Overview of TD Equipment Finance

TD Equipment Finance is a division of TD Bank, offering financial solutions for businesses looking to acquire equipment. They specialize in providing financing options for a wide range of equipment needs, supporting various industries across North America. Their services are designed to help businesses manage cash flow, conserve capital, and modernize their operations.

Primary Business Activities

TD Equipment Finance’s core business revolves around providing financing for equipment purchases. This includes offering leases, loans, and other financing solutions tailored to the specific needs of their clients. They work with businesses of all sizes, from small startups to large corporations, helping them acquire the equipment necessary to operate and grow. They also offer vendor financing programs, working directly with equipment manufacturers and dealers to provide financing options to their customers.

Types of Equipment Financed

TD Equipment Finance provides financing for a broad spectrum of equipment. Their offerings span numerous industries and applications, designed to meet the diverse needs of their clientele.

The types of equipment typically financed include:

- Construction Equipment: This includes heavy machinery such as excavators, bulldozers, loaders, and graders, essential for construction projects.

- Transportation Equipment: Financing is available for vehicles such as trucks, trailers, and buses, crucial for logistics and transportation companies.

- Manufacturing Equipment: They finance equipment used in manufacturing processes, including machinery, production lines, and specialized tools.

- Technology Equipment: This covers computers, servers, software, and other technological assets vital for modern business operations.

- Healthcare Equipment: TD Equipment Finance offers financing for medical devices, diagnostic equipment, and other healthcare-related machinery.

- Agricultural Equipment: Financing is provided for tractors, combines, and other farming equipment used in agricultural operations.

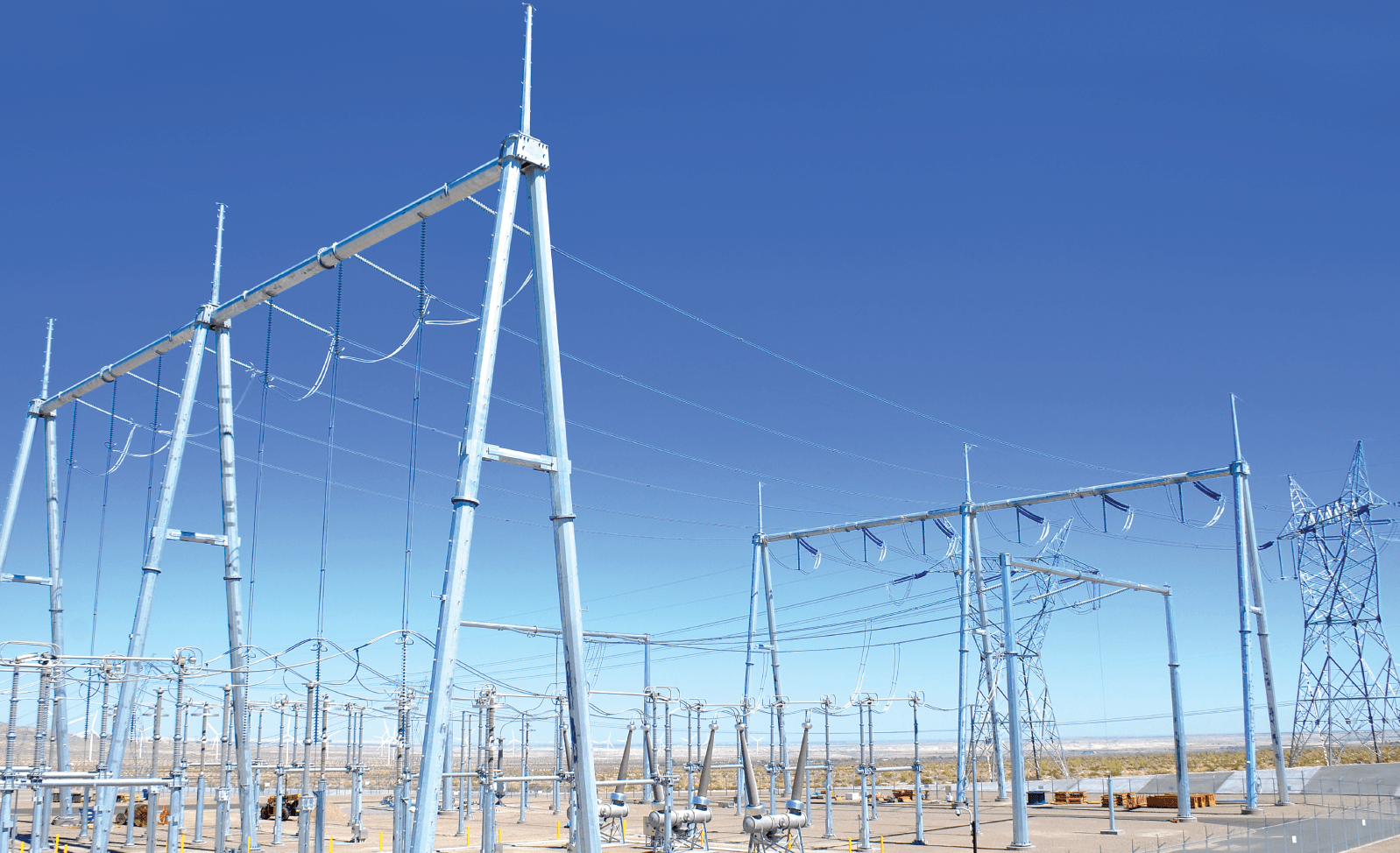

- Energy Equipment: They finance equipment used in the energy sector, including solar panels, wind turbines, and other renewable energy infrastructure.

Brief History of TD Equipment Finance

TD Equipment Finance has evolved over time, building upon its parent company’s strong financial foundation. The milestones reflect its growth and expansion within the equipment financing market.

- Early Years: The origins of TD Equipment Finance are tied to the broader history of TD Bank. The company’s equipment financing services emerged as part of the bank’s expansion into commercial lending.

- Expansion and Growth: Over the years, TD Equipment Finance has expanded its operations across North America, increasing its market share and the range of equipment it finances. This growth was fueled by strategic partnerships and an increased focus on customer service.

- Strategic Acquisitions: TD Bank has made strategic acquisitions to strengthen its position in the equipment finance market. These acquisitions have broadened the company’s capabilities and expanded its customer base.

- Focus on Innovation: TD Equipment Finance has embraced technological advancements to streamline its processes and improve the customer experience. This includes the development of online platforms and digital tools for managing financing agreements.

Products and Services Offered

TD Equipment Finance offers a comprehensive suite of financing solutions designed to meet the diverse needs of businesses acquiring equipment. These options provide flexibility and support for various industries and equipment types, enabling businesses to manage cash flow effectively and invest in essential assets.

Financing Options

TD Equipment Finance provides a range of financing options to cater to different business requirements. These include leases, loans, and lines of credit, each with distinct features and benefits. Understanding these options allows businesses to choose the most suitable solution for their specific circumstances.

- Leases: Leasing equipment allows businesses to use assets without owning them outright. This can be particularly beneficial for rapidly evolving technologies or when conserving capital is a priority. Lease terms and structures can be customized to align with a company’s financial goals and operational needs. A common example is a technology company leasing servers and networking equipment.

- Loans: Equipment loans provide businesses with the funds to purchase equipment, with the asset serving as collateral. Loan terms can vary, providing flexibility in repayment schedules. Loans are often suitable for businesses that prefer ownership and wish to build equity in their assets. For instance, a construction company might obtain an equipment loan to purchase a new excavator.

- Lines of Credit: Lines of credit offer businesses revolving access to funds for equipment purchases. This provides flexibility and allows businesses to acquire equipment as needed. Lines of credit are particularly useful for ongoing equipment needs or unexpected upgrades. A manufacturing plant might utilize a line of credit to finance the purchase of spare parts and minor equipment upgrades.

Equipment Finance Product Table

The following table summarizes the key features and ideal use cases for TD Equipment Finance’s primary product offerings.

| Product | Features | Ideal Use Cases | Benefits |

|---|---|---|---|

| Equipment Lease | Fixed monthly payments, flexible terms, potential for end-of-lease options (purchase, renewal, or return) | Businesses seeking to conserve capital, manage obsolescence risk, and have predictable expenses. Examples include office equipment, IT infrastructure, and transportation vehicles. | Reduced upfront costs, tax advantages (depending on the lease structure), and access to the latest equipment. |

| Equipment Loan | Fixed or variable interest rates, structured repayment schedules, ownership of the asset upon completion of payments. | Businesses that prefer ownership, need to build equity, and have a clear plan for equipment usage. Examples include construction equipment, manufacturing machinery, and medical devices. | Ownership of the asset, potential for tax benefits (depending on the jurisdiction), and building equity. |

| Equipment Line of Credit | Revolving credit, flexible access to funds, interest charged only on the amount used. | Businesses with ongoing equipment needs, unexpected equipment repairs, or those requiring flexibility in their financing options. Examples include retailers, service providers, and companies experiencing rapid growth. | Provides financial flexibility, quick access to funds, and can be used for a variety of equipment needs. |

Specialized Services

TD Equipment Finance offers specialized services to enhance the financing experience for its clients. These services are designed to streamline the equipment acquisition process and provide additional value.

- Vendor Programs: TD Equipment Finance partners with equipment vendors to provide financing solutions directly to their customers. This simplifies the financing process and can offer competitive rates and terms. These programs are often used in the agricultural and healthcare sectors.

- Asset Management: Asset management services help businesses track, manage, and optimize their equipment portfolios. This includes services such as equipment tracking, maintenance scheduling, and disposal planning. This is beneficial for large organizations with extensive equipment holdings.

Target Industries and Markets

TD Equipment Finance strategically focuses its services on several key industries, understanding that each sector has unique equipment financing requirements. This targeted approach allows them to offer specialized solutions, fostering strong client relationships and driving industry-specific expertise. They also maintain a significant geographical presence to serve clients across various markets.

Primary Industries Served

TD Equipment Finance concentrates on several core industries, leveraging their specialized knowledge to provide tailored financial solutions. These industries often require significant capital investment in equipment, making equipment financing a critical need.

- Construction: This sector frequently needs heavy machinery, such as excavators, bulldozers, and cranes. TD Equipment Finance provides financing for these assets, facilitating projects ranging from residential developments to large-scale infrastructure.

- Transportation: Serving the trucking, rail, and marine industries, TD Equipment Finance finances vehicles, trailers, and other essential equipment. This support helps businesses manage cash flow and expand their fleets.

- Manufacturing: Manufacturers require a wide array of equipment, from CNC machines to assembly lines. TD Equipment Finance assists these businesses in acquiring the necessary machinery to enhance production efficiency and competitiveness.

- Healthcare: The healthcare industry needs constant access to advanced medical equipment, including imaging systems, patient monitoring devices, and surgical tools. TD Equipment Finance supports healthcare providers in obtaining these critical assets.

- Technology: Businesses in the technology sector often need cutting-edge equipment like servers, data storage systems, and telecommunications infrastructure. TD Equipment Finance offers financing options that allow technology companies to stay current with rapid advancements.

- Energy: Supporting the renewable and traditional energy sectors, TD Equipment Finance provides financing for equipment like wind turbines, solar panels, and drilling equipment. This helps energy companies to invest in sustainable practices and improve operational effectiveness.

Tailoring Services to Industry Needs, Td equipment finance

TD Equipment Finance customizes its services to address the specific challenges and opportunities within each industry it serves. This approach includes understanding the equipment lifecycle, industry-specific regulations, and the financial dynamics of each sector.

- Construction: For construction companies, TD Equipment Finance may offer flexible payment plans aligned with project timelines and seasonal revenue fluctuations. They also consider the depreciation rates and resale values of heavy equipment. For example, a construction company acquiring a fleet of excavators might benefit from a finance lease with a balloon payment at the end, reducing monthly payments during the project’s initial stages.

- Transportation: In the transportation sector, TD Equipment Finance provides financing options that consider the high utilization rates and long lifespans of vehicles. This can include loans with extended terms to align with the useful life of the equipment. A trucking company could obtain a loan for new semi-trucks with terms of up to seven years, optimizing cash flow and facilitating fleet upgrades.

- Healthcare: Healthcare providers often need financing that aligns with the rapid technological advancements and the regulatory environment. TD Equipment Finance may offer financing structures that accommodate equipment upgrades and changes in medical standards. For instance, a hospital acquiring a new MRI machine might opt for a finance lease, which allows for technology upgrades after a certain period, ensuring the hospital has the latest technology.

Geographical Markets

TD Equipment Finance operates across several key geographical markets, supporting businesses with their equipment financing needs in these regions. This broad presence allows them to serve a diverse range of clients and industries.

- North America: TD Equipment Finance has a significant presence in both the United States and Canada, serving businesses across a wide range of industries. Their comprehensive service offerings support both large corporations and small-to-medium-sized enterprises (SMEs).

- Canada: With its headquarters in Canada, TD Equipment Finance provides strong support to Canadian businesses. They leverage their deep understanding of the Canadian market to offer tailored financing solutions.

- United States: TD Equipment Finance is a major player in the US market, providing extensive financing options to businesses across the country. Their services are designed to meet the diverse needs of US businesses.

Benefits of Using TD Equipment Finance

Choosing TD Equipment Finance offers businesses a strategic advantage in acquiring essential equipment. This approach provides numerous benefits, extending beyond simple financial transactions to encompass cash flow management, strategic planning, and operational efficiency. By leveraging TD Equipment Finance, businesses can optimize their resources and position themselves for sustainable growth.

Advantages of Choosing TD Equipment Finance

TD Equipment Finance provides a range of advantages over other financing options and outright purchases. These advantages are designed to meet the diverse needs of businesses across various industries.

- Preservation of Capital: Financing allows businesses to acquire necessary equipment without depleting their working capital. This is particularly crucial for startups or businesses experiencing rapid growth, where cash is vital for day-to-day operations, inventory, and other strategic investments.

- Flexible Financing Options: TD Equipment Finance offers various financing structures, including leases and loans, tailored to fit specific business needs and cash flow cycles. This flexibility allows businesses to choose the option that best aligns with their financial goals.

- Tax Benefits: In many cases, equipment financing can offer tax advantages. Businesses may be able to deduct lease payments or depreciation expenses, potentially reducing their taxable income. It’s recommended to consult with a tax advisor for specific advice.

- Improved Cash Flow Management: By spreading the cost of equipment over time, financing helps businesses manage their cash flow more effectively. This predictability allows for better budgeting and financial planning.

- Access to Latest Technology: Financing equipment enables businesses to upgrade to the latest technology and equipment without a large upfront investment. This can improve productivity, efficiency, and competitiveness.

- Reduced Obsolescence Risk: With leasing options, businesses can avoid the risk of owning outdated equipment. At the end of the lease term, they can upgrade to newer models, ensuring they remain at the forefront of their industry.

Financing Versus Purchasing Equipment Outright

The decision to finance equipment versus purchasing it outright is a critical one. Each option has its own set of advantages and disadvantages, and the best choice depends on the specific circumstances of the business.

- Upfront Cost: Purchasing equipment outright requires a significant upfront investment, which can strain a business’s cash flow. Financing, on the other hand, spreads the cost over time, making it more manageable.

- Cash Flow Impact: Purchasing equipment directly can significantly impact a company’s cash position. Financing provides predictable monthly payments, improving cash flow forecasting.

- Obsolescence: When purchasing equipment, businesses bear the risk of obsolescence. Financing options, especially leases, can mitigate this risk by allowing businesses to upgrade to newer models at the end of the lease term.

- Tax Implications: Purchasing equipment may allow businesses to claim depreciation expenses. Financing may allow for the deduction of lease payments or interest expenses. Consult with a tax advisor to determine the best option for your business.

- Flexibility: Financing offers greater flexibility in terms of equipment upgrades and changes. Purchasing equipment outright commits a business to a specific asset for a longer period.

- Ownership: Purchasing equipment grants immediate ownership. Financing typically involves a lease or loan agreement, with ownership transferring at the end of the term or through a purchase option.

How TD Equipment Finance Helps Businesses Manage Cash Flow and Improve Profitability

TD Equipment Finance plays a crucial role in helping businesses optimize their financial performance. By providing tailored financing solutions, TD Equipment Finance supports businesses in managing their cash flow and improving their profitability.

- Predictable Payments: TD Equipment Finance offers predictable monthly payments, allowing businesses to accurately forecast their cash flow and budget accordingly. This predictability minimizes financial surprises and facilitates better financial planning.

- Reduced Upfront Costs: By financing equipment, businesses can avoid the large upfront costs associated with purchasing equipment outright. This frees up capital for other strategic investments, such as marketing, research and development, or expansion.

- Improved Working Capital: Preserving working capital is essential for business operations. TD Equipment Finance helps businesses maintain a healthy working capital position, enabling them to meet their short-term obligations and seize growth opportunities.

- Enhanced Profitability: By acquiring the necessary equipment without depleting cash reserves, businesses can generate revenue sooner and increase their profitability. Efficient equipment leads to higher productivity and lower operating costs, further boosting profitability.

- Access to the Latest Technology: TD Equipment Finance facilitates access to the latest equipment and technology. This access improves efficiency, reduces downtime, and enables businesses to stay competitive.

- Strategic Financial Planning: TD Equipment Finance advisors work with businesses to create customized financing solutions that align with their financial goals. This strategic approach supports informed decision-making and helps businesses achieve long-term success.

Application Process and Eligibility

Securing equipment financing from TD Equipment Finance involves a structured process. Understanding the steps and requirements is crucial for a smooth application experience. This section details the application process, necessary documentation, and eligibility criteria.

Application Process

The application process generally involves several key stages, designed to assess the applicant’s creditworthiness and the viability of the equipment being financed.

The typical steps are as follows:

- Initial Consultation: This involves contacting TD Equipment Finance to discuss financing needs and explore available options. This can be done through a phone call, online inquiry, or meeting with a TD Equipment Finance representative. During this phase, applicants can clarify their requirements and gain insights into suitable financing solutions.

- Application Submission: Once the financing option is selected, the applicant submits a formal application. This typically involves completing an application form and providing supporting documentation. The application form requests information about the business, the equipment to be financed, and the desired financing terms.

- Credit Evaluation: TD Equipment Finance conducts a thorough credit evaluation. This involves assessing the applicant’s credit history, financial statements, and other relevant information to determine their creditworthiness. This process is critical in determining the risk associated with the financing.

- Approval and Documentation: If the application is approved, TD Equipment Finance issues a financing offer, which Artikels the terms and conditions of the loan or lease. The applicant then reviews the offer and signs the necessary documentation, including the financing agreement.

- Funding and Equipment Procurement: Once the documentation is finalized, TD Equipment Finance disburses the funds. The equipment is then procured by the applicant, and the financing arrangement commences.

Information and Documentation Required

Applicants are required to provide comprehensive information and documentation to support their financing application. The specific requirements may vary depending on the size and complexity of the financing request, but the following documents are commonly requested:

- Business Information: This includes the business’s legal name, address, structure (e.g., sole proprietorship, partnership, corporation), and industry. This information is crucial for verifying the applicant’s identity and understanding the nature of the business.

- Financial Statements: Financial statements are essential for assessing the applicant’s financial health and ability to repay the financing. Typically, these include:

- Income Statements (Profit and Loss Statements): Showing revenue, expenses, and profit over a specific period.

- Balance Sheets: Providing a snapshot of assets, liabilities, and equity at a specific point in time.

- Cash Flow Statements: Detailing the movement of cash in and out of the business.

- Tax Returns: Business tax returns (e.g., corporate tax returns, partnership tax returns) are often required to verify the financial information provided and assess the applicant’s tax compliance.

- Equipment Details: Information about the equipment to be financed, including the make, model, year, and cost. This is essential for determining the value of the collateral.

- Personal Information (for Sole Proprietors and Guarantors): Personal financial statements, tax returns, and credit history may be required for sole proprietors and any individuals guaranteeing the financing. This allows for a comprehensive assessment of the risk involved.

- Bank Statements: Recent bank statements are often requested to verify cash flow and financial stability.

Eligibility Criteria

TD Equipment Finance uses specific criteria to evaluate applications and determine eligibility for financing. These criteria help assess the applicant’s creditworthiness and the overall risk associated with the financing.

The key eligibility factors considered include:

- Credit History: A strong credit history is a critical factor. TD Equipment Finance reviews the applicant’s credit report to assess their payment behavior, outstanding debts, and overall creditworthiness. Applicants with a history of timely payments and responsible credit management are more likely to be approved.

- Financial Stability: The applicant’s financial stability is evaluated based on their financial statements, including income statements, balance sheets, and cash flow statements. TD Equipment Finance looks for evidence of consistent profitability, strong cash flow, and a healthy debt-to-equity ratio.

- Industry and Business Type: The industry and type of business can influence eligibility. Some industries may be considered higher risk than others. For example, businesses in stable, established industries may be viewed more favorably.

- Equipment Type and Value: The type and value of the equipment being financed are also considered. The equipment serves as collateral, and its value influences the financing terms and risk assessment. The more valuable the equipment, the more likely the application will be approved.

- Loan-to-Value Ratio (LTV): The LTV ratio, which is the amount of financing provided relative to the equipment’s value, is a key factor. A lower LTV ratio (meaning the applicant is contributing a larger down payment) generally indicates lower risk.

- Time in Business: The length of time the business has been operating is often considered. Businesses with a longer operating history may be viewed as more stable and less risky.

Interest Rates, Terms, and Fees

Understanding the financial aspects of equipment financing is crucial for making informed decisions. This section provides a detailed overview of interest rate determination, typical financing terms, and associated fees for TD Equipment Finance products. This information will help potential clients evaluate the overall cost and suitability of their financing options.

Interest Rate Determination

TD Equipment Finance employs a multifaceted approach to determine interest rates, considering various factors to assess risk and establish competitive rates.

- Creditworthiness of the Borrower: A primary factor is the borrower’s credit profile. Strong credit history, demonstrated financial stability, and a history of timely payments generally result in more favorable interest rates. Conversely, borrowers with lower credit scores or limited credit history may face higher rates.

- Type and Age of Equipment: The specific equipment being financed plays a role. Newer, less depreciable equipment typically carries lower risk, influencing rates positively. Specialized or older equipment may have higher rates due to potential resale value and obsolescence concerns.

- Financing Term: The duration of the financing agreement impacts interest rates. Shorter-term financing often comes with lower rates compared to longer-term agreements, which inherently carry greater risk for the lender.

- Market Conditions: Prevailing interest rates in the broader financial market significantly influence those offered by TD Equipment Finance. Benchmarks such as the prime rate or LIBOR (though phasing out) are used as reference points, and rates are adjusted accordingly.

- Down Payment or Collateral: The amount of the down payment or the value of any additional collateral provided by the borrower can affect the interest rate. A larger down payment or substantial collateral can reduce the lender’s risk, potentially leading to lower interest rates.

- Relationship with TD: Existing customers with a long-standing relationship with TD may be eligible for preferential rates and terms.

Typical Financing Terms

TD Equipment Finance offers a range of financing terms tailored to meet the diverse needs of its clients. The specific terms available depend on the equipment type, industry, and the borrower’s financial profile.

- Loan Durations: Loan terms typically range from 24 to 84 months (2 to 7 years). The specific term offered is determined by factors such as the equipment’s useful life, the borrower’s cash flow projections, and the desired payment structure.

- Lease Periods: Lease periods are often structured to align with the equipment’s expected economic life. Lease terms can vary from 24 to 60 months (2 to 5 years) or longer for certain types of equipment. Lease options include Fair Market Value (FMV) leases, $1.00 purchase option leases, and other structures.

- Payment Frequency: Payments can be structured monthly, quarterly, or annually, depending on the borrower’s cash flow needs and preferences. Monthly payments are the most common.

- Customization: TD Equipment Finance often works with clients to customize financing terms to fit their specific requirements. This flexibility allows for adjustments in payment schedules, balloon payments, or other features.

Fees Associated with TD Equipment Finance Products

Various fees may be associated with TD Equipment Finance products, contributing to the overall cost of financing. Transparency regarding these fees is essential for informed decision-making.

- Origination Fees: These fees are charged at the beginning of the financing agreement to cover the costs associated with processing the application, underwriting, and preparing the loan or lease documentation. The fee amount can vary depending on the size and complexity of the financing.

- Documentation Fees: These fees cover the costs associated with preparing and executing the legal documents related to the financing agreement.

- Prepayment Penalties: In some cases, prepayment penalties may apply if the borrower pays off the loan or lease before the end of the term. The purpose of these penalties is to compensate the lender for the loss of interest income. The terms and conditions of any prepayment penalty will be clearly Artikeld in the financing agreement.

- Late Payment Fees: Fees may be assessed for late payments. The amount of the fee and the grace period (if any) will be specified in the financing agreement.

- Other Fees: Depending on the specific financing product and circumstances, other fees such as UCC filing fees (Uniform Commercial Code), title search fees, or insurance-related fees may apply.

Case Studies and Success Stories

TD Equipment Finance’s impact on businesses is best understood through real-world examples. These case studies showcase how various companies have leveraged TD Equipment Finance to overcome financial hurdles, acquire essential equipment, and achieve significant growth. They demonstrate the practical application of the services and highlight the tangible benefits for businesses across different industries.

Construction Company Expansion

A mid-sized construction company, specializing in commercial projects, faced a significant challenge: a surge in demand for their services. To meet this increased workload, they needed to acquire several pieces of heavy machinery, including excavators, bulldozers, and cranes. However, their existing capital was insufficient to cover the upfront costs.

TD Equipment Finance provided a tailored financing solution that allowed the company to purchase the necessary equipment without depleting their working capital. The financing structure included:

- A competitive interest rate, ensuring manageable monthly payments.

- Flexible repayment terms aligned with the equipment’s useful life and the project timelines.

- A streamlined application process, enabling quick access to funds.

The result was a substantial increase in the company’s project capacity and revenue. The company was able to bid on and win larger contracts, leading to a 30% increase in annual revenue within the first year. They also expanded their workforce, creating new jobs in the local community. This demonstrates the crucial role equipment financing can play in facilitating business expansion, particularly in capital-intensive industries.

Healthcare Practice Upgrade

A well-established dental practice aimed to modernize its equipment, including digital X-ray machines, dental chairs, and sterilization equipment. This upgrade was essential to enhance patient care and improve operational efficiency. The practice explored various financing options but found TD Equipment Finance offered the most advantageous terms.

TD Equipment Finance understood the unique needs of healthcare professionals and provided:

- Financing specifically designed for medical and dental equipment.

- Deferred payment options to align with revenue cycles.

- A dedicated account manager to assist with the entire process.

The practice was able to upgrade its equipment, resulting in:

- Improved patient satisfaction due to the advanced technology.

- Increased efficiency in patient appointments and procedures.

- A noticeable increase in the practice’s overall profitability.

This case study illustrates how TD Equipment Finance supports healthcare practices in investing in technology, ultimately leading to improved patient outcomes and business success.

Manufacturing Business Growth

A manufacturing company, specializing in custom metal fabrication, required new machinery to meet growing customer demand and expand its product line. The company needed to acquire a CNC laser cutting machine, a welding robot, and a press brake. Securing the necessary financing was critical to their growth strategy.

TD Equipment Finance offered a comprehensive solution, including:

- Financing options tailored to the manufacturing industry.

- Expert advice on equipment selection and financing strategies.

- Support throughout the equipment acquisition process.

The impact on the business was significant:

- A 25% increase in production capacity within six months.

- The ability to take on larger and more complex projects.

- A boost in overall profitability and market share.

This case study highlights how TD Equipment Finance can be a catalyst for growth in the manufacturing sector, enabling businesses to invest in advanced technology and expand their operations.

Transportation Company Fleet Enhancement

A trucking company sought to upgrade its aging fleet of semi-trucks and trailers. Modernizing the fleet was essential to improve fuel efficiency, reduce maintenance costs, and enhance driver safety. The company needed a financing partner that understood the transportation industry’s specific requirements.

TD Equipment Finance provided a financing package that included:

- Financing options for a wide range of vehicles and trailers.

- Flexible repayment terms to accommodate seasonal fluctuations in revenue.

- Expertise in the transportation industry, ensuring a smooth financing process.

The results were tangible:

- A reduction in fuel costs by 15% due to the newer, more fuel-efficient trucks.

- A decrease in maintenance expenses.

- Improved driver satisfaction and retention.

This case study demonstrates how TD Equipment Finance helps transportation companies enhance their fleets, leading to improved operational efficiency and profitability.

Competitive Landscape

Understanding the competitive landscape is crucial for TD Equipment Finance to maintain its position and identify opportunities for growth. This section analyzes TD Equipment Finance’s key competitors, highlighting its differentiators and comparing its strengths and weaknesses. The equipment finance market is dynamic, and staying informed about the competition is essential for strategic decision-making.

Key Competitors in the Equipment Finance Market

The equipment finance market is highly competitive, with several players vying for market share. These competitors offer various equipment financing solutions, targeting different industries and equipment types.

Some of the most significant competitors of TD Equipment Finance include:

- Wells Fargo Equipment Finance: A major player in the industry, Wells Fargo Equipment Finance provides a wide range of financing options for various equipment types across multiple sectors.

- Bank of America Merrill Lynch Equipment Finance: Another significant competitor, Bank of America Merrill Lynch Equipment Finance, offers comprehensive equipment financing solutions to businesses of all sizes.

- CIT Bank: CIT Bank is a well-known provider of equipment financing, focusing on various industries and equipment types.

- US Bank Equipment Finance: US Bank Equipment Finance provides equipment financing solutions, catering to a diverse range of industries and equipment needs.

- Key Equipment Finance: Key Equipment Finance is a significant competitor offering a broad spectrum of equipment financing options.

Key Differentiators of TD Equipment Finance

TD Equipment Finance distinguishes itself through several key factors that provide it with a competitive edge in the market. These differentiators attract clients and solidify its market position.

Key differentiators include:

- Relationship-Driven Approach: TD Equipment Finance emphasizes building strong, long-term relationships with its clients, offering personalized service and tailored solutions.

- Industry Expertise: The company possesses deep expertise in specific industries, allowing it to provide specialized financing solutions that meet unique needs.

- Commitment to Sustainability: TD Equipment Finance is increasingly focused on financing sustainable and environmentally friendly equipment, appealing to clients with similar values.

- Strong Financial Stability: Backed by TD Bank, a financially robust institution, TD Equipment Finance offers clients financial security and stability.

Strengths and Weaknesses Comparison

Comparing the strengths and weaknesses of TD Equipment Finance against its competitors reveals its competitive positioning and areas for improvement.

A comparative analysis includes:

| Feature | TD Equipment Finance | Competitors |

|---|---|---|

| Strengths | Strong relationship-driven approach; Industry-specific expertise; Financial stability; Commitment to sustainable financing. | Established brand recognition; Large capital base; Extensive product offerings; Broad geographic reach. |

| Weaknesses | Potentially smaller geographic footprint compared to some competitors; May have a narrower range of equipment types financed than some competitors. | May have a less personalized approach; Could face bureaucratic challenges in some areas; Pricing can be competitive but not always the lowest. |

| Relationship Management | Offers a dedicated account manager to help with the financing process. | May not offer the same level of personalized service. |

| Industry Focus | TD Equipment Finance provides specialized solutions for particular sectors. | Offers a broader range of equipment financing, often without a deep industry specialization. |

| Pricing | Offers competitive pricing, which may be influenced by relationship-based strategies. | Often has highly competitive rates due to economies of scale. |

For example, a construction company looking for specialized equipment financing might find TD Equipment Finance more suitable due to its industry expertise and relationship-driven approach, while a large corporation seeking a wide range of financing options might consider a competitor with a broader product portfolio.

TD Equipment Finance offers crucial financing options for businesses needing new machinery. However, understanding the landscape also involves considering diverse financial tools. Exploring avenues like the key housing finance solution can broaden one’s financial perspective. Ultimately, a strong grasp of both TD Equipment Finance and complementary solutions ensures sound financial planning for any business endeavor.

Customer Service and Support

TD Equipment Finance prioritizes providing exceptional customer service and support to ensure a seamless and positive experience for its clients. This commitment extends beyond simply providing financial solutions; it encompasses a dedication to building lasting relationships and offering ongoing assistance throughout the equipment financing lifecycle. TD Equipment Finance understands that efficient and responsive support is crucial for customer satisfaction and success.

Customer Service Channels

TD Equipment Finance offers a variety of channels to ensure customers can easily access the support they need. These channels are designed to accommodate different preferences and communication styles, allowing clients to connect with the company in a way that is most convenient for them.

- Dedicated Account Managers: Each client is typically assigned a dedicated account manager who serves as their primary point of contact. This individual possesses in-depth knowledge of the client’s specific needs and financing arrangements, facilitating personalized service and quick issue resolution. The account manager proactively monitors the client’s portfolio and is readily available to address any questions or concerns.

- Phone Support: TD Equipment Finance provides phone support during business hours, enabling clients to speak directly with customer service representatives. This channel is ideal for immediate assistance with urgent matters, such as inquiries about payment schedules, loan balances, or equipment financing options. The phone support team is trained to handle a wide range of inquiries efficiently and professionally.

- Email Support: Clients can reach out to TD Equipment Finance via email to submit inquiries, request documentation, or communicate complex issues. Email support allows for detailed explanations and the ability to attach supporting documents, ensuring that all relevant information is readily available. Responses are typically provided within a reasonable timeframe, ensuring timely communication.

- Online Portal: Many clients have access to a secure online portal where they can manage their accounts, view statements, track payments, and access other important information. This self-service portal provides 24/7 access to account details, reducing the need for direct contact for routine inquiries.

Commitment to Customer Satisfaction

TD Equipment Finance’s commitment to customer satisfaction is deeply ingrained in its business practices. This commitment is reflected in the company’s approach to every interaction, from the initial application process to ongoing support and account management. The goal is to exceed customer expectations and build long-term relationships based on trust and mutual success.

- Responsive Communication: TD Equipment Finance strives to respond to customer inquiries and requests promptly. This includes acknowledging receipt of communications, providing timely updates, and resolving issues efficiently. The company understands the importance of minimizing wait times and ensuring that clients feel heard and valued.

- Problem Resolution: TD Equipment Finance is committed to resolving customer issues fairly and effectively. The company has established processes for handling complaints and disputes, ensuring that all concerns are thoroughly investigated and addressed. The goal is to find solutions that are satisfactory to both the client and the company.

- Proactive Support: TD Equipment Finance proactively reaches out to clients to provide updates, offer assistance, and identify opportunities for improvement. This includes regular communication from account managers, as well as targeted outreach based on specific needs or industry trends.

- Training and Development: TD Equipment Finance invests in ongoing training and development for its customer service staff. This ensures that employees are equipped with the knowledge and skills necessary to provide exceptional service and support. The company also encourages employees to stay up-to-date on industry trends and best practices.

Accessing Support and Assistance

Customers can access support and assistance from TD Equipment Finance through various channels, ensuring they can easily obtain the help they need. The company’s support infrastructure is designed to be accessible and user-friendly.

- Contact Information: TD Equipment Finance provides readily available contact information, including phone numbers, email addresses, and website links. This information is typically found on the company’s website, in marketing materials, and in account documentation.

- Online Resources: The TD Equipment Finance website offers a wealth of online resources, including FAQs, articles, and guides. These resources provide answers to common questions and offer valuable information about equipment financing.

- Account Manager Communication: Clients are encouraged to communicate directly with their assigned account managers for personalized support and assistance. Account managers can provide tailored advice, answer specific questions, and help clients navigate complex financing arrangements.

- Feedback Mechanisms: TD Equipment Finance welcomes customer feedback and provides mechanisms for clients to share their experiences. This includes surveys, feedback forms, and opportunities to provide testimonials. The company uses this feedback to continuously improve its services and enhance customer satisfaction.

Market Trends and Future Outlook

The equipment finance industry is constantly evolving, driven by technological advancements, shifting economic conditions, and changing customer demands. Understanding these trends and anticipating future developments is crucial for TD Equipment Finance to maintain its competitive edge and ensure long-term success. This section explores current market trends, projects the future outlook for TD Equipment Finance, and details how the company is adapting to these changes.

Current Trends in the Equipment Finance Industry

Several key trends are shaping the equipment finance landscape today. These trends influence the strategies and offerings of companies like TD Equipment Finance.

- Digitalization and Automation: The equipment finance industry is experiencing a rapid shift towards digital platforms. Online application processes, automated underwriting, and digital document management are becoming standard practices. This trend improves efficiency, reduces costs, and enhances the customer experience. For example, TD Equipment Finance’s implementation of online portals for application and account management streamlines processes and provides greater convenience for clients.

- Focus on Sustainability: There’s a growing demand for financing sustainable and energy-efficient equipment. Businesses are increasingly prioritizing environmentally friendly options, driven by both regulatory pressures and consumer preferences. TD Equipment Finance can capitalize on this trend by offering financing solutions specifically tailored to support sustainable equipment purchases, such as electric vehicles or energy-efficient machinery.

- Increased Specialization: The industry is witnessing a trend toward specialization, with lenders focusing on specific equipment types or industry sectors. This allows for deeper expertise and a more tailored approach to customer needs. TD Equipment Finance can leverage its existing strengths in specific sectors, like construction or healthcare, to further refine its offerings and provide specialized financing solutions.

- Rise of Fintech Partnerships: Collaboration between traditional financial institutions and fintech companies is on the rise. These partnerships enable lenders to leverage innovative technologies and expand their reach. TD Equipment Finance can explore strategic partnerships with fintech companies to enhance its digital capabilities, improve customer service, and access new markets.

- Data Analytics and Risk Management: The use of data analytics for risk assessment and decision-making is becoming increasingly important. Lenders are utilizing data to better understand customer behavior, predict potential defaults, and optimize their lending portfolios. TD Equipment Finance can enhance its risk management capabilities by implementing advanced data analytics tools and techniques.

Future Outlook for TD Equipment Finance

The future of TD Equipment Finance is promising, but it will require adaptability and strategic planning to navigate the evolving market dynamics.

- Continued Growth in Demand: The demand for equipment finance is expected to remain strong, driven by ongoing investments in infrastructure, technology, and industrial expansion. As businesses across various sectors continue to upgrade and expand their equipment, the need for financing will persist. TD Equipment Finance, with its established presence and diverse product offerings, is well-positioned to capitalize on this growth.

- Technological Advancements: Technological advancements, such as artificial intelligence (AI) and blockchain, will further transform the industry. AI can be used to automate underwriting processes and improve risk assessment, while blockchain can enhance transparency and security in transactions. TD Equipment Finance needs to proactively adopt these technologies to remain competitive.

- Economic Fluctuations: The equipment finance industry is sensitive to economic cycles. Economic downturns can lead to reduced demand for equipment and increased credit risk. TD Equipment Finance must develop strategies to mitigate these risks, such as diversifying its portfolio, implementing robust credit scoring models, and maintaining strong relationships with its customers.

- Evolving Regulatory Landscape: The regulatory landscape for financial institutions is constantly evolving. TD Equipment Finance must stay compliant with all relevant regulations and adapt its practices to meet changing requirements. This includes adhering to data privacy regulations, anti-money laundering (AML) laws, and other industry-specific guidelines.

- Competitive Intensity: The equipment finance market is highly competitive, with both traditional lenders and new entrants vying for market share. TD Equipment Finance needs to differentiate itself through superior customer service, innovative financing solutions, and a strong brand reputation.

Adapting to Changing Market Conditions and Technological Advancements

TD Equipment Finance is actively taking steps to adapt to the changing market conditions and technological advancements. These efforts are designed to ensure the company’s continued success and relevance in the industry.

- Investing in Digital Transformation: TD Equipment Finance is investing heavily in digital technologies to streamline its operations, improve customer experience, and enhance its competitive position. This includes developing user-friendly online platforms, automating processes, and leveraging data analytics to make informed decisions.

- Focusing on Customer Experience: Providing exceptional customer service is a top priority. TD Equipment Finance is continuously improving its customer service capabilities, including offering personalized solutions, providing responsive support, and building strong relationships with its clients.

- Expanding Product Offerings: TD Equipment Finance is expanding its product offerings to meet the evolving needs of its customers. This includes offering financing solutions for sustainable equipment, exploring new financing structures, and providing specialized financing options for specific industries.

- Building Strategic Partnerships: TD Equipment Finance is actively seeking strategic partnerships with fintech companies and other industry players to enhance its capabilities and expand its reach. These partnerships enable the company to leverage innovative technologies, access new markets, and provide more comprehensive solutions to its customers.

- Prioritizing Data Security and Compliance: Data security and regulatory compliance are paramount. TD Equipment Finance is investing in robust security measures to protect customer data and ensure compliance with all relevant regulations. This includes implementing strong data encryption, adhering to data privacy laws, and regularly auditing its systems and processes.

TD Equipment Finance provides crucial financial solutions for businesses needing to acquire essential assets. Sometimes, however, navigating complex financial landscapes requires specialized expertise, which is where an interim finance director can prove invaluable, offering strategic guidance and ensuring financial stability. Ultimately, this support allows TD Equipment Finance clients to make informed decisions and optimize their investments effectively.