Overview of the WUSTL MS Finance Program

The Washington University in St. Louis (WUSTL) Master of Science in Finance (MSF) program is designed to equip students with the quantitative and analytical skills needed for a successful career in finance. It offers a rigorous curriculum focusing on core financial principles and allows for specialization in various areas. The program is known for its strong connections to industry and its career-focused approach.

Core Curriculum of the Program

The core curriculum of the WUSTL MSF program provides a comprehensive foundation in finance. Students are expected to master fundamental concepts and analytical tools necessary for making sound financial decisions.

The core curriculum typically includes the following key areas:

- Financial Accounting: Students learn about financial statement analysis, accounting principles, and the preparation and interpretation of financial reports. Understanding accounting is crucial for evaluating a company’s financial performance and position.

- Corporate Finance: This area covers capital budgeting, capital structure, dividend policy, and valuation. Students learn how companies make investment and financing decisions to maximize shareholder value.

- Investments: Students explore portfolio theory, asset pricing models (such as the Capital Asset Pricing Model, or CAPM), and the analysis of different investment instruments like stocks, bonds, and derivatives.

CAPM: E(Ri) = Rf + βi * [E(Rm) – Rf] Where: E(Ri) is the expected return of the investment, Rf is the risk-free rate, βi is the beta of the investment, and E(Rm) is the expected return of the market.

- Financial Modeling: Students develop skills in building and using financial models for valuation, forecasting, and decision-making. This includes using software like Excel and other financial modeling tools.

- Econometrics/Quantitative Methods: Students learn statistical techniques and econometric models used in finance for data analysis, hypothesis testing, and forecasting. This includes regression analysis and time series analysis.

- Derivatives: This area focuses on the pricing and use of derivatives, such as options, futures, and swaps, for hedging and speculation.

Program Duration and Structure

The WUSTL MSF program is designed to be completed within a specific timeframe, with a structured curriculum that ensures students gain a solid understanding of finance principles. The program’s structure is typically full-time, allowing students to focus on their studies.

The typical program duration and structure are:

- Duration: The program is usually completed in 16-20 months, depending on the chosen track and whether the student has any prerequisite waivers.

- Structure: The program is structured around a core curriculum and electives. Students usually take a combination of required core courses and elective courses based on their area of interest. The program also may include workshops, seminars, and guest lectures from industry professionals.

- Full-Time Commitment: The program requires a full-time commitment from students, with a rigorous schedule of classes, assignments, and projects. This intensive format allows students to immerse themselves in the study of finance and develop their skills quickly.

- Summer Internship: Many students participate in summer internships to gain practical experience and apply their knowledge in a real-world setting. This is an important aspect of the program, allowing students to build professional networks and gain valuable insights into their desired career paths.

Focus Areas and Specializations

The WUSTL MSF program offers opportunities for students to specialize in specific areas of finance. This allows students to tailor their studies to their career goals and develop expertise in a particular field.

The program may offer specializations in areas such as:

- Investment Management: This specialization focuses on portfolio management, asset allocation, and investment strategies. Students learn about different investment vehicles and how to manage portfolios to achieve specific financial goals.

- Corporate Finance: Students in this specialization focus on financial planning, capital budgeting, mergers and acquisitions (M&A), and corporate restructuring. They learn the skills needed to advise companies on financial matters.

- Financial Engineering: This area focuses on the use of quantitative methods and financial modeling to design and price financial instruments. Students develop strong analytical skills and learn about the latest trends in financial technology.

- Real Estate: Students can focus on real estate investment, development, and finance. This includes learning about real estate valuation, market analysis, and financing options.

- Other Areas: The program may also offer electives in areas such as FinTech, data analytics for finance, and risk management.

Admissions Requirements and Process

The admissions process for the Washington University in St. Louis (WUSTL) Master of Science in Finance (MSF) program is highly competitive. The program seeks candidates with strong academic backgrounds, demonstrated quantitative abilities, and a clear understanding of their career goals. Successful applicants typically possess a combination of these qualities, as well as the ability to articulate their potential contributions to the program and the finance industry. Understanding the specific requirements and the application process is crucial for prospective students.

Academic Prerequisites for Applicants

Applicants to the WUSTL MSF program are expected to have a solid foundation in quantitative disciplines. While a specific undergraduate major is not mandated, a strong academic record in related fields is highly advantageous.

- Recommended Undergraduate Majors: The program favors applicants with undergraduate degrees in areas such as finance, economics, mathematics, statistics, engineering, or a related quantitative field. These majors provide a solid base for the rigorous coursework in the MSF program.

- Required Coursework: Applicants are expected to have completed coursework in calculus, linear algebra, and statistics. A strong understanding of these mathematical concepts is crucial for success in the program’s core finance courses. Some programs might require a pre-program refresher course for applicants who lack these prerequisites.

- GPA Requirements: While there is no explicitly stated minimum GPA, successful applicants typically have a strong GPA from their undergraduate studies. A competitive GPA demonstrates academic proficiency and the ability to handle the demanding curriculum.

- Demonstrated Quantitative Skills: The admissions committee looks for evidence of quantitative aptitude, which can be demonstrated through coursework, relevant work experience, or standardized test scores. This aptitude is critical for grasping complex financial concepts.

Required Standardized Tests and Minimum Score Expectations

Standardized tests are a significant component of the WUSTL MSF application. These tests provide the admissions committee with a standardized measure of an applicant’s quantitative reasoning, verbal reasoning, and analytical writing skills.

- GRE/GMAT Requirement: Applicants are required to submit either the Graduate Record Examinations (GRE) or the Graduate Management Admission Test (GMAT) scores. These tests assess a candidate’s readiness for graduate-level studies. The specific preference between the GRE and GMAT varies by year, so candidates should check the latest admissions guidelines.

- Minimum Score Expectations: While there is no fixed minimum score, competitive applicants generally achieve high scores on the GRE or GMAT. A score in the 70th percentile or higher on both the quantitative and verbal sections is often considered competitive. Applicants should research average scores for admitted students to gauge their competitiveness.

- Test Score Submission: Applicants must arrange for their official test scores to be sent directly to the WUSTL Olin Business School. The school’s code for the GRE is 6929, and for the GMAT, it is Z11-4X-79.

- TOEFL/IELTS Requirement: International applicants whose native language is not English must submit scores from the Test of English as a Foreign Language (TOEFL) or the International English Language Testing System (IELTS). These tests assess English proficiency, which is essential for academic success.

- Minimum TOEFL/IELTS Scores: The program typically requires a minimum TOEFL score of 100 (with minimum scores in each section) or an IELTS score of 7.0 (with no band below 6.0).

Step-by-Step Guide to the Application Process

The application process for the WUSTL MSF program involves several steps, each requiring careful attention and preparation. Following this guide can help streamline the application process.

- Research and Preparation: Begin by thoroughly researching the WUSTL MSF program, its curriculum, faculty, and career outcomes. Understand the program’s requirements and deadlines. Gather all necessary documents, including transcripts, test scores, and letters of recommendation.

- Online Application: Complete the online application form through the WUSTL Olin Business School website. Provide accurate and detailed information about your academic background, work experience, and extracurricular activities.

- Transcripts: Submit official transcripts from all undergraduate and graduate institutions attended. Ensure that transcripts are sent directly from the issuing institution to the Olin Business School.

- Standardized Test Scores: Arrange for official GRE or GMAT scores to be sent to WUSTL using the designated codes. For international applicants, submit TOEFL or IELTS scores.

- Essays: Write compelling essays that address the prompts provided by the program. These essays are an opportunity to showcase your personality, motivations, and career goals. Provide a clear and concise narrative.

- Letters of Recommendation: Request letters of recommendation from professors or supervisors who can attest to your academic abilities and professional skills. Provide recommenders with ample time and necessary information.

- Resume/CV: Prepare a professional resume or curriculum vitae that highlights your work experience, skills, and achievements. Tailor your resume to align with the program’s focus on finance.

- Application Fee: Pay the non-refundable application fee.

- Review and Submission: Carefully review all application materials for accuracy and completeness before submitting the application.

- Interview (If Invited): Some applicants may be invited for an interview. Prepare for the interview by researching common interview questions and practicing your responses.

Application Deadlines Comparison

Application deadlines can vary from year to year, and it is crucial for prospective students to consult the official WUSTL MSF website for the most up-to-date information. The following table provides a general overview of typical deadlines. Note that the exact dates may change, and applicants should always confirm the current deadlines on the Olin Business School website.

| Application Round | Typical Deadline (Year 1) | Typical Deadline (Year 2) | Typical Deadline (Year 3) |

|---|---|---|---|

| Round 1 | October 15 | October 15 | October 15 |

| Round 2 | January 15 | January 15 | January 15 |

| Round 3 | March 15 | March 15 | March 15 |

| Final Round (if applicable) | May 1 | May 1 | May 1 |

Curriculum and Coursework

The Master of Science in Finance (MSF) program at Washington University in St. Louis is designed to equip students with a comprehensive understanding of financial principles and practical skills essential for success in the finance industry. The curriculum is structured to provide a strong foundation in core financial concepts, followed by opportunities to specialize in areas of interest through elective courses. This approach ensures that graduates are well-prepared to meet the evolving demands of the financial world.

Core Courses in MS Finance, Wustl ms finance

The core courses provide a solid foundation in fundamental financial concepts. These courses cover essential areas, ensuring students gain a broad understanding of finance before specializing.

- Financial Accounting: This course covers the fundamentals of financial statement analysis, including balance sheets, income statements, and cash flow statements. Students learn to interpret financial data and assess a company’s financial performance.

- Key Skills Gained: Financial statement analysis, understanding accounting principles, interpreting financial ratios, and evaluating a company’s financial health.

- Corporate Finance: This course focuses on financial decision-making within a corporation, including capital budgeting, capital structure, and dividend policy. Students learn to evaluate investment opportunities and manage corporate finances.

- Key Skills Gained: Capital budgeting techniques, valuation of projects, understanding cost of capital, and making financial decisions to maximize shareholder value.

- Investments: This course covers the principles of investment analysis, including portfolio theory, asset pricing models, and security valuation. Students learn to construct and manage investment portfolios.

- Key Skills Gained: Portfolio construction, asset allocation, risk management, understanding investment strategies, and evaluating investment performance.

- Financial Modeling: This course teaches students to build financial models using spreadsheets. Students learn to forecast financial performance, analyze investment opportunities, and perform sensitivity analysis.

- Key Skills Gained: Spreadsheet modeling, forecasting techniques, sensitivity analysis, and using financial models for decision-making.

- Fixed Income Securities: This course covers the valuation and analysis of fixed-income securities, including bonds, and interest rate derivatives.

- Key Skills Gained: Bond valuation, understanding yield curves, and analyzing fixed-income markets.

- Derivatives: This course explores the use of derivatives, such as options and futures, for hedging and speculation.

- Key Skills Gained: Derivatives valuation, risk management using derivatives, and understanding derivative markets.

Elective Courses and Career Paths

Elective courses allow students to specialize in areas of finance that align with their career goals. These electives offer in-depth knowledge and practical skills relevant to specific career paths. The selection of electives can significantly influence the types of roles graduates are prepared for.

- Private Equity: This elective explores the investment strategies and operations of private equity firms.

- Potential Career Paths: Private Equity Analyst, Investment Associate, Financial Analyst in a private equity-backed company.

- Key Skills Gained: Deal structuring, valuation of private companies, due diligence, and understanding private equity fund operations.

- Hedge Fund Strategies: This course covers the strategies and operations of hedge funds.

- Potential Career Paths: Hedge Fund Analyst, Portfolio Manager, Risk Manager.

- Key Skills Gained: Understanding hedge fund strategies, portfolio management, risk management, and market analysis.

- Real Estate Finance: This elective focuses on the financing and investment in real estate.

- Potential Career Paths: Real Estate Analyst, Investment Manager, Real Estate Development.

- Key Skills Gained: Real estate valuation, financing real estate projects, and understanding real estate markets.

- Investment Banking: This course provides an overview of investment banking activities, including mergers and acquisitions, and initial public offerings.

- Potential Career Paths: Investment Banking Analyst, Associate, or related roles.

- Key Skills Gained: Financial modeling, valuation, deal structuring, and understanding investment banking processes.

- FinTech: This course examines the intersection of finance and technology, covering topics such as blockchain, digital payments, and algorithmic trading.

- Potential Career Paths: FinTech Analyst, Data Scientist, Financial Technology Consultant.

- Key Skills Gained: Understanding FinTech innovations, data analysis, and applying technology to financial problems.

Alignment with Industry Demands

The curriculum is designed to align with current industry demands by incorporating the latest financial tools, techniques, and market trends. The program’s emphasis on practical skills ensures graduates are well-prepared for the challenges of the finance industry. The program regularly reviews and updates its curriculum to reflect changes in the financial landscape.

The MSF program incorporates industry-relevant software and tools. This practical application of theory ensures students can apply their knowledge in real-world scenarios. Case studies, simulations, and guest lectures from industry professionals provide valuable insights and networking opportunities.

Faculty and Research Opportunities

The Washington University in St. Louis (WUSTL) Master of Science in Finance (MSF) program distinguishes itself through its faculty expertise and the extensive research opportunities available to students. This environment fosters a deep understanding of financial principles and encourages active participation in cutting-edge research. Students benefit from direct interaction with renowned scholars, gaining valuable insights and practical experience that prepare them for successful careers in finance.

Faculty Backgrounds, Expertise, and Research Interests

The MSF program boasts a distinguished faculty comprised of experienced academics and industry professionals. Their diverse backgrounds and research interests enrich the learning environment and provide students with a well-rounded financial education.

- Academic Expertise: The faculty holds advanced degrees, including PhDs, from top universities worldwide. They are experts in various areas of finance, such as investments, corporate finance, financial modeling, and behavioral finance. Their research is frequently published in leading academic journals, showcasing their contributions to the field.

- Industry Experience: Many faculty members bring practical experience from the financial industry, including roles in investment banking, asset management, and consulting. This real-world experience allows them to provide students with valuable insights into the practical application of financial theories and current market trends.

- Research Interests: Faculty research interests span a wide range of topics, reflecting the evolving nature of the financial landscape. Some examples include:

- Asset Pricing: Analyzing the determinants of asset prices and market efficiency.

- Corporate Governance: Examining the role of corporate governance in firm performance and shareholder value.

- Behavioral Finance: Investigating the impact of psychological biases on investment decisions.

- Derivatives and Risk Management: Developing strategies for managing financial risk using derivatives.

- Fintech and Innovation: Exploring the impact of technology on financial markets and institutions.

Opportunities for Student Involvement in Research Projects

The MSF program actively encourages student participation in research projects, providing invaluable opportunities to develop research skills and contribute to the advancement of financial knowledge. This involvement can take various forms.

- Research Assistantships: Students can work as research assistants for faculty members, assisting with data collection, analysis, and literature reviews. This provides hands-on experience and allows students to learn directly from experienced researchers.

- Independent Research Projects: Students may undertake independent research projects under the guidance of a faculty advisor. This allows them to explore specific areas of interest in greater depth and develop their research skills.

- Collaboration with Faculty: Students are encouraged to collaborate with faculty on research projects, co-authoring papers, and presenting research findings at conferences.

- Access to Resources: The program provides access to research databases, software, and other resources necessary for conducting research.

Faculty-Led Seminars and Workshops

The MSF program regularly offers faculty-led seminars and workshops to enhance students’ understanding of specific topics and provide opportunities for professional development. These events complement the core curriculum and offer students insights into emerging trends and practical skills.

- Research Seminars: Faculty members present their current research findings, providing students with exposure to cutting-edge research and fostering discussions on important topics in finance. These seminars allow students to understand how research is conducted and how it contributes to the field.

- Industry Workshops: Workshops led by faculty and industry professionals focus on practical skills, such as financial modeling, data analysis, and portfolio management. These workshops equip students with the tools they need to succeed in their careers.

- Career Development Workshops: Workshops cover topics such as resume writing, interview skills, and networking, helping students prepare for their job search.

- Guest Speaker Series: The program hosts guest speakers from the financial industry, providing students with opportunities to learn from experienced professionals and network with potential employers. These speakers share their insights on current market trends, career paths, and industry best practices.

Career Services and Placement

The Washington University in St. Louis (WUSTL) Master of Science in Finance (MSF) program places a strong emphasis on career development and placement, equipping students with the necessary skills and resources to succeed in the competitive financial industry. The program’s career services are designed to provide comprehensive support, from resume building and interview preparation to networking opportunities and job placement assistance.

Career Services Offered

WUSTL’s MSF program provides a robust suite of career services designed to support students throughout their job search journey. These services are integral to the program and are delivered by experienced career advisors who possess deep knowledge of the finance industry.

* Career Advising: Individualized career counseling sessions are offered to help students define their career goals, develop job search strategies, and refine their resumes and cover letters. Advisors also provide guidance on networking and interviewing techniques.

* Resume and Cover Letter Workshops: Students participate in workshops designed to craft compelling resumes and cover letters that highlight their skills and experiences. These workshops often include personalized feedback and editing assistance.

* Interview Preparation: Mock interviews and workshops focusing on behavioral and technical interview skills are offered to prepare students for the rigorous interview process. Students receive feedback and coaching to improve their performance.

* Networking Events: The program hosts numerous networking events, including career fairs, industry panels, and alumni events, to connect students with potential employers and industry professionals. These events provide valuable opportunities for students to build relationships and learn about different career paths.

* Job Board and Recruiting: WUSTL maintains a dedicated job board with postings from leading financial institutions and companies. The career services team actively facilitates on-campus recruiting events and connects students with recruiters.

* Industry-Specific Workshops: Workshops are tailored to specific areas of finance, such as investment banking, asset management, and corporate finance. These workshops provide students with insights into industry trends and best practices.

* Alumni Network: The strong WUSTL alumni network provides valuable mentorship and job opportunities for MSF graduates. Alumni often participate in career events and actively recruit students for their organizations.

Placement of Graduates: Companies and Roles

Graduates of the WUSTL MSF program are well-prepared for a variety of roles within the finance industry. The program’s curriculum, combined with its robust career services, enables graduates to secure positions at top financial institutions and corporations.

The types of companies where graduates are placed include:

* Investment Banks (e.g., Goldman Sachs, JPMorgan Chase, Morgan Stanley)

* Asset Management Firms (e.g., BlackRock, Fidelity Investments, Vanguard)

* Consulting Firms (e.g., McKinsey & Company, Boston Consulting Group, Bain & Company)

* Corporate Finance Departments (e.g., Fortune 500 companies)

* Hedge Funds and Private Equity Firms

Graduates typically secure roles such as:

* Investment Banking Analyst

* Financial Analyst

* Portfolio Manager

* Research Analyst

* Consultant

* Risk Manager

* Corporate Finance Associate

Career Outcomes for Recent Graduates

Recent graduates of the WUSTL MSF program have achieved significant success in securing desirable positions within the finance industry. The following list provides examples of career outcomes:

* Investment Banking Analyst at Goldman Sachs

* Financial Analyst at BlackRock

* Consultant at McKinsey & Company

* Portfolio Manager at Vanguard

* Risk Manager at JPMorgan Chase

* Corporate Finance Associate at a Fortune 500 Company

Company Hiring Trends

The following table provides a snapshot of companies and their hiring trends for MSF graduates. The information is based on recent placement data and publicly available information. Note that specific hiring trends can fluctuate based on market conditions and company needs.

| Company | Hiring Trends | Typical Roles |

|---|---|---|

| Goldman Sachs | Consistent hiring for investment banking analyst roles, with a focus on candidates with strong analytical and quantitative skills. | Investment Banking Analyst, Financial Analyst |

| BlackRock | Increasing demand for candidates with expertise in investment management and portfolio analysis. | Financial Analyst, Portfolio Analyst |

| McKinsey & Company | Continued recruitment of MSF graduates for consulting roles, especially those with experience in financial services. | Consultant, Business Analyst |

Student Life and Campus Experience: Wustl Ms Finance

The Washington University in St. Louis (WUSTL) Master of Science in Finance program provides a comprehensive academic experience, but it also emphasizes the importance of a vibrant student life and a supportive campus environment. The program aims to foster a strong sense of community and provide students with opportunities to develop personally and professionally outside of the classroom. This section details the social, extracurricular, and campus resources available to MS Finance students.

Social and Extracurricular Activities

Student life at WUSTL extends far beyond academics, with numerous opportunities for social interaction and extracurricular involvement. The university encourages students to participate in activities that complement their studies and broaden their horizons.

- Finance-Specific Organizations: Students can engage with their peers and build networks through various finance-related clubs. These organizations often host guest speakers, workshops, and networking events. Examples include:

- Finance Club: A general finance club that hosts career panels, networking events, and workshops on topics such as financial modeling and investment strategies.

- Investment Club: Provides a platform for students to manage a real-world investment portfolio, gaining practical experience in investment analysis and portfolio management.

- Private Equity Club: Offers insights into the private equity industry through case studies, guest speakers, and networking opportunities.

- University-Wide Organizations: Students are encouraged to join a diverse range of organizations, spanning academic, cultural, recreational, and service-oriented interests. This fosters a well-rounded student experience. Examples include:

- Graduate Student Senate: Represents the interests of graduate students and advocates for their needs.

- Sports Clubs: Opportunities to participate in intramural sports and recreational activities.

- Cultural Organizations: Student groups representing various cultural backgrounds, providing opportunities for cultural exchange and understanding.

- Social Events and Networking: The program and the university host numerous social events and networking opportunities throughout the year. These events help students build relationships with their peers, faculty, and industry professionals. These events can include:

- Welcome Week: A series of events at the beginning of the academic year designed to help students acclimate to campus and meet their classmates.

- Career Fairs: Events where students can network with potential employers and explore career opportunities.

- Alumni Events: Opportunities to connect with WUSTL alumni working in the finance industry.

Campus Environment and Resources

WUSTL offers a supportive and resource-rich campus environment designed to enhance the student experience. These resources are accessible to MS Finance students and are designed to support their academic, personal, and professional development.

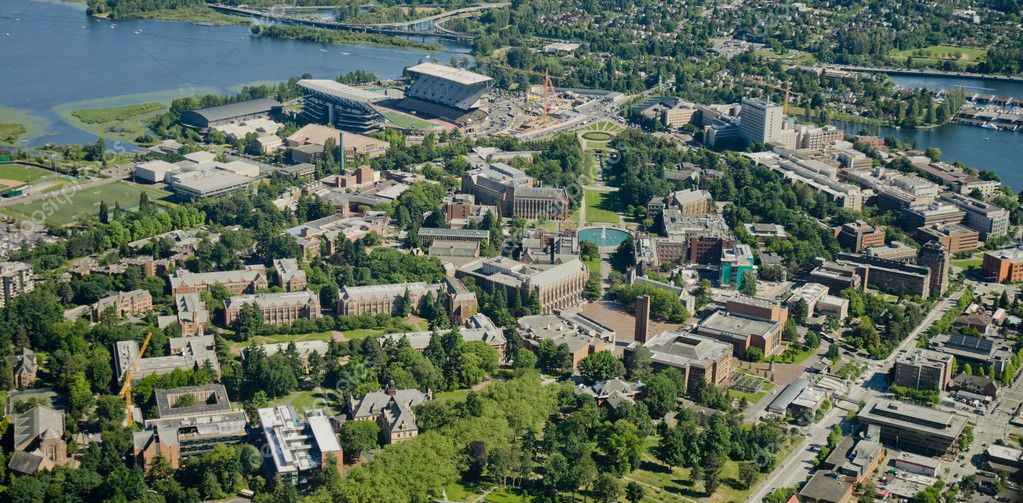

- Campus Facilities: The university provides state-of-the-art facilities, including libraries, computing labs, and recreational centers. The Olin Business School, where the MS Finance program is housed, has dedicated spaces for graduate students.

- Libraries: The university libraries offer extensive resources, including access to academic journals, databases, and research materials essential for finance studies.

- Computing Labs: Access to advanced computing facilities equipped with the software necessary for financial modeling and analysis.

- Recreational Facilities: The university’s athletic facilities offer opportunities for exercise and recreation.

- Student Support Services: WUSTL provides comprehensive support services to assist students with various aspects of their lives, including academic advising, career services, and health and wellness resources.

- Academic Advising: Dedicated academic advisors provide guidance on course selection, program requirements, and career planning.

- Career Services: The Career Services office offers resources for resume writing, interview preparation, and job search strategies.

- Health and Wellness: Counseling services, health clinics, and wellness programs are available to support student well-being.

- Campus Location and Community: The university’s location in St. Louis provides students with access to a vibrant city with a rich cultural heritage and numerous opportunities for internships and career development.

- Proximity to Industry: The location offers access to major financial institutions and corporations, providing networking and internship opportunities.

- Cultural Attractions: Students can explore museums, art galleries, and historical sites.

- Community Engagement: Opportunities to participate in community service projects and volunteer activities.

Cost of Attendance and Financial Aid

Understanding the financial implications of pursuing the MS in Finance program at Washington University in St. Louis is crucial for prospective students. This section details the tuition, associated costs, available financial aid, and potential living expenses to help you plan your budget effectively.

Tuition Fees and Associated Costs

The total cost of the MS in Finance program includes tuition fees and other mandatory expenses. These costs can fluctuate slightly from year to year, so it is important to consult the most recent information available on the program’s official website.

The tuition fee covers the academic instruction, access to university resources, and certain student services. Besides tuition, other associated costs include:

- Health Insurance: All students are required to have health insurance. The cost of health insurance is added to the student’s bill if they do not provide proof of coverage.

- Student Fees: These fees cover various services such as student activities, technology, and other campus resources.

- Books and Supplies: Students are responsible for purchasing textbooks and other course materials. The cost varies depending on the courses taken.

- Transportation: This includes costs associated with commuting to and from campus. Students may consider public transportation, personal vehicles, or other means.

- Personal Expenses: This category covers a wide range of personal needs such as toiletries, entertainment, and other discretionary spending.

Scholarships and Financial Aid Options

Washington University in St. Louis offers various financial aid options to help students manage the cost of the MS in Finance program. These options can significantly reduce the financial burden of the program.

Scholarships are awarded based on merit, need, or specific criteria. They typically do not need to be repaid. Financial aid is available in the form of loans, which must be repaid with interest. Here’s a breakdown of potential aid:

- Merit-Based Scholarships: These scholarships are awarded to students who demonstrate exceptional academic achievement, leadership potential, or other outstanding qualities.

- Need-Based Scholarships: These scholarships are awarded based on the financial need of the student. The university assesses a student’s financial need based on the information provided in the Free Application for Federal Student Aid (FAFSA) or the CSS Profile.

- Graduate Assistantships: Some departments offer graduate assistantships, which provide tuition remission and a stipend in exchange for assisting faculty with research or teaching.

- Federal Loans: Students can apply for federal loans to help finance their education. These loans typically have lower interest rates and more flexible repayment options than private loans.

- Private Loans: Private loans are offered by banks and other lending institutions. The terms and conditions of these loans vary depending on the lender.

Students are encouraged to explore all available financial aid options and apply early to maximize their chances of receiving assistance.

Living Expenses Breakdown

Living expenses are a significant part of the overall cost of attending the MS in Finance program. These expenses can vary based on a student’s lifestyle and choices. The cost of living in St. Louis, Missouri, is generally considered to be moderate compared to other major metropolitan areas in the United States.

A detailed breakdown of potential living expenses is provided below:

- Housing: Housing costs are a major expense. Students can choose to live on or off campus. On-campus housing is generally more expensive but offers convenience. Off-campus housing can be more affordable, but students need to factor in transportation costs.

- Food: Food costs include groceries and dining out. Students can save money by cooking their own meals.

- Utilities: Utilities include electricity, gas, water, and internet. The cost of utilities will vary depending on the size of the housing and usage.

- Transportation: Transportation costs include public transportation, car expenses (if applicable), and ride-sharing services.

- Personal Expenses: This includes entertainment, clothing, and other discretionary spending.

Here is an example of estimated monthly living expenses:

| Expense | Estimated Monthly Cost (USD) |

|---|---|

| Housing (On-Campus) | $1,200 – $1,800 |

| Housing (Off-Campus) | $800 – $1,500 |

| Food | $400 – $800 |

| Utilities | $100 – $200 |

| Transportation | $50 – $150 |

| Personal Expenses | $200 – $500 |

| Total (On-Campus) | $1,950 – $3,450 |

| Total (Off-Campus) | $1,550 – $3,250 |

Note: These are estimates, and actual costs may vary.

Program Rankings and Reputation

Assessing the rankings and reputation of the Washington University in St. Louis (WUSTL) Master of Science in Finance (MSF) program provides crucial insights into its standing within the competitive landscape of finance education. These evaluations help prospective students understand the program’s strengths, benchmark it against peers, and gauge its overall value in the industry. This section delves into the program’s performance in various ranking systems and explores its perceived reputation among employers and professionals.

Program Rankings in Publications

The WUSTL MSF program consistently appears in prominent rankings, reflecting its quality and impact. These rankings are typically based on a variety of factors, including career placement success, student satisfaction, faculty research, and selectivity.

- U.S. News & World Report: While specific program rankings can fluctuate annually, the overall business school (Olin Business School) at WUSTL, which houses the MSF program, consistently ranks highly among top business schools in the United States. These rankings contribute to the program’s overall prestige.

- Financial Times: The Financial Times often provides rankings of Master of Finance programs globally. The WUSTL MSF program’s performance in this ranking, if available, reflects its international standing and the global reach of its graduates. Key metrics include career progress, salary increases, and the diversity of the faculty and student body.

- The Economist: The Economist’s rankings focus on career opportunities and salary expectations. The program’s placement in these rankings showcases its ability to prepare students for successful careers in finance, including areas like investment banking, asset management, and corporate finance.

Reputation Within the Finance Industry

The WUSTL MSF program has cultivated a strong reputation within the finance industry. This reputation is built upon several factors, including the quality of its graduates, the strength of its faculty, and the program’s industry connections.

- Employer Perception: Recruiters from leading financial institutions actively seek out WUSTL MSF graduates. The program’s curriculum is designed to meet the demands of the industry, and the students are well-prepared for various roles. The strong industry connections of the faculty and career services further enhance the program’s appeal to employers.

- Alumni Network: A robust alumni network is a significant asset. WUSTL MSF graduates hold positions at top firms globally, creating a valuable network for current students and alumni. The network provides mentorship opportunities, career guidance, and access to a wide range of job opportunities.

- Faculty Expertise: The faculty members are known for their expertise in various areas of finance. Their research and industry experience contribute to the program’s academic rigor and relevance. Their involvement in industry events and conferences also strengthens the program’s ties to the professional world.

Program Comparison with Similar Programs

Comparing the WUSTL MSF program with other similar programs helps prospective students assess its strengths and weaknesses in relation to its peers. The comparison often involves factors like curriculum, career services, and cost.

- Curriculum Focus: WUSTL’s MSF program is known for its strong focus on quantitative skills and financial modeling. Compared to programs that emphasize broader business concepts, WUSTL’s curriculum is often considered more specialized. For instance, programs at the University of Chicago (Booth School of Business) or Carnegie Mellon University (Tepper School of Business) may offer similar quantitative depth, but the specific emphasis and course offerings may differ.

- Career Services: The career services offered by WUSTL are highly regarded. The program provides dedicated career counseling, resume workshops, and networking events. Comparing these services with those of other programs, such as those at New York University (Stern School of Business) or Columbia University (Columbia Business School), highlights the level of support provided to students in their job search.

- Placement Success: The placement rates and the types of firms where graduates are hired are important metrics. Examining the firms that recruit from WUSTL MSF compared to those recruiting from programs at institutions like MIT (Sloan School of Management) or Stanford University (Graduate School of Business) provides insight into the career opportunities available to graduates.

- Cost and Financial Aid: The cost of attendance and the availability of financial aid are important factors in the decision-making process. Comparing the tuition fees and scholarship opportunities at WUSTL with those of other programs, such as the University of Pennsylvania (Wharton School) or Harvard University (Harvard Business School), provides a clear understanding of the financial investment required.

Application Tips and Strategies

Crafting a successful application to the WUSTL MS Finance program requires careful planning and execution. This section provides essential guidance to help prospective students create a compelling application package, excel in interviews, and differentiate themselves from the competition. A strong application demonstrates not only academic prowess but also a clear understanding of the program’s goals and a genuine interest in finance.

Crafting a Compelling Application

The application process demands attention to detail and a strategic approach. A well-structured application highlights your strengths, showcases your passion for finance, and aligns your goals with the program’s offerings.

- Highlighting Academic Achievements: Provide a clear and concise overview of your academic background. This includes GPA, standardized test scores (GRE/GMAT), and any relevant coursework. Demonstrate a strong academic record by providing specific examples of challenging courses and the grades achieved. For example, if you excelled in a quantitative course, mention the course name and the final grade, showcasing your aptitude for finance-related subjects.

- Writing a Strong Personal Statement: The personal statement is a crucial component of your application. It’s an opportunity to tell your story and demonstrate your fit for the program. Focus on your motivations for pursuing an MS Finance degree, your career aspirations, and how the WUSTL program aligns with your goals. Provide concrete examples of your experiences, such as internships, projects, or volunteer work, that have shaped your interest in finance. For instance, describe a project where you analyzed financial statements or participated in a stock market simulation.

- Securing Strong Letters of Recommendation: Letters of recommendation provide valuable insights into your abilities and character. Choose recommenders who know you well and can speak to your strengths, work ethic, and potential for success in the program. Provide your recommenders with your resume, personal statement, and any other relevant information to help them write a compelling letter. Consider providing them with a brief overview of the program and how your goals align with it.

- Showcasing Relevant Experience: If you have prior work experience, highlight it in your resume and application. Describe your responsibilities, accomplishments, and the skills you developed. Quantify your achievements whenever possible. For example, if you worked in an internship, state the size of the team you worked with, the amount of data you processed, or the results you achieved, such as the amount of cost savings.

- Demonstrating Extracurricular Involvement: Extracurricular activities demonstrate your leadership skills, teamwork abilities, and commitment outside of academics. Include any relevant activities, such as finance clubs, volunteer work, or sports teams. Highlight any leadership roles you held or significant contributions you made.

Preparing for Interviews

Interviews are a critical part of the application process, providing the admissions committee with a chance to assess your personality, communication skills, and fit for the program. Thorough preparation is key to success.

- Researching the Program and the Interviewers: Familiarize yourself with the WUSTL MS Finance program’s curriculum, faculty, and career services. Research the interviewers’ backgrounds and areas of expertise. This will allow you to ask informed questions and demonstrate your genuine interest in the program.

- Practicing Common Interview Questions: Prepare for common interview questions, such as “Why do you want to pursue an MS Finance degree?” “What are your career goals?” “Why WUSTL?” and “Tell me about a time you failed and what you learned.” Practice answering these questions out loud to build your confidence and fluency.

- Preparing Financial and Quantitative Questions: Be prepared for questions related to financial concepts, such as valuation, risk management, and financial modeling. Practice answering these questions using clear and concise language. For example, be prepared to explain the concept of discounted cash flow or the Capital Asset Pricing Model (CAPM).

- Demonstrating Strong Communication Skills: During the interview, speak clearly, concisely, and confidently. Make eye contact, and actively listen to the interviewer’s questions. Provide specific examples to support your answers. Practice your answers to build your confidence and ability to think on your feet.

- Asking Thoughtful Questions: Prepare a few thoughtful questions to ask the interviewer at the end of the interview. This demonstrates your interest in the program and your desire to learn more. Examples include asking about research opportunities, career placement services, or the program’s culture.

Strategies for Standing Out from Other Applicants

In a competitive applicant pool, it’s essential to find ways to distinguish yourself. Demonstrating a unique skill set, a clear understanding of the industry, and a genuine passion for finance can help you stand out.

- Showcasing Unique Skills and Experiences: Highlight any unique skills or experiences that set you apart from other applicants. This could include proficiency in a specific programming language (e.g., Python, R), experience with a particular financial modeling software (e.g., Bloomberg, FactSet), or international experience. For example, if you have experience working with emerging markets, mention the specific countries and financial instruments you worked with.

- Demonstrating a Deep Understanding of the Finance Industry: Show that you have a solid understanding of the finance industry by staying current with financial news and trends. Discuss recent developments in the market, such as changes in interest rates, regulatory updates, or technological advancements. Mention specific companies or industries that interest you.

- Articulating a Clear Career Vision: Have a well-defined career vision and articulate how the WUSTL MS Finance program will help you achieve your goals. Be specific about the types of roles you are interested in, the industries you want to work in, and the skills you want to develop. For example, state that you are interested in a role in investment banking, asset management, or financial consulting.

- Networking and Engaging with the Program: Attend virtual or in-person information sessions, connect with current students and alumni, and follow the program on social media. This demonstrates your genuine interest in the program and provides opportunities to learn more about it. Contacting current students or alumni and asking about their experiences can be a valuable way to gain insights into the program.

- Tailoring Your Application to WUSTL: Tailor your application to the specific strengths and offerings of the WUSTL MS Finance program. Research the program’s curriculum, faculty, and research opportunities. Highlight how your goals align with the program’s strengths and how you can contribute to the program’s community.

Notable Alumni and Their Impact

The Washington University in St. Louis Master of Science in Finance program boasts a strong alumni network, with graduates making significant contributions across various sectors of the finance industry. Their achievements reflect the program’s rigor and its effectiveness in preparing students for leadership roles. These alumni serve as a testament to the program’s quality and provide valuable networking opportunities for current students.

Career Paths of Successful Alumni

Graduates of the WUSTL MSF program pursue diverse career paths. The program’s focus on quantitative skills and financial analysis equips them for a wide range of roles.

- Investment Banking: Many alumni work in investment banking, advising corporations on mergers and acquisitions, raising capital, and other financial transactions. They often start as analysts and progress to higher-level positions such as associates, vice presidents, and managing directors.

- Asset Management: Several alumni build careers in asset management, managing portfolios for institutional investors, such as pension funds and endowments, or for high-net-worth individuals. Their roles involve investment analysis, portfolio construction, and risk management.

- Corporate Finance: Graduates also find employment in corporate finance departments, focusing on financial planning, budgeting, capital allocation, and treasury management. They contribute to the financial health and strategic decision-making of corporations.

- Hedge Funds and Private Equity: Some alumni work at hedge funds and private equity firms, conducting due diligence, making investment decisions, and managing investments in various asset classes.

- Consulting: A smaller group of alumni works in financial consulting, providing expert advice to clients on financial strategies, risk management, and other related areas.

Contributions of Alumni to the Finance Industry

WUSTL MSF alumni impact the finance industry in numerous ways. They drive innovation, contribute to market efficiency, and uphold ethical standards.

- Innovation and Technological Advancements: Alumni often adopt and contribute to financial technology (FinTech) innovations. They implement new technologies to streamline processes, improve trading strategies, and enhance client services.

- Investment Strategies and Portfolio Management: Graduates develop and implement innovative investment strategies. They contribute to portfolio optimization, risk management, and the development of new financial products.

- Risk Management and Regulatory Compliance: Alumni play a crucial role in risk management and compliance. They develop and implement strategies to mitigate financial risks and ensure adherence to regulatory requirements.

- Ethical Leadership and Corporate Governance: Many alumni promote ethical practices and strong corporate governance. They are instrumental in shaping industry standards and fostering trust within the financial system.

- Global Financial Markets: WUSTL MSF graduates work in global financial markets, facilitating cross-border investments, managing international portfolios, and contributing to the stability and efficiency of the global financial system.

Alumni Success Story and Impact

The program’s alumni are recognized for their expertise and leadership. One notable example highlights the impact of the program.

Wustl ms finance – Jane Doe, Class of 20XX, is a Managing Director at a leading investment bank. After graduating from the WUSTL MSF program, she began her career as an analyst and rapidly progressed through the ranks. She has led several high-profile mergers and acquisitions deals, generating substantial returns for clients and earning industry accolades. Her success stems from her strong analytical skills, financial acumen, and leadership abilities, all honed during her time at Washington University. Doe has also been a mentor to current students and a generous donor to the program, supporting future generations of finance professionals.

The WUSTL MS Finance program equips students with a strong foundation in financial principles, making them well-prepared for various career paths. A key area of interest for many graduates is understanding how to navigate the complexities of auto finance solutions , as this impacts investment strategies and consumer behavior. This knowledge is highly valuable, directly relevant to the core curriculum of the WUSTL MS Finance program.

The WUSTL MS Finance program equips students with a strong foundation in financial principles. Graduates often pursue careers in diverse areas, and understanding of specialized fields like equipment finance is crucial. Exploring the intricacies of scl equipment finance provides valuable insights, enhancing the skillset for future roles. This knowledge is particularly beneficial for those seeking roles within the broader financial landscape, directly complementing the WUSTL MS Finance curriculum.