Overview of Plastiq’s Short-Term Financing

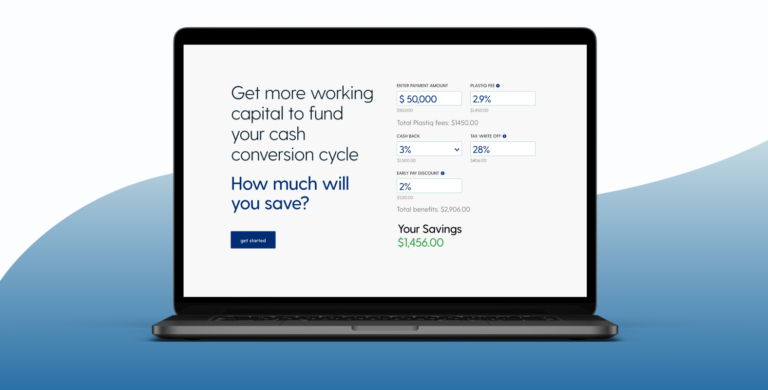

Plastiq offers short-term financing solutions designed to provide businesses with flexible access to capital. This financing option allows businesses to pay vendors and suppliers, even when they lack sufficient funds on hand, by using credit cards. This can be a valuable tool for managing cash flow and taking advantage of opportunities.

Core Concept of Plastiq’s Short-Term Financing

Plastiq’s short-term financing essentially acts as a bridge loan. Businesses use Plastiq to pay their vendors using a credit card, even if the vendor doesn’t directly accept credit card payments. Plastiq then advances the funds to the vendor and the business repays Plastiq, typically over a defined period. This process allows businesses to delay payment to Plastiq while still satisfying their obligations to vendors. The fees associated with the service are often structured as a percentage of the payment amount.

Target Audience for Plastiq’s Short-Term Financing

This financing option is particularly well-suited for specific business types and situations. Understanding the ideal customer profile helps in evaluating its suitability.

- Small and Medium-Sized Businesses (SMBs): SMBs often face cash flow challenges. Plastiq’s financing can provide a lifeline, allowing them to meet immediate obligations without disrupting operations. For instance, a small construction company might use Plastiq to pay for materials while waiting for a payment from a client.

- Businesses with High Credit Card Rewards: Businesses that earn substantial rewards from their credit cards can leverage Plastiq to maximize these benefits. Paying vendors through Plastiq, and subsequently paying the credit card bill, can result in significant rewards accumulation.

- Businesses Seeking to Improve Cash Flow Management: Companies looking for greater control over their finances can use Plastiq to extend payment terms. This can free up working capital and allow businesses to invest in growth opportunities.

- Businesses Facing Seasonal Fluctuations: Businesses with seasonal revenue cycles, such as retailers, can utilize Plastiq to manage expenses during slower periods. This provides financial stability when income is limited.

Main Advantages of Plastiq’s Short-Term Financing

Plastiq’s short-term financing provides several advantages that can benefit businesses in various ways. These advantages contribute to better financial management and operational efficiency.

- Improved Cash Flow: The ability to delay payments allows businesses to better manage their working capital. This can be critical for funding other expenses or investments.

- Flexibility in Payment Options: Businesses can use credit cards to pay vendors, even if those vendors don’t directly accept credit cards. This expands payment options and simplifies transactions.

- Potential for Earning Rewards: Businesses can earn credit card rewards on their spending, effectively offsetting the cost of financing. This can lead to cost savings.

- Simplified Vendor Payments: Plastiq handles the payment process, simplifying vendor relationships and reducing administrative overhead. This can save time and resources.

- Access to Funds When Needed: Provides quick access to capital, allowing businesses to seize opportunities and maintain operations during cash flow gaps.

Eligibility Requirements and Application Process

Understanding the eligibility criteria and the application process is crucial for businesses seeking short-term financing through Plastiq. This section provides a detailed breakdown of the requirements and a step-by-step guide to navigate the application successfully.

Eligibility Criteria

Plastiq has specific criteria businesses must meet to qualify for short-term financing. Meeting these requirements is the first step in accessing their financing options.

- Business Type: Plastiq typically caters to small and medium-sized businesses (SMBs) across various industries. They may have specific restrictions based on industry risk, so it’s important to confirm if your business sector is supported.

- Time in Business: Generally, businesses are required to have been operational for a certain period, often a minimum of six months to a year. This demonstrates a proven track record and operational stability.

- Annual Revenue: A minimum annual revenue threshold is usually in place. This ensures the business has sufficient financial capacity to repay the financing. The exact amount varies, so checking the latest requirements is essential.

- Creditworthiness: Plastiq assesses the business’s creditworthiness, often by reviewing the business credit score and potentially the personal credit scores of the owners. A strong credit profile increases the likelihood of approval and may influence the terms offered.

- Payment History: A positive payment history, especially with vendors and suppliers, can positively influence the application. Consistent and timely payments demonstrate financial responsibility.

- Bank Account: A business bank account is required for both receiving the financing and making repayments.

- Legal Structure: The business must be a legally registered entity, such as a sole proprietorship, partnership, LLC, or corporation. Documentation of this legal structure is necessary.

Step-by-Step Application Guide

Applying for Plastiq short-term financing involves several steps. Following this guide can help streamline the process.

- Create a Plastiq Account: If you don’t already have one, create a Plastiq account on their website. This typically involves providing basic business information.

- Navigate to Financing Options: Once logged in, locate the section related to short-term financing or business loans.

- Provide Business Information: You will be prompted to provide detailed information about your business, including its legal name, address, industry, and financial performance.

- Submit Financial Documentation: Prepare and upload required financial documents.

- Review Terms and Conditions: Carefully review the terms and conditions of the financing, including the interest rate, repayment schedule, and any associated fees.

- Submit Application: After reviewing, submit the completed application.

- Await Approval: Plastiq will review your application and financial documentation. This process can take a few days to a couple of weeks, depending on the completeness of your application and their current processing volume.

- Receive Funds: If approved, the funds will be disbursed to your designated bank account.

- Make Repayments: Adhere to the agreed-upon repayment schedule to avoid late fees or penalties.

Required Documents and Information

Gathering the necessary documents and information beforehand can expedite the application process.

- Business Information: This includes the legal name, address, phone number, and industry of the business.

- Business Tax ID: Provide the Employer Identification Number (EIN) or Taxpayer Identification Number (TIN) of the business.

- Financial Statements: You will likely need to submit financial statements, such as profit and loss statements (P&L), balance sheets, and cash flow statements, typically for the past one to three years.

- Bank Statements: Provide bank statements for the business account, typically for the past three to six months.

- Ownership Information: Information on the business owners, including names, addresses, and potentially social security numbers, is often required.

- Credit Authorization: You may be asked to authorize Plastiq to check your business credit report and, in some cases, the personal credit reports of the owners.

- Payment Processing Information: Details regarding how you currently process payments, if applicable, might be requested.

- Legal Documents: Copies of the business’s legal formation documents, such as articles of incorporation or operating agreements, may be needed.

Interest Rates, Fees, and Payment Terms

Understanding the costs associated with Plastiq’s short-term financing is crucial for making informed financial decisions. This section provides a detailed breakdown of interest rates, fees, and repayment terms to help businesses evaluate the overall expense and suitability of this financing option.

Interest Rates

Plastiq’s interest rates for short-term financing are variable and depend on several factors. These factors include the applicant’s creditworthiness, the amount of financing requested, and the repayment term selected.

The interest rates are typically expressed as an annual percentage rate (APR).

- Variable Rates: Plastiq’s rates fluctuate. This means the interest rate can change over the term of the financing agreement.

- Risk-Based Pricing: Borrowers with stronger credit profiles often qualify for lower interest rates, while those with higher perceived risk may face higher rates.

- Example: A business with excellent credit might be offered an APR of 8% to 12%, while a business with a less established credit history could be offered rates ranging from 15% to 25%.

Fees

In addition to interest rates, Plastiq may impose certain fees. These fees contribute to the overall cost of borrowing.

- Origination Fee: Plastiq may charge an origination fee, a one-time charge assessed at the beginning of the financing term. This fee is typically a percentage of the total loan amount.

- Late Payment Penalties: Failure to make payments on time can result in late payment fees. The specific amount of these fees is Artikeld in the financing agreement.

- Other Fees: Depending on the specific financing agreement, other fees, such as prepayment penalties, might apply.

Payment Terms and Repayment Schedules

Plastiq offers various payment terms and repayment schedules to accommodate different business needs.

- Short-Term Financing: Plastiq’s short-term financing is designed to provide businesses with quick access to funds.

- Repayment Schedules: Repayment schedules can vary, including weekly or monthly installments.

- Flexibility: Plastiq may offer options for businesses to choose a repayment schedule that best suits their cash flow.

- Example: A business could opt for a 6-month repayment term with monthly installments.

Comparing Plastiq’s Financing to Alternatives

Plastiq’s short-term financing offers a unique solution for businesses needing quick access to capital, but it’s essential to understand how it stacks up against other financing options. Comparing Plastiq’s offerings to both traditional and alternative financing methods helps businesses make informed decisions based on their specific needs and financial situations. This section delves into the key differences, advantages, and disadvantages of Plastiq compared to its competitors.

Comparing Plastiq’s Financing to Traditional Business Loans

Traditional business loans, typically offered by banks and credit unions, present a different set of characteristics compared to Plastiq’s short-term financing. Understanding these distinctions is critical for businesses evaluating their financing choices.

- Application Process: Traditional loans often involve a more extensive and time-consuming application process. This includes submitting detailed financial statements, business plans, and collateral information. Plastiq’s application process, in contrast, is generally streamlined and faster, focusing on factors relevant to the payment processing history.

- Funding Speed: Traditional loans can take weeks or even months to be approved and funded. Plastiq often provides funding much quicker, sometimes within days, making it suitable for urgent financial needs.

- Interest Rates and Fees: Traditional loans might offer lower interest rates, particularly for businesses with strong credit profiles. However, they often come with origination fees, prepayment penalties, and other charges. Plastiq’s fees are transparent, but the interest rates may be higher depending on the risk assessment.

- Collateral Requirements: Traditional loans frequently require collateral, such as real estate or equipment, to secure the loan. Plastiq’s financing may not require collateral, but it may involve factors related to payment processing history.

- Credit Score Impact: Applying for traditional loans can impact a business’s credit score, especially if the application is rejected. Plastiq’s impact on credit scores may vary depending on the specific terms and conditions of the financing.

Differences Between Plastiq and Other Alternative Financing Platforms

The alternative financing landscape is crowded with various platforms, each offering unique features and catering to different business needs. Comparing Plastiq with these platforms helps businesses identify the most suitable financing option.

- Focus: Plastiq primarily focuses on providing financing based on payment processing history. Other platforms may specialize in invoice financing, merchant cash advances, or lines of credit.

- Eligibility: Plastiq’s eligibility requirements might be more lenient regarding credit score compared to some platforms. Other platforms may have different eligibility criteria, such as the time in business or annual revenue.

- Funding Amount: The funding amounts offered by Plastiq may vary depending on the business’s payment processing volume. Other platforms may have different limits based on their financing models.

- Repayment Terms: Plastiq’s repayment terms are usually short-term, aligned with the payment processing cycle. Other platforms might offer different repayment schedules, such as daily or weekly payments.

- Use of Funds: Plastiq allows businesses to use funds for various purposes, such as paying vendors or covering operational expenses. Other platforms may have specific restrictions on how the funds can be used.

Comparison Table: Key Features of Different Financing Options

This table provides a comparative overview of key features of different financing options, enabling businesses to make a well-informed decision.

| Feature | Plastiq Short-Term Financing | Traditional Business Loans | Invoice Financing | Merchant Cash Advance |

|---|---|---|---|---|

| Focus | Payment processing history | Business performance, creditworthiness | Unpaid invoices | Future credit card sales |

| Application Process | Streamlined, fast | Extensive, time-consuming | Moderate | Quick and simple |

| Funding Speed | Fast (days) | Slower (weeks/months) | Moderate (days/weeks) | Fast (days) |

| Interest Rates/Fees | Potentially higher interest, transparent fees | Potentially lower interest, origination fees | Fees based on invoice value, interest | Factor rate, daily/weekly payments |

| Collateral | May not require collateral | Often required (assets, real estate) | May require invoice as collateral | None |

| Credit Score Impact | Varies | Can affect credit score | Can affect credit score | Typically no impact |

| Repayment | Short-term, based on payment processing | Fixed schedule (monthly) | Based on invoice collection | Daily or weekly payments based on sales |

Use Cases and Applications

Plastiq’s short-term financing provides a flexible solution for businesses seeking to manage cash flow and fund operational needs. Its versatility makes it suitable for various industries and specific financial scenarios, allowing businesses to bridge funding gaps, capitalize on opportunities, and maintain smooth operations.

Real-World Examples of Business Utilization

Businesses leverage Plastiq’s short-term financing in diverse ways to meet their financial objectives. These real-world examples illustrate the practical application of this financing option.

* Example 1: A Marketing Agency. A marketing agency secures a large new client and needs to scale up its operations quickly. Plastiq’s financing allows them to pay for initial advertising campaigns, hire additional staff, and purchase necessary software without delaying project commencement. This ensures they can deliver on their client’s expectations and maintain a strong cash flow.

* Example 2: A Construction Company. A construction company faces a delay in receiving payments from a client but needs to cover payroll and supplier invoices. They utilize Plastiq to bridge the gap until the client’s payment arrives. This prevents project delays and maintains a positive relationship with their workforce and suppliers.

* Example 3: A Retail Business. A retail business anticipates a surge in sales during a seasonal promotion. They use Plastiq to purchase additional inventory in advance, ensuring they can meet customer demand and maximize sales during the peak season. This strategic investment helps them capitalize on increased revenue potential.

Scenarios Where Financing is Most Beneficial

Plastiq’s short-term financing proves particularly advantageous in specific scenarios where traditional financing options may be less accessible or efficient. These scenarios highlight the financing’s key strengths.

* Bridging Payment Gaps. When there’s a delay between incurring expenses and receiving revenue, Plastiq helps cover immediate costs like supplier invoices, payroll, or rent, ensuring business continuity.

* Capitalizing on Opportunities. If a business identifies a time-sensitive opportunity, such as a bulk purchase discount or a promotional event, Plastiq provides the necessary funds to act swiftly.

* Managing Unexpected Expenses. Unexpected costs, such as equipment repairs or urgent marketing campaigns, can be addressed with Plastiq, preventing disruption to normal operations.

* Building Credit History. For businesses that need to establish or improve their credit profile, responsible use of Plastiq’s financing can contribute positively to their creditworthiness.

Industries Commonly Using Plastiq for Short-Term Funding

Several industries frequently utilize Plastiq’s short-term financing to address their specific financial requirements. The following list details these industries.

* Marketing and Advertising Agencies: These agencies often need quick access to funds for client campaigns, media buys, and talent payments.

* Construction and Contracting: These businesses manage fluctuating cash flow due to project timelines and payment delays, requiring funds for materials, labor, and subcontractors.

* Retail Businesses: Retailers use short-term financing to purchase inventory, especially during seasonal promotions or sales events.

* Consulting Firms: Consultants need financing for operational expenses, marketing, and business development.

* Healthcare Practices: Medical practices may utilize financing for operational costs, equipment purchases, and managing patient billing cycles.

* Manufacturing: Manufacturers often need to fund raw materials, production costs, and supply chain management.

* Technology Companies: Tech companies might use financing for software development, marketing, and scaling their operations.

* E-commerce Businesses: Online retailers often require funds for inventory, advertising, and managing customer orders.

Risks and Considerations

Plastiq’s short-term financing, while offering convenience, comes with inherent risks and requires careful consideration. Understanding these potential downsides is crucial for making informed decisions and avoiding financial pitfalls. This section delves into the specific risks associated with using Plastiq, the importance of cash flow management, and the potential limitations of the service.

Potential Risks of Using Plastiq’s Short-Term Financing

Using short-term financing, including Plastiq’s offerings, exposes businesses to various risks. Awareness of these risks is essential for responsible financial management.

- High Interest Rates and Fees: Short-term financing often carries higher interest rates and fees compared to traditional financing options. These costs can quickly accumulate, increasing the overall expense of borrowing. For example, if a business borrows \$10,000 with a 2% monthly interest rate and a 3% origination fee, the total cost of the loan, including fees and interest over a short period, can be substantial. Businesses must carefully assess whether the benefits of immediate access to funds outweigh the associated costs.

- Debt Accumulation: Relying on short-term financing can lead to a cycle of debt, especially if the underlying financial issues are not addressed. Businesses might take out new loans to repay existing ones, creating a continuous debt burden. This can damage a company’s financial health and hinder its ability to invest in growth opportunities.

- Impact on Credit Score: Failing to make timely payments on Plastiq’s financing can negatively impact a business’s credit score. A lower credit score can make it harder and more expensive to secure future financing, including long-term loans and lines of credit.

- Dependence on the Service: Over-reliance on Plastiq or similar services can make a business vulnerable. If Plastiq’s terms change or if the service is unavailable, the business may face difficulties managing its finances.

Importance of Managing Cash Flow

Effective cash flow management is critical when utilizing short-term financing. It ensures that a business can meet its financial obligations and avoid potential problems.

- Payment Schedule Adherence: Plastiq’s financing agreements require adherence to a strict payment schedule. Businesses must carefully monitor their cash inflows and outflows to ensure they can make timely payments.

- Forecasting and Budgeting: Accurate forecasting of future revenues and expenses is essential. Businesses should create detailed budgets to anticipate cash flow gaps and plan for repayments. A well-defined budget can help identify potential shortfalls and allow for proactive measures.

- Contingency Planning: Unexpected expenses or revenue shortfalls can disrupt cash flow. Businesses should have contingency plans in place, such as a reserve fund or alternative financing options, to address these situations.

- Regular Monitoring: Continuous monitoring of cash flow is vital. Businesses should track their cash position daily or weekly to identify potential issues early on. This allows for timely adjustments to spending or revenue-generating activities.

Potential Drawbacks and Limitations of Plastiq’s Service

While Plastiq offers a convenient way to finance payments, several drawbacks and limitations should be considered.

- Payment Processing Fees: Plastiq charges fees for processing payments, which can increase the overall cost of transactions. These fees vary depending on the payment method and the recipient. Businesses should factor these fees into their financial planning.

- Transaction Limits: Plastiq may impose limits on the amount of payments that can be processed. These limits can restrict a business’s ability to make large payments.

- Eligibility Criteria: Not all businesses are eligible for Plastiq’s short-term financing. The eligibility criteria may include factors such as creditworthiness, payment history, and industry.

- Limited Payment Options: Plastiq may not support all types of payments or recipients. Businesses should verify that Plastiq can process the specific payments they need to make.

- Dependence on Third-Party Services: Plastiq relies on third-party payment processors and financial institutions. This reliance introduces a layer of complexity and potential risks, such as service interruptions or security breaches.

Benefits of Plastiq’s Payment Platform Integration

Plastiq’s strength lies in its seamless integration of financing with its payment platform. This integration provides a unique value proposition, streamlining financial processes and offering significant advantages for businesses. This section will delve into the specific benefits of this integrated approach.

How Plastiq’s Financing Integrates with Its Payment Platform

Plastiq’s platform allows businesses to pay vendors, suppliers, and contractors with credit cards, even if those vendors don’t traditionally accept them. The financing aspect is cleverly interwoven: when a business chooses to pay a bill via credit card through Plastiq and opts for financing, the platform handles the entire transaction. Plastiq pays the vendor on the business’s behalf. The business then repays Plastiq over a predetermined period, along with interest and fees, effectively transforming a credit card payment into a short-term loan. This integration is not just about offering financing; it’s about embedding it within the existing payment workflow.

Advantages of Using Plastiq for Payments and Financing

Using Plastiq for both payments and financing offers several distinct advantages, creating a more efficient and flexible financial management system. These advantages are centered around convenience, cash flow management, and potential rewards.

- Improved Cash Flow Management: Plastiq allows businesses to extend payment terms, freeing up working capital. By using financing, companies can delay payments, providing a buffer to manage cash flow fluctuations. For instance, a small business expecting a large invoice from a supplier can pay it with a credit card through Plastiq, then utilize the financing option to spread the payment over several months, aligning the payment with incoming revenue.

- Potential for Rewards and Rebates: Businesses can earn rewards and cashback on their credit card spending. Even if a vendor doesn’t accept credit cards, Plastiq facilitates the payment, allowing businesses to take advantage of credit card rewards programs. This is particularly beneficial for larger expenses where rewards can accumulate significantly. For example, a company using a credit card with a 1% cashback on all purchases can effectively reduce its overall costs by utilizing Plastiq for payments.

- Simplified Financial Tracking: The platform provides a centralized view of both payments and financing, simplifying reconciliation and financial reporting. All transactions, including payments and loan repayments, are tracked within the Plastiq platform. This eliminates the need to manage multiple payment methods and track various payment schedules separately.

- Access to Capital: The integration offers an alternative source of short-term capital, making it easier to finance essential business expenses. It is particularly useful for businesses that might not qualify for traditional loans or need immediate access to funds.

How the Platform Streamlines Financial Processes for Businesses

Plastiq’s platform significantly streamlines financial processes, enhancing efficiency and reducing administrative burdens. The automation and integration inherent in the platform contribute to a more organized and manageable financial operation.

- Automated Payment Processing: The platform automates payment processing, eliminating the need for manual checks or wire transfers. Businesses can schedule payments in advance and track their status within the platform. This reduces the risk of late payments and frees up time for other crucial tasks.

- Centralized Payment Management: All payment activities are consolidated within a single platform, providing a comprehensive view of all financial transactions. This centralized approach eliminates the need to switch between different systems or manually reconcile accounts.

- Simplified Reconciliation: The platform provides detailed transaction records, making reconciliation with accounting systems easier. The integration with accounting software like QuickBooks and Xero further simplifies the process.

- Enhanced Reporting and Analytics: Plastiq offers reporting and analytics tools that provide insights into spending patterns and cash flow. Businesses can generate reports on payment activity, interest expenses, and outstanding balances.

The Role of Plastiq in Business Growth

Plastiq’s short-term financing solutions offer a powerful catalyst for business expansion. By providing flexible access to capital, the platform empowers businesses to seize growth opportunities, manage cash flow more effectively, and make strategic investments that drive long-term success. Plastiq moves beyond simply facilitating payments; it becomes a strategic partner in helping businesses achieve their growth objectives.

Contribution to Business Expansion, Plastiq short term financing

Plastiq facilitates expansion by providing immediate access to funds. This can be crucial for businesses seeking to scale operations, launch new products, or enter new markets.

- Funding Inventory Purchases: Businesses can utilize Plastiq’s financing to purchase inventory in bulk, taking advantage of supplier discounts and ensuring sufficient stock to meet growing demand. This is particularly valuable for seasonal businesses or those experiencing rapid growth. For example, a retail business anticipating a surge in holiday sales can secure funding to purchase a larger inventory of popular items, maximizing revenue potential.

- Capital for Marketing Campaigns: Effective marketing is essential for reaching new customers and driving sales. Plastiq can provide the necessary funds to launch targeted marketing campaigns, including digital advertising, social media promotions, and traditional media outreach. A software company looking to expand its user base can use Plastiq to fund a targeted advertising campaign on platforms like LinkedIn, reaching potential clients and generating leads.

- Hiring and Training Employees: As a business grows, so does the need for skilled personnel. Plastiq can help fund the hiring and training of new employees, ensuring the business has the resources to support its expansion. This can include funding for recruitment costs, onboarding programs, and ongoing professional development. A construction company securing a large new project might use Plastiq to finance the hiring of additional project managers, skilled tradespeople, and administrative staff, ensuring the project is completed efficiently and effectively.

- Expanding into New Locations: Physical expansion can be a significant step in business growth. Plastiq can provide the capital needed to lease or purchase new office spaces, retail locations, or manufacturing facilities. A restaurant chain looking to open a new branch in a high-traffic area could use Plastiq to secure the funds for lease payments, renovations, and initial operating expenses.

Cash Flow Management and Improvement

Plastiq’s financing features significantly enhance cash flow management, enabling businesses to optimize their financial operations. This improved control is critical for sustaining growth and navigating financial challenges.

- Bridging the Gap Between Expenses and Revenue: Many businesses experience timing mismatches between when they incur expenses and when they receive revenue. Plastiq can provide short-term financing to bridge this gap, ensuring that businesses can meet their financial obligations even during periods of low cash flow. For instance, a consulting firm that invoices clients on a net-30 or net-60 basis can use Plastiq to pay its operating expenses, such as salaries and rent, while waiting for client payments to arrive.

- Extending Payment Terms with Suppliers: Plastiq allows businesses to pay suppliers using credit cards, even if the suppliers do not directly accept them. This effectively extends payment terms, giving businesses more time to manage their cash flow and potentially negotiate better terms with suppliers. This is particularly helpful for small businesses with limited working capital.

- Predictable Payment Schedules: Plastiq’s financing options often come with fixed payment schedules, allowing businesses to forecast their cash outflows with greater accuracy. This predictability simplifies budgeting and financial planning. Businesses can integrate Plastiq’s payment data into their accounting software for automated reconciliation and reporting.

- Reducing Reliance on Traditional Lending: By providing alternative financing options, Plastiq can reduce a business’s dependence on traditional bank loans, which can be difficult and time-consuming to secure. This allows businesses to access capital more quickly and efficiently.

Strategic Investment Opportunities

Plastiq enables strategic investments that can drive long-term growth and competitive advantage. Businesses can leverage financing to capitalize on opportunities that might otherwise be out of reach.

- Investing in Technology and Innovation: Businesses can use Plastiq to fund investments in new technologies, software, or research and development initiatives. This can help them improve efficiency, develop new products, and stay ahead of the competition. A manufacturing company could use Plastiq to finance the purchase of advanced machinery or the implementation of automation systems, increasing production capacity and reducing costs.

- Acquiring Assets: Plastiq can provide the capital needed to acquire assets, such as equipment, vehicles, or even other businesses. This can be a strategic move to expand operations, gain market share, or diversify revenue streams. A logistics company could use Plastiq to finance the purchase of a fleet of delivery trucks, increasing its capacity to serve clients and expand its service area.

- Funding Strategic Partnerships and Alliances: Plastiq can be used to finance investments in strategic partnerships or alliances, such as joint ventures or collaborations with other businesses. This can open up new markets, access new resources, and create synergies that drive growth. A marketing agency could use Plastiq to fund a joint marketing campaign with a complementary business, expanding its reach and generating new leads.

- Investing in Employee Training and Development: A skilled and well-trained workforce is essential for business success. Plastiq can be used to finance employee training programs, professional development courses, and other initiatives that improve employee skills and productivity. A healthcare provider could use Plastiq to finance specialized training for its medical staff, improving the quality of care and attracting top talent.

Customer Reviews and Testimonials: Plastiq Short Term Financing

Understanding customer experiences is crucial for assessing the effectiveness and reliability of any financial product. Analyzing feedback from existing users provides valuable insights into the strengths and weaknesses of Plastiq’s short-term financing options. This section examines both positive and negative customer experiences, offering a balanced perspective on the service.

Positive Customer Experiences

Many businesses have reported positive experiences with Plastiq’s short-term financing, particularly highlighting its convenience and integration with their existing payment systems. These positive reviews often focus on the ease of access to funds and the ability to manage cash flow more effectively.

- Streamlined Payment Processes: Customers frequently praise the platform’s ability to streamline payments to vendors, especially those who don’t accept credit cards directly. This feature simplifies accounting and saves time.

- Improved Cash Flow Management: Businesses appreciate the short-term financing’s role in bridging gaps in cash flow, allowing them to meet immediate obligations without disrupting operations.

- Flexible Repayment Options: The availability of various repayment terms provides businesses with flexibility to align payments with their revenue cycles.

- Ease of Use: The user-friendly interface and straightforward application process are consistently mentioned as positive aspects of the service.

Negative Experiences and Complaints

While Plastiq receives positive feedback, some customers have expressed concerns and complaints. These negative experiences typically relate to interest rates, fees, and customer service interactions.

- High Interest Rates: Some users have cited the interest rates associated with short-term financing as a significant drawback, especially when compared to traditional financing options.

- Fees and Charges: Customers sometimes express dissatisfaction with the fees associated with the service, including transaction fees and late payment penalties.

- Customer Service Issues: Instances of slow response times or difficulties resolving issues with customer support have been reported by some users.

- Limited Availability: Some businesses have reported that they were unable to secure financing due to eligibility requirements.

Example of a Positive Testimonial

“Plastiq’s short-term financing has been a game-changer for our business. We can now pay our vendors on time, even when our cash flow is tight. The platform’s integration with our existing payment system is seamless, and the application process was quick and easy. It allowed us to avoid late payment fees and maintain good relationships with our suppliers. While the interest rates are something to consider, the convenience and flexibility it provides have significantly improved our financial management.” – Sarah Miller, CEO of a small retail business.

Future of Plastiq’s Financing Services

Plastiq’s short-term financing offerings are poised for evolution, driven by technological advancements, changing market dynamics, and a commitment to meeting the evolving needs of businesses. The platform’s future likely involves continuous innovation, expanding its reach, and refining its services to maintain its competitive edge in the fintech landscape.

Potential Developments and Enhancements

Plastiq is likely to focus on several key areas to enhance its financing services. These improvements aim to streamline the user experience, increase efficiency, and offer greater flexibility.

- Integration of AI and Machine Learning: The platform could integrate artificial intelligence (AI) and machine learning (ML) to enhance credit risk assessment, personalize financing options, and automate various processes. For example, AI could analyze a business’s payment history and financial data to predict its ability to repay short-term financing, leading to faster approvals and more tailored terms.

- Expansion of Payment Options: Plastiq may broaden the range of payment options it supports. This could include integrating with new payment networks, cryptocurrencies, or alternative payment methods, catering to a wider range of business needs.

- Enhanced Reporting and Analytics: Offering more sophisticated reporting and analytics tools would empower businesses to track their financing usage, manage cash flow more effectively, and gain deeper insights into their financial performance. This could include dashboards visualizing payment trends, interest expenses, and repayment schedules.

- Improved User Interface and Experience: Continuous improvements to the user interface and overall user experience are crucial. This might involve a more intuitive dashboard, simplified application processes, and better mobile accessibility.

- Strategic Partnerships: Forming partnerships with other financial institutions, software providers, or industry-specific platforms could extend Plastiq’s reach and provide more comprehensive services to its users. This could involve integrations with accounting software, ERP systems, or industry-specific payment platforms.

Adaptation to Changing Market Conditions

The financial landscape is constantly evolving. Plastiq’s ability to adapt to these changes will be critical to its long-term success.

- Economic Fluctuations: During economic downturns, businesses often face cash flow challenges. Plastiq could adapt by offering more flexible repayment terms, adjusting interest rates, or providing alternative financing options to support businesses during difficult times. For instance, they could temporarily suspend payments or allow for extended repayment periods for clients affected by economic hardship.

- Regulatory Changes: Compliance with evolving financial regulations is paramount. Plastiq must stay abreast of regulatory changes and adapt its platform and services accordingly. This might involve updating its KYC (Know Your Customer) and AML (Anti-Money Laundering) protocols or adjusting its terms and conditions to align with new laws.

- Competition: The fintech market is highly competitive. Plastiq will need to differentiate itself by continuously innovating, offering competitive rates and terms, and providing exceptional customer service to stay ahead of its competitors.

- Technological Advancements: The adoption of new technologies, such as blockchain and decentralized finance (DeFi), could influence Plastiq’s services. Exploring these technologies could lead to new financing models, such as decentralized lending or tokenized financing options.

Plans for New Features or Services

Plastiq is likely to introduce new features and services to enhance its short-term financing offerings and meet the evolving needs of its customers.

- Lines of Credit: Plastiq could expand its offerings to include lines of credit, providing businesses with ongoing access to funds, allowing them to manage their cash flow more efficiently.

- Invoice Financing: Expanding into invoice financing, where Plastiq advances funds against outstanding invoices, could provide businesses with immediate access to working capital.

- Foreign Currency Financing: For businesses operating internationally, offering financing in foreign currencies could be a valuable service, allowing them to manage their international transactions more effectively.

- Integration with E-commerce Platforms: Seamless integration with e-commerce platforms could provide financing options directly to businesses selling online, streamlining the application process and providing quick access to funds.

- Customized Financing Solutions: Offering tailored financing solutions based on the specific needs of different industries or business models could differentiate Plastiq from its competitors. This might involve creating industry-specific financing products.

Plastiq short term financing – Plastiq offers short-term financing solutions for various business needs. Considering the financial landscape, aspiring professionals often seek opportunities to gain experience. Exploring options like finance summer internships can provide valuable insights. This experience could potentially inform how one approaches utilizing Plastiq’s short-term financing products in the future, depending on the skills learned.

Plastiq offers short-term financing solutions, but businesses might find themselves needing more specialized options. For instance, if a company requires capital to fulfill a large order, exploring a purchase order financing agreement could be a strategic move. While Plastiq provides flexibility, purchase order financing directly addresses the funding needs tied to specific inventory purchases, ultimately supporting cash flow.