Introduction to Travel Agency Accounting Software

Travel agency accounting is a crucial aspect of running a successful business. Effective financial management allows for accurate tracking of income and expenses, informed decision-making, and ultimately, greater profitability. Travel agency accounting software plays a vital role in streamlining this process.

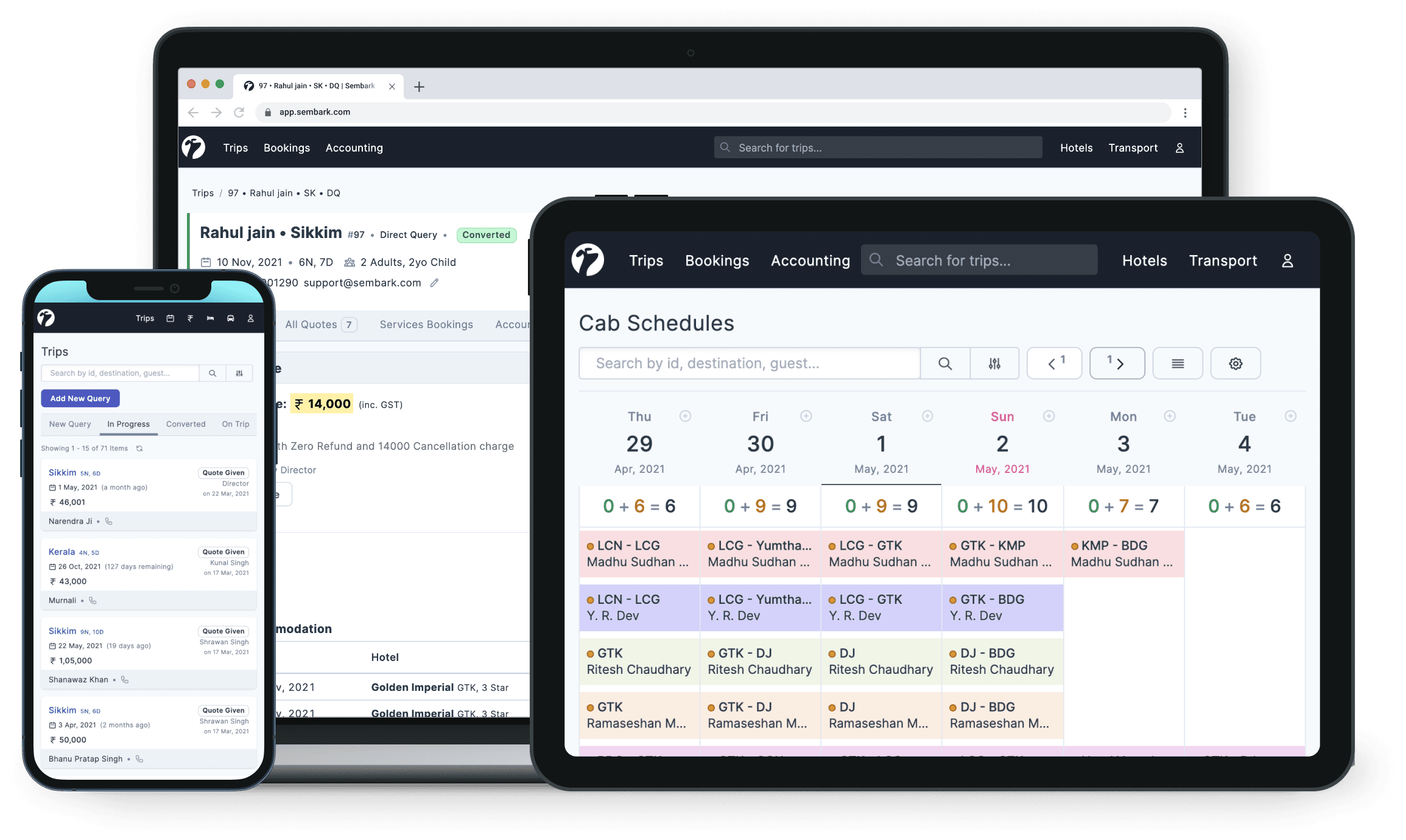

Modern travel agency accounting software offers a comprehensive solution for managing various financial aspects of the business, from client bookings and payments to expense tracking and reporting. This software is designed to automate tasks, reduce manual errors, and provide real-time insights into financial performance, empowering travel agents to focus on growth and customer service.

Typical Functionalities of Travel Agency Accounting Software

Travel agency accounting software typically encompasses a wide array of functionalities, designed to automate and simplify various accounting processes. These functionalities include automated invoicing and payment processing, streamlining the collection of payments from clients. The software also facilitates accurate tracking of expenses related to travel, marketing, and other operational costs. Furthermore, it enables the creation of comprehensive financial reports, offering insights into profitability and performance trends.

Key Benefits of Using Travel Agency Accounting Software

Implementing travel agency accounting software offers numerous advantages. Automation of tasks reduces manual errors, leading to greater accuracy in financial records. Real-time access to financial data empowers informed decision-making and strategic planning. The software also improves cash flow management, enabling businesses to effectively track and manage incoming and outgoing funds. Moreover, comprehensive reporting features provide valuable insights into financial performance, facilitating the identification of areas for improvement and potential growth opportunities.

Examples of Travel Agency Accounting Software

Several software options cater to the specific needs of travel agencies. Popular choices include industry-specific solutions designed with the nuances of the travel industry in mind, as well as more general accounting software platforms that can be adapted to meet the needs of travel agencies. The selection of the right software often depends on factors like budget, the size of the agency, and the specific features required.

Comparison of Travel Agency Accounting Software

This table Artikels common features of various software packages, highlighting differences in pricing, currency support, and reporting capabilities. The availability of specific features can vary depending on the chosen software package, and it is crucial to thoroughly evaluate the needs of your agency before making a selection.

| Software Name | Pricing Model | Currency Support | Reporting Capabilities |

|---|---|---|---|

| TravelPro | Subscription-based | Multi-currency | Detailed financial reports, customizable dashboards |

| AgentManager | Per-user pricing | Multi-currency | Customizable reports, real-time data access |

| BookingBuddy | Flat fee | Single currency | Basic financial reports, invoice management |

| AccuTravel | Per-transaction fee | Multi-currency | Advanced analytics, customizable reports |

Software Features and Functionality: Travel Agency Accounting Software

Travel agency accounting software is more than just a tool; it’s a crucial component for success in today’s competitive market. Accurate financial records are essential for managing budgets, forecasting revenue, and ensuring compliance with industry regulations. A well-designed software solution can streamline operations, automate tedious tasks, and provide valuable insights into agency performance.

Effective accounting software for travel agencies empowers businesses to make informed decisions, optimize resource allocation, and ultimately, drive profitability. It enables travel agents to focus on their core competencies – building client relationships and securing travel arrangements – without being bogged down by complex accounting procedures.

Importance of Accurate Financial Record-Keeping

Accurate financial record-keeping is paramount for travel agencies. It provides a clear picture of income, expenses, and profitability, allowing for informed decision-making. Detailed financial records enable agencies to track performance against budgets, identify areas for improvement, and manage cash flow effectively. Without meticulous record-keeping, agencies risk losing track of crucial financial information, making it difficult to assess their overall health and future prospects.

Need for Automated Processes

Manual accounting processes in travel agencies are often time-consuming and prone to errors. Automation through software reduces the risk of human error, saving time and resources. Automated processes, such as invoice processing and expense tracking, significantly improve efficiency and allow staff to focus on higher-value tasks. This, in turn, reduces administrative burdens and fosters greater accuracy.

Client Payment Management, Travel agency accounting software

Travel agency accounting software facilitates secure and efficient client payment processing. It allows for various payment methods, from credit cards to bank transfers, and tracks each transaction meticulously. This streamlined approach to payment management ensures prompt reconciliation and accurate record-keeping, minimizing the potential for discrepancies. Real-time payment tracking enables agents to maintain excellent communication with clients and ensure a smooth booking process.

Commission and Agent Earnings Tracking

Effective commission tracking is crucial for maintaining fair compensation and transparency within a travel agency. Software solutions can automatically calculate commissions based on predetermined rates and sales figures, providing agents with clear and accurate statements. This feature minimizes disputes and ensures that agents are compensated fairly for their contributions. Furthermore, it facilitates the generation of detailed reports for both internal and external stakeholders.

Reporting Tools

Travel agency accounting software provides diverse reporting tools, empowering agencies to gain insights into various aspects of their operations. These reports can be tailored to specific needs, offering a comprehensive view of revenue streams, expenses, and profitability. This flexibility allows for insightful analysis of performance trends and identification of areas requiring improvement. Customizable reporting enables travel agencies to adapt the information presented to meet their specific requirements.

Comparison of Software Solutions

| Feature | Software A | Software B |

|---|---|---|

| Client Payment Processing | Supports multiple payment gateways, detailed transaction logs | Limited payment gateways, basic transaction history |

| Commission Calculation | Automated commission calculation based on various parameters, customizable commission rates | Manual commission calculation, fixed commission rates |

| Reporting Capabilities | Extensive reporting options, customizable dashboards, real-time data visualization | Basic reporting options, limited data visualization |

| CRM Integration | Seamless integration with leading CRM platforms | Limited CRM integration, basic contact management |

Importance of CRM Integration

Integrated customer relationship management (CRM) features within travel agency accounting software are essential. A CRM module enables a centralized repository for client information, including contact details, booking history, and preferences. This facilitates personalized service, improving client satisfaction and loyalty. By streamlining client interactions and consolidating data, travel agencies can improve efficiency and drive revenue growth. The CRM integration directly contributes to stronger client relationships and enhanced customer service.

Implementation and Integration

Getting your travel agency’s accounting software up and running is a crucial step in streamlining operations. This often involves more than just installing the software; it’s about seamlessly integrating it with your existing processes and systems. A well-executed implementation strategy is key to avoiding costly errors and maximizing the software’s benefits.

Successful implementation hinges on a thorough understanding of your current workflows and data, as well as a clear vision of how the new software will fit into your overall business strategy. Careful planning and a phased approach are essential to minimize disruptions and ensure a smooth transition.

Data Migration Strategies

Effective data migration is vital for a successful software implementation. Simply transferring data isn’t enough; it requires a strategic approach to ensure accuracy and avoid errors. This involves mapping your existing data to the new system’s fields and validating the accuracy of the transferred information. Data cleansing is also a critical step in ensuring the quality of the migrated data. Issues such as inconsistent data formats, missing data, and duplicate entries must be identified and resolved.

Integrating with Other Systems

Integrating the accounting software with other business systems, such as your CRM, is often a crucial part of maximizing efficiency. This integration allows for seamless data flow between systems, eliminating manual data entry and reducing errors. For example, booking information from the CRM can automatically populate the accounting software, streamlining the revenue recognition process. This automation can significantly reduce administrative overhead and improve overall accuracy.

Implementation Challenges

Several potential challenges can arise during the implementation process. One common issue is resistance to change among staff accustomed to the old systems. Training and clear communication are essential to address this resistance and ensure staff adoption. Another potential challenge is the complexity of integrating with existing payment gateways. The specific integration process often depends on the particular payment gateway used. Technical issues and unexpected data discrepancies can also cause delays and frustration. A well-defined implementation plan, including contingency plans, can help mitigate these potential challenges.

Integrating with Payment Gateways

- Assessment of Current Payment Gateway: Carefully evaluate the capabilities of your existing payment gateway. Determine the level of API support and its compatibility with the accounting software.

- Review of Accounting Software API Documentation: Thoroughly review the accounting software’s API documentation to understand the available methods for integrating with payment gateways.

- Data Mapping and Validation: Create a comprehensive data mapping document that Artikels how data will be transferred between the payment gateway and the accounting software. Validate the data to ensure accuracy and consistency during the integration process.

- Testing the Integration: Thoroughly test the integration process with sample transactions to identify and address any potential issues before implementing it on a larger scale. This includes verifying transaction processing, reconciliation, and reporting functions.

- Implementation of the Integration: Follow the accounting software’s instructions to configure the integration. This step may involve specific configurations within both the accounting software and the payment gateway. Pay close attention to any specific instructions or guidelines.

- Post-Implementation Monitoring and Evaluation: After the implementation, monitor the integration process closely to identify any issues and address them promptly. Regular reporting and performance analysis are critical to ensure that the integration continues to function as expected.

Implementing a new accounting system can involve significant initial investment, but long-term gains in efficiency and accuracy often outweigh the short-term costs. Planning ahead and anticipating potential problems are key to a smooth transition.

Financial Reporting and Analysis

Travel agency accounting software goes beyond basic bookkeeping. It empowers agencies to gain a deep understanding of their financial health through robust reporting and analysis. This translates to better decision-making, improved profitability, and more efficient resource allocation. By generating key financial reports, the software provides valuable insights into performance trends and allows for proactive adjustments to strategies.

This comprehensive system allows travel agencies to not only track income and expenses but also delve into the underlying data to uncover patterns and predict future performance. It enables them to understand the profitability of various services, identify cost-saving opportunities, and make informed decisions regarding pricing and marketing strategies.

Financial Reporting Capabilities

This software streamlines the process of generating various financial reports, such as income statements, balance sheets, and cash flow statements. These reports are crucial for evaluating the agency’s financial performance over different periods. Automated report generation saves time and reduces the risk of errors, allowing financial professionals to focus on strategic analysis rather than tedious manual tasks.

Creating Financial Reports

The software allows for the creation of customized financial reports, tailored to specific needs. Income statements, for example, display revenue and expenses for a chosen period. Data can be categorized by different criteria such as service type or client segment. Balance sheets present the agency’s assets, liabilities, and equity at a specific point in time. These reports offer a snapshot of the agency’s financial position and are vital for making informed decisions. Cash flow statements track the movement of cash in and out of the business, helping to assess liquidity and predict future cash needs.

Trend Analysis

Trend analysis is crucial for understanding financial performance over time. The software facilitates this by enabling the comparison of reports across different periods, such as month-over-month or year-over-year. By observing trends in key metrics, agencies can identify patterns, predict future performance, and proactively address any potential issues. For example, if bookings for a particular destination decline consistently, the software can flag this trend, prompting the agency to investigate the reason and adjust their marketing strategies accordingly.

Key Performance Indicators (KPIs)

Tracking key performance indicators (KPIs) is essential for monitoring the success of various aspects of the agency’s operations. The software allows for the selection and monitoring of KPIs such as average revenue per booking, customer lifetime value, and conversion rates. These metrics provide valuable insights into operational efficiency and customer satisfaction. For instance, tracking customer lifetime value allows the agency to focus on retaining existing clients and improving their service offerings to enhance future revenue streams.

Financial Report Comparison

| Report Type | Software A | Software B |

|---|---|---|

| Income Statement | Automated generation with customizable categories | Manual entry with limited categorization options |

| Balance Sheet | Real-time update of asset and liability data | Manual update with periodic reporting |

| Cash Flow Statement | Detailed analysis of cash inflows and outflows | Basic summary of cash transactions |

| Profitability Reports | Segment-wise profitability analysis | Overall profitability report only |

Budgeting and Forecasting

The software enables the creation and management of budgets, providing a baseline for expected performance. Furthermore, it supports forecasting by allowing the input of various factors (e.g., anticipated demand, pricing changes, market trends) to project future financial performance. This feature helps the agency prepare for future challenges and opportunities. For instance, anticipating a potential increase in fuel prices, the software can help adjust pricing strategies and create contingency plans to mitigate the impact. By incorporating historical data and external factors, the software helps travel agencies anticipate future financial performance and make proactive decisions.

Security and Data Management

Protecting sensitive financial data is paramount for any travel agency. Robust security measures are crucial to maintaining client trust, preventing fraud, and ensuring compliance with industry regulations. This section delves into the critical aspects of data security within travel agency accounting software.

Importance of Data Security

Travel agencies handle a significant amount of sensitive data, including client financial information, travel plans, and personal details. Compromised data can lead to financial losses, reputational damage, and legal repercussions. Secure accounting software safeguards this data, reducing the risk of unauthorized access, breaches, and data loss. This protection is essential for building and maintaining client confidence.

Security Measures in Different Software Solutions

Various security measures are implemented in travel agency accounting software to protect data. These measures often include encryption of data at rest and in transit, ensuring that even if a system is compromised, sensitive information remains unreadable. Advanced authentication methods like multi-factor authentication add another layer of security, requiring users to verify their identity using multiple credentials. Regular security audits and vulnerability assessments help identify and address potential weaknesses.

Data Backup and Recovery Strategies

Reliable data backup and recovery strategies are critical for minimizing disruption in the event of system failure or data loss. Regular backups, stored in a secure offsite location, are essential to restore data quickly and efficiently. These backups should be tested regularly to ensure they are functional and can be used to recover data effectively. Redundancy in storage systems further minimizes the risk of complete data loss.

User Access Controls and Permissions

Controlling user access and permissions is a key aspect of data security. The software should allow for granular control over what data each user can access and modify. This approach ensures that only authorized personnel can access sensitive information. Role-based access controls allow administrators to define specific permissions for different user roles, tailoring access to their needs and responsibilities.

Compliance with Industry Regulations

Adherence to industry regulations, such as GDPR (General Data Protection Regulation) and PCI DSS (Payment Card Industry Data Security Standard), is crucial. Travel agency accounting software should incorporate features that enable compliance with these regulations, ensuring the protection of sensitive data and meeting regulatory requirements. This compliance safeguards the agency from potential penalties and maintains trust with customers.

Security Features Comparison

| Software | Encryption | Data Backup | User Access Control |

|---|---|---|---|

| Software A | 256-bit AES encryption | Automated daily backups to cloud storage | Role-based access with granular permissions |

| Software B | 128-bit AES encryption | Weekly backups to external hard drives | User-specific access levels |

| Software C | 256-bit AES encryption with optional key management | Automated incremental backups to cloud and on-site | Role-based access with audit logs |

Customer Support and Training

A robust customer support system is crucial for the success of any accounting software, particularly for travel agencies. It ensures smooth implementation, effective use, and minimizes user frustration, ultimately boosting productivity and return on investment. Comprehensive support allows users to overcome challenges quickly, maximizing the software’s potential to streamline operations and improve financial reporting.

Importance of Comprehensive Support

Travel agency accounting software often involves complex calculations and integrations. Users, especially those unfamiliar with accounting intricacies, may encounter issues needing expert assistance. Proactive support, readily available via multiple channels, is vital to address these challenges effectively and prevent potential operational disruptions. The time saved through swift problem resolution can translate into significant cost savings and increased efficiency.

Support Channels Offered by Software Providers

Various support channels cater to different user needs and preferences. Many providers offer email support, allowing users to submit queries and receive detailed responses at their convenience. Phone support is also crucial for immediate assistance with urgent issues or complex problems requiring a real-time dialogue. Live chat provides instant support during peak operational hours. Online documentation, tutorials, and FAQs offer self-service options, empowering users to resolve many issues independently.

Training Resources and Materials

Comprehensive training materials are essential for maximizing user understanding and adoption of the accounting software. This includes detailed user manuals, step-by-step guides, and interactive tutorials. Well-structured training programs, both online and in-person, empower users with the knowledge to navigate the software effectively. Regular updates and revisions of training materials ensure users are always working with the most current information.

Identifying and Troubleshooting Potential Issues

A proactive approach to troubleshooting potential issues involves establishing clear communication channels and developing a system for reporting and resolving problems. A dedicated support team can quickly analyze user reports and identify common problems. Documentation of solutions to frequent issues helps to build a comprehensive knowledge base, reducing repetitive queries and accelerating problem resolution for future users.

Examples of Training Materials

Different software vendors provide various training resources. Some offer video tutorials demonstrating specific functions, others offer interactive simulations of real-world accounting scenarios, while others provide detailed user manuals with screenshots and explanations. The best training materials cater to different learning styles and provide a comprehensive overview of the software’s functionalities. For example, a vendor might offer webinars covering specific topics like expense reporting or commission calculations, along with downloadable presentations and practice exercises.

Utilizing Online Tutorials for Software Navigation

Online tutorials serve as invaluable resources for navigating the software effectively. Step-by-step instructions, screen recordings, and interactive elements allow users to master the software’s functionalities at their own pace. These resources, often available within the software itself or on dedicated learning platforms, can guide users through data entry, report generation, and other critical processes. By actively engaging with these tutorials, users can develop a deep understanding of the software’s capabilities and its impact on their daily tasks.

Cost and Return on Investment (ROI)

Travel agency accounting software – Choosing the right accounting software for your travel agency is a significant investment. Understanding the total cost of ownership (TCO) and the potential return on investment (ROI) is crucial for making an informed decision. This section will explore how to determine the TCO for various software options, identify factors affecting license and maintenance costs, and demonstrate methods for calculating ROI, ultimately aiding in comparing the costs and benefits of different solutions.

Determining Total Cost of Ownership (TCO)

The TCO encompasses all expenses associated with acquiring, implementing, and maintaining software throughout its lifecycle. Beyond the initial licensing fee, consider ongoing costs like maintenance, updates, support, training, and potential hardware upgrades needed to run the software effectively. Detailed cost breakdowns are essential to fully understand the long-term financial commitment.

Factors Influencing Software License and Maintenance Costs

Several factors impact the price of software licenses and maintenance. The features offered, the number of users, and the type of support included directly affect the licensing fee. Regular updates and maintenance are crucial for software functionality and security. Additional support packages, customization needs, and the need for integration with other systems further influence the overall cost.

Calculating Return on Investment (ROI)

Calculating the ROI of travel agency accounting software involves assessing the potential savings and improvements it offers against the total cost of ownership. This involves identifying quantifiable benefits like reduced manual data entry errors, improved reporting accuracy, increased operational efficiency, and the potential for streamlining administrative tasks. A key aspect is to compare these benefits to the initial and ongoing costs.

ROI = (Benefits – Costs) / Costs

Comparing Costs and Benefits of Different Software Solutions

Different software solutions cater to varying needs and budgets. High-end software might offer extensive features and robust reporting capabilities, but come with a higher licensing and maintenance cost. Mid-range solutions strike a balance between features and price, while budget-friendly options might sacrifice some features for a lower cost. The choice depends on the specific needs and financial capacity of the travel agency.

Pricing Models Comparison

| Software | Licensing Fee | Support Cost | Subscription Fee |

|---|---|---|---|

| TravelPro | $5,000 | $1,000/year (basic) | $300/month |

| Voyager | $2,500 | $500/year (basic) | $150/month |

| RouteMaster | $1,000 | Free Basic Support | $80/month |

Note: Pricing models vary significantly based on the software and the specific features. This table provides a general comparison. Always review the specific terms and conditions from the software vendor for accurate pricing.

So, you’re looking for travel agency accounting software? It’s crucial for keeping track of all those commissions and expenses. Effective travel management for small business is key, and that often involves streamlined accounting. Think about how much easier your life would be with a dedicated system for managing bookings, payouts, and client details. A good travel agency accounting software solution can handle all of that and integrate with other tools for a truly comprehensive travel management approach, allowing you to focus on growing your business.

travel management for small business is essential for optimizing your operations, and good accounting software is a cornerstone of that optimization.

Travel agency accounting software is crucial for keeping track of finances. It helps streamline operations, making sure everything is organized and accounted for. Choosing the right software can be tricky, especially for smaller agencies, which is why exploring options like travel agency software for small business is important. Ultimately, solid accounting software is the bedrock of a successful travel agency, regardless of size.