Overview of Private Equity in Film Financing

Private equity plays a significant role in the complex world of film financing, providing crucial capital for projects ranging from independent films to big-budget blockbusters. This type of financing offers an alternative to traditional methods, such as studio backing or bank loans, and often comes with its own set of advantages and disadvantages. Private equity firms invest in films with the expectation of a substantial return on their investment, typically through a share of the film’s profits. Understanding the role of private equity is essential for anyone involved in film production, from producers seeking funding to investors evaluating opportunities.

Fundamental Role of Private Equity in Funding Film Projects

Private equity’s fundamental role is to inject capital into film projects, acting as a crucial financial lifeline. These firms typically invest in film productions in exchange for a percentage of the film’s profits, providing a significant portion of the overall budget. This funding allows filmmakers to bring their visions to life, covering costs such as pre-production, production, post-production, and distribution.

Stages of Film Production Where Private Equity Investment is Most Prevalent

Private equity investment is most prevalent during specific stages of film production. These are the stages where the potential for profit and risk assessment are clearest.

- Development: Private equity can be used to fund the initial stages, including script development, securing talent, and preparing the project for production. While riskier, this can provide high returns if the project progresses.

- Production: This is the most common stage for private equity investment, as it covers the core costs of filming, including salaries, equipment, and location fees. Investors often seek to be involved during production to oversee spending and manage risks.

- Post-Production: Funding post-production activities, such as editing, visual effects, and sound design, can also be a focus. Private equity firms will assess the post-production plan to ensure it aligns with the film’s overall budget and timeline.

- Distribution and Marketing: Although less common, private equity can also be used for distribution and marketing, helping to secure the film’s release and promote it to a wider audience. This stage is crucial for generating revenue and realizing the investment’s return.

Advantages and Disadvantages of Private Equity Film Financing Compared to Traditional Financing Methods

Private equity film financing offers a unique set of advantages and disadvantages when compared to traditional financing methods. Understanding these differences is critical for producers and investors alike.

- Advantages:

- Access to Capital: Private equity firms can provide significant funding, especially for projects that may struggle to secure traditional financing.

- Expertise and Network: Investors often bring valuable industry knowledge, experience, and connections that can aid in production, distribution, and marketing.

- Flexibility: Private equity deals can be structured to meet the specific needs of a film project, offering flexibility that traditional financing might lack.

- Faster Decision-Making: Private equity firms can make decisions more quickly than large studios or banks, which can be crucial in a fast-paced industry.

- Disadvantages:

- High Cost of Capital: Private equity typically demands a higher rate of return, potentially reducing the overall profitability for the filmmakers.

- Loss of Creative Control: Investors often seek a degree of control over the project, which can sometimes lead to conflicts with the creative team.

- Complexity: Private equity deals can be complex, involving intricate contracts and negotiations that require specialized legal and financial expertise.

- Risk: Film investments are inherently risky, and private equity investors face the potential for significant losses if a film fails to perform well.

Investment Strategies and Deal Structures: Private Equity Film Financing

Private equity firms employ a variety of investment strategies and deal structures when financing film projects. These approaches are tailored to manage risk, maximize returns, and align with the specific characteristics of the film and the overall market conditions. Understanding these strategies and structures is crucial for appreciating the complexities of private equity’s role in film financing.

Common Investment Strategies

Private equity firms typically utilize several key investment strategies to navigate the film financing landscape. These strategies are often employed in combination, depending on the specific project and the firm’s risk appetite.

- Production Financing: This strategy involves providing capital directly to the film’s production. The firm may invest in the film’s budget, covering costs such as pre-production, principal photography, and post-production. The returns are derived from the film’s revenue streams. A specific example is when a private equity firm invests $20 million in a film’s production budget, and receives a percentage of the film’s profits after its theatrical release, home video sales, and streaming revenue.

- Acquisition of Film Rights: Firms may acquire the rights to distribute completed films or libraries of film content. This can be a lower-risk strategy than production financing, as the film’s quality is already established. For instance, a private equity firm might purchase the global distribution rights to a critically acclaimed independent film for $15 million, aiming to generate returns through theatrical release, streaming deals, and international sales.

- Co-financing: Private equity firms often co-finance films alongside other investors, such as studios, other private equity firms, or government film funds. This approach spreads the risk and allows for larger investments. For example, a private equity firm invests $10 million in a $100 million film budget alongside a major studio, sharing the profits proportionally.

- Film Fund Investments: Investing in film funds, which pool capital from multiple investors to finance a portfolio of films, is another strategy. This diversifies the investment and reduces the risk associated with any single project. Consider a private equity firm allocating $50 million to a film fund, which in turn invests in 10 different film projects, mitigating the risk compared to investing solely in one film.

- Specialty Financing: This involves investing in specific aspects of film production, such as tax credits, foreign sales, or gap financing. An example is a private equity firm providing $5 million in gap financing to a film, covering the shortfall between the production budget and the secured funding.

Key Deal Structures

The structure of a private equity film investment significantly impacts the risk and return profile. These structures are carefully designed to align the interests of the investors, the filmmakers, and other stakeholders.

- Equity Investments: This is a direct investment in the film’s ownership, typically involving a share of the profits. The private equity firm receives a percentage of the film’s revenue after recouping its investment. A firm invests $15 million in a film’s equity, entitling them to 20% of the net profits after the film breaks even.

- Debt Financing: Providing loans to finance the film’s production. These loans are secured against the film’s assets and generate returns through interest payments and the repayment of principal. A private equity firm provides a $10 million loan to a film production company, with the loan secured by the film’s distribution rights and generating an annual interest rate of 8%.

- Mezzanine Financing: This is a hybrid form of financing that combines elements of both debt and equity. It typically offers a higher return than debt but carries more risk. It may include warrants or options to convert the debt into equity. For instance, a private equity firm provides $5 million in mezzanine financing, with an interest rate of 10% and warrants to acquire 5% of the film’s equity if certain performance targets are met.

- Profit Participation: This involves the private equity firm receiving a percentage of the film’s profits. The percentage and the definition of “profit” are crucial elements of the deal. A private equity firm invests $2 million and negotiates a 10% profit participation stake after all other investors and stakeholders have been paid.

- Tax Credit Financing: Private equity firms can structure deals to take advantage of tax credits offered by various governments to incentivize film production. For example, a firm invests in a film project specifically to utilize Canadian tax credits, which can reduce the overall production costs.

Due Diligence Process

Thorough due diligence is a critical step for private equity firms before investing in a film project. This process aims to assess the risks and potential rewards, ensuring that the investment aligns with the firm’s investment strategy.

- Financial Analysis: This includes a detailed review of the film’s budget, revenue projections, and potential profitability. The firm assesses the film’s break-even point, projected return on investment (ROI), and cash flow forecasts. For example, a private equity firm examines a film’s budget to ensure it aligns with the project’s scope and projected revenue streams.

- Legal Review: This involves a comprehensive review of the film’s contracts, intellectual property rights, and any existing agreements. The firm assesses the legal risks associated with the project, such as copyright issues or potential lawsuits. This might include examining the chain of title for the film’s screenplay to ensure no copyright infringements exist.

- Market Analysis: This involves assessing the film’s target audience, market trends, and competitive landscape. The firm evaluates the film’s commercial viability and its potential for success in the market. For example, a private equity firm might analyze the box office performance of similar films to gauge the potential audience size and revenue.

- Creative Assessment: This includes evaluating the film’s script, cast, director, and overall creative potential. The firm assesses the quality of the film’s creative elements and its ability to attract audiences. This may involve reading the script, reviewing the director’s previous work, and assessing the cast’s marketability.

- Management Team Assessment: Evaluating the film’s production team, including the producers, director, and key personnel. The firm assesses the team’s experience, track record, and ability to execute the project successfully. This might include reviewing the production team’s previous projects and assessing their ability to manage the film’s budget and schedule.

- Risk Assessment: Identifying and assessing the various risks associated with the film project, such as production delays, cost overruns, and distribution challenges. The firm develops strategies to mitigate these risks. For example, assessing the risk of a major actor dropping out of the project and planning for alternative solutions.

Evaluating Film Project Viability

Private equity investors undertake a rigorous process to assess the commercial potential of a film project. This evaluation goes beyond the creative aspects, delving into financial projections, market analysis, and risk assessment. The goal is to determine whether a film offers a viable investment opportunity with a strong potential for return. This section Artikels the framework, factors, and metrics used in this critical evaluation process.

Framework for Assessing Commercial Potential

Private equity firms employ a multi-faceted framework to gauge a film’s commercial prospects. This framework considers both qualitative and quantitative elements, providing a comprehensive view of the investment’s potential. It is an iterative process, with each stage informing the next.

- Market Analysis: Understanding the target audience, existing market trends, and competitive landscape. This involves analyzing similar films’ performance, box office data, and distribution channels.

- Script Assessment: Evaluating the script’s quality, originality, and commercial appeal. Key considerations include genre, target demographic, and potential for international sales.

- Talent Evaluation: Assessing the cast, director, and key crew members’ track records and marketability. This includes evaluating their previous successes, social media presence, and ability to attract an audience.

- Financial Modeling: Developing detailed financial projections, including revenue forecasts, cost estimations, and profitability analysis. This involves assessing various scenarios and sensitivities.

- Risk Assessment: Identifying and evaluating potential risks associated with the project, such as production delays, budget overruns, and distribution challenges.

- Deal Structuring: Negotiating and structuring the investment deal to protect the investor’s interests and maximize the potential for return.

Factors Considered for Script, Cast, and Director

The script, cast, and director are critical components of a film’s success. Private equity investors carefully evaluate these elements, assessing their potential to attract audiences and generate revenue.

- Script Analysis: The script’s quality and commercial viability are crucial. Investors assess the story’s originality, genre, target demographic appeal, and potential for international sales. They look for a well-structured narrative, compelling characters, and a strong market position. For example, a script with a proven genre (e.g., action, comedy, horror) and a clear target audience (e.g., teenagers, families) is generally more attractive.

- Cast Evaluation: The cast’s marketability and ability to attract audiences are significant factors. Investors consider the actors’ star power, social media following, and previous box office performance. A cast with established stars or rising talent can significantly boost a film’s commercial potential. A-list actors can command higher salaries, but their presence often guarantees a larger audience.

- Director Assessment: The director’s experience, track record, and ability to execute the script are carefully evaluated. Investors consider the director’s previous successes, critical acclaim, and ability to manage a film production. A director with a proven track record of delivering commercially successful films is highly valued. For instance, a director known for creating visually stunning action films might be a good fit for an action-oriented script.

Checklist of Financial Metrics for Profitability and ROI

Private equity investors use a range of financial metrics to gauge a film’s profitability and return on investment (ROI). These metrics provide a quantitative basis for evaluating the investment’s potential and managing its risks.

- Budget: The total cost of producing the film, including pre-production, production, and post-production expenses.

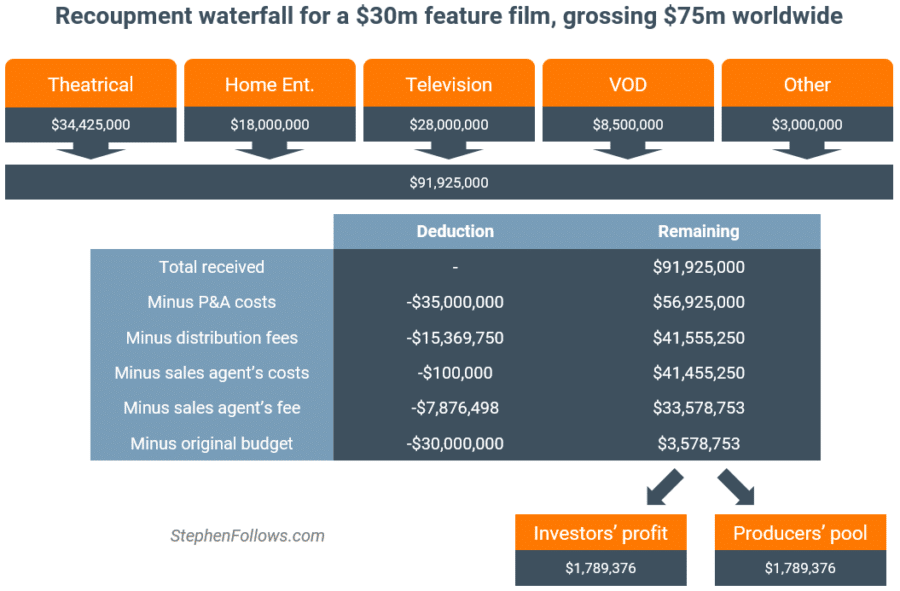

- Revenue Projections: Forecasted income from various sources, including theatrical releases, home entertainment, television licensing, and streaming rights. These projections are based on market analysis, comparable film performance, and distribution agreements.

- Break-Even Point: The point at which the film’s revenue equals its total costs. This is a critical metric for determining the film’s financial viability.

- Return on Investment (ROI): The percentage return on the initial investment. It is calculated as the profit divided by the initial investment. A higher ROI indicates a more profitable investment.

- Internal Rate of Return (IRR): The discount rate that makes the net present value (NPV) of all cash flows from a particular project equal to zero. It is a measure of the profitability of an investment over time.

- Net Present Value (NPV): The difference between the present value of cash inflows and the present value of cash outflows over a period of time. NPV is used in capital budgeting to analyze the profitability of a projected investment or project.

- Profit Margin: The percentage of revenue that remains after deducting all expenses. It indicates the film’s profitability and operational efficiency.

- Distribution Costs: Expenses associated with marketing, advertising, and distributing the film. These costs significantly impact the film’s overall profitability.

- Minimum Guarantee (MG): A guaranteed payment from a distributor to the film’s producers, providing a baseline of revenue.

- Residuals: Payments made to actors, writers, and other creative personnel based on the film’s revenue, often after the initial theatrical release.

Key Players and Market Dynamics

Private equity’s involvement in film financing is shaped by a complex interplay of actors and market forces. Understanding these elements is crucial for grasping the opportunities and risks associated with this investment strategy. This section will identify key players, examine successful examples, and compare the film financing landscape with other industries where private equity thrives.

Types of Private Equity Firms Involved

Several types of private equity firms actively participate in film financing, each with distinct investment strategies and risk profiles.

- Large, Generalist Funds: These firms manage substantial capital and may allocate a portion to film investments as part of a diversified portfolio. Their involvement is often in larger-budget projects or through co-financing arrangements. These funds typically have a broader investment mandate and are less specialized in the film industry.

- Specialized Media and Entertainment Funds: These funds focus exclusively on the media and entertainment sectors, including film, television, and digital content. They possess in-depth industry knowledge and networks, allowing them to identify and manage film-related risks more effectively. They often take a more hands-on approach to their investments.

- Hedge Funds: Some hedge funds, particularly those with a focus on alternative investments, may participate in film financing through debt or equity instruments. Their involvement can be opportunistic, taking advantage of market inefficiencies or specific project opportunities. They often have a shorter-term investment horizon.

- Independent Film Finance Companies: While not strictly private equity, these companies act as intermediaries, connecting film projects with private equity investors and other funding sources. They provide structuring expertise and often take an equity stake in the projects they finance.

Successful Private Equity-Backed Film Projects

Several films have been successfully backed by private equity, demonstrating the potential of this financing model. These examples showcase the diverse strategies and outcomes achieved.

- The King’s Speech (2010): This critically acclaimed film, which won multiple Academy Awards, received financing from a private equity firm. The film’s success, both commercially and critically, provided a strong return on investment. This demonstrates how private equity can contribute to films that garner prestige and financial success.

- La La Land (2016): The musical romantic drama, also a critical and commercial success, received funding from various sources, including private equity. The film’s global appeal and awards recognition led to significant revenue generation. This is an example of how private equity can invest in projects with international appeal.

- Film and Television Production Studios: Private equity has invested in studios that produce film and television content. These investments offer a broader exposure to the film industry than single-project financing. The goal is to capitalize on the studios’ ability to generate multiple revenue streams from a portfolio of projects.

Film Financing Landscape Compared to Other Industries

Comparing film financing to other industries reveals both similarities and differences in how private equity operates.

- Real Estate: Private equity’s involvement in real estate, like film, often involves asset-based investments. The focus is on the underlying value of the property or, in the case of film, the potential for revenue generation from distribution and ancillary rights. Both industries involve significant capital expenditure and are subject to market fluctuations.

- Technology: Private equity in the technology sector frequently focuses on growth investments, funding innovative companies with high growth potential. In film, private equity may invest in production companies with a strong pipeline of projects or in new technologies related to film production and distribution. The risk-reward profile is generally higher in technology, with the potential for substantial returns.

- Healthcare: Private equity in healthcare often involves acquiring and restructuring companies to improve operational efficiency and profitability. In film, private equity firms similarly assess the operational aspects of film production, distribution, and marketing, aiming to maximize revenue and minimize costs. Both industries are subject to regulatory considerations and require a deep understanding of market dynamics.

Private equity firms often seek to replicate the success strategies from other sectors, but adapting them to the specific characteristics of film financing.

Risk Management and Mitigation

Private equity film financing, while potentially lucrative, is inherently risky. The entertainment industry is volatile, and film projects are subject to numerous uncertainties. Effective risk management is crucial for private equity firms to protect their investments and achieve their desired returns. This section details the primary risks, along with strategies and the role of advisors in navigating these challenges.

Primary Risks in Private Equity Film Financing

Film projects are exposed to various risks throughout their lifecycle, from development to distribution. Understanding these risks is the first step in effective mitigation.

- Production Risk: Production delays, cost overruns, and creative disagreements can significantly impact a film’s budget and release schedule. Unexpected events, such as the unavailability of key personnel or unforeseen technical difficulties, can exacerbate these issues.

- Market Risk: The success of a film depends on audience reception, which is difficult to predict. Changing audience tastes, competition from other films, and shifts in distribution models (e.g., the rise of streaming) all contribute to market risk. A film’s performance can be negatively affected by unfavorable reviews or a lack of marketing effectiveness.

- Financial Risk: This encompasses various aspects, including the film’s budget, financing structure, and potential for revenue generation. A poorly structured deal or insufficient funding can lead to financial instability. Interest rate fluctuations and currency exchange rate volatility can also affect profitability, particularly for international co-productions.

- Distribution Risk: Securing adequate distribution channels is vital for reaching audiences and generating revenue. Difficulties in negotiating distribution agreements, the failure of distributors, or unfavorable terms can severely limit a film’s revenue potential. The effectiveness of marketing and promotional campaigns also influences distribution success.

- Legal and Regulatory Risk: Film projects are subject to various legal and regulatory requirements, including intellectual property rights, contracts, and labor laws. Legal disputes, copyright infringement, or regulatory changes can create significant financial and operational risks.

Methods for Mitigating Risks

Several strategies can be employed to mitigate the risks inherent in private equity film financing. These methods aim to reduce potential losses and increase the likelihood of a successful investment.

- Insurance: Insurance policies play a crucial role in protecting against various risks.

- Errors and Omissions (E&O) Insurance: Protects against lawsuits related to copyright infringement, defamation, and other legal issues.

- Completion Bond: Guarantees the film’s completion within budget and on schedule. This bond provides funds to finish the film if the production faces financial difficulties.

- Cast Insurance: Covers losses if key cast members are unable to complete their roles due to illness or injury.

- Distribution Agreements: Securing robust distribution agreements is essential for maximizing revenue.

- Minimum Guarantees (MGs): Distributors often provide a minimum guarantee, a lump-sum payment upfront, which helps to offset production costs.

- Revenue Sharing: Agreements should clearly define the revenue split between the film’s producers and the distributor.

- Territorial Rights: Negotiating the rights for specific territories can maximize revenue potential.

- Co-financing: Sharing the financial burden and risk with other investors or production companies.

- Reduced Risk Exposure: Co-financing diversifies the financial risk.

- Increased Funding: Attracts more capital to the project.

- Access to Expertise: Brings in partners with specialized knowledge or market access.

- Due Diligence: Thorough due diligence is essential before investing.

- Script Assessment: Evaluate the script’s commercial viability and market appeal.

- Budget Review: Scrutinize the budget for accuracy and potential cost overruns.

- Team Evaluation: Assess the experience and track record of the production team.

- Contingency Planning: Preparing for unforeseen events.

- Budget Reserves: Allocate funds to cover unexpected costs.

- Alternative Strategies: Develop backup plans for distribution and marketing.

- Risk Assessments: Conduct comprehensive risk assessments to identify and address potential problems.

Role of Legal and Financial Advisors

Legal and financial advisors are indispensable in private equity film deals, providing expertise and guidance throughout the process. Their roles are crucial for mitigating risks and ensuring the deal’s success.

- Legal Advisors:

- Deal Structuring: Advise on the legal structure of the investment, including partnership agreements and financing documents.

- Contract Negotiation: Negotiate and review contracts with distributors, cast, crew, and other parties.

- Intellectual Property: Ensure the protection of intellectual property rights and handle any related legal issues.

- Risk Assessment: Identify and assess legal risks associated with the project.

- Financial Advisors:

- Financial Modeling: Develop financial models to assess the film’s potential profitability and return on investment.

- Due Diligence: Conduct financial due diligence, including reviewing budgets, revenue projections, and financial statements.

- Deal Structuring: Advise on the financial structure of the deal and negotiate terms with investors.

- Risk Management: Identify and assess financial risks and develop mitigation strategies.

Building a Film Financing Pitch Deck

A compelling pitch deck is the cornerstone of attracting private equity investment in film financing. It’s a visual and concise presentation that conveys the project’s value proposition, financial viability, and risk mitigation strategies. A well-crafted pitch deck can significantly influence investors’ decisions, providing a clear understanding of the project’s potential for return on investment. It needs to be informative, visually appealing, and tailored to the specific interests of private equity investors.

Essential Components of a Compelling Pitch Deck

The structure of a film financing pitch deck is crucial. It must tell a cohesive story, moving logically from the project’s core concept to its financial projections and exit strategy. Each slide should have a clear purpose and contribute to the overall narrative, showcasing the project’s strengths and addressing potential concerns.

- Cover Slide: This slide should include the film’s title, the production company’s logo, and the names of key producers and/or directors. It sets the first impression and should be visually appealing and professional.

- Logline and Synopsis: Provide a concise logline (a one-sentence summary) and a brief, engaging synopsis of the film’s plot. This quickly captures the investor’s attention and conveys the film’s core narrative.

- Market Overview and Competitive Analysis: Analyze the film’s target audience and the current market landscape. Identify comparable films and their performance to demonstrate the project’s potential for success. Include box office data, streaming performance, and critical reception of similar projects.

- Creative Team: Showcase the key creative personnel, including the director, producers, writers, and cast (if available). Highlight their experience, track record, and any awards or accolades they have received. This builds credibility and demonstrates the team’s ability to execute the project successfully.

- Visuals: Include concept art, storyboards, or other visual elements to illustrate the film’s look and feel. These visuals help investors visualize the project and understand the director’s vision.

- Financial Projections: Present detailed financial projections, including the budget, revenue forecasts, and potential return on investment (ROI). This is a critical section that requires accuracy and transparency. (Detailed further below)

- Financing Plan: Artikel the financing structure, including the amount of private equity sought, the sources of other funding (e.g., tax credits, pre-sales), and the proposed equity split. This clarifies how the project will be financed and the investor’s role.

- Marketing and Distribution Strategy: Detail the marketing plan, including target audience, promotional activities, and distribution channels. Explain how the film will reach its audience and generate revenue. (Detailed further below)

- Risk Management: Identify potential risks (e.g., production delays, budget overruns, distribution challenges) and Artikel mitigation strategies. This demonstrates that the producers have considered potential challenges and have plans to address them.

- Use of Funds: Clearly explain how the private equity investment will be used, including specific budget allocations (e.g., pre-production, production, post-production, marketing). This transparency builds trust and demonstrates responsible financial management.

- Exit Strategy: Describe the anticipated exit strategy for investors, such as theatrical release, streaming deals, or sale to a distributor. This Artikels how investors will realize their return on investment.

- Team and Contact Information: Provide contact information for the key team members and any advisors involved in the project. This enables investors to follow up with questions and conduct due diligence.

Designing a Template for Presenting a Film Project’s Financial Projections

Presenting financial projections in a clear and concise format is crucial for attracting private equity investment. The template should include key financial metrics and forecasts to demonstrate the project’s financial viability and potential for profitability. Accuracy and transparency are paramount.

Private equity film financing – A well-structured template should include the following:

- Budget Breakdown: A detailed breakdown of the film’s budget, including all production costs (e.g., pre-production, production, post-production, marketing, and distribution). Include line items for each category, such as cast salaries, location fees, equipment rental, and post-production services.

- Revenue Projections: Forecasted revenue from various sources, including theatrical release, home entertainment (DVD/Blu-ray sales and rentals), television licensing (e.g., broadcast and cable), streaming deals, and international distribution. Base these projections on market research, comparable films, and realistic assumptions.

- Cash Flow Projections: A month-by-month or quarter-by-quarter projection of cash inflows and outflows. This shows how the project will manage its cash flow and when investors can expect returns.

- Profit and Loss Statement (P&L): A summary of the film’s revenues, expenses, and profits over a specific period (e.g., five years). This demonstrates the project’s profitability and overall financial performance.

- Return on Investment (ROI) Analysis: Calculate the potential ROI for investors, including the projected return percentage and the timeframe for realizing the return. Include sensitivity analysis to show how changes in key assumptions (e.g., box office revenue, distribution deals) affect the ROI.

- Break-Even Analysis: Determine the point at which the film’s revenue equals its expenses. This demonstrates the project’s financial stability and risk profile.

- Key Assumptions: Clearly state the assumptions underlying the financial projections, such as the projected number of screens, ticket prices, and distribution deals.

- Example of a Budget Breakdown:

A detailed budget breakdown might include these categories:

| Category | Description | Estimated Cost |

|---|---|---|

| Pre-Production | Script development, location scouting, casting, etc. | $500,000 |

| Production | Principal photography, crew salaries, equipment rental, etc. | $5,000,000 |

| Post-Production | Editing, sound design, visual effects, etc. | $1,500,000 |

| Marketing & Distribution | Advertising, publicity, prints and advertising (P&A), etc. | $2,000,000 |

| Contingency | Unforeseen expenses | $500,000 |

| Total Budget | $9,500,000 |

Revenue Projection Example:

Private equity film financing involves complex deals, often requiring specialized financial knowledge. Aspiring finance professionals can gain crucial experience by participating in a finance summer internship , where they can learn about valuation, deal structuring, and risk assessment. This hands-on experience is invaluable for anyone aiming to work in the exciting world of private equity and film financing.

Assume a film with a $10 million budget is projected to generate revenue from various sources. The revenue projections could look like this:

| Revenue Source | Projected Revenue | Percentage |

|---|---|---|

| Theatrical Release (Domestic) | $20,000,000 | 40% |

| Theatrical Release (International) | $15,000,000 | 30% |

| Home Entertainment (DVD/Blu-ray) | $2,500,000 | 5% |

| Television Licensing | $7,500,000 | 15% |

| Streaming Deals | $5,000,000 | 10% |

| Total Revenue | $50,000,000 | 100% |

ROI Calculation Example:

Private equity film financing often involves complex deals, similar to other investments. Understanding the financial structure is key, and this can sometimes resemble the strategies used in leveraged acquisition finance. Both fields involve assessing risk and structuring debt, ultimately aiming to maximize returns for investors in the film industry through strategic capital deployment and financing models.

If an investor contributes $1 million and the film generates a net profit of $10 million, the ROI would be calculated as follows:

ROI = (Net Profit / Investment) * 100 = ($10,000,000 / $1,000,000) * 100 = 1000%

This indicates a very high return on investment.

Organizing Information for a Film’s Marketing and Distribution Strategy

A well-defined marketing and distribution strategy is essential for maximizing a film’s revenue potential. This section should Artikel the plan for reaching the target audience and generating interest in the film. It should include details on the marketing campaign, distribution channels, and key performance indicators (KPIs).

- Target Audience: Identify the film’s primary and secondary target audiences. This will inform the marketing strategy and help focus efforts on reaching the most relevant viewers.

- Marketing Plan: Detail the marketing activities, including advertising, public relations, social media, and promotional partnerships. Include a timeline and budget for each activity.

- Distribution Strategy: Artikel the planned distribution channels, such as theatrical release, home entertainment, television licensing, and streaming deals. Identify potential distributors and their experience with similar films.

- Marketing Materials: Describe the marketing materials that will be created, such as trailers, posters, website, and social media content. Provide examples or mockups of these materials.

- Key Performance Indicators (KPIs): Define the KPIs that will be used to measure the success of the marketing and distribution efforts. Examples include box office revenue, social media engagement, and streaming views.

- Release Strategy: Specify the planned release date, number of screens, and marketing spend. A well-planned release strategy can maximize box office revenue and build momentum for the film.

- Example of a Marketing Plan:

A marketing plan might include these components:

- Social Media Campaign: Create a dedicated social media presence on platforms like Facebook, Instagram, and Twitter. Engage with potential audiences, run contests, and share behind-the-scenes content. Budget: $50,000.

- Public Relations: Hire a publicist to secure media coverage, interviews, and reviews. Target film critics, entertainment websites, and industry publications. Budget: $30,000.

- Trailer and Poster Campaign: Produce a compelling trailer and eye-catching poster to generate buzz. Distribute the trailer online and in theaters. Budget: $75,000.

- Digital Advertising: Run targeted advertising campaigns on social media, search engines, and entertainment websites. Focus on reaching the film’s target audience. Budget: $100,000.

- Premiere and Film Festivals: Organize a premiere event and submit the film to relevant film festivals. This can generate media attention and build buzz. Budget: $25,000.

Distribution Strategy Example:

A film could employ a multi-platform distribution strategy:

- Theatrical Release: Secure a distribution deal with a major or independent distributor for a wide theatrical release in North America and select international markets.

- Home Entertainment: Release the film on DVD, Blu-ray, and digital platforms (e.g., iTunes, Amazon).

- Television Licensing: Sell the film to television networks and streaming services.

- Streaming Deals: Negotiate deals with major streaming platforms (e.g., Netflix, Amazon Prime Video) for exclusive or non-exclusive streaming rights.

Case Studies and Real-World Examples

Understanding the practical application of private equity in film financing requires examining real-world examples. Analyzing both successful and unsuccessful deals provides valuable insights into the complexities, risks, and rewards associated with this investment strategy. This section will delve into specific case studies, comparing and contrasting different approaches to illustrate the diverse landscape of private equity film financing.

Successful Private Equity Film Financing Deal

Examining successful deals helps to understand the potential for high returns and the factors contributing to their success. This case study will analyze a hypothetical deal structure and its resulting returns.

In 2018, a private equity firm, “Silver Screen Investments,” decided to finance a mid-budget action film, “Crimson Tide.” The film’s budget was $30 million. Silver Screen Investments structured the deal as follows:

* Investment: $15 million (50% of the budget). The remaining $15 million was secured through presales of distribution rights to various territories and tax credits.

* Deal Structure: The firm invested as a limited partner, receiving a percentage of the film’s net profits after recoupment of its initial investment and associated fees. The agreement stipulated a 20% distribution fee to the distributor. The firm received 80% of the net profits until its initial investment was recouped, after which the split shifted to 50/50 with the other investors.

* Film’s Performance: “Crimson Tide” was released theatrically and performed well, generating $80 million in worldwide box office revenue. The film also secured significant revenue from home entertainment and streaming platforms.

* Returns: After all costs, including the distributor’s fee and marketing expenses, the film generated approximately $60 million in net profit.

The return on investment (ROI) for Silver Screen Investments was calculated as follows:

ROI = ((Net Profit / Investment) – 1) * 100

In this case: ROI = (($30 million / $15 million) – 1) * 100 = 100%. Silver Screen Investments doubled its investment. The firm’s investment was recouped within 18 months, after which the profit split shifted.

The success of this deal hinged on several factors:

- A well-defined budget and efficient production management.

- Strong pre-sales of distribution rights, reducing the risk.

- Effective marketing and distribution strategies.

- The film’s ability to resonate with its target audience.

Failed Private Equity Film Financing Deal

Analyzing failed deals is crucial for understanding the pitfalls of film financing and the importance of rigorous due diligence. This case study examines a hypothetical deal that resulted in significant losses.

In 2019, “Golden Reel Capital,” a private equity firm, invested $20 million in a historical drama, “The Last Pharaoh,” with a total budget of $50 million. The remaining funds were to be secured through tax credits, co-production agreements, and foreign pre-sales. The deal structure involved Golden Reel Capital taking a senior position in the capital stack, with a priority claim on revenues.

* Investment: $20 million (40% of the budget).

* Deal Structure: Senior position in the capital stack with a 10% distribution fee. 70% of the net profits until recoupment.

* Causes of Failure:

- Over-Budget: Production costs exceeded the initial budget by $10 million due to unforeseen complications and poor financial management.

- Weak Pre-Sales: Foreign pre-sales were lower than projected due to a decline in the international market for historical dramas.

- Poor Reviews and Box Office Performance: The film received negative reviews and generated only $15 million in worldwide box office revenue.

- Distribution Challenges: The film struggled to secure a wide theatrical release, impacting revenue generation.

The film’s performance was severely hampered by these factors, resulting in a significant loss for Golden Reel Capital. After accounting for distribution fees, marketing expenses, and other costs, the film generated a net loss. The private equity firm lost its entire investment.

This case study highlights the importance of:

- Thorough due diligence, including a detailed review of the script, budget, and production plan.

- Securing robust pre-sales agreements to mitigate risk.

- Managing production costs effectively.

- Conducting market analysis to understand audience preferences.

Comparing and Contrasting Different Approaches to Private Equity Film Financing

Different private equity firms employ varied strategies and deal structures in film financing. Comparing these approaches reveals the diversity of investment strategies and their impact on risk and return.

* Approach 1: The “Conservative” Approach. This strategy focuses on minimizing risk by investing in films with established filmmakers, proven track records, and strong pre-sales.

* Example: A firm invests in a sequel to a successful franchise, securing significant pre-sales and partnering with a major studio for distribution. This approach typically yields moderate returns but offers greater stability.

* Approach 2: The “High-Risk/High-Reward” Approach. This strategy involves investing in independent films with emerging talent, aiming for high returns but accepting greater risk.

* Example: A firm finances a debut feature film by a promising director, betting on critical acclaim and festival success. This approach carries a higher risk of failure but offers the potential for substantial profits if the film becomes a breakout hit.

* Approach 3: The “Portfolio” Approach. This strategy involves diversifying investments across multiple film projects to mitigate risk.

* Example: A firm invests in a portfolio of films, including various genres and budgets, to spread risk and increase the likelihood of generating positive returns overall.

* Approach 4: The “Production Company Partnership” Approach. The firm establishes a long-term partnership with a film production company.

* Example: A private equity firm invests in a film production company and provides ongoing funding for a slate of projects. This structure allows for a more integrated approach to film financing and potentially higher returns.

The choice of approach depends on the firm’s risk tolerance, investment objectives, and market conditions. Understanding these different strategies is crucial for navigating the complexities of private equity film financing.

Future Trends and Innovations

The landscape of private equity film financing is constantly evolving, driven by technological advancements, shifting consumer habits, and the ever-changing dynamics of the entertainment industry. Understanding these future trends and innovations is crucial for investors and filmmakers alike to capitalize on emerging opportunities and navigate potential challenges. This section explores key areas of development and their potential impact.

The Rise of Streaming Platforms

The proliferation of streaming platforms has significantly altered the film financing landscape. Private equity is increasingly recognizing the potential of these platforms as both distribution channels and sources of revenue. This shift presents both opportunities and risks.

- Increased Demand for Content: Streaming services require a vast and consistent supply of content to attract and retain subscribers. This fuels demand for film projects, creating more avenues for financing.

- New Revenue Models: Streaming platforms offer alternative revenue models compared to traditional theatrical releases, including licensing fees, subscription revenue sharing, and direct-to-consumer distribution.

- Data-Driven Decision Making: Streaming platforms collect extensive data on viewer preferences, enabling more informed decisions about content acquisition, development, and marketing. Private equity firms can leverage this data to assess the potential success of film projects and tailor their investment strategies.

- Challenges and Risks: The streaming market is competitive, and profitability is not guaranteed. Over-reliance on a single platform can create vulnerability. Understanding the specific terms of platform agreements and the potential for audience fatigue are critical for investors.

Innovative Financing Models and Technologies

New financing models and technologies are emerging to streamline the film financing process, reduce risk, and increase transparency. These innovations are reshaping how films are funded and distributed.

- Crowdfunding and Micro-Financing: Platforms like Kickstarter and Indiegogo allow filmmakers to raise funds directly from the public, supplementing traditional financing sources. While typically used for smaller-budget projects, crowdfunding can provide early-stage funding and build audience engagement.

- Blockchain Technology: Blockchain can be used to track film rights, manage royalties, and create more transparent and secure financing arrangements. Smart contracts can automate payments and reduce administrative overhead.

- Special Purpose Acquisition Companies (SPACs): SPACs have become another avenue for film financing, allowing film companies to go public without a traditional IPO. This can provide access to significant capital.

- Tax Credits and Incentives Optimization: Advanced software and consulting services are helping film producers maximize available tax credits and incentives offered by various jurisdictions, reducing overall financing costs.

The Impact of Artificial Intelligence and Other Technologies

Artificial intelligence (AI) and other emerging technologies are poised to significantly impact film financing, from pre-production to distribution.

- AI-Driven Script Analysis: AI algorithms can analyze scripts to predict their commercial potential, identify potential risks, and assess audience appeal. This helps investors evaluate projects more efficiently.

- Virtual Production and Extended Reality (XR): Virtual production techniques, including the use of LED volume stages, can reduce production costs and increase creative flexibility. XR technologies can enhance audience engagement and create new revenue streams.

- AI-Powered Marketing and Distribution: AI can be used to personalize marketing campaigns, optimize distribution strategies, and target specific audiences. This can improve the return on investment for film projects.

- Data Analytics for Decision Making: Big data analytics, coupled with AI, can provide insights into market trends, audience preferences, and the performance of past films. This enables more informed investment decisions and risk mitigation strategies. For instance, AI can analyze the success of a specific genre in a particular region, informing investment choices.

Structuring Content with Tables

Structuring content with tables is crucial for presenting complex information in a clear and digestible format. Tables allow for the side-by-side comparison of different financing models, key players, and stages of film production, enhancing the audience’s understanding of the intricate processes involved in private equity film financing. Properly designed tables facilitate data analysis and decision-making, providing a concise overview of the subject matter.

Comparing Film Financing Models

Different film financing models have unique characteristics, each impacting the structure and risk profile of a project. Understanding these differences is essential for investors and producers alike.

Here is a table comparing various film financing models:

| Financing Model | Description | Advantages | Disadvantages |

|---|---|---|---|

| Equity Financing | Investors provide capital in exchange for a share of the film’s profits. |

|

|

| Debt Financing | Funds are borrowed and must be repaid with interest. |

|

|

| Tax Credits | Government incentives that reduce the film’s production costs. |

|

|

| Pre-sales | Selling distribution rights before production to secure funding. |

|

|

Key Players in a Private Equity Film Financing Deal

Understanding the roles and responsibilities of each key player is critical for a successful private equity film financing deal. Each participant brings unique expertise and contributes to the project’s overall success.

Here is a table illustrating the key players involved in a private equity film financing deal:

| Key Player | Role | Responsibilities |

|---|---|---|

| Private Equity Firm | Provides capital for the film’s production. |

|

| Producers | Oversee all aspects of film production. |

|

| Legal Counsel | Provides legal advice and drafts contracts. |

|

Stages of Film Production and Associated Financing Needs

Film production involves distinct stages, each requiring specific financing considerations. Understanding the financing needs at each stage is crucial for efficient budgeting and resource allocation.

Here is a table illustrating the stages of film production and the associated financing needs:

| Production Stage | Activities | Financing Needs | Examples |

|---|---|---|---|

| Development | Scriptwriting, securing rights, and packaging the project. |

|

Paying writers, purchasing book rights, and hiring initial legal counsel. |

| Pre-Production | Casting, location scouting, and securing crew. |

|

Hiring the director and key crew members, securing locations, and initial set design. |

| Production (Principal Photography) | Filming the movie. |

|

Paying for camera rentals, catering, and daily production expenses. |

| Post-Production | Editing, sound design, and visual effects. |

|

Hiring editors, sound engineers, and visual effects artists, and paying for studio time. |

| Distribution and Marketing | Marketing, advertising, and distribution of the film. |

|

Creating trailers, posters, and other marketing materials, and paying for distribution rights. |

Structuring Content with Bullet Points

Structuring content effectively is crucial for conveying complex information clearly and concisely, especially when dealing with the multifaceted world of film financing. Using bullet points helps break down intricate processes, highlight key elements, and illustrate diverse strategies. This approach ensures that the information is easily digestible for investors, producers, and other stakeholders.

Due Diligence Process for Film Projects

Due diligence is a critical process for private equity investors in film. It involves a thorough investigation of a film project to assess its viability and potential risks. The following bullet points Artikel the key steps involved in this process.

- Project Assessment: This initial phase involves reviewing the script, the project’s budget, and the financing plan. Assessing the project’s overall concept, target audience, and market potential is crucial.

- Legal Review: Legal experts scrutinize all contracts, including those with the director, cast, and crew. They assess intellectual property rights, distribution agreements, and potential legal liabilities.

- Financial Modeling and Analysis: Financial analysts create detailed financial models to forecast revenue, expenses, and profitability. They assess the project’s internal rate of return (IRR), net present value (NPV), and payback period.

- Market Analysis: Research is conducted to understand the film’s target market, comparable films, and potential distribution channels. Analyzing box office projections, streaming potential, and international sales forecasts is vital.

- Production Review: The production team and their experience are evaluated. Reviewing the production schedule, location, and any potential logistical challenges is also important.

- Risk Assessment: Identifying and assessing potential risks, such as production delays, budget overruns, and marketing challenges, is key. Mitigation strategies are developed to address these risks.

- Management Team Evaluation: The experience and track record of the producers, director, and key personnel are examined. Their ability to execute the project successfully is assessed.

- Insurance and Bonding: Verification of adequate insurance coverage and bonding is essential to protect against financial losses. This includes errors and omissions (E&O) insurance and completion bonds.

- Final Investment Decision: Based on the findings of the due diligence process, the investor makes a final decision regarding the investment. This includes negotiating the terms of the investment agreement.

Essential Elements of a Film’s Budget

A film’s budget is a comprehensive financial plan that Artikels all anticipated costs associated with the project. The following bullet points highlight the essential elements that make up a film’s budget.

- Pre-Production Costs: These expenses cover the initial planning stages, including script development, location scouting, casting, and pre-production crew salaries.

- Production Costs: These are the expenses incurred during principal photography, including crew salaries, equipment rental, location fees, and catering.

- Post-Production Costs: These expenses cover the editing, sound mixing, visual effects, and color correction phases.

- Cast and Crew Salaries: Compensation for all cast and crew members, including actors, directors, producers, and technical staff, is a significant budget component.

- Equipment Rental: Costs associated with renting cameras, lighting, sound equipment, and other essential gear.

- Location Fees: Payments for the use of filming locations, including permits and any associated costs.

- Insurance and Bonding: Premiums for various types of insurance, such as E&O and completion bonds, to protect against potential risks.

- Marketing and Distribution Costs: Expenses related to marketing the film, including advertising, publicity, and distribution fees.

- Contingency Fund: A reserve fund to cover unexpected costs or budget overruns. A common practice is to allocate 10-15% of the total budget for contingencies.

- Overhead and Administration: Costs associated with office space, administrative staff, and other overhead expenses.

Common Exit Strategies for Private Equity Investors in Film

Private equity investors in film seek to realize a return on their investment through various exit strategies. The following bullet points illustrate the common approaches used.

- Sale to a Studio or Distributor: Selling the film’s rights to a major studio or distribution company is a common exit strategy. This can provide a significant return if the film is successful. For example, the sale of “The Hurt Locker” to Summit Entertainment after its success at the Academy Awards.

- Initial Public Offering (IPO): In rare cases, a film production company or a portfolio of films may be taken public through an IPO. This strategy provides access to a broader investor base and can generate substantial capital.

- Secondary Market Sale: Selling the film’s rights to another investor or private equity firm in the secondary market is another option. This can occur if the film is performing well or if the investor needs to exit before the full distribution cycle.

- Distribution Revenue: Receiving a portion of the revenue generated from the film’s distribution through theatrical releases, streaming platforms, and home video sales. This provides a long-term return based on the film’s performance.

- Mergers and Acquisitions (M&A): Merging the film production company with another company or being acquired by a larger media entity. This can result in a significant payout for investors.

- Residuals and Royalties: Collecting residuals and royalties from the film’s ongoing use in various distribution channels. This provides a continuous revenue stream over the long term.

- Sale of Intellectual Property: Selling the intellectual property rights, such as sequels, remakes, or spin-offs, to another production company or studio. This is especially relevant for successful franchises.

Illustrative Content – No Image Links

Illustrations are crucial in conveying complex information in a visually accessible manner, especially within the intricate world of private equity film financing. They simplify intricate processes, relationships, and potential pitfalls, making them easier to understand for investors and stakeholders. The following descriptions detail the elements and design considerations for three key illustrations essential for a comprehensive understanding of private equity film financing.

Flow of Funds in a Private Equity Film Financing Deal

This illustration depicts the journey of capital from its source to its ultimate use in film production and the subsequent return on investment. It visually Artikels the key stakeholders and their financial interactions, showcasing the various stages of fund disbursement and revenue generation.

The illustration should be a circular flow diagram, with the center depicting the *Film Project*. Arrows should indicate the direction of the financial transactions.

Key components and their placement in the diagram:

* Private Equity Fund: Located at the top of the circle, representing the source of capital. Arrows emanate from this point.

* Investors (Limited Partners – LPs): Positioned slightly to the left of the Private Equity Fund, connected by an arrow. This illustrates the flow of capital *into* the fund from investors.

* Film Production Company (SPV – Special Purpose Vehicle): Situated to the right of the Private Equity Fund, linked by an arrow. This represents the fund’s investment *into* the film project through the SPV.

* Distribution Company: Placed below the Film Production Company, connected by an arrow. This illustrates the film’s sale or licensing *to* distributors.

* Sales Agents: Represented to the left of the Distribution Company, also connected by an arrow. This illustrates how sales agents are used to distribute the film.

* Revenues (Box Office, Streaming, Licensing, etc.): Illustrated as returning *to* the Distribution Company and Sales Agents, creating another set of arrows.

* Repayment of Investment and Profits: Arrows flow *from* the Distribution Company and Sales Agents *to* the Film Production Company (SPV), and then *to* the Private Equity Fund. Finally, the fund distributes the profits *to* the LPs.

* Service Providers: Positioned around the perimeter, connected to relevant points in the flow. Examples include:

* Lawyers: Connected to the Private Equity Fund, SPV, and Distribution Company, representing their involvement in legal structuring and contract negotiation.

* Accountants: Linked to the Private Equity Fund and SPV, illustrating their role in financial reporting and auditing.

* Completion Bond Company: Connected to the Film Production Company, showing their role in mitigating production risk.

* Banks/Lenders: Connected to the SPV and Film Production Company, showing their role in providing loans and other financial services.

* Key Terms: Include brief definitions alongside the relevant components, such as:

* *SPV*: “A legal entity created specifically for the film project, limiting the liability of the fund.”

* *Distribution*: “The process of making the film available to audiences.”

* *ROI*: “Return on Investment, the percentage of profit the fund and investors make.”

This illustration helps clarify the complex relationships and financial transactions involved in private equity film financing.

Risk Factors and Their Impact on Film Financing

This illustration visualizes the various risk factors inherent in film financing and their potential impact on the project’s financial success. The design should highlight the interconnectedness of these risks, demonstrating how they can cascade and affect the overall investment.

The illustration should be a spider diagram, with the *Film Project* at the center. Lines emanate outwards, each representing a risk factor. The lines should vary in thickness, with thicker lines indicating higher potential impact.

Key risk factors and their visual representation:

* Production Risk: Represented by a thick line. Includes:

* *Cost Overruns*: Illustrated as a bubble expanding outward from the Production Risk line, representing budget increases.

* *Production Delays*: Shown as a clock icon, representing the potential for projects going over schedule.

* *Creative Differences*: Depicted as clashing paintbrushes, indicating conflicts that might impact the final product.

* Market Risk: Represented by a thick line. Includes:

* *Changing Audience Preferences*: Shown as a graph line fluctuating wildly, indicating unpredictability.

* *Competition from Other Films*: Illustrated as a group of competing film reels, indicating the challenge of attracting an audience.

* *Over-Saturation of the Market*: Illustrated as a full movie theater, showing the impact of too many films.

* Financial Risk: Represented by a thick line. Includes:

* *Currency Fluctuations*: Depicted as a seesaw with currency symbols on each side, indicating the impact of foreign exchange rate changes.

* *Interest Rate Hikes*: Shown as an arrow pointing upwards, representing the increased cost of borrowing.

* *Distribution Challenges*: Illustrated as a maze, representing the difficulties of securing distribution.

* Talent Risk: Represented by a medium-thickness line. Includes:

* *Cast/Director Availability*: Shown as a calendar with limited availability.

* *Creative Disputes*: Depicted as clashing paintbrushes, indicating conflicts that might impact the final product.

* *Unexpected Behavior*: Illustrated as a silhouette breaking the contract, indicating potential problems.

* Legal and Regulatory Risk: Represented by a medium-thickness line. Includes:

* *Copyright Infringement*: Shown as a lock with a broken key, representing legal challenges.

* *Changes in Tax Laws*: Illustrated as a gavel, representing regulatory changes.

* *Compliance Issues*: Depicted as a document with a red flag, indicating potential non-compliance.

The impact of each risk should be visually represented. For instance, cost overruns might lead to reduced profits, delays might affect release dates, and changes in audience preferences might impact box office revenue. The illustration should also include a section that shows how *Risk Mitigation Strategies* can reduce the impact of these risks.

This illustration provides a comprehensive overview of the multifaceted risks involved in film financing, emphasizing their potential impact and the importance of risk management.

Evaluating a Film Project’s Financial Viability

This illustration Artikels the process of assessing a film project’s financial feasibility, providing a step-by-step guide to the key elements involved in determining its investment potential.

The illustration should be a flowchart, starting with the *Film Project Proposal* at the top and leading to a final decision (Invest/Do Not Invest) at the bottom.

Key stages and components:

* Film Project Proposal: At the beginning, representing the initial submission.

* Market Analysis: Represented by a magnifying glass. Key elements to consider:

* *Genre Analysis*: Illustrate with a graph showing the historical box office performance of the film’s genre. Include examples of successful films in the same genre (e.g., if the film is a superhero movie, show the box office performance of recent Marvel films).

* *Target Audience Analysis*: Show a demographic chart of the intended audience, including age, gender, and location.

* *Competitive Landscape Analysis*: Show a timeline with upcoming releases and their potential impact.

* Budget Analysis: Represented by a calculator. Key elements to consider:

* *Production Budget Breakdown*: Show a pie chart of the budget allocation (e.g., cast, crew, post-production, marketing).

* *Cost Control Measures*: Illustrate with a checklist, including strategies like pre-sales and tax incentives.

* Financial Projections: Represented by a spreadsheet. Key elements to consider:

* *Revenue Projections*: Show a graph with projected box office revenue, streaming revenue, and licensing revenue. Include examples of films with similar revenue streams.

* *Expense Projections*: Show a graph with projected production costs, marketing costs, and distribution fees.

* *Cash Flow Analysis*: Illustrate the projected cash inflows and outflows over the investment period.

* *Break-Even Analysis*: Represented by a graph showing the point at which the film’s revenue covers its costs.

* Risk Assessment: Represented by a checklist. Key elements to consider:

* *Sensitivity Analysis*: Show a table illustrating the impact of different variables (e.g., changes in production costs, changes in box office revenue) on the film’s profitability.

* *Scenario Planning*: Show several different outcomes, representing optimistic, pessimistic, and base-case scenarios.

* Valuation and Return on Investment (ROI): Represented by a scale. Key elements to consider:

* *Net Present Value (NPV)*: Show the formula:

NPV = ∑ (Cash Flow / (1 + Discount Rate)^n) – Initial Investment

Where:

* Cash Flow is the projected cash inflow in each period.

* Discount Rate is the required rate of return.

* n is the number of periods.

* *Internal Rate of Return (IRR)*: Show the formula:

IRR: The discount rate that makes the net present value of all cash flows from a particular project equal to zero.

* *Payback Period*: Show the time it takes for the investment to be recouped.

* Investment Decision: At the end, the flowchart splits into two possible outcomes:

* *Invest*: If the project meets the financial criteria.

* *Do Not Invest*: If the project does not meet the financial criteria.

This flowchart provides a clear, step-by-step guide to the evaluation process, enabling investors to make informed decisions based on comprehensive financial analysis and risk assessment.