Overview of Lasik Vision Institute Financing Options

Lasik Vision Institute understands that the cost of LASIK can be a significant investment. To make vision correction more accessible, they offer a variety of financing options designed to fit different budgets and financial situations. This overview details the various financing plans available, along with the eligibility requirements and important considerations.

Financing Choices Offered by Lasik Vision Institute

Lasik Vision Institute provides several financing avenues to help patients manage the cost of their procedure. These options often include partnerships with financial institutions that specialize in medical financing.

- Third-Party Financing: Lasik Vision Institute frequently partners with third-party lenders. These lenders offer various plans with differing interest rates and terms. This approach provides patients with a range of choices to find a plan that aligns with their financial needs.

- Payment Plans: In some instances, the institute may offer in-house payment plans. These plans typically involve a set monthly payment over a specified period. The details of these plans, including interest rates and terms, vary depending on the specific offer.

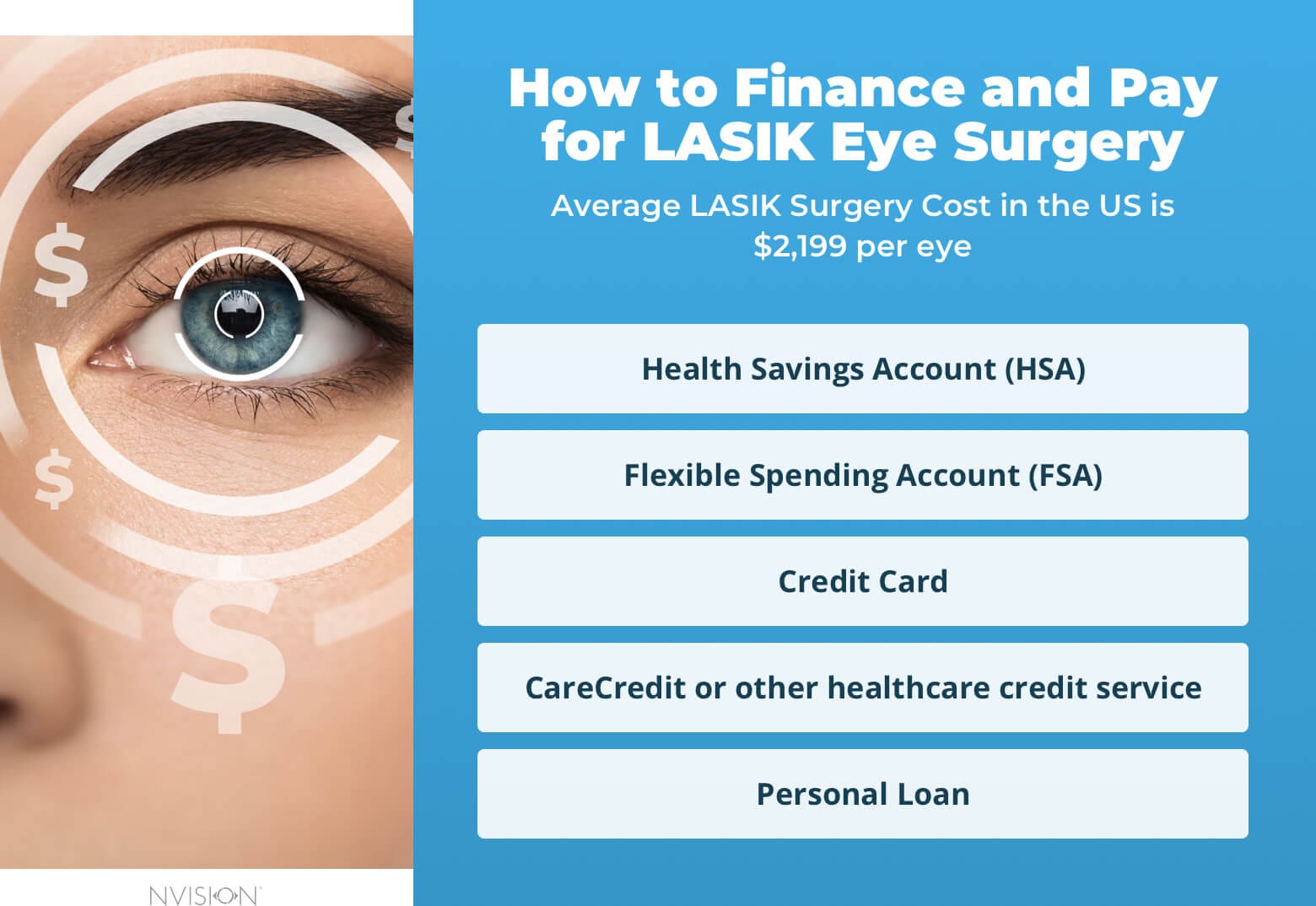

- Flexible Spending Accounts (FSAs) and Health Savings Accounts (HSAs): Lasik Vision Institute often accepts payments from FSAs and HSAs. These accounts allow patients to use pre-tax dollars to cover medical expenses, potentially reducing the overall cost of the procedure.

Eligibility Criteria for Lasik Vision Institute Financing Programs

The eligibility criteria for financing programs at Lasik Vision Institute can vary depending on the specific lender and plan. However, some general requirements typically apply.

- Credit Score: A good credit score is often a primary factor in determining eligibility. Lenders assess creditworthiness to evaluate the risk associated with providing financing. Higher credit scores often lead to more favorable interest rates and terms.

- Income Verification: Lenders may require proof of income to ensure the ability to repay the loan. This can include pay stubs, tax returns, or other documentation.

- Identification: Applicants typically need to provide valid identification, such as a driver’s license or passport.

- Application: Completing a formal application is a standard requirement. The application process usually involves providing personal and financial information.

Lasik Vision Institute Financing Plan Examples

The specific financing plans and their terms can change. The following table provides examples of the types of financing options that might be available. Note that these are illustrative examples, and actual terms and conditions may vary. Patients should always consult with Lasik Vision Institute and the specific lender for the most up-to-date information.

| Financing Plan | Interest Rate | Terms | Associated Fees |

|---|---|---|---|

| Plan A: Third-Party Lender | 5.99% – 12.99% APR (Based on creditworthiness) | 24, 36, or 48 months | Origination Fee (may vary) |

| Plan B: Third-Party Lender | 14.99% APR (Fixed) | 60 months | Late Payment Fee |

| Plan C: In-House Payment Plan (Example) | 0% (for a limited time, promotional) | 12 months | None (if payments are made on time) |

Exploring Specific Financing Programs

Lasik Vision Institute understands that the cost of LASIK can be a significant barrier for many. To make vision correction more accessible, they partner with various financing providers to offer flexible payment options. Understanding the specifics of each program is crucial for making an informed decision.

CareCredit: Overview and Features

CareCredit is a widely accepted healthcare credit card specifically designed for health and wellness expenses, including LASIK. It functions similarly to a regular credit card but offers specific benefits for medical procedures.

- Key Features: CareCredit offers a range of financing options, including promotional periods with deferred interest. This means you may not be charged interest if you pay off the balance within a specified timeframe. However, if the balance isn’t paid within the promotional period, interest accrues from the original purchase date.

- Credit Limits: Approval for CareCredit depends on individual creditworthiness, with credit limits varying accordingly.

- Accepted Locations: CareCredit is accepted at all Lasik Vision Institute locations.

- Repayment Terms: Repayment terms vary depending on the promotional plan chosen. These plans may include short-term, interest-free options or longer-term plans with fixed interest rates.

CareCredit: Advantages and Disadvantages

CareCredit offers distinct advantages and disadvantages that potential patients should carefully consider.

- Advantages:

- Promotional Financing: Offers interest-free promotional periods, allowing patients to spread the cost over time without incurring interest, provided they meet the payment deadlines.

- Dedicated Healthcare Card: Designed specifically for healthcare expenses, making it a convenient option for managing medical costs.

- Wide Acceptance: Accepted at a broad network of healthcare providers, including all Lasik Vision Institute locations.

- Disadvantages:

- Deferred Interest: If the balance isn’t paid within the promotional period, interest accrues from the purchase date, potentially leading to a higher overall cost.

- Interest Rates: Interest rates can be high on standard plans, making it a costly option if promotional periods aren’t utilized effectively.

- Credit Approval: Approval depends on creditworthiness, and individuals with poor credit may not qualify or may receive less favorable terms.

Factors Influencing CareCredit Approval

Several factors influence the approval process for CareCredit. Understanding these factors can help potential applicants assess their chances of approval and prepare accordingly.

- Credit Score: A strong credit score is the most significant factor in determining approval. Applicants with higher scores are more likely to be approved and receive more favorable terms.

- Credit History: A positive credit history, including a history of on-time payments and responsible credit use, increases the likelihood of approval.

- Debt-to-Income Ratio (DTI): Lenders assess the applicant’s ability to manage debt. A lower DTI, indicating a greater ability to repay debt, improves the chances of approval.

- Income: A stable and sufficient income demonstrates the applicant’s capacity to repay the borrowed funds.

- Other Factors: Additional factors, such as the length of credit history and the number of open credit accounts, can also influence the approval decision.

Other Financing Options: Details and Comparisons

While CareCredit is a primary financing option, Lasik Vision Institute may offer other financing programs. The specific details and availability of these programs can vary by location and may change over time. It’s essential to inquire directly with the Lasik Vision Institute location for the most up-to-date information.

- Potential Alternatives: Other financing options might include partnerships with specific banks or credit unions. These programs may offer different interest rates, repayment terms, and approval criteria compared to CareCredit.

- Comparison Considerations: When comparing financing options, consider the following:

- Interest Rates: Compare the annual percentage rates (APRs) of different programs.

- Repayment Terms: Evaluate the length of the repayment period and the monthly payment amounts.

- Fees: Determine if there are any associated fees, such as origination fees or late payment fees.

- Credit Requirements: Assess the credit score and other requirements for each program.

Interest Rates and Terms

Understanding the interest rates and repayment terms associated with Lasik Vision Institute financing is crucial for making informed decisions. This section provides a detailed breakdown of how interest rates are determined and the various repayment options available, empowering you to choose a financing plan that aligns with your financial situation.

Interest Rate Determination

Interest rates for Lasik Vision Institute financing are influenced by several factors. Lenders assess these factors to determine the risk associated with lending to a particular borrower.

Factors that influence interest rates include:

- Credit Score: A borrower’s credit score is a primary factor. Individuals with higher credit scores typically qualify for lower interest rates, as they are perceived as less risky borrowers. Conversely, those with lower scores may face higher rates.

- Loan Amount: The total amount of the loan can affect the interest rate. Larger loans may sometimes come with slightly lower rates, although this is not always the case.

- Repayment Term: The length of the repayment term also plays a role. Shorter terms often have lower interest rates, as the lender faces less risk over a shorter period. Longer terms might have higher rates.

- Lender: Different lenders may offer varying interest rates based on their specific lending policies and risk assessments. Lasik Vision Institute works with various financing partners, each with their own rate structures.

- Market Conditions: General economic conditions, such as prevailing interest rates set by the Federal Reserve, can influence the rates offered by lenders.

The specific interest rate offered will be disclosed during the application process, after the lender has evaluated the applicant’s creditworthiness and other relevant factors. It’s important to carefully review the terms and conditions of the financing agreement before accepting a loan.

Repayment Terms, Lasik vision institute financing

Lasik Vision Institute offers various repayment terms to accommodate different financial situations. These terms dictate the length of time over which the loan is repaid, impacting both the monthly payment amount and the total interest paid.

Available repayment terms may include:

- Short-Term Financing (e.g., 6-12 months): These terms typically have lower overall interest costs but require higher monthly payments. This option is suitable for individuals who prefer to pay off their loan quickly and can afford the larger monthly installments.

- Mid-Term Financing (e.g., 24-36 months): Mid-term options offer a balance between monthly payment affordability and total interest paid. They provide a longer repayment period than short-term options, resulting in lower monthly payments, but the interest paid will be higher than with short-term financing.

- Long-Term Financing (e.g., 48-60 months): These terms provide the lowest monthly payments, making them accessible to a wider range of individuals. However, they result in the highest total interest paid over the life of the loan.

The choice of repayment term depends on an individual’s budget and financial goals. A shorter term is generally more cost-effective in terms of total interest paid, but it requires higher monthly payments. A longer term reduces monthly payments but increases the overall cost due to interest.

Impact of Repayment Terms on Total Cost

The following table illustrates how different repayment terms affect the total cost of a $5,000 loan at a 10% annual interest rate.

| Repayment Term | Monthly Payment | Total Interest Paid | Total Cost |

|---|---|---|---|

| 12 Months | $440.88 | $290.52 | $5,290.52 |

| 24 Months | $232.47 | $599.33 | $5,599.33 |

| 36 Months | $161.22 | $803.92 | $5,803.92 |

| 48 Months | $126.59 | $1,026.32 | $6,026.32 |

| 60 Months | $106.24 | $1,374.24 | $6,374.24 |

This table demonstrates the trade-off between monthly payments and the total cost of the loan. While a longer repayment term offers lower monthly payments, it results in a significantly higher total cost due to the accumulation of interest over a longer period. The example uses a fixed interest rate for illustrative purposes. Actual rates may vary depending on individual circumstances and lender offerings.

Application Process and Requirements

Understanding the application process and requirements for financing at Lasik Vision Institute is crucial for a smooth and efficient experience. This section details the steps involved, necessary documentation, and common pitfalls to avoid, ensuring potential patients are well-prepared to secure financing for their vision correction procedure.

Steps for Applying for Financing

The application process at Lasik Vision Institute is designed to be straightforward.

- Pre-Approval: Patients can often begin by getting pre-approved for financing. This can be done online or over the phone, and it provides an initial estimate of the loan amount and interest rates for which they may qualify. This step doesn’t impact your credit score.

- Consultation: A consultation with a Lasik Vision Institute representative is the next step. During this consultation, the patient will discuss their vision correction options, costs, and the specific financing programs available.

- Application Submission: Once the patient has decided to proceed with financing, they will complete a formal application. This typically involves providing personal and financial information.

- Credit Check: The lender will then perform a credit check to assess the applicant’s creditworthiness.

- Approval and Loan Terms: If approved, the patient will receive the loan terms, including the interest rate, repayment schedule, and total loan amount.

- Procedure Scheduling: Upon acceptance of the loan terms, the patient can schedule their Lasik procedure.

Required Documentation for Application

Preparing the necessary documentation beforehand can expedite the financing application process.

- Identification: A government-issued photo ID, such as a driver’s license or passport, is required to verify the applicant’s identity.

- Proof of Income: This may include pay stubs, W-2 forms, or tax returns to verify the applicant’s income and employment status. The specific requirements may vary depending on the lender.

- Proof of Address: Documents such as a utility bill, lease agreement, or bank statement are typically needed to verify the applicant’s current address.

- Bank Account Information: Some lenders may require bank account information for direct payments or verification purposes.

- Credit History Information: While not a document, the lender will review the applicant’s credit history. Applicants should be aware of their credit score and any potential negative marks on their credit report.

Common Reasons for Denial and How to Avoid Them

Understanding the factors that can lead to financing denial can help applicants improve their chances of approval.

- Poor Credit History: A low credit score or a history of late payments, defaults, or bankruptcies can lead to denial. To avoid this, review your credit report regularly, pay bills on time, and address any outstanding debts before applying for financing.

- Insufficient Income: Lenders require proof of sufficient income to ensure the ability to repay the loan. Ensure you meet the minimum income requirements. If your income is variable, provide documentation that demonstrates a stable income over time.

- High Debt-to-Income Ratio: A high debt-to-income ratio (DTI), meaning a significant portion of your income is already allocated to debt payments, can make you a higher-risk borrower. To improve your DTI, consider paying down existing debts before applying.

- Incomplete Application: Failing to provide all the necessary information or documentation can result in denial. Carefully review the application and ensure all fields are completed accurately.

- Inaccurate Information: Providing false or misleading information on the application can lead to denial. Always be truthful and accurate when providing information.

Hidden Costs and Fees

Understanding the complete financial implications of LASIK eye surgery, including potential hidden costs and fees associated with financing, is crucial for making informed decisions. While the Lasik Vision Institute offers financing options, it’s essential to be aware of all possible charges beyond the advertised interest rates and monthly payments. Failing to account for these could lead to unexpected financial burdens.

Potential Hidden Fees

Various fees can add to the overall cost of LASIK financing. It is essential to carefully review all loan documentation to understand the specific charges associated with a particular financing plan.

- Origination Fees: Some lenders charge an origination fee, a one-time charge for processing the loan. This fee is often a percentage of the total loan amount. For example, if a loan has a $5,000 principal with a 2% origination fee, the fee would be $100, increasing the total cost of the procedure.

- Late Payment Fees: Missing a payment deadline typically results in late fees. These fees are usually a percentage of the overdue payment or a fixed amount. For instance, a late payment fee might be $35 or 5% of the missed payment, depending on the financing agreement.

- Annual Fees: Some credit cards or loans might include annual fees, regardless of how the account is used. These fees can add to the overall cost.

- Prepayment Penalties: Although less common, some loans may have prepayment penalties. These penalties charge the borrower if they pay off the loan early.

- Returned Payment Fees: If a payment is returned due to insufficient funds or another reason, the lender will typically charge a fee.

- Credit Card Fees: If using a credit card to finance the procedure, standard credit card fees such as balance transfer fees or cash advance fees, depending on how the procedure is paid for, may apply.

Penalties for Late or Early Payments

The terms and conditions of a financing agreement Artikel penalties for late or early payments. These penalties can significantly affect the overall cost of the procedure.

- Late Payment Penalties: As previously mentioned, late payments trigger fees. These fees can range from a fixed amount to a percentage of the overdue payment. Repeated late payments can negatively impact a borrower’s credit score.

- Early Repayment Penalties: While not as common, some financing plans might impose penalties for early loan repayment. These penalties can take the form of a percentage of the outstanding balance.

- Impact on Credit Score: Late payments are reported to credit bureaus, which can significantly damage a borrower’s credit score. A lower credit score can make it more difficult to obtain credit in the future and can also lead to higher interest rates on other loans and credit cards.

Hypothetical Example of Total Cost with Fees and Interest

The following example illustrates the potential impact of fees and interest on the total cost of LASIK surgery financed through the Lasik Vision Institute. This is a hypothetical example and does not represent actual financing terms.

Lasik vision institute financing – Scenario: A patient finances a $5,000 LASIK procedure with a 60-month loan at a 10% interest rate.

Understanding Lasik Vision Institute financing options is crucial for those seeking vision correction. Considering the financial aspects, a strong foundation in finance is beneficial. Therefore, a student might find that pursuing an accounting finance double major can provide valuable skills for managing the costs associated with Lasik, including understanding payment plans and budgeting for the procedure. Ultimately, informed financial planning makes Lasik vision correction more accessible.

- Principal Loan Amount: $5,000

- Interest Rate: 10% per annum

- Loan Term: 60 months

- Monthly Payment (approximate): $106.24

- Total Interest Paid Over Loan Term: $1,374.40

- Origination Fee (2%): $100

- Late Payment Fee (per occurrence): $35

- Total Cost of the Procedure (without late fees): $6,474.40

Additional Considerations:

Financing options at Lasik Vision Institute are crucial for many seeking vision correction. Understanding these plans is key, but sometimes, broader financial strategies are needed. For those exploring wider financial possibilities, understanding mna finance can provide valuable insights into investment and capital management. Ultimately, smart financial planning can make Lasik Vision Institute’s services more accessible.

- If the patient makes three late payments, incurring $35 in late fees each time, the total cost increases by $105, bringing the total cost to $6,579.40.

- This example does not include potential fees like annual fees, prepayment penalties, or returned payment fees, which could further increase the total cost.

Comparing Financing with Other Options: Lasik Vision Institute Financing

Understanding the various payment options available for LASIK surgery allows potential patients to make informed decisions based on their financial situations and preferences. While the Lasik Vision Institute offers in-house financing, it’s crucial to compare this option with alternatives like personal loans and credit cards to determine the most advantageous approach. Careful evaluation of interest rates, terms, and potential hidden fees is essential for minimizing the overall cost of the procedure.

Payment Method Comparison

Different payment methods offer unique advantages and disadvantages when financing LASIK surgery. Analyzing these differences helps patients choose the most suitable option for their financial circumstances.

Here’s a comparison table summarizing the pros and cons of different payment methods:

| Payment Method | Pros | Cons | Best Suited For |

|---|---|---|---|

| Lasik Vision Institute Financing |

|

|

Patients who prefer a direct financing option from the provider and may not qualify for better terms elsewhere. |

| Personal Loans |

|

|

Patients with good credit scores seeking potentially lower interest rates and fixed payment terms. |

| Credit Cards |

|

|

Patients who prioritize flexibility and can pay off the balance quickly to avoid interest charges. |

| Health Savings Accounts (HSAs) or Flexible Spending Accounts (FSAs) |

|

|

Patients with established HSA or FSA accounts and sufficient funds available. |

Calculating Overall Cost

Understanding how to calculate the total cost associated with each financing method is crucial for making an informed decision. This involves considering interest rates, repayment terms, and any associated fees.

Let’s illustrate how to calculate the overall cost with examples. Assume the cost of LASIK surgery is $5,000.

Example 1: Lasik Vision Institute Financing

Suppose the Lasik Vision Institute offers financing at a 12% annual interest rate with a 36-month repayment term.

Monthly Payment = P [ i(1 + i)^n ] / [ (1 + i)^n – 1]

Where:

- P = Principal loan amount ($5,000)

- i = Monthly interest rate (annual rate / 12 = 12%/12 = 0.01)

- n = Number of months (36)

Plugging in the values:

- Monthly Payment = $5,000 [ 0.01(1 + 0.01)^36 ] / [ (1 + 0.01)^36 – 1]

- Monthly Payment ≈ $166.07

- Total Paid = Monthly Payment x Number of Months

- Total Paid = $166.07 x 36 = $5,978.52

- Total Interest Paid = $5,978.52 – $5,000 = $978.52

The total cost of the surgery using this financing option is $5,978.52.

Example 2: Personal Loan

Suppose a personal loan is obtained at an 8% annual interest rate with a 36-month repayment term, and no origination fees.

Monthly Payment = P [ i(1 + i)^n ] / [ (1 + i)^n – 1]

Where:

- P = Principal loan amount ($5,000)

- i = Monthly interest rate (annual rate / 12 = 8%/12 = 0.00667)

- n = Number of months (36)

Plugging in the values:

- Monthly Payment = $5,000 [ 0.00667(1 + 0.00667)^36 ] / [ (1 + 0.00667)^36 – 1]

- Monthly Payment ≈ $156.42

- Total Paid = Monthly Payment x Number of Months

- Total Paid = $156.42 x 36 = $5,631.12

- Total Interest Paid = $5,631.12 – $5,000 = $631.12

The total cost of the surgery using this personal loan is $5,631.12, which is less than the Lasik Vision Institute financing option.

Example 3: Credit Card

Assume a credit card with a 15% APR is used, and the balance is not paid off during the promotional period. This example does not include any introductory 0% APR.

Monthly Payment = P [ i(1 + i)^n ] / [ (1 + i)^n – 1]

Where:

- P = Principal loan amount ($5,000)

- i = Monthly interest rate (annual rate / 12 = 15%/12 = 0.0125)

- n = Number of months (36)

Plugging in the values:

- Monthly Payment = $5,000 [ 0.0125(1 + 0.0125)^36 ] / [ (1 + 0.0125)^36 – 1]

- Monthly Payment ≈ $173.06

- Total Paid = Monthly Payment x Number of Months

- Total Paid = $173.06 x 36 = $6,230.16

- Total Interest Paid = $6,230.16 – $5,000 = $1,230.16

The total cost of the surgery using the credit card is $6,230.16, the most expensive option in this example.

These examples illustrate the importance of considering interest rates and repayment terms when choosing a financing option. Even a small difference in interest rates can significantly impact the overall cost. Patients should carefully compare all available options and use online calculators to estimate the total cost before making a decision.

Budgeting for Lasik Eye Surgery

Planning for Lasik eye surgery involves careful financial preparation. Creating a realistic budget is crucial for managing expenses and making informed decisions about financing options. This guide provides a structured approach to budgeting, incorporating financing considerations and strategies for saving money.

Creating a Lasik Budget

Developing a comprehensive budget requires identifying all potential costs associated with the procedure. Understanding these costs allows for effective financial planning and the selection of suitable financing solutions.

Here’s a step-by-step guide to building your Lasik budget:

- Estimate the Total Cost: Begin by obtaining a quote from Lasik Vision Institute. The cost of Lasik varies based on factors such as the type of procedure, the technology used, and the complexity of your vision correction needs. Request a detailed breakdown of all costs included in the quote.

- Assess Financing Options: Determine if you’ll utilize financing. If so, research the different programs offered by Lasik Vision Institute and other lenders. Compare interest rates, repayment terms, and any associated fees. Factor these costs into your overall budget.

- Identify All Expenses: Create a detailed list of all potential expenses. This should include the procedure cost, pre-operative consultations, post-operative medications, follow-up appointments, and any travel or accommodation costs.

- Track Income and Expenses: Monitor your income and current expenses. This provides a clear picture of your financial situation and how much you can realistically allocate to Lasik surgery.

- Set a Savings Goal: If you plan to save for a portion of the procedure, determine a savings goal and create a savings plan. This might involve setting aside a specific amount each month.

- Regularly Review and Adjust: Your budget should be flexible. Review it periodically and adjust it as needed, especially if unexpected expenses arise or if your financial situation changes.

Expenses to Consider

A thorough understanding of the expenses involved in Lasik surgery is essential for accurate budgeting. This section details the various costs to include in your budget.

The following expenses should be included in your budget:

- Procedure Cost: This is the primary cost, and it varies depending on the type of Lasik procedure (e.g., traditional, bladeless, custom). The cost includes the surgeon’s fees, the use of the laser, and the facility fees.

- Pre-operative Examinations: These are essential to determine your candidacy for Lasik and to assess the health of your eyes. They include comprehensive eye exams, corneal mapping, and pupil dilation.

- Post-operative Medications: Prescription eye drops, such as antibiotics and anti-inflammatory medications, are necessary for healing and preventing infection.

- Follow-up Appointments: Several follow-up appointments are scheduled after the surgery to monitor your healing progress and ensure optimal vision correction. These appointments are usually included in the overall cost, but it’s good to confirm.

- Travel and Accommodation: If you live far from the Lasik Vision Institute, factor in travel expenses (e.g., gas, flights, parking) and accommodation costs if necessary.

- Missed Work: Consider any potential loss of income due to time off work for the surgery and recovery period.

- Potential Enhancement Procedures: In rare cases, an enhancement procedure may be required to fine-tune the results. While not always necessary, it’s wise to inquire about the cost.

- Other Potential Costs: Include any additional expenses, such as contact lenses for the time before surgery.

Saving Money Before Surgery

Maximizing savings before your Lasik surgery can help reduce the amount you need to finance. Here are some effective strategies for saving money.

Consider these tips for accumulating savings:

- Create a Dedicated Savings Account: Open a separate savings account specifically for your Lasik surgery. This will help you track your progress and stay focused on your goal.

- Set a Realistic Savings Goal: Determine how much you can realistically save each month.

- Reduce Unnecessary Expenses: Identify areas where you can cut back on spending, such as dining out, entertainment, or subscription services.

- Increase Income: Consider ways to increase your income, such as taking on a part-time job, freelancing, or selling unused items.

- Utilize Tax-Advantaged Accounts: If possible, use a health savings account (HSA) or flexible spending account (FSA) to save for medical expenses. These accounts offer tax benefits.

- Explore Financing Options Early: Research financing options early in the process. This allows you to understand the terms and rates, giving you time to save a larger down payment, which could potentially reduce your interest costs.

- Look for Discounts and Promotions: Inquire about any special offers or discounts from Lasik Vision Institute. They may offer seasonal promotions or discounts for certain procedures.

- Prioritize Needs Over Wants: Distinguish between essential expenses and discretionary spending. Focus on saving and postpone non-essential purchases.

Patient Experiences and Testimonials

Understanding patient experiences is crucial when considering Lasik Vision Institute financing. Hearing firsthand accounts offers valuable insights into the process, from application to repayment, helping prospective patients make informed decisions. These testimonials, both positive and negative, paint a realistic picture of what to expect.

Positive Aspects of Financing Experiences

Many patients report positive experiences with Lasik Vision Institute financing, highlighting the ease of the application process and the affordability of monthly payments. They appreciate the availability of various financing options, catering to different budgets and credit profiles.

* Accessibility: Patients often commend the accessibility of financing, allowing them to undergo the procedure sooner rather than later.

* Affordability: The availability of low monthly payments makes Lasik more accessible.

* Variety of Options: The availability of multiple financing plans provides flexibility.

* Convenience: The streamlined application process is another plus.

* Professional Support: Many patients note positive interactions with the financing representatives.

Negative Aspects of Financing Experiences

While many patients have positive experiences, some report challenges. These include issues with understanding the terms and conditions, unexpected fees, and difficulties managing repayments.

* Complexity of Terms: Some patients find the terms and conditions of the financing agreements complex and difficult to understand.

* Hidden Fees: Some patients have reported unexpected fees, such as late payment charges or processing fees.

* Interest Rate Concerns: The interest rates can sometimes be higher than expected, leading to higher overall costs.

* Repayment Challenges: Some patients struggle with managing repayments, especially if their financial situation changes.

* Communication Issues: Occasional communication issues with the financing provider have been reported.

Frequently Asked Questions About Financing (Patient Perspective)

Patients often have specific questions about Lasik financing. Here are some frequently asked questions, answered from a patient’s perspective:

* What credit score do I need to qualify for financing?

Typically, you’ll need a credit score that indicates responsible financial behavior, though specific requirements vary based on the lender and the financing program.

* What are the interest rates like?

Interest rates vary, so it’s crucial to compare options. Some plans offer introductory rates, while others have fixed rates. Be sure to check all details.

* How long is the repayment period?

Repayment periods can range from a few months to several years. Choose a plan that fits your budget.

* Are there any hidden fees?

Carefully review all the terms and conditions to identify any potential hidden fees, such as origination fees, late payment fees, or prepayment penalties.

* What happens if I can’t make a payment?

Contact the financing provider immediately. They may offer options like payment plans or temporary forbearance, but missing payments can affect your credit score.

* Can I pay off the loan early?

Check the terms and conditions for prepayment penalties. Some loans allow early repayment without penalty, while others may charge a fee.

* How do I apply for financing?

The application process usually involves filling out an online form or completing an application with a financing representative. You’ll need to provide personal and financial information.

* What documents do I need to apply?

You’ll likely need to provide proof of income, identification, and potentially bank statements.

* What if my financing application is denied?

You can explore other financing options, such as personal loans from a bank or credit union, or consider saving up for the procedure.

Illustrative Narrative: A Positive Patient Financing Experience

Sarah, a 32-year-old marketing manager, had dreamed of Lasik for years. The cost seemed prohibitive until she explored the financing options at Lasik Vision Institute. The application process was straightforward; she was approved for a plan with manageable monthly payments and a competitive interest rate. The representative was patient and explained everything clearly. Sarah opted for a three-year repayment plan, allowing her to comfortably fit the payments into her budget. She appreciated the transparency and the lack of hidden fees. After her successful Lasik procedure, Sarah’s vision was corrected, and she enjoyed the freedom of no longer needing glasses or contacts. She diligently made her monthly payments and was thrilled to see the loan balance decreasing. Sarah’s experience underscored the power of accessible financing in making life-changing procedures attainable. She described her experience as

“life-changing and financially manageable.”

Impact of Credit Score

A patient’s credit score is a crucial factor in determining their eligibility for Lasik financing and the terms they receive. Lenders use credit scores to assess the risk associated with lending money. A higher credit score generally translates to more favorable financing options, including lower interest rates and better repayment terms. Understanding how credit scores influence financing is essential for making informed decisions about Lasik surgery.

Credit Score’s Influence on Financing Options

The credit score directly impacts the availability and cost of Lasik financing. Lenders categorize borrowers based on their creditworthiness, and this categorization dictates the financing options available to them.

- Approval Likelihood: Patients with higher credit scores are more likely to be approved for financing. Lenders view these individuals as less risky.

- Interest Rates: Interest rates are often directly tied to credit scores. Higher credit scores usually qualify for lower interest rates, reducing the overall cost of the surgery. Lower scores often result in higher interest rates, making the surgery more expensive.

- Loan Amounts: Credit scores can influence the maximum loan amount offered. Patients with better credit may qualify for larger loans, potentially covering the entire cost of the procedure.

- Repayment Terms: The length of the repayment term might be affected. Higher credit scores could lead to more flexible repayment options, such as longer terms, resulting in lower monthly payments.

Improving Credit Score to Enhance Approval Chances

Improving a credit score can significantly improve the chances of securing favorable Lasik financing. Several strategies can be employed to boost a credit score.

- Pay Bills on Time: Consistent and timely bill payments are a fundamental factor in credit score calculation. Paying bills on or before the due date demonstrates responsible financial behavior.

- Reduce Credit Card Debt: High credit utilization, which is the amount of credit used compared to the total credit available, can negatively impact a credit score. Paying down credit card balances improves credit utilization.

- Check Credit Reports for Errors: Reviewing credit reports from all three major credit bureaus (Equifax, Experian, and TransUnion) can reveal any errors or inaccuracies that could be negatively affecting the score. Disputing these errors can lead to score improvements.

- Avoid Opening Multiple Credit Accounts Simultaneously: Opening several credit accounts at once can be perceived as a sign of financial instability and could lower the credit score.

- Maintain a Mix of Credit: Having a mix of credit accounts, such as credit cards, installment loans (e.g., car loans), and mortgages, can positively impact a credit score, as it shows the ability to manage different types of credit.

Visual Representation: Impact of Credit Score on Interest Rates

The following bar graph illustrates the relationship between credit scores and estimated interest rates for Lasik financing. The graph provides a visual representation of how interest rates vary based on different credit score ranges.

Bar Graph Description:

The bar graph has a vertical axis representing interest rates (in percentages) and a horizontal axis representing credit score ranges. The credit score ranges are categorized as follows: “Exceptional” (800-850), “Very Good” (740-799), “Good” (670-739), “Fair” (580-669), and “Poor” (Below 580).

Each credit score range is associated with a bar, representing the estimated interest rate for Lasik financing. The “Exceptional” credit score range has the lowest bar, indicating the lowest interest rate (e.g., 4.99%). The “Very Good” range has a slightly higher bar (e.g., 7.99%). The “Good” range has a higher bar still (e.g., 11.99%). The “Fair” range has a significantly higher bar (e.g., 17.99%), and the “Poor” range has the highest bar, representing the highest interest rate (e.g., 24.99%).

The bars increase in height as the credit score range decreases, demonstrating the inverse relationship between credit score and interest rate. This visual representation emphasizes the financial advantage of having a higher credit score when seeking Lasik financing.

Example: A patient with an “Exceptional” credit score (800-850) might qualify for an interest rate of 4.99% on a $5,000 Lasik loan. Over a 24-month term, the total interest paid would be approximately $250. Conversely, a patient with a “Fair” credit score (580-669) might face an interest rate of 17.99% on the same loan, resulting in approximately $899 in total interest paid over the same term. These examples highlight the substantial financial implications of credit score on the overall cost of Lasik surgery.

Alternatives to Traditional Financing

For individuals considering LASIK eye surgery, exploring alternatives to traditional financing programs can significantly broaden their financial options. While financing through the LASIK Vision Institute or other lenders is common, several other avenues can help make the procedure more accessible. These alternatives can range from medical credit cards to payment plans offered by the surgeon’s office, and each has its own set of benefits and drawbacks. Understanding these options allows patients to make informed decisions that best fit their financial situations.

Medical Credit Cards

Medical credit cards, such as CareCredit, are specifically designed for healthcare expenses. They often offer promotional financing options, like deferred interest periods, which can be attractive.

- Benefits:

- Often offer promotional financing with 0% interest for a certain period.

- Can be used for various healthcare expenses, not just LASIK.

- Easy application process and quick approval.

- Drawbacks:

- If the balance is not paid off within the promotional period, deferred interest can accrue, potentially leading to high interest charges.

- Credit limits may not always cover the full cost of LASIK.

- Interest rates can be high after the promotional period.

Payment Plans Offered by the Surgeon’s Office

Many LASIK surgeons offer in-house payment plans as an alternative to traditional financing. These plans can be more flexible and tailored to a patient’s individual needs.

- Benefits:

- Potentially lower interest rates than traditional financing.

- More flexible payment terms, such as monthly installments.

- Direct communication with the surgeon’s office can simplify the process.

- Drawbacks:

- Payment plans may require a down payment.

- The availability of these plans varies between surgeons.

- Defaulting on payments could affect the patient-surgeon relationship.

Health Savings Accounts (HSAs) and Flexible Spending Accounts (FSAs)

HSAs and FSAs are tax-advantaged savings accounts that can be used to pay for qualified medical expenses, including LASIK.

- Benefits:

- Contributions to HSAs are often tax-deductible, and the funds can grow tax-free.

- FSAs allow pre-tax dollars to be set aside for medical expenses.

- Can reduce the overall cost of the procedure by using pre-tax dollars.

- Drawbacks:

- HSAs require enrollment in a high-deductible health plan.

- FSAs have a “use it or lose it” rule, meaning funds must be spent within the plan year.

- Contribution limits apply to both HSAs and FSAs.

Personal Loans

Personal loans from banks or credit unions can be used to finance LASIK. These loans typically have fixed interest rates and repayment terms.

- Benefits:

- Can offer lower interest rates than credit cards, especially for those with good credit.

- Fixed monthly payments provide predictability.

- Loan amounts can often cover the full cost of the procedure.

- Drawbacks:

- Requires a credit check, and approval depends on creditworthiness.

- May have origination fees.

- Repayment terms can be relatively short, leading to higher monthly payments.

Crowdfunding

Crowdfunding platforms allow individuals to raise money from a network of friends, family, and even strangers.

- Benefits:

- Can provide a significant amount of funding without incurring debt.

- Allows for community support and engagement.

- May be particularly useful for those who don’t qualify for traditional financing.

- Drawbacks:

- Success depends on the individual’s ability to garner support and reach their fundraising goal.

- May take time to raise the necessary funds.

- There are often platform fees associated with crowdfunding campaigns.

Grants and Financial Assistance Programs

While not as common for elective procedures like LASIK, some charitable organizations and foundations offer grants or financial assistance to individuals who meet specific criteria.

- Benefits:

- Provides free or reduced-cost funding for the procedure.

- Can significantly reduce the financial burden.

- Drawbacks:

- Limited availability and competitive application processes.

- Eligibility requirements are often strict, focusing on financial need or specific medical conditions.