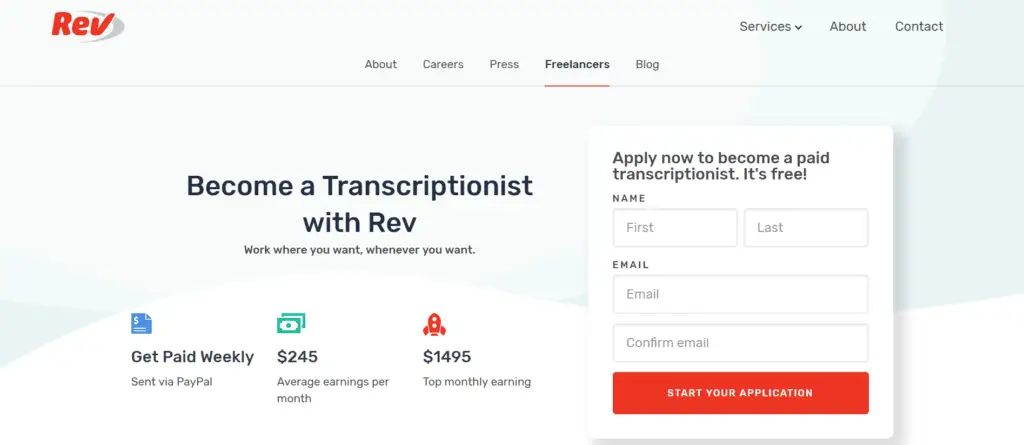

Introduction to Rev Finance

Rev Finance is a decentralized finance (DeFi) platform designed to provide lending and borrowing services, primarily focused on cryptocurrency assets. Its core function is to facilitate peer-to-peer lending and borrowing, allowing users to leverage their crypto holdings for various financial activities. The platform caters to a diverse audience, including crypto investors, traders, and those seeking to access liquidity without selling their digital assets.

Rev Finance operates within the DeFi ecosystem by utilizing smart contracts to automate and secure lending and borrowing processes. Users can deposit their crypto assets as collateral and borrow other cryptocurrencies, or lend their assets to earn interest. This system eliminates intermediaries, offering greater transparency and control to users. The platform’s architecture is built on a blockchain, ensuring that all transactions are recorded and verifiable.

Unique Selling Proposition of Rev Finance

Rev Finance distinguishes itself from other DeFi lending platforms through several key features and functionalities. These aspects collectively contribute to a superior user experience and greater value proposition.

- Enhanced Liquidity Pools: Rev Finance employs advanced algorithms to optimize liquidity pools, ensuring higher asset availability and reduced slippage during trades. This results in more efficient borrowing and lending experiences for users. For example, by dynamically adjusting the pool weights, the platform can maintain a healthy balance between different assets, minimizing price impact.

- Innovative Risk Management: The platform incorporates sophisticated risk management tools, including dynamic interest rate adjustments and liquidation mechanisms. These features help to mitigate potential losses for lenders and borrowers alike. A crucial component of this is the implementation of a collateral ratio that triggers liquidation if a borrower’s collateral value falls below a predefined threshold.

- Cross-Chain Compatibility: Rev Finance aims for cross-chain interoperability, allowing users to lend and borrow assets across multiple blockchain networks. This expands the available asset pool and increases the platform’s accessibility. For instance, this could allow a user to deposit ETH on Ethereum and borrow tokens on Binance Smart Chain, increasing the utility of their assets.

- Governance and Community Involvement: Rev Finance emphasizes community governance, allowing token holders to participate in platform decisions and propose changes. This fosters a decentralized and user-centric environment. Token holders may vote on proposals related to interest rate adjustments, listing new assets, and platform upgrades.

The integration of these features provides a more secure, efficient, and user-friendly DeFi lending experience, setting Rev Finance apart from many competitors.

Key Features of Rev Finance

Rev Finance is designed to provide a comprehensive suite of financial tools and services. Its core features aim to simplify financial management, offering users greater control and insights into their financial activities. These features are built to enhance the user experience, making complex financial tasks more accessible and efficient.

Core Functionality

Rev Finance’s primary function revolves around providing users with a centralized platform to manage their finances. This includes a range of tools designed to track spending, monitor investments, and plan for future financial goals.

- Transaction Tracking: Automatically categorizes transactions, allowing users to easily monitor where their money is being spent. This feature provides detailed insights into spending habits.

- Budgeting Tools: Enables users to create and manage budgets, setting spending limits for different categories. Users can visualize their spending against their budget.

- Investment Tracking: Allows users to monitor the performance of their investments, providing real-time updates and portfolio analysis. This facilitates informed investment decisions.

- Reporting and Analytics: Generates detailed reports on spending, income, and investment performance. These reports offer a clear understanding of financial health.

User Interface and Accessibility, Rev finance

The user interface of Rev Finance is designed with ease of use in mind. Accessibility is a key consideration, ensuring that users of all technical backgrounds can navigate and utilize the platform effectively.

- Intuitive Design: The platform features a clean and straightforward design, making it easy for users to navigate and find the information they need. This minimizes the learning curve for new users.

- Mobile Accessibility: Rev Finance offers mobile apps for both iOS and Android devices, allowing users to manage their finances on the go. This ensures constant access to financial data.

- Customization Options: Users can personalize their dashboards and reports to display the information most relevant to them. This enhances the user experience by providing a tailored view of their finances.

Security and Data Protection

Security is a paramount concern for Rev Finance, and the platform incorporates robust measures to protect user data and financial information. This includes encryption, secure servers, and multi-factor authentication.

- Data Encryption: All user data is encrypted both in transit and at rest, ensuring that sensitive information is protected from unauthorized access. This is a fundamental aspect of data security.

- Secure Servers: Rev Finance utilizes secure servers and infrastructure to store and process user data, minimizing the risk of data breaches. This is a critical element of the platform’s security architecture.

- Multi-Factor Authentication: Users can enable multi-factor authentication to add an extra layer of security to their accounts, preventing unauthorized access even if their password is compromised. This significantly enhances account security.

Comparison of Features and Benefits

The following table summarizes the key features of Rev Finance and their corresponding benefits, providing a concise overview of how each feature enhances financial management.

| Feature | Functionality | Benefit | Impact on User Experience |

|---|---|---|---|

| Transaction Tracking | Automatic categorization of transactions. | Provides insights into spending habits and identifies areas for potential savings. | Simplifies the process of monitoring finances, saving time and effort. |

| Budgeting Tools | Creation and management of budgets with spending limits. | Helps users control their spending and achieve their financial goals. | Empowers users to proactively manage their finances and make informed spending decisions. |

| Investment Tracking | Real-time monitoring of investment performance. | Enables users to track the growth and performance of their investments. | Provides users with a clear overview of their investment portfolio, allowing for quick and informed decisions. |

| Reporting and Analytics | Generation of detailed reports on spending, income, and investments. | Offers a comprehensive view of financial health and performance. | Provides users with actionable insights to improve their financial strategies. |

Benefits of Using Rev Finance

Rev Finance offers a compelling suite of advantages for both personal and business financial management. From enhanced security to streamlined operations and potential cost savings, the platform is designed to empower users with greater control and efficiency over their finances. Understanding these benefits is crucial for anyone considering adopting Rev Finance as their primary financial tool.

Enhanced Security Measures

Rev Finance prioritizes the security of user data and funds through a multi-layered approach. This commitment to security is fundamental to building trust and ensuring the safety of financial assets.

- Encryption: Rev Finance employs robust encryption protocols to protect all sensitive data, both in transit and at rest. This ensures that information remains confidential and inaccessible to unauthorized parties.

- Multi-Factor Authentication (MFA): MFA adds an extra layer of security by requiring users to verify their identity through multiple methods, such as a password, a code sent to their mobile device, and biometric authentication. This significantly reduces the risk of unauthorized account access.

- Regular Security Audits: The platform undergoes frequent security audits by independent third-party firms. These audits assess the platform’s vulnerabilities and ensure compliance with industry best practices. Any identified weaknesses are promptly addressed.

- Fraud Detection Systems: Rev Finance utilizes sophisticated fraud detection systems to identify and prevent suspicious activities. These systems monitor transactions for anomalies and flag potential fraudulent behavior, protecting users from financial loss.

- Compliance with Regulations: Rev Finance adheres to all relevant financial regulations, including data privacy laws. This commitment to compliance provides users with the assurance that their information is handled responsibly and in accordance with legal requirements.

Potential Cost Savings and Efficiency Gains

Utilizing Rev Finance can lead to significant cost savings and increased operational efficiency for businesses and individuals alike. These improvements are realized through automation, streamlined processes, and reduced overhead.

- Automated Financial Processes: Rev Finance automates many routine financial tasks, such as invoice generation, payment processing, and expense tracking. This automation reduces the need for manual data entry and minimizes the risk of human error, saving time and resources.

- Reduced Administrative Costs: By streamlining financial operations, Rev Finance can significantly reduce administrative costs. For example, automating invoice management can eliminate the need for paper-based processes, postage, and manual filing, leading to substantial savings.

- Improved Cash Flow Management: The platform provides real-time insights into cash flow, allowing users to make informed decisions about their finances. This enhanced visibility helps businesses optimize their cash flow, ensuring they have sufficient funds to meet their obligations and take advantage of opportunities.

- Lower Transaction Fees: Depending on the specific services used, Rev Finance may offer lower transaction fees compared to traditional financial institutions. This can result in significant savings, particularly for businesses that process a high volume of transactions.

- Data-Driven Decision Making: Rev Finance provides robust reporting and analytics tools, empowering users to make data-driven decisions. By analyzing financial data, businesses can identify areas for improvement, optimize their spending, and make more informed investment decisions.

Rev Finance: Products and Services

Rev Finance offers a suite of financial products and services designed to cater to diverse financial needs. These offerings aim to provide accessible and efficient solutions for users seeking to manage, grow, and protect their finances. The platform’s services are structured to provide a user-friendly experience, from initial application to ongoing management.

Rev Finance’s Product and Service Offerings

Rev Finance’s product and service portfolio is designed to provide a comprehensive financial solution. This includes a range of services, each with specific features, pricing structures, and eligibility requirements.

- Rev Finance Digital Wallet: This is a core offering, providing users with a secure digital wallet for storing and managing funds. The wallet supports various currencies and allows for easy peer-to-peer (P2P) transfers, online payments, and bill payments.

- Rev Finance Credit Card: The credit card product provides users with access to credit lines, enabling them to make purchases and manage their finances. It offers rewards programs and features like fraud protection.

- Rev Finance Savings Accounts: Rev Finance offers savings accounts with competitive interest rates, designed to help users grow their savings over time. These accounts often have different tiers with varying interest rates based on the amount saved.

- Rev Finance Loans: This service provides access to personal loans for various purposes, such as debt consolidation, home improvements, or unexpected expenses. Loan terms, interest rates, and eligibility requirements vary depending on the specific loan product.

- Rev Finance Investment Platform: The platform offers access to investment options, including stocks, bonds, and potentially, cryptocurrency, providing users with opportunities to diversify their portfolios. The platform often includes tools for portfolio management and investment analysis.

- Rev Finance Insurance Products: Rev Finance partners with insurance providers to offer various insurance products, such as life insurance, health insurance, and property insurance, providing users with protection against unforeseen events.

Pricing Structure and Eligibility Requirements

Understanding the costs and requirements associated with each service is crucial for users. Here’s a breakdown:

- Rev Finance Digital Wallet:

- Pricing: Generally free to open and maintain. Transaction fees may apply for certain services, such as international transfers or currency conversions.

- Eligibility: Requires account verification, which typically involves providing personal information and possibly a government-issued ID.

- Rev Finance Credit Card:

- Pricing: Annual fees may apply, depending on the card type. Interest rates vary based on creditworthiness. Fees may also be charged for late payments or cash advances.

- Eligibility: Credit score, income verification, and other financial information are typically required. Approval is subject to credit checks.

- Rev Finance Savings Accounts:

- Pricing: Generally, there are no monthly fees. However, some accounts may require a minimum balance to avoid fees.

- Eligibility: Requires basic account verification and proof of identity.

- Rev Finance Loans:

- Pricing: Interest rates vary based on the loan amount, term, and creditworthiness. Origination fees and other charges may also apply.

- Eligibility: Credit score, income verification, employment history, and debt-to-income ratio are all considered.

- Rev Finance Investment Platform:

- Pricing: Commission fees may apply for each trade. Other fees may include account maintenance fees or fees for research tools.

- Eligibility: Requires account verification and completion of a risk assessment questionnaire to determine investment suitability.

- Rev Finance Insurance Products:

- Pricing: Premiums vary depending on the type of insurance, coverage amount, and the policyholder’s risk profile.

- Eligibility: Eligibility requirements vary depending on the insurance product. For example, life insurance may require a medical examination.

Steps to Access and Utilize Each Product or Service

Accessing and utilizing Rev Finance products and services typically involves a few key steps.

- Digital Wallet:

- Account Creation: Create an account on the Rev Finance platform, providing the necessary personal information.

- Verification: Verify the account through email or SMS verification.

- Funding: Add funds to the wallet using various methods, such as bank transfers or debit/credit cards.

- Usage: Utilize the wallet for transactions, payments, and transfers.

- Credit Card:

- Application: Apply for a credit card through the Rev Finance platform.

- Approval: Undergo a credit check and wait for approval.

- Activation: Once approved, activate the credit card.

- Usage: Use the credit card for purchases, track spending, and make payments.

- Savings Accounts:

- Account Opening: Open a savings account through the Rev Finance platform.

- Funding: Transfer funds into the savings account.

- Monitoring: Monitor the account balance and accrued interest.

- Loans:

- Application: Apply for a loan through the Rev Finance platform.

- Approval: Undergo a credit check and wait for loan approval.

- Disbursement: Receive the loan funds.

- Repayment: Make loan repayments according to the agreed-upon schedule.

- Investment Platform:

- Account Opening: Open an investment account on the Rev Finance platform.

- Funding: Deposit funds into the investment account.

- Investment Selection: Choose investments based on your risk tolerance and financial goals.

- Portfolio Management: Monitor and manage the investment portfolio.

- Insurance Products:

- Selection: Choose an insurance product based on your needs.

- Application: Apply for the insurance policy through the Rev Finance platform or its partner.

- Underwriting: Undergo the underwriting process.

- Policy Activation: Activate the insurance policy and make premium payments.

Technology and Infrastructure of Rev Finance

Rev Finance’s success hinges on a robust and secure technological foundation. This infrastructure is designed to provide users with a seamless, reliable, and trustworthy experience. It incorporates cutting-edge technology to ensure the security, scalability, and efficiency of all operations.

Underlying Technology

Rev Finance leverages a combination of technologies to build its platform. These technologies are chosen for their security, performance, and ability to integrate with existing financial systems.

- Blockchain Technology: Rev Finance utilizes blockchain technology for its core functionalities. This provides transparency, immutability, and enhanced security for all transactions. Blockchain’s decentralized nature eliminates single points of failure, increasing the resilience of the platform.

- Distributed Ledger Technology (DLT): DLT is a key component of Rev Finance’s infrastructure. It ensures that data is replicated across multiple nodes, improving data integrity and availability. This technology is crucial for maintaining a consistent and accurate record of all financial activities.

- Cloud Infrastructure: Rev Finance relies on cloud infrastructure for scalability and availability. This allows the platform to handle a growing number of users and transactions without compromising performance. Cloud services also provide robust disaster recovery capabilities.

- APIs and Integrations: Rev Finance uses Application Programming Interfaces (APIs) to connect with other financial institutions and services. This allows for seamless integration with existing payment networks and banking systems. These APIs are built with security in mind, ensuring data privacy and integrity.

Security Protocols and Encryption Methods

Security is a paramount concern for Rev Finance. The platform employs a multi-layered security approach to protect user data and financial assets. This approach encompasses several key security protocols and encryption methods.

- Encryption: Rev Finance uses advanced encryption algorithms to protect sensitive data both in transit and at rest. This includes encrypting user credentials, transaction details, and other confidential information. This ensures that even if data is intercepted, it remains unreadable to unauthorized parties.

- Multi-Factor Authentication (MFA): MFA is implemented to verify user identities. This requires users to provide multiple forms of verification, such as passwords, biometric data, and one-time codes. MFA significantly reduces the risk of unauthorized access to accounts.

- Regular Security Audits: Rev Finance conducts regular security audits and penetration testing to identify and address potential vulnerabilities. These audits are performed by independent security experts to ensure the platform’s defenses are up-to-date.

- Compliance with Regulatory Standards: Rev Finance adheres to relevant regulatory standards, such as those related to data privacy and financial security. This includes compliance with regulations like GDPR and PCI DSS, ensuring that user data is handled securely and responsibly.

- Fraud Detection Systems: Rev Finance uses sophisticated fraud detection systems to monitor transactions for suspicious activity. These systems analyze patterns and anomalies to identify and prevent fraudulent transactions.

Scalability and Reliability

The scalability and reliability of the Rev Finance platform are crucial for its long-term success. The platform is designed to handle a growing number of users and transactions while maintaining high performance and availability.

- Horizontal Scaling: The platform is designed to scale horizontally, meaning that additional servers can be added to handle increased load. This allows Rev Finance to accommodate rapid growth in user base and transaction volume.

- Load Balancing: Load balancing distributes traffic across multiple servers, ensuring that no single server is overloaded. This improves performance and prevents service disruptions.

- Redundancy and Failover: Rev Finance employs redundancy and failover mechanisms to ensure high availability. If one server fails, another server automatically takes over, minimizing downtime.

- Data Replication: Data is replicated across multiple servers and geographic locations to ensure data availability and prevent data loss. This also improves the platform’s ability to withstand disruptions.

- Performance Monitoring: Rev Finance continuously monitors the platform’s performance to identify and address any bottlenecks or issues. This proactive approach ensures that the platform remains optimized for peak performance.

Rev Finance

Rev Finance aims to provide a seamless and intuitive experience for users navigating the complexities of decentralized finance. The platform’s design prioritizes clarity, ease of use, and accessibility, ensuring that both experienced DeFi users and newcomers can interact with its features effectively. This section will delve into the user interface, overall user experience, and the accessibility features that contribute to Rev Finance’s user-centric approach.

Rev Finance: User Experience and Interface

The user interface of Rev Finance is crafted with a clean and modern design philosophy. This approach minimizes visual clutter and allows users to focus on the core functionalities of the platform. The design incorporates intuitive navigation and clear labeling to guide users through the various features, from swapping tokens to managing liquidity pools and accessing yield farming opportunities. The consistent design language ensures a cohesive experience across all sections of the platform, reducing the learning curve and promoting user engagement.

The platform is designed for ease of use and navigation. The core functionalities are readily accessible from a central dashboard, providing users with a clear overview of their portfolio and available options. Rev Finance uses a logical layout and responsive design, adapting to different screen sizes and devices, including desktops, tablets, and smartphones. This ensures that users can access and manage their assets conveniently, regardless of their preferred device. Key features include:

- Intuitive Dashboard: The dashboard provides a snapshot of the user’s portfolio, including asset balances, recent transactions, and access to key functionalities. It is designed to be the central hub for managing all DeFi activities.

- Simplified Swapping: The token swapping interface is streamlined, with clear input fields for selecting tokens and specifying the desired amounts. The platform integrates with multiple decentralized exchanges (DEXs) to offer users the best available rates and minimize slippage.

- Liquidity Pool Management: Users can easily add and remove liquidity from various pools. The interface displays important information such as the pool’s current APY, total value locked (TVL), and impermanent loss risks, empowering users to make informed decisions.

- Yield Farming Opportunities: The platform presents available yield farming opportunities in a clear and concise manner, highlighting the potential rewards and associated risks. Users can easily stake their tokens and track their earnings.

- Transaction History: A comprehensive transaction history provides a detailed record of all activities on the platform, allowing users to track their performance and monitor their transactions.

Accessibility features are integrated into Rev Finance to accommodate users with diverse needs. The platform is committed to ensuring that all users, regardless of their abilities, can fully utilize its functionalities. These features include:

- Color Contrast: The platform employs high color contrast throughout the interface to improve readability for users with visual impairments.

- Font Size and Customization: Users can adjust the font size to suit their preferences and improve readability.

- Keyboard Navigation: The platform supports full keyboard navigation, allowing users to interact with the interface without using a mouse.

- Screen Reader Compatibility: The platform is designed to be compatible with screen readers, enabling users with visual impairments to access and understand the information presented on the screen.

- Alternative Text for Images: All images include alternative text descriptions, providing context for users who cannot see the images.

The user experience of Rev Finance is further enhanced by the inclusion of educational resources and community support. The platform provides tutorials, guides, and FAQs to help users understand the intricacies of DeFi and navigate the platform effectively. Additionally, Rev Finance fosters a strong community through various channels, such as forums and social media, where users can ask questions, share their experiences, and receive support from other users and the platform’s team.

Rev finance, with its innovative approach to financial solutions, requires a strong understanding of market dynamics. Aspiring finance professionals often seek advanced education, and a program like the tulane master of finance provides a solid foundation for success in this field. Ultimately, the principles learned can be directly applied to improve strategies in rev finance.

Rev Finance

Rev Finance prioritizes the security and privacy of its users. Implementing robust security measures and adhering to transparent privacy policies is fundamental to building trust and ensuring the safety of user assets and data. This section delves into the specific strategies Rev Finance employs to protect user information and the steps users can take to further enhance their security.

Rev Finance: Security and Privacy

Rev Finance employs a multi-faceted approach to security and privacy, safeguarding user accounts and data from potential threats. This includes a combination of technical safeguards, operational procedures, and user-focused features.

Security Measures for User Accounts and Data Protection

Rev Finance utilizes a range of security measures to protect user accounts and data. These measures are constantly reviewed and updated to address emerging threats and vulnerabilities.

- Encryption: All sensitive data, including user credentials, transaction details, and personal information, is encrypted using industry-standard encryption protocols. This ensures that even if unauthorized access occurs, the data remains unreadable and unusable.

- Two-Factor Authentication (2FA): 2FA is mandatory for all user accounts. This adds an extra layer of security by requiring users to verify their identity using a second factor, such as a code generated by an authenticator app or sent via SMS, in addition to their password. This significantly reduces the risk of unauthorized account access, even if a password is compromised.

- Regular Security Audits: Rev Finance undergoes regular security audits conducted by independent third-party security firms. These audits assess the platform’s security posture, identify potential vulnerabilities, and ensure compliance with industry best practices. Audit reports are often made available to the public or upon request, demonstrating transparency and commitment to security.

- Access Control: Strict access control mechanisms are in place to limit access to sensitive data and systems to authorized personnel only. This includes role-based access control, which restricts access based on job function and responsibilities.

- Fraud Detection Systems: Advanced fraud detection systems are implemented to monitor transactions and identify suspicious activity. These systems use machine learning algorithms and behavioral analysis to detect and prevent fraudulent transactions in real-time.

- Data Backup and Recovery: Regular data backups are performed, and a comprehensive disaster recovery plan is in place to ensure data availability and business continuity in the event of a system failure or security incident.

Privacy Policies and Data Handling

Rev Finance is committed to user privacy and adheres to a comprehensive privacy policy that Artikels how user data is collected, used, and protected. This policy is transparent and accessible to all users.

- Data Collection: Rev Finance collects only the necessary data required to provide its services, such as user registration information, transaction history, and device information. The types of data collected are clearly Artikeld in the privacy policy.

- Data Usage: User data is used to provide and improve services, personalize user experience, and communicate with users. Data is not sold or shared with third parties for marketing purposes without explicit user consent.

- Data Retention: Data retention policies are in place to determine how long user data is stored. Data is retained only for as long as necessary to provide services, comply with legal obligations, and resolve disputes.

- User Rights: Users have the right to access, modify, and delete their personal data. They can also opt out of certain data processing activities, such as marketing communications. The privacy policy details how users can exercise these rights.

- Compliance: Rev Finance complies with relevant data protection regulations, such as GDPR (General Data Protection Regulation) and CCPA (California Consumer Privacy Act), where applicable.

Steps for Users to Enhance Account Security

Users play a crucial role in protecting their own accounts and data. Rev Finance provides guidance and tools to help users enhance their security posture.

- Strong Passwords: Users should create strong, unique passwords that are at least 12 characters long and include a combination of uppercase and lowercase letters, numbers, and symbols. Avoid using easily guessable information like birthdays or names.

- Enable Two-Factor Authentication (2FA): Always enable 2FA on your account. This adds an extra layer of security and significantly reduces the risk of unauthorized access.

- Be Wary of Phishing Attempts: Be cautious of suspicious emails, links, and attachments. Verify the sender’s authenticity before clicking on any links or providing personal information. Rev Finance will never ask for your password or other sensitive information via email.

- Regularly Monitor Account Activity: Regularly review your transaction history and account activity for any suspicious or unauthorized transactions. Report any suspicious activity immediately.

- Keep Software Updated: Ensure that your devices and web browsers are updated with the latest security patches to protect against known vulnerabilities.

- Use a Secure Network: Avoid using public Wi-Fi networks for sensitive transactions. Use a secure, private network or a VPN (Virtual Private Network) to encrypt your internet traffic.

- Educate Yourself: Stay informed about the latest security threats and best practices. Rev Finance may provide security tips and resources to help users protect their accounts.

Rev Finance

Rev Finance strives to provide comprehensive support and resources to its users, ensuring a smooth and informed experience with its platform. Understanding that users may require assistance or information at any time, Rev Finance has established multiple channels for customer support and a variety of readily available resources. This commitment aims to empower users to effectively utilize the platform and resolve any issues they may encounter.

Rev Finance: Customer Support and Resources

Rev Finance offers a multi-faceted approach to customer support, providing users with several avenues to seek assistance. These channels are designed to cater to different user preferences and the complexity of their inquiries. Alongside direct support, a robust library of resources is available to help users independently find answers and learn more about the platform’s functionalities.

- Email Support: Users can contact Rev Finance’s customer support team via email. This channel is suitable for detailed inquiries, reporting issues, or providing feedback. The email address is typically prominently displayed on the Rev Finance website and within the platform itself. Response times are usually within a specified timeframe, depending on the volume of inquiries.

- Live Chat: Real-time support is often provided through a live chat feature integrated into the Rev Finance platform or website. This allows users to receive immediate assistance from a support representative. Live chat is ideal for quick questions and urgent issues.

- Help Center/Knowledge Base: Rev Finance maintains a comprehensive help center or knowledge base. This resource contains a wealth of information, including FAQs, troubleshooting guides, and tutorials. It’s designed to empower users to find answers to common questions independently.

- Social Media Channels: Rev Finance may also utilize social media platforms, such as Twitter, Facebook, or LinkedIn, to provide customer support. Users can reach out through direct messages or by posting questions publicly. Social media channels are often used for announcements, updates, and community engagement.

Rev Finance provides a variety of resources to support users and promote self-service.

Rev finance offers various financial solutions, but for patients seeking specific healthcare payment options, the focus shifts. An interesting alternative for patients to consider is cherry patient financing , known for its flexible payment plans tailored to medical procedures. Ultimately, understanding options like cherry can help patients navigate their healthcare expenses, complementing the broader financial landscape of rev finance.

- Frequently Asked Questions (FAQs): A dedicated FAQ section addresses common questions about the platform’s features, functionalities, and policies. These FAQs cover topics such as account management, transaction procedures, and security protocols.

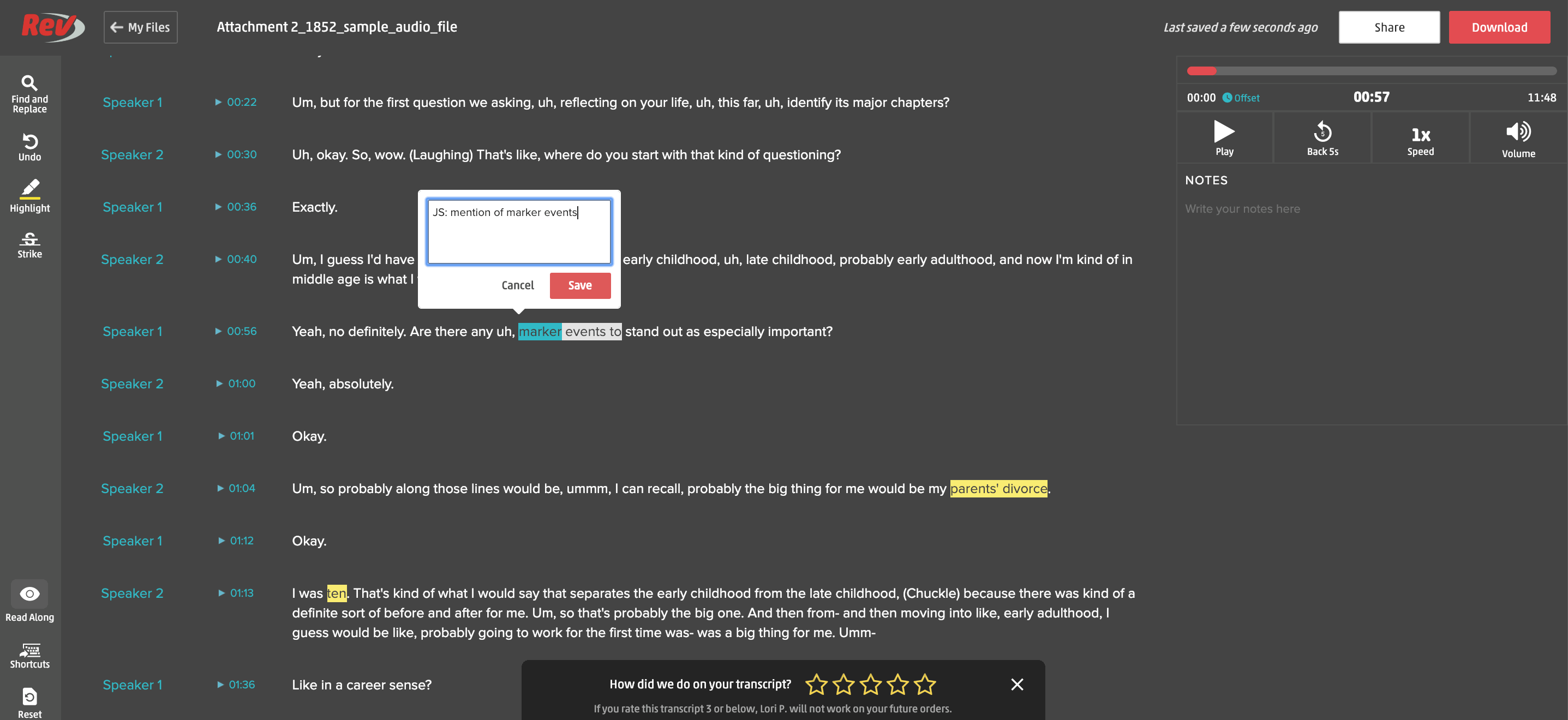

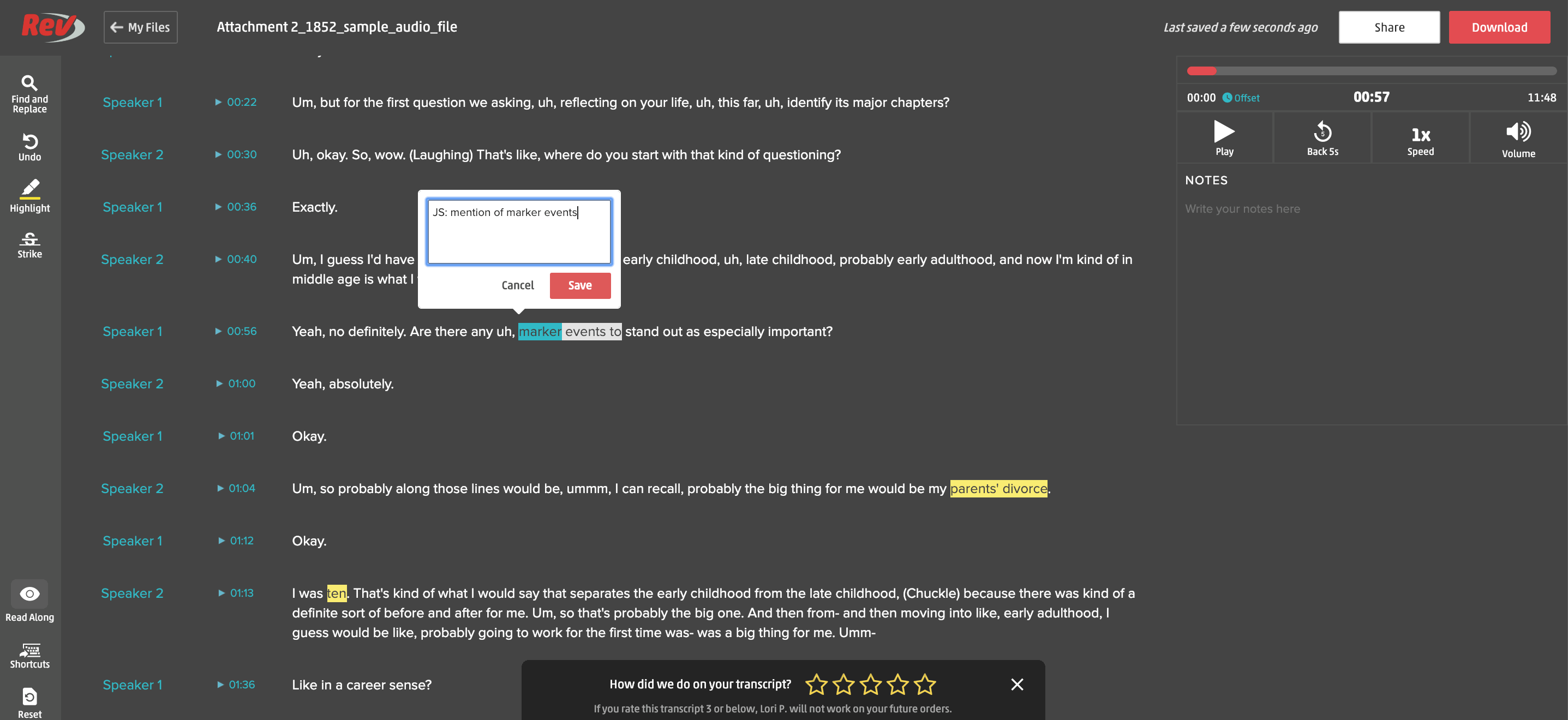

- Tutorials and Guides: Step-by-step tutorials and comprehensive guides are available to help users navigate the platform. These resources often include screenshots and visual aids to facilitate understanding. The tutorials cover various aspects of Rev Finance, from basic usage to advanced features.

- Blog and Articles: The Rev Finance blog and articles provide valuable insights into the platform’s updates, industry trends, and best practices. These articles are designed to keep users informed and engaged with the Rev Finance ecosystem.

- Community Forum: Some platforms may foster a community forum where users can interact with each other, ask questions, and share their experiences. This creates a collaborative environment for users to support each other and learn from their peers.

To contact customer support, users can utilize the following methods:

- Locating Contact Information: The contact information for customer support, including the email address and links to live chat or help center, is usually found on the Rev Finance website and within the platform.

- Using the Live Chat Feature: When available, the live chat feature allows users to connect directly with a support representative for immediate assistance.

- Submitting a Support Ticket: Users can submit a support ticket through the platform or via email. This method is suitable for detailed inquiries or reporting issues.

Rev Finance

Rev Finance’s success hinges not only on its internal functionalities but also on its ability to connect and collaborate with other platforms and services. These integrations enhance user experience, streamline workflows, and broaden the scope of financial management capabilities. The following sections will delve into the specific integrations Rev Finance offers, outlining their advantages and illustrating their impact on financial processes.

Rev Finance: Integration with Other Platforms

Rev Finance aims to provide a seamless financial experience by integrating with various platforms. These integrations are designed to reduce friction, automate tasks, and provide users with a comprehensive view of their finances.

Rev Finance integrates with a variety of financial platforms and services to enhance user experience and streamline financial processes. These integrations allow for data synchronization, automated workflows, and a more comprehensive view of a user’s financial landscape. Some notable integrations include:

- Banking Institutions: Rev Finance often integrates with major banking institutions. This integration allows users to connect their bank accounts directly to the platform.

- Accounting Software: Integration with accounting software, such as Xero or QuickBooks, is common. This allows for the automatic import of financial data, facilitating tasks like expense tracking and reconciliation.

- Payment Gateways: Rev Finance integrates with payment gateways like Stripe or PayPal. This allows users to process payments directly through the platform, simplifying transactions.

- Cryptocurrency Exchanges: Rev Finance may integrate with cryptocurrency exchanges. This allows users to track and manage their digital assets alongside their traditional financial holdings.

- Investment Platforms: Integrations with investment platforms are also available. This integration lets users view and manage their investment portfolios within the Rev Finance interface.

The benefits of these integrations are numerous and contribute significantly to a more efficient and user-friendly financial management experience. These advantages include:

- Automated Data Synchronization: Data is automatically imported from connected accounts, eliminating manual data entry and reducing the risk of errors.

- Consolidated Financial View: Users can view all their financial data, including bank accounts, investments, and transactions, in one centralized location.

- Enhanced Reporting and Analysis: Integrations enable more comprehensive financial reporting and analysis, providing users with valuable insights into their financial performance.

- Time Savings: Automation streamlines tasks like reconciliation and expense tracking, saving users valuable time.

- Improved Accuracy: Automatic data import reduces the potential for human error, leading to more accurate financial records.

The integrations facilitate the streamlining of financial processes. Here are some examples:

- Automated Reconciliation: Integrating with accounting software allows Rev Finance to automatically reconcile bank transactions with accounting records, simplifying the reconciliation process.

- Real-Time Transaction Tracking: Bank integrations provide real-time updates on transactions, enabling users to track their spending and income as it happens.

- Simplified Payment Processing: Integrating with payment gateways allows users to process payments directly within the Rev Finance platform, streamlining invoicing and payment collection.

- Portfolio Tracking: Integration with investment platforms allows users to monitor the performance of their investments alongside their other financial assets.

- Expense Categorization: When connected to a bank account, Rev Finance can categorize transactions automatically, simplifying expense tracking and reporting.

These integrations are critical for delivering a seamless and efficient financial management experience. By connecting with other platforms, Rev Finance offers users a comprehensive and integrated solution for managing their finances.

Rev Finance

Rev Finance’s journey is marked by continuous innovation and a commitment to providing accessible and efficient financial solutions. The company’s roadmap Artikels a clear vision for future growth, encompassing technological advancements, expanded product offerings, and a dedication to user experience. This section delves into Rev Finance’s future developments and strategic plans.

Rev Finance: Future Developments and Roadmap

Rev Finance has a detailed roadmap outlining its future endeavors, centered on enhancing its existing offerings and introducing new features to meet evolving user needs. This strategic plan is built on a foundation of technological innovation, user-centric design, and a commitment to regulatory compliance.

- Expanding Product Ecosystem: Rev Finance plans to broaden its product range to cater to a wider audience. This expansion will include the introduction of new financial instruments and services designed to address specific user requirements. The goal is to offer a comprehensive suite of financial tools within a single platform.

- Enhancing Decentralized Finance (DeFi) Integration: The company is actively exploring deeper integrations with the DeFi ecosystem. This includes facilitating seamless access to decentralized exchanges (DEXs), yield farming opportunities, and other DeFi protocols. This will provide users with greater control over their assets and access to innovative financial products.

- Advanced Security Measures: Rev Finance is committed to implementing state-of-the-art security protocols to protect user funds and data. This includes incorporating multi-factor authentication, advanced encryption techniques, and regular security audits. These measures are designed to mitigate potential risks and ensure a secure environment for all users.

- Improved User Experience: Rev Finance is dedicated to optimizing its platform’s user experience through intuitive interfaces and streamlined processes. This will involve simplifying complex financial tasks and providing users with easy-to-understand information.

- Global Expansion: The company is actively pursuing opportunities to expand its services into new geographic markets. This includes adapting its platform to meet local regulatory requirements and providing localized support. This expansion will allow Rev Finance to serve a broader global audience.

Rev Finance’s vision is to become a leading provider of accessible and innovative financial solutions. This vision is supported by its commitment to continuous improvement and user-centric design. The roadmap Artikels specific milestones, including:

- Technological Upgrades: Implementation of advanced technologies, such as artificial intelligence (AI) and machine learning (ML), to improve risk assessment, fraud detection, and customer support. For example, AI-powered chatbots could provide instant customer support, and ML algorithms could analyze user behavior to personalize financial recommendations.

- Regulatory Compliance: Maintaining and exceeding regulatory requirements across all jurisdictions. This will involve proactively adapting to evolving regulations and ensuring that all products and services meet the highest standards of compliance.

- Strategic Partnerships: Forming strategic alliances with other financial institutions and technology providers to expand its reach and enhance its service offerings. These partnerships could include collaborations with payment processors, insurance providers, and other fintech companies.

- Community Building: Fostering a strong and engaged community through active communication and feedback mechanisms. This includes providing educational resources, hosting user forums, and incorporating user feedback into product development.

The potential improvements and enhancements planned for Rev Finance are designed to make it a more robust, user-friendly, and globally accessible platform.

- Enhanced Mobile App: Development of a more feature-rich and user-friendly mobile application, offering improved accessibility and functionality. This will include features like biometric login, push notifications for transactions, and enhanced portfolio management tools.

- Cross-Chain Compatibility: Integration with multiple blockchain networks to allow users to manage a wider range of digital assets. This will improve interoperability and provide users with greater flexibility in managing their portfolios.

- Advanced Analytics Dashboard: A comprehensive analytics dashboard providing users with detailed insights into their financial performance, including transaction history, portfolio allocation, and performance metrics. This will empower users to make informed financial decisions.

- Personalized Financial Advice: Implementation of personalized financial advice and recommendations based on user data and financial goals. This could include recommendations for investment strategies, budgeting tools, and debt management plans.

- Expanded Educational Resources: Creation of comprehensive educational resources, including tutorials, guides, and webinars, to help users better understand financial concepts and the platform’s features. This will empower users to make informed decisions.