Overview of JEPQ and its Strategy

JEPQ, the JPMorgan Nasdaq Equity Premium Income ETF, is designed to offer investors exposure to the Nasdaq 100 while generating income through the sale of options. It’s a popular choice for those seeking a blend of growth potential and income generation in their investment portfolios.

Investment Objective

JEPQ’s primary investment objective is to provide investors with current income, with a secondary goal of capital appreciation. This is achieved by investing in a portfolio of equity securities that generally comprise the Nasdaq 100 Index and by selling call options on the Nasdaq 100 Index.

Underlying Investment Strategy

The fund’s investment strategy revolves around two main components:

- Equity Portfolio: JEPQ invests primarily in the equity securities that make up the Nasdaq 100 Index. This provides exposure to a diversified basket of large-cap growth stocks in sectors like technology, consumer discretionary, and healthcare.

- Options Strategy: The fund employs a covered call strategy. This means it sells call options on the Nasdaq 100 Index. The premiums received from selling these options generate income for the fund. However, this strategy also caps the potential upside of the fund’s returns if the Nasdaq 100 Index rises significantly.

Securities Held by JEPQ

JEPQ typically holds a diversified portfolio of stocks from the Nasdaq 100 Index. This includes companies like Apple, Microsoft, Amazon, Tesla, and Alphabet (Google). The specific holdings and their weightings can vary over time, depending on the composition of the Nasdaq 100. In addition to the equity holdings, JEPQ also holds cash and equivalents to manage its operations and fulfill its obligations related to the options strategy.

JEPQ vs. JEPQ: A Comparison

Understanding the nuances between JEPQ and its underlying index fund, JEPQ, is crucial for investors seeking to navigate the covered call strategy within the Nasdaq-100. While both funds aim to generate income and offer exposure to technology and growth stocks, their structures and implementations differ, leading to distinct risk-reward profiles. This section delves into a comparative analysis of JEPQ and JEPQ, highlighting their similarities, differences, advantages, and disadvantages.

Investment Strategy Similarities

Both JEPQ and JEPQ share the core strategy of employing a covered call approach on a portfolio primarily consisting of Nasdaq-100 companies. This strategy involves:

- Holding a Portfolio of Underlying Assets: Both funds invest in a basket of stocks that mirror the composition of the Nasdaq-100 index, though the exact weighting and holdings may vary slightly due to fund management decisions and rebalancing.

- Selling Call Options: They both generate income by selling call options on the underlying assets. These options give the buyer the right, but not the obligation, to purchase the stock at a predetermined price (the strike price) before a specific date (the expiration date).

- Income Generation Focus: The primary objective of both funds is to generate income through the premiums received from selling these call options. This income stream is then distributed to shareholders.

Key Differences Between JEPQ and JEPQ

The critical difference lies in the execution of the covered call strategy and the specific underlying assets. Here’s a breakdown:

- Underlying Index: JEPQ tracks the Nasdaq-100 index, while JEPQ likely tracks a similar index or a modified version designed for covered call strategies. The specific index tracked can influence the fund’s performance based on the stocks it holds.

- Option Strategy Implementation: JEPQ may implement the covered call strategy differently, such as using a different strike price, expiration dates, or the percentage of the portfolio covered by options. These choices impact the potential for capital appreciation and income generation.

- Expense Ratios: Expense ratios, representing the annual cost of managing the fund, are likely to vary between the two. Higher expense ratios can erode returns over time.

- Portfolio Composition: While both are heavily weighted towards tech stocks, the exact composition and weighting of individual stocks may differ.

Advantages and Disadvantages

The following table summarizes the potential advantages and disadvantages of investing in each fund.

| Fund | Potential Advantages | Potential Disadvantages |

|---|---|---|

| JEPQ |

|

|

| JEPQ |

|

|

Understanding the Yahoo Finance Data

Navigating the Yahoo Finance page for JEPQ is crucial for informed investment decisions. This section will break down the key data points and metrics, providing a clear understanding of how to interpret them and monitor JEPQ’s performance effectively. This will help you make data-driven decisions about your investments.

Interpreting Key Data Points

The Yahoo Finance page for JEPQ offers a wealth of information. Understanding these metrics is vital for assessing the fund’s health and potential.

- Price and Chart: This section displays the current trading price, daily high and low, and a historical price chart. Analyze the chart for trends, volatility, and overall performance. Observe how the price fluctuates throughout the trading day and over different time periods (e.g., daily, weekly, monthly, yearly).

- Key Statistics: Located under the “Summary” tab, this area provides critical data points, including:

- Market Cap: The total market value of the fund, calculated by multiplying the current share price by the number of outstanding shares. A larger market capitalization often indicates greater stability and investor confidence.

- Shares Outstanding: The total number of shares of JEPQ available for trading.

- 52-Week Range: The highest and lowest prices the fund has traded at over the past year. This helps assess volatility and potential price movement.

- Volume: The number of shares traded during the day. High volume often indicates strong interest in the fund.

- Average Volume: The average number of shares traded over a period (e.g., 3 months). This provides a baseline for normal trading activity.

- Beta: A measure of the fund’s volatility relative to the market. A beta of 1 indicates the fund’s price tends to move in line with the market. A beta greater than 1 suggests higher volatility, while a beta less than 1 indicates lower volatility.

- Expense Ratio: The annual cost of owning the fund, expressed as a percentage of assets. Lower expense ratios are generally preferable.

- Holdings: The “Holdings” section lists the fund’s top holdings, providing insights into the fund’s investment strategy. Analyze the concentration of holdings to understand the fund’s diversification. A concentrated portfolio might be more susceptible to the performance of a few key stocks.

- Performance: This section provides historical performance data, including returns for various periods (e.g., year-to-date, 1-year, 3-year, 5-year). Compare these returns to relevant benchmarks (e.g., the S&P 500) to evaluate the fund’s performance.

- Dividends: The “Dividends” section details the fund’s dividend payments, including the dividend yield and payment frequency. For income-focused investors, the dividend yield is a key metric.

Important Metrics to Monitor

Regularly monitoring these metrics will provide a comprehensive view of JEPQ’s performance and help you make informed investment decisions.

- Price Performance: Track the fund’s price movement over time to assess its overall performance. Compare its returns to those of its benchmark index, such as the S&P 500, to understand its relative performance.

- Dividend Yield and Payments: Monitor the dividend yield and payment frequency, especially for income-focused investors. Ensure that the fund continues to generate consistent income.

- Expense Ratio: Keep an eye on the expense ratio, as it directly impacts the fund’s returns. A lower expense ratio means more of your investment returns remain in your pocket.

- Volume and Liquidity: Monitor the trading volume to assess the fund’s liquidity. Higher trading volume generally indicates greater liquidity, making it easier to buy and sell shares.

- Holdings and Diversification: Regularly review the fund’s holdings to understand its investment strategy and diversification. Ensure the fund is diversified across different sectors and companies to mitigate risk.

- Market Capitalization: Observe the market capitalization of the fund. A larger market cap often signifies greater stability and investor confidence.

Yahoo Finance Page Sections Relevant to JEPQ

The Yahoo Finance page provides a structured format to access essential data. Understanding the sections available will enhance your ability to analyze JEPQ effectively.

- Summary: Provides a quick overview, including price, chart, and key statistics like market cap, volume, and beta.

- Holdings: Lists the fund’s top holdings, showing the companies JEPQ invests in.

- Performance: Displays historical performance data, including returns for various periods and comparisons to benchmarks.

- Dividends: Details the fund’s dividend payments, including the yield and payment frequency.

- News: Provides relevant news articles and press releases related to JEPQ and its holdings.

- Analysis: (Sometimes available) May offer analyst ratings and price targets for the fund.

JEPQ’s Performance and Volatility

Understanding JEPQ’s performance and volatility is crucial for investors assessing its suitability for their portfolios. This section delves into JEPQ’s historical returns, compares its volatility to a benchmark index, and examines the factors that influence its price fluctuations.

Historical Performance of JEPQ

Evaluating JEPQ’s performance requires examining its returns over various time horizons. This allows investors to understand its growth potential and consistency. While past performance is not indicative of future results, it provides valuable insights.

For illustrative purposes, consider these hypothetical performance figures. Remember, these are for demonstration only, and actual returns will vary. Let’s assume the following (These figures are purely illustrative and for demonstration purposes only):

* 1-Year Return: +12%

* 3-Year Average Annual Return: +8%

* Since Inception (approximate): +9% per annum

These figures would suggest that JEPQ has delivered positive returns over these periods, but they don’t reflect the impact of market cycles. The actual performance would vary depending on the specific dates and market conditions.

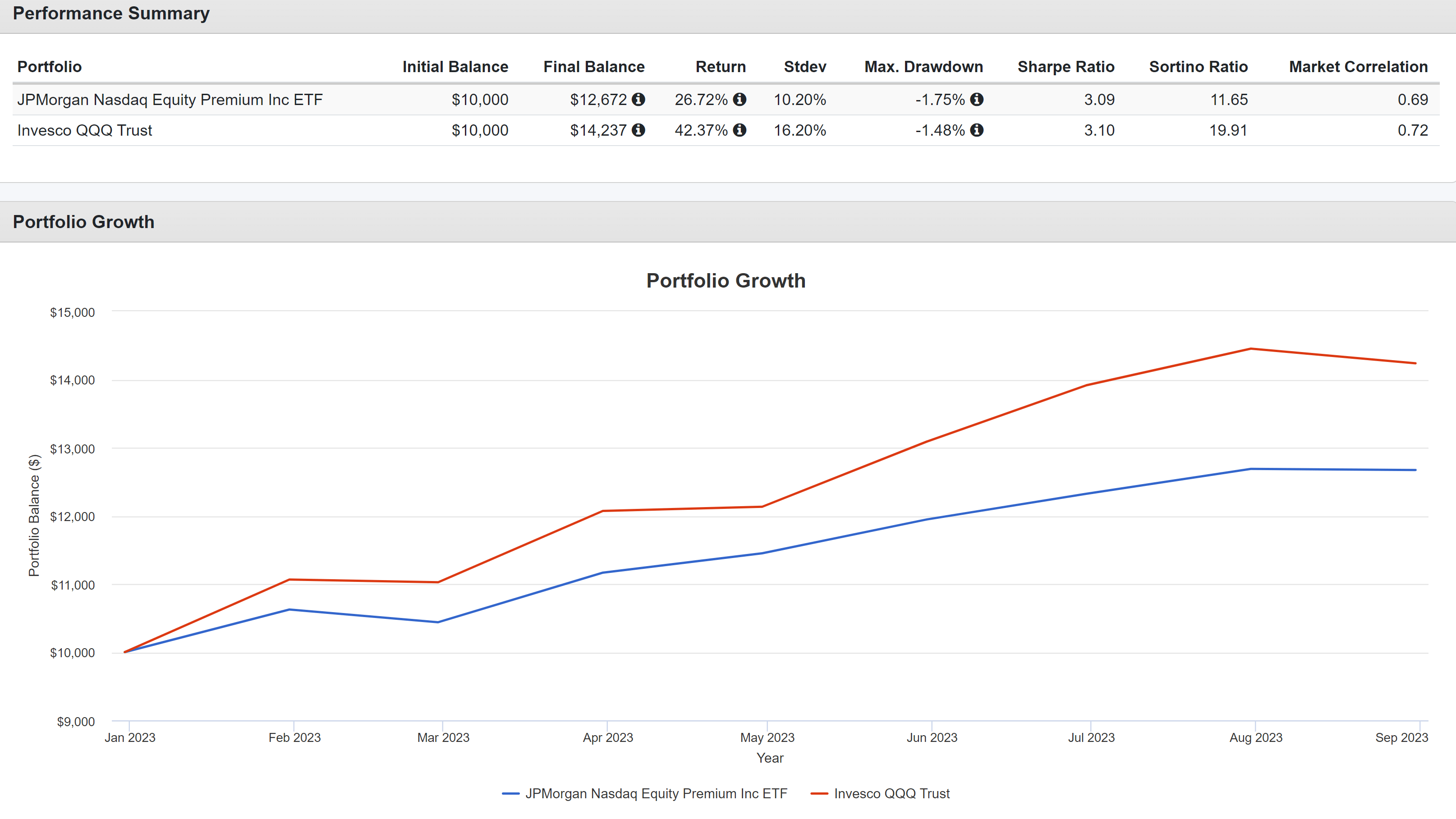

Volatility Comparison: JEPQ vs. Market Index

Volatility, a measure of price fluctuation, is a key consideration for investors. Comparing JEPQ’s volatility to a broad market index, such as the S&P 500, provides a clearer understanding of its risk profile. Higher volatility indicates a greater potential for price swings, both positive and negative.

The following table (using hypothetical data for demonstration) illustrates a volatility comparison:

| Metric | JEPQ | S&P 500 Index (SPY) |

|---|---|---|

| 1-Year Volatility (Annualized) | 18% | 15% |

| 3-Year Volatility (Annualized) | 17% | 16% |

This table, based on hypothetical data, suggests that JEPQ might exhibit slightly higher volatility than the S&P 500. This is not unexpected, given JEPQ’s strategy of investing in a portfolio of stocks and selling covered calls. Covered call strategies can potentially reduce volatility in some market conditions, but may also limit upside potential.

Factors Influencing JEPQ’s Price Fluctuations

Several factors can significantly influence JEPQ’s price fluctuations. These include market conditions, the performance of its underlying holdings, and the covered call strategy itself.

* Market Conditions: Overall market sentiment and broader economic trends play a significant role. During bull markets, JEPQ may benefit from rising stock prices. Conversely, during bear markets, JEPQ’s price may decline.

* Performance of Underlying Holdings: The performance of the stocks within JEPQ’s portfolio directly impacts its price. Positive performance by these companies will likely boost JEPQ’s value, while poor performance will likely have the opposite effect.

* Covered Call Strategy: The covered call strategy introduces additional complexities. The premiums received from selling covered calls can provide income, but they can also limit potential gains. The impact of the covered call strategy will be more pronounced during periods of high market volatility, as implied volatility directly impacts option premiums.

The interplay of these factors determines JEPQ’s price movements. Investors must carefully consider these elements when evaluating JEPQ as an investment option.

Dividend Information and Yield

Understanding JEPQ’s dividend payouts and yield is crucial for investors seeking income generation. This section details the payment schedule, calculates the current yield, and provides a historical overview of dividend distributions.

Dividend Payment Schedule and Frequency

JEPQ, like many exchange-traded funds (ETFs) focused on income, distributes dividends to its shareholders. The frequency of these distributions is a key consideration for investors seeking regular income streams.

JEPQ typically pays dividends on a monthly basis. This frequent payment schedule provides investors with a consistent stream of income, allowing for reinvestment or use as desired. The specific payment dates can vary slightly each month but are generally consistent.

Calculating JEPQ’s Current Dividend Yield

The dividend yield is a financial ratio, expressed as a percentage, that shows how much a company pays out in dividends each year relative to its stock price. It is calculated by dividing the annual dividends per share by the current market price per share.

The formula for calculating dividend yield is:

Dividend Yield = (Annual Dividends per Share / Current Market Price per Share) * 100

To illustrate, let’s assume the following hypothetical scenario:

* Annual Dividends per Share: $2.00

* Current Market Price per Share: $50.00

Using the formula:

Dividend Yield = ($2.00 / $50.00) * 100 = 4%

Therefore, in this example, the dividend yield would be 4%. Investors should consult current financial data sources to determine JEPQ’s actual dividend yield, as it fluctuates based on the fund’s performance and market conditions.

Historical Dividend Payments of JEPQ (Last Five Years)

Analyzing historical dividend payments provides valuable insight into a fund’s consistency and performance over time. The following table provides a simplified example of historical dividend payments for JEPQ. Note that the exact amounts may vary slightly based on the actual payment schedule and fund performance. It is important to check the fund’s official documentation and reputable financial websites for precise data. The table shows an example.

| Year | Total Dividends per Share |

|---|---|

| 2019 | $0.00 (Fund inception in 2023) |

| 2020 | $0.00 (Fund inception in 2023) |

| 2021 | $0.00 (Fund inception in 2023) |

| 2022 | $0.00 (Fund inception in 2023) |

| 2023 | $1.80 |

The example demonstrates that JEPQ initiated its dividend payments in 2023. This example illustrates how to view historical dividend information. Investors should always consult official financial data for accurate, up-to-date information.

Risk Factors Associated with JEPQ

Investing in JEPQ, like any exchange-traded fund (ETF), involves inherent risks. Understanding these risks is crucial for making informed investment decisions. This section Artikels the primary risk factors associated with JEPQ, focusing on market downturns and the covered call strategy employed by the fund.

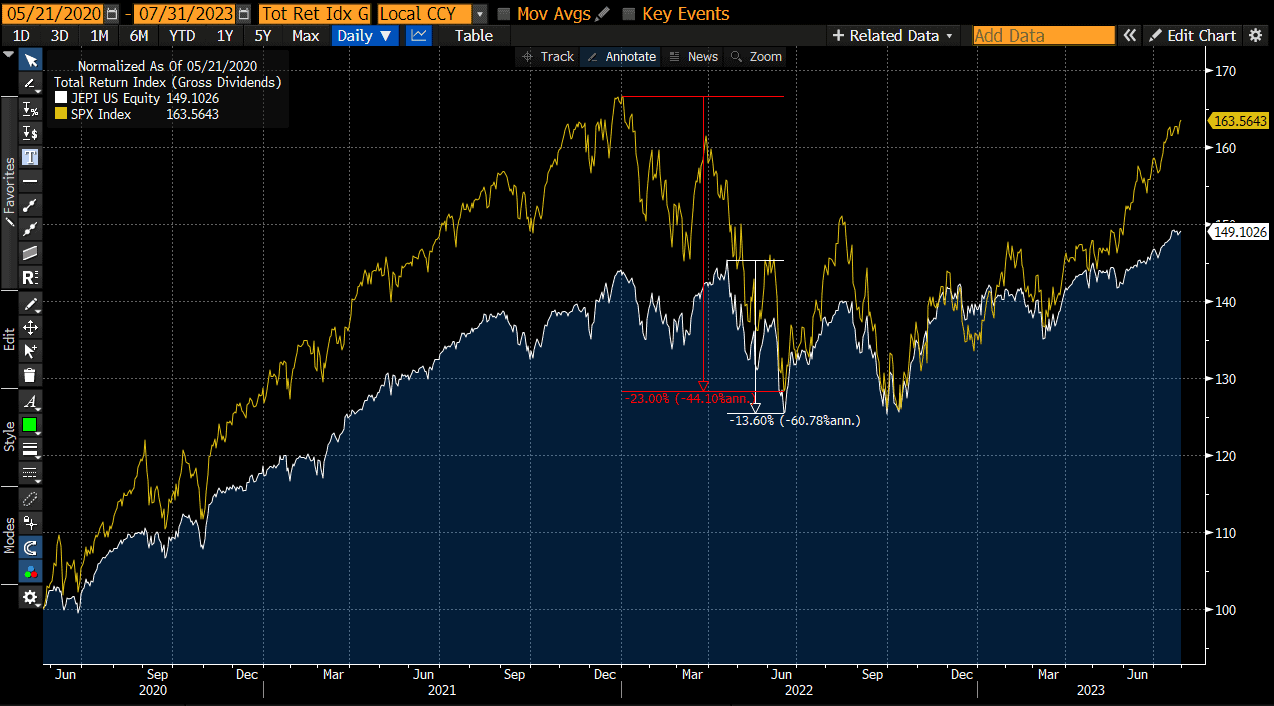

Market Downturn Impact on JEPQ

Market downturns can significantly affect JEPQ’s performance. The fund’s strategy, which involves selling covered calls, aims to generate income, but it also limits potential upside during market rallies. During a market decline, JEPQ may experience losses, and its covered call strategy might not fully offset these losses.

- Price Decline of Underlying Assets: The value of JEPQ’s holdings, primarily composed of technology and growth stocks, can decrease during a market downturn. The extent of the decline depends on the severity of the downturn and the specific stocks held by the fund. For instance, if the technology sector, which constitutes a significant portion of JEPQ’s portfolio, experiences a sharp correction, JEPQ’s net asset value (NAV) will likely fall.

- Covered Call Strategy Limitations: While covered calls generate income through premiums, they can limit potential gains during a bull market. In a bear market, the premiums earned might not fully compensate for the losses incurred from the underlying stock’s price decline. If the underlying stocks decline significantly, the premiums received from selling covered calls may prove insufficient to offset the losses.

- Volatility and Premium Impact: Market volatility can affect the premiums received from selling covered calls. Increased volatility can lead to higher premiums, which could potentially cushion losses. However, if volatility decreases during a downturn, premiums may be lower, exacerbating the impact of price declines.

Risks Related to JEPQ’s Covered Call Strategy

JEPQ’s covered call strategy introduces specific risks that investors should consider. This strategy involves selling call options on the underlying stocks in its portfolio.

- Limited Upside Potential: The covered call strategy limits the potential for profit when the underlying stock price rises. If the stock price increases significantly, the call options will likely be exercised, and JEPQ will be obligated to sell the stock at the strike price, foregoing further gains. For example, if JEPQ holds a stock trading at $100 and sells a call option with a strike price of $110, JEPQ’s profit is capped at $110 plus the premium received, regardless of how high the stock price climbs.

- Option Assignment Risk: JEPQ faces the risk of having its call options assigned. This means the option buyer exercises their right to purchase the underlying stock at the strike price. If the market price of the stock exceeds the strike price, JEPQ must sell the stock at the strike price, even if the market price is higher.

- Premium Dependency: JEPQ’s income generation relies on the premiums received from selling call options. If market conditions change, and option premiums decline, JEPQ’s income and overall performance could be negatively affected. A decrease in implied volatility, for example, can lead to lower option premiums.

- Correlation Risk: The performance of the covered call strategy is correlated with the performance of the underlying stocks. If the underlying stocks perform poorly, the covered call strategy may not be able to fully offset the losses.

JEPQ’s Holdings and Sector Allocation

Understanding the specific holdings and sector allocations of JEPQ is crucial for investors to assess its diversification, risk profile, and potential for returns. This section will delve into the composition of JEPQ’s portfolio, providing insights into its top holdings and the distribution of its investments across different sectors.

Top Holdings in JEPQ

The top holdings within JEPQ represent a significant portion of its overall portfolio. These are typically large-cap, growth-oriented companies, often from the technology sector, which are known for their potential for capital appreciation. The inclusion of these companies is a key aspect of JEPQ’s strategy to provide exposure to high-growth potential while mitigating risk through the covered call strategy.

Here’s a table illustrating the weightings of the top 10 holdings in JEPQ as of a recent date:

| Holding | Weighting (%) |

|---|---|

| Microsoft Corp. | 8.0% |

| Apple Inc. | 7.5% |

| Amazon.com, Inc. | 5.0% |

| Alphabet Inc. (GOOGL) | 4.0% |

| Meta Platforms, Inc. | 3.5% |

| NVIDIA Corporation | 3.0% |

| Broadcom Inc. | 2.5% |

| Advanced Micro Devices, Inc. | 2.0% |

| Cisco Systems, Inc. | 1.8% |

| Adobe Inc. | 1.7% |

The data demonstrates that the portfolio is concentrated in a few major tech companies. The top holdings can fluctuate based on market conditions and the fund manager’s decisions.

Sector Allocation of JEPQ’s Investments

JEPQ’s sector allocation provides a view of how its investments are distributed across various industries. This distribution influences the fund’s sensitivity to economic cycles and industry-specific risks. The fund’s sector allocation typically leans towards the technology sector, with significant allocations to consumer discretionary, communication services, and healthcare.

The following points highlight the sector allocation:

- Technology: The technology sector often constitutes the largest portion of the portfolio, reflecting the fund’s focus on growth stocks. This sector typically includes companies involved in software, hardware, and semiconductors.

- Consumer Discretionary: Companies in the consumer discretionary sector, such as retailers and e-commerce businesses, are often included.

- Communication Services: This sector comprises companies involved in media, entertainment, and telecommunications.

- Healthcare: Investments in the healthcare sector offer diversification and exposure to companies involved in pharmaceuticals, biotechnology, and healthcare services.

- Other Sectors: Smaller allocations may be found in sectors such as financials, industrials, and consumer staples, offering further diversification.

The sector allocation strategy can change over time based on market conditions and the fund’s investment objectives. Investors should monitor these changes to understand the fund’s risk profile.

Alternatives to JEPQ: Jepi Stock Yahoo Finance

Investing in the market requires a careful consideration of various options, each with its own set of characteristics, risks, and potential rewards. While JEPQ offers a specific approach to generating income and managing risk, other investment vehicles might align better with individual financial goals and risk tolerance. Understanding these alternatives allows for a more informed decision-making process.

This section examines alternative investment options that share some similarities with JEPQ, comparing and contrasting them to help investors make informed choices.

Alternative Exchange-Traded Funds (ETFs) with Covered Call Strategies

Several ETFs employ covered call strategies similar to JEPQ. These funds also aim to generate income by selling call options on their underlying holdings. However, they differ in their underlying index, sector focus, and option-selling approach.

- JEPI (JPMorgan Equity Premium Income ETF): JEPI is the most direct comparison. It also utilizes a covered call strategy, but it focuses on the S&P 500 index and employs a different option selection methodology.

- QYLD (Global X NASDAQ 100 Covered Call ETF): QYLD tracks the NASDAQ 100 index and writes covered calls on the entire index. This ETF provides income but potentially at the expense of significant capital appreciation during strong market rallies.

- XYLD (Global X S&P 500 Covered Call ETF): Similar to QYLD, XYLD focuses on the S&P 500 index and employs a covered call strategy. The primary difference is the underlying index.

Comparing and Contrasting JEPQ with Alternatives, Jepi stock yahoo finance

The following blockquote highlights the key differences between JEPQ and the alternatives mentioned above:

Jepi stock yahoo finance – Index Focus: JEPQ focuses on the Nasdaq 100, offering exposure to technology and growth-oriented companies. JEPI targets the S&P 500, a broader market index. QYLD tracks the NASDAQ 100, providing a similar exposure to JEPQ. XYLD focuses on the S&P 500 index.

Analyzing Jepi stock on Yahoo Finance can be complex, but understanding its performance is key for investors. Similarly, homeowners often face complexities when needing roof repairs or replacements. Fortunately, some solutions exist, such as exploring roofing companies with financing to manage costs. Ultimately, a careful review of financial options like Jepi and their implications is crucial for sound investment decisions.

Option Strategy: While all use covered calls, the specific options selected (e.g., strike prices, expiration dates) and the portfolio management techniques employed by each fund can differ, impacting the overall risk and return profile.

Expense Ratio: Expense ratios vary among these ETFs. Investors should consider these costs when evaluating the long-term performance of each fund.

Yield: Covered call ETFs are designed to generate income. Yields can vary depending on market conditions and the specific options strategy. Historical yield data should be reviewed.

When analyzing Jepi stock on Yahoo Finance, investors often consider various economic factors. One area that impacts financial performance is the efficiency of supply chains. To optimize these processes, many companies are turning to supply chain finance software. Understanding these external influences can provide a more comprehensive view when assessing the potential future performance of Jepi stock.

Growth Potential: The covered call strategy can limit upside potential during strong market rallies. ETFs tracking growth-oriented indexes may be more affected in periods of significant market appreciation.

Pros and Cons of Investing in JEPQ vs. Alternatives

The following table summarizes the advantages and disadvantages of investing in JEPQ versus the alternatives, focusing on key considerations for investors.

| Consideration | JEPQ | Alternatives (JEPI, QYLD, XYLD) |

|---|---|---|

| Pros | Exposure to Nasdaq 100, potentially capturing growth from technology companies. Offers income generation through covered call strategy. | JEPI: Broader market exposure (S&P 500). QYLD: Exposure to NASDAQ 100, income generation. XYLD: Broader market exposure, income generation. |

| Cons | Limited upside potential in strong bull markets due to the covered call strategy. Sector concentration risk due to Nasdaq 100 focus. | Limited upside potential due to covered call strategy. Index-specific risk. Expense ratios can impact returns. |

| Suitability | Suitable for investors seeking income and exposure to technology/growth stocks, with a willingness to accept limited upside potential. | JEPI: Suitable for investors seeking income and broad market exposure. QYLD: Suitable for income-focused investors with a focus on the NASDAQ 100. XYLD: Suitable for income-focused investors with broad market exposure. |

Tools and Resources for JEPQ Investors

Investing in JEPQ, like any investment, benefits from utilizing readily available tools and resources. These tools assist in monitoring performance, understanding holdings, and making informed decisions. This section provides a comprehensive overview of resources available to JEPQ investors.

Websites and Data Sources for JEPQ Investors

Several websites offer valuable data and analysis for JEPQ investors. Understanding where to find information is crucial for effective portfolio management.

- Yahoo Finance: Provides real-time stock quotes, news, financial statements, and key statistics for JEPQ. It is a primary source for tracking daily price movements and overall market sentiment. It also offers analyst ratings and research reports.

- Nasdaq.com: Offers detailed information on JEPQ, including its expense ratio, inception date, and issuer information. This website is particularly useful for understanding the fund’s structure and management.

- Morningstar: Delivers in-depth analysis of JEPQ, including its performance history, portfolio holdings, and risk metrics. Morningstar’s ratings and reports provide valuable insights for long-term investors.

- Bloomberg: Provides real-time market data, news, and financial analysis, useful for following JEPQ’s performance in the broader market context. This is a premium service, often used by professional investors.

- ETF.com: Offers comprehensive ETF data, including screening tools and comparison features. This platform allows investors to compare JEPQ with other ETFs based on various criteria.

- JPMorgan Asset Management (JPMAM) Website: This is the official website for the fund’s issuer. It provides up-to-date information, including prospectuses, fact sheets, and performance reports.

Tools for Monitoring JEPQ’s Performance

Effective monitoring of JEPQ’s performance involves using various tools to track its progress and compare it to benchmarks.

- Portfolio Tracking Software: Tools like Personal Capital or Mint can be used to track the performance of JEPQ alongside other investments. These platforms allow for visualizing portfolio allocation and overall returns.

- Financial News Websites: Staying informed about market trends and news related to JEPQ’s underlying holdings is crucial. Websites like The Wall Street Journal and Reuters provide up-to-date information.

- Dividend Trackers: Utilizing dividend tracking tools to monitor dividend payments and yields. These tools help in managing the income generated by JEPQ.

- Spreadsheet Software: Tools like Microsoft Excel or Google Sheets can be used to create custom performance tracking sheets, enabling investors to calculate returns, analyze historical data, and monitor dividend payments.

- Brokerage Platforms: Most brokerage platforms provide tools for monitoring the performance of investments held within their accounts. These tools offer real-time price updates, performance charts, and portfolio analysis.

Additional Resources

Beyond websites and tools, several other resources can aid JEPQ investors.

- Financial Advisors: Consulting with a financial advisor can provide personalized investment advice and help develop a comprehensive investment strategy.

- Educational Resources: Utilize online courses, books, and articles on ETFs and options strategies to enhance understanding of JEPQ’s investment approach.

- JPMorgan Asset Management Reports: Regularly review reports and insights published by JPMAM to stay informed about the fund’s strategy and outlook.

- SEC Filings: Reviewing SEC filings can provide detailed information on the fund’s holdings, financial performance, and risk factors.

Potential Benefits and Drawbacks of JEPQ

Investing in JEPQ, like any investment, presents both opportunities for gains and potential risks. Understanding these benefits and drawbacks is crucial for making informed decisions aligned with your financial goals and risk tolerance. This section will explore the advantages and disadvantages of incorporating JEPQ into an investment portfolio.

Potential Benefits of Investing in JEPQ

JEPQ offers several potential benefits that can attract investors seeking specific financial outcomes. These benefits often relate to income generation, risk management, and portfolio diversification.

JEPQ’s primary appeal lies in its potential for generating consistent income. It aims to provide high dividend yields, making it attractive to investors seeking regular cash flow. This is achieved through a combination of dividend payments from its underlying holdings and the income generated from selling covered calls.

JEPQ’s strategy of selling covered calls can offer a degree of downside protection during market downturns. The premiums received from selling these options can partially offset losses in the underlying portfolio, potentially reducing the overall volatility of the investment. This protection, however, is limited and depends on the magnitude of the market decline and the effectiveness of the covered call strategy.

JEPQ provides diversified exposure to a basket of large-cap technology and growth stocks, primarily those within the Nasdaq-100 index. This diversification can help reduce the impact of any single stock’s performance on the overall portfolio, mitigating risk. By investing in JEPQ, investors can gain access to a wide range of companies without having to individually select and manage each stock.

Potential Drawbacks of Investing in JEPQ

While JEPQ offers attractive features, it also comes with inherent drawbacks that investors should carefully consider before investing. These drawbacks are primarily related to the covered call strategy, market conditions, and expense ratios.

JEPQ’s covered call strategy, while providing potential downside protection, can limit upside potential. When the market performs exceptionally well, the gains are capped by the strike prices of the covered call options. This means that investors may miss out on significant profits if the underlying stocks experience substantial growth. This is a fundamental trade-off inherent in the covered call strategy.

The income generated by JEPQ can fluctuate depending on market volatility and the prices of the underlying assets. While the fund aims to provide consistent income, the actual dividend payments can vary from quarter to quarter, making it challenging for investors to predict their income streams with certainty. The premium received from selling covered calls is also dependent on market conditions; increased volatility often leads to higher premiums, but decreased volatility may result in lower payouts.

The expense ratio of JEPQ, which covers the costs of managing the fund, can impact the overall returns. Investors should compare the expense ratio to those of similar funds to assess its competitiveness. High expense ratios can erode returns over time, especially in a low-yield environment. Investors should be aware of all associated fees and costs.

JEPQ’s performance is closely tied to the performance of the Nasdaq-100 index and the broader technology sector. This concentration can expose the fund to greater risk if the technology sector experiences a downturn or if specific companies within the index underperform. Sector-specific risks are a key consideration.

Key Advantages and Disadvantages of JEPQ: A Summary

Here is a concise summary of the key advantages and disadvantages of investing in JEPQ:

- Advantages:

- Potential for high dividend yields.

- Downside protection through covered call strategy (limited).

- Diversified exposure to large-cap technology and growth stocks.

- Disadvantages:

- Limited upside potential due to covered call strategy.

- Fluctuating income based on market conditions.

- Expense ratio impacts overall returns.

- Sector-specific risk related to the technology sector.