Introduction to Surf Trip Travel Insurance

Surf trip travel insurance is a crucial component of any surf adventure. It provides financial protection against unforeseen circumstances that can disrupt your trip, from medical emergencies to lost luggage or trip cancellations. A well-structured policy can provide peace of mind, allowing you to fully immerse yourself in the thrill of surfing and the beauty of your destination without worrying about the financial implications of unexpected events.

Importance of Travel Insurance for Surf Trips

Surf trips, often involving remote locations and potentially hazardous activities, amplify the need for comprehensive travel insurance. Unexpected injuries, illnesses, or equipment malfunctions can lead to significant expenses, especially when far from home. Insurance safeguards against these potential financial burdens, allowing you to focus on the surfing experience instead of worrying about costs.

Protecting your surf trip is crucial, and travel insurance is a must. But what about your gear? Packing light is key, and the ulanzi zero y lightweight travel tripod is perfect for capturing those epic waves without the extra baggage. It’s super portable and sturdy, making it ideal for all your surf adventures. Ultimately, having good surf trip travel insurance is the best way to make sure your trip goes off without a hitch, whether you’re capturing memories with your gear or just enjoying the ride!

Common Reasons Surf Trip Travelers Need Insurance

Many unforeseen events can disrupt a surf trip, making insurance a necessity. These include medical emergencies, such as injuries sustained during surfing or illnesses contracted during travel. Trip cancellations due to unforeseen circumstances, like weather events or personal emergencies, can also lead to significant financial losses. Furthermore, lost or damaged luggage can disrupt your trip and lead to expenses for replacement items. Finally, travel delays or disruptions can cause unforeseen expenses and lost time.

Thinking about booking that epic surf trip? Don’t forget travel insurance! It’s crucial for covering unexpected issues, especially if you’re heading off the beaten path. For a taste of adventure, check out some recent Timbuktu travel reviews to get a sense of what to expect. timbuktu travel reviews Will you need a specific type of coverage for extreme sports like surfing?

It’s worth doing your research and getting the right policy before you go! Having insurance can give you peace of mind, allowing you to fully enjoy your surfing adventure.

Typical Coverage Provided by Surf Trip Travel Insurance Policies

Surf trip travel insurance policies typically offer a wide range of coverages. These policies usually include medical expenses, covering costs associated with medical care, hospitalization, and repatriation in case of an emergency. They often include trip cancellation and interruption coverage, reimbursing you for non-refundable expenses if your trip is canceled or interrupted due to unforeseen events. Furthermore, lost or damaged baggage coverage helps to replace essential items if your luggage is lost or damaged during your travels. Additionally, policies commonly provide coverage for accidental death and dismemberment, offering financial protection to your loved ones in case of a tragedy.

Comparison of Different Types of Surf Trip Travel Insurance

| Insurance Type | Coverage | Cost | Suitable For |

|---|---|---|---|

| Basic | Covers essential aspects like medical emergencies, trip cancellations, and lost luggage. Often has limited coverage amounts and exclusions. | Generally more affordable | Budget-conscious travelers with minimal needs and predictable trips. |

| Comprehensive | Provides broader coverage, including a wider range of medical expenses, trip disruptions, and more extensive baggage coverage. Often includes higher coverage limits and fewer exclusions. | Higher cost | Adventurous travelers, those traveling to remote locations, or those with pre-existing conditions. |

The table above highlights the varying levels of protection offered by different insurance types. Careful consideration of your needs and budget will help you choose the most appropriate policy.

Coverage Considerations for Surf Trip Insurance

Protecting your investment in a surf trip goes beyond just packing your board and sunscreen. A comprehensive travel insurance policy is crucial for navigating the unexpected, ensuring your trip remains enjoyable and worry-free. From thrilling waves to potential mishaps, proper coverage is vital for a safe and successful surf adventure.

Proper surf trip insurance can cover a range of unforeseen circumstances, from medical emergencies to equipment loss, and everything in between. This comprehensive approach is essential for safeguarding your well-being and your financial investment in the trip. Understanding the specific types of coverage needed and comparing different policies is key to making the right decision.

Water Sports Coverage

Surf trips inherently involve water sports. This type of activity necessitates specialized coverage that extends beyond standard travel insurance. A robust policy should address injuries sustained during surfing, paddleboarding, or other water-based activities. This includes potential medical expenses, lost wages due to injury, and even emergency evacuation if required.

Medical Emergencies Coverage

Medical emergencies can strike anywhere, anytime. During a surf trip, access to quality medical care might be limited. A strong travel insurance policy should include coverage for medical expenses, including hospital stays, surgeries, and doctor’s visits. Consider policies that specify coverage for pre-existing conditions and the extent of coverage for ambulance services or airlifts in remote locations. Crucially, check for limitations in coverage based on the location of your surf trip.

Trip Cancellation or Interruption Coverage

Unexpected events can disrupt even the best-laid travel plans. A surf trip is no exception. Insurance policies that cover trip cancellations or interruptions due to unforeseen circumstances, like illness, natural disasters, or even flight delays, are crucial. This coverage can help mitigate financial losses and provide a sense of security knowing you are protected against unexpected changes.

Adventure Activities Coverage

Surf trips often involve a range of adventure activities beyond simply surfing. This could include kayaking, rock climbing, or hiking. Adventure activities coverage is critical for protecting against injuries, accidents, or equipment malfunctions during these activities. The policy should explicitly state the types of activities covered and the limits of coverage for injuries sustained during them.

Equipment Damage Coverage

Surfboards, wetsuits, and other equipment are essential components of a surf trip. Insurance policies should include coverage for damage or loss of this equipment due to theft, accidental damage, or unforeseen circumstances. This protection is vital for ensuring your investment in equipment is safeguarded during your trip.

Potential Scenarios for Surf Trip Insurance

- Equipment Damage: A strong surf trip policy would cover a damaged surfboard due to a mishap during a particularly rough surf session.

- Injury during Surfing: A surfer injured while catching a wave and requiring medical attention and a trip to the hospital would be covered by insurance.

- Trip Cancellation due to Illness: If you fall ill before or during your surf trip, the policy should cover the cost of canceling the trip or getting you home.

- Lost Luggage: The policy should provide coverage for lost luggage containing your surf equipment.

Selecting a Travel Insurance Policy for Surfing Trips

- Coverage Limits: Carefully review the policy’s limits for medical expenses, trip cancellations, and other potential claims. Be aware of any deductibles or out-of-pocket expenses.

- Exclusions: Identify any activities or circumstances that are specifically excluded from coverage. For example, some policies may not cover injuries sustained while engaging in risky or reckless behavior.

- Reputation and Customer Reviews: Look into the reputation of the insurance provider. Read customer reviews to get an idea of their handling of claims and overall customer service.

- Read the Fine Print: Understand the policy’s terms and conditions. Be clear on any limitations or exclusions, especially related to water sports and adventure activities.

Insurance Provider Comparison Table, Surf trip travel insurance

| Insurance Provider | Water Sports Coverage | Medical Emergencies Coverage | Adventure Activities Coverage | Trip Cancellation Coverage |

|---|---|---|---|---|

| Company A | Yes (limited) | Yes (comprehensive) | Yes (moderate) | Yes (moderate) |

| Company B | Yes (extensive) | Yes (limited) | Yes (extensive) | Yes (extensive) |

| Company C | Yes (comprehensive) | Yes (comprehensive) | Yes (comprehensive) | Yes (comprehensive) |

Essential Features and Benefits: Surf Trip Travel Insurance

Surf trip travel insurance isn’t just about covering your gear; it’s about protecting your entire trip. This comprehensive insurance goes beyond basic travel insurance, addressing the unique risks and adventures inherent in surfing. Crucially, it safeguards not only your financial well-being but also your physical safety and enjoyment of the trip.

Understanding the specific features and benefits of surf trip insurance is paramount for making an informed decision. This helps you tailor the coverage to your individual needs and budget, ensuring you’re adequately protected during your surf adventure.

Key Features Differentiating Surf Trip Insurance

Surf trip insurance often includes specialized coverage for activities like surfing, paddleboarding, and other water sports. This coverage can include provisions for medical emergencies related to these activities, such as injuries sustained while surfing or during a paddleboarding session. This distinguishes it from standard travel insurance policies that may not offer the same level of protection for water-sport-related injuries. It also typically includes provisions for lost or damaged surfboards, wetsuits, and other surf-specific equipment. This specialized coverage is a significant differentiator and should be a primary consideration for any surfer planning a trip.

Benefits for Peace of Mind

Surf trip insurance provides peace of mind by covering unforeseen circumstances, including medical expenses, trip cancellations, and lost or damaged belongings. Having this protection allows you to fully immerse yourself in the surf without worrying about financial burdens or logistical issues. It removes the anxiety associated with potential emergencies, allowing you to focus on enjoying your surf adventure.

Examples of Assistance in Unforeseen Circumstances

Imagine a situation where you break your surfboard during a surfing session. Surf trip insurance can cover the cost of repairing or replacing your damaged board. Or, consider the scenario of a sudden illness or injury while on a surf trip. The insurance policy can cover the medical expenses and any associated travel costs. Furthermore, if you need to cancel your trip due to a severe illness or injury, some policies will cover non-refundable expenses. These are just a few examples of how surf trip insurance can assist in unforeseen circumstances, offering a safety net for the unexpected.

Advantages and Disadvantages of Different Plans

Different surf trip travel insurance plans offer varying levels of coverage and price points. Some plans may cover a broader range of activities, such as extreme sports, while others may focus specifically on surfing-related incidents. Carefully comparing different plans and reading the fine print is essential to understand the coverage details. Understanding the coverage limitations is crucial, ensuring that you are aware of what is and isn’t covered under each policy. This can help you select a plan that aligns with your budget and needs.

Common Exclusions in Surf Trip Travel Insurance

| Category | Typical Exclusions |

|---|---|

| Pre-existing Conditions | Conditions that existed before the policy’s effective date, unless specifically covered by an add-on or rider. |

| Intentional Acts | Injuries or damages resulting from intentional actions. |

| Illegal Activities | Injuries or damages incurred during illegal activities. |

| Self-inflicted Injuries | Injuries caused by the insured’s own negligence or reckless behavior. |

| Extreme Sports (beyond coverage limits) | Activities deemed too dangerous or exceeding the policy’s stated coverage limits. |

Policies vary, so always review the specific terms and conditions of the chosen plan. Thorough examination of exclusions is crucial for a comprehensive understanding of the insurance coverage.

Types of Surf Trip Travel Insurance

Choosing the right surf trip travel insurance is crucial for a smooth and worry-free adventure. Different policies cater to varying needs and experience levels, ensuring you’re protected against unforeseen circumstances. Understanding the various types available is key to making an informed decision.

Comprehensive vs. Specific Activity-Based Policies

Comprehensive travel insurance policies offer broad coverage for a wide range of situations, including trip cancellations, medical emergencies, and lost belongings. However, they may not always provide the specific level of protection needed for activities like surfing. Activity-based insurance policies, on the other hand, focus on particular activities, providing tailored coverage for those specific risks. For instance, a surfing-specific policy might cover injuries sustained while surfing, while a general policy might not provide the same level of detail. A careful assessment of your specific needs is essential when choosing between these options.

Policies for Beginners and Experienced Surfers

The level of coverage required often varies based on a surfer’s experience. Beginners might require more comprehensive medical coverage for potential minor injuries, while experienced surfers, who are often engaging in more challenging maneuvers, may need more specific protection against injuries resulting from more intense activities. Insurance providers understand these differing needs and frequently offer policies tailored to beginner or experienced surfer profiles.

Importance of Reading Policy Terms and Conditions

Before purchasing any travel insurance, meticulously review the policy terms and conditions. This document Artikels the specifics of coverage, exclusions, and limitations. A thorough understanding of the fine print is essential to avoid surprises or disappointments in the event of a claim. Pay close attention to details like the maximum coverage amounts, the types of activities covered, and the specific conditions under which a claim will be approved. Policies often have specific language and definitions, and it’s critical to understand them completely.

Comparison of Insurance Options

| Insurance Type | Benefits | Drawbacks |

|---|---|---|

| Comprehensive Travel Insurance | Broad coverage for various situations; often includes trip cancellation, medical emergencies, and lost belongings. | Might not provide sufficient coverage for surfing-specific risks; may have higher premiums. |

| Activity-Based (Surfing) Insurance | Tailored coverage for surfing-related injuries and equipment loss; may offer lower premiums for surfers. | Limited coverage for other aspects of travel; may not cover all possible situations. |

| Beginner Surfer Policy | Often includes more extensive medical coverage for potential minor injuries, providing peace of mind for those new to surfing. | Might have higher premiums; specific coverage may be limited. |

| Experienced Surfer Policy | Specific coverage for more demanding surfing activities, like advanced maneuvers; may include coverage for more serious injuries. | Coverage might not be as extensive for non-surfing related incidents. |

This table provides a basic comparison, but policy specifics can vary significantly. Always check with the insurer for precise details before making a decision.

Claims Process and Procedures

Navigating the insurance claims process can feel daunting, especially when dealing with an unexpected surf trip incident. This section Artikels the steps involved in making a claim, common reasons for denials, and how to effectively document events to maximize your chances of a successful claim. Understanding these procedures is crucial for a smooth and efficient claim resolution.

Understanding the claim process ensures you’re prepared for potential issues and can take proactive steps to strengthen your case. Knowing what to expect, and how to best document incidents, can dramatically improve your chances of a successful claim outcome.

Steps Involved in Making a Surf Trip Insurance Claim

A well-structured claim process, starting with the initial report, is key. The precise steps may vary depending on the specific insurance provider and policy, but generally, the process follows these stages:

- Initial Contact and Reporting: Immediately contact your insurance provider and report the incident. Provide details about the incident, including the date, time, location, and any witnesses. This initial report acts as the starting point for the claims process.

- Documentation Gathering: Collect all relevant documentation, including medical records, police reports (if applicable), witness statements, photographs of the damage or injury, and any other supporting evidence.

- Claim Form Submission: Complete the insurance claim form accurately and completely, providing all necessary information requested by the provider. Be thorough in your answers and submit any supporting documents mentioned in the form.

- Medical Treatment and Evaluation: If applicable, follow any instructions from the insurance provider regarding medical treatment. They may require documentation of medical care to evaluate the extent of the injury and assess its relation to the incident.

- Evaluation and Decision: The insurance company will review the claim, supporting documents, and medical records to assess coverage and determine the claim’s validity.

- Settlement or Denial: The insurance provider will either approve the claim and initiate the payment process, or deny the claim with an explanation of the reason for denial.

Common Reasons for Insurance Claim Denials

Understanding why a claim might be denied can help you avoid future issues. Common reasons include:

- Pre-existing Conditions: If the injury or condition existed prior to the surf trip and is not directly related to the incident, the claim might be denied.

- Lack of Proper Documentation: Insufficient or incomplete documentation, such as missing medical records, witness statements, or photographs, can lead to claim denial.

- Failure to Adhere to Policy Terms: Not following policy guidelines, such as failing to notify the insurer within the specified timeframe, or not seeking necessary medical treatment, can invalidate the claim.

- Activities Outside Policy Coverage: Engaging in activities not covered by the policy, like reckless or prohibited actions, could result in claim denial.

- Non-Accidental Events: If the injury is the result of a non-accident, like a pre-existing condition aggravated by the trip, the claim may not be covered.

Effective Documentation for Insurance Claims

Thorough documentation is crucial for a successful claim.

- Photographs: Capture photographs of the incident site, injuries, and any relevant damage. Include the date, time, and location of the photo.

- Medical Records: Maintain detailed records of all medical treatment received, including diagnoses, dates of treatment, and any prescriptions.

- Witness Statements: If possible, obtain written statements from witnesses to the incident, detailing what they observed.

- Police Reports: If the incident involved police involvement, ensure you obtain a copy of the police report.

- Detailed Account: Write a detailed account of the incident, outlining the circumstances, the sequence of events, and the extent of your injuries.

Importance of Timely Reporting for Insurance Claims

Reporting your claim promptly is essential for maximizing your chances of a successful claim. Insurance policies often include deadlines for reporting incidents.

- Policy Requirements: Review your insurance policy for the specific reporting timeframe. Adherence to these timelines is crucial for claim processing.

- Fresh Evidence: Timely reporting helps preserve evidence that might be lost or become less reliable with time.

- Prevent Delay: Reporting promptly reduces potential delays in the claim process.

Step-by-Step Procedure for Filing a Claim for a Surf Trip Accident

A well-organized process is vital. Follow these steps for filing a surf trip accident claim:

- Contact Your Insurer Immediately: Notify your insurance provider about the accident as soon as possible. Provide the details of the incident.

- Gather Evidence: Collect all relevant documents and evidence, including medical records, photographs, and witness statements.

- Complete the Claim Form: Fill out the claim form accurately, providing all required information.

- Submit Documentation: Submit all gathered evidence to your insurer, ensuring it’s organized and clearly labeled.

- Follow Up: Regularly follow up with your insurer to ensure the claim is being processed and understand the next steps.

Comparing Insurance Providers

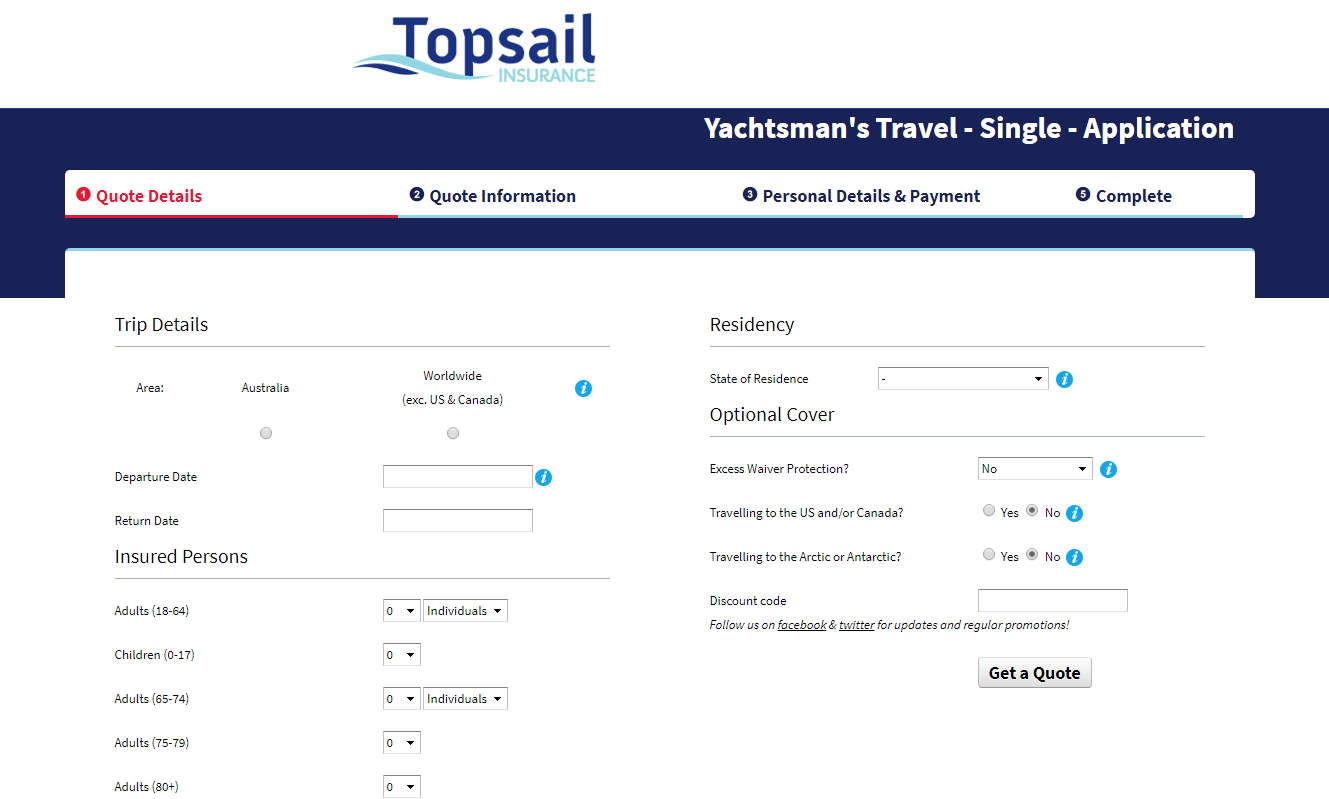

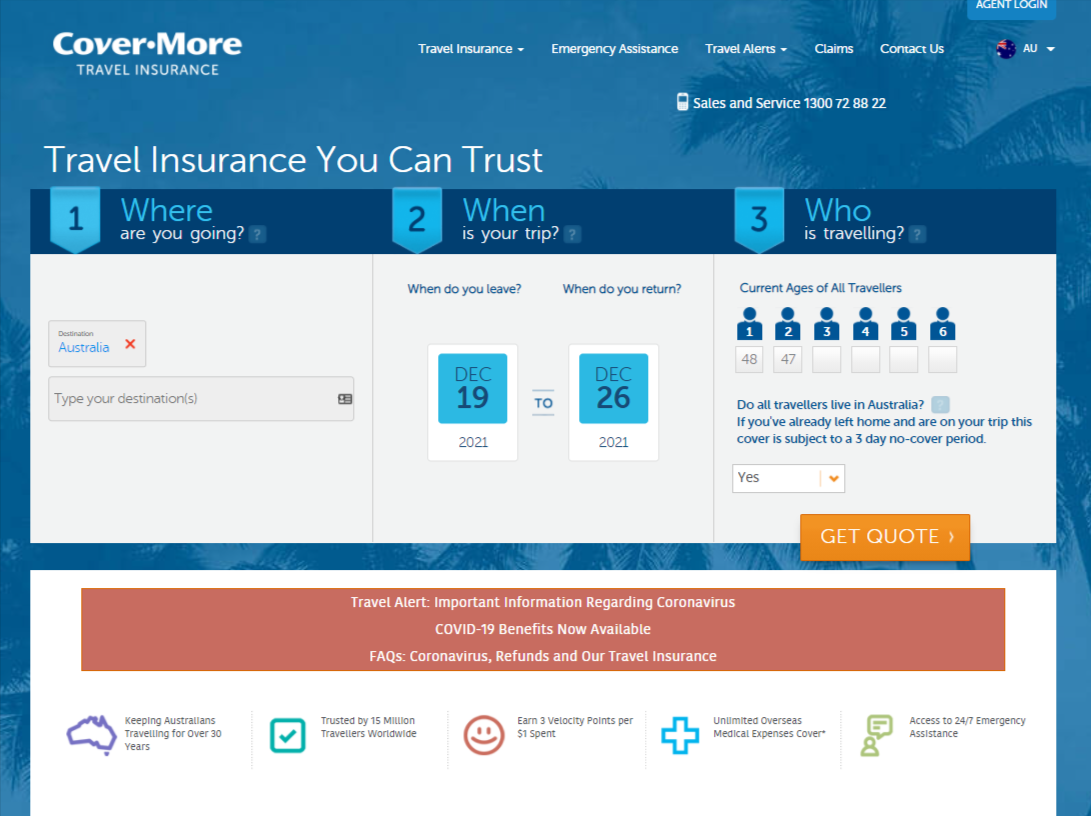

Choosing the right surf trip travel insurance can be tricky, with many providers vying for your business. It’s crucial to understand the nuances of different policies and compare them based on your specific needs and the nature of your surf trip. A well-researched decision will help you enjoy your surf adventure without worrying about unforeseen circumstances.

Careful consideration of various factors, like coverage limits, cancellation policies, and medical expense reimbursements, will help you select the best fit for your surf trip. Comparing pricing and coverage options amongst different providers is a key step in ensuring you get the most value for your money.

Factors to Consider When Choosing a Provider

Comparing insurance providers requires careful consideration of multiple aspects. Coverage limits for medical expenses, lost luggage, and trip cancellations are vital to evaluate. Specific surfing-related activities and risks should also be factored in, such as potential injuries from waves or accidents during surf lessons. Read the fine print carefully to ensure that the policy covers the specific type of surf activities you plan to undertake. Assess the provider’s reputation and customer service reviews. A reputable provider with responsive and helpful customer service can be invaluable if you encounter problems during your trip.

Reputable Insurance Providers for Surf Trips

Several reputable insurance companies offer specialized surf trip travel insurance. Some popular and well-regarded providers include:

- Travel Guard: Known for comprehensive coverage options, including adventure activities.

- World Nomads: A popular choice for adventurous travelers, including surfers, with a focus on flexibility and ease of use.

- Allianz Global Assistance: A large and established provider offering a wide range of travel insurance plans, including surf-specific options.

- SafetyWing: A more budget-friendly option, known for providing travel insurance with strong coverage for adventure activities.

Pricing and Coverage Options Comparison

Pricing and coverage options vary significantly among insurance providers. This often depends on factors such as the duration of your trip, the destination, the level of coverage you need, and the specific activities you’ll be engaging in. Some providers may offer lower premiums for shorter trips or basic coverage, while others may provide higher premiums for comprehensive coverage and extensive adventure activities. It is important to carefully evaluate the pricing structure, and the coverage level for each policy before making a decision.

Pros and Cons of Different Surf Trip Insurance Providers

The following table summarizes the pros and cons of various surf trip insurance companies, providing a concise comparison. This helps to understand the strengths and weaknesses of each provider.

| Insurance Provider | Pros | Cons |

|---|---|---|

| Travel Guard | Comprehensive coverage options, strong reputation | Potentially higher premiums compared to other providers |

| World Nomads | Flexibility, ease of use, good coverage for adventure activities | Limited customer service options in some cases |

| Allianz Global Assistance | Wide range of plans, established provider | May have less competitive pricing for surf-specific plans |

| SafetyWing | Budget-friendly option, good coverage for adventure activities | Potentially less comprehensive coverage compared to other providers |

Customer Reviews

Customer reviews provide valuable insights into the experiences of past policyholders. For example, many reviews praise Travel Guard for their comprehensive coverage and responsive customer service, especially when dealing with medical emergencies during surf trips. World Nomads is often commended for its ease of use and the flexibility of their policies. However, some reviews highlight a lack of readily available customer support with World Nomads. Allianz Global Assistance receives mixed reviews, with some praising their wide range of plans, while others find their pricing less competitive. SafetyWing often receives positive feedback for their affordable pricing, but some customers report limitations in coverage for specific adventure activities.

Cost and Value Considerations

Surf trip travel insurance isn’t just about peace of mind; it’s about protecting your investment in an awesome adventure. Understanding the cost and how it relates to the value you receive is crucial to making the right choice. A well-chosen policy can save you from significant financial hardship if something unexpected happens, while an overpriced or inadequate policy could leave you vulnerable.

Evaluating the cost of surf trip insurance requires a careful look at the potential risks you face. Factors like the length of your trip, the destination’s remoteness, and the specific activities you plan to participate in all influence the appropriate level of coverage and, consequently, the premium.

Average Cost of Surf Trip Travel Insurance

The average cost of surf trip travel insurance varies considerably. It depends on the insurer, the duration of your trip, the type of activities you’ll be engaging in, and the level of coverage. A trip to a popular surf destination like California or Hawaii during peak season, with extensive activities, will likely cost more than a shorter trip to a less populated area.

Cost vs. Coverage Level

The cost of surf trip insurance is directly related to the scope of coverage. Policies with broader coverage for medical expenses, trip interruptions, and lost luggage will typically command a higher premium. Policies with more limited coverage, such as those only covering trip cancellations, will be less expensive.

Evaluating Value Against Potential Risks

To determine the value of surf trip insurance, consider the potential financial implications of unforeseen circumstances. For example, a serious injury requiring extensive medical treatment in a foreign country could result in exorbitant costs. If you’re travelling with significant assets or debts, this aspect of insurance becomes even more critical. The premium might seem high, but the protection it offers can be invaluable.

Price Comparisons for Different Surf Trip Travel Insurance Packages

| Insurance Provider | Package A (Basic) | Package B (Standard) | Package C (Comprehensive) |

|---|---|---|---|

| SurfSafe | $75 | $150 | $250 |

| OceanBound | $80 | $175 | $300 |

| WaveRider | $60 | $120 | $200 |

Note: Prices are estimates and may vary based on individual circumstances. These are examples and do not represent all available providers.

Budget-Friendly Options for Surf Trip Insurance

Many budget-friendly options exist. Focus on policies that cover the essential aspects of your trip, such as medical emergencies and trip cancellations.

- Consider shorter trips: The cost per day of insurance decreases with shorter trips.

- Choose travel insurance providers that specialize in surf trips: These companies may offer more tailored packages at competitive rates.

- Look for discounts: Some insurers offer discounts for students, young adults, or groups traveling together.

- Compare policies carefully: Don’t assume that a lower price means a lower level of coverage. Read the policy details thoroughly.

Tips for Choosing the Right Policy

Choosing the right surf trip travel insurance is crucial for a worry-free adventure. A well-selected policy protects you against unforeseen circumstances, from minor mishaps to major emergencies. Understanding the nuances of different policies and carefully considering your specific needs are key to making an informed decision.

A comprehensive understanding of the policy’s exclusions and limitations is vital. This allows you to anticipate potential gaps in coverage and tailor your choices accordingly. By comparing policies based on your specific needs, you can ensure you’re selecting a plan that adequately addresses your concerns.

Understanding Policy Exclusions and Limitations

Policy exclusions and limitations define situations where coverage won’t apply. These are essential to understand to avoid unpleasant surprises. Carefully scrutinize these clauses to pinpoint potential gaps in coverage. For example, a policy might exclude pre-existing medical conditions, or injuries resulting from reckless behavior.

Comparing Policies Based on Specific Needs

When comparing policies, consider factors such as the duration of your trip, the level of adventure, and your personal health. A policy for a week-long beginner’s surf trip will likely differ significantly from a month-long expedition involving advanced surfing and potentially more challenging activities.

Questions to Ask When Selecting Surf Trip Travel Insurance

Several questions can help you evaluate a policy’s suitability:

- Does the policy cover medical expenses, including emergency evacuation?

- Does the policy cover lost or damaged belongings, including surfboards and gear?

- Does the policy cover trip cancellations or interruptions due to unforeseen circumstances?

- What are the maximum payout limits for various covered events?

- Are there any specific exclusions related to surfing activities (e.g., injuries from surfing-related incidents)?

- What is the claims process and how long does it typically take to receive a payout?

Verifying Insurance Provider Legitimacy

Ensure the insurance provider is reputable and financially stable. Check for accreditation from reputable industry organizations. Review online reviews and ratings from past policyholders. Contacting the provider directly for clarification on specific clauses and coverage details is another vital step. Verify the provider’s licensing and financial stability through online resources and official documents.

Checklist for Choosing Surf Trip Insurance

This checklist can help you systematically evaluate different policies:

- Policy Duration: Does the coverage align with the duration of your trip?

- Coverage Limits: Are the payout limits sufficient for your needs?

- Exclusions: Are there any exclusions that could affect your trip?

- Claims Process: Is the claims process straightforward and efficient?

- Provider Reputation: Is the provider reputable and financially stable?

- Customer Service: Are there sufficient contact channels to address concerns?

- Cost-Benefit Analysis: Does the coverage justify the premium cost?

Illustrative Case Studies

Real-world examples often illustrate the importance and effectiveness of surf trip travel insurance more clearly than abstract descriptions. These case studies highlight various scenarios, from successful claims to situations where coverage was denied, providing valuable insights into how the insurance works in practice.

Successful Insurance Claim for a Surf Trip

Sarah, a seasoned surfer, experienced a debilitating ankle injury during a surf trip. She had comprehensive surf trip insurance that covered medical expenses. Her claim was processed smoothly, and she received reimbursement for all medical bills, including hospital stays, physiotherapy, and prescription medications. The insurance company’s prompt handling of her claim allowed her to focus on her recovery rather than the financial burden.

Scenario of Insurance Coverage Denial

Mark booked a surf trip to a remote location with limited medical facilities. He had surf trip insurance but did not disclose a pre-existing medical condition, a known history of severe allergies to certain types of shellfish, which often grow in coastal regions. His claim for emergency medical care due to a severe allergic reaction was denied because his policy explicitly excluded pre-existing conditions. This emphasizes the critical importance of complete and accurate information during the insurance application process.

Medical Emergency Scenario

Imagine Emily, a beginner surfer, experiencing a sudden and severe allergic reaction to a local seafood dish during a surf trip. Her surf trip insurance, which included comprehensive medical coverage, immediately kicked in. The insurance company arranged for immediate evacuation to a hospital with specialized care for her specific allergy. The coverage included not only the emergency treatment but also the transportation costs and the ongoing medical care, ensuring her safety and well-being throughout the ordeal. This highlights the value of comprehensive coverage for unforeseen medical emergencies.

Accident Recovery with Insurance Assistance

David, a surfing enthusiast, sustained a broken arm while attempting a challenging maneuver. His surf trip insurance, which included accident coverage, facilitated his return trip and ensured he received necessary medical care. The insurance company negotiated with local healthcare providers for cost-effective care, and David was able to receive the appropriate treatment while ensuring his trip was not financially jeopardized. This case study demonstrates the insurance’s support in handling unforeseen accidents, including providing necessary support for the traveler.

Trip Cancellation Due to Unforeseen Circumstances

Amelia had booked a surf trip to a remote island with limited flight options. A volcanic eruption in the area led to flight cancellations, forcing her to return home prematurely. Her surf trip insurance, which included trip cancellation coverage, reimbursed her for the non-refundable flights and accommodation expenses, ensuring she didn’t lose money due to the unforeseen event. This illustrates how insurance can provide financial support in the event of trip cancellations due to unforeseen circumstances.