Overview of QLD Yahoo Finance

QLD Yahoo Finance is a localized version of Yahoo Finance specifically tailored for users in Queensland, Australia. Its primary purpose is to provide Queenslanders with comprehensive and up-to-date financial information, market data, and investment tools. The platform aims to empower users to make informed financial decisions by offering access to a wide range of resources and insights relevant to the Queensland market and broader financial landscape.

Financial Data Available

QLD Yahoo Finance provides a wealth of financial data catering to the needs of Queensland users. This includes, but is not limited to, the following:

- Stock Quotes: Real-time and historical stock prices for companies listed on the Australian Securities Exchange (ASX) and global markets. This allows users to track the performance of their investments and monitor market trends.

- Market Indices: Information on key market indices, such as the ASX 200, providing a snapshot of overall market performance. This is crucial for understanding the broader economic environment.

- Currency Exchange Rates: Updated currency exchange rates, essential for those involved in international trade or investing in foreign markets.

- Commodities Data: Prices and trends for various commodities, including gold, oil, and agricultural products, which are particularly relevant given Queensland’s significant role in resource industries.

- Company Profiles: Detailed profiles of listed companies, including financial statements, key metrics, and news, allowing users to conduct thorough research.

- Financial News: Access to breaking financial news and analysis from reputable sources, providing context and insights into market movements.

- Portfolio Tracking: Tools for users to create and manage their investment portfolios, tracking performance and monitoring asset allocation.

Target Audience and Relevance

QLD Yahoo Finance is designed to serve a diverse audience, including:

- Individual Investors: Those looking to manage their personal investments, track market trends, and make informed decisions about their portfolios.

- Business Owners: Entrepreneurs and business owners in Queensland who need access to financial data to make strategic decisions about their businesses.

- Financial Professionals: Financial advisors, analysts, and other professionals who require reliable data and analysis to serve their clients.

- Students and Educators: Those studying finance or economics, who can use the platform for educational purposes and research.

- General Consumers: Individuals interested in staying informed about financial markets and the economy.

The platform’s relevance lies in its ability to provide localized information, making it more pertinent to Queenslanders. For example, the inclusion of commodities data relevant to Queensland’s mining and agricultural sectors, along with news specific to the state’s economy, enhances its utility. This focus helps users understand market dynamics and make more informed decisions based on data relevant to their local context.

Navigating the QLD Yahoo Finance Interface

The QLD Yahoo Finance interface, while drawing on the broader Yahoo Finance platform, provides specific tools for investors interested in the Queensland market. Understanding how to navigate this interface efficiently is crucial for accessing relevant financial information. This guide provides a structured approach to finding financial instruments, setting up a personalized portfolio, and utilizing the search function.

Locating Financial Instruments

Finding specific financial instruments, such as stocks or mutual funds, is a fundamental task within the QLD Yahoo Finance interface. The platform’s search and navigation features are designed to streamline this process.

To locate a specific financial instrument, follow these steps:

- Use the Search Bar: The primary method for finding a financial instrument is by using the search bar located at the top of the page. Enter the ticker symbol (e.g., BHP for BHP Group) or the company name. The search bar provides suggestions as you type, which can speed up the process.

- Select from Suggestions: As you type, the platform will display a list of suggested matches. These suggestions include stocks, mutual funds, ETFs, and other financial instruments. Carefully review the suggestions to ensure you select the correct instrument based on its ticker symbol and exchange (e.g., ASX for Australian Securities Exchange).

- Navigate to the Instrument’s Page: Once you select the correct instrument from the search results, you will be directed to its dedicated page. This page provides detailed information, including the current stock price, trading volume, financial statements, news articles, and analyst ratings.

- Filter by Exchange (if necessary): If you’re searching for a company that is listed on multiple exchanges, you might need to filter the results. The interface usually allows you to specify the exchange to narrow down the search (e.g., ASX for companies listed on the Australian Securities Exchange).

Setting Up a Personalized Portfolio

Creating a personalized portfolio allows you to track the performance of specific investments relevant to your interests. QLD Yahoo Finance offers a straightforward process for setting up and managing a portfolio.

Here’s how to set up a personalized portfolio:

- Access the Portfolio Section: Log in to your Yahoo Finance account. Navigate to the “Portfolio” section, usually found in the top navigation bar. If you don’t have an account, you will need to create one.

- Create a New Portfolio: Click on the option to “Create Portfolio” or a similar button. You will be prompted to name your portfolio (e.g., “Queensland Investments”) and may be able to choose a currency.

- Add Instruments: Use the search bar or instrument lookup tool within the portfolio creation interface to add the stocks, mutual funds, or other financial instruments you want to track. Enter the ticker symbol or company name and add the number of shares or units you own.

- Track Performance: Once you’ve added your investments, the portfolio will display real-time performance data, including gains and losses, portfolio value, and percentage changes. You can customize the view to show specific metrics, such as dividend yields or price-to-earnings ratios.

- Edit and Manage: You can edit your portfolio at any time by adding or removing investments, updating the number of shares, or adjusting the purchase price. The platform often provides tools to analyze your portfolio’s performance, including diversification analysis and risk assessment.

Utilizing the Search Functionality for Queensland-Based Companies

The search functionality on QLD Yahoo Finance is a powerful tool for finding information about Queensland-based companies. Utilizing the search effectively is key to uncovering relevant data.

To use the search functionality effectively for Queensland-based companies:

- Start with Company Names: Begin by typing the full or partial name of the Queensland-based company into the search bar. For example, start with “Queensland Rail” or “Suncorp”. The platform will display suggested matches.

- Use Ticker Symbols: If you know the ticker symbol of the Queensland company (e.g., SUN for Suncorp), use that directly in the search bar for more precise results.

- Review Search Results: The search results will typically include a mix of stocks, news articles, financial reports, and other relevant information. Pay close attention to the company’s listing exchange (e.g., ASX) to ensure you’re viewing the correct financial instrument.

- Analyze Company Information: Once you’ve found the company’s stock page, review the available information. This includes the stock price, financial statements, news, analyst ratings, and key statistics.

- Filter News and Articles: Use the filtering options within the news section to refine your search. This allows you to find articles specifically about Queensland-related business news, economic trends, or company-specific developments.

Data & Information Available

QLD Yahoo Finance offers a comprehensive suite of financial data and news, providing Queensland-based investors and analysts with the tools needed to make informed decisions. This includes real-time market updates, in-depth company profiles, and historical data, all accessible through an intuitive interface. The platform’s strength lies in its ability to aggregate information from various reliable sources, ensuring users have access to the latest and most relevant financial insights.

Financial News and Reports

QLD Yahoo Finance provides a wide array of financial news and reports, keeping users abreast of market trends and developments. This information is crucial for understanding the current economic climate and its impact on investments.

- Market Updates: Real-time market data, including stock quotes, index movements (such as the ASX 200), and currency exchange rates, are readily available. These updates are crucial for day traders and investors who need to monitor price fluctuations.

- News Articles: Access to news articles from reputable financial news providers, covering topics like company earnings reports, economic indicators, and global market events that can affect Queensland-based companies.

- Analyst Ratings and Recommendations: Information on analyst ratings and recommendations for specific stocks, providing insights into expert opinions on company performance and future prospects. This can help investors gauge market sentiment.

- Company-Specific News: Focused news and press releases directly related to Queensland-based companies, offering insights into their operations, strategic initiatives, and financial performance. This is particularly useful for investors interested in specific local businesses.

- Economic Reports: Access to economic reports and data releases from government agencies and financial institutions, providing a broader perspective on the economic environment. These reports may include information on GDP growth, inflation rates, and employment figures.

Historical Stock Prices and Financial Data

QLD Yahoo Finance offers extensive historical stock prices and other relevant financial data for Queensland companies. This data is essential for conducting technical analysis, evaluating past performance, and making informed investment decisions.

- Historical Stock Prices: Users can access historical stock prices for Queensland-based companies, including daily, weekly, monthly, and yearly data. This historical data is used to identify trends, patterns, and potential investment opportunities.

- Financial Statements: Access to key financial statements such as income statements, balance sheets, and cash flow statements for publicly listed Queensland companies.

- Key Financial Ratios: Calculation and presentation of important financial ratios (e.g., P/E ratio, debt-to-equity ratio, return on equity) to help users evaluate a company’s financial health and performance.

- Historical Earnings Data: Information on historical earnings per share (EPS) and revenue figures, allowing investors to assess a company’s growth and profitability over time.

- Dividend Information: Details on dividend payments, including dividend yields, payment dates, and dividend history, which are relevant for income-seeking investors.

Data Sources and Reliability

QLD Yahoo Finance aggregates data from various sources, each with its own level of reliability. Understanding the sources and their associated strengths and weaknesses is crucial for interpreting the information provided. The following table provides a comparison of data sources used by QLD Yahoo Finance, considering their reliability:

| Data Source | Description | Reliability | Potential Limitations |

|---|---|---|---|

| ASX (Australian Securities Exchange) | Official source for stock prices, trading volumes, and company announcements for listed companies. | High: Considered a primary and reliable source for Australian stock market data. | Limited to companies listed on the ASX; data may be delayed slightly. |

| Reuters/Bloomberg | Reputable financial news and data providers. | High: Known for their extensive global financial data coverage and real-time information. | Subscription services, so some data may be behind a paywall; can be susceptible to errors. |

| Company Filings (e.g., ASIC) | Official filings from companies, including financial statements and annual reports. | High: Official and legally required information. | Can be delayed; requires some financial literacy to interpret the information. |

| Financial News Providers (e.g., The Australian Financial Review, The Sydney Morning Herald) | News articles and reports from reputable financial news sources. | Medium to High: Reputable sources but subject to journalistic interpretation. | Can have biases; news articles are often time-sensitive. |

Using QLD Yahoo Finance for Investment Decisions

QLD Yahoo Finance empowers investors to make informed decisions by providing tools and data to monitor and analyze Queensland-based assets. This section delves into how users can leverage the platform to manage their investments effectively, access critical financial information, and visualize performance trends.

Monitoring Queensland-Based Investments

The platform allows users to track the performance of their investments in Queensland-based companies, enabling them to stay informed about market fluctuations and portfolio health.

To monitor Queensland-based investments effectively, users can utilize several features:

- Creating a Portfolio: Users can create personalized portfolios by adding stocks, bonds, and other financial instruments specific to Queensland companies. This feature allows for a consolidated view of all investments.

- Real-Time Data: Access to real-time stock quotes, price changes, and trading volume provides up-to-the-minute insights into market activity. This helps investors react quickly to market movements.

- Customizable Alerts: Setting up price alerts and news alerts ensures users are notified of significant events affecting their investments. Alerts can be tailored to specific price thresholds or company-related news.

- Performance Tracking: The platform offers tools to track the performance of individual investments and the overall portfolio. Investors can analyze gains, losses, and overall returns over various time periods.

- News and Analysis: Staying informed about company news, industry trends, and economic indicators is crucial. QLD Yahoo Finance provides access to news articles, analyst ratings, and financial reports related to Queensland-based companies.

Accessing and Interpreting Financial Statements for Queensland Companies

Understanding financial statements is essential for evaluating the financial health and performance of Queensland-based companies. QLD Yahoo Finance provides access to these statements, empowering investors to make informed decisions.

Key financial statements available on the platform include:

- Income Statement: This statement reveals a company’s revenues, expenses, and profit or loss over a specific period. Investors can assess profitability and operational efficiency.

- Balance Sheet: The balance sheet provides a snapshot of a company’s assets, liabilities, and equity at a specific point in time. Investors can assess financial stability and leverage.

- Cash Flow Statement: This statement tracks the movement of cash in and out of a company, categorized by operating, investing, and financing activities. It provides insights into a company’s ability to generate cash and manage its finances.

- Key Financial Ratios: The platform often provides key financial ratios calculated from the financial statements. These ratios, such as the price-to-earnings ratio (P/E) and debt-to-equity ratio (D/E), help investors evaluate a company’s valuation and financial health.

Interpreting these statements requires a basic understanding of financial accounting. Consider the following when analyzing a company’s financial performance:

- Revenue Growth: Increasing revenue typically indicates a growing business. Investors should analyze the sources of revenue and the sustainability of growth.

- Profit Margins: High-profit margins suggest efficient operations and pricing power. Investors should compare profit margins to industry averages.

- Debt Levels: High debt levels can increase financial risk. Investors should analyze the debt-to-equity ratio and the company’s ability to service its debt.

- Cash Flow: Positive cash flow from operations is crucial for a company’s long-term sustainability. Investors should examine the sources and uses of cash.

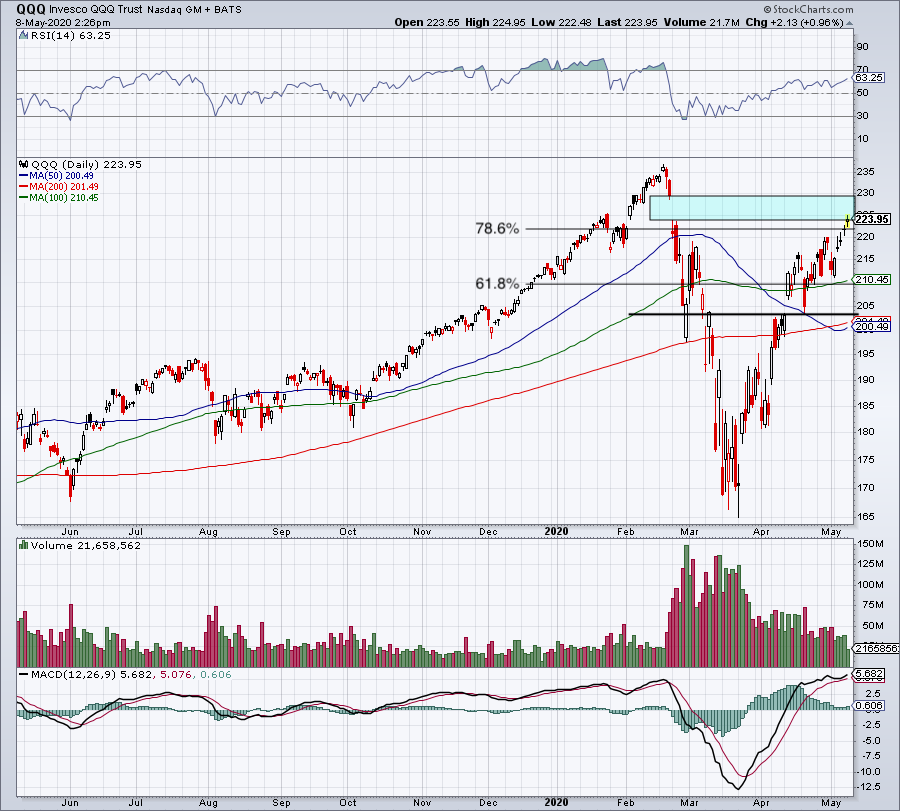

Using Charting Tools to Visualize Stock Performance

The platform’s charting tools offer powerful visualization capabilities, allowing investors to analyze stock performance trends, identify patterns, and make informed decisions.

Key features of the charting tools include:

- Price Charts: Users can view various types of price charts, including line charts, bar charts, and candlestick charts, to visualize price movements over time.

- Technical Indicators: The platform offers a range of technical indicators, such as moving averages, Relative Strength Index (RSI), and Moving Average Convergence Divergence (MACD), to identify potential buy and sell signals.

- Customizable Timeframes: Charts can be viewed over different timeframes, from intraday to several years, allowing investors to analyze short-term and long-term trends.

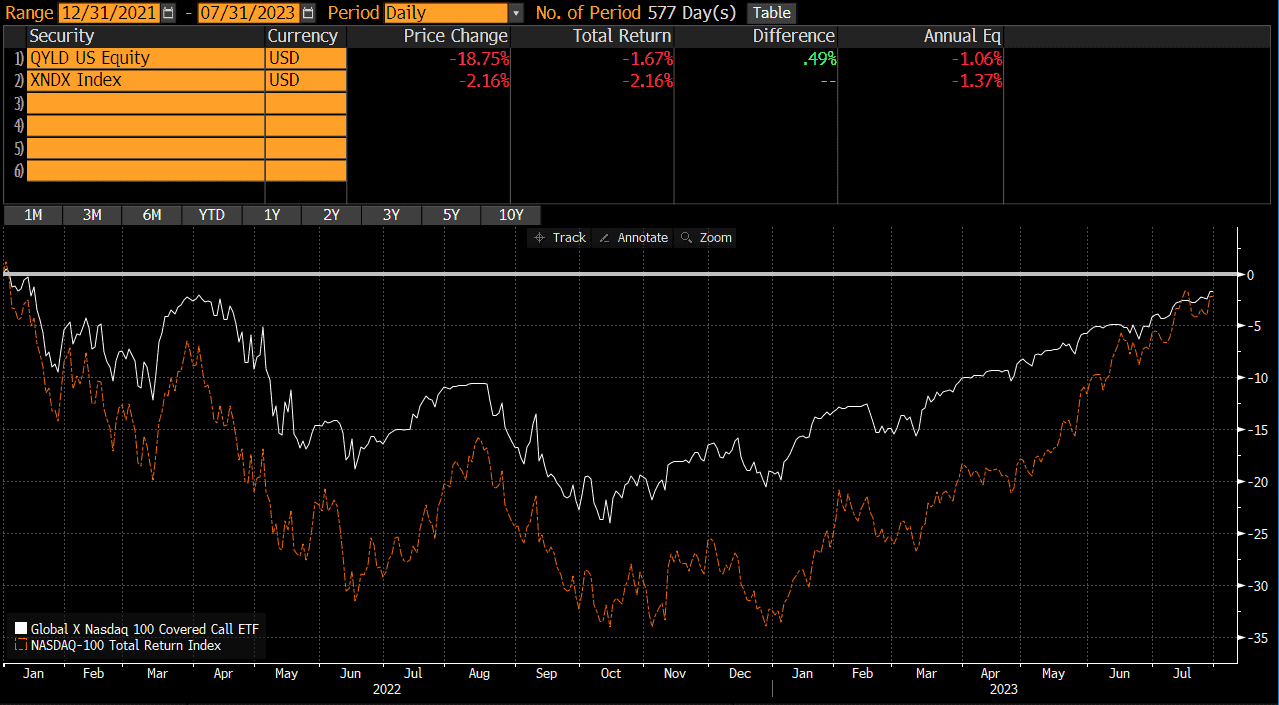

- Comparison Tools: Users can compare the performance of different stocks or indices to assess relative performance.

- Drawing Tools: The platform often includes drawing tools to add trendlines, support and resistance levels, and other annotations to the charts.

Example of using charting tools:

Let’s consider a Queensland-based mining company, “GoldCo”.

1. Identifying Trends: By examining a candlestick chart of GoldCo’s stock price over the past year, an investor might observe an upward trend, indicating positive investor sentiment and potentially increasing profitability.

2. Applying Technical Indicators: Applying a 50-day moving average to the chart could help identify potential buy signals. If the stock price crosses above the 50-day moving average, it could signal a bullish trend.

3. Using Drawing Tools: Drawing trendlines to identify support and resistance levels can help an investor determine potential entry and exit points for their trades. For instance, if the stock price repeatedly bounces off a support level, it could be a good entry point.

Features and Tools

QLD Yahoo Finance offers a suite of features and tools designed to empower investors in Queensland. These resources provide a comprehensive approach to managing investments, from real-time data tracking to in-depth financial analysis. The platform’s user-friendly interface makes these powerful tools accessible to both novice and experienced investors.

Key Features: Alerts and Watchlists

Alerts and watchlists are crucial for staying informed about market movements and managing a portfolio effectively. They allow investors to monitor specific investments and receive timely notifications based on predefined criteria.

- Alerts: Users can set up alerts for various events, including:

- Price changes: Receive notifications when a stock price reaches a specified target or threshold.

- Volume spikes: Get alerted when trading volume increases significantly, potentially indicating increased interest or volatility.

- News and events: Be informed about company-specific news releases, earnings announcements, and other relevant events that may impact stock performance.

- Watchlists: Create custom watchlists to track the performance of specific stocks, sectors, or market indices.

- Customization: Organize watchlists based on investment goals, interests, or research.

- Real-time data: Monitor key metrics such as price, volume, and percentage change for each security in the watchlist.

- Portfolio tracking: Easily monitor the overall performance of a portfolio by including all holdings in a watchlist.

Assessing Performance of Queensland-Based Investments

QLD Yahoo Finance provides tools for in-depth analysis of Queensland-based investments, allowing investors to evaluate performance and make informed decisions. The platform provides various analytical tools and key financial metrics.

- Financial Statements: Access income statements, balance sheets, and cash flow statements for publicly listed Queensland companies. This information is crucial for understanding a company’s financial health and performance.

- Income Statement Analysis: Examine revenue, expenses, and net income to assess profitability.

- Balance Sheet Review: Evaluate assets, liabilities, and equity to assess financial stability.

- Cash Flow Analysis: Analyze cash inflows and outflows to assess a company’s ability to generate cash.

- Key Metrics and Ratios: Utilize financial ratios and key metrics to evaluate a company’s performance relative to its peers and industry benchmarks.

- Price-to-Earnings Ratio (P/E): Evaluate the valuation of a company’s stock.

- Earnings Per Share (EPS): Assess a company’s profitability on a per-share basis.

- Return on Equity (ROE): Evaluate how effectively a company uses shareholder investments to generate profits.

- Historical Data and Charts: Utilize historical data and interactive charts to visualize price trends, identify patterns, and make informed investment decisions. This can help identify trends and potential investment opportunities.

Researching Dividend Payouts from Queensland Companies

QLD Yahoo Finance provides the data and tools necessary to research dividend payouts from Queensland companies. This information is critical for income-focused investors.

- Dividend Information: Locate the dividend yield, payout ratio, and ex-dividend date for Queensland-based companies.

- Dividend Yield: Calculate the annual dividend payment as a percentage of the stock price.

- Payout Ratio: Determine the percentage of earnings paid out as dividends.

- Ex-Dividend Date: Understand the date by which an investor must own the stock to receive the dividend.

- Dividend History: Review a company’s historical dividend payments to assess its dividend growth and stability.

- Screening Tools: Use the platform’s screening tools to filter companies based on dividend yield, payout ratio, and other criteria. This allows investors to narrow their focus to companies that meet their specific investment criteria.

QLD Yahoo Finance vs. Other Financial Platforms

QLD Yahoo Finance, while a valuable resource, operates within a competitive landscape of financial platforms. Understanding its strengths and weaknesses in comparison to alternatives is crucial for making informed investment decisions. This section provides a comparative analysis, highlighting key differences in data availability, features, and suitability for different investor profiles.

Comparing Data Availability and Features

Financial platforms vary significantly in the breadth and depth of data they offer, as well as the features designed to help users analyze that data. This table provides a direct comparison of QLD Yahoo Finance against other popular platforms.

| Platform | Data Availability | Key Features | Cost |

|---|---|---|---|

| QLD Yahoo Finance | Real-time and historical stock prices, financial statements, news, analyst ratings, economic data (limited). Coverage of Australian and international markets. | Portfolio tracking, basic charting tools, news aggregation, screening tools. | Free (with ads), premium subscription for enhanced features. |

| Bloomberg Terminal | Comprehensive real-time data for global markets, including detailed financial statements, economic indicators, and news from various sources. | Advanced charting, sophisticated analytics, portfolio optimization, news alerts, trading capabilities, research reports, and access to proprietary data. | Expensive subscription (typically thousands of dollars per month). |

| Refinitiv Eikon | Extensive real-time and historical data across all asset classes, including news, company fundamentals, and economic data. | Advanced analytics, news and research integration, portfolio management, trading tools. | Expensive subscription. |

| TradingView | Real-time and historical data, including stocks, forex, futures, and cryptocurrencies. Access to a wide range of charting tools. | Advanced charting tools, social networking for traders, screener, paper trading. | Free (with ads), paid subscriptions for advanced features and data. |

Advantages and Disadvantages of QLD Yahoo Finance

QLD Yahoo Finance offers a compelling set of features, but it’s not without its limitations. Weighing these pros and cons is essential for determining its suitability.

- Advantages:

- Accessibility: It is freely accessible, making it a cost-effective option for investors of all levels.

- User-Friendly Interface: The interface is generally easy to navigate, making it suitable for beginners.

- News and Information Aggregation: Provides a centralized location for financial news, market data, and analyst ratings.

- Portfolio Tracking: Allows users to monitor their investments.

- Australian Market Focus: Provides comprehensive coverage of Australian stocks and markets.

- Disadvantages:

- Limited Advanced Analytics: Lacks the sophisticated analytical tools found on more professional platforms.

- Data Depth: While sufficient for basic analysis, the depth of data is less comprehensive than paid platforms.

- Customization: Customization options are limited compared to platforms like Bloomberg Terminal or Refinitiv Eikon.

- Advertising: The free version includes advertisements, which can be distracting.

Platform Suitability for Different Investors

The ideal platform depends heavily on an investor’s experience level and investment goals. Different platforms cater to different needs.

- Beginner Investors: QLD Yahoo Finance is a good starting point. Its ease of use, free access, and basic tools make it ideal for those learning about investing. The portfolio tracking feature allows beginners to monitor their investments without a steep learning curve. The news aggregation feature also helps them stay informed about market developments.

- Experienced Investors: Experienced investors may find QLD Yahoo Finance too basic. Platforms like Bloomberg Terminal or Refinitiv Eikon offer more in-depth data, advanced analytics, and sophisticated trading tools. TradingView is a good alternative for experienced investors who require advanced charting and technical analysis.

Resources and Support

QLD Yahoo Finance provides a comprehensive suite of resources and support options designed to assist users in navigating the platform and making informed financial decisions. Understanding these resources is crucial for maximizing the value derived from the platform and ensuring a positive user experience. This section Artikels the available support channels, help documentation, and frequently asked questions to help users effectively utilize QLD Yahoo Finance.

Accessing Help Documentation, Qld yahoo finance

QLD Yahoo Finance offers detailed help documentation to guide users through the platform’s features and functionalities. This documentation is a valuable resource for understanding how to use various tools, interpret data, and troubleshoot common issues.

- The Help Center is typically accessible via a dedicated “Help” or “Support” link, often found in the platform’s navigation menu or footer.

- Users can search the Help Center using s related to their queries. The search function is designed to return relevant articles, tutorials, and FAQs.

- Help documentation often includes step-by-step guides, screenshots, and explanations of financial concepts.

- The documentation covers a wide range of topics, including account management, data interpretation, platform features, and troubleshooting.

- The documentation is usually organized into categories or sections, such as “Getting Started,” “Investing,” “Market Data,” and “Account Settings,” to facilitate easy navigation.

Contacting Customer Support

In addition to help documentation, QLD Yahoo Finance provides avenues for users to contact customer support for personalized assistance. This support system is designed to address complex issues and provide tailored solutions.

- Customer support is usually accessible via email, phone, or a contact form on the platform.

- Contact information for customer support is typically found in the “Contact Us” or “Support” section of the website.

- Users are encouraged to provide detailed information about their issues when contacting support, including screenshots or error messages.

- Support teams often have specific response times, and users should be aware of these expectations.

- The customer support team can assist with a wide range of issues, including technical problems, account inquiries, and data discrepancies.

Frequently Asked Questions (FAQs)

A comprehensive FAQ section addresses common user queries, providing quick answers to frequently encountered questions. This section is designed to offer immediate solutions to common issues and streamline the user experience.

- How do I reset my password? Instructions for resetting passwords are usually provided, involving steps such as clicking a “Forgot Password” link and following the prompts to receive a reset link via email.

- How can I contact customer support? Information regarding the available support channels, such as email, phone, or a contact form, is provided.

- Where can I find historical stock prices? Instructions on how to access historical stock price data through the platform’s charting tools or data download options are detailed.

- How do I create a watchlist? Steps to create and manage watchlists, allowing users to track specific stocks or assets of interest, are Artikeld.

- How do I interpret financial ratios? Explanations of key financial ratios and how they are calculated and used in investment analysis are provided.

- How do I download financial data? Instructions on how to download financial data in various formats, such as CSV or Excel, for offline analysis are offered.

- What are the fees associated with using QLD Yahoo Finance? Information regarding any fees associated with the platform’s premium features or data services is presented.

- How do I update my account information? Instructions on how to update personal information, such as contact details or account settings, are included.

- How do I report a data error? Guidelines for reporting data discrepancies or inaccuracies to the platform’s data providers are provided.

- What are the different types of charts available? Descriptions of the different chart types available on the platform, such as line charts, bar charts, and candlestick charts, and how to use them are provided.

Understanding Market Data for Queensland

Queensland’s economic landscape is unique, driven by resources, tourism, and agriculture. Understanding the specific market data available on QLD Yahoo Finance is crucial for investors seeking to make informed decisions. This section details the economic indicators, industry-specific data, and tools for tracking trends within Queensland’s financial markets.

Economic Indicators Relevant to Queensland Markets

QLD Yahoo Finance provides access to key economic indicators essential for assessing the health and direction of the Queensland economy. These indicators offer insights into various sectors, aiding investors in making informed decisions.

- Gross State Product (GSP): The GSP measures the total value of goods and services produced in Queensland. Tracking GSP growth provides a broad overview of economic expansion or contraction. For example, if the GSP shows consistent growth, it can signal a positive environment for investment.

- Employment Data: Employment figures, including unemployment rates and job creation data, are critical. High employment rates often correlate with increased consumer spending and business activity. The platform provides data on employment levels across different industries within Queensland.

- Inflation Rates: Inflation data, such as the Consumer Price Index (CPI), helps investors understand the purchasing power of money and the potential impact on business profitability. Rising inflation may prompt interest rate adjustments by the Reserve Bank of Australia (RBA), influencing investment strategies.

- Retail Sales: Retail sales figures indicate consumer spending patterns. Increased retail sales often reflect a strong economy and can positively affect companies in the retail and consumer discretionary sectors.

- Housing Market Data: Information on housing prices, construction activity, and mortgage rates is available. The housing market significantly impacts the Queensland economy, influencing related industries like construction and finance.

- Interest Rates: Tracking the official cash rate set by the RBA and other interest rates is vital. Interest rate changes affect borrowing costs for businesses and consumers, influencing investment decisions.

- Government Spending: Information on government expenditure and infrastructure projects provides insights into government economic stimulus and potential opportunities for investment in specific sectors.

Industry-Specific Data for Queensland Companies

Beyond broad economic indicators, QLD Yahoo Finance offers industry-specific data for Queensland-based companies, allowing for a more granular analysis of investment opportunities. This data assists in identifying companies poised for growth or facing challenges.

- Resources Sector Data: Queensland is a major producer of coal, natural gas, and other resources. The platform provides data on commodity prices, production volumes, and company performance within the resources sector.

- Tourism Sector Data: Data on tourism arrivals, hotel occupancy rates, and tourism revenue provides insights into the performance of Queensland’s tourism industry. This is particularly relevant for companies involved in hospitality, travel, and related services.

- Agricultural Sector Data: Information on crop yields, livestock prices, and agricultural exports is available. This data is crucial for understanding the performance of companies in the agricultural sector, a significant part of Queensland’s economy.

- Real Estate Sector Data: Detailed data on property values, rental yields, and construction activity is available. This information is critical for assessing investment opportunities in Queensland’s real estate market.

- Financial Sector Data: Information on the performance of financial institutions, including banks and insurance companies, is available. This helps investors understand the financial health of the state’s economy.

- Healthcare Sector Data: Data on healthcare spending, hospital activity, and pharmaceutical sales. This sector is a significant employer and contributor to the Queensland economy.

Tracking Economic Trends Affecting Queensland’s Financial Markets

QLD Yahoo Finance provides tools and features to track economic trends that affect Queensland’s financial markets. These tools help investors stay informed and make timely decisions.

- News and Analysis: The platform provides access to financial news and analysis from reputable sources, including reports on economic indicators, industry trends, and company performance.

- Historical Data and Charts: Users can access historical data and create charts to visualize trends in economic indicators, stock prices, and other relevant metrics. For instance, plotting the GSP growth over time can reveal long-term economic trends.

- Alerts and Notifications: Setting up alerts for specific economic indicators or company news allows investors to receive timely notifications about significant events or changes.

- Portfolio Tracking: The platform enables users to track their investment portfolios and monitor the performance of Queensland-based companies.

- Economic Calendar: The economic calendar highlights upcoming economic releases and events, such as interest rate decisions and inflation data releases, allowing investors to anticipate market movements.

- Company Profiles: Accessing detailed company profiles provides information on financial performance, business operations, and key executives for Queensland-based companies. This helps investors assess the strength and potential of companies.

Potential Risks and Considerations: Qld Yahoo Finance

Relying solely on any single financial platform, including QLD Yahoo Finance, for investment decisions carries inherent risks. It is crucial to understand these potential pitfalls and to adopt a diversified approach to information gathering and analysis to mitigate them. This section Artikels the key considerations and emphasizes the importance of a critical and informed perspective when using the platform.

Risks of Sole Reliance

Using only QLD Yahoo Finance can expose investors to several risks, potentially leading to suboptimal or even detrimental investment outcomes. These risks stem from the limitations inherent in any single data source.

- Data Accuracy and Timeliness: While platforms strive for accuracy, data errors or delays can occur. Real-time market data, in particular, is subject to fluctuations and potential inaccuracies, which could influence trading decisions. For example, a minor discrepancy in a stock price reported on QLD Yahoo Finance compared to a different platform, if acted upon immediately, could result in a less favorable trade.

- Limited Scope of Analysis: QLD Yahoo Finance may not offer the depth of analysis available on more sophisticated platforms or through professional financial advisors. Relying solely on the platform’s data might prevent a comprehensive understanding of investment opportunities and risks.

- Platform-Specific Biases: Every platform has its own algorithms and data processing methods. These internal processes can introduce biases, potentially influencing investment recommendations or the presentation of information. This bias can be subtle but can lead to systematic errors in investment choices.

- Lack of Personalized Advice: QLD Yahoo Finance provides generalized information. It does not offer personalized financial advice tailored to individual circumstances, risk tolerance, or financial goals. Decisions made solely based on the platform’s information might not align with an investor’s unique needs.

- Over-reliance on Automated Tools: The platform’s tools, such as stock screeners or automated analysis features, can be helpful, but over-reliance on them without critical evaluation can be dangerous. These tools might generate results that are not suitable or appropriate for all investors.

Importance of Verifying Data

Verifying data from multiple sources is a fundamental principle of sound investment practice. Cross-referencing information helps to identify potential errors, inconsistencies, and biases, leading to more informed decisions.

- Cross-Verification with Other Financial Platforms: Compare data from QLD Yahoo Finance with information from other reputable financial platforms, such as Bloomberg, Refinitiv, or other financial news sources. Look for consistency in stock prices, financial ratios, and news reports. Significant discrepancies should prompt further investigation.

- Consulting Primary Sources: Whenever possible, consult primary sources of information. For example, review company filings (such as annual reports and quarterly reports) on the relevant stock exchanges’ websites to confirm financial data.

- Seeking Professional Advice: Consider consulting with a qualified financial advisor or investment professional. They can provide personalized advice and help interpret data from multiple sources. A financial advisor can offer an independent perspective and help manage risk.

- Understanding the Data’s Context: Evaluate the context in which the data is presented. Consider the source of the data, the methodology used to collect and analyze it, and any potential biases. For example, a positive earnings report should be viewed in light of industry trends and the company’s competitive position.

- Using Multiple Analytical Tools: Utilize a variety of analytical tools to assess investments. This can include technical analysis (examining charts and patterns), fundamental analysis (evaluating a company’s financials), and economic analysis (considering macroeconomic factors).

Platform Disclaimers and Warnings

QLD Yahoo Finance, like all financial platforms, provides disclaimers and warnings regarding the use of its data. Understanding these disclaimers is essential for managing expectations and mitigating potential risks.

- Data Accuracy Disclaimer: Platforms typically state that they do not guarantee the accuracy, completeness, or timeliness of the data. This means that investors should not assume the information is error-free.

- Investment Advice Disclaimer: QLD Yahoo Finance likely includes a disclaimer stating that the platform does not provide investment advice. The information is for informational purposes only and should not be considered a recommendation to buy or sell any security.

- Risk Disclosure: The platform may include a general risk disclosure, reminding users that investments can lose value, and past performance is not indicative of future results. This emphasizes the inherent risks associated with investing.

- User Responsibility: Disclaimers often place the responsibility for investment decisions on the user. Users are encouraged to conduct their own research and seek professional advice before making any investment choices.

- Third-Party Content Disclaimer: If QLD Yahoo Finance incorporates content from third-party sources (e.g., news articles, analyst reports), the platform may disclaim responsibility for the accuracy or reliability of that content. Users should be aware of the source and potential biases of such information.

Future of QLD Yahoo Finance

The future of QLD Yahoo Finance, like any financial platform, is intrinsically linked to technological advancements, evolving market dynamics, and the needs of its users. Predicting the exact trajectory is impossible, but we can speculate on potential developments and improvements based on current trends and industry best practices. Adaptation and innovation are key to remaining relevant and competitive in the ever-changing financial landscape.

Adapting to Financial Market Changes

The financial market is characterized by constant flux. QLD Yahoo Finance must be agile to address these changes.

- Integration of AI and Machine Learning: Artificial intelligence (AI) and machine learning (ML) are rapidly transforming financial analysis. The platform could integrate these technologies to provide more sophisticated features. For example:

- Predictive Analytics: Utilizing ML algorithms to forecast stock prices, market trends, and potential investment risks. This could involve analyzing vast datasets of historical prices, news sentiment, and economic indicators.

- Personalized Recommendations: AI-powered tools could analyze a user’s investment history, risk tolerance, and financial goals to provide customized investment recommendations and portfolio optimization strategies.

- Enhanced Data Visualization and Reporting: As the volume of available financial data grows, the platform will need to offer more intuitive and informative ways to visualize and interpret this information.

- Interactive Charts and Dashboards: Offering customizable dashboards that allow users to track key metrics, compare investments, and monitor portfolio performance in real-time.

- Automated Reporting: Generating automated reports that summarize investment performance, highlight potential risks, and provide insights into market trends.

- Mobile Optimization and Accessibility: With the increasing reliance on mobile devices, QLD Yahoo Finance will need to ensure a seamless and user-friendly experience across all platforms.

- Dedicated Mobile App: Developing a fully-featured mobile app that provides access to all platform features, including real-time market data, portfolio tracking, and trading capabilities.

- Improved Accessibility Features: Ensuring the platform is accessible to users with disabilities by adhering to accessibility standards and providing features such as screen reader compatibility and customizable font sizes.

Potential New Features and Functionalities

To stay ahead of the competition and cater to evolving user needs, QLD Yahoo Finance could introduce a range of new features and functionalities.

- Expanded Investment Options:

The platform could broaden its scope to include a wider range of investment options.- Cryptocurrency Integration: Providing real-time data, analysis, and potentially even trading capabilities for cryptocurrencies, such as Bitcoin and Ethereum.

- Alternative Investments: Offering information and analysis on alternative investments like private equity, real estate, and commodities.

- Advanced Trading Tools:

The platform could offer more sophisticated trading tools for experienced investors.- Advanced Order Types: Supporting complex order types like stop-loss orders, trailing stop orders, and bracket orders.

- Algorithmic Trading: Providing tools or APIs that allow users to automate their trading strategies.

- Enhanced Educational Resources:

To empower users with the knowledge and skills they need to make informed investment decisions, QLD Yahoo Finance could enhance its educational offerings.- Interactive Tutorials and Courses: Creating interactive tutorials and courses on various investment topics, from basic concepts to advanced strategies.

- Expert Analysis and Commentary: Providing access to expert analysis, market commentary, and investment insights from financial professionals.

- Social and Community Features:

Incorporating social and community features could enhance user engagement and provide a platform for investors to connect and share ideas.- Discussion Forums: Creating discussion forums where users can discuss market trends, share investment ideas, and ask questions.

- Portfolio Sharing: Allowing users to share their portfolio performance (with appropriate privacy settings) to get feedback and compare strategies.

Queensland’s financial landscape, as often reflected on QLD Yahoo Finance, is dynamic. Construction businesses are always seeking ways to expand, and a key element of growth is securing capital. Many firms are now exploring options to offer financing to customers for construction , allowing them to manage cash flow better. This strategy is something that QLD Yahoo Finance frequently covers, especially when assessing the success of local businesses and market trends.

While QLD Yahoo Finance offers insights into Queensland’s economic landscape, understanding modern financial models is crucial. Many businesses are now leveraging saas finance solutions for streamlined operations. This shift impacts how we interpret data on platforms like QLD Yahoo Finance, necessitating a broader perspective on financial management and investment strategies within the region.