Overview of Hearth Financing

Hearth Financing provides a platform connecting homeowners with financing options for home improvement projects. It streamlines the process of securing loans, offering a convenient alternative to traditional methods. Hearth aims to simplify the complexities of home improvement financing, providing homeowners with various choices to fund their projects.

Services Provided by Hearth

Hearth primarily acts as a marketplace for home improvement loans. The platform connects homeowners with lenders, allowing them to compare loan offers from multiple sources. This can potentially lead to more favorable terms and interest rates compared to applying with a single lender.

Hearth offers several key services:

- Loan Application: Homeowners can apply for loans through the Hearth platform. The application process is designed to be user-friendly, guiding users through the necessary steps.

- Loan Comparison: Hearth facilitates the comparison of loan offers from various lenders. This allows homeowners to evaluate different terms, interest rates, and repayment options.

- Access to Lenders: Hearth partners with a network of lenders specializing in home improvement loans. This gives homeowners access to a wider range of financing options.

- Project Cost Estimation: Hearth provides tools and resources to help homeowners estimate the cost of their home improvement projects. This can be useful for determining the appropriate loan amount.

Home Improvement Projects Typically Financed

Hearth financing is commonly used for a wide array of home improvement projects, including both interior and exterior renovations. The platform caters to projects of varying sizes and scopes.

Common projects financed through Hearth include:

- Kitchen Renovations: This includes updating cabinets, countertops, appliances, and flooring. Kitchen renovations often involve significant costs, making financing a viable option.

- Bathroom Remodels: Projects can range from minor upgrades to complete bathroom overhauls, covering new fixtures, tiling, and layouts.

- Roofing and Siding: These exterior projects are crucial for protecting a home and are often costly. Hearth financing can assist with the expenses.

- HVAC Systems: Replacing or upgrading heating, ventilation, and air conditioning systems can be expensive. Hearth offers financing for these essential home systems.

- Window and Door Replacements: Replacing windows and doors can improve energy efficiency and curb appeal.

- Additions and Extensions: Financing is available for larger projects like adding rooms or expanding the existing living space.

- Swimming Pools: Hearth can finance the construction of new pools.

- Landscaping: Hearth can finance landscape projects.

Target Audience and Benefits for Homeowners

Hearth financing primarily targets homeowners who are planning home improvement projects and require financial assistance. The platform aims to make the financing process easier and more accessible.

The target audience includes:

- Homeowners Seeking Financing: Individuals who need to borrow money to fund home improvement projects.

- Homeowners Looking for Competitive Rates: Those who want to compare multiple loan offers to secure the best terms.

- Homeowners Seeking a Streamlined Process: Individuals who prefer a convenient and efficient loan application experience.

Benefits for homeowners include:

- Convenience: Hearth simplifies the loan application process, making it easier for homeowners to secure financing.

- Choice: Access to a network of lenders provides homeowners with a wider range of loan options.

- Competitive Rates: The ability to compare loan offers can lead to more favorable interest rates and terms.

- Flexibility: Hearth offers various loan types and repayment options to suit different financial needs.

- Project Cost Estimation: Tools and resources can help homeowners plan and budget for their projects.

Eligibility Requirements

Qualifying for Hearth financing involves meeting specific criteria that assess a homeowner’s ability to repay the loan. These requirements help Hearth and its lending partners mitigate risk and ensure responsible lending practices. Understanding these factors is crucial for homeowners considering this financing option.

Basic Requirements for Homeowners

Homeowners must meet several fundamental criteria to be eligible for Hearth financing. These requirements are standard across the lending industry and are designed to evaluate a borrower’s creditworthiness and financial stability.

- Credit Score: A minimum credit score is typically required. While the exact minimum varies based on the specific lender and loan product, a good credit score significantly increases the chances of approval and can influence the interest rate offered. A higher credit score indicates a lower risk of default.

- Debt-to-Income Ratio (DTI): Lenders assess the borrower’s DTI, which is the percentage of gross monthly income that goes towards paying debts. A lower DTI is generally preferred, as it suggests the borrower has sufficient income to cover the new loan payment without overextending their finances.

- Income Verification: Proof of income is required to verify the borrower’s ability to repay the loan. This can include pay stubs, tax returns, and bank statements. Consistent and sufficient income is a key factor in the approval process.

- Homeownership: While Hearth financing is for home improvement projects, the applicant must be a homeowner. This is a fundamental requirement, as the loan is secured by the property.

- Project Details: The homeowner must have a specific home improvement project in mind. Hearth needs to understand the scope and cost of the project to determine the loan amount and assess the associated risk.

Factors Influencing Creditworthiness

Several factors significantly influence a homeowner’s creditworthiness, impacting their application’s approval and the loan terms offered. These factors are assessed to gauge the borrower’s likelihood of repaying the loan as agreed.

- Credit History: A detailed credit history is reviewed, including payment history, outstanding debts, and any instances of bankruptcy or foreclosure. A positive credit history, with a record of timely payments, is a strong indicator of creditworthiness.

- Credit Utilization: This refers to the amount of credit a borrower is using compared to their total available credit. Keeping credit utilization low (ideally below 30%) demonstrates responsible credit management.

- Income Stability: Consistent employment and a stable income source are crucial. Lenders prefer borrowers with a reliable income stream, as it reduces the risk of the borrower defaulting on the loan.

- Existing Debt Obligations: The amount of existing debt, including mortgages, car loans, and credit card balances, is considered. A lower level of existing debt indicates a greater ability to manage the new loan.

- Payment History on Previous Loans: This is a crucial indicator. A history of missed payments, defaults, or late payments on previous loans or credit accounts negatively impacts creditworthiness.

Documentation Homeowners Need to Provide

Homeowners applying for Hearth financing need to provide specific documentation to support their application. This documentation verifies the information provided and allows the lender to assess the borrower’s eligibility and financial situation.

- Proof of Identity: A government-issued photo ID, such as a driver’s license or passport, is required to verify the applicant’s identity.

- Proof of Income: This typically includes pay stubs from the last 1-2 months, W-2 forms, and/or tax returns. Self-employed individuals may need to provide additional documentation, such as bank statements and profit and loss statements.

- Bank Statements: Recent bank statements are often requested to verify income, assets, and spending habits. These statements also help lenders assess the borrower’s financial stability.

- Project Details: Information about the home improvement project, including a detailed scope of work and cost estimates from a contractor, is required.

- Credit Authorization: Applicants must authorize a credit check, allowing Hearth to access their credit report.

Application Process

Applying for Hearth financing involves a structured process designed to assess a homeowner’s eligibility and determine the loan terms. Understanding each stage is crucial for a smooth application experience. This guide provides a step-by-step overview of the application process, from initial inquiry to loan approval.

Step-by-Step Application Guide

The application process with Hearth is designed to be user-friendly and efficient. Here’s a breakdown of the typical steps involved:

- Initial Inquiry and Pre-Qualification: The process begins with a homeowner expressing interest in Hearth financing. This typically involves visiting the Hearth website or contacting a representative. During this initial phase, homeowners provide basic information about their project and financial situation. This data is used to determine if they meet the basic eligibility criteria. Pre-qualification provides an estimated loan amount and interest rate, without impacting the homeowner’s credit score.

- Formal Application: If the homeowner is pre-qualified and wishes to proceed, they will then complete a formal application. This step requires more detailed financial information, including income verification, employment history, and information about existing debts. Supporting documentation, such as pay stubs and tax returns, may be requested.

- Credit Check and Underwriting: Once the formal application is submitted, Hearth conducts a thorough credit check. This process involves assessing the homeowner’s creditworthiness, reviewing their credit history, and evaluating their ability to repay the loan. Hearth’s underwriting team assesses the risk associated with the loan application.

- Loan Offer and Terms: Based on the underwriting process, Hearth will provide a loan offer, which includes the loan amount, interest rate, repayment terms, and any associated fees. The homeowner reviews the offer and decides whether to accept it.

- Loan Agreement and Closing: If the homeowner accepts the loan offer, they sign the loan agreement. This document Artikels the terms and conditions of the loan. The closing process involves finalizing the loan and disbursing the funds to the homeowner or directly to the contractor.

Tips to Improve Application Success

Several factors can significantly influence the success of a Hearth financing application. Implementing these strategies can improve a homeowner’s chances of approval and secure favorable loan terms:

- Maintain a Good Credit Score: A strong credit score is one of the most critical factors in loan approval. Regularly review your credit report for errors and take steps to improve your credit score before applying. This includes paying bills on time, reducing credit card debt, and avoiding opening new credit accounts shortly before applying.

- Provide Accurate and Complete Information: Ensure all information provided on the application is accurate and complete. Inaccurate or incomplete information can delay the process or lead to rejection. Double-check all details before submitting the application.

- Verify Income and Employment: Be prepared to provide documentation to verify your income and employment history. This may include pay stubs, W-2 forms, and tax returns. Consistency in employment history can also strengthen your application.

- Manage Debt-to-Income Ratio: A lower debt-to-income (DTI) ratio indicates a better ability to manage debt. Reducing existing debts before applying can improve your DTI ratio and increase your chances of approval.

- Shop Around for Quotes: Before applying, obtain quotes from multiple contractors to determine the total project cost accurately. This helps ensure you request the correct loan amount and that the project budget is realistic.

- Review Loan Terms Carefully: Before accepting a loan offer, carefully review all terms and conditions, including the interest rate, repayment schedule, and any associated fees. Ensure you understand the obligations and can comfortably meet the repayment schedule.

Loan Options and Terms

Understanding the loan options and terms offered by Hearth financing is crucial for homeowners seeking to finance home improvement projects. This knowledge allows borrowers to make informed decisions, selecting the most suitable financing options that align with their financial situations and project goals. Evaluating the various loan choices and their associated terms empowers homeowners to manage their finances effectively and minimize the overall cost of their projects.

Loan Amounts and Interest Rates

Hearth financing provides a range of loan amounts designed to accommodate various home improvement projects, from minor renovations to extensive overhauls. These loan amounts, combined with competitive interest rates, make Hearth a viable option for many homeowners.

The loan amounts typically offered by Hearth can range from a few thousand dollars to upwards of $100,000, depending on the borrower’s creditworthiness, the project scope, and other factors. Interest rates are also a key consideration, as they significantly impact the total cost of the loan. Hearth’s interest rates vary based on several factors, including the borrower’s credit score, the loan amount, and the loan term. It is important to note that these rates can change over time, reflecting market conditions.

Fixed-Rate vs. Variable-Rate Loans

Hearth offers both fixed-rate and variable-rate loans, each with distinct characteristics that appeal to different borrowers. Choosing between these two loan types depends on individual risk tolerance and financial goals.

- Fixed-Rate Loans: Fixed-rate loans maintain the same interest rate throughout the loan term. This provides predictability, as the monthly payment remains constant. This stability is particularly beneficial during periods of rising interest rates, as borrowers are shielded from increased costs. However, fixed-rate loans may come with slightly higher interest rates initially compared to variable-rate loans.

- Variable-Rate Loans: Variable-rate loans, also known as adjustable-rate loans, have interest rates that fluctuate based on a benchmark interest rate, such as the prime rate. This can result in lower initial interest rates than fixed-rate loans. However, the interest rate, and consequently the monthly payment, can increase or decrease over time. This presents both opportunities and risks; borrowers benefit if interest rates fall but face higher payments if rates rise.

Impact of Loan Terms on Project Cost

The loan term, or the duration of the loan repayment, significantly influences the total cost of a home improvement project. Longer loan terms typically result in lower monthly payments but lead to higher overall interest paid. Conversely, shorter loan terms usually mean higher monthly payments but lower total interest costs.

Consider these examples:

| Scenario | Loan Amount | Interest Rate | Loan Term | Monthly Payment | Total Interest Paid |

|---|---|---|---|---|---|

| Scenario 1: Shorter Loan Term | $30,000 | 7% | 5 years | $594.08 | $5,644.78 |

| Scenario 2: Longer Loan Term | $30,000 | 7% | 15 years | $269.75 | $18,555.67 |

In these scenarios, the total interest paid varies dramatically. While the shorter loan term (5 years) has significantly higher monthly payments, it results in much lower overall interest costs compared to the longer loan term (15 years).

The formula for calculating the monthly payment on a fixed-rate loan is: M = P [ i(1 + i)^n ] / [ (1 + i)^n – 1] where M is the monthly payment, P is the principal loan amount, i is the monthly interest rate (annual rate / 12), and n is the number of months in the loan term.

Interest Rates and Fees

Understanding the interest rates and fees associated with Hearth financing is crucial for making informed financial decisions. These costs significantly impact the overall expense of your home improvement project. This section will break down the factors influencing interest rates, demonstrate how to calculate total loan costs, and Artikel potential fees you might encounter.

Factors Influencing Interest Rates

Several factors influence the interest rates Hearth offers. These factors are assessed to determine the risk associated with lending to a particular borrower.

- Credit Score: Your credit score is a primary determinant. Borrowers with higher credit scores typically qualify for lower interest rates, reflecting a lower risk of default for the lender. Conversely, those with lower credit scores may face higher rates.

- Loan Amount: The size of the loan can influence the interest rate. Larger loans might sometimes come with slightly lower rates, although this isn’t always the case.

- Loan Term: The length of the loan term (the repayment period) affects the interest rate. Shorter loan terms often come with lower interest rates but higher monthly payments. Longer terms typically have higher interest rates but lower monthly payments.

- Debt-to-Income Ratio (DTI): Hearth assesses your DTI, which is the percentage of your gross monthly income that goes towards paying your debts. A lower DTI indicates a lower risk and can lead to more favorable interest rates.

- Type of Home Improvement Project: While not a direct factor, the nature of the project can indirectly influence rates. For instance, projects that increase the home’s value might be viewed more favorably by lenders.

- Market Conditions: Prevailing interest rates in the broader market also play a role. If overall interest rates are rising, Hearth’s rates are likely to follow suit.

Calculating the Total Cost of a Loan

Calculating the total cost of a Hearth loan involves understanding how interest and fees accumulate over the loan’s life. Here’s how to estimate your total loan cost:

How does hearth financing work – Step 1: Determine the Principal. This is the initial amount you borrow from Hearth. For example, if you borrow $20,000, your principal is $20,000.

Step 2: Identify the Interest Rate. The interest rate is expressed as an annual percentage rate (APR). Let’s assume your interest rate is 9%.

Step 3: Determine the Loan Term. This is the duration of your loan, usually expressed in years. Let’s say your loan term is 5 years.

Step 4: Calculate the Monthly Payment. Use a loan calculator (available on Hearth’s website or other financial websites) to determine your monthly payment. For our example, a $20,000 loan at 9% interest over 5 years results in a monthly payment of approximately $412.35.

Step 5: Calculate the Total Amount Paid. Multiply your monthly payment by the number of months in the loan term (loan term in years * 12). In our example, $412.35 * 60 months = $24,741.

Step 6: Calculate the Total Interest Paid. Subtract the principal from the total amount paid. In our example, $24,741 – $20,000 = $4,741. This is the total interest you’ll pay over the life of the loan.

Total Cost = Principal + Total Interest + Fees

Example: If you borrow $15,000 with an interest rate of 8% over 3 years and incur a $100 origination fee, the calculation would look like this:

Monthly Payment: Approximately $470.47

Total Paid: $470.47 * 36 = $16,936.92

Total Interest: $16,936.92 – $15,000 = $1,936.92

Total Cost: $15,000 + $1,936.92 + $100 = $17,036.92

Potential Fees Associated with Hearth Financing

Hearth may charge various fees. It is crucial to review the loan terms carefully.

| Fee | Description | Potential Cost | When it Applies |

|---|---|---|---|

| Origination Fee | A fee charged by the lender for processing your loan application. | Typically 0% to 5% of the loan amount. | At the time the loan is originated. |

| Late Payment Fee | A fee charged if you miss a payment or pay late. | Varies, often a percentage of the overdue payment or a fixed amount. | If a payment is not made by the due date. |

| Prepayment Penalty | A fee charged if you pay off your loan before the agreed-upon term. | Can be a percentage of the outstanding balance. | If you pay off the loan early (not all loans have this). |

| Returned Payment Fee | A fee charged if your payment is returned due to insufficient funds. | Varies, often a fixed amount. | If a payment is rejected by your bank. |

Repayment Procedures

Understanding the repayment process is crucial for homeowners utilizing Hearth financing. This section details the methods for making payments, addresses the consequences of missed payments, and Artikels options available to borrowers facing financial difficulties. Managing your loan effectively ensures you maintain good credit and avoid potential complications.

Payment Methods and Due Dates

Hearth offers several convenient options for homeowners to make their loan payments. It is essential to understand these methods and the associated due dates to avoid late fees or damage to your credit score.

Payment options typically include:

- Online Payments: Homeowners can usually make payments through Hearth’s online portal. This method often allows for automatic payments, providing a convenient “set it and forget it” approach.

- Mail: Payments can be mailed to a designated address, usually provided in the loan documents. Always send payments well in advance of the due date to account for mail delivery times.

- Phone: Some lenders may offer the option to make payments via phone. This may involve automated systems or speaking with a customer service representative.

- Automatic Payments: Enrolling in automatic payments, often via bank account withdrawals, ensures timely payments and minimizes the risk of missing a due date.

Due dates are clearly stated in the loan agreement. Homeowners should carefully review their loan documents to determine their payment schedule. Missing a payment, even by a single day, can trigger late fees and negatively impact your credit score.

Hearth financing operates by connecting homeowners with various lenders for home improvement projects. Understanding the process is key, but it’s also smart to check out independent assessments. To gain further insights, consider reading resolve finance reviews to gauge real-world experiences with similar services. Ultimately, evaluating all aspects will help you determine if Hearth financing is the right fit for your specific needs and financial situation.

Consequences of Missed Payments

Missing a payment can have several negative repercussions. Understanding these consequences is critical for managing your loan responsibly.

The primary consequences of a missed payment include:

- Late Fees: Hearth, like most lenders, will likely assess a late fee for each missed payment. The amount of the fee is specified in the loan agreement.

- Credit Score Impact: Missed payments are reported to credit bureaus and can significantly lower your credit score. A lower credit score can make it more difficult and expensive to obtain credit in the future.

- Delinquency and Default: If payments remain overdue for an extended period, the loan can become delinquent. Continued delinquency can lead to default, which allows the lender to take further action, such as initiating collection efforts or, in the case of secured loans, potentially foreclosing on the property.

The severity of the consequences increases with the length of time a payment is missed. Therefore, addressing payment issues promptly is vital.

Hearth financing simplifies home improvement projects, offering various loan options. However, what happens when you need assistance outside of typical business hours? Understanding the limitations and alternative solutions is key. Thankfully, resources exist to help you navigate financial needs even beyond finance business hours , ensuring your home projects remain on track. Ultimately, knowing how Hearth financing functions allows for better management of your home renovation journey.

Options for Homeowners Experiencing Financial Hardship

Homeowners facing financial difficulties have options to explore. Contacting Hearth as soon as possible is the first and most important step.

Possible options may include:

- Loan Modification: Hearth might be willing to modify the loan terms, such as lowering the interest rate or extending the repayment period, to make payments more manageable.

- Payment Deferral or Forbearance: In some cases, Hearth may allow a temporary suspension or reduction of payments. This provides temporary relief, but the missed payments must be repaid later.

- Refinancing: Refinancing the loan with another lender could potentially offer better terms, allowing for lower monthly payments. However, this depends on the homeowner’s current financial situation and credit score.

- Debt Counseling: Seeking assistance from a credit counseling agency can provide guidance on budgeting, debt management, and negotiating with lenders.

Example: A homeowner who loses their job and is struggling to make payments should immediately contact Hearth to discuss their situation. They might be able to negotiate a temporary payment deferral until they find new employment. Failure to communicate and address the issue could result in the loss of the home or severe credit damage.

It is crucial to remember that these options are not guaranteed and depend on the lender’s policies and the homeowner’s individual circumstances. Proactive communication and early intervention are critical in navigating financial hardship.

Benefits of Hearth Financing

Hearth financing offers several advantages for homeowners seeking to fund home improvement projects. It provides a streamlined and often more accessible way to secure funding compared to traditional options. Understanding these benefits can help homeowners make informed decisions about how to finance their renovations and maximize the return on their investment.

Key Advantages of Hearth Financing

Hearth financing distinguishes itself through several key features that appeal to homeowners. These advantages often translate into a smoother and more advantageous borrowing experience.

- Convenience and Speed: Hearth’s online platform simplifies the application process. Homeowners can apply for financing and receive pre-qualified offers quickly, often within minutes. This rapid turnaround is a significant benefit compared to the longer processing times associated with traditional bank loans or home equity products.

- Wide Range of Loan Options: Hearth provides access to a network of lenders, offering various loan options. This variety allows homeowners to select a loan that best fits their specific needs and financial situation. Options may include unsecured loans, which don’t require collateral, and loans with varying terms and interest rates.

- Competitive Interest Rates: Hearth works with lenders that often offer competitive interest rates. While rates depend on individual creditworthiness and the loan terms, the platform’s ability to facilitate comparison shopping helps homeowners find favorable rates.

- Fixed Interest Rates: Many Hearth loans feature fixed interest rates. This predictability allows homeowners to budget effectively for their monthly payments, as the interest rate remains constant throughout the loan term.

- No Home Equity Required: Unlike home equity loans or HELOCs, many Hearth loans are unsecured. This means homeowners can access financing without putting their home at risk as collateral. This is especially beneficial for those who may not have significant equity in their homes or prefer not to use their home as collateral.

- Integration with Contractors: Hearth often partners with contractors, streamlining the process. This integration can simplify the payment process and potentially offer project management tools.

Comparison with Other Financing Options

Comparing Hearth financing with alternatives such as home equity loans and credit cards reveals important distinctions. Each option presents unique advantages and disadvantages.

Home Equity Loans and HELOCs:

Home equity loans and Home Equity Lines of Credit (HELOCs) offer lower interest rates than many unsecured loans, especially when the borrower has substantial home equity. However, they require the homeowner to use their home as collateral, posing a risk of foreclosure if payments are missed. HELOCs have variable interest rates, which can fluctuate with market conditions. Home equity loans and HELOCs typically involve longer application processes and may require appraisals.

Credit Cards:

Credit cards offer flexibility and convenience for smaller projects. However, they often come with high-interest rates, especially if the balance is carried over from month to month. Using credit cards for large projects can quickly accumulate significant interest charges. While some credit cards offer introductory 0% APR periods, these are temporary, and the rate will increase significantly after the promotional period. Also, credit card limits may not be sufficient for substantial home improvement projects.

Here’s a comparison table:

| Feature | Hearth Financing | Home Equity Loan/HELOC | Credit Cards |

|---|---|---|---|

| Collateral | Typically unsecured | Home (secured) | Unsecured |

| Interest Rates | Competitive, can be fixed | Often lower, can be fixed or variable | Higher, variable |

| Loan Amount | Varies, often lower than home equity products | Higher, based on home equity | Limited by credit limit |

| Application Process | Quick, online | Slower, involves appraisal | Instant |

| Risk | Lower (unsecured) | Higher (home at risk) | High interest charges if balance carried |

Maximizing Home Value with Hearth Financing

Homeowners can strategically use Hearth financing to increase their home’s value. Investing in projects that enhance curb appeal, functionality, or energy efficiency often yields the best returns.

- Kitchen Renovations: Kitchen remodels are a proven way to boost home value. Hearth financing can help cover the costs of new cabinetry, appliances, countertops, and flooring. According to the National Association of Realtors, a minor kitchen remodel can often yield a return on investment (ROI) of over 80% when selling a home.

- Bathroom Upgrades: Modernizing bathrooms with updated fixtures, tiling, and improved layouts can significantly increase a home’s appeal and value. Hearth financing can facilitate these renovations. A bathroom remodel can provide a strong ROI, particularly if it addresses outdated features or expands the space.

- Adding a Deck or Patio: Outdoor living spaces are highly desirable. Hearth financing can fund the construction of decks, patios, or outdoor kitchens. These projects can add significant value and appeal to potential buyers. A well-designed deck or patio can increase a home’s perceived living space and desirability.

- Energy-Efficient Upgrades: Installing energy-efficient windows, insulation, or solar panels can reduce utility bills and enhance a home’s value. Hearth financing can help cover these costs. Homeowners can often recoup the investment through lower energy costs and increased home value.

- Curb Appeal Enhancements: Improving the exterior of a home can make a strong first impression. Hearth financing can be used for landscaping, new siding, or a fresh coat of paint. These projects can significantly boost a home’s market value and attract potential buyers.

Potential Drawbacks

While Hearth financing can be a valuable tool for home improvement, it’s essential to be aware of its potential drawbacks before making a decision. Understanding these disadvantages allows you to make informed choices and mitigate potential risks. Ignoring these aspects could lead to financial strain and project setbacks.

High Interest Rates and Fees

The interest rates and fees associated with Hearth financing can be a significant disadvantage, especially for borrowers with less-than-perfect credit. These costs can significantly increase the overall cost of the home improvement project.

- Higher APRs: Hearth, as a marketplace, connects borrowers with various lenders. Depending on the lender and the borrower’s creditworthiness, the Annual Percentage Rate (APR) can be considerably higher than other financing options, such as home equity loans or lines of credit. For instance, a borrower with a low credit score might be offered an APR exceeding 20% or even higher.

- Origination Fees: Some lenders may charge origination fees, which are fees paid upfront to process the loan. These fees can range from 1% to 5% of the loan amount. For a $20,000 loan, this could translate to a fee of $200 to $1,000, effectively increasing the total amount borrowed.

- Late Payment Fees: Missing a payment can result in late payment fees, which can further increase the overall cost of the loan. These fees are typically a percentage of the overdue payment.

- Prepayment Penalties: Some lenders may include prepayment penalties, which charge a fee if the borrower pays off the loan early. This discourages early repayment and increases the overall interest paid if the borrower is unable to pay off the loan early.

Risk of Overspending

Taking out a loan for home improvement projects can lead to overspending, especially if the project’s scope expands beyond the initial budget.

- Increased Project Scope: With readily available funds, homeowners may be tempted to expand the scope of their projects, adding features or upgrades they initially didn’t plan for. This can quickly lead to exceeding the original loan amount and potentially requiring additional financing.

- Cost Overruns: Home improvement projects often encounter unforeseen expenses, such as hidden structural issues or unexpected material price increases. These cost overruns can quickly deplete the loan funds, leaving the homeowner with insufficient funds to complete the project.

- Lack of Financial Discipline: Without careful budgeting and financial planning, borrowers may not track expenses effectively, leading to overspending and potential financial strain.

Potential for Debt Accumulation

Using Hearth financing can contribute to overall debt accumulation, particularly if the borrower already has existing debts.

- Increased Debt-to-Income Ratio: Taking on a home improvement loan increases the borrower’s debt-to-income (DTI) ratio, which is a key factor in determining creditworthiness. A high DTI can make it more difficult to obtain future loans or credit cards.

- Impact on Credit Score: Making late payments or defaulting on the home improvement loan can negatively impact the borrower’s credit score, making it harder to secure financing in the future.

- Financial Stress: The burden of managing another loan payment can cause financial stress, particularly if the borrower experiences unexpected income loss or other financial hardships.

Project Delays and Disputes

Home improvement projects can encounter delays and disputes with contractors, which can further complicate the financing process.

- Contractor Delays: Projects may be delayed due to contractor issues, such as material shortages, labor shortages, or poor workmanship. These delays can extend the project timeline and increase the risk of exceeding the loan term.

- Disputes with Contractors: Disputes with contractors over the quality of work, payment terms, or project scope can arise, potentially leading to legal battles and additional expenses.

- Impact on Loan Disbursement: Delays and disputes can affect the disbursement of loan funds, potentially hindering the project’s progress and causing further financial strain.

Mitigating the Risks

There are several steps borrowers can take to mitigate the risks associated with Hearth financing and home improvement projects.

- Shop Around and Compare Rates: Compare interest rates and fees from multiple lenders through Hearth and other sources to find the most favorable terms.

- Create a Detailed Budget: Develop a comprehensive budget that includes all project costs, contingency funds for unexpected expenses, and a payment schedule.

- Choose a Reputable Contractor: Select a licensed and insured contractor with a proven track record and positive reviews. Obtain multiple bids and carefully review the contract.

- Negotiate Payment Terms: Negotiate payment terms with the contractor, tying payments to milestones completed rather than paying upfront.

- Monitor Project Progress: Regularly monitor the project’s progress and communicate with the contractor to address any issues promptly.

- Consider Alternatives: Explore alternative financing options, such as home equity loans or lines of credit, to determine if they offer more favorable terms.

- Review the Loan Terms Carefully: Before signing the loan agreement, carefully review all terms and conditions, including interest rates, fees, repayment schedules, and prepayment penalties. Understand your obligations and the consequences of default.

Hearth vs. Other Financing Options

Choosing the right financing option for home improvement projects is crucial, and understanding the alternatives to Hearth is essential for making an informed decision. Comparing Hearth’s offerings with traditional bank loans, home equity lines of credit (HELOCs), and personal loans helps homeowners assess which option best suits their financial needs and circumstances. This section provides a detailed comparison of Hearth financing with these alternative financing methods.

Comparing Hearth Financing with Traditional Bank Loans

Traditional bank loans, particularly those secured for home improvements, offer a well-established financing route. Banks often provide competitive interest rates, especially for borrowers with excellent credit scores. However, the application process and requirements can be more stringent than those of Hearth.

Here’s a comparison:

* Application Process: Bank loans typically involve a more extensive application process, requiring detailed financial documentation, credit checks, and potentially property appraisals. Hearth’s application process is often streamlined and online-based, offering quicker approvals.

* Credit Score Requirements: Banks usually require higher credit scores for approval, often in the “good” to “excellent” range (670+). Hearth may be more flexible with credit score requirements, catering to a wider range of borrowers, including those with less-than-perfect credit.

* Loan Amounts: Traditional bank loans can offer larger loan amounts, suitable for extensive home renovations. Hearth’s loan amounts might be more limited, depending on the lender and the borrower’s creditworthiness.

* Interest Rates: Banks may offer slightly lower interest rates, especially to borrowers with high credit scores. Hearth’s interest rates can be competitive but may be higher than those offered by banks due to the potentially higher risk profile of some borrowers.

* Collateral: Bank loans for home improvements can sometimes be secured against the property, potentially offering lower interest rates but posing a risk to the homeowner’s assets. Hearth loans are often unsecured, which means the home isn’t used as collateral.

* Funding Time: Banks might take longer to process and disburse funds. Hearth typically offers faster funding times, sometimes within a few days.

Contrasting Hearth Financing with Home Equity Lines of Credit (HELOCs)

Home Equity Lines of Credit (HELOCs) are another financing option, particularly attractive to homeowners with existing equity in their homes. HELOCs provide a revolving line of credit, allowing homeowners to borrow, repay, and borrow again during a draw period.

Key differences between Hearth and HELOCs include:

* Collateral: HELOCs use the homeowner’s equity as collateral, which can result in lower interest rates but also increases the risk of losing the home if the borrower defaults. Hearth loans are often unsecured, avoiding this risk.

* Interest Rates: HELOCs often have variable interest rates, which can fluctuate with market conditions. Hearth loans typically offer fixed interest rates, providing more predictable monthly payments.

* Loan Structure: HELOCs offer a revolving line of credit, allowing for ongoing borrowing and repayment. Hearth loans are typically structured as installment loans with a fixed repayment schedule.

* Draw Period: HELOCs have a draw period, during which the homeowner can borrow funds. After the draw period ends, the repayment period begins. Hearth loans have a fixed repayment term from the outset.

* Fees: HELOCs may involve various fees, such as origination fees, annual fees, and draw fees. Hearth loans may have fewer fees, although this can vary depending on the lender.

* Credit Requirements: HELOCs often require excellent credit scores and a significant amount of home equity. Hearth may be more accessible to borrowers with lower credit scores or less equity.

* Use of Funds: HELOCs can be used for a variety of purposes, not just home improvements. Hearth loans are specifically designed for home improvement projects.

Comparing Hearth Financing with Personal Loans

Personal loans are another common financing option for home improvement projects. These loans are typically unsecured and can be obtained from various lenders, including banks, credit unions, and online lenders.

Here’s a bullet-point comparison:

* Interest Rates: Personal loan interest rates can vary widely depending on the borrower’s creditworthiness and the lender. Hearth interest rates are often competitive, but borrowers should compare offers.

* Loan Amounts: Personal loan amounts can vary, often depending on the lender and the borrower’s credit profile. Hearth offers specific loan amounts based on the project and the lender’s criteria.

* Application Process: Both Hearth and personal loan applications are typically online and streamlined compared to bank loans. However, personal loan applications may vary depending on the lender.

* Funding Time: Both options often provide quick funding, potentially within a few days.

* Fees: Both options may include origination fees or other associated costs. It’s crucial to review the loan terms for any fees.

* Credit Requirements: Both Hearth and personal loans have credit score requirements. Hearth might be more flexible for those with less-than-perfect credit.

* Repayment Terms: Both offer fixed repayment terms, allowing for predictable monthly payments.

* Collateral: Both are typically unsecured, which means the home isn’t used as collateral.

* Loan Purpose: Both can be used for home improvement projects, although personal loans can be used for other purposes.

Hearth Financing for Contractors: How Does Hearth Financing Work

Hearth financing offers a valuable partnership opportunity for contractors, providing them with a powerful tool to enhance their sales process and improve customer satisfaction. By offering financing options through Hearth, contractors can make their services more accessible to a wider range of clients, ultimately boosting their business. This section delves into the specifics of how contractors can leverage Hearth financing to their advantage.

Partnering with Hearth

Contractors can become partners with Hearth through a straightforward application process. This typically involves providing basic business information, such as their company’s name, contact details, and the types of services they offer. Hearth then reviews the application and, upon approval, provides the contractor with access to its platform and resources. This allows contractors to offer Hearth financing to their customers directly. The integration process is designed to be user-friendly, allowing contractors to quickly and easily present financing options to their clients.

Benefits for Contractors

Offering Hearth financing provides several significant benefits for contractors, improving their sales and customer relationship.

- Increased Sales and Revenue: Offering financing removes the immediate cost barrier for potential clients, making it easier for them to say yes to projects. This can lead to a higher conversion rate and increased overall sales volume.

- Larger Project Sizes: With financing available, clients may be more willing to undertake larger or more comprehensive projects than they otherwise would. This translates into higher revenue per project for the contractor.

- Faster Project Approval: Clients who are approved for financing can often begin their projects sooner, as they don’t have to wait to save the entire project cost.

- Enhanced Customer Satisfaction: Providing financing options demonstrates a commitment to customer service and can improve client satisfaction. Clients appreciate the flexibility and convenience of paying for their projects over time.

- Simplified Sales Process: Hearth’s platform streamlines the financing application process, making it easier for contractors to offer and manage financing options.

- Competitive Advantage: Offering financing gives contractors a competitive edge in the market, as it differentiates them from competitors who do not offer such options.

Integrating Hearth Financing into the Sales Process

Contractors can seamlessly integrate Hearth financing into their existing sales processes.

- Presenting Financing Options Early: Contractors should introduce Hearth financing options early in the sales process, ideally during the initial consultation or estimate phase. This allows clients to consider financing as part of their decision-making process.

- Using Hearth’s Online Tools: Hearth provides online tools, such as payment calculators, that contractors can use to help clients understand their monthly payments and financing options.

- Training Sales Teams: It’s crucial to train sales teams on how to effectively present Hearth financing and answer client questions. This ensures that the sales team is comfortable and confident when discussing financing options.

- Including Financing Information in Proposals: Contractors should include information about Hearth financing in their project proposals, making it easy for clients to understand the available options.

- Streamlining the Application Process: Make the application process as simple as possible. Hearth provides online application portals that can be easily integrated into the contractor’s website or sales workflow.

- Offering Promotions: Consider offering special promotions, such as interest-free periods or reduced rates, to incentivize clients to use Hearth financing.

Customer Reviews and Testimonials

Understanding customer experiences is crucial when evaluating any financial service. Reviews and testimonials offer invaluable insights into the practical application of Hearth financing, revealing both its strengths and areas needing improvement. Analyzing this feedback provides a comprehensive view of the customer journey, from application to repayment.

Positive Customer Experiences

Positive reviews often highlight the ease of use and convenience of Hearth financing. Customers frequently commend the platform’s streamlined application process and the speed with which they receive loan approvals.

- Simple Application Process: Many users appreciate the straightforward online application, which minimizes paperwork and reduces the time required to secure funding. One customer mentioned, “The application was incredibly easy, and I had an offer within minutes.”

- Competitive Interest Rates: Customers frequently report finding competitive interest rates, especially when compared to traditional financing options. This can lead to significant savings over the loan term.

- Variety of Loan Options: The availability of different loan amounts and terms allows customers to find a financing solution that aligns with their specific project needs and financial capabilities.

- Excellent Customer Service: Positive testimonials often praise Hearth’s customer service representatives for their responsiveness, helpfulness, and ability to guide customers through the financing process. One user noted, “The customer service team was fantastic; they answered all my questions promptly and professionally.”

- Quick Funding: Speed of funding is a significant advantage. Customers appreciate the ability to receive funds quickly, allowing them to start their home improvement projects without delay.

Common Customer Complaints and Hearth’s Responses

While Hearth generally receives positive feedback, some common complaints arise, providing opportunities for improvement. Addressing these issues demonstrates a commitment to customer satisfaction.

- Interest Rate Concerns: Some customers express concerns about the interest rates offered, particularly if they have less-than-perfect credit. Hearth responds by emphasizing the importance of credit score and the factors that influence rates, such as the loan amount and repayment term. They often suggest exploring options to improve credit scores before applying.

- Communication Issues: A few customers report occasional communication delays or difficulties. Hearth addresses this by investing in its customer service infrastructure, including training staff and improving communication channels (e.g., email, phone, and chat).

- Eligibility Requirements: Some users find the eligibility requirements strict, leading to loan denials. Hearth clarifies its eligibility criteria on its website and provides resources to help potential borrowers understand the requirements.

- Contractor Integration Issues: In some cases, issues arise related to contractor interactions or payment processing. Hearth works to improve the contractor network and payment systems, providing more support to contractors to ensure a smoother experience.

Influence of Customer Feedback on Hearth’s Services

Customer feedback is instrumental in shaping Hearth’s services and operations. By actively monitoring and analyzing reviews, testimonials, and complaints, Hearth can identify areas for improvement and implement changes to enhance the customer experience.

- Product Development: Feedback helps Hearth refine its loan products and features. For example, customer input may influence the introduction of new loan options or the adjustment of existing terms.

- Service Enhancements: Complaints about customer service lead to improvements in training, staffing, and communication protocols. This ensures that customers receive timely and helpful support.

- Process Optimization: Customer feedback can highlight inefficiencies in the application or repayment processes. Hearth uses this information to streamline processes, making them more user-friendly.

- Transparency and Education: Feedback regarding interest rates or eligibility requirements encourages Hearth to provide more transparent information and educational resources to potential borrowers.

Future of Hearth Financing

The home improvement financing landscape is constantly evolving, driven by technological advancements, changing consumer preferences, and shifts in the broader economic climate. Hearth, as a significant player in this space, is poised to adapt and innovate to remain competitive and meet the evolving needs of homeowners and contractors. This section explores potential future developments and innovations for Hearth, its adaptability to market changes, and a descriptive illustration of a future platform feature.

Technological Advancements and Platform Enhancements

Hearth’s future likely hinges on leveraging technology to enhance its platform and streamline the financing process. This includes greater integration of artificial intelligence (AI) and machine learning (ML) to improve various aspects of its operations.

- AI-Powered Loan Decisioning: AI algorithms can analyze applicant data more comprehensively and efficiently than traditional methods. This could lead to faster loan approvals, more personalized loan offers, and reduced risk for lenders. For example, AI could analyze a homeowner’s credit history, income, and the details of their home improvement project to instantly determine their eligibility and offer a tailored loan package. This could significantly reduce the application processing time from days to minutes.

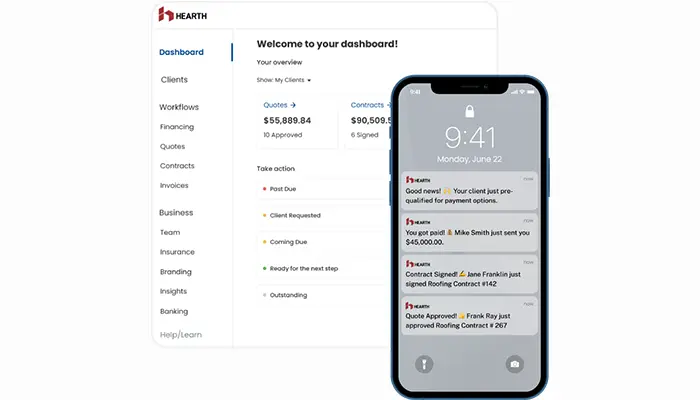

- Enhanced Customer Experience: AI-powered chatbots and virtual assistants could provide 24/7 customer support, answering frequently asked questions and guiding users through the application process. Personalized dashboards could offer homeowners a clear view of their loan status, payment schedules, and project progress.

- Blockchain Integration: Blockchain technology could be used to enhance security and transparency in the financing process. Smart contracts could automate loan disbursement and repayment, reducing the risk of fraud and errors. This could also allow for greater transparency in the terms and conditions of the loan.

- Integration with Smart Home Technology: Hearth could integrate with smart home platforms, allowing homeowners to finance not only the cost of home improvement projects but also the installation of smart home devices and energy-efficient upgrades. This could lead to a more comprehensive financing solution.

Adapting to Market Changes

The home improvement market is subject to various factors, including economic cycles, interest rate fluctuations, and shifts in consumer demand. Hearth must adapt to these changes to remain relevant and competitive.

- Economic Downturns: During economic downturns, homeowners may be more hesitant to undertake large home improvement projects. Hearth could respond by offering more flexible loan terms, such as lower interest rates or longer repayment periods, to make financing more accessible. Hearth might also focus on financing smaller, more essential projects, such as repairs and energy-efficient upgrades.

- Interest Rate Fluctuations: Interest rate changes can significantly impact the cost of borrowing. Hearth could mitigate this risk by offering a range of loan products with varying interest rate structures, including fixed-rate and adjustable-rate loans. This allows homeowners to choose the option that best suits their financial situation and risk tolerance.

- Shifting Consumer Preferences: Consumer preferences are constantly evolving. Hearth could adapt by offering financing options for emerging home improvement trends, such as sustainable living, smart home technology, and outdoor living spaces. This could involve partnering with contractors specializing in these areas to offer bundled financing packages.

- Regulatory Changes: The financial services industry is subject to ongoing regulatory changes. Hearth must ensure compliance with all applicable laws and regulations. This could involve investing in compliance technology and training its staff to stay abreast of the latest developments.

Descriptive Illustration of a Future Hearth Platform Feature, How does hearth financing work

Imagine a future Hearth platform feature called “Project Harmony.” This feature utilizes AI to provide homeowners with a seamless and integrated home improvement financing experience.

Project Harmony operates as follows:

- Project Planning: Homeowners can input details about their desired home improvement project, including the scope of work, budget, and desired timeline. The platform, powered by AI, analyzes this information and suggests qualified contractors in their area. It also provides estimated project costs based on current market data, helping homeowners to create a realistic budget.

- Contractor Matching: Hearth’s AI algorithm matches homeowners with contractors based on their project needs, budget, and location. It also considers contractor reviews, ratings, and project history to ensure a good fit. The platform offers homeowners detailed profiles of each contractor, including examples of their work and customer testimonials.

- Instant Loan Approval: Once a homeowner selects a contractor and project details are finalized, Project Harmony provides instant loan approval. The AI-powered engine analyzes the homeowner’s financial information and offers tailored loan options, including interest rates, repayment terms, and loan amounts.

- Project Management: The platform provides project management tools to track the project’s progress. Homeowners can communicate with their contractor, view invoices, and monitor payment schedules. AI-powered alerts notify homeowners of important milestones, potential delays, and payment reminders.

- Post-Project Analysis: After the project is completed, the platform provides a summary of the project, including the final cost, the contractor’s performance, and the homeowner’s overall satisfaction. It also offers homeowners the opportunity to leave reviews and testimonials, which helps other homeowners in the future.

Illustration of the interface:

The interface would feature a clean and intuitive design, with a central dashboard displaying the homeowner’s project status. Interactive maps would highlight local contractors, with detailed profiles accessible via a simple click. The platform would use visual aids, such as progress bars and charts, to illustrate project milestones and payment schedules. The platform would also include a secure messaging system for communication with the contractor and Hearth’s support team.

Benefit of Project Harmony:

This feature streamlines the entire home improvement process, from project planning to completion. It saves homeowners time and effort, reduces stress, and increases the likelihood of a successful and satisfying home improvement experience. It fosters a collaborative environment between homeowners, contractors, and Hearth, improving the overall efficiency and transparency of the financing process.