Introduction to Merchant Consumer Financing

Merchant consumer financing, a pivotal component of the retail landscape, allows consumers to purchase goods and services and pay for them over time. This financing option is offered directly at the point of sale by the merchant or through a third-party financial institution. It provides an alternative to paying the full price upfront, making larger purchases more accessible and potentially boosting sales for the merchant.

Fundamental Concept and Role in Retail

Merchant consumer financing essentially extends credit to consumers for purchases. This credit is usually provided through installment plans, allowing customers to pay off their purchases in regular payments over a set period. The merchant either absorbs the cost of the financing (by offering 0% interest options, for example) or partners with a financial institution that handles the financing and charges interest to the consumer. This system is a crucial tool for merchants looking to increase sales volume and attract customers who might otherwise be deterred by the initial cost of an item.

Brief History and Evolution

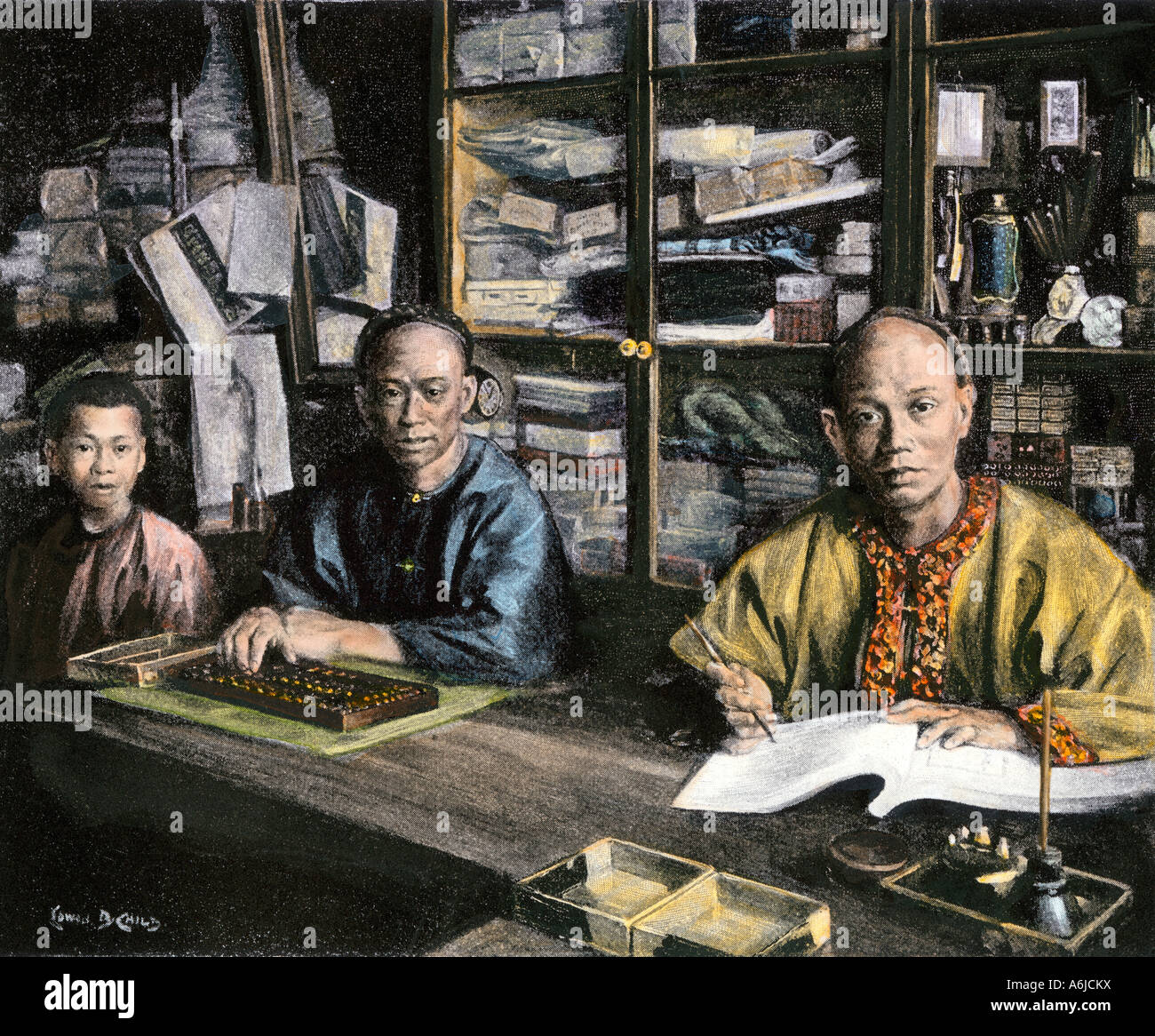

The concept of merchant consumer financing isn’t new. Its roots can be traced back to the early days of retail, evolving alongside the development of credit and financial institutions.

The evolution of merchant consumer financing can be summarized as follows:

- Early Forms (Late 19th and Early 20th Centuries): Merchants began offering in-house credit and installment plans, primarily for high-ticket items like furniture and appliances. These early systems were often informal and reliant on the merchant’s personal assessment of a customer’s creditworthiness.

- The Rise of Department Store Credit (Mid-20th Century): Department stores played a significant role in formalizing consumer credit. They introduced store credit cards, which provided customers with a convenient way to make purchases and pay over time. This period saw the expansion of consumer credit and the standardization of credit terms.

- The Era of Third-Party Financing (Late 20th and Early 21st Centuries): The growth of financial institutions and the development of sophisticated credit scoring systems led to the emergence of third-party financing options. Merchants partnered with banks and other lenders to offer financing at the point of sale. This allowed merchants to offer a wider range of financing options without bearing the full financial burden.

- Modern Merchant Consumer Financing (Present): Today, merchant consumer financing is highly diverse, with options ranging from traditional installment loans to buy-now-pay-later (BNPL) services. Digital platforms and fintech companies have revolutionized the industry, making financing more accessible and convenient for both merchants and consumers.

Key Benefits for Merchants

Merchant consumer financing offers a range of advantages for businesses, ultimately contributing to increased sales and customer loyalty.

The benefits for merchants are:

- Increased Sales Volume: Offering financing removes the immediate price barrier, allowing customers to purchase more expensive items or purchase more items overall.

- Higher Average Transaction Value: Customers are often willing to spend more when they can pay over time, leading to higher average transaction values.

- Improved Customer Conversion Rates: Providing financing options can convert more browsers into buyers, especially for larger purchases.

- Enhanced Customer Loyalty: Financing options can foster customer loyalty by making purchases more accessible and convenient.

- Competitive Advantage: Offering financing can differentiate a merchant from competitors who do not provide such options.

Key Benefits for Consumers

Consumers also benefit from merchant consumer financing, gaining greater purchasing power and flexibility.

The advantages for consumers are:

- Increased Purchasing Power: Financing allows consumers to acquire goods and services they might not be able to afford upfront.

- Budgeting Flexibility: Installment plans provide a structured way to pay for purchases, making budgeting easier.

- Access to Essential Goods and Services: Financing can make essential items like appliances, furniture, and healthcare services more accessible.

- Building Credit History: Making timely payments on financing agreements can help consumers build or improve their credit scores.

- Convenience and Ease of Use: Modern financing options are often easy to apply for and use, providing a seamless purchasing experience.

Types of Merchant Consumer Financing

Merchant consumer financing comes in various forms, each tailored to different consumer needs and business models. Understanding the distinctions between these financing types is crucial for merchants seeking to offer flexible payment options and for consumers looking for accessible financing solutions. This section will explore the most common types of merchant consumer financing, highlighting their key features, terms, and suitability for different scenarios.

Point-of-Sale (POS) Loans

Point-of-sale (POS) loans offer immediate financing at the time of purchase. This type of financing is often facilitated through partnerships between merchants and specialized lenders. POS loans are designed to be a seamless part of the checkout process.

- Process and Functionality: POS loans integrate directly into the merchant’s checkout system, both online and in-store. When a customer selects a financing option, they apply for a loan during the purchase process. Approval decisions are typically made quickly, often within seconds, allowing the customer to complete the purchase immediately.

- Terms and Conditions: POS loans usually offer fixed interest rates and repayment terms, ranging from a few months to several years, depending on the loan amount and the lender’s policies. Loan amounts vary based on the lender and the merchant’s agreement, often starting at a few hundred dollars and extending to tens of thousands.

- Suitability: POS loans are well-suited for merchants selling higher-priced items, such as furniture, electronics, or home improvement services. They are also useful for businesses where customers may not have immediate access to large sums of cash but want to spread payments over time.

- Example: A customer purchasing a new refrigerator for $2,500 at an appliance store might apply for a POS loan through the store’s checkout system. If approved, they would make monthly payments over a specified term, such as 12 or 24 months, with interest.

Installment Plans

Installment plans allow consumers to pay for a purchase in a series of fixed payments over a set period. These plans can be offered directly by the merchant or through a third-party financing provider. They differ from POS loans primarily in their structure and the flexibility they offer.

- Process and Functionality: Installment plans typically involve a pre-arranged agreement between the merchant and the customer. The customer agrees to make regular payments, often monthly, until the purchase price is fully paid. This arrangement can be formalized through a contract or agreement.

- Terms and Conditions: Installment plans may or may not involve interest, depending on the merchant’s policy. The repayment terms can vary widely, from a few months to several years. The terms are usually agreed upon at the time of purchase and are fixed for the duration of the plan.

- Suitability: Installment plans are appropriate for a wide range of businesses, including those selling both high- and low-cost items. They provide flexibility for both merchants and customers, as the terms can be customized to suit specific needs. They are a good option for businesses that want to encourage repeat purchases.

- Example: A customer buys a $1,000 laptop from an online retailer. The retailer offers an installment plan with no interest, allowing the customer to pay $100 per month for 10 months.

Revolving Credit

Revolving credit, typically in the form of a store credit card, provides a line of credit that consumers can use repeatedly. This type of financing offers ongoing access to funds up to a pre-approved credit limit.

- Process and Functionality: Customers apply for a store credit card, and if approved, they receive a credit limit. They can then use the card to make purchases at the merchant’s store or online. As the customer makes payments, their available credit replenishes, allowing them to make further purchases.

- Terms and Conditions: Revolving credit often involves interest charges on outstanding balances. The interest rates can vary and are usually expressed as an annual percentage rate (APR). Credit limits and payment terms are determined by the lender and the customer’s creditworthiness.

- Suitability: Revolving credit is well-suited for merchants who want to encourage repeat business and build customer loyalty. It allows customers to make purchases without having to apply for financing each time. It’s often offered by large retailers and department stores.

- Example: A customer has a store credit card with a $5,000 credit limit at a department store. They purchase a new wardrobe for $800. They then make monthly payments on the $800 balance. As they make payments, their available credit increases, allowing them to make further purchases up to their $5,000 limit.

Comparison of Financing Types

The following table summarizes the key features of each type of merchant consumer financing:

| Feature | POS Loans | Installment Plans | Revolving Credit |

|---|---|---|---|

| Approval Process | Quick, at point of sale | Can be pre-arranged or at point of sale | Requires credit application and approval |

| Interest Rates | Fixed | May or may not include interest | Variable (APR) |

| Repayment Terms | Fixed | Fixed | Minimum monthly payments, revolving |

| Credit Limit | Determined by loan amount | Determined by purchase price | Pre-approved |

| Suitability | Higher-priced items, immediate financing needs | Wide range of products, flexible terms | Repeat purchases, customer loyalty |

Merchant Benefits of Offering Financing

Merchant consumer financing provides numerous advantages, transforming how businesses operate and interact with their customers. Offering financing can lead to increased sales, higher customer loyalty, and improved overall profitability. This section explores the key benefits merchants can realize by incorporating financing options into their business models.

Increased Sales Volume and Average Transaction Value

Offering financing can significantly boost both sales volume and the average transaction value. Customers are often more willing to make larger purchases when they have the option to pay over time.

- Higher Purchase Power: Financing removes the immediate financial barrier, allowing customers to afford more expensive items or services. For instance, a customer might be hesitant to purchase a $2,000 home theater system outright but could comfortably manage monthly payments.

- Increased Sales Conversions: Providing financing can convert potential customers who might have abandoned their purchase due to budget constraints. A study by the National Retail Federation found that businesses offering financing saw an average sales increase of 20-30%.

- Larger Order Sizes: Customers are more likely to add additional items or upgrades to their purchase when financing is available. A customer buying a new appliance might add an extended warranty or related accessories, knowing they can spread the cost.

- Faster Sales Cycles: Financing can streamline the sales process. Customers can make immediate purchasing decisions without waiting to save the full amount, accelerating the time it takes to close a deal.

Attracting New Customers and Improving Customer Loyalty

Implementing merchant consumer financing is a powerful tool for attracting new customers and cultivating stronger customer loyalty. This strategy can provide a competitive edge, setting a business apart from those that do not offer financing options.

- Competitive Advantage: Offering financing can differentiate a business from competitors who do not provide this option. This can be particularly effective in markets with high price sensitivity.

- Wider Customer Reach: Financing makes products and services accessible to a broader audience, including customers with limited immediate cash flow. This can unlock new market segments.

- Enhanced Customer Loyalty: Customers who utilize financing often develop a stronger relationship with the merchant. This is because financing demonstrates a commitment to customer needs and a willingness to facilitate purchases.

- Repeat Business: Financing can encourage repeat purchases. Customers who have a positive experience with financing are more likely to return for future purchases.

Potential Return on Investment (ROI) for Merchants

Calculating the potential ROI from offering merchant consumer financing requires careful consideration of various factors, including the cost of financing, increased sales volume, and the average transaction value. The following table illustrates a simplified example, showcasing the potential financial benefits.

| Metric | Scenario 1: Baseline | Scenario 2: With Financing | Change |

|---|---|---|---|

| Monthly Sales Volume | $50,000 | $65,000 | +30% |

| Average Transaction Value | $250 | $325 | +30% |

| Cost of Financing (per transaction) | $0 | $10 | N/A |

| Monthly Revenue from Financing | $0 | $15,000 | N/A |

| Net Profit (Assuming 20% profit margin) | $10,000 | $13,000 | +30% |

Merchant consumer financing – Explanation of the Table:

Merchant consumer financing allows businesses to offer payment plans to customers, boosting sales and customer loyalty. This strategy is particularly relevant when considering the broader landscape of new venture finance , as startups often explore innovative funding models. Ultimately, understanding merchant consumer financing helps businesses optimize their financial strategies and provide flexible payment options for their consumers, improving their overall financial health.

This table illustrates a hypothetical scenario comparing a merchant’s performance before and after implementing a financing program. Scenario 1 represents the baseline, while Scenario 2 shows the impact of offering financing. The key metrics highlighted include monthly sales volume, average transaction value, the cost associated with financing, monthly revenue from financing, and net profit. By offering financing, the merchant experiences a significant increase in sales volume and average transaction value, leading to a substantial boost in net profit. The cost of financing is considered in the calculations, and the overall impact is a positive return on investment.

Merchant consumer financing provides flexible payment options, boosting sales and customer loyalty. Understanding the landscape involves recognizing key players, and one such entity is american lending finance , which offers diverse financing solutions. Ultimately, the success of merchant consumer financing depends on strategic partnerships and adapting to evolving consumer needs, thereby driving sustained growth for businesses.

Consumer Benefits of Utilizing Financing: Merchant Consumer Financing

Merchant consumer financing offers significant advantages to consumers, primarily by making purchases more accessible and manageable. It empowers consumers to acquire goods and services they might otherwise postpone or be unable to afford upfront. This accessibility can be a crucial tool for both planned and unexpected expenses, impacting various aspects of a consumer’s financial well-being.

Making Purchases More Affordable

Merchant consumer financing makes purchases more affordable by spreading the cost over time. This allows consumers to avoid paying the full price upfront, which can be a significant barrier, particularly for larger purchases.

For example:

* A consumer needs a new refrigerator, which costs $1,500. Without financing, they would need to pay the full amount immediately.

* With financing, the consumer can pay, for instance, $100 per month for 18 months, making the purchase more manageable within their monthly budget.

This structure reduces the immediate financial burden, making essential or desired items attainable.

Managing Budgets and Facilitating Large Purchases

Consumer financing aids in budget management and allows consumers to make large purchases that would otherwise be difficult. By breaking down the cost into smaller, predictable payments, consumers can better plan and allocate their finances.

Here are some examples:

* Home Appliances: Financing can enable the purchase of essential appliances like washing machines, dryers, or dishwashers without depleting savings.

* Medical Expenses: Unexpected medical bills can be a financial strain. Financing can help manage these costs over time, preventing immediate financial hardship.

* Home Improvements: Renovations or repairs, such as a new roof or a kitchen remodel, can be financed, allowing homeowners to improve their property without a large upfront payment.

* Furniture and Electronics: Purchasing furniture or the latest electronics can be facilitated through financing, allowing consumers to enjoy these items without significant immediate expense.

* Education: Financing can support educational pursuits, such as vocational training or higher education courses, enabling individuals to invest in their future.

The ability to spread payments helps in maintaining a balanced budget, reducing the need to use emergency funds or delay necessary purchases.

Potential Risks Associated with Consumer Financing

While consumer financing offers numerous benefits, it also carries potential risks that consumers must be aware of. Understanding these risks is crucial for making informed financial decisions.

Here are some key risks:

* Debt Accumulation: The primary risk is the potential for accumulating debt. Taking on multiple financing agreements or exceeding one’s ability to repay can lead to a cycle of debt.

* Interest Charges: Financing often involves interest charges, which increase the total cost of the purchase. Consumers must carefully consider the interest rate and the total cost of the financing over the repayment period.

* Late Payment Fees: Missing payments can result in late payment fees, which add to the overall cost and can negatively impact credit scores.

* Impact on Credit Score: Consistent late payments or defaults can severely damage a consumer’s credit score, making it difficult to obtain future financing or secure favorable interest rates.

* Overspending: The availability of financing can encourage overspending. Consumers may be tempted to purchase items they do not need or cannot realistically afford.

It’s important to assess one’s financial situation and ability to repay before entering into a financing agreement.

The Application Process and Approval

Understanding the application process and credit approval criteria is crucial for both merchants and consumers engaging in financing. This section details the typical steps involved in securing merchant consumer financing and the factors influencing approval decisions. It provides a practical guide for consumers, ensuring they are well-informed and prepared to navigate the process successfully.

Typical Application Process

The application process for merchant consumer financing generally follows a standardized sequence. This process is designed to efficiently assess a consumer’s creditworthiness and determine eligibility for financing.

The application process typically includes the following steps:

- Application Submission: The consumer initiates the process by completing an application, often online or in-store. This typically involves providing personal information such as name, address, contact details, and employment history. The application also requires details about the purchase the consumer intends to finance.

- Information Verification: The financing provider verifies the information provided by the consumer. This often involves checking the accuracy of the personal details, employment, and income.

- Credit Check: A credit check is conducted to assess the consumer’s credit history. This involves reviewing the consumer’s credit score, payment history, outstanding debts, and other relevant credit information from credit bureaus.

- Approval Decision: Based on the information gathered and the credit check results, the financing provider makes an approval decision. This may involve automated scoring systems or manual review by a credit analyst.

- Offer and Agreement: If approved, the consumer receives a financing offer, including the loan amount, interest rate, repayment terms, and any associated fees. The consumer must agree to the terms and sign a financing agreement.

- Purchase Completion: Upon agreement, the financing provider disburses the funds to the merchant, and the consumer can complete the purchase. The consumer then begins making payments according to the agreed-upon schedule.

Factors Influencing Credit Approval

Several factors play a significant role in determining a consumer’s credit approval for merchant financing. Understanding these factors can help consumers improve their chances of being approved and secure favorable financing terms.

Key factors considered during the credit approval process include:

- Credit Score: The credit score is a primary indicator of creditworthiness. Lenders use it to assess the risk associated with lending money to a consumer. A higher credit score generally leads to better financing terms. For example, a consumer with a credit score of 700 or higher may qualify for lower interest rates compared to a consumer with a score below 600.

- Credit History: The credit history reveals the consumer’s past borrowing and repayment behavior. Positive credit history, including on-time payments and responsible credit utilization, enhances approval chances. Negative marks, such as late payments, defaults, or bankruptcies, can negatively impact the decision.

- Debt-to-Income Ratio (DTI): DTI measures the proportion of a consumer’s monthly income allocated to debt payments. Lenders use DTI to determine the consumer’s ability to manage additional debt. A lower DTI indicates a better ability to handle debt obligations.

- Income and Employment: Stable employment and a consistent income stream are essential. Lenders want assurance that the consumer can repay the loan. Verification of employment and income is standard practice.

- Credit Utilization: Credit utilization refers to the amount of credit a consumer uses compared to their total available credit. Keeping credit utilization low, ideally below 30%, is beneficial. High credit utilization can signal financial strain.

Step-by-Step Guide for Consumers

Applying for merchant consumer financing requires careful preparation and attention to detail. Following a step-by-step guide can streamline the process and increase the likelihood of approval.

Here’s a practical guide for consumers applying for merchant consumer financing:

- Assess Financial Needs: Determine the exact amount of financing required and create a budget. Understanding the purchase price and any associated costs is essential.

- Check Credit Score and Report: Obtain a copy of your credit report from all three major credit bureaus (Experian, Equifax, and TransUnion) to understand your credit profile. Review for errors and address any discrepancies.

- Research Financing Options: Explore the financing options offered by the merchant and compare them to other potential financing sources, such as personal loans or credit cards.

- Gather Required Documentation: Prepare the necessary documentation, which typically includes:

- Proof of Identification: Driver’s license, passport, or other government-issued ID.

- Proof of Address: Utility bill, bank statement, or lease agreement.

- Proof of Income: Pay stubs, W-2 forms, or tax returns.

- Bank Statements: Recent bank statements may be requested to verify income and financial stability.

- Complete the Application: Fill out the application accurately and honestly, providing all required information. Review the application carefully before submitting it.

- Review the Terms and Conditions: If approved, carefully review the financing agreement, including the interest rate, repayment terms, and any fees. Ask questions if anything is unclear.

- Make Timely Payments: Once the financing is approved, adhere to the payment schedule to maintain a good credit history.

Pro Tip: Set up automatic payments to avoid late fees and ensure timely payments.

Compliance and Regulations

Merchant consumer financing operates within a complex legal landscape designed to protect consumers and ensure fair lending practices. Navigating these regulations is crucial for both merchants and lenders to avoid legal issues and maintain consumer trust. Compliance involves understanding and adhering to a variety of federal and state laws, which can vary depending on the specific financing arrangement and the location of the business.

Key Regulations Governing Merchant Consumer Financing

Several key regulations shape the landscape of merchant consumer financing. These regulations aim to protect consumers from predatory lending practices, ensure transparency, and promote fair treatment. Compliance with these is a must for all parties involved.

- Truth in Lending Act (TILA): This federal law requires lenders to disclose the terms and conditions of a loan to consumers. This includes the annual percentage rate (APR), finance charges, and the total cost of the credit. TILA ensures that consumers have the information they need to make informed decisions about borrowing money.

- Equal Credit Opportunity Act (ECOA): ECOA prohibits lenders from discriminating against credit applicants based on race, color, religion, national origin, sex, marital status, or age. It ensures that all consumers have equal access to credit. Lenders must evaluate creditworthiness based on objective criteria, not on discriminatory factors.

- Fair Credit Reporting Act (FCRA): FCRA regulates the collection, dissemination, and use of consumer information. It gives consumers the right to access their credit reports and dispute any inaccuracies. This helps protect consumers from identity theft and ensures the accuracy of credit information.

- State-Specific Regulations: Many states have their own consumer protection laws that may be more stringent than federal regulations. These laws can cover areas such as interest rate caps, licensing requirements for lenders, and debt collection practices. Merchants and lenders must comply with the laws of the states in which they operate. For example, California has specific regulations related to the disclosure of financing terms for retail installment contracts.

Consumer Protection Laws Applicable to Financing Arrangements

Consumer protection laws are designed to safeguard consumers from unfair or deceptive practices in the financial industry. These laws provide recourse for consumers who are harmed by illegal or unethical lending practices.

- Fair Debt Collection Practices Act (FDCPA): This federal law regulates debt collectors and prohibits abusive, deceptive, and unfair debt collection practices. It protects consumers from harassment and ensures they are treated fairly during the debt collection process.

- Usury Laws: These state laws set limits on the interest rates that lenders can charge. Usury laws vary by state and can significantly impact the profitability of merchant consumer financing. Lenders must ensure that their interest rates comply with the usury laws in the states where they operate.

- Consumer Financial Protection Bureau (CFPB) Regulations: The CFPB is a federal agency responsible for enforcing federal consumer financial laws. The CFPB has the authority to investigate and take action against companies that violate these laws. The CFPB’s regulations cover a wide range of financial products and services, including consumer financing.

- State Attorney General Enforcement: State Attorneys General also play a critical role in enforcing consumer protection laws. They can investigate complaints, file lawsuits, and take other actions to protect consumers from unfair or deceptive practices.

Responsibilities of Merchants and Lenders in Ensuring Compliance, Merchant consumer financing

Both merchants and lenders have distinct responsibilities in ensuring compliance with the applicable laws and regulations. A collaborative approach is often the most effective way to mitigate risks and maintain a compliant financing program.

- Merchant Responsibilities:

- Due Diligence: Merchants should carefully vet the lenders they partner with to ensure they are reputable and compliant with all applicable laws.

- Transparency: Merchants should clearly disclose the financing options available to consumers, including the terms and conditions, interest rates, and any fees.

- Training: Merchants should train their employees on the basics of consumer financing and the importance of compliance.

- Record Keeping: Merchants should maintain accurate records of all financing transactions.

- Lender Responsibilities:

- Licensing: Lenders must obtain any necessary licenses required by state law.

- Compliance Program: Lenders should establish a robust compliance program to ensure they are adhering to all applicable laws and regulations.

- Disclosure: Lenders must provide consumers with all required disclosures, including the APR, finance charges, and other important terms.

- Fair Lending Practices: Lenders must comply with the ECOA and avoid any discriminatory lending practices.

- Data Security: Lenders must protect consumer data and comply with data security regulations.

Technology and Merchant Consumer Financing

Technology plays a pivotal role in modern merchant consumer financing, streamlining processes and enhancing the overall experience for both merchants and consumers. From initial application to final payment, technology provides the infrastructure for efficiency, security, and scalability. It allows for seamless integration with existing business systems, offering flexibility and data-driven insights to optimize financing programs. The adoption of technology is not merely an option but a necessity for merchants seeking to compete in today’s dynamic marketplace.

Online Application Platforms and Payment Processing Systems

Online application platforms and payment processing systems are the cornerstones of modern merchant consumer financing. These technologies facilitate the entire financing lifecycle, from the initial application to the final payment. They improve accessibility, accelerate approvals, and provide a user-friendly experience.

- Online Application Platforms: These platforms allow consumers to apply for financing directly through a merchant’s website or point-of-sale (POS) system. They often integrate with credit bureaus and other data sources to provide instant or near-instant credit decisions. These platforms often utilize responsive design, ensuring a seamless experience across all devices. For example, a furniture store might use an online application platform that allows customers to apply for financing while browsing products on their website, increasing conversion rates and sales.

- Payment Processing Systems: Integrated payment processing systems are essential for handling financing transactions. These systems securely process payments, track installment schedules, and manage customer accounts. They integrate with various payment methods, including credit cards, debit cards, and ACH transfers, providing flexibility for both merchants and consumers. For instance, a dental clinic can use a payment processing system to automatically deduct monthly payments from a patient’s bank account, simplifying the payment process and reducing the risk of missed payments.

Efficiency and Security of Financing Transactions

Technology significantly improves the efficiency and security of merchant consumer financing transactions. Automated processes, data analytics, and robust security protocols contribute to a safer and more streamlined financing experience.

- Automation: Automation streamlines several aspects of the financing process, including application review, approval, and payment processing. This reduces manual intervention, minimizes errors, and accelerates transaction times. For example, automated credit scoring systems can instantly assess a consumer’s creditworthiness, providing near-instant approval decisions.

- Data Analytics: Data analytics provides valuable insights into consumer behavior, payment patterns, and risk assessment. Merchants can leverage this data to personalize financing offers, identify potential fraud, and optimize their financing programs. For example, analyzing payment data can help identify customers at risk of default, allowing merchants to proactively offer payment plans or other assistance.

- Security Protocols: Robust security protocols, such as encryption, tokenization, and multi-factor authentication, protect sensitive consumer data and prevent fraud. These measures ensure that financial transactions are secure and compliant with industry regulations. For example, tokenization replaces sensitive cardholder data with a unique identifier, reducing the risk of data breaches.

Latest Trends in Technology for Merchant Consumer Financing

The field of merchant consumer financing is constantly evolving, driven by technological advancements. Staying informed about the latest trends is essential for merchants to remain competitive and provide the best possible financing experience.

- Artificial Intelligence (AI) and Machine Learning (ML): AI and ML are being used to improve credit scoring, personalize financing offers, and detect fraud. AI-powered chatbots can provide customer support, answering questions and guiding consumers through the application process. For example, ML algorithms can analyze large datasets to identify patterns and predict credit risk more accurately than traditional methods.

- Blockchain Technology: Blockchain technology offers enhanced security and transparency in financing transactions. It can be used to create secure and immutable records of payment schedules and transactions, reducing the risk of fraud and disputes. For example, blockchain can be used to create a decentralized ledger for financing agreements, making them more transparent and tamper-proof.

- Mobile-First Financing: With the increasing use of smartphones, mobile-first financing solutions are becoming more prevalent. Consumers can apply for financing, manage their accounts, and make payments directly from their mobile devices. This enhances convenience and accessibility. For example, a consumer can use a mobile app to apply for financing while shopping in a store and receive an instant approval decision.

- Embedded Finance: Embedded finance integrates financing options directly into the merchant’s platform or ecosystem. This allows consumers to access financing seamlessly at the point of purchase. For example, a software provider might embed financing options directly within its billing system, allowing customers to pay for subscriptions over time.

Risk Management in Merchant Consumer Financing

Merchant consumer financing, while offering significant benefits, introduces various risks that merchants must actively manage to ensure financial stability and protect their business. Effective risk management involves understanding these potential pitfalls and implementing strategies to mitigate their impact. A proactive approach to risk management is crucial for the long-term success of any merchant offering consumer financing.

Types of Risks in Merchant Consumer Financing

Merchant consumer financing exposes businesses to several key risks that can impact profitability and operational efficiency. Recognizing these risks is the first step towards effective management.

- Credit Risk: This is the risk that consumers will default on their financing obligations, leading to losses for the merchant. Credit risk is directly related to the creditworthiness of the borrowers. The probability of default increases with lower credit scores.

- Fraud Risk: Fraud encompasses various deceptive practices, including identity theft, application fraud, and synthetic identity fraud. These activities can result in financial losses and legal repercussions for the merchant.

- Operational Risk: This refers to the potential for losses resulting from inadequate or failed internal processes, people, and systems, or from external events. Examples include errors in loan processing, system failures, or disruptions to payment systems.

- Liquidity Risk: This is the risk that a merchant may not have sufficient cash flow to meet its financial obligations, such as funding loans or covering operating expenses. This can be exacerbated by high default rates or delays in payments from consumers.

- Compliance Risk: Merchants must adhere to numerous regulations, including those related to lending practices, data privacy, and anti-money laundering (AML). Non-compliance can lead to fines, legal action, and reputational damage.

- Reputational Risk: Poor handling of financing programs, including aggressive collection practices or unfair terms, can damage a merchant’s reputation and erode customer trust.

Strategies for Mitigating Risks

Merchants can employ several strategies to effectively manage the risks associated with consumer financing. These strategies involve careful planning, due diligence, and ongoing monitoring.

- Credit Scoring: Implement a robust credit scoring system to assess the creditworthiness of applicants. This involves analyzing credit reports, payment history, and other relevant data to assign a credit score. Higher scores indicate lower credit risk. Utilize a tiered credit system to offer different financing terms (e.g., interest rates, loan amounts) based on the applicant’s credit score.

- Fraud Detection: Employ fraud detection tools and techniques to identify and prevent fraudulent applications. This can include identity verification, address verification, and the use of fraud scoring models. Implement real-time monitoring of loan applications and transactions to detect suspicious activity.

- Loan Portfolio Diversification: Avoid concentrating financing on a small number of high-risk borrowers or products. Diversifying the loan portfolio across different consumer segments and product categories can reduce the impact of defaults.

- Due Diligence: Conduct thorough due diligence on all financing partners, including lenders and service providers. Verify their financial stability, compliance practices, and risk management capabilities.

- Data Security: Implement robust data security measures to protect sensitive consumer information from unauthorized access or breaches. This includes encryption, access controls, and regular security audits.

- Insurance: Consider obtaining credit insurance to protect against losses from consumer defaults. This can transfer some of the credit risk to an insurance provider.

Best Practices for Managing Consumer Defaults and Collections

Managing consumer defaults and collections requires a delicate balance between recovering funds and maintaining customer relationships. Adopting best practices can improve recovery rates while minimizing negative impacts.

- Early Intervention: Implement a proactive approach to identify and address potential defaults early on. This includes sending timely payment reminders and contacting consumers who are behind on their payments.

- Communication and Payment Plans: Establish clear and consistent communication with borrowers. Offer flexible payment plans or modifications to help consumers manage their debts and avoid default. This may involve temporary interest rate reductions or extending the loan term.

- Collection Agency Management: If internal collection efforts fail, engage a reputable collection agency. Ensure the agency complies with all applicable laws and regulations regarding debt collection practices.

- Legal Action (as a Last Resort): Consider legal action to recover debts only after exhausting all other collection efforts. Seek legal counsel to ensure compliance with all applicable laws and regulations.

- Charge-Off Policy: Establish a clear policy for writing off uncollectible debts. This involves determining when a debt is unlikely to be recovered and removing it from the balance sheet.

- Continuous Monitoring and Analysis: Continuously monitor the performance of the financing program and analyze default rates, recovery rates, and other key metrics. Use this data to identify areas for improvement and refine risk management strategies. For example, a high default rate on a specific product category may indicate a need to adjust the financing terms or credit approval criteria for that product.

Case Studies: Successful Merchant Consumer Financing Programs

Understanding how merchant consumer financing works in practice is crucial for merchants considering its implementation. Examining successful case studies provides valuable insights into effective strategies, potential challenges, and the overall impact of offering financing options. These real-world examples showcase the diverse applications of merchant consumer financing across different industries and highlight the key factors contributing to their success.

Retail: Furniture Retailer

This case study examines a furniture retailer that implemented a consumer financing program to increase sales and attract more customers.

The furniture retailer partnered with a financial technology company to offer a range of financing options at the point of sale, including installment loans and revolving credit lines. They promoted the financing options through in-store signage, online advertising, and email marketing campaigns.

Key strategies and tactics:

- Prominent Point-of-Sale Integration: Financing options were seamlessly integrated into the checkout process, making it easy for customers to apply and receive approval quickly. This integration significantly reduced friction in the buying process.

- Targeted Marketing Campaigns: The retailer ran targeted marketing campaigns, highlighting the benefits of financing for specific product categories, such as luxury sofas or complete bedroom sets.

- Flexible Financing Terms: Offering a variety of financing terms, including 0% APR options for a limited time, appealed to a wider customer base and increased purchase value.

- Staff Training: Sales staff received comprehensive training on how to explain the financing options to customers and address any concerns they might have.

The results were impressive:

- Increased Sales: The retailer experienced a significant increase in sales volume, particularly for higher-priced items.

- Higher Average Order Value (AOV): Customers who used financing tended to spend more per transaction.

- Improved Customer Loyalty: Offering financing options helped the retailer build customer loyalty by providing a more convenient and affordable shopping experience.

Lessons learned:

- Seamless Integration is Key: The ease of applying for and using financing options is critical to success.

- Targeted Marketing Drives Results: Focusing marketing efforts on specific products and customer segments can maximize the impact of the financing program.

- Staff Training Matters: Well-trained staff can effectively communicate the benefits of financing and help customers make informed decisions.

Healthcare: Dental Practice

This case study illustrates how a dental practice leveraged consumer financing to make expensive treatments more accessible and boost patient acquisition.

The dental practice partnered with a healthcare financing provider to offer patients payment plans for various procedures, including cosmetic dentistry, orthodontics, and implants. They prominently displayed information about the financing options in their waiting room, on their website, and during patient consultations.

Key strategies and tactics:

- Transparent Pricing and Payment Plans: The practice provided clear and transparent pricing for all treatments, along with detailed information about available payment plans.

- Patient Education: Dentists and staff were trained to explain the benefits of financing and address any concerns patients might have about the cost of treatment.

- Streamlined Application Process: The financing application process was designed to be quick and easy, with online applications and instant approval decisions.

- Integration with Practice Management Software: The financing program was integrated with the practice’s existing software, simplifying billing and payment tracking.

The impact of the financing program:

- Increased Patient Volume: The practice saw an increase in the number of new patients seeking treatment.

- Higher Treatment Acceptance Rates: Patients were more likely to accept recommended treatments when financing was available.

- Improved Cash Flow: The practice experienced improved cash flow by receiving payments upfront from the financing provider.

Lessons learned:

- Focus on Patient Education: Clearly explaining the benefits of financing and addressing patient concerns is essential.

- Simplify the Application Process: A quick and easy application process increases patient satisfaction.

- Integration is Crucial: Integrating the financing program with existing practice systems streamlines operations.

Home Improvement: Contractor Services

This case study explores a home improvement contractor that implemented consumer financing to secure more projects and increase project values.

The contractor partnered with a financing company specializing in home improvement loans. They offered financing options to customers for various projects, such as kitchen renovations, bathroom upgrades, and new roofing installations. The financing options were promoted through sales presentations, online quotes, and marketing materials.

Key strategies and tactics:

- Pre-Approval Options: The contractor offered pre-approval for financing, allowing potential customers to determine their budget before starting a project.

- Project-Specific Financing: Financing options were tailored to the specific needs of each project, including different loan amounts and repayment terms.

- Marketing Focus on Affordability: Marketing materials emphasized the affordability of home improvement projects when financed, highlighting monthly payment amounts.

- Partnership with Reliable Financing Providers: The contractor partnered with a reputable financing company to ensure a smooth and trustworthy experience for customers.

The outcomes of the financing program:

- Increased Project Wins: The contractor saw a significant increase in the number of projects secured.

- Higher Project Values: Customers were more likely to undertake larger projects when financing was available.

- Improved Sales Cycle: The financing options helped shorten the sales cycle by making it easier for customers to make a decision.

Lessons learned:

- Offer Pre-Approval: Pre-approval provides customers with a clear understanding of their financing options.

- Tailor Financing to Projects: Customizing financing options to fit project needs increases customer satisfaction.

- Focus on Affordability in Marketing: Highlighting monthly payments can make projects seem more accessible.

Future Trends in Merchant Consumer Financing

The merchant consumer financing landscape is constantly evolving, driven by technological advancements, changing consumer preferences, and shifts in the economic environment. Understanding these emerging trends is crucial for merchants and consumers alike to make informed decisions and leverage the benefits of these financing options. The future of merchant consumer financing promises to be dynamic, with a focus on greater accessibility, personalization, and integration with the overall shopping experience.

The Rise of Buy Now, Pay Later (BNPL)

Buy Now, Pay Later (BNPL) options have rapidly gained popularity, transforming the way consumers make purchases. This trend is significantly impacting both merchants and consumers, creating new opportunities and challenges. BNPL services typically allow consumers to split purchases into installments, often with little or no interest, making them an attractive alternative to traditional credit cards.

- Impact on Merchants: BNPL services can increase sales conversion rates and average order values. By offering flexible payment options, merchants can attract a wider customer base, including those who might be hesitant to use credit cards or lack access to traditional financing. Merchants often pay a fee to BNPL providers, which can impact their profit margins. However, the increase in sales volume can often offset these costs. For example, a furniture retailer partnering with a BNPL provider might see a 20% increase in sales, even after accounting for the fees.

- Impact on Consumers: BNPL offers consumers greater flexibility and control over their finances. It allows them to spread out payments over time, making larger purchases more manageable. However, consumers should be aware of the potential risks, such as late payment fees and the accumulation of debt. Overspending is a significant concern, as the ease of access to credit can lead to impulsive purchases. It is crucial for consumers to understand the terms and conditions of BNPL agreements and to budget accordingly.

Potential Innovations in Merchant Consumer Financing Over the Next 5 Years

The next five years are poised to bring about significant innovations in merchant consumer financing, driven by advancements in technology and evolving consumer needs. These innovations will likely enhance the shopping experience, provide greater financial flexibility, and introduce new ways for merchants to engage with their customers.

- AI-Powered Personalized Financing: Artificial intelligence (AI) will play a significant role in personalizing financing options. AI algorithms can analyze a customer’s purchase history, creditworthiness, and preferences to offer tailored financing plans. This could include dynamic interest rates, flexible payment schedules, and pre-approved credit limits. For example, a clothing retailer could use AI to offer a customer a BNPL plan with a longer repayment period based on their purchase history and credit profile.

- Embedded Financing at Checkout: Financing options will become increasingly integrated into the checkout process. Merchants will offer financing directly within their online stores or at physical point-of-sale systems, making it seamless for customers to apply and receive approval. This integration will reduce friction in the purchasing process and improve the overall customer experience. Imagine a customer buying a new laptop online; they would see financing options (BNPL, installment loans) directly on the product page and checkout, making the decision-making process much simpler.

- Increased Use of Open Banking: Open banking allows third-party providers to access consumer financial data with their consent, enabling more accurate risk assessments and personalized financing offers. This can lead to faster approval times and lower interest rates for consumers. For instance, a merchant could use open banking to verify a customer’s income and credit history in real-time, reducing the need for extensive paperwork.

- Expansion of BNPL into New Sectors: While BNPL is already prevalent in e-commerce, it is expected to expand into new sectors, such as healthcare, education, and travel. This expansion will provide consumers with more flexible payment options for essential services. For example, a patient could use BNPL to finance a medical procedure or a student could use it to pay for tuition fees.

- Decentralized Finance (DeFi) and Cryptocurrency Integration: DeFi and cryptocurrencies could potentially disrupt the traditional financing landscape. Merchants might start accepting cryptocurrency payments with built-in financing options, and DeFi platforms could offer innovative lending solutions. However, the volatility of cryptocurrencies and regulatory uncertainties pose challenges to widespread adoption. A luxury goods retailer could allow customers to finance purchases using a stablecoin, with payments automatically converted to fiat currency.