.

- Credit Check and Verification: The lender will conduct a thorough credit check and verify the information provided in your application. This may involve contacting your references and verifying your income and employment.

- Underwriting and Approval: The lender’s underwriting team will assess your application based on various factors, including your credit score, debt-to-income ratio, and the value of your home. If approved, you’ll receive a loan offer outlining the terms and conditions.

- Loan Agreement and Closing: If you accept the loan offer, you’ll sign a loan agreement. This document details the loan amount, interest rate, repayment schedule, and other important terms. The closing process involves finalizing the loan and disbursing the funds.

- Roofing Installation and Payment: The roofing project commences after funding. The lender may disburse funds directly to the roofing contractor or to you in installments, depending on the agreement.

Documents Typically Required for a Roof Financing Application

Lenders require specific documents to verify the information provided in your application and assess your ability to repay the loan. Gathering these documents beforehand can expedite the application process.

- Proof of Identification: This typically includes a driver’s license, passport, or other government-issued photo ID.

- Proof of Income: Lenders will require documentation to verify your income, such as pay stubs, W-2 forms, or tax returns. Self-employed individuals may need to provide bank statements and profit and loss statements.

- Proof of Employment: Some lenders may request a letter from your employer verifying your employment status and income.

- Credit Report: While the lender will pull your credit report, it’s helpful to have a copy for your records. This allows you to identify any potential issues and address them before applying.

- Homeowner’s Insurance Information: You’ll need to provide information about your homeowner’s insurance policy.

- Roofing Contract or Estimate: You will need a detailed estimate or contract from the roofing contractor, outlining the scope of work and the total project cost.

- Property Appraisal (if required): Depending on the loan amount and the lender’s policies, an appraisal of your home may be required.

How to Prepare for the Application Process

Proper preparation can significantly increase your chances of approval and streamline the application process. Taking the following steps can help.

- Review Your Credit Report: Obtain a copy of your credit report from all three major credit bureaus (Experian, Equifax, and TransUnion) to identify any errors or negative items. Address any issues before applying for financing.

- Assess Your Budget: Determine how much you can realistically afford to pay each month. Consider the loan amount, interest rate, and repayment terms. Use online calculators to estimate your monthly payments.

- Gather Financial Documents: Collect all the necessary documents, such as pay stubs, tax returns, and bank statements, to have them readily available when you apply.

- Shop Around for Lenders: Compare offers from multiple lenders to find the best interest rates, terms, and conditions.

- Choose a Roofing Contractor: Select a reputable roofing contractor and obtain a detailed estimate for the project. This is a crucial step in determining the loan amount you’ll need.

The Importance of Reading the Fine Print in a Financing Agreement

Thoroughly reviewing the financing agreement is critical before signing. This document Artikels the terms and conditions of the loan, including the interest rate, repayment schedule, and any associated fees.

Understanding the terms can prevent unexpected financial burdens and protect your interests.

- Interest Rate: Pay close attention to the interest rate, whether it’s fixed or variable. A fixed rate remains constant throughout the loan term, while a variable rate can fluctuate.

- Repayment Schedule: Carefully review the repayment schedule, including the monthly payment amount and the loan term. Ensure the payments fit comfortably within your budget.

- Fees and Charges: Be aware of any fees associated with the loan, such as origination fees, prepayment penalties, or late payment fees.

- Default Provisions: Understand the consequences of defaulting on the loan, including potential foreclosure.

- Prepayment Penalties: Determine if there are any penalties for paying off the loan early.

- Liens: Understand whether the loan agreement grants the lender a lien on your property.

For example, a homeowner in Dallas, Texas, might secure a 15-year roof financing loan with a 7% interest rate. Reading the fine print could reveal a prepayment penalty of 2% of the outstanding balance if the loan is paid off within the first three years. Understanding this penalty is crucial for financial planning and avoiding unexpected costs.

Impact of Roof Type and Cost

The type of roof you choose and its associated cost significantly impact your financing options. Understanding this relationship is crucial for securing favorable loan terms and managing your budget effectively. From the materials used to the scope of the project, every decision influences the total expense and, consequently, the financing options available to you.

Roof Type and Financing Options

The choice of roofing material directly affects the availability and terms of your financing. Different materials have varying lifespans, installation complexities, and costs, all of which lenders consider when assessing risk.

- Asphalt Shingles: These are the most common and generally the most affordable roofing option. Financing for asphalt shingle roofs is readily available, often with competitive interest rates and shorter loan terms (e.g., 5-15 years). Due to their relatively lower cost, the loan amounts are typically smaller, leading to more manageable monthly payments.

- Metal Roofing: Metal roofs, including steel, aluminum, and copper, are more expensive upfront but offer significantly longer lifespans. Lenders often view metal roofs as a more secure investment, potentially leading to better loan terms, such as lower interest rates and longer repayment periods (e.g., 15-25 years). However, the higher initial cost means a larger loan amount.

- Tile Roofing: Tile roofs, made from clay or concrete, are also a premium option with a high upfront cost. Like metal roofs, they offer longevity, which can attract favorable financing terms. Financing for tile roofs is available, though the interest rates may be slightly higher than for metal roofs, and loan terms often range from 15-30 years. The higher cost translates to a larger loan, impacting monthly payments.

- Other Materials: Specialty materials like wood shakes or slate often require specialized installation and can be very expensive. Financing is available, but the options might be more limited, and the terms could be less favorable due to the higher risk associated with these materials.

Impact of Roofing Project Cost on Loan Terms

The total cost of your roofing project is a primary determinant of the loan amount, interest rate, and repayment terms offered by lenders. A higher project cost necessitates a larger loan, which may influence the interest rate and the duration of the loan.

- Loan Amount: The cost of the project directly dictates the loan amount you need. This includes the cost of materials, labor, permits, and any additional expenses.

- Interest Rate: Higher loan amounts can sometimes lead to slightly higher interest rates, as the lender assumes more risk. However, factors like your credit score and the type of roof also play a significant role.

- Loan Term: The loan term (the repayment period) is often influenced by the loan amount. Larger loans may require longer terms to keep monthly payments affordable. Common loan terms range from 5 to 30 years, depending on the lender and the project’s specifics.

- Monthly Payments: The loan amount, interest rate, and loan term all contribute to your monthly payments. A longer loan term reduces monthly payments but increases the total interest paid over the life of the loan.

Comparison of Financing Options Based on Project Cost

Financing options vary depending on the total cost of the roofing project. Consider the following examples to understand how different project costs impact loan terms and monthly payments. The figures provided are illustrative and can vary based on the lender, your creditworthiness, and prevailing market conditions.

- Scenario 1: Asphalt Shingle Replacement – Project Cost: $8,000

- Financing Option: Personal Loan or Home Improvement Loan

- Interest Rate: 8%

- Loan Term: 7 years

- Monthly Payment: Approximately $130

- Scenario 2: Metal Roof Installation – Project Cost: $25,000

- Financing Option: Home Equity Loan or Home Improvement Loan

- Interest Rate: 7%

- Loan Term: 15 years

- Monthly Payment: Approximately $225

- Scenario 3: Tile Roof Installation – Project Cost: $45,000

- Financing Option: Home Equity Loan or Cash-Out Refinance

- Interest Rate: 6.5%

- Loan Term: 20 years

- Monthly Payment: Approximately $330

Chart Illustrating the Relationship Between Roof Material Cost, Financing Terms, and Monthly Payments

The following table provides a visual representation of how roof material costs, financing terms, and monthly payments are interconnected. This chart helps illustrate the impact of different roofing materials on financing.

| Roof Material | Estimated Project Cost | Financing Option | Interest Rate | Loan Term | Estimated Monthly Payment |

|---|---|---|---|---|---|

| Asphalt Shingles | $8,000 | Personal Loan | 8% | 7 years | $130 |

| Metal Roofing | $25,000 | Home Improvement Loan | 7% | 15 years | $225 |

| Tile Roofing | $45,000 | Home Equity Loan | 6.5% | 20 years | $330 |

Avoiding Common Pitfalls

Navigating roof financing can be complex, and it’s easy to make mistakes that can lead to rejection, unfavorable terms, or even financial hardship. Understanding the common pitfalls and taking proactive steps to avoid them is crucial for a successful roofing project. This section Artikels the key areas to be aware of when applying for roof financing.

Common Mistakes in Application

Many applicants inadvertently sabotage their chances of approval or secure less favorable loan terms. Being aware of these common mistakes is the first step towards avoiding them.

- Inaccurate Information: Providing incorrect or incomplete information on the application is a major red flag. This includes misstating income, employment history, or existing debts. Lenders verify this information, and discrepancies can lead to immediate denial. For instance, a homeowner might overestimate their monthly income to qualify for a larger loan, only to have the application rejected when the lender discovers the discrepancy during verification.

- Ignoring Credit Report Errors: Failing to review and correct errors on your credit report can negatively impact your credit score and loan eligibility. These errors can include incorrect payment history, inaccurate account balances, or fraudulent activity. Before applying, obtain copies of your credit reports from all three major credit bureaus (Experian, Equifax, and TransUnion) and dispute any inaccuracies.

- Applying for Too Much: Borrowing more than you need can strain your budget and make repayment difficult. It can also make it harder to qualify in the first place. Carefully assess your roofing needs and obtain quotes from multiple contractors to determine the actual cost. Don’t overestimate the amount needed; it’s always better to borrow what you need.

- Shopping Around Too Much (or Not Enough): Applying for financing with multiple lenders simultaneously can trigger multiple hard inquiries on your credit report, which can temporarily lower your credit score. However, not shopping around enough can mean missing out on better interest rates and terms. A reasonable approach is to compare offers from a few different lenders within a short period (e.g., 14-45 days), as credit scoring models generally treat these as a single inquiry.

- Lack of Preparation: Failing to gather necessary documentation before applying can delay the process and potentially lead to denial. Be prepared to provide proof of income, employment verification, bank statements, and other financial documents.

Protecting Yourself from Predatory Lending Practices

Predatory lenders often target vulnerable borrowers with high-interest rates, hidden fees, and deceptive terms. Protecting yourself requires vigilance and careful scrutiny of loan offers.

- Understanding the Definition of Predatory Lending: Predatory lending involves loan terms that are unfair or abusive. These may include excessively high interest rates, excessive fees, and loan structures designed to make it difficult for borrowers to repay the loan.

- Identifying Red Flags: Be wary of lenders who pressure you to sign immediately, offer loans without checking your credit, or have complicated and unclear terms. Other red flags include excessively high interest rates or fees, and prepayment penalties.

- Researching Lenders: Before applying for a loan, research the lender’s reputation. Check online reviews, ratings from the Better Business Bureau, and any complaints filed with consumer protection agencies. Look for transparency and honesty in their dealings.

- Reading the Fine Print: Carefully review all loan documents before signing. Pay close attention to the interest rate, fees, repayment schedule, and any penalties for late payments or prepayment. Seek clarification on any terms you don’t understand.

- Seeking Professional Advice: Consider consulting with a financial advisor or credit counselor before taking out a loan. They can help you understand the terms and conditions and identify any potential risks.

Understanding Loan Terms and Conditions

A thorough understanding of the loan terms and conditions is essential to avoid unpleasant surprises and ensure you can comfortably manage the repayment.

- Interest Rates: Understand the interest rate structure (fixed or variable) and how it will impact your monthly payments and the total cost of the loan. A fixed-rate loan provides payment stability, while a variable-rate loan can fluctuate.

- Fees: Be aware of all fees associated with the loan, including origination fees, application fees, and late payment fees. These fees can significantly increase the overall cost of the loan.

- Repayment Schedule: Carefully review the repayment schedule, including the loan term (the length of time you have to repay the loan) and the frequency of payments (monthly, bi-weekly, etc.). Ensure the schedule fits your budget.

- Prepayment Penalties: Determine if there are any penalties for paying off the loan early. Some lenders charge fees if you pay off the loan before the agreed-upon term.

- Default Consequences: Understand the consequences of defaulting on the loan, including potential foreclosure on your home. Make sure you can meet your obligations.

Situations That Could Lead to Loan Denial

Several factors can lead to a loan application being denied. Understanding these factors can help you improve your chances of approval.

- Poor Credit History: A low credit score, a history of late payments, or a high debt-to-income ratio can significantly reduce your chances of approval. Lenders assess creditworthiness based on these factors.

- Insufficient Income: If your income is not sufficient to cover the loan payments, the lender may deny your application. Lenders will look at your income and debts to ensure you can afford the payments.

- High Debt-to-Income Ratio (DTI): A high DTI indicates that a significant portion of your income is already committed to debt payments, making it riskier for lenders to approve additional loans.

- Incomplete Application: Failure to provide all the required information or documentation can lead to denial. This can delay the process or even cause an application to be rejected.

- Unstable Employment History: A history of frequent job changes or periods of unemployment can raise concerns about your ability to repay the loan. Lenders prefer borrowers with a stable employment record.

Post-Approval Considerations: Credit Score Needed For Roof Financing

Securing roof financing is a significant step, but the journey doesn’t end with approval. Understanding the post-approval phase is crucial for responsible financial management and ensuring a smooth experience. This section provides guidance on managing your loan, navigating payments, and exploring future options.

Managing Loan Payments

Once your roof financing is approved, effective payment management is paramount. Consistent and timely payments are essential for maintaining a good credit standing and avoiding penalties.

The following points Artikel the key aspects of managing your loan payments:

- Payment Schedule Adherence: Carefully review your loan agreement to understand the payment schedule. Note the due dates, the amount of each payment, and the payment methods accepted by the lender. Set up reminders or automatic payments to avoid missing deadlines.

- Payment Methods: Explore the various payment methods offered by your lender. These typically include online payments, automatic debit from a bank account, mailing a check, or making payments in person. Choose the method that best suits your needs and ensures timely payment.

- Budgeting for Payments: Incorporate your monthly loan payments into your budget. Allocate sufficient funds each month to cover the payment amount. Consider using budgeting tools or apps to track your expenses and ensure you have enough available funds.

- Tracking Payments: Keep records of all payments made. This can include saving payment confirmations, bank statements, or online payment receipts. This documentation can be useful in case of any discrepancies or disputes.

- Contacting the Lender: If you encounter any difficulties making payments, contact your lender immediately. They may be able to offer options such as temporary payment adjustments or payment plans. Early communication can prevent more serious consequences.

Implications of Missed Payments

Missing loan payments can have serious repercussions on your credit score and financial well-being. Understanding the consequences of late or missed payments is crucial for avoiding these pitfalls.

Here’s a breakdown of the potential implications:

- Credit Score Impact: Late payments are reported to credit bureaus and can significantly lower your credit score. A lower credit score can make it harder to obtain credit in the future, and it may also result in higher interest rates on future loans.

- Late Fees and Penalties: Lenders typically charge late fees for missed payments. These fees add to the overall cost of the loan and can quickly accumulate.

- Interest Rate Increases: Some loan agreements include provisions for increasing the interest rate if payments are missed. This can lead to higher monthly payments and a greater overall cost for the roof financing.

- Default and Repossession: If you consistently miss payments, your loan can go into default. In extreme cases, the lender may have the right to repossess the roof (though this is rare).

- Legal Action: In some instances, lenders may pursue legal action to recover the outstanding debt. This could result in a lawsuit, which can further damage your credit score and financial standing.

Refinancing the Roof Financing Loan

Refinancing your roof financing loan can be a strategic move to potentially secure better terms, such as a lower interest rate or a different payment schedule. This can be particularly beneficial if your credit score has improved since the original loan was obtained or if interest rates have declined.

Consider the following when evaluating refinancing:

- Improved Creditworthiness: If your credit score has increased since you obtained the original loan, you may qualify for a lower interest rate through refinancing.

- Lower Interest Rates: If interest rates have decreased since your original loan, refinancing can potentially save you money over the remaining term of the loan.

- Adjusting Loan Terms: Refinancing can allow you to change the terms of your loan, such as the loan duration. This can be helpful if you want to shorten the loan term to pay off the loan faster or extend it to lower your monthly payments.

- Cash-Out Refinancing: In some cases, you may be able to refinance for an amount higher than your current loan balance and receive the difference in cash. This can be used for other home improvements or financial needs.

- Researching Refinancing Options: Explore different lenders and compare interest rates, fees, and loan terms. Consider the total cost of refinancing, including any associated fees.

- Calculating the Break-Even Point: Determine the break-even point, which is the time it takes for the savings from the lower interest rate to offset the costs of refinancing.