Introduction to Finance Flow Charts

Finance flow charts are visual representations of financial processes, illustrating the steps, decisions, and outcomes involved in managing money. They provide a clear, concise way to understand complex financial operations. They use standardized symbols to depict different actions, such as processes, decisions, and data inputs, allowing for a structured and easily digestible overview of financial workflows.

Definition of a Finance Flow Chart

A finance flow chart is a diagram that visually Artikels the steps of a financial process. It employs a standardized set of symbols to represent various actions and decisions within the process. The chart illustrates the sequence of activities, from the starting point to the final outcome, making it easier to understand and analyze the process. They are also known as process flow diagrams or process maps.

Primary Purpose of Using Flow Charts in Financial Contexts

The primary purpose of using finance flow charts is to improve clarity, efficiency, and control within financial operations. By visually mapping out processes, flow charts enable financial professionals to identify bottlenecks, redundancies, and areas for improvement. They facilitate better communication among team members, streamline workflows, and ensure consistent execution of financial tasks.

Common Scenarios Where Finance Flow Charts Are Most Beneficial

Finance flow charts are particularly valuable in various financial scenarios. They help simplify and improve understanding of complex processes.

- Budgeting and Forecasting: Flow charts can visually represent the steps involved in creating and managing budgets, from revenue projections to expense allocation. This can include depicting the flow of data used for forecasting, the decision points in budget approval, and the actions taken based on budget variances. For example, a flow chart might illustrate how sales data feeds into revenue projections, which then inform expense planning, culminating in a final budget.

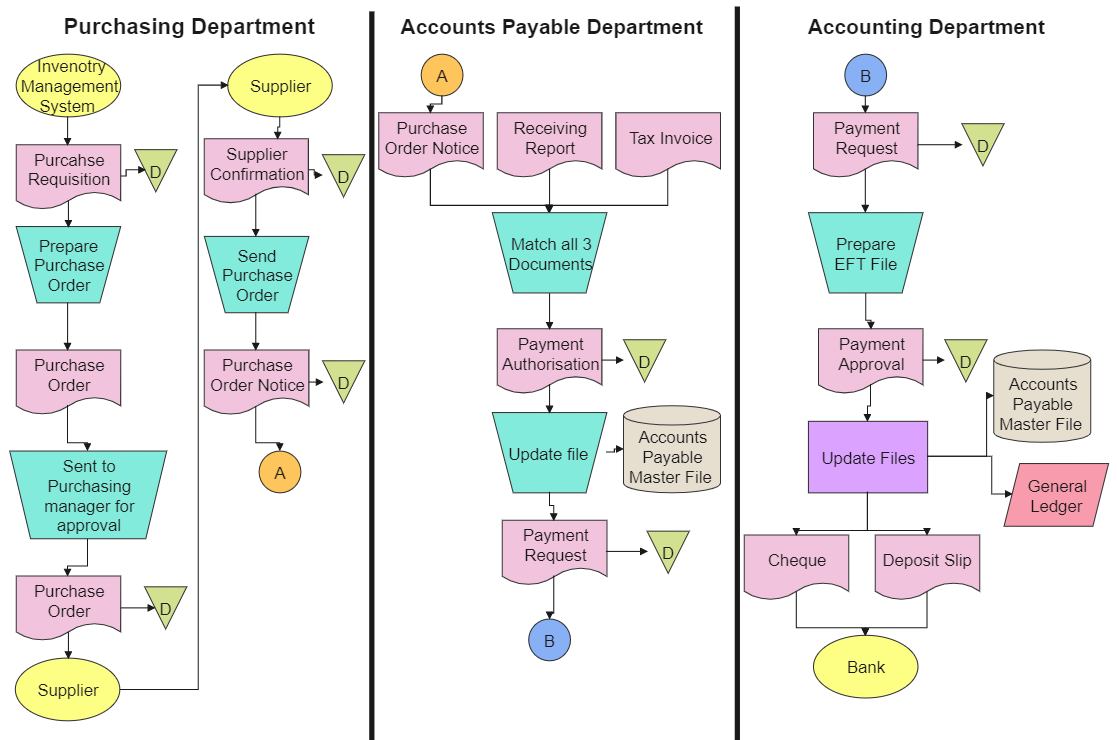

- Accounts Payable and Receivable: Flow charts are used to illustrate the processes for managing payments to vendors (accounts payable) and collecting payments from customers (accounts receivable). They can map the steps from invoice receipt to payment processing (accounts payable) and from invoice generation to payment collection (accounts receivable). A flow chart for accounts payable might show the steps: invoice received -> invoice verification -> payment approval -> payment processing -> record keeping.

- Investment Management: Flow charts can Artikel the steps involved in investment decision-making, from research and analysis to portfolio allocation and performance monitoring. This can involve mapping the stages of investment research, the decision criteria used to select investments, and the process of monitoring portfolio performance.

- Loan Processing: Flow charts can represent the steps involved in loan applications, from application submission to loan disbursement. This includes the steps of application intake, credit checks, approval decisions, and fund distribution. For example, the process may include: application received -> credit check -> approval/denial -> if approved, fund disbursement.

- Fraud Detection and Prevention: Flow charts can illustrate the processes used to detect and prevent financial fraud, mapping out the steps involved in identifying suspicious transactions and implementing fraud prevention measures. This includes the flow of information through various checks and balances, highlighting potential vulnerabilities and decision points for intervention.

- Financial Reporting: Flow charts can visually depict the steps involved in preparing financial statements, from data collection to report generation. They clarify the flow of data from various sources, the processing steps involved, and the generation of key financial reports.

Types of Finance Flow Charts

Finance flow charts are versatile tools, each designed to illuminate a specific facet of financial management. They visually represent complex processes, making them easier to understand and analyze. These charts use various visual representations to communicate information effectively, from simple shapes to complex diagrams. Understanding the different types of finance flow charts and their specific applications is crucial for effective financial planning and decision-making.

Budgeting Flow Charts

Budgeting flow charts visually represent the process of creating and managing a budget. They Artikel the steps involved in income and expense tracking, allocation of funds, and monitoring financial performance.

The following are the typical steps involved in a budgeting flow chart:

- Income Identification: This step involves identifying all sources of income, such as salary, investments, and other earnings.

- Expense Categorization: Categorizing all expenses into fixed (e.g., rent, mortgage payments) and variable (e.g., groceries, entertainment) categories.

- Budget Creation: Creating a budget that allocates income to different expense categories, including savings and investments.

- Tracking and Monitoring: Regularly tracking income and expenses, comparing them to the budget, and identifying any variances.

- Budget Adjustment: Making necessary adjustments to the budget based on changes in income, expenses, or financial goals.

Budgeting flow charts often use a simple, linear structure. The process typically begins with income and ends with financial goals. Decision points, represented by diamonds, may indicate whether adjustments are needed. For instance, a diamond might represent a check to see if spending in a particular category exceeds the budgeted amount. If it does, the chart directs the user to either reduce spending or adjust the budget.

Investment Flow Charts

Investment flow charts provide a visual guide to the investment process. They Artikel the steps involved in setting investment goals, selecting investments, managing a portfolio, and reviewing performance.

The investment process, as represented in a flow chart, typically includes the following steps:

- Define Investment Goals: Clearly stating investment objectives, such as retirement planning, purchasing a home, or funding education.

- Assess Risk Tolerance: Evaluating the investor’s ability and willingness to take on risk.

- Develop an Investment Strategy: Creating a plan that Artikels the asset allocation, investment vehicles, and time horizon.

- Select Investments: Choosing specific investments, such as stocks, bonds, mutual funds, or real estate.

- Implement the Strategy: Putting the investment strategy into action by purchasing the selected investments.

- Monitor and Review: Regularly monitoring the portfolio’s performance and making adjustments as needed.

Investment flow charts often use a more complex structure, including decision points (diamonds) to represent choices, such as selecting an investment vehicle based on risk tolerance or rebalancing the portfolio based on market performance. For example, a diamond might indicate whether the portfolio’s asset allocation is within the target ranges. If not, the chart directs the user to rebalance the portfolio by buying or selling assets.

Debt Management Flow Charts

Debt management flow charts visually depict the process of managing and reducing debt. They guide individuals or organizations through steps to understand debt obligations, create a repayment plan, and achieve financial freedom.

The debt management process typically includes the following steps:

- Debt Identification: Identifying all debts, including credit card balances, student loans, mortgages, and other obligations.

- Debt Prioritization: Prioritizing debts based on interest rates, amounts owed, and other factors.

- Repayment Strategy Selection: Choosing a debt repayment strategy, such as the debt snowball or debt avalanche method.

- Budget Adjustment: Adjusting the budget to allocate funds towards debt repayment.

- Debt Repayment: Making regular payments according to the chosen repayment plan.

- Monitoring and Review: Tracking progress and making adjustments as needed.

Debt management flow charts frequently employ a branching structure, with decision points (diamonds) to illustrate choices, such as selecting a repayment strategy. For example, a diamond might represent a decision between the debt snowball (paying off the smallest debts first) and the debt avalanche (paying off the highest-interest debts first). The chart then directs the user down the appropriate path based on their chosen strategy.

Comparison of Visual Representations in Finance Flow Charts

Different finance flow charts use various visual elements to represent financial processes effectively. The table below compares the visual representations used in budgeting, investment, and debt management flow charts.

| Chart Type | Purpose | Visual Elements | Typical Structure |

|---|---|---|---|

| Budgeting | Illustrates the process of creating and managing a budget, tracking income and expenses, and allocating funds. | Rectangles (processes), diamonds (decisions), arrows (flow direction), and sometimes, icons to represent income sources and expense categories. | Typically linear, starting with income identification and ending with financial goals, with decision points for budget adjustments. |

| Investment | Provides a guide for setting investment goals, selecting investments, managing a portfolio, and reviewing performance. | Rectangles (steps), diamonds (decisions, e.g., risk assessment), arrows (flow direction), and sometimes, visual cues for asset allocation. | More complex, often branching, with decision points to guide investment choices and portfolio adjustments based on market conditions or performance. |

| Debt Management | Visualizes the process of managing and reducing debt, including debt identification, repayment planning, and progress tracking. | Rectangles (steps), diamonds (decisions, e.g., repayment strategy selection), arrows (flow direction), and often, visual aids for debt prioritization. | Often branching, with decision points to choose debt repayment strategies and adjust budgets, showing the path towards debt reduction. |

The choice of visual representation depends on the complexity of the process and the target audience. Simpler processes, like basic budgeting, may use a more linear structure. More complex processes, like investment or debt management, often require branching structures with decision points.

Building a Finance Flow Chart: The Process

Creating a finance flow chart is a structured approach to visualize and understand financial processes. It helps to identify inefficiencies, track progress, and make informed decisions. The following steps Artikel the process of building an effective finance flow chart.

Step-by-Step Procedure for Creating a Finance Flow Chart

The process of creating a finance flow chart can be broken down into several key steps. Following these steps ensures clarity and accuracy in representing financial processes.

- Define the Scope and Purpose: Clearly identify the financial process you want to chart. Determine the specific goals of the flow chart. Are you mapping out a budgeting process, an investment strategy, or a loan application? Knowing the purpose guides the level of detail required.

- Gather Data and Information: Collect all relevant data related to the process. This includes financial statements, transaction records, policy documents, and any other pertinent information. Accurate data is crucial for a reliable flow chart.

- Identify the Key Steps and Activities: Break down the financial process into its individual steps and activities. Document each step in chronological order. Each activity should be concise and easily understandable.

- Choose the Appropriate Symbols: Select the correct flowchart symbols to represent each step. Standard symbols, such as rectangles for processes, diamonds for decisions, parallelograms for inputs/outputs, and arrows for flow direction, should be used consistently.

- Artikel the Flow: Connect the steps with arrows to show the sequence of actions. Ensure the flow is logical and easy to follow. Consider using swimlanes if different departments or individuals are involved.

- Create a Draft and Review: Develop an initial draft of the flow chart. Review it with stakeholders to ensure accuracy and completeness. Gather feedback and make necessary revisions.

- Refine and Finalize: Improve the flow chart based on feedback. Ensure clarity, accuracy, and visual appeal. Add any necessary annotations or explanations. Finalize the chart for distribution and use.

- Maintain and Update: Financial processes can change over time. Regularly review and update the flow chart to reflect any modifications or new procedures.

Sample Chart for a Basic Personal Budgeting Process

A basic personal budgeting flow chart can illustrate the steps involved in managing personal finances. This example provides a simplified view.

Finance flow chart – The flow chart below Artikels the steps involved in a basic personal budgeting process. It helps individuals visualize and manage their income and expenses effectively.

1. Start:

2. Income: Collect and list all income sources (salary, investments, etc.).

3. Expenses: Categorize and list all expenses (housing, food, transportation, etc.).

4. Calculate Net Income: Calculate Net Income by using the formula:

Net Income = Total Income – Total Expenses

Understanding a finance flow chart is crucial for any business, providing a visual roadmap of financial processes. This becomes especially critical when considering the complexities of software development finance , which demands careful budgeting and resource allocation. Ultimately, a well-defined finance flow chart ensures efficient tracking and management of funds, supporting informed decision-making throughout the financial lifecycle.

5. Decision: Is Net Income Positive or Negative?

- If Positive: Invest/Save, the surplus is used for investment or savings.

- If Negative: Reduce expenses, and review the budget to identify areas for cost reduction.

6. Review and Adjust: Regularly review and adjust the budget based on actual spending and financial goals.

7. End: The process is complete.

Understanding a finance flow chart is crucial for visualizing financial processes. It helps break down complex information into easily digestible steps. For those interested in advanced financial strategies, exploring georgetown finance could provide valuable insights. Ultimately, mastering the finance flow chart empowers informed decision-making and efficient resource allocation.

The flow chart would visually represent these steps, with rectangles for activities (e.g., “Collect Income,” “List Expenses”), a diamond for the decision (“Is Net Income Positive?”), and arrows showing the flow direction. This simplified chart serves as a foundation for more complex financial planning.

Symbols and Notations in Finance Flow Charts

Finance flow charts use standardized symbols to visually represent the steps, decisions, and data flow within a financial process. Understanding these symbols is crucial for interpreting and creating effective flow charts that accurately depict complex financial operations. These symbols ensure clarity and consistency, allowing anyone familiar with the conventions to quickly grasp the process being illustrated.

Process Symbol

The process symbol, typically a rectangle, represents a specific action or task within the financial workflow. It encapsulates any operation that transforms inputs into outputs.

Here’s how the process symbol is used in a financial context:

- Expense Tracking: A process symbol might represent “Record Invoice” in an expense management flow chart. This indicates the action of entering invoice details into an accounting system.

- Investment Analysis: In an investment decision flow chart, a process symbol could signify “Calculate ROI” (Return on Investment), indicating the calculation of the profitability of an investment.

- Loan Application: The process symbol can represent “Verify Credit Score” in a loan application process, indicating the step where a credit score is checked.

Decision Symbol

The decision symbol, a diamond shape, represents a point in the process where a choice or evaluation must be made. It typically has multiple exit paths, each corresponding to a different outcome based on the decision.

Here’s how the decision symbol is used in a financial context:

- Loan Approval: A decision symbol could represent “Credit Score Above 650?” in a loan application process. The chart branches based on whether the applicant’s credit score meets the threshold, leading to “Approve Loan” or “Reject Loan.”

- Investment Strategy: In an investment strategy flow chart, a decision symbol might ask “Market Volatility High?” This prompts a decision to either “Invest in Defensive Stocks” or “Invest in Growth Stocks” depending on the market conditions.

- Budgeting: A decision symbol could be “Spending Exceeding Budget?” in a budgeting flow chart. This decision leads to either “Adjust Spending” or “Continue with Current Spending,” depending on whether the budget is being adhered to.

Input/Output Symbol

The input/output symbol, a parallelogram, represents the input of data into the process or the output of data from the process. It signifies where information enters or leaves the system.

Here’s how the input/output symbol is used in a financial context:

- Invoice Processing: In an invoice processing flow chart, an input/output symbol might represent “Receive Invoice.” This indicates the point where an invoice enters the system for processing.

- Financial Reporting: An input/output symbol could signify “Generate Financial Report,” indicating the output of a financial statement.

- Sales Forecasting: In a sales forecasting flow chart, an input/output symbol could represent “Enter Sales Data,” signifying the input of historical sales figures into the forecasting model.

Document Symbol

The document symbol, which often resembles a document or a piece of paper, represents a document or report that is part of the process.

Here’s how the document symbol is used in a financial context:

- Accounts Payable: A document symbol can represent “Invoice” in an accounts payable process.

- Budgeting: In a budgeting process, a document symbol can represent the “Budget Report” itself.

- Loan Application: The document symbol could represent “Loan Application Form” in a loan application process.

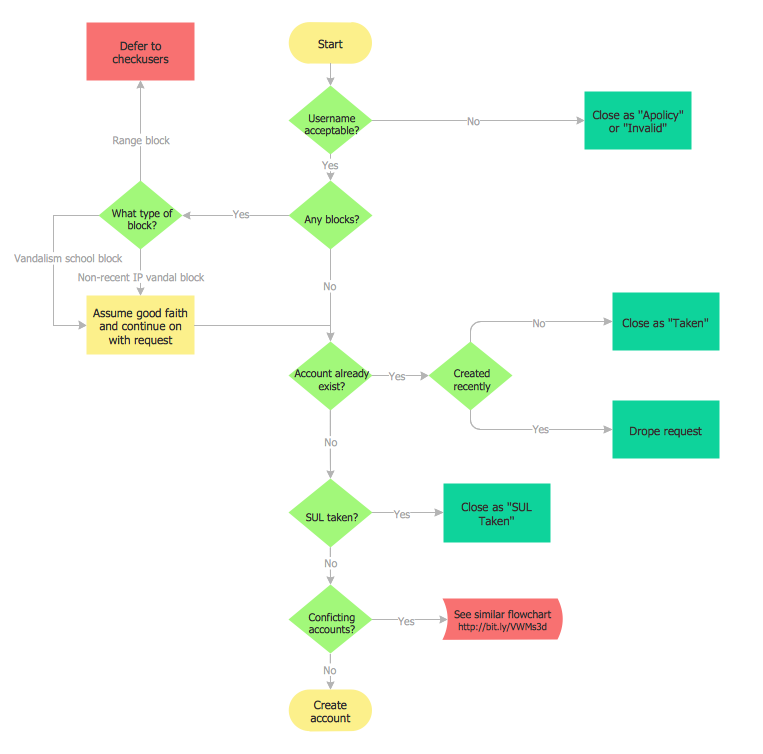

Connector Symbols

Connector symbols, typically circles or small rectangles, are used to link different parts of the flow chart, especially when the chart spans multiple pages or sections. They indicate the continuation of the flow from one point to another.

Here’s how connector symbols are used in a financial context:

- Complex Processes: If a financial process is too large to fit on a single page, connector symbols are used to indicate where the flow continues on another page. For instance, in a detailed investment analysis, a connector might indicate a jump from the “Risk Assessment” section to the “Portfolio Diversification” section.

- Repetitive Tasks: Connectors can be used to loop back to a previous step in a process. For example, in a budgeting process, if spending exceeds the budget (indicated by a decision symbol), a connector could loop back to a “Review Spending” process symbol.

- Cross-referencing: Connectors help to connect different sections of a complex flow chart. For instance, in a chart depicting the entire financial reporting cycle, a connector could lead from the “General Ledger” section to the “Financial Statement Preparation” section.

Creating a Budgeting Flow Chart

Budgeting flow charts are invaluable tools for visualizing the financial planning process. They break down complex financial information into easily digestible steps, making it simpler to understand income, track expenses, and achieve financial goals. This section will detail the process of creating a personal budgeting flow chart, providing examples of how to represent key financial elements and goals visually.

The Budgeting Flow Chart Creation Process

Creating a budgeting flow chart involves several key steps, starting with defining financial goals and ending with monitoring and adjustment. Each step is represented by a specific shape and connected by arrows, illustrating the flow of the budgeting process.

- Define Financial Goals: Begin by identifying short-term and long-term financial goals. These could include saving for a down payment on a house, paying off debt, or building an emergency fund. Clearly defining goals provides direction for the budget.

- Calculate Income: Determine all sources of income, including salary, wages, investments, and any other regular income streams. This is typically represented by a parallelogram, which signifies input.

- Track Expenses: Categorize and track all expenses. Expenses are usually classified into fixed expenses (rent, mortgage, utilities) and variable expenses (groceries, entertainment, dining out). This step often involves a decision diamond to differentiate between expense categories.

- Calculate Savings: Determine how much money will be saved each month. Savings are often a non-negotiable part of the budget and are represented by a separate process within the chart.

- Allocate Funds: Allocate income to expenses and savings. This step shows how money is distributed based on the budget.

- Monitor and Adjust: Regularly monitor the budget and make adjustments as needed. This step is crucial for staying on track and adapting to changing circumstances. A loop or feedback arrow often represents this iterative process.

Representing Income, Expenses, and Savings

Visually representing income, expenses, and savings is a core element of a budgeting flow chart. The chart uses different shapes and connecting lines to illustrate these financial elements.

- Income Representation: Income is typically represented using a parallelogram. For example, a person earning a monthly salary of $4,000 would have a parallelogram labeled “Monthly Salary: $4,000.” This is the starting point of the chart.

- Expense Representation: Expenses are categorized and often represented using rectangles. Fixed expenses, such as rent ($1,200), and variable expenses, such as groceries ($400), are listed in separate rectangles. Decision diamonds can be used to determine whether an expense falls within a specific category.

- Savings Representation: Savings are represented by a separate process. For instance, a designated rectangle might state, “Savings: $500 per month.” This highlights the importance of saving as a key component of the budget.

- Connecting Lines and Arrows: Arrows show the flow of money. An arrow would flow from the “Monthly Salary” parallelogram to the “Expenses” rectangles and the “Savings” rectangle, indicating how the income is allocated.

Visualizing Financial Goals

Financial goals are incorporated into the budgeting flow chart to provide a clear path toward achieving them. The flow chart helps in visualizing the process of allocating funds towards these goals.

- Emergency Fund: To illustrate saving for an emergency fund, a rectangle could be labeled “Emergency Fund: Save $1,000.” The flow chart would show a portion of the monthly savings being directed towards this goal.

- Debt Repayment: For debt repayment, a rectangle might state, “Debt Repayment: $200 per month.” The chart would show a portion of the allocated funds directed towards paying off debt.

- Investing: If the goal is to invest, a rectangle could represent “Investment: $300 per month.” The flow chart visually demonstrates how funds are allocated towards investments.

- Goal Tracking: The flow chart can incorporate progress tracking. For example, a progress bar within the “Emergency Fund” rectangle can show how close a person is to reaching their goal of $1,000.

Creating an Investment Decision Flow Chart

Constructing an investment decision flow chart provides a structured approach to evaluating potential investments, ensuring a systematic and logical process. This chart visually maps the steps involved, from initial screening to final investment decisions, incorporating risk assessment and return calculations.

Constructing a Flow Chart for Investment Decisions

Building an effective investment decision flow chart requires a clear understanding of the investment process and a logical sequence of steps. The flow chart should begin with the initial investment opportunity and conclude with the final investment decision, whether to invest or reject.

- Start with the Opportunity: Begin the flow chart with a clear representation of the investment opportunity. This could be a stock, bond, real estate, or any other asset.

- Initial Screening: Implement an initial screening stage to eliminate investments that do not meet basic criteria. This might involve checking the investment’s suitability based on risk tolerance, investment goals, and time horizon.

- Data Gathering: Collect all necessary data related to the investment, including financial statements, market analysis, and economic forecasts.

- Analysis and Valuation: Perform a detailed analysis of the investment, using techniques such as fundamental analysis, technical analysis, or discounted cash flow (DCF) analysis to determine its intrinsic value.

- Risk Assessment: Identify and assess the potential risks associated with the investment. This includes market risk, credit risk, liquidity risk, and any other relevant risks.

- Return Calculation: Calculate the expected return on investment (ROI), considering factors such as dividends, interest payments, and potential capital appreciation.

- Decision Point: Based on the analysis, risk assessment, and return calculation, a decision point is reached. This is often represented by a decision diamond in the flow chart.

- Investment Decision: If the investment meets the criteria, proceed to invest. If not, the flow chart should indicate the reasons for rejection.

- Monitoring and Review: Include a feedback loop for monitoring the investment’s performance and reviewing the decision regularly.

Representing Risk Assessment and Return Calculations

Incorporating risk assessment and return calculations is critical for informed investment decisions. The flow chart should visually represent these aspects to ensure they are thoroughly considered at each stage.

- Risk Assessment Methods: Several methods can be used to represent risk. These include:

- Sensitivity Analysis: This technique evaluates how the investment’s outcome changes when one or more input variables change. The flow chart can illustrate different scenarios, such as best-case, worst-case, and most-likely scenarios.

- Scenario Analysis: This method assesses the investment’s performance under different economic or market conditions. The flow chart can branch out to show different outcomes based on these scenarios.

- Monte Carlo Simulation: This uses a computer program to simulate a large number of potential outcomes, providing a range of possible returns and associated probabilities. The flow chart can reference the results of this simulation.

- Return Calculation Methods: Return calculations are crucial for evaluating the potential profitability of an investment. These include:

- Net Present Value (NPV): This calculates the present value of future cash flows, minus the initial investment. The flow chart can display the NPV calculation and its impact on the investment decision.

Formula: NPV = Σ (Cash Flow / (1 + Discount Rate)^Time) – Initial Investment

- Internal Rate of Return (IRR): This is the discount rate at which the NPV of an investment equals zero. The flow chart can show the IRR and how it compares to the investor’s required rate of return.

- Payback Period: This is the time it takes for an investment to generate enough cash flow to recover its initial cost. The flow chart can show the payback period and its relevance to the investment decision.

- Net Present Value (NPV): This calculates the present value of future cash flows, minus the initial investment. The flow chart can display the NPV calculation and its impact on the investment decision.

Examples of Different Investment Paths

The flow chart should be adaptable to various investment paths, reflecting different investment strategies and asset classes.

- Stock Investment Path:

- Initial Screening: The investor begins by defining criteria, such as market capitalization, industry, and financial health.

- Fundamental Analysis: Analyzing the company’s financial statements (income statement, balance sheet, cash flow statement) to determine its intrinsic value.

- Technical Analysis: Using charts and patterns to identify potential entry and exit points.

- Decision Point: Based on the analysis, decide whether to buy, sell, or hold the stock.

- Example: Consider a flow chart for investing in Apple (AAPL) stock. The initial screening would involve checking its market cap, industry (technology), and financial health (e.g., debt-to-equity ratio). The fundamental analysis would involve examining its revenue growth, profit margins, and cash flow. Technical analysis might involve identifying support and resistance levels. The decision point would determine whether to buy AAPL based on the analysis.

- Bond Investment Path:

- Initial Screening: The investor determines the bond’s credit rating, maturity date, and yield.

- Credit Analysis: Assessing the issuer’s ability to repay the bond.

- Interest Rate Risk Assessment: Evaluating how changes in interest rates affect the bond’s value.

- Decision Point: Decide whether to buy, sell, or hold the bond.

- Example: A flow chart for investing in U.S. Treasury bonds would start with the bond’s credit rating (AAA), maturity date, and yield. Credit analysis would focus on the U.S. government’s ability to repay the debt. Interest rate risk assessment would evaluate how changes in interest rates impact the bond’s value. The decision point would determine whether to buy the bond based on the analysis.

- Real Estate Investment Path:

- Initial Screening: The investor determines the property type, location, and price range.

- Property Analysis: Assessing the property’s condition, potential rental income, and market value.

- Risk Assessment: Evaluating potential risks, such as vacancy rates, property taxes, and maintenance costs.

- Decision Point: Decide whether to purchase the property.

- Example: Consider a flow chart for investing in a rental property. The initial screening would involve defining the property type (e.g., single-family home), location (e.g., a specific city), and price range. Property analysis would assess the property’s condition, potential rental income, and market value. Risk assessment would evaluate vacancy rates, property taxes, and maintenance costs. The decision point would determine whether to purchase the property based on the analysis.

Creating a Debt Management Flow Chart

A debt management flow chart is a visual tool designed to guide individuals through the process of managing and repaying their debts. It Artikels the steps involved, from identifying debts to implementing a repayment strategy and tracking progress. This type of flow chart is invaluable for organizing financial information and making informed decisions about debt repayment.

Designing a Debt Repayment Strategy

Creating a debt repayment strategy flow chart begins with identifying all debts and their associated details. This includes the creditor, the outstanding balance, the interest rate, and the minimum payment due date. The chart then maps out the chosen repayment method, whether it’s the debt snowball, debt avalanche, or a hybrid approach.

The first step involves gathering information about all debts. This information should be organized into a table or list. For example:

| Debt Type | Creditor | Balance | Interest Rate | Minimum Payment |

|---|---|---|---|---|

| Credit Card | Chase | $5,000 | 18% | $150 |

| Student Loan | Federal Loan Servicer | $20,000 | 5% | $200 |

| Auto Loan | Bank of America | $10,000 | 6% | $300 |

Next, the flow chart will show the decision points, which are often the selection of a repayment method.

- Debt Snowball Method: The flow chart would show prioritizing the smallest debt balance first, regardless of interest rate. This method aims to provide psychological wins early on, motivating the borrower.

- Debt Avalanche Method: The flow chart would show prioritizing debts with the highest interest rates, aiming to minimize the total interest paid over time.

- Hybrid Approach: The flow chart may incorporate elements of both methods, perhaps focusing on high-interest debts first while also considering smaller debts for quick wins.

The chart should also show how extra payments are allocated. For example, if using the debt snowball, extra payments would go towards the smallest balance until it’s paid off, and then the next smallest, and so on. If using the debt avalanche, extra payments would go to the debt with the highest interest rate until paid off.

Representing Debt Repayment Methods

Different debt repayment methods can be effectively represented in a debt management flow chart. These methods offer distinct approaches to debt reduction, and visualizing them helps in making informed decisions.

The flow chart employs different shapes to represent actions and decisions. Rectangles often denote actions, while diamonds signify decision points.

* Debt Snowball Example:

* Start with a list of all debts, ordered from smallest balance to largest.

* The flow chart begins with the “Identify all debts” action, leading to a decision diamond: “Smallest balance paid off?”.

* If “Yes,” the chart proceeds to the next smallest debt. If “No,” the chart shows making the minimum payment on all debts except the smallest, where extra payments are made.

* The chart continues this process until all debts are paid off.

* Debt Avalanche Example:

* Start with a list of all debts, ordered from highest interest rate to lowest.

* The flow chart begins with the “Identify all debts” action, leading to a decision diamond: “Highest interest rate debt paid off?”.

* If “Yes,” the chart proceeds to the next highest interest rate debt. If “No,” the chart shows making the minimum payment on all debts except the highest interest rate debt, where extra payments are made.

* The chart continues this process until all debts are paid off.

* Hybrid Approach Example:

* Start with a list of all debts.

* The flow chart may have a decision point: “Prioritize high-interest debts?”.

* If “Yes,” the chart follows the avalanche method for high-interest debts.

* If “No,” the chart might use the snowball method for smaller debts to create quick wins, and then switch to the avalanche method for larger debts.

Each method can be visually represented using flow chart symbols, clearly illustrating the steps involved and the decision-making process.

Incorporating Timelines and Milestones

Timelines and milestones are essential elements to include in a debt management flow chart. They provide a realistic framework for debt repayment, helping to track progress and maintain motivation.

To incorporate timelines, the flow chart should include estimated timeframes for each stage of the repayment process. This can be achieved by adding annotations or dedicated sections to the flow chart.

For instance, in a debt snowball strategy, the flow chart could include a timeline estimating how long it will take to pay off each debt.

To include milestones, the flow chart can identify specific points where progress is measured.

- Debt Elimination Milestones: These are the points when a specific debt is completely paid off. The flow chart would visually highlight the achievement of each debt elimination.

- Balance Reduction Milestones: These are the points where the debt balance has reached a specific lower value.

- Review Milestones: These are the points where the debt repayment strategy is reviewed and adjusted, typically every few months.

These milestones are important for monitoring progress and making adjustments to the repayment plan as needed. The flow chart could include checkpoints, such as “Review progress after 6 months,” or “Adjust budget if needed.” These checkpoints ensure that the plan remains aligned with the individual’s financial situation.

Tools and Software for Creating Finance Flow Charts

Creating effective finance flow charts requires the right tools. Selecting the appropriate software can significantly impact the clarity, efficiency, and overall quality of the flow charts. This section explores the various tools available, compares their features, and provides guidance on using a basic flow chart tool.

Software and Tools Available

A variety of software and tools cater to the creation of finance flow charts, each with its strengths and weaknesses. These tools range from simple, free options to sophisticated, paid software. The choice depends on the complexity of the flow charts needed, the user’s technical proficiency, and the budget available.

Comparison of Features and Functionalities

Different flow chart tools offer varying functionalities, impacting their suitability for different needs. The following table provides a comparison of some popular tools, highlighting their key features:

| Tool | Key Features | Ease of Use | Pricing | Use Cases |

|---|---|---|---|---|

| Microsoft Visio | Extensive shape libraries, data linking, collaboration features, advanced diagramming capabilities. | Moderate to High (Steeper learning curve for advanced features) | Subscription-based, various plans available. | Complex financial processes, enterprise-level budgeting, investment strategies. |

| Lucidchart | Real-time collaboration, integration with cloud services (Google Drive, Dropbox), extensive template library. | Easy to use, intuitive interface. | Subscription-based, various plans available (including free plans with limited features). | Budgeting, debt management, investment decision-making, team collaboration. |

| draw.io (Diagrams.net) | Free and open-source, web-based, integration with cloud storage, vast shape libraries. | Easy to use, drag-and-drop interface. | Free. | Simple flow charts, basic budgeting, personal finance planning. |

| Google Drawings | Free, web-based, simple interface, integration with Google Workspace. | Easy to use, basic features. | Free. | Quick drafts, basic financial planning, simple visualizations. |

Using a Basic Flow Chart Tool

Understanding the basic steps involved in using a flow chart tool can significantly enhance efficiency. Let’s consider a generic approach, applicable to many tools like draw.io or Google Drawings. The following steps Artikel the process:

- Choosing a Template or Starting from Scratch: Many tools offer pre-built templates for various purposes, including finance. Selecting a template can save time and provide a structured starting point. Alternatively, users can start with a blank canvas and build the flow chart from scratch, allowing for greater customization.

- Selecting and Adding Shapes: Flow chart tools provide a library of shapes, each representing a different action or decision point. Drag and drop the relevant shapes onto the canvas. Common shapes include:

- Start/End: Represent the beginning and end of a process (usually an oval).

- Process: Represents an action or step (usually a rectangle).

- Decision: Represents a decision point with multiple possible outcomes (usually a diamond).

- Input/Output: Represents data input or output (usually a parallelogram).

- Connector: Represents the flow of the process (usually an arrow).

- Connecting Shapes with Arrows: Use arrows to connect the shapes and illustrate the flow of the process. Arrows should clearly indicate the sequence of actions and the direction of decision paths.

- Adding Text and Labels: Add text inside the shapes to describe the action, decision, or data represented. Use clear and concise language to ensure the flow chart is easily understood. Label the arrows, especially at decision points, to indicate the conditions or outcomes.

- Customizing the Appearance: Most tools allow customization of the shapes, colors, and fonts to enhance the visual appeal and clarity of the flow chart. Consider using a consistent color scheme and font style for a professional look.

- Saving and Sharing: Save the flow chart in a suitable format (e.g., PNG, PDF, or the tool’s native format). Share the flow chart with stakeholders for review and feedback. Collaboration features in tools like Lucidchart allow for real-time co-editing.

Best Practices for Finance Flow Chart Design

Creating effective finance flow charts requires careful planning and execution. The goal is to visually represent complex financial processes in a clear, concise, and easily understandable manner. Adhering to best practices ensures that your flow charts are not only aesthetically pleasing but also serve their intended purpose of facilitating decision-making, improving efficiency, and reducing errors.

Clarity and Simplicity in Design

Flow charts should prioritize clarity and simplicity. Overly complex diagrams can be confusing and counterproductive. The focus should always be on conveying information effectively.

- Use Standard Symbols Consistently: Employ universally recognized symbols and notations. This minimizes the learning curve for users and ensures consistent interpretation. For instance, use a rectangle for a process, a diamond for a decision, and a parallelogram for input/output. Avoid creating custom symbols unless absolutely necessary, and if so, clearly define their meaning in a legend.

- Minimize Clutter: Avoid overcrowding the chart with unnecessary details. Focus on the essential steps and decisions. Use concise labels and descriptions. Consider breaking down complex processes into multiple, smaller, more manageable flow charts.

- Use Clear and Concise Language: Write clear and unambiguous labels for each step and decision point. Avoid jargon or technical terms that the target audience may not understand. Employ active voice and action verbs to make the process flow more dynamic.

- Maintain a Logical Flow: Arrange the steps in a logical sequence, typically from top to bottom or left to right. Use arrows to clearly indicate the flow of the process. Ensure that the flow is consistent and easy to follow. Avoid crossing lines unnecessarily, as this can create confusion.

Avoiding Common Pitfalls in Flow Chart Design

Several common mistakes can undermine the effectiveness of a finance flow chart. Awareness of these pitfalls is crucial for creating robust and reliable diagrams.

- Lack of a Defined Scope: Before starting, clearly define the scope of the flow chart. What process are you mapping? What is the purpose of the chart? A well-defined scope helps to avoid unnecessary complexity and ensures that the chart remains focused.

- Ignoring the Target Audience: Consider the knowledge and experience of the intended audience. Tailor the level of detail and terminology to their understanding. A flow chart for financial analysts will differ significantly from one designed for the general public.

- Using Inconsistent Formatting: Maintain consistency in formatting throughout the chart. Use the same font, font size, and style for all text elements. Ensure consistent spacing and alignment. This improves readability and professionalism.

- Failing to Review and Update: Financial processes are dynamic and subject to change. Regularly review and update your flow charts to reflect any changes in procedures, regulations, or systems. A stale flow chart can lead to errors and inefficiencies.

- Over-complicating Decision Points: Decision points, represented by diamonds, should be kept simple and clear. Avoid complex decision trees with numerous branches. Break down complex decisions into smaller, more manageable steps. Ensure each branch of a decision point leads to a clear and distinct outcome.

Tips for Easy Understanding and Interpretation

Making flow charts easy to understand is critical for their practical use. This involves several design considerations.

- Use Color Strategically: Color can be used to highlight key steps, differentiate between different types of activities, or indicate the status of a process. However, avoid using too many colors, as this can be distracting. Use a color legend to explain the meaning of each color. For example, use green to represent approved steps, red to represent rejected steps, and yellow for steps in progress.

- Provide a Legend or Key: Include a legend or key that explains the meaning of each symbol, notation, and color used in the flow chart. This is especially important if you are using custom symbols or colors. The legend should be easily accessible and clearly labeled.

- Use Annotations and Comments: Add annotations or comments to provide additional context or explanations for specific steps or decisions. This is particularly helpful for complex processes or for explaining the rationale behind certain choices.

- Test with Users: Before finalizing the flow chart, test it with a representative sample of your target audience. Ask them to interpret the chart and identify any areas of confusion or ambiguity. Use their feedback to refine the design and improve its clarity.

- Version Control: Implement version control for your flow charts, especially if they are subject to frequent updates. This allows you to track changes, revert to previous versions if necessary, and maintain a clear audit trail. Clearly label each version with a date and a brief description of the changes made.

Advanced Techniques: Customizing Finance Flow Charts

Customizing finance flow charts allows for greater flexibility and tailored analysis, providing a more nuanced understanding of financial processes. This involves adapting the charts to specific needs, incorporating visual enhancements, and integrating them with other financial tools. This approach maximizes the utility of flow charts, transforming them from static diagrams into dynamic, interactive resources.

Customizing for Specific Needs

Adapting finance flow charts to unique requirements involves tailoring the structure, content, and level of detail to match the specific financial scenario being analyzed. This can range from personal budgeting to complex corporate financial planning.

- Tailoring to Industry-Specific Processes: Different industries have distinct financial workflows. For instance, a manufacturing company’s cash flow chart will differ significantly from a software development company’s. Customization involves incorporating industry-specific terminology, processes, and key performance indicators (KPIs).

- Adjusting for Complexity: The level of detail in a flow chart should align with the complexity of the financial process. Simple flow charts are suitable for basic budgeting, while complex processes like investment portfolio management require detailed charts with multiple decision points and branching paths.

- Personalizing for Individual Financial Goals: Individuals can customize flow charts to align with their specific financial objectives, such as saving for retirement, paying off debt, or investing in real estate. This includes incorporating personal income, expenses, and investment strategies.

- Using Conditional Logic: Incorporating conditional logic, such as “If [condition], then [action],” allows for dynamic decision-making within the flow chart. This is particularly useful in investment decision-making, where choices depend on market conditions or risk tolerance. For example, “If the stock price increases by 10%, then sell.”

Incorporating Data Visualization Elements

Data visualization elements significantly enhance the clarity and impact of finance flow charts, making complex information more accessible and easier to interpret. This can involve the use of colors, shapes, and interactive elements to highlight key data and trends.

- Color-Coding for Emphasis: Use color to differentiate between different financial categories, such as income (green), expenses (red), and investments (blue). This makes it easier to visually track and analyze financial flows. For example, a budgeting flow chart might use green for income sources, red for expenses, and blue for savings and investments.

- Shape Coding for Decision Points: Employ different shapes to represent different types of actions or decisions. For instance, diamonds can represent decision points, rectangles can represent processes, and parallelograms can represent data input or output. This helps in quickly identifying the nature of each step in the flow chart.

- Adding Data Tables and Charts: Integrate data tables and charts directly into the flow chart to display financial data visually. This could include bar charts to show expense categories, pie charts to represent asset allocation, or line graphs to track investment performance over time.

- Interactive Elements: Incorporate interactive elements, such as tooltips or pop-up windows, to provide additional information on hover or click. This allows users to explore the data in more detail without cluttering the main flow chart.

Integrating with Other Financial Planning Tools

Integrating finance flow charts with other financial planning tools creates a cohesive and comprehensive financial management system. This integration streamlines processes, improves data accuracy, and provides a more holistic view of financial activities.

- Linking with Budgeting Software: Integrate flow charts with budgeting software such as Mint or YNAB (You Need a Budget). This allows for automatic data synchronization, ensuring that the flow chart reflects real-time financial data. This integration facilitates the creation of a budget flow chart that is always up-to-date.

- Connecting with Investment Platforms: Integrate flow charts with investment platforms like Fidelity or Vanguard. This enables users to visualize investment strategies, track portfolio performance, and make informed investment decisions based on the data presented in the flow chart.

- Integrating with Accounting Software: For businesses, integrating flow charts with accounting software like QuickBooks or Xero allows for a comprehensive view of financial processes. This integration streamlines financial reporting, making it easier to identify areas for improvement.

- Utilizing APIs for Data Exchange: Employ Application Programming Interfaces (APIs) to automatically exchange data between the flow chart and other financial tools. This eliminates the need for manual data entry and reduces the risk of errors.

Flow Chart for Financial Planning for Small Businesses

A financial planning flow chart is an indispensable tool for small businesses, offering a visual roadmap to guide financial decisions and ensure long-term sustainability. It helps business owners understand their financial position, track progress toward goals, and identify potential risks. By visually representing the financial planning process, the flow chart simplifies complex information and facilitates better communication among stakeholders.

Essential Elements of a Financial Planning Flow Chart

The foundation of a robust financial planning flow chart for small businesses comprises several key elements. These elements work together to provide a comprehensive overview of the financial planning process.

- Starting Point: The flow chart should begin with a clear starting point, typically the business’s current financial status. This includes assets, liabilities, and owner’s equity. This is the foundation upon which all future planning is built.

- Goal Setting: Define specific, measurable, achievable, relevant, and time-bound (SMART) financial goals. These goals could include revenue targets, profit margins, debt reduction, or expansion plans. The flow chart should incorporate a step for goal setting.

- Data Collection and Analysis: This element involves gathering and analyzing financial data. This includes historical financial statements (income statements, balance sheets, cash flow statements), market research, and industry trends. The analysis identifies strengths, weaknesses, opportunities, and threats (SWOT analysis).

- Strategy Development: Develop financial strategies based on the analysis and goals. This may include pricing strategies, marketing plans, cost-cutting measures, and investment decisions.

- Budgeting: Create a detailed budget outlining projected revenues, expenses, and profits. This budget serves as a financial roadmap for the business.

- Implementation: Put the financial strategies and budget into action. This involves executing the plans and managing resources effectively.

- Monitoring and Control: Regularly monitor financial performance against the budget and goals. This includes tracking key performance indicators (KPIs) and making adjustments as needed.

- Review and Revision: The flow chart should incorporate a step for periodic review and revision of the financial plan. This ensures the plan remains relevant and effective as the business evolves.

Representing Revenue Streams, Cost of Goods Sold, and Operating Expenses

Accurately representing revenue streams, the cost of goods sold (COGS), and operating expenses is crucial for a small business financial planning flow chart. This representation allows for a clear understanding of profitability.

- Revenue Streams: Identify and visually represent all sources of revenue. Use distinct shapes or colors to differentiate various revenue streams, such as sales of goods, services, or other income. For example, a rectangle could represent sales revenue, while a diamond could signify interest income. The flow chart should show how each revenue stream contributes to total revenue.

- Cost of Goods Sold (COGS): Represent COGS, the direct costs associated with producing goods or services. This includes raw materials, direct labor, and manufacturing overhead. Show how these costs are deducted from revenue to arrive at gross profit. This section typically involves a process that leads to the calculation of gross profit.

- Operating Expenses: Display operating expenses, such as rent, salaries, marketing costs, and utilities. Use separate shapes or color-coding to categorize different types of operating expenses. The flow chart should illustrate how these expenses are subtracted from gross profit to determine operating income (EBIT – Earnings Before Interest and Taxes).

- Integration: The flow chart should clearly demonstrate the relationship between revenue, COGS, and operating expenses. The flow should visually represent the calculation of gross profit, operating income, and ultimately, net income (profit or loss).

Methods for Visually Representing Profit and Loss Calculations

Visually representing profit and loss calculations enhances understanding and allows for quick analysis. Different methods can be employed to effectively communicate financial performance.

- Income Statement Structure: The flow chart can mirror the structure of a traditional income statement.

- Start with Revenue.

- Subtract COGS to arrive at Gross Profit.

- Subtract Operating Expenses to arrive at Operating Income (EBIT).

- Subtract Interest and Taxes to arrive at Net Income (Profit or Loss).

Each step can be represented by a shape (e.g., a rectangle for revenue, a parallelogram for expenses) with arrows indicating the flow of calculations.

- Color-Coding: Use color-coding to differentiate between revenue, costs, and profits. For instance, green could represent revenue, red could represent expenses, and blue could represent profit. This visual cue helps in quickly identifying areas of concern or success.

- Percentage Representation: Include percentages to show the relationship between different financial metrics. For example, show the gross profit margin (Gross Profit / Revenue) and the net profit margin (Net Income / Revenue). This allows for a quick assessment of profitability.

- Data Tables: Incorporate data tables within the flow chart to present key financial figures in a clear and concise format. These tables can display monthly or quarterly performance data.

- Example: Consider a small bakery. The flow chart would show:

- Sales of baked goods (revenue).

- Cost of flour, sugar, and labor (COGS).

- Rent, utilities, and marketing (operating expenses).

- The final calculation leading to net profit or loss.

The chart would use shapes and arrows to visually represent these calculations, with color-coding to differentiate revenue, costs, and profit.

- Formula Representation: Include key formulas directly in the flow chart to clarify the calculations. For example:

Gross Profit = Revenue – COGS

Net Income = Revenue – COGS – Operating Expenses – Interest – Taxes

Common Mistakes to Avoid: Finance Flow Chart

Creating finance flow charts is a powerful tool for visualizing financial processes and making informed decisions. However, even with the best intentions, errors can creep into the design and implementation of these charts. These mistakes can lead to confusion, misinterpretations, and ultimately, flawed financial strategies. This section highlights common pitfalls to avoid, along with examples of how to rectify them.

Ignoring the Target Audience

A critical mistake is failing to consider the intended audience when designing a finance flow chart. Different audiences require different levels of detail and clarity.

- Example: A flow chart designed for a financial analyst should be highly detailed, including specific formulas and calculations. A flow chart for a non-financial manager, however, should focus on the overall process and key decision points, avoiding overwhelming them with technical jargon.

- Correction: Before creating a flow chart, identify the target audience and their level of financial literacy. Tailor the chart’s complexity, terminology, and level of detail accordingly.

Overcomplicating the Flow Chart

A common error is creating flow charts that are overly complex, filled with unnecessary steps, and difficult to follow. Simplicity is key to effective communication.

- Example: A debt management flow chart might include every possible scenario, including obscure repayment options, making it cumbersome to navigate.

- Correction: Focus on the core processes and decision points. Use clear and concise language. Simplify the chart by breaking down complex processes into smaller, more manageable steps. Consider using sub-flow charts for more detailed information if necessary.

Using Inconsistent Symbols and Notations

Consistency in symbols and notations is crucial for clarity and understanding. Using different symbols for the same action or inconsistent formatting leads to confusion.

- Example: Using a diamond shape for both a decision point and a data input could lead to misunderstandings about the process.

- Correction: Adhere to standard flowchart symbols and notations. Maintain consistency throughout the chart. Define a legend explaining each symbol and its meaning. Ensure all users understand the symbol conventions used.

Failing to Update the Flow Chart

Finance is dynamic. Ignoring the need to update flow charts to reflect changes in regulations, financial products, or internal processes is a serious mistake.

- Example: A budgeting flow chart that doesn’t account for changes in tax laws will lead to inaccurate budgeting and financial planning.

- Correction: Regularly review and update flow charts to reflect current conditions. Establish a process for reviewing and updating charts whenever significant changes occur in the financial landscape or within the organization.

Lack of Clarity in Decision Points

Decision points are critical elements in a flow chart. Vague or unclear decision points can lead to misinterpretations and incorrect actions.

- Example: A decision point that asks, “Is the investment risky?” is subjective and open to interpretation.

- Correction: Phrase decision points as clear, unambiguous questions with binary (yes/no) or multiple-choice answers. Use specific criteria or thresholds for making decisions. For instance, instead of “Is the investment risky?”, use “Does the investment’s beta exceed 1.2?”

Neglecting Data Validation and Verification, Finance flow chart

Finance flow charts often involve calculations and data inputs. Failing to incorporate data validation and verification steps can lead to errors and inaccurate results.

- Example: A loan application flow chart might not include a step to verify the applicant’s income, potentially leading to the approval of loans that the applicant cannot repay.

- Correction: Include data validation steps to ensure the accuracy and completeness of inputs. Implement verification steps to check the results of calculations. This might involve cross-referencing data with external sources or performing sanity checks.

Omitting Key Steps

Leaving out crucial steps in the process can lead to incomplete or misleading financial strategies.

- Example: An investment decision flow chart that skips the step of risk assessment could lead to inappropriate investment choices.

- Correction: Carefully review the entire financial process and ensure that all essential steps are included in the flow chart. Consult with financial experts to identify any missing elements.

Using Generic or Vague Language

Using generic or vague terms can lead to confusion and misinterpretation.

- Example: Instead of stating “Assess financial health,” specify “Calculate debt-to-income ratio.”

- Correction: Use precise and specific language. Avoid jargon unless it is understood by the target audience. Provide definitions for any technical terms used.

Poor Formatting and Layout

Poor formatting and layout make flow charts difficult to read and understand.

- Example: Crowding steps too closely together or using inconsistent line styles can make the chart confusing.

- Correction: Use a clear and consistent layout. Ensure adequate spacing between steps and use appropriate line styles. Consider using different colors to highlight different sections of the chart.

Not Testing the Flow Chart

Failing to test a finance flow chart before implementation can lead to errors and inefficiencies.

- Example: A budgeting flow chart that is not tested might contain calculation errors, leading to inaccurate budget projections.

- Correction: Test the flow chart thoroughly using various scenarios. Conduct simulations to identify any potential errors or inefficiencies. Have others review and test the chart to provide feedback.

Ignoring Regulatory Compliance

Financial flow charts must adhere to all relevant regulations and compliance requirements.

- Example: A flow chart related to Know Your Customer (KYC) processes must comply with anti-money laundering (AML) regulations.

- Correction: Ensure that the flow chart complies with all relevant financial regulations and industry standards. Regularly review the chart to ensure ongoing compliance. Consult with legal and compliance professionals.

Failure to Document Assumptions

Assumptions are often made during the creation of a flow chart. Failing to document these assumptions can lead to misunderstandings and errors.

- Example: An investment flow chart might assume a specific rate of return. Not documenting this assumption can lead to inaccurate financial projections if the actual rate of return differs.

- Correction: Clearly document all assumptions used in the flow chart. This documentation should include the basis for each assumption and any limitations. Regularly review and update assumptions as needed.

Consequences of Poorly Designed Flow Charts

Poorly designed finance flow charts can have significant consequences, including:

- Financial Losses: Inaccurate budgeting, poor investment decisions, and ineffective debt management can lead to financial losses.

- Operational Inefficiencies: Confusing flow charts can slow down processes, increase errors, and reduce productivity.

- Compliance Issues: Failure to comply with regulations can result in penalties and legal issues.

- Reputational Damage: Errors and inefficiencies can damage an organization’s reputation and erode stakeholder trust.

- Misinterpretation of Financial Data: Poorly designed flow charts can lead to misinterpretations of financial data, resulting in incorrect decision-making.

Flow Chart for Evaluating Loan Options

A loan evaluation flow chart is a visual tool designed to guide individuals or businesses through the process of selecting the most suitable loan option. It systematically breaks down the decision-making process, ensuring all critical factors are considered before committing to a loan. This helps borrowers make informed choices and avoid potential financial pitfalls.

Designing a Loan Evaluation Flow Chart

The design of a loan evaluation flow chart begins with defining the scope and purpose. The chart should clearly Artikel the steps involved in comparing loan options, from initial research to final selection.

The process typically involves these key steps:

- Define Loan Needs: Determine the purpose of the loan (e.g., home purchase, business expansion), the required loan amount, and the desired repayment terms.

- Research Loan Options: Explore various loan providers, including banks, credit unions, and online lenders. Identify potential loan products that meet the defined needs.

- Gather Information: Collect detailed information about each loan option, including interest rates, fees, terms, and eligibility requirements.

- Compare Loan Options: Evaluate the gathered information using a structured comparison process.

- Assess Eligibility: Determine if the borrower meets the eligibility criteria for each loan option.

- Select Loan Option: Choose the loan option that best aligns with the borrower’s financial goals and circumstances.

- Apply for Loan: Initiate the loan application process with the chosen lender.

- Loan Approval: Follow the loan approval process, providing required documentation and information.

Methods for Comparing Interest Rates, Terms, and Fees

Comparing interest rates, terms, and fees is crucial for making an informed loan decision. The flow chart should incorporate methods to facilitate this comparison.

Several comparison methods are available:

- Interest Rate Comparison: The most important aspect is to compare the Annual Percentage Rate (APR) which includes the interest rate and fees.

- Example: Consider two loans: Loan A with a 6% APR and Loan B with a 5.5% APR. Loan B, with the lower APR, is initially more attractive.

- Term Comparison: Evaluate the loan repayment term. Longer terms typically result in lower monthly payments but higher total interest paid over the loan’s life. Shorter terms offer higher monthly payments but save on interest.

- Example: A $100,000 loan at 6% APR has a monthly payment of $773.33 over 20 years and $1,110.21 over 10 years. The total interest paid is $85,600.40 for 20 years and $33,225.20 for 10 years.

- Fee Comparison: Identify all associated fees, such as origination fees, prepayment penalties, and late payment fees. These fees can significantly impact the overall cost of the loan.

- Example: A loan with a 1% origination fee on a $200,000 loan means a $2,000 fee upfront.

- Total Cost of the Loan: Calculate the total cost, including principal, interest, and all fees, over the loan term. This provides a comprehensive view of the loan’s true cost.

Visually Representing the Loan Approval Process

The loan approval process can be effectively visualized within the flow chart to guide borrowers through each stage.

The approval process is typically represented with these steps:

- Application Submission: The borrower submits a loan application with all required documentation. This step is often represented by a rectangle.

- Verification and Underwriting: The lender verifies the information provided and assesses the borrower’s creditworthiness and ability to repay the loan. This step might involve a diamond shape, representing a decision point.

- Example: The lender might check the borrower’s credit score, income, and debt-to-income ratio.

- Decision: The lender makes a decision on the loan application (approved, denied, or needs further information). This can also be represented by a diamond shape.

- Example: If the credit score is below a certain threshold, the loan may be denied.

- Loan Offer/Denial: If approved, the lender issues a loan offer, outlining the terms and conditions. If denied, the lender provides a reason for the denial. This could be represented by a parallelogram shape.

- Acceptance/Rejection: The borrower either accepts the loan offer or rejects it.

- Closing/Funding: If accepted, the loan is closed, and the funds are disbursed to the borrower.

The flow chart should use clear symbols (rectangles for processes, diamonds for decisions, and arrows for direction) to guide the user through the process. Each step should have a brief description.

Illustrative Examples

Finance flow charts are powerful tools for visualizing complex financial processes. They break down intricate decision-making pathways into manageable steps, making them easier to understand, analyze, and improve. These examples illustrate how flow charts can be applied to common financial scenarios, clarifying the steps involved and potential outcomes.

Savings Account Selection Flow Chart

Selecting the right savings account involves comparing various features and benefits to find the best fit for individual needs. This flow chart guides the user through the process.

The savings account selection process begins with identifying financial goals. From there, the process systematically evaluates different account types and their characteristics.

- Start: Define savings goals (e.g., emergency fund, down payment, travel).

- Determine Account Type:

- High-Yield Savings Account? Evaluate if high-yield accounts are suitable.

- Yes: Proceed to Step 4.

- No: Consider other options.

- Consider Alternatives: Research and compare other account types such as Certificates of Deposit (CDs), Money Market Accounts (MMAs), and traditional savings accounts.

- Research High-Yield Savings Accounts:

- Compare Interest Rates: Research and compare the annual percentage yields (APYs) offered by different banks and credit unions.

- Fees? Evaluate any associated fees (e.g., monthly maintenance fees, transaction fees).

- Minimum Balance Requirements? Check for minimum balance requirements.

- FDIC Insured? Confirm that the account is FDIC-insured (up to $250,000).

- Compare Accounts: Compare the features, interest rates, and fees of different accounts based on the research.

- Select Account: Choose the savings account that best aligns with your goals and preferences.

- Open Account: Complete the application process and fund the new savings account.

- Monitor Account: Regularly monitor the account to track interest earned and ensure the account continues to meet your needs.

- Outcome: A savings account is selected, opened, and actively used, helping the user to achieve their financial goals.

Credit Card Application Flow Chart

Applying for a credit card involves several steps, including evaluating eligibility and comparing different card offers. The flow chart illustrates this process.

This flow chart clarifies the process, from initial eligibility checks to the final approval or denial.

- Start: Determine the need for a credit card.

- Assess Creditworthiness:

- Check Credit Score: Obtain a copy of your credit report and check your credit score. This will influence the types of cards you are eligible for.

- Credit Score Above 670? Evaluate if the credit score is above 670, which is generally considered good.

- Yes: Proceed to Step 4.

- No: Consider credit-building options (e.g., secured credit card).

- Improve Credit Score (if needed): If the credit score is low, take steps to improve it, such as paying bills on time and reducing credit utilization.

- Research Credit Card Options:

- Determine Card Type: Decide which type of card best suits your needs (e.g., rewards card, cash-back card, balance transfer card).

- Compare Offers: Research and compare different credit card offers based on factors such as interest rates, fees, rewards, and benefits.

- Select Credit Card: Choose the credit card that best matches your financial needs and spending habits.

- Apply for Credit Card: Complete the credit card application, providing all required information.

- Credit Card Application Review: The credit card issuer reviews the application.

- Approval?

- Yes: The application is approved. The card is issued and sent to the applicant.

- No: The application is denied.

- If Approved: Activate the credit card and begin using it responsibly.

- If Denied: Review the reason for denial and consider taking steps to improve creditworthiness.

- Outcome (Approval): The applicant receives and uses a credit card responsibly.

- Outcome (Denial): The applicant is denied a credit card. They can then take steps to improve their creditworthiness and reapply later.

Retirement Planning Flow Chart

Retirement planning is a long-term process that involves setting goals, saving consistently, and making investment decisions. The flow chart Artikels the key steps.

The retirement planning process begins with establishing goals and continues through investment strategies and regular reviews.

- Start: Determine retirement goals and desired lifestyle.

- Estimate Retirement Expenses: Calculate estimated monthly expenses in retirement.

- Determine Retirement Savings Needs: Calculate the total amount of savings needed to cover retirement expenses, considering factors such as inflation and life expectancy.

- Assess Current Financial Situation:

- Calculate Current Savings: Determine current retirement savings (e.g., 401(k), IRA).

- Calculate Other Assets: Include other assets such as investments and real estate.

- Develop a Retirement Savings Plan:

- Set Savings Rate: Determine the percentage of income to save for retirement.

- Choose Investment Vehicles: Select appropriate investment vehicles (e.g., 401(k), IRA, taxable investment accounts).

- Determine Asset Allocation: Decide how to allocate investments across different asset classes (e.g., stocks, bonds, real estate).

- Implement the Plan:

- Open and Fund Retirement Accounts: Open the necessary retirement accounts and begin making contributions.

- Invest Contributions: Invest contributions according to the asset allocation strategy.

- Monitor and Review:

- Regularly Review Investments: Regularly review the investment portfolio.

- Rebalance Portfolio: Rebalance the portfolio as needed to maintain the desired asset allocation.

- Review and Adjust Plan: Review the retirement plan annually and make adjustments as needed based on changes in income, expenses, or market conditions.

- Approaching Retirement:

- Evaluate Retirement Options: Explore options such as taking Social Security benefits and deciding when to retire.

- Create a Withdrawal Strategy: Develop a plan for withdrawing funds from retirement accounts.

- Retirement: Begin retirement, managing income, and investments.

- Outcome: Successful retirement with sufficient income to maintain a desired lifestyle.