Defining Sailing Travel Insurance

Sailing travel insurance is a specialized form of travel insurance designed specifically for sailors. Unlike general travel insurance, which typically covers a broader range of activities, sailing insurance focuses on the unique risks associated with seafaring adventures. It’s crucial for protecting your investment in your boat, personal belongings, and yourself during your voyages. This specialized coverage extends beyond basic travel insurance to encompass liabilities, potential damage, and unforeseen events encountered during sailing trips.

Types of Sailing Travel Insurance

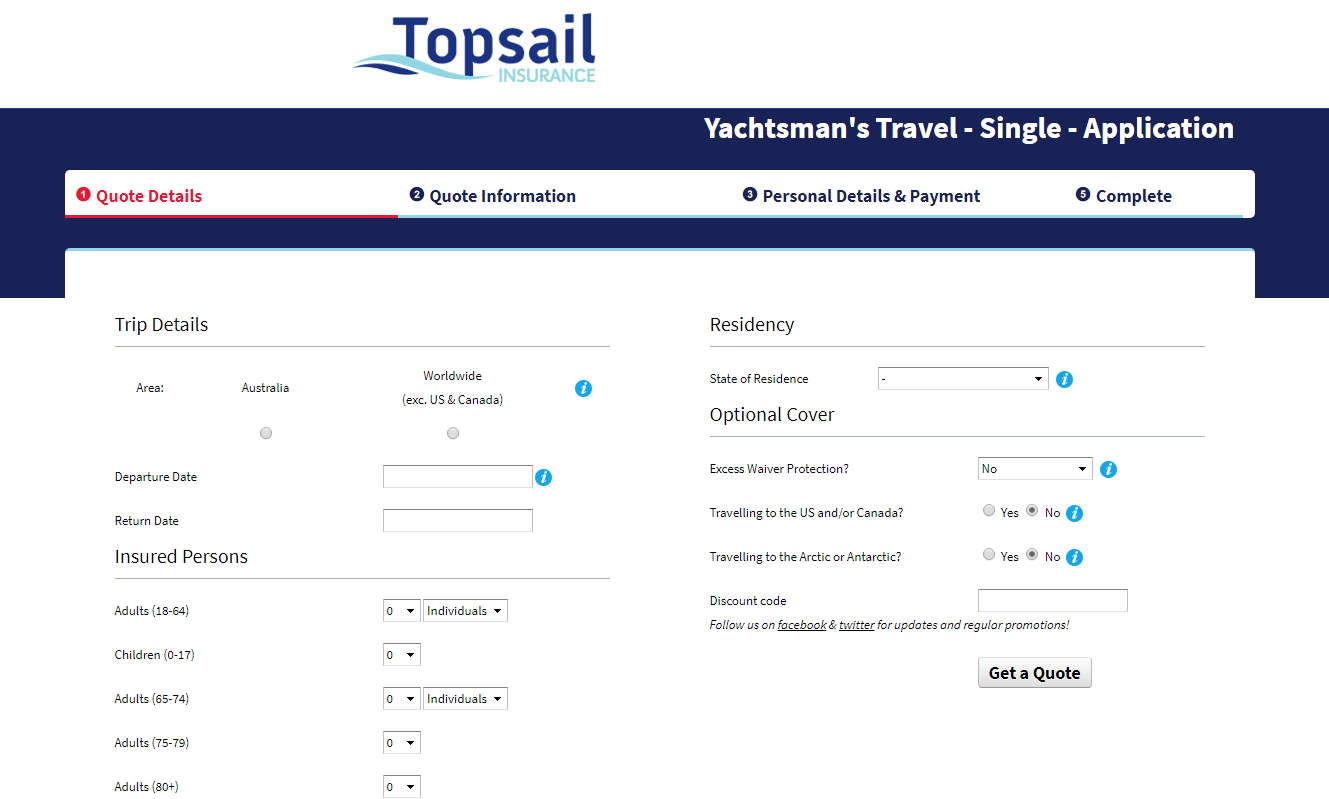

Sailing travel insurance comes in various forms, catering to different needs and durations of voyages. A single-trip policy is ideal for a specific sailing expedition, offering coverage for a predetermined period. Annual multi-trip policies are beneficial for sailors undertaking multiple trips throughout the year, providing comprehensive coverage for each voyage. Consider the frequency and duration of your sailing trips when choosing the most suitable policy.

Key Benefits and Coverage

Sailing travel insurance offers a range of benefits beyond the standard travel insurance coverages. It often includes protection against medical expenses incurred during a sailing trip, including repatriation costs if necessary. Crucially, it often covers damage to your boat, personal belongings, and liability for any accidents or damages caused during your voyage. Policies can also provide assistance in case of a breakdown or other emergencies encountered while at sea. Furthermore, some policies offer assistance with lost or damaged sailing equipment.

Comparison: Sailing Travel Insurance vs. General Travel Insurance

| Feature | Sailing Travel Insurance | General Travel Insurance |

|---|---|---|

| Medical Expenses | Covers medical expenses incurred during a sailing trip, including repatriation. | Covers medical expenses during a trip, typically up to a certain limit. |

| Boat Damage | Covers damage to the insured boat caused by unforeseen events at sea. | Does not cover damage to personal property or vehicles, unless explicitly stated. |

| Personal Belongings | Covers loss or damage to personal belongings during the voyage. | Covers loss or damage to personal belongings in specific situations (e.g., theft). |

| Liability | Covers liability for any accidents or damages caused during a sailing trip. | Covers liability in specific situations (e.g., accidents). |

| Emergency Assistance | Offers assistance in case of breakdowns, medical emergencies, or other unforeseen events at sea. | Provides assistance in case of emergencies, typically land-based. |

| Equipment Coverage | May include coverage for lost or damaged sailing equipment. | Does not typically cover specialized equipment. |

This table highlights the key differences in coverage between sailing and general travel insurance. Sailing insurance caters specifically to the unique risks associated with sailing, providing more comprehensive protection for the boat, personal belongings, and the sailor. General travel insurance focuses on a broader range of travel risks but may not cover specific sailing-related perils.

Coverage Details: Sailing Travel Insurance

Sailing travel insurance isn’t just about protecting your trip; it’s about safeguarding your entire sailing adventure. This crucial component of your sailing plans covers a wide range of potential issues, from unexpected medical emergencies to the loss of your precious boat. Understanding the specifics of your coverage is key to making informed decisions and having peace of mind while exploring the open water.

Cancellation Coverage

Cancellation coverage for sailing trips often includes circumstances like severe weather, unforeseen medical issues, or family emergencies. The policy specifics dictate the percentage of prepaid expenses covered and the timeframe for claiming these benefits. For instance, if your trip is canceled due to a sudden, serious illness requiring hospitalization, your insurance might cover non-refundable flight costs, accommodation, and boat rental fees.

Medical Expenses Coverage

Sailing travel insurance policies typically cover medical expenses incurred during your trip. This coverage extends to both accidents and illnesses. The amount covered varies between policies. Crucially, it’s essential to verify the maximum payout and the types of medical services included (e.g., ambulance, hospital stays, doctor visits).

Lost Belongings Coverage

Lost or stolen items during your sailing trip are often covered under this section. Policies generally have limitations on the total amount covered per item and the total coverage amount. Crucially, you should document your belongings before the trip, detailing the items’ value and serial numbers. This helps in accurately assessing the claim in case of loss.

Trip Interruption Coverage

This part of the policy covers situations where your sailing trip needs to be cut short due to unforeseen circumstances. Examples include sudden severe weather, a family emergency, or a medical emergency that requires immediate attention. Coverage often extends to return travel expenses and any unused portions of your planned trip.

Sailing-Specific Accident and Injury Coverage

Sailing accidents, injuries, and illnesses are often specifically addressed. This coverage is tailored to the inherent risks of sailing, including injuries from falls overboard, collisions with other vessels, or injuries due to equipment malfunction. The coverage often includes the cost of necessary medical treatment, evacuation, and potential repatriation.

Damage to or Loss of Sailboat or Equipment

Coverage for damage or loss of your sailboat or equipment varies significantly. This section of the policy will specify what constitutes covered damage (e.g., collisions, acts of nature) and the associated limits. It’s crucial to note the policy’s provisions for pre-existing damage, wear and tear, or damage caused by your own negligence.

Crucial Scenarios

Sailing travel insurance becomes indispensable in several scenarios. Imagine a sudden illness forcing you to cut your sailing trip short, or a severe storm damaging your sailboat beyond repair. Insurance can cover these situations, allowing you to recoup some of the expenses and continue your life. Alternatively, a mishap that results in a serious injury can lead to substantial medical costs. Insurance can help alleviate this financial burden.

Exclusions and Limitations

| Category | Description |

|---|---|

| Pre-existing Conditions | Generally, conditions diagnosed before the policy purchase are not covered. |

| Self-Inflicted Injuries | Injuries caused by intentional actions or recklessness are typically excluded. |

| Normal Wear and Tear | Damage due to normal wear and tear on the boat or equipment is excluded. |

| Excluded Activities | Some activities, such as extreme water sports or specific types of racing, might not be covered. |

| Acts of War | Coverage is usually excluded for damages or injuries resulting from war or acts of terrorism. |

Policies vary, so always check the specific wording of your chosen policy. Review the full policy document for complete details.

Key Considerations for Sailing Travelers

Choosing the right sailing travel insurance is crucial for protecting your investment, peace of mind, and overall enjoyment of your voyage. This involves more than just selecting a policy; it requires careful consideration of the specific terms, conditions, and providers available. Understanding your needs and potential risks is paramount to making an informed decision.

Understanding Policy Terms and Conditions

Sailing travel insurance policies, like other types of travel insurance, are complex documents. Thorough review of the policy’s terms and conditions is essential. This includes understanding the scope of coverage, including what events are covered, the limitations on the coverage, and the specific procedures for filing claims. Reading through the fine print can help avoid surprises or misunderstandings down the road. Pay close attention to details like the definition of “accidental damage” or “medical expenses,” as these can differ significantly between policies.

Factors to Consider When Choosing a Provider

Several factors influence the selection of a sailing travel insurance provider. Assess the provider’s reputation, financial stability, and track record for handling claims. Look for providers with experience in the sailing industry, as they will likely understand the unique challenges and risks associated with sailing trips. Compare the provider’s pricing structure. Consider factors like the duration of the trip, the destinations, and the types of activities involved. Consider the level of customer support offered by the provider. A responsive and helpful support team can be invaluable if you encounter issues during your voyage.

Comparing Different Providers and Pricing Structures, Sailing travel insurance

Comparing different providers allows you to evaluate their offerings and pricing. Use online comparison tools to quickly evaluate policies and their corresponding costs. Consider the coverage limits, deductibles, and exclusions of each policy. Compare the premiums for different policy durations and the specific coverage for sailing-related incidents. Seek advice from sailing communities and forums to gain insights into the experiences of others with various insurance providers. This can provide valuable information and insights about the quality of service and claims handling processes. A table comparing key aspects of different providers can be very helpful.

| Provider | Coverage Limit (USD) | Deductible (USD) | Sailing-Specific Coverage | Customer Reviews |

|---|---|---|---|---|

| InsureMyTrip | 100,000 | 500 | Yes, including damage to boat | 4.5/5 stars |

| SailSafe | 150,000 | 1,000 | Yes, including crew injury | 4.7/5 stars |

| Seaworthy Insurance | 125,000 | 250 | Yes, including medical evacuation | 4.3/5 stars |

Reviewing Policy Exclusions and Limitations

Understanding the policy’s exclusions and limitations is crucial. Exclusions define events or circumstances that are not covered by the insurance. These often include pre-existing conditions, certain types of weather events, and activities considered hazardous. Identify specific limitations, such as maximum payout amounts or coverage durations. This step helps you avoid disappointment if a situation falls outside the policy’s scope. Consider how these limitations might affect your specific sailing trip.

Common Mistakes Travelers Make When Selecting Sailing Travel Insurance

Failing to read the policy’s fine print, not understanding the scope of coverage, and not considering the exclusions and limitations are common mistakes. Not comparing providers or pricing structures can also lead to an inadequate or overpriced policy. Not factoring in the duration of the trip, the destinations, and the specific activities involved in the trip can also lead to an unsuitable policy. Reviewing past sailing experiences and researching policies from reputable providers can help avoid these common pitfalls.

Claims and Procedures

Navigating the claims process for sailing travel insurance can feel daunting, but understanding the steps involved can ease your mind. A well-defined process ensures a smooth resolution should the unexpected occur during your sailing adventure. This section will Artikel the claims process, required documentation, timelines, and provide a step-by-step guide to help you.

Claims Process Overview

The claims process for sailing travel insurance typically involves several steps, designed to efficiently assess the validity and scope of your claim. Insurance companies strive to resolve claims promptly and fairly. This process ensures accountability and protects both the policyholder and the insurer.

Required Documentation

Thorough documentation is critical for a successful sailing travel insurance claim. A complete and accurate claim package allows the insurance provider to assess the situation effectively. This reduces the risk of delays and ensures your claim is processed efficiently. Key documents often include:

- Policy details, including policy number and the effective dates of coverage.

- Detailed description of the incident, including dates, times, locations, and any relevant circumstances surrounding the claim.

- Photographs or videos documenting the damage or loss.

- Medical records (if applicable) for medical expenses.

- Police reports or other official documents related to the incident.

- Receipts for any out-of-pocket expenses.

- Proof of purchase for any items lost or damaged.

Claim Timeline

Claim processing times vary depending on the complexity of the claim and the insurance provider. Factors such as the need for further investigation, verification of documents, and the availability of necessary resources can influence the timeframe. Generally, expect a response within a reasonable timeframe, often within a few weeks for straightforward claims. More complex claims might take longer.

Step-by-Step Claim Filing Guide

Filing a claim efficiently involves following these steps:

- Contact the insurance provider as soon as possible after the incident. This ensures prompt reporting and the start of the claim process.

- Gather all required documents. Organize them for easy access and review.

- Complete the claim form accurately, providing detailed information about the incident.

- Submit all the necessary documents electronically or via mail, as instructed by the insurer.

- Follow up with the insurance provider to check on the status of your claim.

Common Reasons for Claim Denials

Understanding potential reasons for claim denials can help you avoid them. This proactive approach ensures your claim is well-prepared and compliant with the terms of your policy.

| Reason | Explanation |

|---|---|

| Failure to report the incident promptly | Claims filed significantly after the incident might be denied due to the time lapse and lack of evidence that may be affected by time. |

| Insufficient documentation | Missing or incomplete documentation may lead to denial. The insurance company needs verifiable evidence to assess the claim. |

| Violation of policy terms | Claims that violate policy terms, such as pre-existing conditions or exclusions, may be denied. |

| Fraudulent claims | Any attempt to deceive or misrepresent the circumstances of the incident will result in a denial. |

| Lack of coverage | Certain incidents or losses may fall outside the scope of your policy’s coverage, leading to a denial. |

Comparing Insurance Providers

Choosing the right sailing travel insurance can be tricky. With numerous providers offering varying levels of coverage and pricing, it’s essential to compare policies carefully. This section will guide you through the process of evaluating different insurance options, considering crucial factors like policy features, coverage details, and provider reputations.

Policy Features and Coverage Comparison

Different providers offer diverse sailing travel insurance packages. To effectively compare, focus on the specific coverages relevant to your sailing trips. This includes comprehensive coverage for medical expenses, trip cancellations, lost luggage, and liability protection, particularly important for sailing activities. Assess if the policy covers incidents during chartering, crew activities, or unforeseen damage to the vessel. Look for policies explicitly addressing typical sailing risks like storms, equipment malfunctions, or navigation errors.

Examples of Policy Wordings

Policy wordings can significantly impact the scope of coverage. Understanding the fine print is critical. Here are examples of how different providers address specific sailing-related risks.

“Coverage for medical expenses arising from injuries sustained during a sailing trip, including emergency medical evacuation, provided the trip is pre-approved by the insurance provider.” – Example from Provider A

“Comprehensive protection for trip cancellations or interruptions due to unforeseen weather conditions, including damage to the sailing vessel, if properly documented.” – Example from Provider B

Provider Comparison Table

The following table compares key features and pricing of three leading sailing travel insurance providers:

| Feature | Provider A | Provider B | Provider C |

|---|---|---|---|

| Medical Expenses (USD) | Up to $1,000,000 | Up to $500,000 | Up to $2,000,000 |

| Trip Cancellation (USD) | Up to 50% of trip cost | Up to 75% of trip cost | Up to 100% of trip cost (with conditions) |

| Liability Protection (USD) | $500,000 per incident | $1,000,000 per incident | $2,000,000 per incident |

| Premium (USD, 10-day trip) | $150 | $200 | $250 |

Customer Reviews and Ratings

Customer reviews provide valuable insights into the reliability and responsiveness of insurance providers. Checking online reviews, ratings, and testimonials helps assess customer service quality and the resolution of claims.

| Provider | Average Rating | Customer Reviews (Excerpt) |

|---|---|---|

| Provider A | 4.5/5 | “Quick and efficient claim processing. Great customer support.” |

| Provider B | 4.2/5 | “Helpful in navigating the claims process, although slightly higher premiums.” |

| Provider C | 4.7/5 | “Excellent customer service, very responsive to inquiries.” |

Factors to Consider

Evaluating sailing travel insurance providers involves considering several key factors. Reputable providers often have strong track records, transparent policies, and dedicated customer support teams. Consider the insurance company’s reputation within the travel and sailing industry. Thoroughly examine customer reviews and ratings. Ensure clear communication channels and claim procedures are readily available.

Illustrative Scenarios

Sailing travel insurance is crucial for protecting your investment and peace of mind when embarking on a voyage. Understanding how it works in various situations is essential to making informed decisions. This section provides real-world examples to illustrate the different ways insurance can benefit you.

Having a comprehensive insurance policy can significantly mitigate the financial risks associated with sailing adventures. It’s not just about financial protection, but also about safeguarding your well-being and the smooth execution of your sailing trip.

Scenario 1: Trip Cancellation

A sailing enthusiast booked a highly anticipated voyage to the Galapagos Islands. Unforeseen circumstances arose—a sudden illness requiring extensive medical treatment—necessitating the cancellation of the trip. The sailing travel insurance policy covered the full amount of non-refundable deposits and expenses, allowing the traveler to recover financially from the unforeseen event.

Scenario 2: Medical Expenses During a Sailing Accident

While sailing in the Caribbean, a traveler experienced a serious injury during a sudden storm. The boat capsized, and the traveler suffered a broken arm and other injuries. The sailing travel insurance policy promptly covered all the necessary medical expenses, including hospital stays, surgeries, and rehabilitation, ensuring that the traveler received the best possible care without facing significant financial burden.

Scenario 3: Excluded Damage to a Boat Due to a Pre-Existing Condition

A seasoned sailor with a pre-existing issue with the hull of their boat sought sailing travel insurance. During the trip, a severe storm caused substantial damage to the hull, resulting in significant repair costs. However, the policy specifically excluded pre-existing hull damage, so the insurance company didn’t cover the repair costs, as the damage stemmed from an issue the boat already had. This example highlights the importance of carefully reviewing policy exclusions.

Scenario 4: Trip Interruption

A traveler’s planned sailing trip was unexpectedly interrupted by a severe hurricane. The storm forced the traveler to abandon the trip and return home prematurely. The sailing travel insurance policy covered the unused portion of the trip, including lost expenses like accommodations, boat rentals, and other trip-related costs.

Scenario 5: Failure to Meet Policy Conditions

A traveler booked sailing travel insurance but failed to provide accurate information about their sailing experience and the vessel’s age. This omission significantly affected the policy’s coverage. During the trip, an incident occurred, and the insurance company declined the claim because the traveler did not fully disclose relevant information, leading to a denial of coverage. This scenario underscores the necessity of accurate and complete disclosure when purchasing sailing travel insurance.

Understanding Policy Exclusions

Sailing travel insurance is designed to protect you during your adventures on the water, but it’s crucial to understand what’s *not* covered. Knowing the policy exclusions upfront prevents unpleasant surprises when a claim arises. Understanding these limitations ensures you’re prepared for unexpected situations and can make informed decisions about your trip.

Policy exclusions are an integral part of any insurance contract. They define the situations where the insurance company won’t pay out a claim. This is not a punitive measure, but rather a way to manage risk and maintain financial stability for the insurance provider. By understanding these exclusions, you can proactively plan for potential issues and ensure your trip proceeds smoothly.

Common Exclusions in Sailing Travel Insurance

Policy exclusions vary between providers, so always carefully review the specific policy documents. A thorough understanding of exclusions helps you decide if the policy aligns with your needs and budget.

- Pre-existing medical conditions: Policies often exclude coverage for pre-existing medical conditions, meaning those that were diagnosed or treated before the policy was purchased. If you have a pre-existing condition, you should carefully evaluate if the policy’s coverage for medical emergencies and related expenses adequately addresses your situation. It’s essential to disclose all relevant medical information during the application process. Be prepared to discuss any limitations or precautions required for your health condition during the sailing trip.

- Certain types of activities: Some policies may not cover activities considered high-risk, such as certain extreme sports or activities undertaken outside of specified areas. Review the policy carefully to identify any restrictions on activities like scuba diving, waterskiing, or specific types of sailing. The policy may exclude activities that are deemed unusually dangerous, or that deviate significantly from the intended nature of the trip.

- Exclusions specific to sailing: These policies may exclude coverage for damage to or loss of sailing equipment, such as masts, sails, or other accessories, under certain circumstances. They might also exclude coverage for damage or loss of the vessel if it’s not properly maintained, or if the damage occurs due to a lack of proper maintenance.

Sailing Equipment Coverage Details

Understanding what’s covered and not covered regarding your sailing equipment is crucial. The specifics can vary considerably depending on the policy and the nature of the damage.

- Covered equipment: Most policies cover standard sailing equipment, like life jackets, safety gear, and basic navigational tools. Ensure you understand the specific definitions of covered equipment within the policy.

- Uncovered equipment: Custom-built or highly specialized equipment, particularly expensive or non-standard items, might not be fully covered. Any modifications or enhancements to the standard equipment might not be covered. Also, damage to equipment that is improperly maintained or handled might not be covered. Similarly, damage to the vessel itself due to pre-existing damage, or due to a lack of proper maintenance and repair, is often excluded.

Illustrative Examples of Uncovered Damages

Here are some examples of situations where your policy might not cover damages:

| Scenario | Likely Exclusion |

|---|---|

| Damage to a sail caused by a pre-existing tear that wasn’t properly repaired before the trip. | Pre-existing condition or lack of maintenance. |

| Loss of a GPS device due to theft while the vessel was anchored in a known high-theft area. | Theft in high-risk areas. |

| Damage to a custom-designed mast during a storm that exceeded the design specifications of the vessel. | Damage exceeding the vessel’s design limitations or specialized equipment. |

Choosing the Right Policy

Finding the perfect sailing travel insurance policy is crucial for protecting your trip and your finances. It’s not a one-size-fits-all solution; your ideal policy depends on your specific needs, the type of sailing trip you’re planning, and your budget. Carefully consider the details and compare different options to make an informed decision.

Choosing the right insurance policy involves a meticulous process of evaluating your needs and comparing various options. This requires a deep dive into the specifics of different policies to ensure that your chosen plan adequately protects you during your sailing adventure.

Comparing Different Policies

Understanding the specifics of each policy is key to making a well-informed decision. Look beyond the advertised premiums. Compare coverage limits, exclusions, and claim procedures to see how they align with your sailing trip’s unique characteristics. Focus on the details rather than just the price tag. Thorough comparison will help identify the policy that best fits your requirements.

- Policy Details: Scrutinize the policy wording for clarity on coverage limits, types of incidents covered, and exclusions. Pay close attention to the specifics of the sailing-related activities covered, including specific types of boats and the waters you plan to sail.

- Coverage Limits: Assess the maximum payout for various covered events, such as medical expenses, trip cancellation, and lost belongings. Determine if these limits adequately address potential risks, considering the duration and scale of your sailing trip.

- Exclusions: Carefully review the exclusions to identify any potential gaps in coverage. Understand what situations or events are not covered by the policy. Look for specific exclusions that may apply to sailing, such as pre-existing conditions or certain types of weather events.

- Claim Procedures: Understand the process for filing a claim. Investigate the timeframes involved, required documentation, and any potential appeal processes. Familiarize yourself with the insurance provider’s claim handling procedures.

Evaluating Coverage Needs

The level of coverage you need depends largely on the scope of your sailing trip. Consider factors such as the duration of the voyage, the types of waters you’ll be sailing in, the potential risks involved, and your personal circumstances. Assessing your needs is critical to making a decision that suits your particular situation.

- Trip Duration: Longer trips often necessitate a more comprehensive policy with higher coverage limits for medical expenses and trip interruptions.

- Sailing Conditions: Sailing in remote or challenging waters often requires additional coverage for medical evacuation, rescue services, or assistance in case of an accident or emergency.

- Personal Circumstances: Your financial situation and health status will influence your coverage needs. Pre-existing medical conditions may necessitate specific considerations within the insurance policy.

- Potential Risks: Assess the potential risks associated with your sailing trip. Evaluate the likelihood of incidents like storms, equipment failure, or accidents. Consider the remoteness of the location to factor in the time and expense of rescue or medical assistance.

Checklist for Evaluating Options

A structured approach helps you compare different policies effectively. This checklist will ensure that you have considered all relevant factors when making your decision.

- Identify your specific needs: Detail the type of sailing trip, the duration, and the specific waters involved. This will assist you in selecting the policy that best addresses your needs.

- Compare policy details: Compare coverage limits, exclusions, and claim procedures of various providers. Consider the potential cost and time of a claim.

- Evaluate coverage levels: Consider your budget and the potential risks involved. Adjust coverage levels according to the potential cost of medical care, trip interruption, or lost belongings.

- Review policy exclusions: Understand the specific situations or events not covered by the policy. Identify potential gaps in coverage that may not adequately address your sailing trip.

- Seek expert advice: If needed, consult with a financial advisor or travel agent specializing in sailing insurance for personalized guidance.

Criteria for Choosing a Suitable Policy

Consider these criteria to select the right policy for your needs and budget.

- Budget: Compare the premiums of different policies. Consider the overall cost of the policy and whether it aligns with your financial capabilities.

- Coverage scope: Ensure the policy covers all aspects of your sailing trip. Consider medical expenses, trip cancellations, lost belongings, and liabilities.

- Policy provider reputation: Research the reputation of the insurance provider and their history of handling claims. Read reviews and testimonials to gauge their reliability.

- Flexibility: Consider the policy’s flexibility. Determine whether it adapts to the specifics of your sailing trip and adjusts to any unforeseen circumstances.

Sailing travel insurance is crucial for peace of mind, covering unexpected hiccups like equipment malfunctions or weather delays. Thinking about a shorter trip? You might be interested in a half day travel discount code, which could help you save money on your next adventure. These deals can be a great way to get more out of your sailing trip, while still having comprehensive insurance to protect your investment.

half day travel discount code could be just the ticket for some extra savings, making your sailing travel insurance even more worthwhile.

Sailing travel insurance is a must for any adventurous sailor, covering mishaps at sea. Thinking about a trip to Africa? You’ll need robust travel insurance, and africa travel insurance is crucial for exploring the continent safely. Ultimately, comprehensive sailing travel insurance will protect you against unforeseen events during your voyages.