Introduction to Structured Trade and Commodity Finance

Structured trade and commodity finance (STCF) is a specialized form of financing that facilitates international trade in physical commodities. It goes beyond traditional trade finance by incorporating more complex structures and risk mitigation techniques to address the specific needs of businesses involved in these transactions. STCF plays a crucial role in enabling global commerce, particularly for industries dealing with the volatile nature of commodity markets.

Core Principles Differentiating Structured Trade Finance

The core principles of structured trade finance distinguish it from traditional trade finance through a focus on the underlying commodity, the transaction’s specific characteristics, and the risk profile. This approach allows for tailored financing solutions that are not typically available through standard trade finance products.

- Focus on the Commodity: Unlike traditional trade finance, STCF centers on the commodity being traded. The lender’s primary security is often the commodity itself, its future cash flows, or related assets. This means the lender assesses the commodity’s quality, marketability, and storage, along with the overall supply chain.

- Transaction-Specific Structuring: STCF transactions are customized to fit the specifics of each deal. This includes the commodity, the parties involved, the payment terms, and the risk mitigation strategies. The structuring aims to create a robust framework that protects the lender’s interests, especially in high-value or complex transactions.

- Enhanced Risk Mitigation: STCF employs various risk mitigation techniques beyond those used in traditional trade finance. These can include collateral management, hedging strategies, insurance, and the use of special-purpose vehicles (SPVs) to isolate risks. These techniques are critical in managing the inherent risks associated with commodity trading, such as price volatility and counterparty risk.

Commodities Involved in Structured Trade Finance

Structured trade finance is heavily involved in financing transactions involving a wide array of commodities, spanning both hard and soft commodities. The choice of commodity significantly influences the structure and risk assessment of the financing deal.

- Energy Commodities: These include crude oil, refined petroleum products (like gasoline and diesel), natural gas, and coal. The price volatility of these commodities necessitates sophisticated risk management techniques.

- Metals: Precious metals such as gold, silver, and platinum are often financed, along with base metals like copper, aluminum, and iron ore. The financing structures may involve pre-export financing, inventory financing, and other specialized arrangements.

- Agricultural Products: STCF is also prevalent in financing agricultural commodities such as grains (wheat, corn, soybeans), soft commodities (coffee, cocoa, sugar), and other agricultural products. The financing often supports pre-harvest, post-harvest, and export financing.

- Other Commodities: Other commodities such as fertilizers, chemicals, and even industrial raw materials can also be part of STCF transactions. The specifics of each deal will depend on the nature of the commodity, the trade routes, and the involved parties.

Main Objectives of Using Structured Trade Finance

Businesses use structured trade finance to achieve several key objectives, enabling them to participate in global trade more effectively and efficiently. These objectives are often critical for growth, risk management, and operational optimization.

- Access to Financing: STCF provides access to capital for businesses that may not qualify for traditional financing due to their size, creditworthiness, or the complexity of their transactions. The structure of the financing, based on the underlying commodity and the transaction itself, allows lenders to assess and manage risks more effectively.

- Risk Mitigation: A primary objective is to mitigate the risks inherent in commodity trading. STCF structures can incorporate various risk management tools, such as hedging, insurance, and collateral management, to protect against price volatility, counterparty default, and other potential losses.

- Optimized Cash Flow Management: STCF can help businesses manage their cash flow more efficiently. By providing financing for the purchase, storage, and transportation of commodities, STCF enables businesses to smooth out their cash flow cycles and improve working capital management.

- Increased Trade Volumes: By facilitating access to capital and mitigating risks, STCF enables businesses to engage in larger and more complex trade transactions. This can lead to increased trade volumes, market share growth, and improved profitability.

- Supply Chain Optimization: STCF can support the optimization of supply chains. The structured approach can integrate financing with logistics and inventory management, improving the efficiency and reliability of the supply chain. This is particularly important in industries where timely delivery of commodities is crucial.

Key Instruments and Structures

Structured trade and commodity finance relies on a variety of financial instruments and structures to facilitate international trade and mitigate associated risks. These tools provide crucial support for transactions involving physical commodities, offering security to lenders and enabling businesses to access the capital needed to execute complex deals. Understanding these instruments and structures is essential for anyone involved in this sector.

Letters of Credit in Structured Trade Finance

Letters of Credit (LCs) are a cornerstone of structured trade finance, acting as a guarantee of payment from a bank to a seller, provided that the seller fulfills the terms and conditions specified in the LC. This mechanism provides assurance to the seller, especially in cross-border transactions where trust can be a challenge.

The role of LCs in structured trade finance includes:

- Payment Guarantee: LCs guarantee payment to the seller upon presentation of specified documents that demonstrate compliance with the terms of the sale. This significantly reduces the risk of non-payment for the seller.

- Risk Mitigation: LCs mitigate the risk of political instability, currency fluctuations, and buyer default, as the issuing bank assumes the payment obligation.

- Facilitating Trade: By reducing risk, LCs facilitate trade between parties who may not have an established relationship or trust. They enable transactions that might otherwise be impossible.

- Security for Lenders: LCs can be assigned to lenders as collateral, providing them with a secure means of repayment. This enhances the lender’s willingness to provide financing.

- Customization: LCs can be tailored to meet the specific requirements of a transaction, including the type of commodity, shipment schedule, and payment terms.

For example, consider a commodity trade where a buyer in Europe is purchasing crude oil from a seller in the Middle East. The buyer’s bank issues an LC in favor of the seller, stipulating that payment will be made upon presentation of documents such as a bill of lading, inspection certificates, and other required documentation. Once the seller provides these documents and they are found to be in compliance, the bank guarantees payment, even if the buyer defaults. This structure ensures the seller receives payment, regardless of the buyer’s financial position.

Borrowing Base Facilities

Borrowing base facilities are a common financing structure used in structured trade and commodity finance. They provide borrowers with access to revolving credit based on the value of their underlying assets, typically inventory or receivables. The availability of credit fluctuates based on the value of the collateral.

The mechanics of a borrowing base facility involve:

- Collateral Assessment: The lender periodically assesses the value of the borrower’s collateral, such as inventory or receivables, to determine the borrowing base. This assessment often involves independent verification and valuation.

- Credit Availability: The borrower can borrow up to a percentage of the borrowing base, known as the advance rate. This percentage reflects the lender’s risk appetite and the quality of the collateral.

- Revolving Nature: Borrowing base facilities are typically revolving, meaning the borrower can repay and re-borrow funds within the agreed-upon period.

- Monitoring and Reporting: The borrower is required to provide regular reports on the status of the collateral, including inventory levels, sales, and collections. The lender monitors these reports to ensure the borrower’s compliance with the terms of the facility.

- Margin and Pricing: The interest rate charged on the facility often floats and is based on a benchmark rate (e.g., LIBOR or SOFR) plus a margin, which reflects the risk of the borrower and the underlying collateral.

A hypothetical example involves a trading company importing copper. The lender assesses the value of the copper inventory stored in bonded warehouses. If the copper is valued at $10 million and the advance rate is 70%, the borrowing base is $7 million. The trading company can borrow up to $7 million, using the copper inventory as collateral. As the copper is sold, the proceeds are used to repay the loan, and the borrowing base is reassessed to determine the available credit for future imports.

Pre-Export Financing Structures

Pre-export financing is a type of structured trade finance that provides funding to commodity producers to support the production of goods for export. These structures are particularly common in the agricultural and mining sectors. Several different structures exist, each with its own advantages and disadvantages.

| Structure | Description | Advantages | Disadvantages |

|---|---|---|---|

| Pre-Export Finance with Offtake Agreement | The lender provides financing based on a commitment from a buyer (offtaker) to purchase the commodity at a predetermined price. | Provides strong security for the lender due to the offtake agreement; secures a market for the producer. | The price risk remains with the producer; the structure is highly dependent on the creditworthiness of the offtaker. |

| Inventory Financing | The lender provides financing against the producer’s inventory, which is typically stored in a bonded warehouse. | Relatively straightforward structure; provides liquidity to the producer. | The lender bears the risk of commodity price fluctuations; requires robust inventory management and monitoring. |

| Production Payment Loan | The lender provides financing based on a percentage of future production, secured by the commodity itself. | Aligns the interests of the lender and producer; can be structured to mitigate price risk. | Requires accurate production forecasts; complex structuring. |

| Receivables Financing | The lender provides financing based on the producer’s future receivables from the sale of the commodity. | Provides quick access to working capital; reduces credit risk associated with buyers. | Requires strong sales and collection processes; the lender relies on the creditworthiness of the buyers. |

Risk Mitigation Strategies

Structured trade and commodity finance (STCF) inherently involves various risks due to the complexities of international trade, fluctuating commodity prices, and the involvement of multiple parties. Effective risk mitigation is crucial for the success and sustainability of STCF transactions. This section explores the key risks and the strategies employed to manage them.

Risks Associated with Structured Trade and Commodity Finance

STCF faces several significant risks, requiring careful management. These risks can be broadly categorized as:

- Credit Risk: The risk that a counterparty (e.g., buyer, seller, bank) will default on its obligations. This is a primary concern in STCF.

- Commodity Price Risk: The risk that fluctuations in commodity prices will negatively impact the profitability of the transaction. This is particularly relevant in long-term contracts.

- Country Risk: The risk associated with political instability, economic downturns, or regulatory changes in the country where the transaction takes place. This includes expropriation, currency controls, and contract enforcement issues.

- Operational Risk: The risk of losses resulting from inadequate or failed internal processes, people, and systems, or from external events. This can encompass logistical delays, documentation errors, and fraud.

- Liquidity Risk: The risk that a party will not be able to meet its short-term financial obligations. This can arise from unexpected events or delays in payments.

- Currency Risk: The risk of losses arising from fluctuations in exchange rates between currencies. This is common in international trade transactions.

- Force Majeure: The risk of events beyond the control of the parties, such as natural disasters, wars, or political unrest, that can disrupt the transaction.

Comparing and Contrasting Risk Mitigation Techniques: Insurance and Hedging

Two primary risk mitigation techniques in STCF are insurance and hedging, each addressing different types of risk.

- Insurance: Provides protection against specific risks, transferring the financial burden to an insurer. Common types of insurance in STCF include:

- Credit Insurance: Protects against the risk of non-payment by the buyer due to insolvency or protracted default. For example, a trading company exporting wheat to Egypt might purchase credit insurance to cover the risk that the Egyptian buyer defaults.

- Political Risk Insurance: Covers losses arising from political events such as expropriation, war, or currency inconvertibility. A company investing in a copper mine in a politically unstable country might use political risk insurance.

- Marine Insurance: Protects against loss or damage to goods during shipment.

- Hedging: Uses financial instruments to reduce the impact of price fluctuations or currency movements. Common hedging instruments include:

- Forward Contracts: Agreements to buy or sell a commodity or currency at a predetermined price on a future date. For example, a farmer expecting a harvest of soybeans might enter into a forward contract to sell the soybeans at a fixed price to protect against a price decline.

- Futures Contracts: Standardized contracts traded on exchanges to buy or sell a commodity or currency at a future date.

- Options: Contracts that give the buyer the right, but not the obligation, to buy or sell a commodity or currency at a predetermined price.

- Swaps: Agreements to exchange cash flows based on different interest rates or currencies.

Structured trade and commodity finance – Comparison:

Insurance primarily mitigates the risk of loss from specific events, while hedging aims to manage price or currency fluctuations. Insurance transfers risk to an insurer, while hedging uses financial instruments to offset potential losses. Insurance is generally a cost that adds to the overall transaction cost, whereas hedging can be cost-neutral or potentially generate profit depending on market movements. The choice between insurance and hedging, or a combination of both, depends on the specific risks involved and the objectives of the parties.

Structured trade and commodity finance plays a crucial role in facilitating global commerce. However, unforeseen circumstances can lead to financial distress. Understanding strategies for navigating challenges, including options that go beyond finance debt settlement , is vital for participants. Ultimately, robust risk management and diversified financing approaches are essential for maintaining stability within structured trade and commodity finance.

Methods for Mitigating Counterparty Risk

Counterparty risk, the risk of default by one of the parties in a transaction, is a central concern in STCF. Several methods are used to mitigate this risk:

- Letters of Credit (LCs): A bank guarantees payment to the seller, provided the seller meets the terms and conditions specified in the LC. This reduces the seller’s risk of non-payment. For instance, a U.S. exporter of machinery to a company in Nigeria might require an LC from a reputable Nigerian bank.

- Guarantees: A third party, such as a parent company or a bank, guarantees the obligations of the counterparty. This provides an additional layer of security.

- Collateralization: The borrower provides assets (e.g., goods, receivables) as security for the loan. In a gold financing deal, the gold itself often serves as collateral.

- Prepayment: The buyer makes a partial or full payment upfront, reducing the seller’s risk. This is common in commodity transactions.

- Escrow Accounts: Funds are held by a third party until specific conditions are met, ensuring that payments are made only when the agreed-upon terms are fulfilled.

- Credit Insurance: As mentioned earlier, this protects against the risk of non-payment by the buyer.

- Due Diligence: Thoroughly assessing the creditworthiness and financial stability of the counterparty before entering into a transaction. This includes reviewing financial statements, credit reports, and other relevant information.

- Diversification: Spreading the risk across multiple counterparties, so that the failure of one counterparty does not have a significant impact on the overall portfolio.

- Monitoring: Continuously monitoring the financial health and performance of the counterparty throughout the transaction. This allows for early detection of potential problems.

- Netting Agreements: Agreements that allow parties to offset their mutual obligations, reducing the overall credit exposure.

Parties Involved and Their Roles

Structured trade and commodity finance transactions involve a complex interplay of various parties, each with specific roles and responsibilities. Understanding these roles is crucial for comprehending the intricacies of these financing structures and managing the associated risks effectively. The successful execution of these deals relies on the seamless coordination and cooperation among these key players.

Key Players and Their Responsibilities

Several key players are essential to structured trade and commodity finance transactions. Their responsibilities are well-defined to ensure the smooth flow of goods and funds.

- Traders: Traders are the central figures in commodity transactions, responsible for buying and selling commodities. They identify market opportunities, negotiate contracts, and manage the physical movement of goods. Their responsibilities include:

- Identifying and sourcing commodities.

- Negotiating the terms of sale and purchase agreements.

- Managing logistics, including transportation, warehousing, and insurance.

- Monitoring market conditions and managing price risk.

- Banks: Banks provide the financial backing necessary to facilitate these transactions. They offer a range of services, including:

- Providing financing, such as letters of credit, guarantees, and loans.

- Managing payment flows.

- Assessing and mitigating risks.

- Structuring and administering the financing arrangements.

- Commodity Producers: Commodity producers are the entities that extract or produce the underlying commodities. Their roles include:

- Producing or extracting the commodity.

- Ensuring the quality and quantity of the commodity.

- Delivering the commodity according to the contract terms.

- Managing their production and supply chain.

Function of Commodity Inspection Agencies

Commodity inspection agencies play a vital role in structured finance deals by providing independent verification of the quality, quantity, and condition of the commodities being traded. Their assessments are crucial for mitigating risks and ensuring the integrity of the transaction.

- Role in Verification: These agencies perform inspections at various stages of the trade, including at the point of origin, during loading, and upon arrival at the destination. They provide:

- Quality Assessment: Evaluating the commodity against agreed-upon standards.

- Quantity Verification: Confirming the amount of commodity delivered.

- Condition Assessment: Assessing the physical state of the commodity.

- Importance for Lenders: Their reports provide assurance to lenders that the collateral for the financing is in good order and meets the agreed-upon specifications. This helps:

- Reduce the risk of non-performance.

- Facilitate the release of funds.

- Protect the lender’s investment.

- Examples of Agencies: Several reputable inspection agencies operate globally, including:

- SGS (Société Générale de Surveillance)

- Bureau Veritas

- Intertek

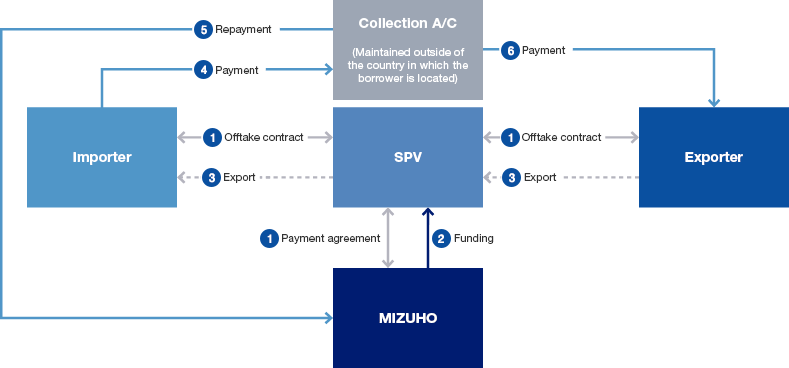

Flow of Funds in a Structured Trade Finance Transaction

The flow of funds in a structured trade finance transaction is a carefully orchestrated process, designed to ensure the smooth movement of both goods and money. This process typically involves several key steps.

The following describes a typical structured trade finance transaction. It involves a commodity producer (e.g., a mining company) selling a commodity (e.g., copper) to a trader. The trader then sells the commodity to an end-buyer (e.g., a manufacturer). A bank provides financing to the trader. The description of the fund flow follows:

- Contract and Order: The commodity producer and the trader enter into a sales contract, specifying the quantity, quality, price, and delivery terms of the copper. The trader then secures a purchase order from the end-buyer.

- Financing Application: The trader applies for financing from a bank. The bank assesses the creditworthiness of the trader, the producer, and the end-buyer, along with the viability of the transaction and the value of the commodity.

- Letter of Credit (LC) Issuance: If the bank approves the financing, it issues a Letter of Credit (LC) in favor of the commodity producer, or provides another type of financial instrument like a guarantee. The LC guarantees payment to the producer upon presentation of specified documents, such as bills of lading and inspection certificates, which confirm the shipment of the copper.

- Commodity Shipment and Inspection: The commodity producer ships the copper to the trader, and the shipment is inspected by an independent inspection agency to verify the quantity and quality of the copper.

- Document Presentation: The commodity producer presents the required documents, including the bill of lading and inspection certificate, to the bank.

- Payment to Producer: The bank reviews the documents to ensure they comply with the LC terms. If the documents are in order, the bank makes payment to the commodity producer.

- Sale to End-Buyer and Payment: The trader sells the copper to the end-buyer. The end-buyer pays the trader, either directly or through another financial instrument, as per the contract.

- Repayment to Bank: The trader uses the funds received from the end-buyer to repay the bank for the financing provided.

Visual Representation:

The visual representation of this process would show a circular flow, starting with the sales contract between the producer and trader. An arrow would lead from the trader to the bank for the financing application. The bank would then issue a Letter of Credit (LC) or provide a guarantee to the producer. Another arrow from the producer would go to the trader, indicating the shipment of the commodity, which would be accompanied by an inspection certificate, with an arrow pointing to the bank. The bank then makes a payment to the producer. Simultaneously, the trader sells to the end-buyer, and the end-buyer’s payment flows back to the trader. Finally, the trader repays the bank, completing the cycle.

This detailed description highlights the key steps and the directional flow of funds and goods, ensuring that all parties involved are protected and the transaction proceeds smoothly. The use of an LC provides security for the producer and the bank, mitigating the risks associated with the transaction.

Structured trade and commodity finance plays a crucial role in facilitating global commerce, providing essential funding for businesses involved in the movement of goods. However, understanding the nuances of financial operations is vital, which is where resources like city finance gilmer tx can offer insights into local economic landscapes. Ultimately, a strong grasp of these financial dynamics is essential for effectively navigating the complexities of structured trade and commodity finance.

Regulatory and Legal Considerations

Structured trade and commodity finance operates within a complex web of regulations and legal frameworks. These considerations are crucial for ensuring the legality, compliance, and overall viability of transactions. Understanding these elements is essential for mitigating risks and navigating the global landscape of trade finance.

Key Regulatory Frameworks Impacting Structured Trade Finance Globally

The global nature of structured trade finance necessitates adherence to a variety of regulatory frameworks. These frameworks vary across jurisdictions, creating a complex environment for participants. Compliance with these regulations is essential to avoid penalties and ensure the integrity of transactions.

- Basel III Accord: This international regulatory framework, developed by the Basel Committee on Banking Supervision, focuses on banking supervision. It sets standards for capital adequacy, stress testing, and liquidity risk management. For structured trade finance, Basel III impacts capital requirements for banks involved in financing trade transactions, influencing their lending decisions and the pricing of trade finance products. For example, banks are required to hold more capital against higher-risk transactions.

- Anti-Money Laundering (AML) and Know Your Customer (KYC) Regulations: These regulations are designed to prevent money laundering and terrorist financing. Financial institutions involved in structured trade finance must implement robust AML and KYC procedures to verify the identity of their customers, monitor transactions, and report suspicious activities. This includes due diligence on all parties involved, including buyers, sellers, and intermediaries. The Wolfsberg Group provides guidance on these regulations for financial institutions.

- Sanctions Regulations: Various countries and international bodies, such as the United Nations and the European Union, impose sanctions on specific countries, entities, and individuals. These sanctions can restrict trade with sanctioned parties and impact the ability to finance transactions involving them. For example, the U.S. Treasury Department’s Office of Foreign Assets Control (OFAC) enforces sanctions programs that can significantly affect trade finance transactions.

- Trade Finance Regulations: Specific regulations exist in various jurisdictions to govern trade finance activities. These regulations can cover areas such as export controls, import regulations, and the registration of trade finance instruments. These regulations ensure that trade finance transactions are conducted in a transparent and compliant manner.

- Data Privacy Regulations: Regulations like the General Data Protection Regulation (GDPR) in the European Union and the California Consumer Privacy Act (CCPA) in the United States impact how data related to trade finance transactions is collected, processed, and stored. Compliance with these regulations is crucial to protect sensitive information.

Impact of Sanctions and Trade Restrictions on Commodity Finance Transactions

Sanctions and trade restrictions pose significant challenges to commodity finance transactions. They can lead to delays, increased costs, and even the termination of transactions. Understanding and navigating these restrictions is essential for mitigating risks and ensuring compliance.

- Restricted Parties: Sanctions can prohibit or restrict trade with specific countries, entities, or individuals. This means that commodity finance transactions involving these parties are often prohibited or require special licenses. For example, if a sanctioned entity is a shareholder in a trading company, it could affect financing.

- Commodity Restrictions: Certain commodities may be subject to sanctions or trade restrictions. This could involve restrictions on the export or import of specific goods, such as oil, gas, or precious metals, from or to sanctioned countries. The U.S. has restrictions on certain types of oil transactions with Venezuela, for example.

- Payment Restrictions: Sanctions can limit the ability to make payments to or receive payments from sanctioned parties. This can impact the payment mechanisms used in commodity finance transactions, such as letters of credit and wire transfers.

- Due Diligence Requirements: Financial institutions and traders must conduct thorough due diligence to identify any potential sanctions risks. This includes screening all parties involved in a transaction against sanctions lists and verifying the origin and destination of the commodities.

- Compliance Costs: Complying with sanctions regulations can be costly. This includes the costs of implementing compliance programs, conducting due diligence, and obtaining licenses when required.

Example of How a Legal Framework Impacts a Structured Trade Finance Transaction

The following example illustrates how a specific legal framework, the Uniform Commercial Code (UCC) in the United States, can influence a structured trade finance transaction involving the sale of agricultural commodities.

- Scenario: A U.S. agricultural exporter sells soybeans to a European buyer. The transaction is financed by a U.S. bank through a letter of credit (LC). The soybeans are stored in a warehouse in the U.S. before shipment.

- UCC Impact: The UCC, specifically Article 9 (Secured Transactions), governs the creation and perfection of security interests in personal property, including the soybeans.

- Legal Considerations:

- Security Interest: The bank, as the financing party, wants to secure its interest in the soybeans to ensure repayment of the loan.

- Perfection: The bank must “perfect” its security interest by filing a financing statement (UCC-1) with the appropriate state authorities. This gives the bank priority over other creditors who may have claims against the soybeans.

- Warehouse Receipts: The warehouse receipt, which represents ownership of the soybeans while in storage, is a key document. The bank might take possession of the warehouse receipt to further secure its interest.

- Negotiation of the LC: The UCC influences the process of the letter of credit negotiation and presentation of documents. The bank needs to ensure that all the documents required under the LC comply with the UCC.

- Default and Remedies: If the buyer defaults on the payment, the UCC Artikels the bank’s remedies, such as the right to seize and sell the soybeans to recover its loan.

- Outcome: By complying with the UCC, the bank establishes a legally enforceable security interest in the soybeans, mitigating its credit risk and ensuring its ability to recover its investment in case of default.

Market Trends and Developments

The structured trade and commodity finance landscape is constantly evolving, driven by shifts in global trade patterns, technological advancements, and increasing awareness of environmental and social responsibility. Understanding these trends is crucial for participants in the market to navigate challenges and capitalize on opportunities. This section delves into the key market trends, the impact of technology, and the growing influence of ESG factors.

Current Trends in the Structured Trade Finance Market

Several key trends are shaping the structured trade finance market. These trends are interconnected and influence the strategies employed by banks, commodity traders, and other stakeholders.

- Increased Focus on Emerging Markets: Emerging markets continue to represent significant growth opportunities, driving demand for structured trade finance. These markets often have higher perceived risks, making structured finance instruments crucial for mitigating these risks. For example, financing deals in countries with less developed financial infrastructure or political instability necessitate robust risk mitigation strategies, such as collateralization and credit insurance, which are common in structured trade finance.

- Growing Demand for Supply Chain Finance: Supply chain finance solutions are becoming increasingly popular. They help optimize working capital and improve efficiency across the supply chain. This involves providing financing to suppliers and buyers, enabling them to manage their cash flow more effectively. A practical example is a bank providing financing to a large retailer to pay its suppliers earlier, thus improving the suppliers’ cash flow while the bank earns fees and interest.

- Digitization and Automation: The industry is embracing digitization and automation to streamline processes, reduce costs, and improve efficiency. This includes the use of digital platforms for trade documentation, KYC (Know Your Customer) processes, and payment processing. Digital platforms are replacing manual processes, reducing the time and cost associated with trade finance transactions.

- Increased Regulatory Scrutiny: Regulatory bodies are intensifying their scrutiny of trade finance activities to combat financial crime and ensure compliance. This includes enhanced due diligence requirements and stricter adherence to anti-money laundering (AML) regulations. The implementation of these regulations increases the complexity and cost of doing business, forcing institutions to invest in robust compliance systems.

- Rise of Alternative Finance Providers: Alternative finance providers, such as fintech companies and non-bank lenders, are gaining a foothold in the market. They offer innovative solutions and can be more agile than traditional banks. These providers often focus on specific niches or underserved markets.

Impact of Technology on Commodity Finance

Technology is transforming commodity finance, offering new opportunities for efficiency, transparency, and risk management. Blockchain technology, in particular, is poised to have a significant impact.

- Blockchain’s Role in Trade Finance: Blockchain technology provides a secure and transparent platform for managing trade transactions. It enables the creation of immutable records of transactions, reducing the risk of fraud and errors. It also streamlines the exchange of documents and information among parties involved in the trade.

- Smart Contracts and Automation: Smart contracts, self-executing contracts written on a blockchain, automate various aspects of trade finance, such as payments and documentation. This reduces the need for intermediaries and speeds up the transaction process. For example, a smart contract could automatically release payment to a seller once proof of shipment is verified.

- Enhanced Traceability and Transparency: Blockchain facilitates end-to-end traceability of commodities, from origin to destination. This is particularly important for ensuring the ethical sourcing of commodities and combating illicit activities. The ability to track the journey of a commodity helps verify its authenticity and compliance with regulations.

- Improved Access to Finance: Blockchain-based platforms can improve access to finance for smaller commodity traders who may have difficulty accessing traditional banking services. By providing a more transparent and efficient platform, blockchain can help reduce the perceived risk and make it easier for these traders to obtain financing.

- Challenges and Considerations: While the potential of blockchain is significant, challenges remain, including the need for industry-wide adoption, interoperability between different platforms, and regulatory clarity. The industry is working on addressing these challenges through standardization and collaboration.

Environmental, Social, and Governance (ESG) Factors Influencing Structured Trade Finance

ESG factors are increasingly influencing structured trade finance decisions. Investors and stakeholders are demanding greater transparency and accountability regarding the environmental and social impact of trade finance activities.

- Environmental Considerations: Environmental factors include the impact of commodity production and transportation on the environment, such as carbon emissions and deforestation. Trade finance institutions are increasingly evaluating the environmental performance of their clients and incorporating environmental criteria into their lending decisions.

- Social Considerations: Social factors include labor practices, human rights, and community engagement. Trade finance institutions are assessing their clients’ social performance, ensuring that they adhere to ethical standards and contribute positively to the communities in which they operate. This involves due diligence to ensure that labor standards are met and that communities are not negatively impacted by trade activities.

- Governance Considerations: Governance factors include corporate governance structures, transparency, and ethical conduct. Trade finance institutions are assessing their clients’ governance practices to ensure that they are well-managed and operate with integrity. This includes evaluating the client’s board of directors, management team, and compliance programs.

- Impact on Financing Decisions: ESG considerations are influencing financing decisions. Trade finance institutions are offering green financing products and incorporating ESG criteria into their risk assessments. Clients with strong ESG performance are more likely to receive favorable financing terms.

- Examples of ESG Integration:

- Green Trade Finance: Banks provide financing for transactions related to renewable energy, sustainable agriculture, and other environmentally friendly activities.

- Sustainable Supply Chain Finance: Banks offer financing to companies that are committed to sustainable sourcing and responsible supply chain practices.

- ESG-Linked Loans: Loan terms are linked to the borrower’s ESG performance, with incentives for achieving sustainability targets.

Case Studies

Understanding real-world applications of structured trade and commodity finance is crucial. Case studies provide valuable insights into how these financial instruments are deployed, the challenges encountered, and the strategies employed to mitigate risks and achieve successful outcomes. This section presents two case studies: one highlighting a successful transaction and another illustrating a deal that faced significant challenges.

Successful Structured Trade Finance Deal: Soybean Export from Brazil

This case study examines a structured trade finance deal involving the export of soybeans from Brazil to China. The deal showcases the application of various instruments and structures to facilitate a large-scale commodity trade.

The scenario involves a Brazilian soybean exporter, “Soja Brasil,” and a Chinese importer, “China Grains.” Soja Brasil needs financing to purchase soybeans from farmers, process the beans, and transport them to the port for shipment. China Grains requires a reliable supply of soybeans and seeks to secure favorable pricing. A bank, “Global Trade Bank,” steps in to provide the necessary financing and risk mitigation.

* The Structure: Global Trade Bank provides a pre-export finance facility to Soja Brasil. This involves a loan secured by the soybeans themselves, as well as receivables from China Grains.

* Key Instruments:

* Pre-export Finance: Global Trade Bank provides a short-term loan to Soja Brasil, based on the expected revenue from the soybean export.

* Letters of Credit (LC): China Grains opens a confirmed LC in favor of Soja Brasil, guaranteeing payment upon presentation of the required shipping documents. This mitigates the credit risk of China Grains.

* Commodity Price Hedging: Soja Brasil uses futures contracts on the Chicago Board of Trade (CBOT) to hedge against potential price fluctuations during the period between purchase and export.

* Insurance: Marine cargo insurance is purchased to protect against loss or damage to the soybeans during transit.

* Risk Mitigation Strategies:

* Credit Risk: Global Trade Bank assesses the creditworthiness of both Soja Brasil and China Grains. The confirmed LC from China Grains significantly reduces the credit risk.

* Commodity Price Risk: Hedging with futures contracts on the CBOT mitigates the risk of adverse price movements.

* Political Risk: Export credit insurance or political risk insurance might be considered to cover potential risks in Brazil or China.

* Operational Risk: Careful monitoring of the shipment, warehousing, and documentation processes is essential.

* Outcome: The deal is successfully executed. Soja Brasil receives the financing needed to purchase and export the soybeans. China Grains receives a reliable supply of soybeans at a predetermined price. Global Trade Bank earns fees and interest. The transaction benefits all parties involved. The successful completion of the deal demonstrates the effectiveness of structured trade finance in facilitating international commodity trade, ensuring access to essential goods, and supporting economic growth.

Challenged Structured Trade Finance Deal: Copper Concentrate Import to India

This case study illustrates a structured trade finance deal that encountered significant challenges. The deal highlights the importance of due diligence, robust risk management, and the potential pitfalls of complex commodity transactions.

The scenario involves an Indian importer, “India Metals,” seeking to import copper concentrate from a mine in a developing country. India Metals secures financing from a bank, “Trade Finance Bank,” to facilitate the import.

* The Structure: Trade Finance Bank provides a short-term trade finance facility to India Metals, secured by the copper concentrate.

* Key Instruments:

* Import Letter of Credit: Trade Finance Bank issues an import LC in favor of the exporter, guaranteeing payment upon presentation of the required shipping documents.

* Inventory Finance: The bank may provide financing against the copper concentrate stored in a bonded warehouse in India.

* Challenges and Issues:

* Quality Disputes: Upon arrival in India, India Metals disputes the quality of the copper concentrate, claiming it does not meet the specifications agreed upon in the sales contract. This leads to protracted negotiations and delays in payment.

* Price Volatility: The price of copper fluctuates significantly during the period of the transaction, impacting the value of the collateral.

* Political and Regulatory Risk: Changes in import regulations in India or political instability in the exporting country create uncertainty and potential disruptions.

* Fraud: There are allegations of misrepresentation of the quality or quantity of the copper concentrate, potentially involving collusion between various parties.

* Solutions and Mitigation Efforts:

* Independent Inspection: Prior to shipment, an independent inspection company is engaged to verify the quality and quantity of the copper concentrate.

* Detailed Contract Terms: The sales contract is reviewed and updated to include clear specifications, dispute resolution mechanisms, and penalties for non-compliance.

* Price Hedging: India Metals and Trade Finance Bank implement hedging strategies to mitigate the risk of price volatility.

* Insurance: Appropriate insurance coverage is put in place to cover potential risks, including cargo insurance and political risk insurance.

* Legal Action: The bank may pursue legal action to recover its funds if the disputes cannot be resolved amicably.

* Outcome: The deal faces significant delays and financial losses. The quality dispute and price volatility erode the value of the collateral. The bank incurs legal expenses and potential losses. The case underscores the critical importance of thorough due diligence, rigorous risk management, and the need for clear contractual agreements in structured trade finance transactions, especially those involving complex commodities and emerging market counterparties.

Comparative Analysis of Case Studies, Structured trade and commodity finance

This table compares and contrasts the two case studies, highlighting key differences and similarities.

| Feature | Soybean Export (Successful) | Copper Concentrate Import (Challenged) | Key Differences/Similarities |

|---|---|---|---|

| Commodity | Soybeans (agricultural commodity) | Copper Concentrate (industrial commodity) | Different commodities have different risk profiles. Agricultural commodities are subject to weather-related risks, while industrial commodities are influenced by global economic factors. |

| Transaction Type | Export | Import | The direction of the trade affects the documentation, regulations, and potential risks involved. Export transactions often benefit from established trade routes and infrastructure. |

| Counterparties | Brazilian exporter, Chinese importer | Indian importer, exporter from a developing country | The location and creditworthiness of counterparties influence the risk profile. Emerging market counterparties may present higher credit and political risks. |

| Risk Profile | Lower credit risk (confirmed LC), price hedging in place, relatively stable market | Higher credit risk, price volatility, quality disputes, potential for fraud | The level of risk significantly affects the structuring of the deal and the risk mitigation strategies employed. The copper concentrate deal had a higher overall risk profile. |

| Key Instruments | Pre-export finance, LC, commodity price hedging | Import LC, inventory finance | Both deals utilize LCs as a key instrument. Pre-export finance is common for exporters, while inventory finance is used for importers. |

| Outcomes | Successful execution, benefits for all parties | Delays, financial losses, disputes | The outcomes highlight the importance of effective risk management and thorough due diligence in structured trade finance. |

| Lessons Learned | Importance of robust risk management, clear contracts, and due diligence | The need for rigorous due diligence, robust risk mitigation, clear contractual agreements, and the selection of reliable counterparties. | Both case studies emphasize the critical role of risk management and due diligence in structured trade finance, regardless of the specific commodity or transaction type. |

Financing Structures for Different Commodities

Structured trade and commodity finance are highly adaptable, and financing strategies vary significantly based on the underlying commodity. This section delves into the specific financing structures used for crude oil, agricultural commodities, and contrasts financing approaches for soft versus hard commodities. Understanding these nuances is crucial for mitigating risks and optimizing transactions in this dynamic field.

Financing Structures for Crude Oil Transactions

Crude oil transactions necessitate sophisticated financing structures due to the high values, logistical complexities, and price volatility inherent in the market. These structures are designed to address these specific challenges.

Key financing structures employed include:

* Pre-export Financing: This involves providing funds to oil producers based on future oil exports. The lender secures the loan with an assignment of the export contracts and a lien on the oil. This structure is common in countries with significant oil reserves and can help producers access capital for exploration, development, or operational expenses.

* Borrowing Base Facilities: Banks provide a revolving credit facility, with the borrowing base determined by the value of the borrower’s proven oil reserves. The borrowing base is periodically reviewed and adjusted based on reserve valuations and market conditions. This provides flexibility for the borrower to draw down funds as needed.

* Reserve-Based Lending (RBL): Similar to borrowing base facilities, RBL relies on the value of the borrower’s oil reserves as collateral. However, RBL facilities typically have longer tenors and are often used for larger projects. The lender’s recovery is primarily dependent on the successful extraction and sale of the oil.

* Trade Finance Instruments: Letters of credit, guarantees, and documentary collections are frequently used to facilitate the trade of crude oil. These instruments mitigate the credit risk associated with the buyer and seller, ensuring payment and delivery of the oil.

* Structured Prepayments: These involve a buyer prepaying a seller for future oil deliveries. The prepayment is typically secured by an offtake agreement, which grants the buyer the right to purchase the oil at a predetermined price. This structure can be beneficial for both parties, providing the seller with immediate cash flow and the buyer with a secure supply of oil.

* Inventory Financing: This structure involves financing the storage of crude oil in tanks or terminals. The lender takes a security interest in the oil inventory and monitors its value to ensure the loan is adequately secured. This is particularly useful when the price of oil is expected to increase, allowing the borrower to profit from the price appreciation.

These structures are often combined and tailored to the specific needs of the transaction, the parties involved, and the prevailing market conditions. For example, a pre-export financing agreement might be combined with a letter of credit to provide additional security.

Financing Methods for Agricultural Commodity Trade

Agricultural commodity trade financing focuses on addressing the seasonality, perishability, and price volatility inherent in agricultural products. Financing structures are designed to support farmers, traders, and processors throughout the agricultural value chain.

Common financing methods include:

* Warehouse Receipt Financing: This structure involves providing loans secured by warehouse receipts, which represent ownership of stored commodities. The lender typically takes a security interest in the stored goods and monitors their quality and quantity. This provides farmers and traders with access to working capital while they wait for favorable market prices.

* Pre-Harvest Financing: This type of financing is provided to farmers before the harvest. It helps them cover the costs of planting, growing, and harvesting crops. The lender is typically secured by a lien on the future crop.

* Post-Harvest Financing: This provides financing to traders or processors after the harvest. The lender may take a security interest in the harvested crop or the processed product. This allows traders and processors to purchase and process commodities without tying up their own capital.

* Export Credit Agencies (ECAs): ECAs provide financing and guarantees to support the export of agricultural commodities. This can help exporters secure financing and mitigate the risk of non-payment by foreign buyers.

* Trade Finance Instruments: Letters of credit, guarantees, and documentary collections are widely used to facilitate agricultural commodity trade. These instruments help mitigate the credit risk associated with the buyer and seller, ensuring payment and delivery of the commodities.

* Supply Chain Finance: This involves optimizing the flow of funds within the agricultural supply chain. It allows farmers, traders, and processors to access financing more efficiently and at lower costs. This can include reverse factoring, where a buyer pays the supplier’s invoice early, or dynamic discounting, where suppliers offer discounts for early payment.

* Microfinance: In some developing countries, microfinance institutions provide small loans to farmers to support their agricultural activities. These loans can help farmers purchase inputs, improve their yields, and access markets.

The choice of financing method depends on various factors, including the type of commodity, the size of the transaction, the creditworthiness of the parties involved, and the prevailing market conditions. For example, financing for coffee beans might involve warehouse receipt financing, while financing for wheat exports could utilize export credit guarantees.

Differences in Financing Approaches: Soft Commodities vs. Hard Commodities

The financing approaches for soft commodities (agricultural products) and hard commodities (minerals and metals) differ significantly due to their inherent characteristics, market dynamics, and supply chain structures.

Key differences include:

* Perishability and Storage:

* Soft Commodities: Many soft commodities are perishable and require careful storage and handling. Financing structures must consider the risks of spoilage, quality degradation, and storage costs.

* Hard Commodities: Hard commodities are generally more durable and can be stored for extended periods without significant degradation. This simplifies storage and financing logistics.

* Seasonality:

* Soft Commodities: Agricultural production is highly seasonal, with harvests occurring at specific times of the year. Financing needs fluctuate based on the planting, growing, and harvesting cycles.

* Hard Commodities: Mining and production of hard commodities are less seasonal, allowing for more consistent financing needs.

* Price Volatility:

* Soft Commodities: Soft commodity prices are often subject to significant volatility due to weather conditions, disease outbreaks, and global demand fluctuations. Financing structures must incorporate risk mitigation strategies to address price risks, such as hedging.

* Hard Commodities: While hard commodity prices can also be volatile, they are often influenced by different factors, such as global economic growth, infrastructure development, and geopolitical events.

* Supply Chain Complexity:

* Soft Commodities: The agricultural supply chain is often more fragmented, involving numerous small farmers, traders, and processors. Financing often needs to be tailored to accommodate this complexity.

* Hard Commodities: The supply chain for hard commodities is often more concentrated, with fewer large producers and traders.

* Collateral:

* Soft Commodities: Collateral for soft commodity financing can include warehouse receipts, crop liens, and receivables. The value of the collateral can be affected by crop yields, market prices, and storage conditions.

* Hard Commodities: Collateral for hard commodity financing can include the commodity itself, mining assets, and offtake agreements. The value of the collateral is generally more stable, but can be influenced by global demand and production costs.

* Market Liquidity:

* Soft Commodities: The market for some soft commodities may be less liquid than the market for hard commodities, especially in certain regions or during specific times of the year.

* Hard Commodities: The market for many hard commodities is highly liquid, with active trading on global exchanges. This can facilitate financing by providing readily available market prices and hedging opportunities.

Understanding these differences is critical for structuring appropriate financing solutions that meet the specific needs and risks of each commodity type. For example, financing for coffee exports might involve a combination of pre-export financing, warehouse receipt financing, and hedging strategies to manage price volatility. In contrast, financing for copper concentrate could involve a borrowing base facility secured by the value of the copper reserves and a forward sale agreement.

Due Diligence and Compliance

Structured trade and commodity finance transactions are inherently complex, involving multiple parties, jurisdictions, and significant financial exposure. Rigorous due diligence and adherence to stringent compliance protocols are therefore critical to mitigate risks, ensure the integrity of transactions, and protect all stakeholders. This process helps to prevent financial crimes, reputational damage, and legal repercussions.

Importance of Thorough Due Diligence

Thorough due diligence is the cornerstone of responsible lending and investment in structured trade and commodity finance. It is a multifaceted process that extends beyond simply verifying the financial standing of a borrower. It involves a comprehensive assessment of the borrower, the underlying commodity, the transaction structure, and the involved parties.

Compliance Requirements for AML and KYC Regulations

Compliance with Anti-Money Laundering (AML) and Know-Your-Customer (KYC) regulations is a non-negotiable requirement in structured trade and commodity finance. These regulations are designed to prevent financial crimes, including money laundering and terrorist financing. Financial institutions and other participants must establish robust programs to identify, assess, and mitigate these risks.

The key components of AML/KYC compliance include:

- Customer Identification Program (CIP): This involves verifying the identity of the customer. This is achieved through various methods, including collecting identifying information like name, date of birth, address, and government-issued identification. For corporate entities, this extends to verifying the legal existence, ownership structure, and beneficial owners.

- Customer Due Diligence (CDD): This goes beyond basic identification to assess the customer’s risk profile. It involves gathering information about the customer’s business activities, the nature of the relationship, and the purpose of the transaction. This is essential for identifying potentially suspicious activity.

- Enhanced Due Diligence (EDD): EDD is required for higher-risk customers, such as those operating in high-risk jurisdictions or involved in complex transactions. It involves more in-depth scrutiny, including enhanced transaction monitoring and scrutiny of the source of funds.

- Transaction Monitoring: Ongoing monitoring of transactions is critical to detect suspicious activity. This involves setting up automated systems to flag unusual transactions, such as large cash deposits, transactions with high-risk countries, or transactions that deviate from the customer’s normal activity.

- Reporting Suspicious Activity: Financial institutions are required to report suspicious transactions to the relevant authorities, such as the Financial Crimes Enforcement Network (FinCEN) in the United States or the Financial Conduct Authority (FCA) in the United Kingdom. This reporting is crucial for law enforcement to investigate potential financial crimes.

Step-by-Step Procedure for Conducting Due Diligence

A structured, step-by-step approach is essential for effective due diligence in structured trade finance. This procedure ensures that all critical aspects of the transaction are thoroughly examined.

- Initial Assessment and Screening: This is the first step, involving a preliminary review of the proposed transaction. It includes a high-level assessment of the commodity, the parties involved, and the proposed financing structure. This stage also involves screening against sanctions lists, politically exposed persons (PEPs) lists, and negative news databases to identify potential red flags.

- Customer Identification and Verification: This involves verifying the identity of all parties involved, including the borrower, the seller, the buyer, and any guarantors. This is where KYC procedures are implemented. For corporate entities, this involves obtaining and verifying corporate documents, such as articles of incorporation, certificates of good standing, and information on ownership and control.

- Creditworthiness Assessment: A thorough assessment of the borrower’s creditworthiness is crucial. This involves analyzing financial statements, including balance sheets, income statements, and cash flow statements, to assess the borrower’s ability to repay the financing. It also includes an assessment of the borrower’s credit history and industry experience.

- Transaction Structure Review: The proposed transaction structure is carefully reviewed to identify potential risks. This includes assessing the security arrangements, the payment terms, and the underlying contracts. Legal counsel should be involved to review all relevant documentation.

- Commodity Due Diligence: This involves assessing the commodity itself, including its market value, storage and transportation logistics, and any associated risks. This can include verifying the quality of the commodity, ensuring proper insurance coverage, and assessing the risk of price volatility.

- Counterparty Due Diligence: The due diligence process extends to all counterparties involved in the transaction, including suppliers, buyers, and intermediaries. This involves assessing their creditworthiness, reputation, and compliance with AML/KYC regulations.

- Site Visits and Inspections: Site visits and inspections may be necessary, especially for commodity storage facilities or production sites. This provides firsthand verification of the commodity’s existence, condition, and storage arrangements. These visits also allow for assessment of operational and environmental risks.

- Ongoing Monitoring and Review: Due diligence is not a one-time process. Ongoing monitoring and review of the transaction are essential to identify and mitigate emerging risks. This includes monitoring the borrower’s financial performance, tracking commodity prices, and ensuring compliance with all contractual obligations.

- Documentation and Reporting: All due diligence findings must be thoroughly documented, and reports should be prepared for the relevant stakeholders. This documentation should be maintained throughout the life of the transaction and be readily available for review by regulators and auditors.

Emerging Markets and Structured Finance

Structured trade finance plays a crucial role in facilitating economic growth in emerging markets, offering essential funding for commodity transactions and international trade. However, these markets also present unique challenges. Understanding both the opportunities and the hurdles is vital for successful implementation of structured finance solutions.

Opportunities and Challenges of Structured Trade Finance in Emerging Markets

Emerging markets offer significant opportunities for structured trade finance due to their reliance on commodity exports and imports. However, several challenges must be addressed.

- Increased Trade Volume and Economic Growth: Emerging markets often experience rapid economic expansion, leading to increased demand for commodities and manufactured goods, driving trade volume and requiring financing solutions.

- Access to Resources and Market Expansion: These markets often possess significant natural resources, creating opportunities for commodity-backed financing and facilitating access to global markets.

- Higher Yields and Returns: Due to the perceived higher risk, structured trade finance in emerging markets can offer higher returns compared to developed markets, attracting investors.

- Political and Economic Instability: Political instability, currency fluctuations, and sovereign risk can significantly impact the viability of trade finance transactions.

- Lack of Infrastructure: Inadequate infrastructure, including ports, transportation networks, and storage facilities, can create logistical challenges and increase transaction costs.

- Regulatory and Legal Frameworks: Inconsistent or underdeveloped legal and regulatory frameworks can lead to uncertainty and difficulties in enforcing contracts.

- Information Asymmetry and Transparency: Lack of transparency in financial reporting and information asymmetry can make it difficult to assess creditworthiness and manage risk.

- Currency Risk: Currency fluctuations can significantly impact the value of transactions and the ability of borrowers to repay their obligations.

The Role of Development Finance Institutions (DFIs)

Development Finance Institutions (DFIs) are critical players in supporting commodity finance in emerging markets, mitigating risks, and fostering sustainable development.

- Risk Mitigation: DFIs often provide guarantees, political risk insurance, and other forms of credit enhancement to mitigate risks associated with emerging market transactions. This is particularly crucial in regions with high political or economic volatility.

- Capacity Building: DFIs provide technical assistance and training to local banks and businesses, improving their capacity to participate in structured trade finance transactions. This fosters a more robust and sustainable financial ecosystem.

- Long-Term Financing: DFIs often offer longer-term financing options than commercial banks, which is crucial for projects with extended repayment periods, such as infrastructure development or large-scale commodity projects.

- Catalyzing Private Sector Investment: By providing financing and risk mitigation tools, DFIs attract private sector investment in emerging markets, supplementing local resources and fostering economic growth.

- Focus on Sustainability and Social Impact: Many DFIs prioritize projects with positive environmental and social impacts, ensuring that financing supports sustainable development and responsible business practices.

Visual Representation of Goods Flow in a Structured Trade Finance Transaction

A descriptive account of a visual representation illustrates the flow of goods in a structured trade finance transaction in an emerging market. This example focuses on the export of coffee beans from a fictitious country, “Zambia,” to a buyer in “Germany.”

The illustration would be a flowchart.

The process begins with the Zambian coffee farmer, who has an agreement to sell his coffee to a local Zambian exporter. The exporter, in turn, has a sales contract with a German importer.

1. Pre-shipment financing: A Zambian bank provides pre-shipment financing to the exporter, secured by a pledge of the coffee beans. The bank might also require the exporter to obtain a credit insurance policy to cover the risk of non-payment by the German importer. The DFI might provide a guarantee to the Zambian bank to reduce the bank’s risk exposure.

2. Goods Preparation and Transportation: The coffee beans are harvested, processed, and prepared for export. They are then transported to a warehouse. The warehouse operator issues a warehouse receipt, which serves as proof of ownership of the coffee beans.

3. Shipping and Documentation: The coffee beans are loaded onto a ship. The exporter prepares the necessary shipping documents, including a bill of lading, which represents title to the goods.

4. Letter of Credit (L/C) Issuance and Confirmation: The German importer opens a Letter of Credit (L/C) with their bank in Germany in favor of the Zambian exporter. The Zambian exporter’s bank (the advising bank) receives the L/C and advises the exporter. The L/C guarantees payment to the exporter, provided they present the required documents. A DFI could have guaranteed this L/C.

5. Document Presentation and Payment: Once the coffee beans have shipped, the exporter presents the shipping documents (bill of lading, commercial invoice, etc.) to the advising bank. The advising bank checks the documents for compliance with the L/C terms. If the documents are in order, the bank forwards them to the German importer’s bank (the issuing bank). The issuing bank then makes payment to the exporter’s bank, which, in turn, credits the exporter’s account.

6. Goods Arrival and Sale: The coffee beans arrive in Germany. The German importer takes possession of the goods. The importer sells the coffee beans to coffee roasters and retailers. The proceeds from the sale of the coffee are used to repay the importer’s obligations to its bank.

The visual representation would show the circular flow of funds and goods, highlighting the roles of each party and the key documents involved. The inclusion of a DFI would be clearly marked to illustrate its role in risk mitigation and providing financial support.