Overview of Travel Insurance in Asia

Traveling to Asia offers incredible cultural experiences and breathtaking landscapes, but unforeseen events can quickly disrupt your journey. Travel insurance provides a crucial safety net, protecting you from medical emergencies, lost belongings, trip cancellations, and other potential problems. This comprehensive guide explores the importance of travel insurance for Asian adventures and how to choose the right policy.

Significance of Travel Insurance in Asia

Travel insurance is more than just a backup plan; it’s a vital component of a smooth and worry-free Asian journey. Asia’s diverse range of destinations, from bustling cityscapes to remote mountain villages, presents various risks. Medical expenses in some Asian countries can be substantial, and navigating healthcare systems without pre-arranged coverage can be challenging. Moreover, unexpected delays or cancellations due to unforeseen circumstances can lead to significant financial losses. Travel insurance mitigates these risks, offering financial protection and peace of mind.

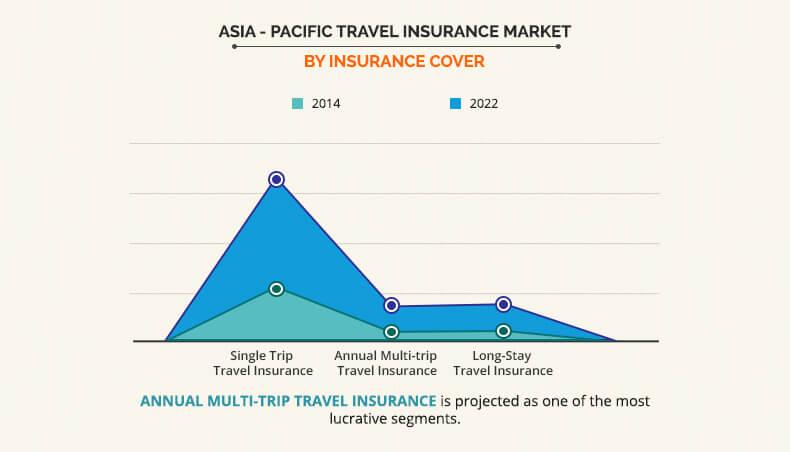

Types of Travel Insurance Policies for Asian Destinations

Several types of travel insurance policies cater to different needs and budgets. Comprehensive policies typically cover medical emergencies, trip cancellations, lost baggage, and travel delays. Budget-friendly options might offer basic coverage for medical expenses and lost belongings. Policies may also include specific add-ons for adventure activities like trekking or scuba diving. Furthermore, some policies specialize in covering specific Asian destinations, addressing potential country-specific risks.

Key Considerations When Selecting a Policy

Choosing the right travel insurance policy involves careful consideration of various factors. First, assess your budget and determine the level of coverage you require. Second, identify potential risks specific to your planned destinations and activities. For example, trekking in Nepal necessitates higher medical and evacuation coverage than a city break in Bangkok. Furthermore, understand the policy’s exclusions, as these will Artikel what is not covered. Finally, compare policies from different providers to ensure you’re getting the best value for your money. Thorough research and comparison shopping are crucial to avoid costly mistakes.

Comparison Table of Insurance Providers

| Insurance Provider | Policy Type | Coverage Amount (Example) | Premium (Example) | Customer Reviews (Example) |

|---|---|---|---|---|

| Company A | Comprehensive | USD 100,000 Medical | USD 50 | High customer satisfaction |

| Company B | Basic | USD 50,000 Medical | USD 30 | Good customer support |

| Company C | Adventure | USD 200,000 Medical | USD 75 | Excellent for extreme activities |

This table provides a basic comparison; always consult the policy documents for detailed information. Pricing and coverage amounts vary based on individual circumstances and trip specifics.

Inclusions and Exclusions in Travel Insurance Plans

Understanding the inclusions and exclusions in your travel insurance policy is vital. Inclusions typically cover medical expenses, trip cancellations, lost baggage, and emergency evacuation. Exclusions often relate to pre-existing medical conditions, certain adventure activities without prior notice, and specific pre-existing health issues. Crucially, review the fine print and seek clarification on any ambiguities.

| Coverage Type | Typical Inclusions | Typical Exclusions |

|---|---|---|

| Medical Expenses | Emergency treatment, hospitalization, evacuation | Pre-existing conditions, self-inflicted injuries |

| Trip Cancellation | Unforeseen circumstances preventing travel | Personal decisions, changes in plans |

| Lost Baggage | Compensation for lost or damaged items | Items not declared, intentional damage |

This table provides a general overview. Specific inclusions and exclusions vary significantly based on the chosen policy and provider.

Coverage Specifics for Asian Destinations

Planning a trip to Asia? Beyond the breathtaking landscapes and vibrant cultures, understanding the specific insurance needs for different Asian countries is crucial. This isn’t a one-size-fits-all situation; medical emergencies, trip disruptions, and even baggage issues can vary significantly depending on your destination and activities. This section delves into the nuances of coverage tailored for Asian travel.

Medical Coverage in Specific Asian Countries

Medical expenses can quickly spiral out of control in a foreign country, especially in Asia where healthcare costs can differ dramatically. Understanding the potential costs is key to choosing the right level of coverage. For example, while some countries have robust public healthcare systems, others may require significant out-of-pocket expenses. The level of pre-existing condition coverage varies considerably between insurance providers, making it vital to thoroughly review your policy. This is particularly important for travelers with pre-existing medical conditions. Always check if your policy covers the specific treatments or procedures you might need in your chosen destinations. Hospitalisation costs in developed Asian countries such as Japan or South Korea can be substantial, and travelers need adequate coverage to manage these costs.

Trip Cancellation and Interruption Coverage in Asian Travel

Unexpected events can disrupt even the best-laid travel plans. Trip cancellation and interruption coverage becomes incredibly valuable in Asia, where natural disasters, political unrest, or sudden illness can throw a wrench into your itinerary. This coverage helps to recoup financial losses associated with cancelled flights, hotels, or tours due to unforeseen circumstances. Consider the frequency of typhoons in Southeast Asia or potential political instability in certain regions when assessing your needs. For example, if you’re planning a trip during typhoon season in the Philippines, trip interruption coverage could be critical to help you adjust your plans or return home if necessary.

Baggage and Personal Liability Coverage in Asian Destinations

Lost or damaged luggage can significantly impact your travel experience, especially in bustling Asian cities where theft or mishaps can occur. Comprehensive baggage coverage provides financial support for replacing lost or damaged belongings. Consider the value of your electronics, clothing, and other personal items to determine the appropriate coverage amount. Personal liability coverage is also crucial in case of accidental damage to others’ property or injuries you might cause during your travels. For example, if you accidentally damage a taxi or injure someone in a public place, your personal liability coverage will help cover the associated costs.

Cost of Travel Insurance for Different Durations of Stay

The cost of travel insurance is often directly related to the duration of your trip. The longer your stay, the higher the premiums are likely to be. This is because the insurance provider is covering a greater potential period of risk. For example, a two-week trip to Thailand will likely have a higher premium than a three-day trip to Singapore. You can also often find discounted rates for shorter trips or if you are travelling with multiple people. The premium will also vary according to the coverage and level of protection required.

Level of Coverage Differing for Various Activities in Different Asian Locations

Different activities in different Asian destinations require varying levels of coverage. Adventure activities like hiking in the Himalayas or scuba diving in the Maldives often come with inherent risks. If you plan on undertaking such activities, you’ll need to ensure that your travel insurance policy covers these specific activities. The policy may have exclusions for certain activities, such as extreme sports, and you must ensure the insurance covers them. For example, a policy might have different limits for medical expenses for a trekking trip compared to a sightseeing tour.

Specific Asian Country Focus

Southeast Asia, with its vibrant cultures and stunning landscapes, presents unique travel insurance needs for different types of travelers. Backpackers, adventure seekers, and those exploring cultural experiences all require specific coverage tailored to their activities and destinations. Understanding the unique risks associated with visa requirements, cultural immersion, and specific country regulations is crucial for selecting the right insurance policy. This section delves into the tailored insurance needs for various activities and countries in Asia.

Navigating the diverse landscapes and cultures of Asia necessitates a nuanced understanding of travel insurance. Different regions present varying challenges, from the remote trails of Nepal to the bustling markets of Thailand. This section highlights the critical factors influencing travel insurance needs for different activities and destinations, ensuring a safe and smooth trip.

Backpacking in Southeast Asia

Backpacking in Southeast Asia often involves budget travel, with potential for extended stays in various locations. Travelers should prioritize comprehensive coverage for medical emergencies, lost or stolen belongings, and trip interruptions. Essential coverage includes medical expenses, evacuation, lost baggage, and trip cancellations. Insurance policies should also address the possibility of needing to extend their stay due to unforeseen circumstances.

Adventure Travel in Nepal and Bhutan

Adventure travel in Nepal and Bhutan demands specialized insurance. These destinations are renowned for trekking and mountaineering, posing significant risks. Travelers should ensure their policy covers the inherent risks of altitude sickness, accidents during treks or expeditions, and helicopter evacuation in case of emergency. Travelers should consider the specific medical needs associated with these activities, including potential altitude-related issues.

Cultural Experiences in Different Asian Regions

Cultural experiences in Asia necessitate specific insurance considerations. Travelers engaging in cultural immersion may face risks related to local customs, traditions, and potentially limited access to medical facilities. Insurance should cover potential medical issues, lost or damaged belongings, and cultural misunderstandings. Travelers should also consider how their chosen activities may affect their insurance coverage.

Visa Requirements and Travel Insurance for Specific Asian Nations

Visa requirements vary considerably across Asian countries. Some nations require proof of travel insurance as part of the visa application process. Travelers must verify the visa requirements for their destination and ensure their insurance policy meets those standards. Thorough research into specific visa regulations and insurance coverage is crucial for a seamless journey.

Documents for Travel Insurance Claims in Asian Countries

Proper documentation is vital for smooth travel insurance claims in Asian countries. Travelers should carefully prepare the necessary documents, which may include the following:

- Original insurance policy document.

- Proof of travel arrangements (e.g., flight tickets, hotel bookings).

- Medical records and receipts (if applicable).

- Police report (if there’s been theft or an accident).

- Passport and visa (if applicable).

- Itinerary.

- Photographs (of damage, injuries, or receipts).

Proper documentation can significantly expedite the claims process. The specific requirements may vary by insurance provider and country, so it’s essential to review the policy details and contact the insurance company before traveling.

Claims and Assistance

Navigating the intricacies of travel insurance claims, especially in a diverse region like Asia, can feel daunting. However, with a clear understanding of the process and available resources, filing a claim becomes significantly less stressful. This section delves into the practical steps involved in lodging claims, securing emergency assistance, and handling lost or damaged belongings.

Filing a claim shouldn’t be a daunting task, but a straightforward process. This guide Artikels the key steps and resources available to you during your travels.

Filing a Travel Insurance Claim in Asia

Understanding the claim process beforehand is crucial for a smooth experience. Start by carefully reviewing your policy document. This will Artikel the specific procedures for filing a claim, including the required documentation and timeframes. Maintain meticulous records of all expenses, receipts, and communication with the insurance provider. This organized approach will expedite the claim processing and minimize potential issues.

- Initial Steps: Contact your insurance provider as soon as possible after the incident. Provide details about the incident, including the date, time, location, and a brief description of the event. This initial communication will initiate the claim process.

- Documentation Collection: Gather all necessary documents, including your travel insurance policy details, supporting documentation related to the claim (such as medical bills, police reports, or receipts for lost items), and any relevant photos or videos. Detailed records will significantly aid in the claim’s assessment.

- Claim Submission: Submit your claim online or via the designated method Artikeld in your policy. Follow the specific instructions provided by your insurer for the complete submission. Ensure you have all the required documentation in order.

- Follow-up and Resolution: Regularly follow up with your insurance provider to check on the claim status. This communication ensures a transparent and timely resolution to your claim.

Contacting Insurance Providers During Emergencies

Insurance providers have multiple channels for emergency contact, tailored to specific situations.

- 24/7 Contact Lines: Many providers offer dedicated 24/7 emergency contact lines, accessible via phone. This ensures immediate assistance in urgent situations, such as medical emergencies or flight disruptions.

- Mobile Applications: Some providers have mobile applications that allow you to report emergencies and track claim progress. This is particularly helpful for quick updates and easy access to assistance.

- Email and Online Portals: Email and online portals provide alternative means for contacting insurance providers, useful for non-emergency situations. These channels allow for detailed information submission and communication.

Accessing Emergency Medical Assistance

Understanding how to access emergency medical assistance through travel insurance in Asia is crucial.

- Emergency Medical Assistance Numbers: Your policy should provide a list of emergency medical assistance numbers. This list will include local emergency numbers and dedicated numbers for the insurance provider.

- Hospital Liaison Services: Some providers offer hospital liaison services to assist with medical arrangements and costs. This support can help manage the complex procedures of receiving medical care.

- Pre-Trip Medical Information: It’s essential to inform your insurer about any pre-existing medical conditions. This crucial step allows them to properly assess your needs in an emergency.

Handling Lost or Damaged Belongings

Insurance policies often cover lost or damaged belongings.

- Policy Coverage: Carefully review your policy to understand the extent of coverage for lost or damaged belongings. This includes the types of items covered and the compensation limits.

- Reporting Lost Items: Report the loss of items immediately to the local authorities and to your insurance provider. Obtain necessary documentation, such as police reports, to expedite the claim process.

- Documentation for Damaged Items: For damaged items, collect detailed documentation, including photos of the damage, receipts for purchase, and any evidence of the incident.

Emergency Contact Numbers for Asian Insurance Providers

Travel insurance in asia – Unfortunately, a comprehensive table of contact numbers for all Asian insurance providers is impractical due to the vast number of providers and constantly changing numbers. However, you can find this information directly on your specific travel insurance policy.

Navigating travel insurance in Asia can be tricky, with so many different policies and coverage levels. But if you’re headed to Dallas, Texas, and need a reliable travel partner, Colwick Travel Dallas Texas offers a range of services that might make your trip even smoother. Ultimately, good travel insurance in Asia is crucial for peace of mind, protecting your investment and your health.

| Insurance Provider | Emergency Contact Number (Example) |

|---|---|

| XYZ Insurance | +886-123-4567 (Taiwan) |

| ABC Insurance | +66-800-123456 (Thailand) |

Cost and Value Analysis

Navigating the world of travel insurance can feel like deciphering a complex code. Different policies offer varying levels of coverage, and prices fluctuate significantly depending on the destination and your personal needs. Understanding the cost-benefit analysis is crucial to ensuring you’re getting the best value for your money.

Comparing the cost of travel insurance across various Asian destinations reveals a significant disparity. Factors like the level of medical care readily available in a particular country, the potential for natural disasters, and the overall safety of the destination all influence the insurance premiums. This analysis delves into the factors impacting insurance costs, empowering you to make informed decisions.

Comparison of Travel Insurance Costs Across Asian Destinations

Different Asian countries present varying risks, affecting insurance premiums. Countries with well-developed healthcare systems and lower incidences of serious illness or injury typically command lower premiums. Conversely, destinations with limited access to medical care or higher risks (like natural disasters or political instability) will have higher premiums.

- Thailand: Known for its affordable healthcare and generally stable environment, Thailand typically has relatively lower travel insurance premiums compared to other Asian countries. However, the cost varies depending on the level of coverage chosen.

- Japan: Japan’s advanced healthcare infrastructure and high safety standards usually lead to more expensive premiums than in some Southeast Asian countries. However, the quality of care is often worth the added cost.

- Philippines: The Philippines presents a moderate cost for travel insurance, balancing affordable healthcare options with certain risks. The price depends on the specific chosen coverage and the duration of your stay.

Factors Influencing Travel Insurance Premiums in Asia

Several factors contribute to the price of travel insurance in Asia. Understanding these factors will help you make more informed decisions about the coverage you need and the price you’re willing to pay.

- Destination Risk Assessment: The level of risk associated with a specific destination is a primary determinant of premium costs. Countries with higher incidences of natural disasters, political unrest, or health concerns will typically have higher premiums.

- Trip Duration: The length of your trip is another key factor. Longer trips often come with a higher risk profile, leading to higher premiums. This is especially true for those traveling to countries with limited access to medical care or in areas prone to natural disasters.

- Coverage Levels: The extent of coverage you select directly impacts the premium. Comprehensive coverage, including medical evacuation, trip cancellation, and lost luggage, typically results in higher premiums compared to basic coverage.

- Traveler Profile: Your age, health condition, and pre-existing medical conditions can also influence premium costs. Insurers often assess these factors to determine the level of risk associated with your travel plans.

Value Proposition of Different Coverage Options

Different travel insurance providers offer various coverage options. Understanding the nuances of these options allows you to choose the best fit for your budget and needs.

| Coverage Option | Description | Value Proposition |

|---|---|---|

| Basic Coverage | Covers basic medical emergencies and trip cancellations. | Suitable for budget-conscious travelers or those traveling to destinations with readily available medical care. |

| Comprehensive Coverage | Covers a wider range of risks, including medical emergencies, trip cancellations, lost luggage, and more. | Offers more protection and peace of mind, especially for travelers with a higher risk profile or those traveling to destinations with limited medical care. |

| Adventure/Extreme Sports Coverage | Specifically designed for activities with higher risk factors, such as trekking or scuba diving. | Essential for those participating in adventure activities or traveling to remote areas. |

Benefits of Travel Insurance Versus the Costs of Not Having It

The benefits of travel insurance often outweigh the potential costs of not having it.

Purchasing travel insurance provides financial protection against unexpected events, allowing you to focus on enjoying your trip without worrying about the financial implications of unforeseen circumstances.

The costs of not having travel insurance can be significant, particularly in the case of medical emergencies or trip disruptions. Medical expenses abroad can be exorbitant, and travel delays or cancellations can lead to significant financial losses.

Choosing the Right Insurance Provider: Travel Insurance In Asia

Navigating the world of travel insurance, especially in the diverse landscape of Asia, can feel like a minefield. With numerous providers vying for your attention, choosing the right one for your trip can be daunting. This section focuses on crucial criteria for selecting a reliable provider, ensuring your trip remains worry-free, regardless of unforeseen circumstances.

Key Criteria for Selecting a Reputable Provider, Travel insurance in asia

Selecting a reputable travel insurance provider for Asia hinges on several critical factors. Financial stability is paramount, as it guarantees the ability to pay claims. Comprehensive coverage tailored to Asian destinations is essential, considering the unique risks and challenges presented by different countries. Strong customer service and readily available assistance, particularly in a foreign environment, is crucial. Finally, competitive pricing without sacrificing coverage is vital.

Financial Stability and Reputation

Insurance providers’ financial stability and reputation are crucial indicators of their trustworthiness. A financially sound company is more likely to honour claims, preventing potential delays and complications during difficult situations.

| Insurance Provider | Reputation Score (1-5, 5 being highest) | Financial Stability Rating (e.g., AM Best rating) |

|---|---|---|

| AIG Travel Insurance | 4 | Excellent |

| Travel Guard | 4.5 | Strong |

| World Nomads | 4.2 | Good |

| Allianz Global Assistance | 4 | Very Good |

Note: Reputation scores are based on customer reviews and industry analysis. Financial stability ratings are sourced from independent rating agencies.

Importance of Reading the Fine Print

Thorough review of policy terms and conditions is essential. This includes understanding the scope of coverage, exclusions, and limitations. Hidden clauses can significantly impact your claim process. Don’t hesitate to scrutinize the fine print; this is a critical step in securing the appropriate protection.

Verifying Legitimacy of an Asian Insurance Provider

Ensuring the legitimacy of an insurance provider in Asia is crucial. Look for official licenses and regulatory approvals from relevant Asian authorities. Consult reputable financial watchdogs or government agencies for verification. Avoid providers without clear regulatory backing.

Comparing Customer Service Reputation

Customer service reputation plays a vital role in the travel insurance decision-making process. A company with a positive track record in resolving claims quickly and efficiently provides peace of mind. Research customer reviews and testimonials to gauge the provider’s responsiveness and efficiency in handling inquiries. Look for providers with dedicated customer support channels readily accessible in the Asian time zone.

Tips and Advice for Travelers

Navigating the world of travel insurance, especially in Asia, can feel overwhelming. Understanding the nuances of coverage, costs, and provider specifics is crucial. This section provides practical tips to help you choose the right policy and avoid common pitfalls. From understanding limitations to ensuring smooth claims processing, these insights will empower you to make informed decisions.

Choosing the right travel insurance is paramount to a worry-free trip. It’s not just about financial protection; it’s about peace of mind. This section Artikels key strategies for selecting the ideal policy, minimizing risks, and maximizing support in case of unforeseen circumstances.

Choosing the Right Travel Insurance Policy

Thorough research and comparison are essential. Don’t just pick the cheapest option; evaluate the scope of coverage, the reputation of the provider, and the claims process. Consider your trip’s specific needs. For instance, if you’re hiking in the Himalayas, you’ll need different coverage than if you’re relaxing on a beach.

- Review the policy’s exclusions and limitations. A policy that seems comprehensive might have hidden exclusions. Pay close attention to what’s not covered to avoid surprises.

- Understand the terms and conditions. Carefully read the policy documents, and ask questions if anything is unclear. Look for clauses that address pre-existing conditions, medical emergencies, and specific activities.

- Compare policies from different providers. Use online comparison tools to assess coverage options, premiums, and claim processes. Look for providers with a solid reputation and a track record of prompt and efficient claims handling.

Avoiding Common Mistakes in Purchasing Travel Insurance

Impulsive decisions often lead to regrets. Don’t rush into purchasing travel insurance. Take your time to assess your needs and compare policies.

- Not reading the fine print. Many travelers overlook exclusions and limitations, leading to disappointment when they try to make a claim.

- Choosing the cheapest option without considering coverage. The lowest premium might not always equate to the most comprehensive coverage. Consider the value proposition.

- Failing to consider pre-existing conditions. If you have a pre-existing health condition, ensure that the policy covers it. Some policies may require a waiting period or have specific limitations.

Understanding the Limitations of Travel Insurance Coverage

Travel insurance is a safeguard, not a guarantee. It has limitations, and understanding these is crucial.

- Pre-existing conditions. Many policies exclude or restrict coverage for pre-existing medical conditions. Ensure the policy clearly Artikels the coverage for pre-existing ailments.

- Coverage for specific activities. Certain activities, such as extreme sports or scuba diving, may not be covered. Check the policy’s terms for adventure activities or hazardous sports.

- Limitations on medical expenses. Policies often have maximum payout amounts for medical expenses. Understand these limits to avoid financial surprises.

Ensuring the Best Possible Support from the Insurance Provider

A reliable insurance provider can make a significant difference in a stressful situation. Establish clear communication channels and maintain detailed records.

- Maintain a record of your trip details. Keep copies of your flight tickets, hotel bookings, and other important documents.

- Understand the claims process. Knowing the steps involved in filing a claim will be helpful. Understand what documentation is required and how long the process might take.

- Communicate promptly and clearly. If an incident occurs, contact your insurance provider immediately and provide all necessary details.

What to Do in Case of Unforeseen Circumstances

Having a plan in place can significantly ease the stress of an unexpected event.

- Contact your insurance provider immediately. Prompt action is crucial in handling unforeseen circumstances. Follow the steps Artikeld in your policy.

- Gather all necessary documentation. Have copies of your travel insurance policy, medical records, and receipts. Gather all evidence relevant to the claim.

- Seek professional medical assistance if needed. Prioritize your health and safety. Obtain necessary medical care and keep records of all expenses.

Navigating travel insurance in Asia can be tricky, but it’s equally important for adventures like an African safari. Thinking about your trip to the Serengeti? You’ll need comprehensive coverage, and thankfully, african safari travel insurance is readily available to protect you from unexpected issues. Ultimately, good travel insurance in Asia is crucial for peace of mind, whether you’re exploring bustling cities or remote villages.