Defining Medex Travel Insurance

Medex travel insurance is a specialized form of travel insurance designed to meet the unique healthcare needs of travelers. Unlike standard travel insurance policies, Medex often emphasizes comprehensive medical coverage, potentially including pre-existing conditions, and often provides specific benefits for medical emergencies and evacuations. Understanding the nuances of Medex insurance is crucial for travelers seeking robust protection beyond typical coverage.

Medex travel insurance offers a comprehensive approach to travel protection, encompassing medical expenses, emergency evacuations, and potentially repatriation. This coverage is designed to safeguard travelers against unexpected medical situations while abroad, ensuring financial security during potentially challenging times.

Types of Medex Travel Insurance Plans

Medex insurance plans vary considerably in terms of coverage. Some plans focus on basic medical emergencies, while others offer broader protection including pre-existing conditions and extensive repatriation services. Plan differences are often determined by factors such as the destination, the duration of the trip, and the traveler’s specific medical needs. The plan selection should be tailored to the individual traveler’s needs and budget.

Coverage Differences from Standard Travel Insurance

A key differentiator between Medex travel insurance and standard travel insurance lies in the depth of medical coverage. Standard policies typically focus on emergency medical expenses, but Medex plans often extend this coverage to include pre-existing conditions, potentially higher daily expense limits, and specialized benefits such as emergency medical evacuation. This expanded coverage is crucial for travelers with pre-existing conditions or those venturing to regions with limited healthcare infrastructure.

Comparison Table: Medex vs. Standard Travel Insurance

| Feature | Medex Travel Insurance | Standard Travel Insurance |

|---|---|---|

| Coverage for Pre-existing Conditions | Often includes coverage, with varying terms and conditions | Typically excludes pre-existing conditions |

| Daily Expense Limits | Potentially higher daily limits for medical expenses | Lower daily limits for medical expenses |

| Emergency Medical Evacuation | Generally comprehensive coverage, including transport to a specialized facility | May have limitations or exclusions for evacuation costs |

| Repatriation | May include repatriation costs for deceased individuals | Often does not include repatriation |

| Pricing | Usually higher than standard travel insurance, due to the expanded coverage | Generally more affordable than Medex plans |

| Exclusions | Specific exclusions can vary by policy; review carefully | Specific exclusions can vary by policy; review carefully |

Coverage Details

Medex Travel Insurance provides comprehensive coverage for unforeseen medical events during your travels. Understanding the specifics of this coverage is crucial for making informed decisions about your trip and ensuring peace of mind. This section details the scope of medical protection, claim filing procedures, and real-world examples of how Medex Travel Insurance can be beneficial.

Emergency Medical Situations

Medex Travel Insurance prioritizes your well-being by offering robust coverage for emergency medical situations abroad. This includes treatment for illnesses or injuries requiring immediate attention, such as accidents, sudden illnesses, or acute conditions. The coverage extends to necessary hospitalizations, surgeries, and intensive care, as well as ambulance transportation. The policy Artikels specific situations where emergency medical services are covered. Examples include a sudden heart attack abroad or a serious injury during a hiking trip. It’s essential to remember that pre-existing conditions may have specific terms and conditions.

Claim Filing and Reimbursement

Filing a claim with Medex Travel Insurance involves a straightforward process. Policyholders must document their medical expenses meticulously, collecting receipts, medical reports, and any necessary documentation. This comprehensive documentation ensures a smooth claim process. The insurance provider will guide policyholders through the process, providing necessary forms and instructions. The claims process is usually handled electronically, allowing for faster processing and reimbursements.

Situations Where Medex Travel Insurance is Beneficial

Medex Travel Insurance is invaluable in a wide range of situations. For example, if you experience a severe allergic reaction during a trip, the policy would cover the necessary medical care. A sudden illness requiring hospitalization in a foreign country would also be covered. Another scenario includes a severe injury during an outdoor activity like skiing, where the insurance will cover the necessary medical expenses. In all these scenarios, Medex Travel Insurance provides financial security and support during a medical crisis abroad.

Coverage for Pre-Existing Medical Conditions

Medex Travel Insurance addresses pre-existing medical conditions, though coverage may vary based on the specific policy. Some pre-existing conditions might be excluded or have limitations on coverage. Policyholders should carefully review the policy’s terms and conditions to understand the specific coverage for their pre-existing medical issues. Policyholders should consult with Medex Travel Insurance representatives to discuss pre-existing conditions and ensure their needs are met.

Dental Emergencies and Related Services

The policy defines the extent of coverage for dental emergencies and related services. The policy specifies whether routine dental checkups or more serious dental issues are covered. Examples include emergency dental procedures, such as fillings or extractions due to injury, are usually covered. Policyholders should always confirm specific details with Medex Travel Insurance. Understanding the extent of coverage for dental care is crucial for planning a trip.

Typical Medical Expenses Covered

The table below Artikels the typical medical expenses covered by Medex Travel Insurance. This information is not exhaustive and specific coverages can vary depending on the chosen plan.

| Category | Typical Expenses Covered |

|---|---|

| Hospitalization | Room and board, medical services, medications, and diagnostic tests |

| Surgeries | Surgical procedures, anesthesiology, and post-operative care |

| Emergency Treatment | Emergency room visits, ambulance transport, and immediate medical interventions |

| Outpatient Care | Doctor visits, diagnostic tests, and prescription medications |

| Dental Emergencies | Emergency dental procedures, fillings, extractions, etc. |

Eligibility and Enrollment: Medex Travel Insurance

Securing travel insurance is crucial for any trip, especially for unforeseen medical expenses. Understanding the eligibility criteria and enrollment process for Medex Travel Insurance ensures a smooth experience and appropriate coverage. This section will Artikel the requirements for purchasing a policy, including age, health status, and destination limitations, as well as the enrollment steps and documentations needed.

Eligibility Criteria

Medex Travel Insurance policies have specific eligibility requirements to ensure the insurance aligns with the risk profile of the insured. These criteria generally consider age, health status, and the destination of travel. Applicants need to meet these standards to be considered for coverage.

- Age Restrictions: Policies typically have minimum and maximum age limits for coverage. Individuals outside this range may be ineligible or require special considerations. For example, children under 18 might require parental consent or a separate policy.

- Health Status: Applicants with pre-existing medical conditions may be subject to additional underwriting criteria or exclusions. Some policies may require a medical questionnaire or physical examination to assess the applicant’s health status. The extent of required information can vary depending on the specifics of the policy.

- Destination Limitations: Certain destinations may carry higher risk profiles for medical emergencies, and some policies may exclude or limit coverage in these areas. This is to manage the risk for the insurer. For example, coverage might be limited or unavailable for travel to countries with limited medical infrastructure.

Enrollment Process

The enrollment process for Medex Travel Insurance involves several steps, ensuring the applicant’s information is accurately captured and processed. This streamlined procedure minimizes potential issues during claim settlements.

- Application Submission: Applicants need to complete an online or paper application form, providing details about their personal information, travel plans, and medical history. This form is crucial in establishing the applicant’s profile for underwriting.

- Payment and Confirmation: Once the application is reviewed and approved, the applicant will be required to pay the premium. This process is usually completed online through secure payment gateways. A confirmation of coverage will be issued following successful payment.

- Policy Issuance: After the payment is processed, the insurance policy will be issued electronically or via mail. This document Artikels the terms and conditions of coverage, coverage limits, and important contact information.

Document Requirements

Various documents may be required for obtaining a Medex Travel Insurance policy. These documents help verify the applicant’s identity, travel plans, and medical history.

MedEx travel insurance is a solid choice for most trips, but when you’re planning an expedition like an Antarctica cruise, you need extra coverage. That’s where finding the best travel insurance for antarctica cruise comes in handy. This comprehensive guide will help you compare policies and choose the right protection. Ultimately, MedEx’s flexibility and robust coverage still makes it a top choice for adventure travellers, even for those icy landscapes.

- Passport Copy: A copy of the passport is essential to verify the applicant’s identity and travel plans.

- Visa Information: If required, a copy of the visa for the travel destination is needed.

- Proof of Travel Arrangements: Flight tickets, hotel bookings, or itinerary details might be requested to confirm the trip details.

- Medical Records (if applicable): In cases of pre-existing medical conditions, medical records may be required to assess the risk profile.

Enrollment Options

Medex Travel Insurance may offer various enrollment options to cater to different customer needs and preferences. These options might include online applications, phone support, or in-person consultations.

MedEx travel insurance is a lifesaver, especially when you’re planning an adventure. Thinking about layering up for chilly flights and unexpected weather? Check out the amazing deals on white and warren cashmere travel wraps at white and warren cashmere travel wrap sale. Perfect for keeping you cozy and protected, it’s a fantastic accessory that’ll help you feel confident and prepared for any travel situation.

MedEx will make sure your trip is worry-free, whether you’re bundled up in a cashmere wrap or not!

Step-by-Step Guide

The enrollment process generally follows these steps for a smooth experience:

- Review Policy Details: Thoroughly review the policy details and coverage limits to ensure it meets your travel needs.

- Complete Application: Fill out the application form accurately, providing all necessary details and required documentation.

- Pay Premium: Pay the premium amount via the specified method.

- Receive Policy Confirmation: Confirm receipt of the policy document electronically or via mail.

Eligibility Summary Table

| Plan Type | Age Limit (Min/Max) | Pre-existing Conditions | Destination Restrictions |

|---|---|---|---|

| Basic Plan | 18-65 | May have exclusions | Limited coverage for high-risk areas |

| Standard Plan | 18-75 | Some conditions may be covered with additional fees | Covers most destinations with standard exclusions |

| Premium Plan | 18-80 | Wide coverage for most pre-existing conditions | Comprehensive coverage globally |

Benefits and Advantages

Embarking on international travel often entails a myriad of uncertainties. From unforeseen medical emergencies to unexpected trip disruptions, travelers face potential financial and logistical challenges. Medex Travel Insurance offers a comprehensive solution, providing peace of mind and safeguarding against these uncertainties. This section highlights the key advantages and benefits of choosing Medex Travel Insurance, emphasizing its value proposition compared to other travel insurance options.

Medex Travel Insurance stands out due to its comprehensive coverage, competitive pricing, and dedicated customer service. It provides a strong financial safety net for unforeseen circumstances, ensuring travelers can focus on enjoying their journey without worry.

Unique Benefits of Medex Travel Insurance

Medex Travel Insurance offers a unique blend of benefits not always found in other travel insurance options. It provides more extensive coverage for pre-existing conditions than many competitors. This tailored approach ensures that travelers with chronic health issues are adequately protected during their journeys. Furthermore, Medex’s coverage extends to a broader range of medical treatments, including emergency dental procedures and ambulance services, often excluded from other plans.

Importance for International Travel

International travel presents unique challenges, requiring a robust travel insurance plan. Medical expenses abroad can quickly escalate, potentially overwhelming a traveler’s budget. Medex Travel Insurance mitigates these risks by covering necessary medical treatments, ensuring financial stability in case of an emergency. The plan also often includes provisions for evacuation services, which are crucial for serious medical conditions or natural disasters in remote locations.

Financial Protection for Travelers

Medex Travel Insurance provides substantial financial protection against unexpected medical expenses. The plan typically covers a wide range of medical costs, including hospitalization, surgery, and doctor’s fees. This comprehensive coverage can shield travelers from significant financial burdens in the event of an illness or injury. Furthermore, it often includes provisions for repatriation, which covers the cost of returning a traveler home in the event of a serious medical emergency. For example, a traveler experiencing a sudden heart attack abroad can have their medical expenses and repatriation costs covered, significantly reducing the financial strain on the individual.

Peace of Mind During International Travel

Medex Travel Insurance is designed to foster peace of mind for travelers embarking on international adventures. Knowing they have comprehensive coverage for medical emergencies, lost luggage, or trip cancellations alleviates anxiety. This assurance allows travelers to fully immerse themselves in the experience, confident that they are protected against unforeseen circumstances. This peace of mind is priceless, allowing travelers to enjoy the destinations they visit and the experiences they seek.

Cost Comparison and Coverage

Medex Travel Insurance offers a range of plans tailored to different needs and budgets. The premiums vary depending on factors such as trip duration, destination, and coverage limits. However, the potential medical expenses covered by the plan often far outweigh the cost of the policy. For instance, a trip to a high-cost medical region like the United States might require a significantly higher premium than a trip to a lower-cost region like Mexico, but the potential coverage in the United States will often justify the higher cost. It’s crucial to compare the potential medical costs against the cost of the policy to determine the best fit.

Trip Cancellation or Interruption Benefits

In the event of a trip cancellation or interruption due to unforeseen circumstances, Medex Travel Insurance often offers coverage for non-refundable expenses. This coverage can include prepaid flights, accommodation, and other travel arrangements. For example, if a traveler contracts a serious illness preventing them from traveling, Medex might cover the cost of the non-refundable trip bookings. This protection against financial loss is a significant advantage of Medex Travel Insurance.

Advantages over Other Options

| Feature | Medex Travel Insurance | Other Options |

|---|---|---|

| Coverage for Pre-existing Conditions | More extensive coverage | Limited or excluded coverage |

| Emergency Dental Procedures | Included | Often excluded |

| Ambulance Services | Included | Often excluded or limited |

| Repatriation | Often included | May not be included |

| Trip Cancellation/Interruption | Comprehensive coverage | Limited coverage or exclusions |

Claims and Reimbursement

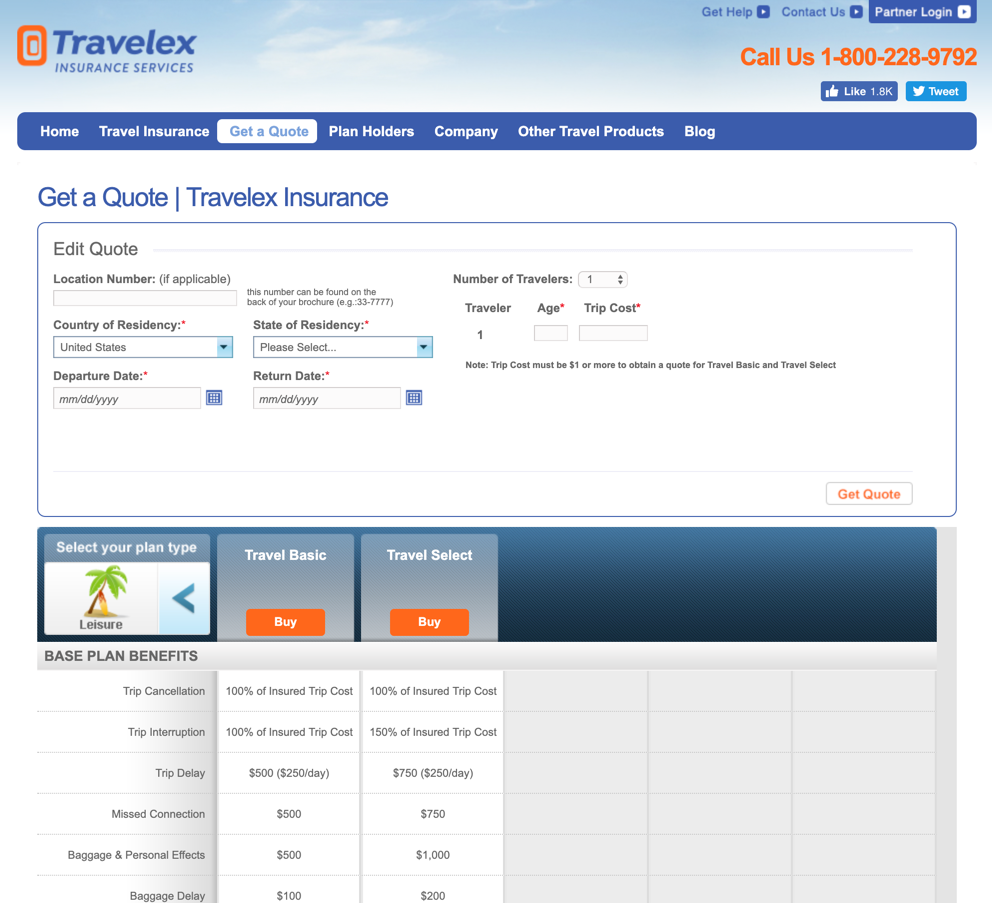

![Travelex Travel Insurance Coverage Review - Worth It? [2021] Travelex Travel Insurance Coverage Review - Worth It? [2021]](https://www.nriol.net/storage/2022/06/travelex-insurance-services-claim.webp)

Navigating the claims process can be a crucial aspect of travel insurance. Understanding the procedure, required documents, and potential issues can help you make the most of your coverage. This section provides a detailed guide to filing and receiving reimbursement under Medex Travel Insurance.

Claim Filing Procedure

Medex Travel Insurance follows a standardized claim process. Generally, you must submit a detailed claim form, providing comprehensive information about the incident and associated expenses. This form typically includes sections for personal details, travel itinerary, nature of the claim, and supporting documentation. The claim form should be submitted through the designated channels, which could be online portals, dedicated email addresses, or postal mail. Submitting your claim promptly after the incident is crucial.

Required Documents for Claims Processing

The specific documents required for a claim vary depending on the nature of the claim. Generally, these documents will support the validity and extent of your claim. Crucial documents often include proof of the incident, medical bills, receipts for expenses, police reports (if applicable), and travel documents. Insurance policies often stipulate the necessary documentation, so reviewing the policy details is essential.

Claim Processing Timeframe and Reimbursement

The timeframe for claim processing and reimbursement can vary, depending on the complexity of the claim and the availability of supporting documentation. Medex Travel Insurance aims to process claims efficiently, but there can be delays. Expect a response within a reasonable period, and keep in touch with the claims department for updates. Generally, claims for straightforward medical expenses might be processed faster than claims involving extensive medical procedures.

Appealing Denied Claims

If your claim is denied, you have the right to appeal. Medex Travel Insurance provides a formal appeals process. This usually involves providing additional supporting evidence and explaining why the initial denial was incorrect. A detailed explanation of the reasons for the denial and the supporting evidence to refute the denial is essential.

Potential Issues and Resolution

Several potential issues might arise during the claim process. For example, incomplete documentation, incorrect claim forms, or disputes over the validity of expenses can all cause delays. Keeping detailed records, communicating effectively with the claims department, and understanding the insurance policy terms will help minimize potential issues.

| Potential Issue | Solution |

|---|---|

| Incomplete documentation | Gather missing documents promptly and resubmit the claim. |

| Incorrect claim form | Review the claim form instructions carefully and resubmit the correct form. |

| Disputes over expenses | Provide additional supporting evidence and clarify the reasons for the expenses. |

| Communication breakdown | Maintain consistent communication with the claims department. |

Step-by-Step Claim Filing and Reimbursement Guide

- Review your Medex Travel Insurance policy to understand the claim process and required documents.

- File a claim form promptly after the incident using the designated method (online, email, or mail).

- Gather all necessary documents, including medical bills, receipts, and travel records.

- Submit the completed claim form and supporting documents.

- Monitor the claim status and contact the claims department for updates.

- If the claim is denied, follow the appeal process by providing additional evidence and clarifying the issues.

- Upon approval, the reimbursement will be processed according to the policy terms.

Exclusions and Limitations

Understanding the exclusions and limitations of your travel insurance policy is crucial for making informed decisions. Knowing what isn’t covered can save you potential disappointment and financial headaches during your trip. This section delves into common exclusions, their rationale, and examples to help you navigate the complexities of travel insurance coverage.

Common Exclusions and Limitations

Travel insurance policies, while designed to protect you, have inherent limitations. These exclusions are in place to manage risk and ensure the insurer’s financial stability. It is essential to thoroughly review these exclusions before purchasing a policy.

- Pre-existing medical conditions: Many travel insurance policies have limitations on coverage for pre-existing medical conditions. This is often due to the inherent risk and unpredictability associated with such conditions. Policies may exclude or limit coverage for illnesses or injuries that manifested before the policy’s effective date, or those requiring ongoing treatment or medication. A common example involves a traveler with a history of asthma who needs an inhaler. While the inhaler may be covered, additional complications related to the pre-existing asthma condition are unlikely to be covered. Policies will typically Artikel specific conditions that might affect coverage.

- Coverage for Activities that Carry a High Risk of Injury: Policies typically exclude or limit coverage for injuries sustained during activities that carry a significant risk of injury, such as skydiving, bungee jumping, or extreme sports. These activities are considered inherently risky, and the insurance company cannot reasonably be held responsible for injuries that arise from them. The insurer’s responsibility is primarily focused on medical emergencies and unforeseen circumstances, not those involving known, high-risk activities.

- Acts of War and Terrorism: Travel insurance policies often exclude coverage for losses or injuries resulting from acts of war, terrorism, or civil unrest. These events are generally considered beyond the control of the insurance company and fall outside the scope of typical coverage. Such exclusions protect the insurer from the substantial financial burden that large-scale events might impose.

- Losses from Personal Negligence: Coverage may not extend to losses or injuries arising from the insured’s intentional or negligent actions. For example, injuries caused by intoxicated driving or intentional self-harm are usually excluded. The policyholder’s responsibility for their actions is paramount.

Reasons for Exclusions

Exclusions are often based on the insurer’s assessment of risk and the need to maintain financial stability. By excluding certain types of losses or events, the insurance company can effectively manage the potential financial burden associated with these circumstances.

- Risk Assessment: Insurance companies assess the risk of various events and conditions. Higher-risk activities or pre-existing conditions are excluded or subject to specific limitations to control the potential financial impact on the insurer.

- Financial Viability: Insurance companies need to remain financially viable. Exclusions and limitations help manage costs and ensure that they can fulfill their obligations to policyholders for covered events.

Examples of Uncovered Expenses

Understanding what is not covered is as important as knowing what is. These examples illustrate situations where Medex Travel Insurance might not cover expenses.

- A traveler with a history of heart disease who experiences a heart attack during a trip to a remote location. This may not be covered, depending on the specific policy and the timing of the pre-existing condition.

- A traveler injured while participating in a bungee jump. This is likely excluded due to the inherent risk of the activity.

- A traveler who loses their passport due to their own negligence. This is likely excluded as it’s a direct result of the traveler’s actions.

Importance of Understanding Exclusions

Carefully reviewing exclusions is critical to avoid any surprises during a trip. It is better to know upfront what isn’t covered than to be faced with an unexpected expense.

Impact of Pre-existing Conditions

Pre-existing conditions are often excluded or have limitations in travel insurance. It’s essential to understand how pre-existing conditions might impact your coverage. The policy terms will specify how pre-existing conditions are handled, including the timeline, the types of conditions covered, and the extent of coverage.

Table of Common Exclusions and Limitations

| Exclusion Category | Description |

|---|---|

| Pre-existing Conditions | Conditions that manifested or required treatment before the policy’s effective date. |

| High-Risk Activities | Injuries sustained during activities with a high risk of injury (e.g., skydiving, bungee jumping). |

| Acts of War and Terrorism | Losses or injuries resulting from acts of war, terrorism, or civil unrest. |

| Personal Negligence | Losses or injuries caused by intentional or negligent actions. |

Illustrative Scenarios

Navigating the complexities of travel can be fraught with unexpected challenges. Medex Travel Insurance isn’t just a policy; it’s a safety net that provides peace of mind during your adventures. These illustrative scenarios highlight how the policy can intervene in various real-world and hypothetical situations, offering a glimpse into its practical applications and limitations.

Real-World Examples of Assistance

Medex Travel Insurance has proven invaluable to numerous travelers. One user, Sarah, experienced a sudden illness while vacationing in Thailand. Thanks to the quick and efficient claim process, she received necessary medical attention and repatriation, ensuring a smooth and stress-free return home. Another traveler, David, had a baggage delay, and the insurance covered the cost of essential clothing and toiletries, preventing him from being stranded. These are just two examples of how Medex Travel Insurance actively supports travelers in distress.

Crucial Coverage Scenarios

Imagine a scenario where a traveler experiences a serious accident during a hiking trip in the Himalayas. Without adequate medical insurance, the cost of emergency evacuation and treatment could be catastrophic. Medex Travel Insurance would cover these substantial expenses, allowing the traveler to receive prompt and appropriate care, safeguarding their health and financial well-being. A similar situation could involve a traveler experiencing a sudden illness requiring intensive care and hospitalization abroad. The coverage would assist in handling the costs related to diagnosis, treatment, and repatriation, ensuring the traveler’s recovery and safe return home.

Scenarios Where Coverage Does Not Apply

While Medex Travel Insurance offers comprehensive coverage, certain situations fall outside its scope. For instance, pre-existing conditions not disclosed during enrollment might not be covered. Similarly, intentional self-harm or injuries resulting from illegal activities would likely be excluded. Carefully reviewing the policy’s exclusions and limitations is crucial to understanding the boundaries of coverage.

Hypothetical Situations Requiring Coverage

A hypothetical scenario involves a traveler booking a last-minute trip to a remote island nation. A sudden tropical storm causes significant damage to the traveler’s accommodation and personal belongings. Medex Travel Insurance could cover the costs of temporary lodging and replacement of lost items, ensuring the traveler’s comfort and safety during the recovery period. Another hypothetical situation: a family traveling to a foreign country for a child’s medical procedure. Medex Travel Insurance could help manage the substantial costs associated with medical care, travel, and accommodation, significantly alleviating the financial strain of such an event.

Impact of Factors on Coverage Amount

The coverage amount provided by Medex Travel Insurance is influenced by various factors. These include the type of plan selected, the duration of the trip, and the specific medical needs of the traveler. For instance, a traveler seeking extensive coverage for a prolonged trip to a high-risk destination will typically pay a higher premium, reflecting the higher potential for claims. A comprehensive understanding of these factors can enable travelers to select the most appropriate coverage based on their individual needs.

Illustrative Scenarios – Bullet Points, Medex travel insurance

Here are some illustrative scenarios in bullet points to further clarify the coverage’s application:

- A traveler experiences a sudden illness requiring hospitalization in a foreign country. Medex Travel Insurance would cover the costs of hospitalization, medical treatments, and repatriation.

- A traveler’s baggage is lost during international travel. The insurance would cover the cost of replacing essential items, ensuring the traveler’s continued comfort and safety.

- A traveler’s flight is delayed, and they miss their connecting flight, causing a significant disruption to their travel plans. The insurance may cover reasonable expenses incurred due to the delay, such as hotel accommodations and meals.

- A traveler experiences a sudden injury while engaging in a high-risk activity (e.g., extreme sports). The coverage might not apply depending on the nature of the activity and the policy’s exclusions.