Overview of Travel Insurance Reviews

Online reviews of international travel insurance offer a mixed bag of experiences. While many praise the peace of mind provided by comprehensive coverage, others express frustration with confusing policies, high premiums, or inadequate customer service. Understanding these common themes helps potential travelers make informed decisions when choosing a policy.

A thorough analysis of these reviews reveals recurring patterns in customer feedback, allowing us to pinpoint both the strengths and weaknesses of various travel insurance options. By dissecting the positive and negative aspects of different insurance providers, we can gain a clearer picture of the overall quality of international travel insurance.

Common Themes in Travel Insurance Reviews

International travel insurance reviews frequently highlight the importance of comprehensive coverage for medical emergencies, trip cancellations, and lost luggage. However, the specific inclusions and exclusions often vary considerably between policies. Understanding these variations is crucial for making an informed decision.

Strengths and Weaknesses of Travel Insurance Coverage

| Aspect | Strengths | Weaknesses |

|---|---|---|

| Coverage | Comprehensive medical coverage, including emergency evacuation and repatriation, is a significant strength. Many policies also provide adequate coverage for trip cancellations, delays, and lost luggage. Specific coverage for pre-existing conditions is also a plus for some policies. | Some policies have limitations on pre-existing conditions, potentially excluding critical coverage for travelers with health concerns. The scope of coverage for unforeseen events may not be detailed enough for specific situations. Coverage for adventure activities may be excluded or limited. |

| Price | A range of policies cater to different budgets, allowing travelers to choose a plan that matches their needs and financial constraints. Discounts for multiple travelers or for purchasing policies in advance can help reduce the overall cost. | Premiums can be significantly high, especially for comprehensive coverage. There’s often a lack of transparency in pricing structures, making it challenging to compare policies effectively. Hidden fees or deductibles can add to the overall cost. |

| Customer Service | Some providers receive praise for their responsive and helpful customer service teams, providing quick and effective assistance in resolving claims. Excellent customer service is crucial for a smooth claim process. | Many reviewers express dissatisfaction with slow claim processing times, unhelpful customer service representatives, or inadequate communication throughout the claims process. A lack of clarity in policy terms and conditions can also lead to difficulties during claims. |

Factors to Consider When Choosing a Policy

Evaluating your specific travel needs and budget is paramount. Consider the type of trip, the duration, the destination, and your personal health status. This will help you determine the level of coverage you require. Reading reviews from other travelers who have similar itineraries and health conditions can provide valuable insights. Thoroughly compare the policy documents to understand exclusions and limitations before purchasing.

Coverage Comparison Across Providers

Inf travel insurance reviews – Choosing the right international travel insurance can be tricky. Different providers offer varying levels of coverage, and understanding these nuances is crucial for a smooth trip. This section dives into the commonalities and discrepancies in coverage across various providers, based on user reviews, to help you make an informed decision.

Medical Expense Coverage Differences

Medical emergencies abroad can be costly. Reviews consistently highlight significant disparities in medical expense coverage among providers. Some policies have high daily limits, extensive pre-authorization requirements, or exclusions for pre-existing conditions, while others offer more flexible and comprehensive coverage.

Trip Cancellation and Interruption Coverage

Unexpected events can disrupt travel plans. Policies vary considerably in trip cancellation and interruption coverage. Reviews show that some providers have stringent clauses regarding the reasons for cancellation, potentially leaving travelers with limited or no reimbursement. Other policies offer broader coverage for a wider range of unforeseen circumstances.

Baggage Loss and Delay Coverage

Lost or delayed baggage can be extremely frustrating. Reviews reveal that the coverage for baggage loss and delay varies greatly. Some policies provide reimbursement for only the immediate cost of replacing essentials, while others cover a broader range of items, including electronics and clothing.

Specific Coverage Examples and Exclusions

User experiences paint a clear picture of the varying degrees of coverage. For example, a traveler requiring extensive medical care during a trip might find that some policies only cover a fraction of the costs, while others offer significantly broader protection. Similarly, a sudden illness forcing a trip cancellation might be fully covered by one policy but not another.

Table of Coverage Comparison

| Provider | Medical Expenses | Trip Cancellation | Baggage Loss | Specific Example |

|---|---|---|---|---|

| Company A | High daily limit, excludes pre-existing conditions | Covers cancellations due to severe illness, but with strict waiting periods | Replaces lost items up to a specific value | Traveler with pre-existing condition needing emergency surgery abroad might face limited coverage. |

| Company B | Flexible daily limit, comprehensive coverage | Covers a broader range of cancellations, including natural disasters | Replaces a wider range of lost items, including electronics and clothing | A traveler who needs to cancel a trip due to a sudden family emergency could find better coverage with this policy. |

| Company C | Moderate daily limit, some pre-existing condition exclusions | Covers cancellations due to severe illness or injury | Covers lost baggage up to a reasonable amount, excluding expensive items | A traveler who lost their camera and laptop during a trip may have limited coverage with this option. |

Customer Service Experiences: Inf Travel Insurance Reviews

Beyond the coverage and price, the quality of customer service plays a crucial role in a travel insurance policy’s value. Customer reviews often reveal significant differences in how providers handle claims, which can range from smooth and efficient to frustrating and time-consuming. Understanding these experiences is essential for making an informed decision.

I’ve been digging into INF travel insurance reviews lately, and one thing that keeps popping up is the question of whether Thrifty Traveler Premium is worth the price. If you’re considering it, definitely check out this insightful piece on is thrifty traveler premium worth it. Ultimately, the best travel insurance depends on your specific needs and budget, and INF reviews often highlight that fact.

It’s good to compare different options before you commit.

Common Customer Service Experiences

Across various travel insurance providers, customer service experiences exhibit a wide spectrum. Some customers praise the promptness and helpfulness of representatives, while others report frustrating delays and unhelpful interactions. The handling of claims is a key area of concern, with reviews frequently highlighting both positive and negative experiences.

Recurring Issues with Claims Processing

A recurring issue in travel insurance claims processing is the length of time it takes to receive a response or a final decision. Some users report delays of several weeks or even months, creating significant stress and inconvenience during a potentially already challenging situation. This delay can stem from various factors, including complex documentation requirements, lengthy internal review processes, and sometimes, simply insufficient staff resources.

Resolution Times and Customer Service Tone

Resolution times vary considerably among providers, with some demonstrating a demonstrably faster turnaround than others. The tone of customer service representatives is another significant factor. Positive reviews often cite helpful, understanding, and patient representatives who guide customers through the process. Conversely, negative reviews frequently describe representatives as unhelpful, unhelpful, or dismissive. This can significantly impact the customer experience, regardless of the outcome of the claim.

Categorized Customer Service Experiences

| Provider | Claim Process | Resolution Time | Customer Service Tone |

|---|---|---|---|

| Provider A | Generally smooth, clear communication | Average resolution time: 2-4 weeks | Helpful, patient, and professional |

| Provider B | Complex documentation requirements, slow initial response | Average resolution time: 6-8 weeks | Dismissive, unhelpful, or lack of empathy |

| Provider C | Straightforward, easily accessible forms | Average resolution time: 3-5 weeks | Helpful, but occasional delays in follow-up |

| Provider D | Inconsistent, sometimes unclear processes | Average resolution time: 4-6 weeks | Varying, some helpful, others indifferent |

Note: These are generalized observations based on aggregated reviews. Individual experiences may vary.

I’ve been looking into various travel insurance options lately, and INF travel insurance reviews seem pretty mixed. Some people rave about their coverage, while others have had negative experiences. Interestingly, I came across a travel company called ou concur travel that specializes in tailor-made trips. Maybe their services would pair well with a robust travel insurance plan like INF, ensuring comprehensive coverage for a unique and potentially challenging trip.

Overall, the INF travel insurance reviews are still a bit of a puzzle, but I’m hoping to find some more definite answers soon.

Pricing and Value Analysis

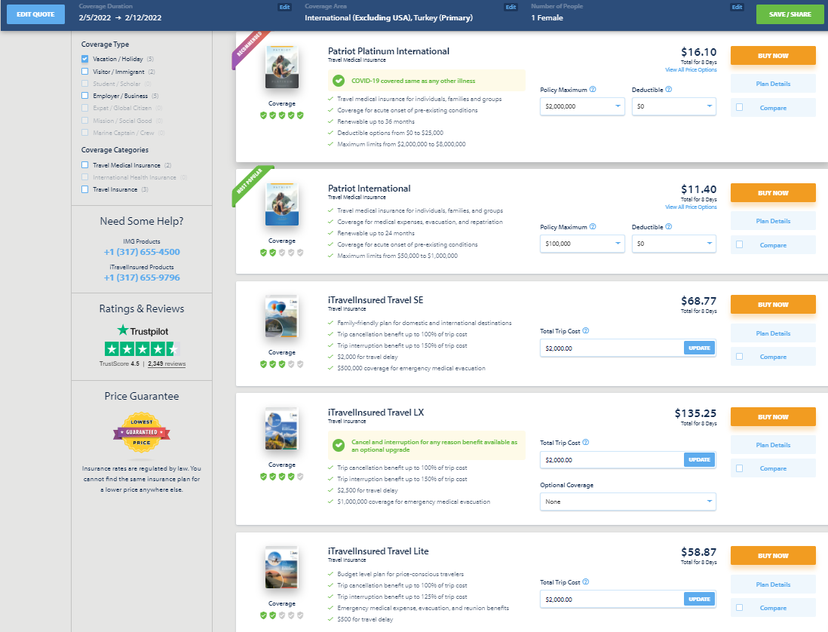

Travel insurance pricing is a complex interplay of factors, making it difficult to compare value across providers. Reviews often highlight discrepancies in pricing strategies, reflecting the diverse range of coverage options and associated costs. Understanding these factors is crucial for selecting the right policy for your needs and budget.

Different providers employ various pricing models, often influenced by factors such as the destination, trip duration, and traveler profile. Analyzing the value proposition necessitates considering the specific features and coverage levels offered. Crucially, a policy’s perceived value is subjective and depends heavily on individual needs and travel preferences.

Pricing Strategies Across Providers

User reviews consistently reveal variations in pricing strategies among providers. Some companies emphasize comprehensive coverage at higher price points, while others offer more basic plans at lower costs. This difference in approach reflects the distinct priorities and target audiences of each provider. The pricing structure frequently reflects the risk assessment undertaken by the insurer, taking into account factors such as destination, trip length, and activities planned.

Features and Coverage Levels

The relationship between pricing and coverage is multifaceted. More comprehensive policies typically include broader coverage for medical emergencies, trip cancellations, lost luggage, and other unforeseen events. Policies with higher coverage often come with higher premiums. For example, a policy that covers pre-existing conditions may command a higher price than one that excludes them. Travel insurance is not a one-size-fits-all solution. Careful consideration of specific needs is essential for achieving optimal value.

Value Proposition for Different Budgets and Travel Styles

The value proposition for travel insurance varies significantly depending on individual budgets and travel styles. Budget travelers may find basic plans sufficient for covering essential aspects like medical emergencies, while those with more extravagant travel plans may require extensive coverage for trip cancellations or lost luggage. A comprehensive analysis should evaluate the costs against the benefits. For example, a family traveling with young children might value enhanced coverage for medical emergencies.

Structured Comparison of Pricing Models, Features, and Value

| Provider | Price | Coverage Level | Value Proposition |

|---|---|---|---|

| Company A | $150 – $300 | Basic coverage for medical emergencies, trip cancellations, and lost luggage | Suitable for budget travelers seeking essential coverage. |

| Company B | $250 – $500 | Comprehensive coverage including pre-existing conditions, trip cancellations, and emergency medical evacuation | Ideal for travelers with higher budgets who require extensive protection. |

| Company C | $100 – $200 | Limited coverage for medical emergencies, but with exclusions for pre-existing conditions. | Good for travelers seeking basic protection but with potential limitations. |

Specific Claims and Issues

Navigating the complexities of international travel can be fraught with unexpected challenges. Travel insurance, while meant to provide a safety net, sometimes falls short in fulfilling its promise. Reviews frequently highlight specific claims and issues, revealing areas where insurance providers might need to improve their processes and policies. Understanding these recurring problems allows travelers to make more informed decisions when choosing a policy.

This section dives into common claims and issues, analyzing how users articulate these problems within their reviews. We will examine the specific circumstances leading to these issues and provide a collection of claim examples, along with the reported resolutions, offering a clearer picture of the realities of international travel insurance claims.

Common Claim Types

Travel insurance policies, despite their comprehensive nature, frequently encounter issues in specific areas. This section examines the most common types of claims raised in reviews. These range from straightforward medical emergencies to more nuanced issues concerning trip cancellations or delays.

Examples of Specific Claims and Resolutions

| Claim Type | Description | Resolution |

|---|---|---|

| Medical Expenses | A traveler in Southeast Asia experienced a sudden and severe illness requiring hospitalization. The insurance policy covered the costs, but there were delays in processing the claim. The review detailed a frustrating wait and multiple follow-up calls to the insurance company. | The insurance company eventually paid the medical expenses but the lengthy processing time was a significant complaint. |

| Trip Cancellation | A family’s trip to Europe was canceled due to unforeseen circumstances. Their reviews detailed how the insurance company was slow to process the cancellation claim and offered only a partial reimbursement for prepaid trip expenses. | The family received a partial refund after numerous attempts to contact customer service and escalating the issue. |

| Lost Luggage | A traveler’s luggage was lost during a layover in Europe. The review emphasized the lack of clear guidelines regarding lost luggage procedures. The claim process was convoluted, and the reimbursement was insufficient to cover the replacement costs. | The traveler received a minimal amount of compensation that did not cover the full cost of replacement items. The review noted the lack of communication and support throughout the claim process. |

| Emergency Evacuation | A traveler experienced a serious medical emergency while traveling in South America. The review highlighted the insurance company’s prompt assistance in arranging emergency evacuation. However, the traveler felt the process of obtaining necessary approvals for the evacuation was time-consuming. | The company successfully arranged evacuation but the review expressed concerns about the administrative burden and bureaucratic procedures involved. |

| Travel Delay | A traveler encountered a significant flight delay due to weather conditions, impacting their itinerary. The review noted the lack of coverage for additional expenses incurred due to the delay, like accommodation and meals. | The insurance company did not provide any coverage for additional expenses incurred due to the delay. |

Review Reliability and Bias

Navigating the online world of travel insurance reviews can be tricky. While user reviews offer valuable insights, they’re not always objective. Understanding the potential biases and limitations inherent in these reviews is crucial for making informed decisions. A seemingly positive review might be skewed by a particular user experience, and a negative one might reflect a specific, isolated incident. This section delves into the nuances of review reliability, examining how context and user experience shape opinions and offering strategies to evaluate reviews critically.

Review reliability is significantly influenced by the reviewer’s personal circumstances and expectations. Factors like the specific travel plans, pre-existing conditions, or the level of service encountered can dramatically impact a review. This subjectivity necessitates a cautious approach when evaluating the overall picture.

Identifying Potential Biases, Inf travel insurance reviews

User reviews are often influenced by personal experiences and individual perspectives. A positive experience with a specific insurance provider might lead to a glowing review, while a negative interaction could result in a harsh assessment. This personal element can overshadow the broader picture of the provider’s service.

- Pre-existing Conditions: A traveler with pre-existing medical conditions might have a significantly different experience with coverage than one without. A review focusing on the lack of coverage for a specific condition should be considered in the context of the reviewer’s situation.

- Travel Complexity: The complexity of a traveler’s itinerary (e.g., a multi-country trip with numerous activities) might affect their experience. A simple trip might yield a more concise and less complex review compared to a lengthy and extensive journey.

- Service Interactions: The speed and quality of customer service during a claim process can significantly influence a review. A smooth claim process might result in a positive review, whereas a frustrating one could lead to a negative assessment.

Review Context and User Experience

The context surrounding a review is critical. Consider the circumstances surrounding the review. For example, a reviewer experiencing a sudden illness during a trip might have a more intense emotional reaction, influencing the review’s tone and content.

“My flight was delayed, and the insurance company was absolutely useless. They didn’t even respond to my calls.”

This quote, while negative, might not reflect the company’s typical service quality. The reviewer’s experience with the delay might have overshadowed their experience with the company in other contexts.

“I had a wonderful trip, and the insurance covered everything. I’m so glad I had this coverage.”

This positive review might reflect a straightforward and uncomplicated experience. However, the reviewer might not have encountered a challenging scenario that might test the provider’s resilience.

Evaluating Review Reliability

Multiple reviews, especially those from various users, offer a more comprehensive picture. Look for consistency in the positive and negative feedback. Reviews that deviate significantly from the overall trend should be examined cautiously. The number of reviews also contributes to the overall reliability.

- Look for consistency: Are positive reviews consistently praising the same aspects? Are negative reviews consistently focused on the same issues?

- Consider review date: Older reviews might not reflect current policies or practices. Newer reviews provide a more up-to-date picture.

- Analyze reviewer demographics: Are the reviews primarily from a specific group of travelers (e.g., budget travelers)?

Differentiating Valid from Misleading Reviews

Determining the validity of a review requires careful consideration of the reviewer’s experience and the context surrounding the review. Look for evidence of factual claims, and compare them to other reviews and the provider’s official information. Review the entire context, and avoid drawing conclusions based on isolated incidents.

Travel Insurance Selection Strategies

Choosing the right travel insurance can be daunting, with countless providers and policies vying for your attention. Understanding your needs and comparing policies effectively is crucial to securing the best protection for your trip. This section provides a structured approach to help you navigate the selection process.

Identifying Your Specific Needs

Travel insurance policies are designed to address various potential issues, from medical emergencies to trip cancellations. To choose the right policy, carefully consider your travel plans and personal circumstances. Think about the destinations you’ll be visiting, the duration of your trip, and your planned activities. Are you traveling to a remote area with limited access to healthcare? Do you have pre-existing medical conditions? Consider these factors when evaluating potential policies.

Creating a Checklist of Key Factors

A comprehensive checklist ensures you don’t overlook critical elements when comparing policies. This checklist will serve as your guide, ensuring you don’t miss vital details when comparing different policies.

- Coverage amounts for medical expenses, trip cancellations, and lost luggage.

- Specific exclusions and limitations on coverage.

- Details on the claims process, including required documentation and timeframes.

- The reputation and financial stability of the insurance provider, as evidenced by industry ratings and reviews.

- Customer service contact information and availability.

- Policy cancellation and refund options.

Evaluating Different Policies

This process involves systematically comparing different policies based on your needs and the checklist. A structured approach will help you make an informed decision.

- Review Coverage Details: Compare the specific coverage options offered by different providers. Pay close attention to the scope of medical coverage, cancellation/interruption benefits, and baggage protection.

- Analyze Policy Exclusions: Carefully scrutinize the exclusions and limitations of each policy. Understanding what isn’t covered is as important as what is.

- Compare Pricing and Value: Consider the cost of the policy relative to the coverage offered. Don’t just look at the price; evaluate the value proposition.

- Assess Customer Service Reputation: Check customer reviews and testimonials to gauge the provider’s responsiveness and efficiency in handling claims.

- Verify Claims Process: Understand the claims process and required documentation for each policy. A transparent and efficient claims process can save you time and effort in the event of a claim.

Questions to Ask Yourself

Evaluating a policy involves introspection and careful consideration of your specific circumstances.

- Can I afford the policy premium, and does the coverage align with my budget?

- Does the policy offer adequate protection for the activities I plan to undertake during my trip?

- What are the potential risks and challenges I might encounter during my travel, and does the policy provide sufficient coverage for those situations?

- Does the policy’s cancellation and interruption coverage align with my trip’s critical dates and itinerary?

- Do I need supplemental coverage, like travel assistance or emergency evacuation, beyond the standard policy?