Technological Advancements and Their Influence: Pharma Pulse 12/20/24: Trends In Enterprise Value Growth And

Technological advancements are profoundly reshaping the pharmaceutical industry, acting as a key driver of enterprise value growth. The integration of innovative technologies is not merely enhancing efficiency but is fundamentally altering the drug discovery, development, and delivery processes, leading to increased profitability and market competitiveness. This section will explore the specific impact of AI and personalized medicine, highlighting their contributions to pharmaceutical enterprise value.

The application of artificial intelligence (AI) and machine learning (ML) across various stages of the pharmaceutical pipeline is revolutionizing the industry. From drug discovery and development to clinical trials and post-market surveillance, AI algorithms are accelerating processes, improving accuracy, and reducing costs. For example, AI can analyze vast datasets of genomic information, identifying potential drug targets and predicting drug efficacy more efficiently than traditional methods. This accelerates the time-to-market for new drugs, a crucial factor in maximizing return on investment and securing market share.

AI-Driven Drug Discovery and Development

AI algorithms are significantly improving the efficiency and success rate of drug discovery. By analyzing massive datasets of molecular structures, biological pathways, and clinical trial data, AI can identify promising drug candidates, predict their efficacy and safety profiles, and optimize their design. This reduces the time and cost associated with traditional trial-and-error approaches, leading to faster development cycles and increased profitability. For instance, Atomwise uses AI to screen millions of molecules to identify potential drug candidates, significantly reducing the time and resources required for traditional high-throughput screening. This accelerated discovery process directly contributes to increased enterprise value by bringing new drugs to market sooner and potentially commanding higher prices due to market exclusivity.

Personalized Medicine and its Impact on Enterprise Value

Personalized medicine, enabled by advancements in genomics and other “omics” technologies, is transforming the pharmaceutical industry by tailoring treatments to individual patients based on their unique genetic makeup, lifestyle, and environmental factors. This approach promises more effective treatments with fewer side effects, leading to improved patient outcomes and increased market demand. For example, companies are developing companion diagnostics that identify patients most likely to benefit from specific therapies, improving treatment efficacy and reducing healthcare costs. The development and successful implementation of personalized medicine strategies directly contribute to enhanced enterprise value through higher pricing power for targeted therapies and improved patient compliance.

Hypothetical Scenario: A Novel AI-Powered Drug Delivery System

Imagine a pharmaceutical company developing a novel AI-powered drug delivery system that uses implantable sensors and machine learning algorithms to precisely control drug release based on real-time patient data. This system would optimize drug efficacy while minimizing side effects, leading to significantly improved patient outcomes. The resulting increased demand and premium pricing for this personalized drug delivery technology would dramatically boost the company’s enterprise value. This scenario is not unrealistic; similar technologies are already under development, suggesting that this type of innovation could represent a substantial future driver of enterprise value in the pharmaceutical sector. Such a system could command a significantly higher price than traditional drug delivery methods, leading to substantial revenue growth and a marked increase in the company’s market capitalization.

Financial Performance Indicators

Understanding a pharmaceutical company’s financial health is crucial for assessing its enterprise value growth. Several key performance indicators (KPIs) offer valuable insights into a company’s profitability, efficiency, and overall financial strength. Analyzing these metrics provides a comprehensive picture of the company’s performance and its potential for future growth.

Return on Equity (ROE)

Return on Equity (ROE) measures a company’s profitability relative to shareholders’ equity. It indicates how efficiently a company is using its shareholders’ investments to generate profits. A higher ROE suggests better management of assets and greater profitability.

ROE = Net Income / Shareholders’ Equity

ROE is calculated by dividing the company’s net income by its shareholders’ equity. A high ROE indicates strong profitability and efficient use of capital, while a low ROE might signal inefficiency or challenges in generating profits. Industry benchmarks are essential for interpreting ROE effectively; a company’s ROE should be compared to its competitors to assess its relative performance.

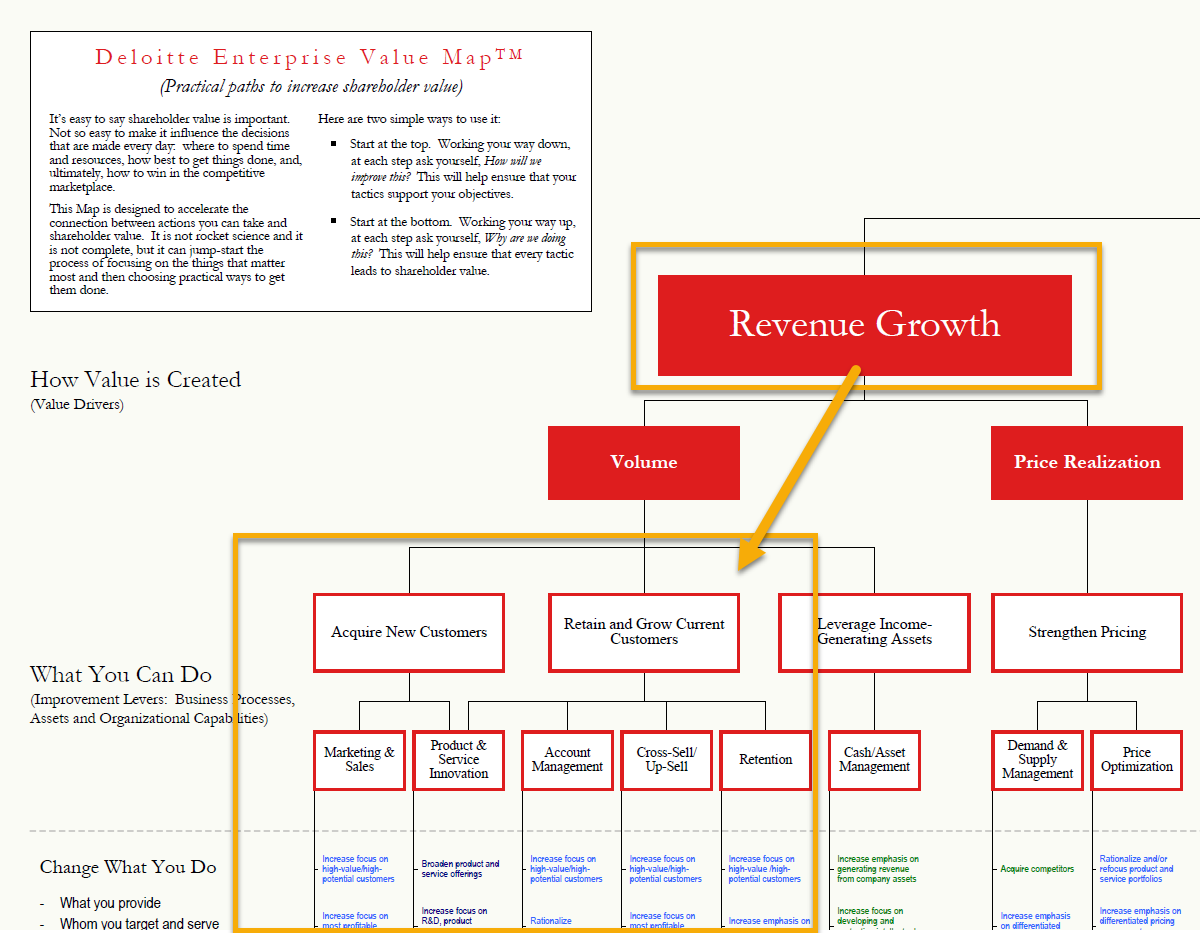

Revenue Growth

Revenue growth reflects the increase in a pharmaceutical company’s sales over a specific period. Sustained revenue growth is a key indicator of a company’s market position, product demand, and overall success. It’s essential for long-term enterprise value growth.

Revenue growth is simply calculated as the percentage change in revenue from one period to the next. For example, if a company’s revenue increased from $1 billion to $1.2 billion in a year, its revenue growth would be 20%. Consistent and substantial revenue growth is a strong signal of a healthy and expanding business. Factors influencing revenue growth include new product launches, market share gains, and pricing strategies.

Earnings Per Share (EPS), Pharma Pulse 12/20/24: Trends in Enterprise Value Growth and

Earnings Per Share (EPS) represents the portion of a company’s profit allocated to each outstanding share. It reflects the profitability available to shareholders. A consistently increasing EPS usually indicates a company’s strong financial performance and increased shareholder value.

EPS = (Net Income – Preferred Dividends) / Weighted Average Outstanding Shares

EPS is calculated by subtracting preferred dividends from net income and then dividing the result by the weighted average number of outstanding shares. A rising EPS trend demonstrates improved profitability and suggests positive future growth prospects. Analyzing EPS alongside other KPIs provides a more comprehensive understanding of a company’s financial health and enterprise value growth potential.

Hypothetical Financial Statement Snippet

The following table presents a hypothetical financial statement snippet showcasing strong performance in the three selected KPIs for a pharmaceutical company named “NovaPharm”:

| KPI | Value (USD Millions) | Year-over-Year Change (%) | Interpretation |

|---|---|---|---|

| Return on Equity (ROE) | 25 | +10% | Strong profitability and efficient use of shareholder investments. Above industry average. |

| Revenue Growth | 1500 | +15% | Significant increase in sales, indicating strong market demand and successful product launches. |

| Earnings Per Share (EPS) | 5.00 | +12% | Increased profitability per share, reflecting positive growth and value creation for shareholders. |

Future Outlook and Predictions

The pharmaceutical market is poised for continued growth, driven by an aging global population, the rise of chronic diseases, and ongoing technological advancements. However, navigating this landscape requires a keen understanding of both the opportunities and the challenges that lie ahead. The next 12 months will be crucial in shaping the industry’s trajectory, particularly concerning enterprise value growth.

The projected growth trajectory for the pharmaceutical market over the next 12 months is estimated to be in the range of 4-6%, driven primarily by increased demand for innovative therapies and expanding access to healthcare in emerging markets. This growth, however, is not uniform across all segments. While oncology and immunology continue to show strong growth potential, other therapeutic areas may experience slower growth due to factors like patent expirations and pricing pressures. For example, the successful launch of a novel biologic drug could significantly boost a company’s enterprise value, mirroring the impact of recent successful immunotherapies. Conversely, the loss of exclusivity on a blockbuster drug could negatively impact a company’s valuation, as seen with several established medications in recent years.

Potential Challenges and Opportunities for Enterprise Value Growth

Several factors will influence enterprise value growth in the pharmaceutical sector over the next year. Opportunities exist in areas such as personalized medicine, gene therapy, and artificial intelligence-driven drug discovery. However, challenges remain, including regulatory hurdles, increasing R&D costs, and pricing pressures from payers. The successful navigation of these challenges will be key to maximizing enterprise value. For instance, companies that effectively leverage AI in drug discovery could significantly reduce development times and costs, leading to a higher return on investment and increased enterprise value. Conversely, companies facing significant regulatory delays or pricing disputes could experience a decline in their valuation.

Promising Areas for Investment

Given the current landscape, several areas within the pharmaceutical industry appear particularly promising for investment. These include:

- Oncology: Continued advancements in immunotherapy and targeted therapies are driving significant growth in this area. Investment in companies developing novel oncology treatments, particularly those addressing unmet medical needs, is likely to yield strong returns.

- Biosimilars: The growing market for biosimilars presents significant opportunities for cost savings and increased access to life-saving medications. Investment in companies developing and commercializing high-quality biosimilars is expected to be lucrative.

- Digital Therapeutics: The integration of digital technologies into healthcare is transforming the pharmaceutical industry. Investment in companies developing innovative digital therapeutics holds considerable promise.

It’s important to note that these are just a few examples, and the success of any investment will depend on various factors, including market conditions and the specific company’s performance. Diversification across different therapeutic areas and investment strategies is crucial to mitigate risk. For example, investing in a company specializing in both biosimilars and digital therapeutics could offer a balanced portfolio approach, hedging against potential market fluctuations within a single therapeutic area.