Program Overview: WUSTL Master of Finance

The Washington University in St. Louis (WUSTL) Master of Finance program provides students with a rigorous and comprehensive education in finance, equipping them with the knowledge and skills necessary for success in a variety of finance careers. The program’s curriculum is designed to provide a strong foundation in financial theory and practice, with opportunities for specialization.

Core Curriculum

The core curriculum of the WUSTL Master of Finance program is designed to provide students with a solid understanding of fundamental financial concepts. These courses are required for all students and cover a broad range of topics essential for a career in finance.

- Financial Accounting: This course provides a comprehensive understanding of financial statement analysis, including balance sheets, income statements, and cash flow statements. Students learn how to interpret financial data and make informed investment decisions.

- Corporate Finance: This course focuses on the financial decisions of corporations, including capital budgeting, capital structure, and dividend policy. Students learn to evaluate investment projects, determine the optimal mix of debt and equity financing, and understand the impact of financial decisions on shareholder value.

- Investments: This course covers the principles of investment management, including portfolio construction, asset pricing, and risk management. Students learn to analyze different investment instruments, such as stocks, bonds, and derivatives, and develop strategies for managing investment portfolios.

- Financial Modeling: This course teaches students how to build and use financial models to analyze financial data and make informed decisions. Students learn to use spreadsheet software and other tools to model financial statements, value companies, and evaluate investment opportunities.

- Derivatives: This course covers the theory and application of derivative instruments, such as options, futures, and swaps. Students learn how to price and use derivatives for hedging and speculation.

- Fixed Income Securities: This course provides an in-depth understanding of fixed-income securities, including bonds, and other debt instruments. Students learn about bond valuation, yield curve analysis, and the risks associated with fixed-income investments.

- Econometrics: This course introduces students to statistical methods used in finance, including regression analysis and time series analysis. Students learn how to use econometric techniques to analyze financial data and test financial theories.

Elective Options

The WUSTL Master of Finance program offers a variety of elective courses, allowing students to specialize in areas of interest. Students can choose from a wide range of electives to tailor their studies to their specific career goals.

- Investment Management Track: This track allows students to delve deeper into portfolio management, including advanced topics in asset allocation, hedge fund strategies, and global investment strategies.

- Corporate Finance Track: This track allows students to further develop their knowledge of corporate finance, covering topics such as mergers and acquisitions, restructuring, and financial strategy.

- Financial Engineering Track: This track focuses on quantitative finance and financial modeling, covering topics such as advanced derivatives pricing, risk management, and computational finance.

- Real Estate Finance Track: This track provides a specialized focus on real estate investment, development, and finance.

Program Structure and Duration

The WUSTL Master of Finance program is designed to be completed in a full-time format. The program’s structure is designed to provide students with a focused and immersive learning experience.

- Full-Time Program: The program is designed to be completed in 16 months. Students typically begin their studies in the fall semester and complete the program in the following spring.

- Coursework: Students typically take 10-12 courses throughout the program. The curriculum includes core courses in finance, as well as elective courses that allow students to specialize in areas of interest.

- Experiential Learning: The program offers opportunities for experiential learning, such as case studies, simulations, and projects, to enhance students’ practical skills.

Program Objectives and Career Paths

The WUSTL Master of Finance program aims to equip students with a strong foundation in finance and the skills necessary to succeed in a variety of finance careers. The program’s objectives are designed to prepare students for leadership roles in the financial industry.

- Knowledge and Skills: The program aims to provide students with a comprehensive understanding of financial theory and practice, including financial accounting, corporate finance, investments, and derivatives. Students develop strong analytical, problem-solving, and communication skills.

- Career Paths: Graduates of the WUSTL Master of Finance program are well-prepared for a variety of careers in finance, including investment banking, asset management, corporate finance, financial analysis, and consulting.

- Career Services: The program provides career services, including career counseling, resume workshops, and networking events, to assist students in their job search.

Admission Requirements and Application Process

The Washington University in St. Louis (WUSTL) Master of Finance program maintains a rigorous application process designed to identify highly qualified candidates. This section provides a detailed overview of the eligibility criteria, application steps, and specific considerations for international applicants. Understanding these requirements is crucial for prospective students aiming to successfully navigate the admissions process.

Eligibility Criteria

Admission to the WUSTL Master of Finance program is highly competitive. Applicants are evaluated based on a holistic review of their academic achievements, standardized test scores, and professional experience. Meeting the minimum requirements does not guarantee admission, as the admissions committee considers all aspects of an applicant’s profile.

- GPA Requirements: Applicants are expected to have a strong undergraduate academic record. While there is no strict minimum GPA, successful applicants typically have a GPA of 3.0 or higher on a 4.0 scale. Strong performance in quantitative courses, such as mathematics, statistics, and economics, is particularly important.

- Standardized Test Scores (GRE/GMAT): The program requires either the Graduate Record Examinations (GRE) or the Graduate Management Admission Test (GMAT). There is no preference for either test; the admissions committee considers both equally. Competitive applicants typically score above the average in both the quantitative and verbal sections. The average GMAT score for admitted students is usually around 680-720, while the average GRE score is around 320-330. However, these are just averages, and scores should be viewed in the context of the entire application.

- Work Experience Requirements: While not mandatory, relevant work experience is highly valued. Applicants with internships or full-time experience in finance or a related field often have a significant advantage. The admissions committee looks for evidence of leadership potential, analytical skills, and a demonstrated interest in finance. Applicants without prior work experience are also considered, particularly those with strong academic records and compelling career goals.

Application Process

The application process for the WUSTL Master of Finance program is entirely online. Applicants should carefully review the following steps and ensure they meet all deadlines.

- Application Form: Complete the online application form available on the program’s website. This includes personal information, academic history, and professional experience.

- Transcripts: Submit official transcripts from all previously attended undergraduate and graduate institutions. Transcripts must be submitted directly from the issuing institution to the university.

- GRE/GMAT Scores: Arrange for official score reports from the Educational Testing Service (ETS) for GRE or the Graduate Management Admission Council (GMAC) for GMAT to be sent directly to Washington University in St. Louis. The institution’s code is required for this process.

- Essays: Submit a series of essays as part of the application. These essays are designed to assess your motivations for pursuing the degree, your career goals, and your fit with the program.

- Letters of Recommendation: Provide the contact information for individuals who can provide letters of recommendation. Two letters of recommendation are required, ideally from professors or employers who can speak to your academic and professional abilities.

- Resume/CV: Submit a current resume or curriculum vitae that details your work experience, education, skills, and other relevant information.

- Application Fee: Pay the non-refundable application fee. The fee amount is specified on the program’s website and is subject to change.

- Deadlines: The program typically has several application deadlines throughout the year, including early action, priority, and final deadlines. Applicants are encouraged to apply early to increase their chances of admission and scholarship consideration. Specific dates are published on the program’s website.

International Applicants

International applicants must meet additional requirements to be considered for admission. This section provides information regarding English language proficiency and visa requirements.

- TOEFL/IELTS Scores: International applicants whose native language is not English are required to submit scores from the Test of English as a Foreign Language (TOEFL) or the International English Language Testing System (IELTS). Minimum score requirements are typically specified on the program’s website, but generally, a TOEFL score of 100 or higher and an IELTS score of 7.0 or higher are considered competitive.

- Visa Information: Admitted international students will receive instructions on obtaining an F-1 student visa. This process involves providing financial documentation to demonstrate the ability to cover tuition, fees, and living expenses. The university will issue an I-20 form, which is required to apply for the visa. Students should begin the visa application process as soon as they receive their I-20.

- Financial Documentation: International applicants must provide documentation demonstrating sufficient financial resources to cover the cost of attendance for the duration of the program. This may include bank statements, scholarship letters, or other forms of financial support.

Faculty and Research Opportunities

The Washington University in St. Louis (WUSTL) Master of Finance program provides students with unparalleled access to leading finance experts and cutting-edge research opportunities. The program’s faculty are not only accomplished academics but also bring a wealth of real-world experience, ensuring a curriculum that is both rigorous and relevant. This section details the faculty, research prospects, and industry connections available to students.

Faculty Expertise and Experience

The WUSTL Master of Finance program boasts a faculty comprised of renowned professors with diverse expertise in various areas of finance. Their academic credentials are complemented by extensive industry experience, allowing them to bridge the gap between theory and practice.

The faculty includes:

- Professors with Deep Academic Credentials: Many professors hold PhDs from top universities and have published extensively in leading finance journals. This ensures that students are learning from individuals at the forefront of financial research.

- Industry Veterans: Several faculty members have held significant positions in the financial industry, including roles at investment banks, hedge funds, and consulting firms. This practical experience enriches the classroom experience, providing real-world insights and case studies.

- Diverse Specializations: The faculty’s expertise spans various areas of finance, including investment management, corporate finance, financial modeling, and risk management. This broad range of expertise allows students to tailor their studies to their specific interests.

- Commitment to Student Success: Faculty members are dedicated to student success, offering office hours, mentoring, and guidance on career paths. They are committed to fostering a collaborative and supportive learning environment.

Research Opportunities for Students

Students in the Master of Finance program have access to a variety of research opportunities that enhance their academic experience and prepare them for careers in finance. These opportunities provide students with the chance to contribute to the advancement of financial knowledge and develop critical research skills.

The available research opportunities are:

- Research Assistantships: Students can work as research assistants for faculty members, assisting with ongoing research projects. This provides valuable hands-on experience in data analysis, literature reviews, and research methodologies.

- Research Projects: Students can undertake independent research projects under the guidance of faculty advisors. This allows them to delve deeper into specific areas of interest and develop their research skills.

- Access to Research Centers: Students have access to the resources and facilities of the university’s research centers, such as the Center for Finance and Accounting. This access provides them with opportunities to attend seminars, workshops, and conferences.

- Collaboration with Faculty: Students have the opportunity to co-author research papers with faculty members, which can significantly enhance their academic credentials and career prospects.

Industry Connections and Networking

The WUSTL Master of Finance program is strongly connected to the financial industry, providing students with ample opportunities to network with professionals and gain insights into the industry. These connections are invaluable for career development and placement.

The program offers the following industry connections:

- Guest Lectures: The program regularly hosts guest lectures by industry professionals, providing students with insights into current trends and practices in finance. These lectures offer valuable networking opportunities.

- Workshops: Workshops are conducted on various topics, such as resume writing, interviewing skills, and financial modeling, preparing students for their careers.

- Networking Events: The program organizes networking events, such as career fairs and alumni events, providing students with opportunities to connect with industry professionals.

- Mentorship Programs: Students can participate in mentorship programs, pairing them with experienced professionals in the financial industry. These programs provide guidance and support as students navigate their careers.

- Career Services: The university’s career services department offers comprehensive support, including resume reviews, mock interviews, and job placement assistance.

Program Costs and Financial Aid

Understanding the financial aspects of the Washington University in St. Louis (WUSTL) Master of Finance program is crucial for prospective students. This section provides a detailed overview of the tuition fees, associated costs, and available financial aid options, empowering applicants to make informed decisions about their investment in the program.

Tuition and Associated Costs

The total cost of the WUSTL Master of Finance program encompasses tuition fees and various other expenses. These expenses are important for students to consider when planning their finances.

- Tuition Fees: Tuition constitutes the primary cost of the program. The exact tuition amount is subject to change, so prospective students should consult the official WUSTL website for the most up-to-date figures. Typically, tuition is charged per credit hour or on a flat-fee basis per semester.

- Living Expenses: Living expenses vary based on lifestyle choices and accommodation preferences. Students should budget for housing (on or off-campus), food, transportation, and personal expenses. St. Louis offers a range of housing options, from apartments to shared housing, with varying costs.

- Books and Supplies: Students should allocate funds for textbooks, software, and other course materials. The cost of these items can fluctuate depending on the specific courses and resources required.

- Other Fees: Additional fees may include health insurance, student activity fees, and technology fees. These fees contribute to the overall cost of attending the program and provide access to various university resources.

Financial Aid Options

WUSTL offers several financial aid options to help students finance their Master of Finance education. These options can significantly reduce the financial burden and make the program more accessible.

- Scholarships: The university and external organizations provide various scholarships to students based on merit, need, or specific criteria. These scholarships can range from partial tuition waivers to full-tuition coverage. Prospective students should research available scholarship opportunities and meet the application deadlines.

- Fellowships: Some programs offer fellowships, which may include a stipend, tuition remission, and other benefits. Fellowships are often awarded based on academic excellence, research potential, and other qualifications.

- Loans: Students can apply for federal and private loans to cover tuition and living expenses. Federal loans typically offer more favorable terms and interest rates. Private loans may offer additional funding options but often have stricter repayment terms.

- Assistantships: Some departments offer teaching or research assistantships. These positions provide a stipend and may include tuition remission. They also offer valuable experience in teaching or research.

Cost Comparison with Similar Programs, Wustl master of finance

The cost of the WUSTL Master of Finance program can be compared with similar programs at other universities to help prospective students make informed decisions. This table provides a comparative overview, noting that costs are subject to change and students should consult the official websites of each program for the most current information.

| University | Program | Estimated Tuition (USD) | Other Estimated Costs (USD) |

|---|---|---|---|

| Washington University in St. Louis | Master of Finance | [Insert Current Tuition Fee – e.g., $75,000 – Subject to Change] | [Insert Estimated Other Costs – e.g., $30,000 – Subject to Change] |

| University of Chicago | Master of Science in Financial Mathematics | [Insert Current Tuition Fee – e.g., $80,000 – Subject to Change] | [Insert Estimated Other Costs – e.g., $35,000 – Subject to Change] |

| Carnegie Mellon University | Master of Science in Computational Finance | [Insert Current Tuition Fee – e.g., $78,000 – Subject to Change] | [Insert Estimated Other Costs – e.g., $32,000 – Subject to Change] |

| Massachusetts Institute of Technology (MIT) | Master of Finance | [Insert Current Tuition Fee – e.g., $85,000 – Subject to Change] | [Insert Estimated Other Costs – e.g., $38,000 – Subject to Change] |

Note: The information presented in the table is for illustrative purposes only. Actual costs may vary. Prospective students should always consult the official websites of each university for the most accurate and up-to-date information. Financial aid availability also varies.

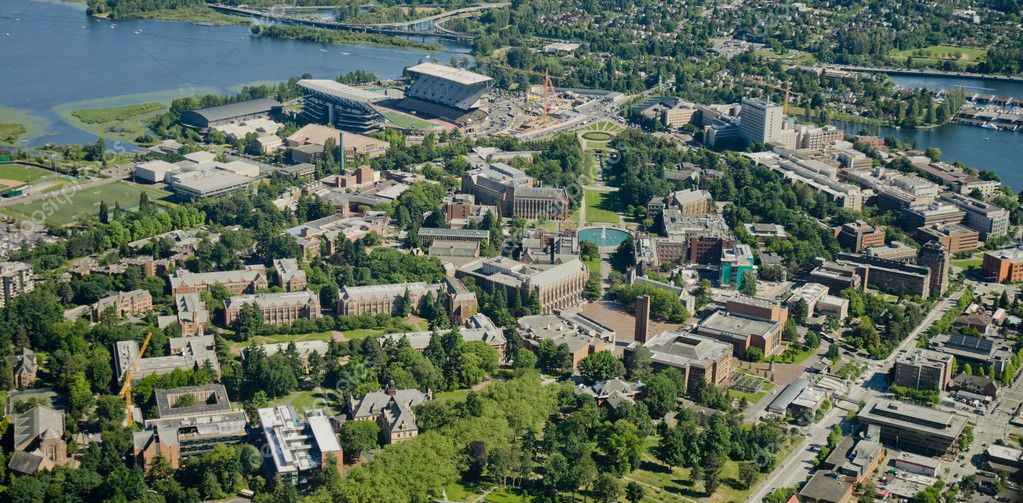

Student Life and Campus Resources: Wustl Master Of Finance

The Washington University in St. Louis Master of Finance program offers more than just academic rigor; it fosters a vibrant student life and provides extensive resources to support students’ overall well-being and success. Students can immerse themselves in a rich campus environment, connect with peers, and access valuable services designed to enhance their educational journey and prepare them for future careers.

Student Clubs and Organizations

Student involvement in clubs and organizations is a cornerstone of the WUSTL experience. These groups provide opportunities for networking, skill development, and social engagement. Students can explore their interests, build lasting relationships, and gain valuable leadership experience.

- Finance Clubs: Students can join finance-specific clubs like the Finance Club, Investment Club, or Private Equity Club. These clubs often host guest speakers, organize case competitions, and provide networking opportunities with industry professionals. For example, the Finance Club at WUSTL regularly invites professionals from Goldman Sachs and JP Morgan to speak about career paths and market trends.

- Professional Organizations: Students can participate in professional organizations such as the Graduate Finance Association, which provides networking and career development opportunities. This includes resume workshops and mock interviews.

- Cultural and Social Clubs: Beyond finance, students can engage with various cultural, social, and recreational clubs. These include the Graduate Student Senate, various sports clubs, and arts organizations, promoting a well-rounded campus experience.

Campus Resources

Washington University in St. Louis provides comprehensive resources to support students academically, personally, and professionally. These resources are designed to enhance the learning experience and promote student well-being.

- Libraries: The university’s libraries, including Olin Library, offer extensive collections of books, journals, and online databases relevant to finance and other disciplines. These libraries also provide study spaces, research assistance, and access to specialized software.

- Computer Labs: State-of-the-art computer labs are available with access to financial modeling software such as Bloomberg Terminal and FactSet. These labs are essential for coursework and research projects.

- Health Services: The Habif Health and Wellness Center offers medical, mental health, and wellness services. This ensures students have access to comprehensive healthcare throughout their academic journey. Counseling services and stress management workshops are also available.

- Career Services: The Weston Career Center offers career counseling, resume workshops, mock interviews, and job placement assistance specifically tailored to finance careers. The center also organizes career fairs and connects students with potential employers.

- Athletic Facilities: Students have access to various athletic facilities, including a recreation center, swimming pool, and sports fields, promoting a healthy lifestyle and providing opportunities for social interaction.

Advantages of Studying in St. Louis

Studying in St. Louis presents several advantages that enhance the overall student experience and career prospects. The city offers a unique combination of affordability, cultural richness, and a growing job market.

- Cost of Living: The cost of living in St. Louis is significantly lower than in many other major cities, allowing students to manage their finances more effectively. According to Numbeo, the consumer prices in St. Louis are approximately 10% lower than in New York City, and rent prices are about 60% lower.

- Cultural Attractions: St. Louis boasts a vibrant cultural scene with numerous museums, art galleries, and music venues. The St. Louis Art Museum, the Missouri History Museum, and the City Museum provide enriching experiences outside of the classroom.

- Job Market: The St. Louis job market is experiencing growth, particularly in the finance and technology sectors. Major companies like Edward Jones, Wells Fargo Advisors, and Centene Corporation are headquartered or have significant operations in the region, providing numerous job opportunities for graduates.

- Networking Opportunities: The presence of these companies and a growing startup scene creates ample networking opportunities for students. WUSTL’s proximity to these firms allows for direct engagement and potential internships or job placements.

Program Strengths and Differentiators

The Washington University in St. Louis (WUSTL) Master of Finance program distinguishes itself through a combination of academic rigor, practical application, and a supportive learning environment. This program is designed to equip graduates with the skills and knowledge needed to excel in the dynamic field of finance. Its unique strengths stem from its curriculum, faculty expertise, and focus on career development.

Academic Excellence and Curriculum Design

The WUSTL Master of Finance program offers a curriculum built on a strong foundation in financial theory and quantitative methods. The program’s structure allows students to tailor their studies to their specific career interests.

- Core Curriculum: Students gain a comprehensive understanding of core finance principles, including corporate finance, investments, financial modeling, and derivatives. This provides a solid base for advanced study and practical application.

- Electives: A wide range of elective courses allows students to specialize in areas such as asset management, private equity, real estate, or fintech. This flexibility helps students align their education with their career goals.

- Quantitative Focus: The program emphasizes quantitative skills, with courses in econometrics, data analysis, and programming. This prepares graduates for the increasingly data-driven nature of the finance industry.

- Global Perspective: The curriculum incorporates a global perspective, with courses addressing international finance and global markets. This is crucial in today’s interconnected financial world.

Practical Application and Real-World Experience

The program prioritizes practical application through case studies, simulations, and opportunities for real-world experience. This ensures that students are well-prepared to enter the workforce.

- Case Studies: Students analyze real-world financial cases, applying their knowledge to solve complex problems. This develops critical thinking and decision-making skills.

- Financial Modeling: Students build and utilize financial models to evaluate investments, value companies, and manage risk. This hands-on experience is highly valued by employers.

- Simulations: Students participate in simulations, such as trading simulations, to experience the dynamics of financial markets. This provides a realistic understanding of market behavior and trading strategies.

- Internships: The program encourages and supports students in securing internships at leading financial institutions. This provides valuable work experience and networking opportunities.

- Applied Learning Projects: Students may participate in applied learning projects, such as the investment fund management program, to apply their knowledge in a practical setting. This allows students to gain real-world experience in managing investments and making financial decisions.

Faculty Expertise and Industry Connections

The program benefits from a distinguished faculty comprised of experienced academics and industry professionals. This combination provides students with both theoretical knowledge and practical insights.

- Expert Faculty: Professors are experts in their respective fields, conducting cutting-edge research and bringing real-world experience to the classroom.

- Industry Practitioners: Guest lecturers and adjunct faculty from the finance industry provide valuable insights and networking opportunities.

- Career Services: The program offers comprehensive career services, including resume workshops, interview preparation, and networking events. This supports students in their job search and career development.

- Networking Opportunities: Students have access to networking events, industry conferences, and alumni connections, providing opportunities to build relationships with professionals in the field.

Student and Alumni Perspectives

The following quotes from current students and alumni highlight the program’s strengths:

“The curriculum’s focus on practical application, including case studies and simulations, has been invaluable in preparing me for my internship. I feel confident in my ability to apply what I’ve learned in a real-world setting.” – Current Student

“The faculty’s expertise and industry connections were instrumental in helping me secure my first job after graduation. The program provided me with the knowledge and network I needed to succeed.” – Alumnus/Alumna

“The program’s emphasis on quantitative skills and financial modeling gave me a significant advantage in the job market. I was able to hit the ground running in my role.” – Alumnus/Alumna

Comparing with other Finance Masters

Choosing a Master of Finance program is a significant decision, and prospective students should carefully evaluate various programs to determine the best fit for their career aspirations. This section provides a comparative analysis of the WUSTL Master of Finance program with a similar program at a peer institution, highlighting key differences in curriculum, career services, and faculty expertise. This comparison will help prospective students make an informed decision.

Curriculum Comparison

The curriculum is a critical aspect of any Master of Finance program. Differences in course offerings, specialization options, and the emphasis on practical versus theoretical knowledge can significantly impact a graduate’s career trajectory. The WUSTL Master of Finance program typically offers a strong foundation in core finance principles, complemented by specialized tracks.

- WUSTL Master of Finance: The curriculum often includes courses such as Financial Modeling, Corporate Finance, Investments, and Derivatives. Students can choose from specializations like Investment Management or Corporate Finance. The program emphasizes both theoretical understanding and practical application through case studies, simulations, and projects.

- Peer Institution (Example: University of Michigan’s Master of Management program with a Finance Concentration): The curriculum usually offers a similar core set of finance courses but may have a different emphasis. The University of Michigan program may have a broader focus on management principles in addition to finance, offering a more holistic business education. Specializations might include corporate finance, investment management, or real estate.

Career Services Comparison

Career services play a crucial role in assisting graduates in securing internships and full-time employment. The effectiveness of these services often depends on the program’s industry connections, career coaching, and alumni network.

- WUSTL Master of Finance: The program often provides comprehensive career services, including resume workshops, interview preparation, and networking events with potential employers. WUSTL frequently has strong connections with firms in the Midwest and nationally.

- Peer Institution (Example: University of Michigan’s Master of Management program with a Finance Concentration): The University of Michigan program benefits from a robust career services infrastructure, including career fairs, on-campus recruiting, and access to a large alumni network. The program leverages the university’s brand and geographic location to connect students with opportunities across various sectors.

Faculty Expertise Comparison

The expertise of the faculty is another key factor to consider. Faculty research interests, industry experience, and teaching styles can significantly influence the learning experience and the depth of knowledge students gain.

- WUSTL Master of Finance: The program typically boasts faculty with strong academic credentials and practical experience. The faculty often conduct research in areas like asset pricing, corporate governance, and behavioral finance, bringing cutting-edge insights to the classroom.

- Peer Institution (Example: University of Michigan’s Master of Management program with a Finance Concentration): The University of Michigan program features a distinguished faculty, including professors with extensive industry experience and renowned researchers. The faculty’s expertise covers a wide range of finance topics, and their research often informs the curriculum.

Comparative Table of Key Metrics

The following table provides a comparative overview of key metrics for the WUSTL Master of Finance program and a similar program at a peer institution.

| Metric | WUSTL Master of Finance | University of Michigan (Example) – Master of Management with Finance Concentration | Notes |

|---|---|---|---|

| Program Length | Typically 16-20 months | Typically 20 months | Program lengths can vary based on individual circumstances and program structure. |

| Tuition Cost (Estimated) | $75,000 – $85,000 | $80,000 – $90,000 | Tuition costs are approximate and can change. Always consult the official program websites for the most up-to-date information. |

| Average Salary Post-Graduation (Estimated) | $90,000 – $120,000 | $95,000 – $130,000 | Salary ranges are estimates and depend on the role, experience, and location. |

| Acceptance Rate (Estimated) | 20-30% | 15-25% | Acceptance rates vary annually based on the applicant pool. |

Advantages of WUSTL’s Program

WUSTL’s Master of Finance program often offers several advantages over competing institutions. These advantages can significantly impact the student experience and career prospects.

- Industry Connections: WUSTL frequently cultivates strong relationships with financial institutions and corporations, especially in the Midwest, leading to valuable networking opportunities and internship placements.

- Research Opportunities: The program often provides students with opportunities to participate in faculty research projects, gaining valuable experience in financial analysis and research methodologies.

- Smaller Class Sizes: Smaller class sizes often lead to more personalized attention from faculty and a more collaborative learning environment.

- Specific Specializations: The program might offer niche specializations that align with current industry trends or specific career goals, such as alternative investments or fintech.

Preparing for the Program

Prospective students should proactively prepare for the WUSTL Master of Finance program to maximize their chances of admission and success. This preparation involves academic readiness, application enhancement, and interview practice. By focusing on these areas, applicants can demonstrate their commitment and potential to excel in the program.

Recommended Pre-Program Coursework and Readings

A strong foundation in quantitative subjects and finance fundamentals significantly benefits incoming students. While the program provides a comprehensive curriculum, prior exposure to certain concepts can ease the transition and allow students to delve deeper into the material. The following coursework and readings are highly recommended.

- Mathematics: A solid understanding of calculus, linear algebra, and probability and statistics is crucial. These are foundational for many finance concepts.

- Calculus: Review differential and integral calculus, including optimization techniques.

- Linear Algebra: Familiarize yourself with matrices, vectors, and eigenvalues.

- Probability and Statistics: Understand probability distributions, hypothesis testing, and regression analysis.

- Finance: Prior exposure to core finance principles is advantageous.

- Corporate Finance: Study topics such as capital budgeting, cost of capital, and financial statement analysis.

- Investments: Learn about asset pricing, portfolio theory, and market efficiency.

- Recommended Readings: Consider reading introductory textbooks and articles.

- “Investments” by Bodie, Kane, and Marcus: A comprehensive overview of investment principles.

- “Corporate Finance” by Ross, Westerfield, and Jaffe: A classic textbook covering corporate finance topics.

Tips for Improving Applications

Crafting a compelling application requires showcasing relevant experiences and highlighting skills. Applicants should focus on demonstrating their aptitude for finance and their potential for success in the program.

- Highlight Relevant Experiences: Emphasize any prior experience in finance, economics, or related fields.

- Internships: Describe your responsibilities and accomplishments during internships in finance, banking, or consulting. Quantify your achievements whenever possible. For example, “Assisted in the analysis of a $50 million M&A deal, contributing to the due diligence process.”

- Projects: If you have worked on finance-related projects, detail your role, the methodologies used, and the results achieved.

- Demonstrate Quantitative Skills: Showcase your proficiency in quantitative analysis and problem-solving.

- Academic Performance: Highlight strong grades in relevant coursework, especially in mathematics, statistics, and finance.

- Technical Skills: Mention your experience with programming languages like Python or R, and financial modeling software such as Excel.

- Prepare for Interviews: Practice answering common interview questions to present yourself confidently.

- Behavioral Questions: Reflect on your past experiences and be prepared to provide specific examples.

- Technical Questions: Review fundamental finance concepts and practice problem-solving.

- Tailor Your Application: Customize your application to reflect your specific interests and goals.

- Statement of Purpose: Clearly articulate your reasons for pursuing the Master of Finance at WUSTL and how the program aligns with your career aspirations.

- Resume: Ensure your resume is well-organized, concise, and highlights your most relevant experiences and skills.

Common Interview Questions and How to Answer Them

Interviews assess both technical knowledge and behavioral traits. Prepare by practicing answers to common questions, focusing on providing clear, concise, and insightful responses.

- Behavioral Questions: These questions assess your past behavior to predict future performance.

- “Tell me about a time you failed.”

- How to Answer: Choose a specific example, describe the situation, explain your actions, and detail what you learned from the experience. Focus on the lessons learned and how you have grown. For instance, “During a project, I made a mistake in the initial model setup. I immediately corrected the error, learned to double-check assumptions, and developed a new checklist to prevent future mistakes.”

- “Describe a challenging situation you faced and how you overcame it.”

- How to Answer: Use the STAR method (Situation, Task, Action, Result). Briefly describe the situation, the task you needed to accomplish, the actions you took, and the positive result achieved. For example, “During my internship, I had to complete a complex financial analysis within a tight deadline. I organized my time, broke the task into smaller steps, and sought help from colleagues when needed, ultimately delivering the analysis on time and exceeding expectations.”

- “Why are you interested in the Master of Finance program at WUSTL?”

- How to Answer: Articulate your specific reasons for choosing the program, highlighting its strengths and how they align with your career goals. Mention specific faculty, courses, or opportunities that attract you. For example, “I am particularly interested in WUSTL’s strong faculty in financial econometrics and the hands-on experience offered through the Applied Finance Practicum, which aligns with my career goal of becoming a quantitative analyst.”

- “Tell me about a time you failed.”

- Technical Questions: These questions test your understanding of finance concepts.

- “Explain the concept of the time value of money.”

- How to Answer: Explain that money available at the present time is worth more than the same amount in the future due to its potential earning capacity. Provide a simple example. For instance, “A dollar today is worth more than a dollar tomorrow because it can be invested and earn interest.”

- “What is the difference between a stock and a bond?”

- How to Answer: Describe the fundamental differences. A stock represents ownership in a company, while a bond represents a loan to a company or government. Discuss the risk and return profiles. For example, “A stock provides ownership and potential for higher returns but also carries higher risk, while a bond offers a fixed income stream with lower risk.”

- “What is the Capital Asset Pricing Model (CAPM)?”

- How to Answer: Explain the CAPM as a model that describes the relationship between expected return and risk for an asset.

The formula is: E(Ri) = Rf + βi * [E(Rm) – Rf], where E(Ri) is the expected return of the investment, Rf is the risk-free rate, βi is the beta of the investment, and E(Rm) is the expected return of the market.

For example, “The CAPM helps investors determine the expected return on an investment, considering its sensitivity to market movements.”

- How to Answer: Explain the CAPM as a model that describes the relationship between expected return and risk for an asset.

- “Explain the concept of the time value of money.”

Specializations and Tracks

The WUSTL Master of Finance program offers students the opportunity to tailor their studies through specialized tracks, allowing for a deeper dive into specific areas of finance. These specializations provide focused coursework and experiential learning opportunities, preparing graduates for targeted career paths. Students can choose from several tracks, each designed to equip them with the knowledge and skills needed to excel in their chosen field.

Specialization Options Available

The program typically features several specializations, each focusing on a distinct area within finance. These specializations allow students to develop expertise in specific areas, enhancing their marketability to potential employers. The available tracks may include Investment Management, Corporate Finance, and Financial Engineering. The specific courses and career outcomes associated with each track are detailed below.

Investment Management Specialization

This specialization focuses on the principles and practices of managing investment portfolios, including security analysis, portfolio construction, and risk management. Students gain a comprehensive understanding of financial markets and investment strategies.

- Core Courses:

- Financial Accounting

- Corporate Finance

- Investments

- Portfolio Management

- Fixed Income Securities

- Elective Courses:

- Advanced Investments

- Hedge Funds and Alternative Investments

- Behavioral Finance

- Derivatives

- Private Equity

- Career Outcomes: Graduates pursuing this specialization are well-prepared for roles such as:

- Portfolio Manager

- Investment Analyst

- Research Analyst

- Hedge Fund Analyst

- Financial Advisor

Corporate Finance Specialization

This track focuses on the financial decisions of corporations, including capital budgeting, capital structure, and mergers and acquisitions. Students learn to analyze financial statements, evaluate investment opportunities, and manage corporate finance activities.

- Core Courses:

- Financial Accounting

- Corporate Finance

- Valuation

- Financial Modeling

- Mergers and Acquisitions

- Elective Courses:

- Advanced Corporate Finance

- International Finance

- Real Estate Finance

- Private Equity

- Restructuring and Turnaround

- Career Outcomes: Graduates from this specialization are well-suited for positions such as:

- Financial Analyst

- Corporate Treasurer

- Financial Manager

- Investment Banker

- Management Consultant

Financial Engineering Specialization

This track combines finance, mathematics, and computer science to develop sophisticated financial models and analytical tools. Students gain expertise in quantitative finance, derivatives pricing, and risk management.

- Core Courses:

- Financial Accounting

- Corporate Finance

- Investments

- Derivatives

- Financial Modeling

- Elective Courses:

- Advanced Derivatives

- Computational Finance

- Risk Management

- Algorithmic Trading

- Financial Econometrics

- Career Outcomes: Graduates of this specialization are prepared for roles such as:

- Quantitative Analyst (Quant)

- Risk Manager

- Financial Engineer

- Algorithmic Trader

- Model Validator

Table of Specialization Details

This table provides a comparative overview of the core courses, elective courses, and potential career outcomes for each specialization within the WUSTL Master of Finance program. The structure helps students easily compare and contrast the different tracks available, aiding in their decision-making process.

| Specialization | Core Courses | Elective Courses | Career Outcomes |

|---|---|---|---|

| Investment Management | Financial Accounting, Corporate Finance, Investments, Portfolio Management, Fixed Income Securities | Advanced Investments, Hedge Funds and Alternative Investments, Behavioral Finance, Derivatives, Private Equity | Portfolio Manager, Investment Analyst, Research Analyst, Hedge Fund Analyst, Financial Advisor |

| Corporate Finance | Financial Accounting, Corporate Finance, Valuation, Financial Modeling, Mergers and Acquisitions | Advanced Corporate Finance, International Finance, Real Estate Finance, Private Equity, Restructuring and Turnaround | Financial Analyst, Corporate Treasurer, Financial Manager, Investment Banker, Management Consultant |

| Financial Engineering | Financial Accounting, Corporate Finance, Investments, Derivatives, Financial Modeling | Advanced Derivatives, Computational Finance, Risk Management, Algorithmic Trading, Financial Econometrics | Quantitative Analyst (Quant), Risk Manager, Financial Engineer, Algorithmic Trader, Model Validator |

The WUSTL Master of Finance program equips students with the skills needed to navigate complex financial landscapes. A key area of study often includes understanding funding strategies, such as convertible note financing , a popular choice for early-stage ventures. Graduates from WUSTL are well-prepared to evaluate and advise on these crucial investment decisions, ultimately shaping the financial future of businesses.

A WUSTL Master of Finance degree can equip you with the analytical skills needed to navigate the complex world of investments. While traditional finance offers solid career paths, the burgeoning crypto market presents new opportunities. Understanding concepts like Retik Finance crypto could complement your finance knowledge, making you a more versatile candidate in the job market, and further enhancing your expertise within the WUSTL program.