Admission Requirements and Process

The HEC Paris Master in Finance program is highly competitive, attracting top talent from around the globe. Understanding the admission requirements and navigating the application process is crucial for prospective students. This section Artikels the essential prerequisites, application steps, and the importance of key components like essays and recommendations.

Essential Prerequisites for Application

Admission to the HEC Paris Master in Finance requires candidates to meet specific academic and professional criteria. These prerequisites ensure that admitted students possess the necessary foundation to succeed in the rigorous program.

* Undergraduate Degree: Applicants must hold a Bachelor’s degree or its equivalent from a recognized university. The specific field of study is less critical than the overall academic performance. However, a strong background in quantitative subjects, such as economics, mathematics, or engineering, is highly advantageous.

* GMAT/GRE Scores: While not always mandatory, a strong GMAT or GRE score is a significant advantage. HEC Paris considers these scores as indicators of analytical and quantitative skills, essential for the program’s curriculum. The average GMAT score for admitted students typically hovers around 700. A competitive GRE score is similarly important.

* English Language Proficiency: Since the program is taught in English, non-native English speakers must demonstrate proficiency. This is usually achieved through standardized tests such as TOEFL or IELTS. Specific minimum scores are required, with higher scores often preferred. For instance, a TOEFL score of 100 or an IELTS score of 7.0 is a typical benchmark.

* Work Experience (Optional but Recommended): While not a strict requirement, some professional experience, such as internships or full-time work, is often beneficial. It can demonstrate a candidate’s practical understanding of the financial industry and their career goals.

Application Process Details

The application process for the HEC Paris Master in Finance is structured and involves several stages. Applicants should carefully adhere to the deadlines and provide all required documentation.

* Application Deadlines: HEC Paris typically has multiple application rounds throughout the year. Each round has a specific deadline, and applying early is generally recommended. Deadlines can vary each year; prospective applicants should consult the official HEC Paris website for the most up-to-date information. Missing a deadline will likely result in the application not being considered.

* Required Documents: The application requires several documents, including transcripts from all previously attended universities, a resume or curriculum vitae (CV), proof of English language proficiency (if applicable), GMAT/GRE scores (if submitted), and letters of recommendation. Additionally, applicants must submit a completed application form and pay an application fee.

* Interview Procedures: Shortlisted candidates are invited for an interview. Interviews are usually conducted by members of the admissions committee and may be held in person or via video conferencing. The interview assesses a candidate’s suitability for the program, their motivations, and their career aspirations.

Essays and Letters of Recommendation Importance

Essays and letters of recommendation play a critical role in the application process, offering insights beyond academic transcripts and test scores. They provide a comprehensive view of the applicant.

* Essays: The essays allow applicants to showcase their personality, experiences, and career goals. They should articulate their motivations for pursuing the Master in Finance, highlighting their relevant skills and experiences. Essays are an opportunity to demonstrate critical thinking, writing ability, and a clear understanding of the financial industry.

* Letters of Recommendation: Letters of recommendation provide an external perspective on the applicant’s abilities and potential. They should be written by individuals who can attest to the applicant’s academic or professional performance, leadership skills, and suitability for the program. Recommenders should provide specific examples to support their evaluations.

Application Process Steps

The following steps Artikel the typical application process, from initial inquiry to acceptance.

- Initial Inquiry and Research: Prospective applicants begin by researching the program, its curriculum, and the admission requirements. They may attend online information sessions or visit the HEC Paris website for detailed information.

- Preparation for Standardized Tests: If applicable, applicants prepare for and take the GMAT or GRE, and TOEFL or IELTS. They aim to achieve competitive scores.

- Document Compilation: Applicants gather all required documents, including transcripts, resume/CV, and proof of English language proficiency.

- Application Form Submission: The online application form is completed and submitted, along with the required supporting documents and the application fee.

- Essay Writing: Applicants write compelling essays that highlight their experiences, motivations, and career aspirations.

- Recommendation Request: Applicants request letters of recommendation from relevant individuals, providing them with necessary information and deadlines.

- Interview Invitation (if shortlisted): Shortlisted candidates are invited for an interview with the admissions committee.

- Interview Preparation: Candidates prepare for the interview by researching common interview questions and practicing their responses.

- Interview: The interview is conducted, assessing the candidate’s suitability for the program.

- Admission Decision: The admissions committee reviews all applications and makes admission decisions.

- Acceptance and Enrollment: Admitted students accept their offer of admission and complete the enrollment process.

Program Benefits and Value Proposition

The HEC Paris Masters in Finance program offers a compelling value proposition, equipping graduates with the skills, knowledge, and network to excel in the competitive world of finance. The program’s benefits extend beyond academic rigor, providing a launchpad for diverse career paths and access to a global network of industry professionals. The following sections delve into the specific advantages of the program, including career opportunities, global reputation, and the benefits of its location in Paris.

Career Opportunities Available to Graduates

Graduates of the HEC Paris Masters in Finance program are highly sought after by leading financial institutions worldwide. The program’s curriculum, combined with its strong industry connections, prepares students for a wide range of roles across various sectors.

- Investment Banking: Many graduates pursue careers in investment banking, working on mergers and acquisitions (M&A), initial public offerings (IPOs), and other corporate finance transactions. They often join top-tier investment banks in roles such as analyst, associate, or even directly as a senior hire depending on prior experience.

- Asset Management: The program opens doors to careers in asset management, including roles in portfolio management, fund analysis, and wealth management. Graduates find opportunities at global asset management firms and hedge funds.

- Private Equity and Venture Capital: Graduates are well-positioned for roles in private equity and venture capital, where they analyze investment opportunities, conduct due diligence, and manage portfolios of investments.

- Corporate Finance: Opportunities exist in corporate finance departments of multinational corporations, where graduates work on financial planning, treasury management, and financial analysis.

- Sales and Trading: Some graduates pursue careers in sales and trading, working with financial instruments such as stocks, bonds, and derivatives.

- FinTech: The program also prepares students for the rapidly growing FinTech sector, where they can work in areas such as financial technology, data analytics, and digital finance.

Graduates typically secure positions in major financial hubs such as London, New York, and Hong Kong, as well as in Paris and other European cities. The career services offered by HEC Paris, including career fairs, networking events, and personalized career coaching, play a significant role in facilitating these career placements.

Program’s Reputation and Rankings Compared

HEC Paris consistently ranks among the top business schools globally for its Masters in Finance program. This strong reputation is a key factor in attracting top talent and providing graduates with a competitive advantage in the job market. Comparing the program’s rankings with other leading finance programs reveals its position within the global landscape.

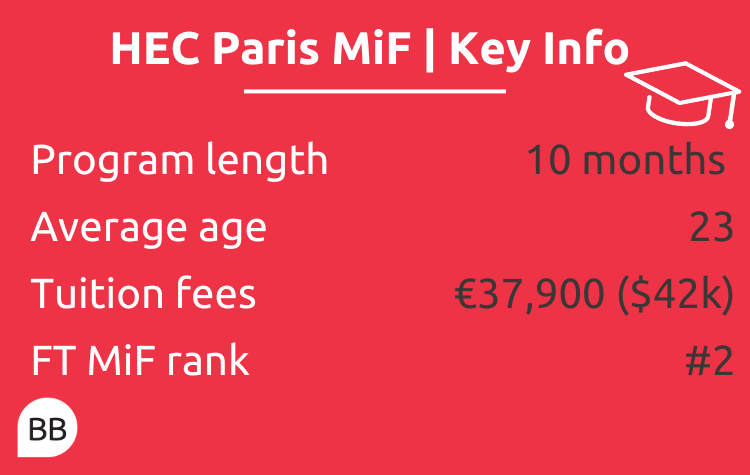

- Global Rankings: The HEC Paris Masters in Finance program frequently appears at the top of global rankings. For example, in recent years, it has consistently ranked among the top 3 programs worldwide in the Financial Times Masters in Finance ranking.

- Peer Comparison: When compared to other top-tier programs, such as the London Business School (LBS) Masters in Finance and the MIT Sloan Masters of Finance, HEC Paris consistently demonstrates strong performance across key metrics, including career placement, salary progression, and alumni network strength.

- Alumni Network: The extensive and influential alumni network of HEC Paris provides graduates with invaluable connections and support throughout their careers. The network spans across various industries and geographies, offering mentoring, job opportunities, and business collaborations.

- Curriculum Strength: The program’s curriculum is designed to provide a strong foundation in financial theory and practical skills, including quantitative methods, financial modeling, and valuation techniques. The curriculum is constantly updated to reflect the latest trends and developments in the finance industry.

These factors contribute to the program’s overall reputation and ensure that graduates are highly regarded by employers worldwide. The consistent high rankings and the strength of the alumni network are crucial differentiators.

Benefits of the Program’s Location and Network in Paris

The location of the HEC Paris campus in Paris offers unique advantages to students, including access to a vibrant financial market, a strong alumni network, and cultural experiences.

- Proximity to Financial Institutions: Paris is a major financial center, providing students with direct access to a wide range of financial institutions, including investment banks, asset management firms, and regulatory bodies. This proximity facilitates networking opportunities, internships, and job placements.

- Industry Connections: The program benefits from strong ties with the French and European financial industries. This includes guest lectures from industry professionals, company visits, and networking events, providing students with valuable insights and connections.

- Alumni Network in Paris: The Paris location provides unparalleled access to the HEC Paris alumni network. Many alumni are based in Paris and actively participate in mentoring, career events, and recruiting activities, providing a valuable resource for current students.

- Cultural and Social Environment: Paris offers a rich cultural and social environment, providing students with opportunities to experience art, history, and cuisine. This cultural immersion enhances the overall student experience and fosters personal and professional growth.

- Career Opportunities in Europe: The program’s location facilitates career opportunities within Europe. Many graduates choose to work in Paris or other European financial centers, taking advantage of the region’s economic growth and diverse job market.

The combination of a strong academic program, industry connections, and a prime location in Paris provides students with a significant advantage in their career pursuits.

Comparison Table of Programs

The following table compares the HEC Paris Masters in Finance program to two other leading programs, highlighting key differences in curriculum, career outcomes, and location.

| Program | Curriculum Focus | Career Outcomes | Location and Network |

|---|---|---|---|

| HEC Paris Masters in Finance | Comprehensive, covering all areas of finance with a strong emphasis on practical skills and quantitative methods. Includes specialization options. | Graduates are recruited by top investment banks, asset management firms, and private equity funds globally. Strong placement in Paris, London, and New York. | Located in Paris, providing access to a major financial center and a strong European network. Extensive alumni network worldwide. |

| London Business School (LBS) Masters in Finance | Offers a flexible curriculum with a focus on financial markets and investment management. Includes specialized tracks. | Graduates are highly sought after by investment banks, asset management firms, and consulting firms. Strong placement in London and other financial hubs. | Located in London, providing access to a major global financial center. Strong international alumni network. |

| MIT Sloan Masters of Finance | Emphasizes quantitative methods and financial engineering. Focuses on data analytics and technological advancements in finance. | Graduates are recruited by investment banks, hedge funds, and FinTech companies. Strong placement in the United States, particularly on the West Coast. | Located in Cambridge, Massachusetts, with strong ties to the Boston financial and technology communities. Global alumni network. |

Faculty and Research

HEC Paris Master in Finance distinguishes itself through its exceptional faculty, renowned for their expertise, research contributions, and connections to the financial industry. The program provides students with access to leading academics and industry professionals, fostering a dynamic learning environment. This section delves into the faculty’s expertise, research activities, and their impact on the program’s value.

Faculty Expertise and Research Areas

The HEC Paris Master in Finance faculty comprises leading academics and practitioners with extensive experience in various areas of finance. Their expertise spans corporate finance, asset pricing, financial econometrics, behavioral finance, and risk management, among other specializations. The faculty’s research is at the forefront of financial innovation, contributing to the understanding of complex financial markets and instruments.

The faculty’s research interests are diverse, covering areas such as:

- Asset Pricing: Modeling and understanding the valuation of financial assets, including stocks, bonds, and derivatives.

- Corporate Finance: Analyzing corporate decisions, including capital structure, mergers and acquisitions, and investment strategies.

- Financial Econometrics: Applying statistical methods to financial data for forecasting and risk management.

- Behavioral Finance: Examining the impact of psychological biases on financial decision-making.

- Risk Management: Developing and implementing strategies to mitigate financial risks.

- Fintech: Exploring the intersection of finance and technology, including topics like blockchain, cryptocurrencies, and algorithmic trading.

Research Projects and Publications, Hec paris masters in finance

Faculty members at HEC Paris actively engage in cutting-edge research, publishing their findings in top-tier academic journals and contributing to industry publications. Their research projects often involve collaboration with industry partners, providing students with opportunities to gain practical insights.

Examples of research projects and publications include:

- Research on Sustainable Finance: Several faculty members are actively involved in research examining the role of Environmental, Social, and Governance (ESG) factors in investment decisions. This research is published in leading finance journals and informs the curriculum on sustainable finance.

- Studies on Fintech Adoption: Research analyzing the impact of financial technology on market efficiency, consumer behavior, and regulatory frameworks. Findings are presented at academic conferences and industry events.

- Publications in Top Journals: Faculty members regularly publish in journals such as the Journal of Finance, Review of Financial Studies, and Journal of Financial Economics. These publications showcase the faculty’s research contributions and their impact on the field.

Access to Industry Professionals and Guest Lecturers

The program provides students with unparalleled access to industry professionals through guest lectures, workshops, and networking events. This access enhances the practical relevance of the curriculum and provides students with opportunities to learn from experienced practitioners.

The program’s industry connections include:

- Guest Lectures: Industry experts from investment banks, asset management firms, consulting companies, and regulatory bodies regularly deliver guest lectures, sharing their practical experiences and insights.

- Workshops and Seminars: Workshops on topics such as financial modeling, trading strategies, and career development are led by industry professionals.

- Networking Events: Networking events facilitate interactions between students, faculty, and industry professionals, providing opportunities for career exploration and mentorship.

Notable Faculty Members

The HEC Paris Master in Finance program boasts a distinguished faculty, each contributing unique expertise and experience. The following are examples of notable faculty members and their contributions:

- Professor X, Corporate Finance: Professor X specializes in corporate finance and valuation. His research focuses on mergers and acquisitions and capital structure. He brings his extensive industry experience to the classroom, teaching practical applications of financial theories.

- Professor Y, Asset Pricing: Professor Y’s expertise lies in asset pricing and derivatives. His research investigates the behavior of financial markets and the valuation of complex financial instruments. His insights into market dynamics enhance the program’s asset pricing curriculum.

- Professor Z, Financial Econometrics: Professor Z focuses on financial econometrics and risk management. His research examines the application of statistical methods to financial data. He guides students in applying quantitative techniques to real-world financial problems.

Student Life and Campus Experience

HEC Paris Master in Finance students benefit from a vibrant campus life and a wealth of opportunities to enhance their academic experience and personal development. The program fosters a strong sense of community through various student-led initiatives and access to world-class facilities. Students gain invaluable experiences both inside and outside the classroom, contributing to their professional and personal growth.

Student Clubs, Organizations, and Extracurricular Activities

HEC Paris offers a diverse range of student clubs and organizations catering to various interests, allowing students to connect with peers, develop leadership skills, and pursue their passions. These activities enrich the student experience and provide networking opportunities.

- Finance Clubs: Several finance-focused clubs provide platforms for students to deepen their knowledge, network with industry professionals, and participate in competitions. Examples include:

- HEC Finance Club: Organizes conferences, workshops, and career events with leading financial institutions.

- Private Equity Club: Focuses on private equity and venture capital, offering networking opportunities and case study competitions.

- Trading Club: Provides hands-on experience in financial markets through simulations and trading competitions.

- Professional Clubs: Clubs dedicated to specific career paths, such as consulting, marketing, and entrepreneurship, provide resources and networking opportunities for students.

- Sports and Cultural Clubs: Numerous sports clubs, including football, basketball, and tennis, as well as cultural clubs, such as the International Club and the Arts Club, offer students a chance to socialize and pursue their hobbies.

- Student Associations: These organizations represent the student body and organize social events, parties, and other activities.

Campus Facilities and Resources

HEC Paris provides state-of-the-art facilities and resources to support students’ academic and personal well-being. The campus is designed to foster a collaborative and stimulating learning environment.

- Libraries: The HEC Paris library offers a comprehensive collection of books, journals, and online resources relevant to finance and business. The library provides study spaces, computer labs, and research assistance.

- Study Spaces: Dedicated study rooms and quiet areas are available throughout the campus, providing students with comfortable environments for individual and group study.

- Computer Labs: Well-equipped computer labs with the latest software and technology are available for students to use for coursework and research.

- Sports Facilities: The campus features sports facilities, including a gym, swimming pool, and outdoor sports fields, promoting a healthy lifestyle.

- Student Residences: On-campus housing options provide convenient and comfortable living arrangements for students, fostering a sense of community.

- Career Services: The HEC Paris Career Center offers resources and support for career development, including resume workshops, interview preparation, and networking events.

International Exchange Programs and Study Abroad

HEC Paris encourages its students to gain international experience through exchange programs and study abroad opportunities. These programs broaden students’ perspectives and enhance their global understanding.

- Exchange Programs: The Master in Finance program offers exchange programs with leading business schools worldwide, allowing students to study at partner institutions for a semester. Examples of partner schools include:

- London Business School (UK)

- Columbia Business School (USA)

- INSEAD (France/Singapore)

- University of Oxford (UK)

- Dual Degree Programs: Students can pursue dual degree programs, earning degrees from both HEC Paris and a partner university. These programs provide in-depth international exposure and enhance career prospects.

- Study Trips: The program organizes study trips to financial centers worldwide, such as London, New York, and Hong Kong, providing students with insights into the global financial industry.

Student Testimonials

Student testimonials offer valuable insights into the program’s impact and the experiences of current and former students. These perspectives highlight the benefits of the program and its contribution to career development.

- Testimonial 1: “The Master in Finance program at HEC Paris provided me with a strong foundation in finance and a global network of peers and professionals. The career services were invaluable in helping me secure a job at a top investment bank.” – *Former Student, Investment Banking Analyst*

- Testimonial 2: “The diverse student body and the focus on practical application were the highlights of my experience. The opportunity to participate in the finance club and attend industry events significantly enhanced my learning.” – *Current Student, Finance Club President*

- Testimonial 3: “The exchange program allowed me to study at a prestigious university in another country, broadening my horizons and exposing me to different cultures and perspectives. This experience was crucial for my career development.” – *Former Student, Portfolio Manager*

- Testimonial 4: “The faculty’s expertise and the program’s rigorous curriculum prepared me for the challenges of the financial industry. The strong alumni network continues to provide support and mentorship.” – *Former Student, Private Equity Associate*

Cost and Financial Aid

Understanding the financial implications of pursuing a Master in Finance at HEC Paris is crucial for prospective students. This section provides a comprehensive overview of the tuition fees, associated costs, and the various financial aid options available to help students finance their education. Careful planning and exploration of these resources can significantly impact the affordability and accessibility of the program.

Tuition Fees and Associated Costs

The total cost of the Master in Finance program at HEC Paris encompasses tuition fees and various other expenses. These costs are essential considerations when budgeting for the program.

The tuition fees for the Master in Finance program are subject to change annually. Prospective students should consult the official HEC Paris website or contact the admissions office for the most up-to-date information. Besides tuition, students should also budget for living expenses, which can vary depending on their lifestyle and accommodation choices. These expenses typically include housing, food, transportation, and personal spending. Health insurance and the cost of books and course materials are also significant factors.

For example, based on historical data, a student could anticipate needing approximately €20,000 – €25,000 per year for living expenses, but this is highly dependent on personal choices.

Travel costs, particularly for international students, must also be factored in.

Scholarships, Grants, and Other Financial Aid Options

HEC Paris offers a range of financial aid opportunities to assist students in financing their studies. These include scholarships, grants, and other support mechanisms.

Financial aid options are designed to make the program more accessible to a diverse student body. Students are encouraged to explore all available avenues to minimize their financial burden. Scholarship opportunities are often merit-based or need-based, and some may be specific to certain nationalities or areas of study. Grants may also be available from external organizations.

Student Loans and Financing Alternatives

Student loans and other financing alternatives represent viable options for funding the Master in Finance program. Students should research and compare different loan options to find the most suitable terms and conditions.

Several banks and financial institutions offer student loans specifically for international students. The terms, interest rates, and repayment schedules vary, so thorough research is essential.

Additionally, students might explore personal financing options or consider part-time employment to supplement their income. However, it’s important to carefully balance work commitments with the demanding academic requirements of the program.

Types of Financial Aid Available

A variety of financial aid options are available to students at HEC Paris, helping to make the program accessible to a wider range of applicants.

- HEC Paris Scholarships: These are often merit-based or need-based and can significantly reduce tuition costs. The specific types and amounts of scholarships offered vary from year to year.

- External Scholarships and Grants: Students are encouraged to explore scholarships and grants offered by external organizations, foundations, and government agencies. These can provide additional financial support.

- Student Loans: Both French and international banks offer student loans to help finance the program. The terms and conditions of these loans vary.

- Merit-Based Awards: Awards are often given based on academic achievements and professional experience. These awards can sometimes cover a portion of tuition fees.

- Need-Based Financial Aid: Students with demonstrated financial need may be eligible for need-based financial aid, which can include tuition reductions or living expense support.

Alumni Network and Impact

The HEC Paris Master in Finance program boasts a powerful and influential alumni network that significantly impacts the career trajectories of its graduates and the broader finance industry. This network provides invaluable support, mentorship, and networking opportunities, fostering a lifelong connection among alumni and current students. The strength of this network is a key differentiator for the program, offering a tangible advantage in the competitive world of finance.

Size and Scope of the Alumni Network

The HEC Paris alumni network is vast and globally dispersed. It encompasses graduates from various HEC Paris programs, including the Master in Finance, creating a robust and diverse community.

The network’s reach extends across:

- Global Presence: Alumni are located in major financial centers worldwide, including London, New York, Hong Kong, Singapore, and Paris.

- Industry Representation: Alumni hold positions across a broad spectrum of financial institutions, including investment banks, asset management firms, hedge funds, private equity firms, and corporate finance departments.

- Seniority Levels: The network includes professionals at all levels, from recent graduates to senior executives and partners. This provides access to a wide range of expertise and experience.

- Network Size: The HEC Paris alumni network, encompassing all programs, numbers over 70,000 members. The Master in Finance alumni constitute a significant portion of this overall network.

Examples of Successful Alumni and Their Career Paths

HEC Paris Master in Finance graduates have achieved significant success in the finance industry, holding prominent positions and making substantial contributions. Their career paths showcase the versatility and prestige of the program.

Here are examples of successful alumni and their career paths:

- Jean-Pierre Mustier: A prominent figure in European finance, Jean-Pierre Mustier is a former CEO of UniCredit. His career path illustrates the program’s ability to prepare graduates for leadership roles in major financial institutions. His success exemplifies the opportunities for advancement available to graduates.

- Delphine Arnault: As Chairman and CEO of Christian Dior SE, Delphine Arnault’s career demonstrates the program’s relevance in broader business and finance, including luxury goods and retail. Her leadership in a globally recognized company highlights the program’s ability to produce well-rounded business leaders.

- Alumni in Investment Banking: Many graduates pursue careers in investment banking, progressing to roles such as Managing Director at firms like Goldman Sachs, Morgan Stanley, and JP Morgan. Their responsibilities include advising on mergers and acquisitions, underwriting securities, and managing client relationships.

- Alumni in Asset Management: Numerous alumni excel in asset management, managing portfolios, conducting research, and overseeing investment strategies at firms such as BlackRock, Amundi, and Axa Investment Managers.

- Alumni in Private Equity: Graduates frequently join private equity firms, working on deal sourcing, due diligence, and portfolio management. Their expertise contributes to the growth and success of these firms.

Ways in Which the Alumni Network Supports Current Students and Graduates

The HEC Paris alumni network provides extensive support to current students and graduates, enhancing their career prospects and professional development. This support includes mentorship programs, networking events, and job placement assistance.

The alumni network offers various forms of support:

- Mentorship Programs: Alumni mentor current students, providing guidance on career paths, job search strategies, and industry insights.

- Networking Events: Regular networking events, both on-campus and globally, connect students and alumni, facilitating relationship-building and information sharing.

- Job Placement Assistance: Alumni often assist with job placements by providing referrals, conducting mock interviews, and offering insights into company cultures.

- Career Workshops: Alumni lead career workshops and seminars, covering topics such as resume writing, interview skills, and industry-specific knowledge.

- Industry Insights: Alumni share their experiences and expertise, providing current students with valuable insights into the latest trends and challenges in the finance industry.

- Access to Exclusive Resources: Graduates gain access to exclusive job boards, alumni directories, and industry-specific resources.

Descriptive Narrative About a Successful Alumnus

Consider the story of a hypothetical alumnus, “Antoine Dupont,” who graduated from the HEC Paris Master in Finance program a decade ago. Antoine’s career trajectory exemplifies the transformative impact of the program.

Antoine started his career in investment banking at a leading firm in London. His strong analytical skills and financial acumen, honed during his time at HEC Paris, quickly propelled him through the ranks. Within five years, he was promoted to Vice President, managing significant deals and advising clients on complex financial transactions. He then transitioned to a senior role in a prominent hedge fund, where he specialized in quantitative strategies. Antoine’s ability to leverage his education and network to advance his career is a testament to the value of the HEC Paris Master in Finance program. He actively participates in alumni events, mentors current students, and regularly contributes to the program’s career development initiatives. He embodies the program’s commitment to fostering a supportive and successful alumni community. His career path illustrates how graduates can use their knowledge and the network to achieve high levels of success in the financial industry.

Program Structure and Teaching Methods: Hec Paris Masters In Finance

The HEC Paris Master in Finance is meticulously structured to provide a comprehensive and practical education. The program employs a diverse range of teaching methodologies designed to equip students with both theoretical knowledge and the practical skills necessary for success in the finance industry. This approach ensures students are well-prepared to tackle real-world challenges and contribute meaningfully to the financial world.

Teaching Methodologies

The program utilizes a multi-faceted approach to teaching, encompassing various methods to cater to diverse learning styles and ensure a deep understanding of financial concepts.

- Case Studies: Real-world case studies are extensively used to immerse students in practical scenarios, allowing them to apply theoretical knowledge to complex business problems. These case studies often involve analyzing financial statements, evaluating investment opportunities, and making strategic decisions.

- Simulations: Financial simulations provide a dynamic and interactive learning experience. Students engage in simulated trading environments, manage investment portfolios, and make decisions under pressure, fostering their ability to adapt to market volatility and make informed choices.

- Practical Exercises: Hands-on exercises, such as financial modeling and valuation projects, reinforce theoretical concepts and build practical skills. Students gain experience using industry-standard software and tools.

- Lectures and Seminars: Traditional lectures and seminars provide a strong foundation in financial theory and concepts, delivered by renowned faculty and industry experts.

- Group Projects: Collaborative group projects encourage teamwork, communication, and problem-solving skills. Students work together to analyze complex financial issues, develop solutions, and present their findings.

Real-World Projects and Case Studies

Students are actively involved in projects and case studies that mirror the challenges faced by finance professionals. These experiences bridge the gap between theory and practice.

- Mergers and Acquisitions Case Study: Students analyze a hypothetical M&A deal, evaluating the target company, performing due diligence, and structuring the transaction. This project allows them to apply valuation techniques, understand deal dynamics, and consider the strategic implications of the merger.

- Portfolio Management Simulation: Students manage a simulated investment portfolio, making asset allocation decisions, monitoring performance, and adapting to changing market conditions. They learn to balance risk and return and develop their investment strategies.

- Private Equity Investment Project: Students evaluate a potential private equity investment, assessing the target company’s financials, developing a business plan, and negotiating the terms of the investment.

- Corporate Valuation Project: Students use various valuation methods, such as discounted cash flow analysis and comparable company analysis, to determine the intrinsic value of a company. They gain experience using financial modeling software and interpreting financial data.

Use of Technology and Digital Tools

Technology is an integral part of the learning environment, enhancing the educational experience and preparing students for the digital age of finance.

- Bloomberg Terminals: Students have access to Bloomberg terminals, the industry-standard platform for financial data, news, and analytics. They learn to use the terminal to research companies, analyze market trends, and make informed investment decisions.

- Financial Modeling Software: Students gain proficiency in using financial modeling software, such as Excel and specialized applications, to build complex financial models, perform valuations, and conduct sensitivity analyses.

- Online Learning Platforms: The program utilizes online learning platforms to deliver course materials, facilitate online discussions, and provide access to supplementary resources.

- Data Analytics Tools: Students are introduced to data analytics tools, such as Python and R, to analyze large datasets, identify trends, and develop data-driven insights. This prepares them for roles requiring data analysis skills.

Key Modules, Teaching Methods, and Descriptions

The following table Artikels the key modules within the program, the corresponding teaching methods employed, and a brief description of the module’s focus.

| Module | Teaching Methods | Description |

|---|---|---|

| Corporate Finance | Lectures, Case Studies, Practical Exercises | Covers financial decision-making within corporations, including capital budgeting, capital structure, and dividend policy. Students analyze real-world case studies and engage in financial modeling exercises. |

| Financial Markets and Instruments | Lectures, Simulations, Seminars | Provides a comprehensive understanding of financial markets, including stocks, bonds, derivatives, and other financial instruments. Students participate in simulated trading exercises to gain practical experience. |

| Investment Management | Lectures, Case Studies, Portfolio Management Simulations | Focuses on investment strategies, portfolio construction, and performance evaluation. Students manage simulated investment portfolios and analyze real-world case studies of investment firms. |

| Financial Modeling and Valuation | Lectures, Practical Exercises, Group Projects | Teaches students how to build financial models, perform valuations, and conduct sensitivity analyses. Students work on group projects to apply valuation techniques to real companies. |

| Derivatives and Risk Management | Lectures, Simulations, Case Studies | Explores the use of derivatives for hedging and speculation, as well as the principles of risk management. Students analyze case studies involving risk management strategies and participate in simulated trading exercises. |

| Private Equity and Venture Capital | Lectures, Case Studies, Guest Speakers | Provides an overview of the private equity and venture capital industries, including investment strategies, deal structuring, and valuation techniques. Students analyze case studies of private equity deals and hear from industry experts. |

Preparing for the Program

The HEC Paris Master in Finance is a rigorous program that demands significant preparation. Prospective students who invest time in pre-program preparation are more likely to succeed academically and professionally. This preparation not only covers technical skills but also helps students adapt to the demanding environment of the program.

Building a Foundation in Finance

A strong foundation in finance is crucial for success in the program. Students should aim to understand core concepts and principles before starting. This will allow them to grasp more advanced topics and contribute meaningfully to class discussions from day one.

- Financial Accounting: Understanding financial statements (balance sheet, income statement, cash flow statement), accounting principles (GAAP or IFRS), and financial ratio analysis. Resources include textbooks like “Financial Accounting” by Robert Libby, Patricia Libby, and Frank Hodge, and online courses on platforms like Coursera and edX. For example, being able to quickly analyze a company’s profitability using its income statement is a fundamental skill.

- Corporate Finance: Key concepts such as time value of money, capital budgeting, cost of capital, and dividend policy. The textbook “Corporate Finance” by Ross, Westerfield, and Jordan is a standard reference. Students should practice applying these concepts to real-world case studies.

- Investments: Understanding asset pricing, portfolio theory (Markowitz model), and the characteristics of different asset classes (stocks, bonds, derivatives). “Investments” by Bodie, Kane, and Marcus is a comprehensive resource. Knowing how to calculate the expected return and risk of a portfolio is a critical skill.

- Financial Modeling: Proficiency in building financial models in Excel, including forecasting, valuation, and scenario analysis. Practice building models for different types of companies and projects. Resources include online tutorials and specialized courses.

Developing Quantitative Skills

The Master in Finance program relies heavily on quantitative skills. Students should prepare by improving their proficiency in mathematics, statistics, and econometrics.

- Mathematics: A solid understanding of calculus (derivatives, integrals), linear algebra (matrices, vectors), and probability theory is essential. Reviewing textbooks like “Calculus” by James Stewart and “Linear Algebra and Its Applications” by David C. Lay is beneficial.

- Statistics: Knowledge of descriptive statistics, probability distributions, hypothesis testing, regression analysis, and time series analysis. “Statistics” by David Freedman, Robert Pisani, and Roger Purves is a widely used textbook. Practice with statistical software like R or Python.

- Econometrics: Basic understanding of econometric models and their application to financial data. “Introductory Econometrics” by Jeffrey Wooldridge provides a good introduction.

- Programming (Optional, but Recommended): Familiarity with programming languages like Python or R can be highly advantageous for data analysis and financial modeling. Online courses and tutorials can provide a good starting point. Knowing how to write code to automate financial calculations can significantly increase efficiency.

Strategies for Navigating the Program

Successfully navigating the program requires more than just technical skills. Students should develop effective study habits, time management strategies, and networking skills.

- Time Management: The program is intensive, and effective time management is crucial. Create a detailed schedule, prioritize tasks, and allocate sufficient time for studying, assignments, and extracurricular activities. Use tools like calendars and to-do lists to stay organized.

- Study Habits: Develop effective study habits, such as active learning, spaced repetition, and practice problem-solving. Form study groups to collaborate with classmates and learn from each other.

- Networking: Attend networking events, career fairs, and alumni events to build relationships with classmates, faculty, and industry professionals. Prepare a concise and compelling elevator pitch to introduce yourself and your career goals.

- Seeking Support: Utilize the resources available to you, such as career services, academic advisors, and the student support services. Don’t hesitate to ask for help when needed.

- Stay Informed: Read financial news publications (e.g., The Wall Street Journal, Financial Times), follow financial blogs, and stay updated on current events in the financial markets. This will help you contextualize your learning and engage in informed discussions.

Essential Skills and Knowledge Areas

Prospective students should focus on these essential skills and knowledge areas before starting the program.

- Financial Statement Analysis: Ability to read and interpret financial statements.

- Valuation Techniques: Understanding of discounted cash flow (DCF), relative valuation, and other valuation methodologies.

- Portfolio Construction: Knowledge of portfolio theory and asset allocation strategies.

- Risk Management: Understanding of financial risk and risk management techniques.

- Excel Proficiency: Ability to build and use financial models in Excel.

- Statistical Analysis: Basic understanding of statistical concepts and their application in finance.

- Communication Skills: Ability to communicate effectively, both verbally and in writing.

- Problem-Solving Skills: Ability to analyze complex problems and develop solutions.

- Teamwork and Collaboration: Ability to work effectively in teams.

- Time Management and Organization: Skills to manage time and stay organized.

The HEC Paris Masters in Finance program is renowned for producing top-tier financial professionals. To stay ahead in this competitive field, understanding modern tools is crucial. For example, graduates are increasingly leveraging Robotic Process Automation, or rpa for finance , to streamline operations and improve efficiency, skills highly valued in the job market. Therefore, a strong foundation in both finance theory and technological application is key for any aspiring HEC Paris graduate.

HEC Paris’s Master in Finance is a highly-regarded program, but those seeking a global perspective often consider alternatives. Prospective students might also evaluate the offerings at London Business School. Specifically, the lbs msc finance program is a strong competitor, providing a similarly rigorous curriculum. Ultimately, the choice between HEC Paris and other programs like LBS hinges on individual career goals and preferences within the finance sector.